Endeavour Silver Corp.

(“Endeavour” or the “Company”)

(NYSE: EXK; TSX: EDR) is pleased to report an update on

the 2024 exploration and evaluation initiatives at its 100% owned

Pitarrilla project. Engineering firms have been retained to

commence technical studies for the basis of a future economic

study.

Since acquiring the Pitarrilla project in July

2022, Endeavour has re-logged historic drill core to further

understand the geology and mineralization controls of the deposit.

Priority has been focused on identifying and defining numerous

high-grade feeder structures that are interpreted to be the source

of the silver, lead and zinc sulphide mineralization, and that

extend through the high-grade manto, originally identified by SSR

Mining. The Company published a technical report dated November 21,

2022 outlining Mineral Resource Estimates (See news release dated

December 8, 2022).

Endeavour has refurbished an existing

underground ramp and extended it over 1.3 kilometres. The ramp has

been developed through the projected feeder structures and

crosscuts have been made for drill stations to further interpret

and test the high-grade zones and its feeder structures with core

drilling at various angles. The ramp lies directly above the manto.

This work confirmed management’s interpretation and identified at

least four structures that extend through the manto (Figures 1 and

2): Palmito vein, Danna vein, Victoria vein and Casas Blancas vein.

During development of the ramp, additional mineralized structures

were also identified, including the Norma vein, Danna hanging wall

(HW) vein and Peña dike. Further work and interpretation are

required to understand the significance and extent of these

additional structures. In the ramp, the Peña dyke is the thickest

structure with channel samples averaging 4.5 metres to 4.7 metres

in width, oriented near perpendicular to strike. Results from the

16 channel samples are presented in Figure 3 and Table 3.

Since August, the Company completed nine diamond

drill holes, six from surface and three from underground drill

stations. The three holes from underground were targeted to

intersect the manto and multiple veins, while the holes drilled

from surface were directed to intersect the Casas Blancas vein. All

holes successfully intersected the targeted mineralization,

supporting managements geological interpretation and the potential

of underground bulk tonnage mining.

Based on the re-logging of historic drill holes

resulting in re-interpreting the geologic model along with current

activities, it is estimated that all four primary feeder veins have

a vertical extent of approximately 600 to 800 metres and strike

lengths approaching 700 metres; these veins appear open to depth.

Danna is the largest vein with an approximate 800 metre vertical

extent and a strike length approaching 500 metres. Thicknesses can

vary but are typically three metres wide (ETW). This work is being

performed to understand the potential for an underground bulk

tonnage mining scenario, which would focus mining activities on the

high-grade structures and manto.

"The combined favorable grades, strike length,

vertical extent, and vein proximity, along with the manto’s size

and continuity, make the deposit attractive for underground bulk

mining," said Don Gray, Chief Operating Officer. "Our exploration

team’s careful attention while relogging the historic drill results

provided an alternative geologic model. Not only are ongoing

drilling and underground development work confirming this model,

but they are also validating our original decision to acquire

Pitarrilla. We are quite confident Pitarilla will create

significant shareholder value and prove to be Endeavour’s next

cornerstone asset."

The Company is also pleased to announce that SGS

Canada Inc., SGS Bateman, JDS Energy & Mining, T Engineering,

Stantec and SRK Consulting have been retained to begin preliminary

work on the project. This work will include the metallurgical

testing program with a comprehensive review of historical test

data, flowsheet evaluation, mine design, rock mechanics evaluation,

backfill testing and design, hydrology investigations, and tailing

storage facility design. The work will build on the SSR Mining’s

extensive previous work and will be used to advance the project to

the development stage, forming the basis for an economic study by

the end of 2025.

Figure 1. Pitarrilla Cross

Section

Cross section view of Manto Pitarrilla showing

various feeder structures, location of the underground ramp and

2024 drill traces

Figure 2. Plan View Map – Manto

Pitarrilla

Plan view of Manto Pitarrilla showing various

feeder structures, location of the underground ramp, underground

drill stations and 2024 underground drill holes

Table 1. Underground Diamond Drill

Results

|

Hole |

Structure |

From |

To |

Core Length |

True Width |

Ag |

Zn |

Pb |

Au |

Cu |

|

(m) |

(m) |

(m) |

(m) |

(gpt) |

(%) |

(%) |

(gpt) |

(%) |

|

BPU-001 |

Manto Pitarrilla |

169.65 |

171.80 |

2.15 |

1.38 |

11 |

7.54 |

0.03 |

0.01 |

0.01 |

|

Including |

171.25 |

171.80 |

0.55 |

0.35 |

14 |

13.15 |

0.04 |

0.01 |

0.01 |

|

Palmito |

171.80 |

173.30 |

1.50 |

0.96 |

44 |

15.20 |

0.23 |

0.27 |

0.01 |

|

Including |

172.70 |

173.30 |

0.60 |

0.39 |

81 |

17.60 |

0.45 |

0.49 |

0.01 |

|

Manto Pitarrilla Cont' |

173.30 |

229.90 |

56.60 |

37.21 |

64 |

5.72 |

0.23 |

0.04 |

0.17 |

|

Including |

227.60 |

228.35 |

0.75 |

0.70 |

715 |

7.02 |

0.57 |

0.04 |

2.64 |

|

Danna |

229.90 |

237.00 |

7.10 |

6.67 |

146 |

6.54 |

0.72 |

0.06 |

0.23 |

|

Including |

230.70 |

231.45 |

0.75 |

0.70 |

410 |

18.25 |

0.39 |

0.08 |

1.17 |

|

Manto Pitarrilla Cont' |

241.20 |

266.00 |

24.80 |

22.23 |

112 |

3.61 |

0.54 |

0.02 |

0.06 |

|

Including |

263.00 |

264.20 |

1.20 |

0.92 |

1,145 |

4.48 |

1.61 |

0.21 |

0.14 |

|

Victoria |

332.15 |

334.65 |

2.50 |

1.06 |

1,082 |

1.26 |

2.04 |

0.07 |

0.21 |

|

Including |

332.75 |

334.00 |

1.25 |

0.32 |

3,500 |

4.04 |

6.54 |

0.19 |

0.68 |

|

BPU-002 |

Manto Pitarrilla |

146.55 |

176.45 |

29.90 |

22.56 |

34 |

1.11 |

0.11 |

0.07 |

0.01 |

|

Including |

162.25 |

163.25 |

1.00 |

0.77 |

149 |

3.08 |

0.90 |

0.13 |

0.03 |

|

Palmito |

176.45 |

177.45 |

1.00 |

0.97 |

63 |

1.29 |

0.02 |

0.36 |

0.01 |

|

Including |

176.45 |

177.45 |

1.00 |

0.97 |

63 |

1.29 |

0.02 |

0.36 |

0.01 |

|

Manto Pitarrilla Cont' |

179.95 |

288.20 |

108.25 |

82.92 |

87 |

2.35 |

0.55 |

0.02 |

0.08 |

|

Including |

246.30 |

247.10 |

0.80 |

0.61 |

371 |

14.55 |

1.58 |

0.07 |

0.29 |

|

Danna |

290.10 |

292.10 |

2.00 |

1.73 |

559 |

4.72 |

1.44 |

0.45 |

0.12 |

|

Including |

290.10 |

291.15 |

1.05 |

0.91 |

686 |

3.96 |

1.16 |

0.25 |

0.11 |

|

Victoria |

298.50 |

299.60 |

1.10 |

1.03 |

521 |

1.51 |

4.17 |

0.19 |

0.06 |

|

Including |

299.10 |

299.60 |

0.50 |

0.47 |

699 |

1.89 |

5.19 |

0.23 |

0.09 |

|

Manto Pitarrilla Cont' |

299.60 |

337.75 |

38.15 |

25.94 |

241 |

1.91 |

0.92 |

0.04 |

0.18 |

|

Including |

327.95 |

329.35 |

1.40 |

0.90 |

2,020 |

3.96 |

5.74 |

0.04 |

1.58 |

|

Manto Pitarrilla Cont' |

349.60 |

364.35 |

14.75 |

9.07 |

162 |

2.04 |

1.09 |

0.03 |

0.22 |

|

Including |

353.40 |

353.70 |

0.30 |

0.19 |

1,175 |

7.75 |

11.70 |

0.38 |

0.26 |

|

BPU-003 |

Manto Pitarrilla |

227.50 |

237.40 |

9.90 |

9.30 |

50 |

5.25 |

0.46 |

0.01 |

0.02 |

|

Including |

236.60 |

237.40 |

0.80 |

0.75 |

104 |

14.45 |

1.28 |

0.01 |

0.03 |

|

Palmito |

237.40 |

239.00 |

1.60 |

1.50 |

83 |

15.34 |

0.88 |

0.01 |

0.03 |

|

Including |

238.40 |

239.00 |

0.60 |

0.56 |

100 |

17.90 |

1.06 |

0.01 |

0.05 |

|

Manto Pitarrilla Cont' |

239.00 |

257.65 |

18.65 |

17.53 |

35 |

5.80 |

0.27 |

0.01 |

0.01 |

|

Including |

254.80 |

255.80 |

1.00 |

0.94 |

18 |

14.75 |

0.03 |

0.01 |

0.01 |

|

Danna |

257.65 |

264.45 |

6.80 |

6.39 |

5 |

5.59 |

0.00 |

0.04 |

0.04 |

|

Including |

261.35 |

262.35 |

1.00 |

0.94 |

7 |

11.35 |

0.00 |

0.01 |

0.07 |

|

Manto Pitarrilla Cont' |

264.45 |

269.20 |

4.75 |

4.46 |

5 |

2.77 |

0.00 |

0.01 |

0.01 |

|

Manto Pitarrilla Cont' |

273.10 |

288.75 |

15.65 |

14.71 |

116 |

5.94 |

1.44 |

0.07 |

0.04 |

|

Including |

285.55 |

286.55 |

1.00 |

0.94 |

136 |

18.35 |

1.47 |

0.01 |

0.14 |

|

Manto Pitarrilla Cont' |

295.45 |

306.45 |

11.00 |

9.53 |

131 |

3.49 |

1.21 |

0.05 |

0.03 |

|

Including |

299.45 |

300.45 |

1.00 |

0.87 |

344 |

4.94 |

3.99 |

0.02 |

0.03 |

|

Manto Pitarrilla Cont' |

324.20 |

339.60 |

15.40 |

9.47 |

9 |

2.78 |

0.06 |

0.01 |

0.01 |

|

Including |

329.20 |

330.20 |

1.00 |

0.64 |

10 |

6.29 |

0.05 |

0.01 |

0.01 |

|

Manto Pitarrilla Cont' |

367.20 |

385.00 |

17.80 |

9.43 |

69 |

2.78 |

0.35 |

0.01 |

0.05 |

|

Including |

379.00 |

380.00 |

1.00 |

0.50 |

241 |

3.24 |

1.71 |

0.02 |

0.06 |

|

Manto Pitarrilla Cont' |

399.60 |

410.00 |

10.40 |

7.97 |

44 |

3.09 |

0.28 |

0.03 |

0.04 |

|

Including |

405.60 |

406.60 |

1.00 |

0.77 |

31 |

5.83 |

0.18 |

0.01 |

0.05 |

|

Manto Pitarrilla Cont' |

560.95 |

575.55 |

14.60 |

13.62 |

183 |

1.79 |

0.52 |

0.06 |

0.04 |

|

Including |

572.00 |

573.05 |

1.05 |

0.99 |

325 |

1.93 |

1.23 |

0.12 |

0.05 |

|

Victoria |

577.15 |

579.00 |

1.85 |

1.42 |

296 |

0.94 |

1.48 |

0.05 |

0.04 |

|

Including |

577.15 |

578.00 |

0.85 |

0.65 |

351 |

0.61 |

2.27 |

0.09 |

0.04 |

Note: No capping has been applied but high-grade

intervals have been highlighted. True width has been calculated

from interpreted sections

Table 2. Surface Diamond Drill

Results

|

Hole |

Structure |

From |

To |

Core Length |

True Width |

Ag |

Zn |

Pb |

Au |

Cu |

|

(m) |

(m) |

(m) |

(m) |

(gpt) |

(%) |

(%) |

(gpt) |

(%) |

|

BPD-495 |

Casas Blancas |

311.65 |

314.30 |

2.65 |

2.65 |

239 |

3.29 |

0.71 |

0.02 |

0.01 |

|

Including |

311.65 |

312.55 |

0.90 |

0.90 |

625 |

1.76 |

0.63 |

0.01 |

0.01 |

|

BPD-496 |

Casas Blancas |

354.25 |

356.10 |

1.85 |

1.72 |

124 |

6.00 |

0.58 |

0.13 |

0.03 |

|

Including |

355.30 |

355.80 |

0.50 |

0.46 |

161 |

9.99 |

0.62 |

0.25 |

0.05 |

|

BPD-497 |

Casas Blancas |

445.10 |

447.50 |

2.40 |

2.26 |

173 |

2.15 |

0.90 |

0.13 |

0.02 |

|

Including |

445.10 |

445.30 |

0.20 |

0.19 |

480 |

11.50 |

5.49 |

0.39 |

0.09 |

|

BPD-498 |

Casas Blancas |

382.60 |

384.15 |

1.55 |

1.27 |

55 |

3.74 |

0.18 |

0.02 |

0.01 |

|

Including |

383.45 |

384.15 |

0.70 |

0.57 |

113 |

6.98 |

0.22 |

0.05 |

0.02 |

|

BPD-499 |

Casas Blancas |

325.50 |

328.35 |

2.85 |

2.18 |

173 |

6.95 |

1.11 |

0.07 |

0.01 |

|

Including |

327.25 |

327.75 |

0.50 |

0.38 |

220 |

13.80 |

1.52 |

0.08 |

0.02 |

|

BPD-500 |

Casas Blancas |

388.00 |

389.50 |

1.50 |

0.96 |

156 |

2.41 |

0.43 |

0.06 |

0.02 |

|

Including |

388.00 |

388.75 |

0.75 |

0.48 |

298 |

4.45 |

0.82 |

0.08 |

0.03 |

Note: No capping has been applied but high-grade

intervals have been highlighted. True width has been calculated

from interpreted sections.

Figure 3. Peña Dyke

The Peña Dyke is locally mineralized (pre-manto)

and has a rhyolitic composition

Table 3. Peña Dyke Channel Sample

Results

|

Channel |

Channel Length |

Ag |

Zn |

Pb |

Au |

Cu |

|

(gpt) |

(%) |

(%) |

(gpt) |

(%) |

|

1 |

6.60 |

147 |

1.47 |

1.24 |

0.06 |

0.16 |

|

2 |

4.80 |

309 |

1.99 |

2.56 |

0.17 |

0.49 |

|

3 |

4.20 |

562 |

2.52 |

5.34 |

0.07 |

0.78 |

|

4 |

3.85 |

511 |

4.54 |

3.03 |

0.09 |

1.71 |

|

5 |

3.95 |

351 |

4.18 |

1.06 |

0.23 |

1.58 |

|

6 |

4.10 |

366 |

3.40 |

2.60 |

0.16 |

0.53 |

|

7 |

5.10 |

350 |

3.28 |

3.08 |

0.14 |

0.28 |

|

8 |

4.90 |

229 |

2.55 |

1.60 |

0.10 |

0.21 |

|

9 |

5.35 |

210 |

2.82 |

1.24 |

0.06 |

0.16 |

|

Avg |

4.76 |

319 |

2.85 |

2.32 |

0.12 |

0.58 |

|

|

|

|

|

|

|

|

|

Channel |

Channel Length |

Ag |

Zn |

Pb |

Au |

Cu |

|

(gpt) |

(%) |

(%) |

(gpt) |

(%) |

|

A |

5.35 |

424 |

2.16 |

4.89 |

0.09 |

0.24 |

|

B |

5.65 |

137 |

3.31 |

0.44 |

0.04 |

0.46 |

|

C |

4.70 |

127 |

3.35 |

0.68 |

0.03 |

0.24 |

|

D |

4.35 |

155 |

3.45 |

0.69 |

0.04 |

0.41 |

|

E |

4.25 |

79 |

4.32 |

0.52 |

0.03 |

0.17 |

|

F |

3.60 |

351 |

3.21 |

2.65 |

0.03 |

0.81 |

|

G |

3.70 |

328 |

4.62 |

2.31 |

0.03 |

0.69 |

|

Avg |

4.51 |

225 |

3.42 |

1.75 |

0.05 |

0.41 |

|

|

|

|

|

|

|

|

Note: No capping has been applied but high-grade

intervals have been highlighted. True width has been calculated

from interpreted sections.

Longitudinal sections identifying the

mineralized horizons of the outline veins are available here with

historical and current drill holes.

Pitarrilla is a large undeveloped silver, lead,

and zinc project located 160 kilometres north of Durango City, in

northern Mexico. The project is within the Municipality of Santa

María del Oro and Indé on the eastern flank of the Sierra Madre

Occidental mountain range. The property comprises 4,950 hectares

across five concessions and has significant infrastructure in place

with direct access to utilities. A significant resource has been

defined with over 225,000 metres of exploration drilling incurred

to date. A number of key permits are already in place for

underground mining and development, including permits for water use

and discharge, general use of explosives, change use of soil, as

well as underground mining and development which are permitted

under an Environmental Impact Statement.

About Endeavour Silver

Endeavour is a mid-tier precious metals company

with a strong commitment to sustainable and responsible mining

practices. With operations in Mexico and the development of the new

cornerstone mine in Jalisco state, the company aims to contribute

positively to the mining industry and the communities in which it

operates. In addition, Endeavour has a portfolio of exploration

projects in Mexico, Chile and the United States to facilitate its

goal to become a premier senior silver producer.

Quality Assurance / Quality

Control

Drill core samples were shipped to ALS Limited

in Zacatecas, Mexico for sample preparation and then for analysis

at the ALS laboratory in North Vancouver and rock samples were

shipped to SGS Lab in Durango, Mexico for sample preparation and

analysis. The ALS Zacatecas, North Vancouver facilities and SGS lab

are ISO 9001 and/or ISO/IEC 17025 certified. Silver and base metals

were analyzed using a four-acid digestion with an ICP-AES / ICP-OES

finish and gold was assayed by 30-gram fire assay with atomic

absorption (“AA”) spectroscopy finish. Over limit analyses for

silver were re-assayed by 30-gram fire assay and gravimetric finish

and for lead and zinc re-assayed using an ore-grade four-acid

digestion with ICP-AES / ICP-OES finish.

Control samples comprising certified reference

samples, duplicates and blank samples were systematically inserted

into the sample stream and analyzed as part of the Company’s

quality assurance / quality control protocol.

Qualified Person

Dale Mah, P.Geo., Vice President Corporate

Development, a qualified person under NI 43-101, has approved the

scientific and technical information contained in this news

release.

Contact Information Allison

Pettit Director, Investor Relations Email: apettit@edrsilver.com

Website: www.edrsilver.com Follow Endeavour Silver on Facebook, X,

Instagram and LinkedIn

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the United States private

securities litigation reform act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding the anticipated

work program at Pitarrilla, a future economic study at Pitarrilla,

Pitarrilla’s potential to create shareholder value, and the timing

and results of various activities. The Company does not intend to

and does not assume any obligation to update such forward-looking

statements or information, other than as required by applicable

law.

Forward-looking statements or information

involve known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, production

levels, performance or achievements of Endeavour and its operations

to be materially different from those expressed or implied by such

statements. Such factors include but are not limited to changes in

production and costs guidance; the reliability of Mineral Resource

Estimates; results of the work program at Pitarrilla; the ongoing

effects of inflation and supply chain issues on mine economics;

national and local governments’ legislation, taxation, controls,

regulations and political or economic developments in Canada and

Mexico; financial risks due to precious metals prices; operating or

technical difficulties in mineral exploration, development and

mining activities; risks and hazards of mineral exploration,

development and mining; the speculative nature of mineral

exploration and development; risks in obtaining necessary licenses

and permits; fluctuations in the prices of silver and gold,

fluctuations in the currency markets (particularly the Mexican

peso, Chilean peso, Canadian dollar and U.S. dollar); and

challenges to the Company’s title to properties; as well as those

factors described in the section “risk factors” contained in the

Company’s most recent form 40F/Annual Information Form filed with

the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on

assumptions management believes to be reasonable, including but not

limited to: the continued operation of the Company’s mining

operations, no material adverse change in the market price of

commodities, the reliability of Mineral Resource Estimates;

anticipated results of the work program at Pitarrilla, mining

operations will operate and the mining products will be completed

in accordance with management’s expectations and achieve their

stated production outcomes, and such other assumptions and factors

as set out herein. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

information, there may be other factors that cause results to be

materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any

forward-looking statements or information will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements or information. Accordingly,

readers should not place undue reliance on forward-looking

statements or information.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/200f59e6-0265-43b8-ae53-f842e9848035

https://www.globenewswire.com/NewsRoom/AttachmentNg/fbd3032a-3c60-434b-8b28-f5c93e2f864b

https://www.globenewswire.com/NewsRoom/AttachmentNg/261ed65c-5c33-4783-8ea2-ae9b69af5f5b

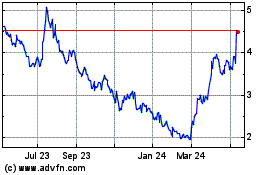

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Nov 2024 to Dec 2024

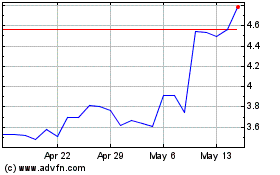

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Dec 2023 to Dec 2024