false000094414800009441482024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

November 1, 2024

Date of Report (Date of earliest event reported)

CBIZ, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-32961 | | 22-2769024 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

5959 Rockside Woods, Blvd. N. Suite 600

Independence, Ohio 44131

(Address of principal executive offices, including zip code)

216-447-9000

(Registrant's telephone number, including area code)

Note Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

On which registered |

| Common Stock, $0.01 par value | | CBZ | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On November 1, 2024, CBIZ, Inc. (the "Company") filed a Current Report on Form 8-K (the "Original Form 8-K") to report the completion (the "Closing") of the Merger (defined below) consummated in connection with the Agreement and Plan of Merger (the “Merger Agreement”), dated July 30, 2024, with Marcum LLP, a New York registered limited liability partnership (“Marcum”), Marcum Advisory Group LLC, a Delaware limited liability company and wholly owned subsidiary of Marcum (“MAG”), PMMS LLC, a Delaware limited liability company and a wholly owned subsidiary of the Company (“Merger Sub”), and Marcum Partners SPV LLC, a Delaware limited liability company (the “Owner Representative”).

Under the terms of the Merger Agreement, at the closing, Merger Sub merged with and into MAG, with MAG continuing as the surviving entity and as a wholly owned subsidiary of the Company (the “Merger”). Prior to the closing of the Merger, Marcum contributed substantially all of its non-attest business assets to MAG, subject to certain exclusions, and MAG assumed certain Marcum liabilities. In a separate transaction, CBIZ CPAs P.C., previously known as Mayer Hoffman McCann P.C., a national independent certified public accounting firm with which the Company has an existing Administrative Services Agreement, purchased from Marcum substantially all of Marcum’s attest business assets, subject to certain exclusions.

As permitted under Item 9.01 of Form 8-K, this Amendment No.1 to the Current Report on Form 8-K ("Amendment No.1") amends and supplements the Original Form 8-K solely to provide the unaudited pro forma combined financial information required under Item 9.01 of Form 8-K within 71 calendar days after the date on which the Original Form 8-K was required to be filed.

Item 9.01 Financial Statements and Exhibits

(b) Pro forma financial information.

The unaudited pro forma condensed combined financial information of the Company required to be filed in connection with the acquistion described in Item 2.01 in the Original Form 8-K is filed as Exhibit 99.1 to this Amendment No. 1 and incorporated by reference herein.

(d) Exhibits

99.1 Unaudited Pro Forma Condensed Combined Financial Information of the Company 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 5, 2024

CBIZ, Inc.

| | | | | | | | |

| By: | | /s/ Jaileah X. Huddleston |

| Name: | | Jaileah X. Huddleston |

| Title: | | Senior Vice President, Chief Legal Officer, and Corporate Secretary |

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Introduction

As previously disclosed, on July 30, 2024, CBIZ, Inc. (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Marcum LLP, a New York registered limited liability partnership (“Marcum”), Marcum Advisory Group LLC, a Delaware limited liability company and wholly owned subsidiary of Marcum (“MAG”), PMMS LLC, a Delaware limited liability company and a wholly owned subsidiary of the Company (“Merger Sub”), and Marcum Partners SPV LLC, a Delaware limited liability company (the “Owner Representative”). The transactions contemplated by the Merger Agreement were consummated on November 1, 2024.

Under the terms of the Merger Agreement, at the closing, Merger Sub merged with and into MAG, with MAG continuing as the surviving entity and as a wholly owned subsidiary of the Company (the “Merger”). Prior to the closing of the Merger, Marcum contributed substantially all of its non-attest business assets to MAG, subject to certain exclusions, and MAG assumed certain Marcum liabilities. In a separate transaction, CBIZ CPAs P.C., previously known as Mayer Hoffman McCann P.C., a national independent certified public accounting firm with which the Company has an existing Administrative Services Agreement, purchased from Marcum substantially all of Marcum’s attest business assets, subject to certain exclusions (the "Attest Purchase"). The Merger and the transactions contemplated by the Merger Agreement are referred to herein as the “Transaction.”

The following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X.

The unaudited pro forma condensed combined balance sheet as of June 30, 2024 gives effect to the Transaction (including the Merger and the Attest Purchase) and the Debt Financing, as if those transactions had been completed on June 30, 2024 and combines the unaudited consolidated balance sheet of the Company as of June 30, 2024 with Marcum’s unaudited consolidated balance sheet as of June 30, 2024.

The unaudited pro forma condensed combined statements of income for the six months ended June 30, 2024 and the twelve months ended December 31, 2023 give effect to the Transaction and the Debt Financing (as defined below), as if those transactions had occurred on January 1, 2023, the first day of the Company’s fiscal year 2023 and combines the historical results of the Company and Marcum. The unaudited pro forma condensed combined statements of income for the twelve months ended December 31, 2023 combines the audited consolidated statements of income of the Company for the twelve months ended December 31, 2023 and Marcum’s audited consolidated statements of income for the twelve months ended December 31, 2023. The unaudited pro forma condensed combined statements of income for the six months ended June 30, 2024 combines the unaudited consolidated statements of income of the Company for the six months ended June 30, 2024 with Marcum’s unaudited consolidated statements of income for the six months ended June 30, 2024.

The historical financial statements of the Company and Marcum have been adjusted in the accompanying unaudited pro forma condensed combined financial information to give effect to pro forma events that constitute accounting adjustments, which are necessary to account for the Transaction, and the Debt Financing, in accordance with U.S. GAAP. The unaudited pro forma adjustments are based upon available information and certain assumptions that the Company management believes are reasonable.

The unaudited pro forma condensed combined financial information should be read in conjunction with:

●The accompanying notes to the unaudited pro forma condensed combined financial information;

●The separate audited financial statements of the Company as of and for the twelve months ended December 31, 2023 and the related notes, included in the Company’s Annual Report on Form 10-K for the twelve months ended December 31, 2023, filed with Securities and Exchange Commission ("SEC") on February 23, 2024;

●The separate unaudited interim financial statements of the Company as of and for the six months ended June 30, 2024 and the related notes, included in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024 filed with SEC on August 1, 2024;

●The separate audited financial statements of Marcum as of and for the year ended December 31, 2023 and the related notes, filed as Exhibit 99.2 to the Form 8-K filed with SEC on November 1, 2024; and

●The separate unaudited financial statements of Marcum as of and for the six months ended June 30, 2024 and the related notes, filed as Exhibit 99.3 to the Form 8-K filed with SEC on November 1, 2024.

Description of the Transaction

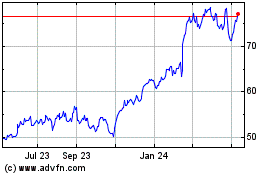

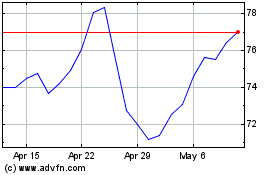

Subject to the terms of the Merger Agreement, the aggregate consideration paid by the Company in connection with the Transaction is approximately $2.2 billion, on a cash-free and debt-free basis and subject to calculation and adjustments as provided in the Merger Agreement, of which approximately $1.1 billion, was paid in cash and the remainder will be paid in approximately 14.3 million shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) (based on $76.84 per share as specified in the Merger Agreement, which was the 30-day volume weighted average price of our Common Stock as of three business days prior to the date of the Merger Agreement) (the “Stock Consideration”).

The Stock Consideration will be delivered as follows: (i) 5% of the total shares will be subject to continued service requirements and, subject to satisfaction of those requirements, will be delivered on the fourth anniversary of the closing (the “Performance Shares”); (ii) 20% of the total shares will be delivered on January 2, 2025; and (iii) 75% of the total shares will be delivered in 36 equal monthly installments, commencing on January 2, 2025.

Description of the Debt Financing

On November 1, 2024, the Company entered into a Credit Agreement (the “Credit Agreement”) with Bank of America, as administrative agent, and the lenders named therein. Pursuant to the Credit Agreement, the lenders provided for senior secured credit facilities (the “Credit Facilities”) in an aggregate principal amount of $2.0 billion, consisting of a five-year senior secured term loan facility (“Term Facility”) in an aggregate principal amount equal to $1.4 billion and a $600 million five-year senior secured revolving credit facility (“Revolving Facility”). The Credit Facilities bear interest based on Term SOFR plus an Applicable Margin determined by the Company’s Total Net Leverage Ratio, which is initially 2.25% at closing. The Company drew on the Term Facility in its entirety at close of the Transaction, with the remaining funding drawn through the Revolving Facility. For purposes of the unaudited pro forma condensed combined financial information, the amount drawn on the Revolving Facility is estimated to be $124.4 million, but the actual amount drawn may differ based on the Company’s financial position at the closing date. The Company used the proceeds of the Credit Facilities to (i) pay the cash consideration in the Transaction, including payment for certain indebtedness of Marcum, (ii) pay transaction costs, which include financial advisory fees and other professional fees and (iii) settle the Company’s historical Bank debt (the "Debt Financing").

Accounting for the Transaction

The Transaction is being accounted for using the acquisition method of accounting in accordance with Accounting Standards Codification (ASC) 805—Business Combinations, which we refer to as “ASC 805”. The Company’s management has evaluated the guidance contained in ASC 805 with respect to the identification of the acquirer in the Transaction and concluded, based on a consideration of the pertinent facts and circumstances, that the Company is the acquirer for financial accounting purposes. Accordingly, the Company’s cost to acquire Marcum has been allocated to the Company’s acquired assets and liabilities based upon their estimated fair values. The allocation of the Transaction consideration is estimated and is dependent upon estimates of certain valuations that are subject to change. Any differences between the estimated fair value of the consideration transferred and the estimated fair value of the assets acquired and liabilities assumed will be recorded as an adjustment to goodwill. The allocation of the aggregate Transaction consideration and related adjustments reflected in this unaudited pro forma condensed combined financial information are preliminary and subject to revision based on a final determination of fair value. Refer to Note 1—Basis of Presentation for more information.

The unaudited pro forma condensed combined financial information has been prepared for illustrative purposes only and is not necessarily indicative of what the combined company’s financial position or results of operations would have been had the Transaction occurred as of the dates indicated. The unaudited pro forma condensed combined financial information also should not be considered indicative of the future results of operations or financial position of the Company.

The Merger is subject to closing adjustments that have not yet been finalized. The pro forma adjustments are preliminary and have been made solely for the purpose of providing unaudited pro form condensed combined financial information as required by SEC rules. Differences between these preliminary estimates and the final business combination accounting may be material.

CBIZ, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

As of June 30, 2024

(In thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CBIZ Inc.

Historical as of June 30, 2024 | | Marcum LLP

Historical & Reclassed as of June 30, 2024 (Note 2) | | Transaction Accounting Adjustments | | Note | | Debt Financing Adjustments | | Note | | Pro Forma Combined |

| ASSETS | | | | | | | | | | | | | |

| Current Assets: | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 1,128 | | $ | 5,946 | | $ | (1,122,443) | | 4(a) | | $ | 1,122,443 | | 5(a) | | $ | 7,074 |

| Restricted cash | 44,947 | | — | | — | | | | — | | | | 44,947 |

| Accounts receivable, net | 477,841 | | 289,592 | | (24,346) | | 4(b) | | — | | | | 743,087 |

| Other current assets | 38,892 | | 34,985 | | 6,000 | | 4(c) | | — | | | | 79,877 |

Current assets before funds held for clients | 562,808 | | 330,523 | | (1,140,789) | | | | 1,122,443 | | | | 874,985 |

| Funds held for clients | 131,128 | | — | | — | | | | — | | | | 131,128 |

| Total current assets | 693,936 | | 330,523 | | (1,140,789) | | | | 1,122,443 | | | | 1,006,113 |

| Non-current assets: | | | | | | | | | | | | | |

| Property and equipment, net | 56,667 | | 26,979 | | 5,570 | | 4(d) | | — | | | | 89,216 |

| Goodwill and other intangible assets, net | 1,035,148 | | 312,132 | | 1,529,887 | | 4(e) | | — | | | | 2,877,167 |

| Assets of deferred compensation plan | 162,133 | | — | | — | | | | — | | | | 162,133 |

| Right-of-use assets, net | 203,972 | | 147,915 | | (5,570) | | 4(d) | | — | | | | 346,317 |

| Other non-current assets | 8,949 | | 3,876 | | 12,000 | | 4(f) | | — | | | | 24,825 |

| Total non-current assets | 1,466,869 | | 490,902 | | 1,541,887 | | | | — | | | | 3,499,658 |

| Total assets | $ | 2,160,805 | | $ | 821,425 | | $ | 401,098 | | | | $ | 1,122,443 | | | | $ | 4,505,771 |

| LIABILITIES | | | | | | | | | | | | | |

| Current Liabilities: | | | | | | | | | | | | | |

| Accounts payable | $ | 109,253 | | $ | 12,294 | | $ | (4,019) | | 4(g) | | $ | — | | | | $ | 117,528 |

| Income taxes payable | 7,374 | | — | | — | | | | — | | | | 7,374 |

| Accrued personnel costs | 95,267 | | 29,536 | | 22,478 | | 4(h) | | — | | | | 147,281 |

| Contingent purchase price liabilities | 54,780 | | 66,910 | | (29,766) | | 4(i) | | — | | | | 91,924 |

| Operating lease liabilities | 38,077 | | 25,007 | | (1,680) | | 4(j) | | — | | | | 61,404 |

| Other current liabilities | 31,389 | | 75,103 | | (27,294) | | 4(k) | | 70,000 | | 5(b) | | 149,198 |

Current liabilities before client fund obligations | 336,140 | | 208,850 | | (40,281) | | | | 70,000 | | | | 574,709 |

| Client fund obligations | 131,623 | | — | | — | | | | — | | | | 131,623 |

| Total current liabilities | 467,763 | | 208,850 | | (40,281) | | | | 70,000 | | | | 706,332 |

| Non-current liabilities: | | | | | | | | | | | | | |

| Bank debt | 381,000 | | 112,496 | | (112,496) | | 4(m) | | 1,073,449 | | 5(c) | | 1,454,449 |

| Debt issuance costs | (1,340) | | (294) | | 294 | | 4(m) | | (21,006) | | 5(c) | | (22,346) |

Total long-term debt, net | 379,660 | | 112,202 | | (112,202) | | | | 1,052,443 | | | | 1,432,103 |

| Income taxes payable | 2,149 | | — | | — | | | | — | | | | 2,149 |

| Deferred income taxes, net | 32,726 | | — | | — | | | | — | | | | 32,726 |

| Deferred compensation plan obligations | 162,133 | | — | | — | | | | — | | | | 162,133 |

| Contingent purchase price liabilities | 29,059 | | 88,919 | | (74,813) | | 4(i) | | — | | | | 43,165 |

| Lease liabilities | 194,704 | | 140,899 | | (3,890) | | 4(n) | | — | | | | 331,713 |

| Other non-current liabilities | 1,177 | | 328,468 | | (328,468) | | 4(l) | | — | | | | 1,177 |

| Total non-current liabilities | 801,608 | | 670,488 | | (519,373) | | | | 1,052,443 | | | | 2,005,166 |

| Total liabilities | 1,269,371 | | 879,338 | | (559,654) | | | | 1,122,443 | | | | 2,711,498 |

| STOCKHOLDERS' EQUITY | | | | | | | | | | | | | |

| Common Stock | 1,379 | | — | | — | | | | — | | | | 1,379 |

| Additional paid in capital | 845,962 | | 83,948 | | 850,752 | | 4(o) | | — | | | | 1,780,662 |

| Retained earnings | 951,761 | | (154,644) | | 122,783 | | 4(o) | | — | | | | 919,900 |

| Treasury stock | (910,322) | | — | | — | | | | — | | | | (910,322) |

| Accumulated other comprehensive income | 2,654 | | 12,783 | | (12,783) | | 4(o) | | — | | | | 2,654 |

| Total stockholders’ equity | 891,434 | | (57,913) | | 960,752 | | | | — | | | | 1,794,273 |

| Total liabilities and stockholders’ equity | $ | 2,160,805 | | $ | 821,425 | | $ | 401,098 | | | | $ | 1,122,443 | | | | $ | 4,505,771 |

See the accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

CBIZ, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

For The Six Months Ended June 30, 2024

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | CBIZ Inc.

Historical Six Months Ended June 30, 2024 | | Marcum LLP

Historical & Reclassed Six Months Ended June 30, 2024 (Note 2) | | Transaction Accounting Adjustments | | Note | | Debt Financing Adjustments | |

Note | |

Proforma Combined |

| Revenue | | $ | 914,309 | |

| $ | 662,257 | | $ | (24,346) | | | 4(p) | | — | | | | | $ | 1,552,220 | |

| Operating expenses | | 742,853 | |

| 318,423 | | 181,095 | | | 4(q) | | — | | | | | 1,242,371 | |

| Gross margin | | 171,456 | | | 343,834 | | | (205,441) | | | | | — | | | | | 309,849 | |

| Corporate general and administrative expenses | | 40,761 | |

| 26,723 | | 3,000 | | | 4(r) | | — | | | | | 70,484 | |

| Operating income | | 130,695 | | | 317,111 | | | (208,441) | | | | | — | | | | | 239,365 | |

| Other (expense) income: | | |

|

| | | | | | | | | | |

| Interest expense | | (10,395) | |

| (5,426) | | 4,535 | | | 4(s) | | (41,740) | | | 5(d) | | (53,026) | |

| Other income, net | | 11,907 | |

| 2,963 | | — | | | | | — | | | | | 14,870 | |

Total other income (expense), net | | 1,512 | | | (2,463) | | | 4,535 | | | | | (41,740) | | | | | (38,156) | |

| Income before income tax expense | | 132,207 | | | 314,648 | | | (203,906) | | | | | (41,740) | | | | | 201,209 | |

| Income tax expense | | 35,530 | |

| — | | 31,308 | | | 4(t) | | (11,800) | | | | | 55,038 | |

| Net Income | | $ | 96,677 | | | $ | 314,648 | | | $ | (235,214) | | | | | $ | (29,940) | | | | | $ | 146,171 | |

| Earnings Per Share: | | |

| |

|

|

| |

| |

|

|

|

|

Basic | | $ | 1.93 | |

|

|

|

|

|

|

|

|

| 4(u) |

| $ | 2.30 | |

Diluted | | $ | 1.92 | |

| |

|

|

|

|

| |

| 4(u) |

| $ | 2.29 | |

| Basic weighted average shares outstanding | |

50,079 |

|

|

| | | | | |

| 4(u) |

| 63,627 |

| Diluted weighted average shares outstanding | |

50,248 |

| |

| |

|

|

|

|

| 4(u) |

| 63,894 |

See the accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information.

CBIZ, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

For the Year Ended December 31, 2023

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | CBIZ Inc.

Historical Year Ended December 31, 2023 | | Marcum LLP

Historical & Reclassed Year Ended December 31, 2023 (Note 2) | | Transaction Accounting Adjustments | | Note | | Debt Financing Adjustments | |

Note | |

Proforma Combined |

| Revenue | | $ | 1,591,194 |

| $ | 1,119,252 | | $ | (11,618) | | 4(p) | | — | | | | $ | 2,698,828 |

| Operating expenses | | 1,367,990 |

| 658,509 | | 312,075 | | 4(q) | | — | | | | 2,338,574 |

| Gross margin | | 223,204 | | 460,743 | | (323,693) | | | | — | | | | 360,254 |

| Corporate general and administrative expenses | | 57,965 |

| 53,006 | | 37,861 | | 4(r) | | — | | | | 148,832 |

| Operating income | | 165,239 | | 407,737 | | (361,554) | | | | — | | | | 211,422 |

| Other (expense) income: | | |

|

| | | | | | | | | | |

| Interest expense | | (20,131) |

| (14,561) | | 12,108 | | 4(s) | | (87,771) | | 5(d) | | (110,355) |

| Gain on sale of operations, net | | 176 |

| — | | — | | | | — | | | | 176 |

| Other income (expense), net | | 21,019 |

| (3,363) | | — | | | | — | | | | 17,656 |

Total other income (expense), net | | 1,064 | | (17,924) | | 12,108 | | | | (87,771) | | | | (92,523) |

| Income before income tax expense | | 166,303 | | 389,813 | | (349,446) | | | | (87,771) | | | | 118,899 |

| Income tax expense | | 45,335 |

| — | | 11,412 | | 4(t) | | (24,814) | | | | 31,933 |

| Net Income | | $ | 120,968 | | $ | 389,813 | | $ | (360,858) | | | | $ | (62,957) | | | | $ | 86,966 |

| Earnings Per Share: | | |

| |

|

|

| |

| |

|

|

|

|

Basic | | $ | 2.42 | |

|

|

|

|

|

|

|

|

| 4(u) |

| $ | 1.37 |

Diluted | | $ | 2.39 | |

| |

| |

|

|

| |

| 4(u) |

| $ | 1.36 |

| Basic weighted average shares outstanding | |

49,989 |

|

|

| |

|

|

| |

| 4(u) |

| 63,537 |

| Diluted weighted average shares outstanding | |

50,557 |

| |

| |

|

|

| |

| 4(u) |

| 63,715 |

See the accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information.

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Note 1 - Basis of Presentation

The unaudited pro forma condensed combined financial information has been prepared by the Company in accordance with Article 11 of Regulation S-X to reflect the Merger, the Attest Purchase and the Debt Financing. As a result of the pre-existing ASA arrangement the Company has with CBIZ CPAs, the Company bears certain economic risks of CBIZ CPAs, and therefore CBIZ CPAs qualifies as a variable interest entity for which the Company is the primary beneficiary. Therefore, for purposes of the unaudited pro forma condensed combined financial information, the Attest Purchase is reflected in conjunction with the purchase of the non-attest business of Marcum, and together with the Merger and the Debt Financing, will be referred to herein as the “Transaction.”

The unaudited pro forma condensed combined financial information presented is for illustrative purposes only and is not necessarily indicative of what the Company’s condensed combined statements of income or condensed combined balance sheet would have been had the Transaction been consummated as of the dates indicated or will be for any future periods. The unaudited proforma condensed combined financial information does not purport to project the future financial position or results of operations of the Company following the closing of the Transaction. The pro forma condensed combined financial information reflects transaction accounting adjustments the Company believes are necessary to present fairly the Company’s unaudited pro forma financial position and results of operations following the closing as of and for the periods indicated. The unaudited pro forma condensed combined financial information does not reflect any cost savings, operating synergies, or revenue enhancements that the combined company may achieve as a result of the Transaction, nor does it reflect the costs to integrate the operations of the Company and Marcum or the costs necessary to achieve any cost savings, operating synergies, and revenue enhancements.

The unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting in accordance with ASC 805, with the Company as the accounting acquirer, using the fair value concepts defined in ASC Topic 820, Fair Value Measurement, and based on the historical consolidated financial statements of the Company and Marcum. Under ASC 805, all assets acquired and liabilities assumed in a business combination are recognized and measured at their assumed acquisition date fair value, while transaction costs associated with the business combination are expensed as incurred. The excess of Transaction consideration over the estimated fair value of assets acquired and liabilities assumed, if any, is allocated to goodwill.

The allocation of the aggregate Transaction consideration depends upon certain estimates and assumptions, all of which are preliminary. The allocation of the aggregate Transaction consideration has been made for the purpose of developing the unaudited proforma condensed combined financial information. The final determination of fair values of assets acquired and liabilities assumed relating to the Transaction could differ materially from the preliminary allocation of aggregate Transaction consideration.

The transaction accounting adjustments represent the Company’s best estimates and are based upon currently available information and certain assumptions that the Company believes are reasonable under the circumstances. The Company is not aware of any material transactions between the Company and Marcum (prior to the announcement of the Transaction) during the periods presented. Accordingly, adjustments to eliminate transactions between the Company and Marcum have not been reflected in the unaudited proforma condensed combined financial information.

The Company has commenced a preliminary review of Marcum’s accounting policies to determine if differences in accounting policies and account classifications require reclassification of results operations or reclassification of assets and liabilities to conform to the Company’s accounting policies and classifications. The accounting policies followed in preparing the unaudited pro forma condensed combined financial information reflect the adjustments known at this time to conform Marcum’s historical financial information to the Company’s significant accounting policies described in the Transaction Accounting Adjustments in Note 4(b) and 4(p) below.

The Company may identify additional differences between the accounting policies of the two companies, which when conformed, could have a material impact on the unaudited pro forma condensed combined financial information. In addition, as discussed in Note 2, certain reclassification adjustments have been made to conform Marcum’s historical financial statement presentation to the Company’s historical financial statement presentation.

Note 2 - Reclassification and Perimeter Adjustments

During the preparation of this unaudited pro forma condensed combined financial information, the Company management performed a preliminary analysis of Marcum’s financial information to identify differences in financial statement presentation as compared to the presentation of the Company. With the information currently available, the Company has made reclassification adjustments to conform Marcum’s historical financial statement presentation to the Company’s historical financial statement presentation. Following

the Transaction, the combined company will finalize the review of its financial statement presentation, which could be materially different from the amounts set forth in the unaudited pro forma condensed combined financial information presented herein.

Additionally, the historical financial information of Marcum has been adjusted to remove the net assets and operations of certain Excluded Subsidiaries (as defined in the Merger Agreement) that are not being acquired or assumed as part of the Transaction. As such, the following unaudited pro forma condensed combined balance sheet adjustments reflect the elimination of the assets and liabilities attributable to the Excluded Subsidiaries, and the following unaudited pro forma condensed combined statements of income adjustments reflect the elimination of the direct revenues and expenses related to the Excluded Subsidiaries. The pro forma adjustments related to the deal perimeter are preliminary and are based upon currently available information and expectations as it relates to the deal perimeter. Actual results may differ materially from the assumptions within the accompanying unaudited pro forma condensed combined financial information.

Refer to the table below for a summary of reclassification and perimeter adjustments made to present Marcum’s balance sheet as of June 30, 2024 to conform with that of the Company (in thousands):

| | | | | | | | | | | | | | | | | | | | |

Marcum LLP Historical Condensed Consolidated Balance Sheet Line Items | CBIZ Inc. Historical Condensed Consolidated Balance Sheet Line Items | Marcum LLP Historical Consolidated Balances as of June 30, 2024 |

Reclassification |

Note |

Perimeter Adjustment |

Marcum LLP Adjusted as of June 30, 2024 |

| Cash and cash equivalents | Cash and cash equivalents | $ | 15,279 | $ | — | | | $ | (9,333) | | $ | 5,946 |

| Fees receivable, net | Accounts receivable, net | $ | 161,441 | $ | 134,211 | | (a) | $ | (6,060) | | $ | 289,592 |

| Unbilled fees, net | | $ | 134,211 | $ | (134,211) | (a) | $ | — | $ | — |

| Prepaid expenses and other current assets | Other current assets | $ | 34,985 | $ | — | | $ | — | $ | 34,985 |

| Property and equipment, net | Property and equipment, net | $ | 28,334 | $ | — | | $ | (1,355) | $ | 26,979 |

| Goodwill and other intangible assets, net | $ | — | $ | 348,405 | | (b) | $ | (36,273) | | $ | 312,132 |

| Goodwill | | $ | 268,109 | $ | (268,109) | (b) | $ | — | $ | — |

| Intangible assets, net | | $ | 80,296 | $ | (80,296) | (b) | $ | — | $ | — |

| Right of use asset - Operating leases, net | Right-of-use assets, net | $ | 146,616 | $ | 5,570 | (c) | $ | (4,271) | $ | 147,915 |

| Right of use asset - Finance leases, net | | $ | 5,570 | $ | (5,570) | (c) | $ | — | $ | — |

| Other assets | Other non-current assets | $ | 5,372 | $ | — | | $ | (1,496) | $ | 3,876 |

| Accounts payable | $ | — | $ | 12,294 | (d) | $ | — | $ | 12,294 |

| Accrued personnel costs | $ | — | $ | 29,536 | (e) | $ | — | $ | 29,536 |

| Other current liabilities | $ | — | $ | 75,333 | (f) | $ | (230) | $ | 75,103 |

| Accounts payable and accrued expenses | | $ | 58,136 | $ | (58,136) | (d) (e) (f) | $ | — | $ | — |

| Deferred revenue | | $ | 33,220 | $ | (33,220) | (f) | $ | — | $ | — |

| Current portion of contingent liabilities | Contingent purchase price liabilities | $ | 66,910 | $ | — | | $ | — | $ | 66,910 |

| Current portion of projected benefit obligation | | $ | 9,098 | $ | (9,098) | (f) | $ | — | $ | — |

| Current portion of operating lease liability | Operating lease liabilities | $ | 25,637 | $ | 1,680 | (g) | $ | (2,310) | $ | 25,007 |

| Current portion of finance lease liability | | $ | 1,680 | $ | (1,680) | (g) | $ | — | $ | — |

| Current portion of notes payable | | $ | 16,709 | $ | (16,709) | (f) | $ | — | $ | — |

| Contingent liabilities, net of current portion | Contingent purchase price liabilities | $ | 112,349 | $ | — | | $ | (23,430) | $ | 88,919 |

| Projected benefit obligation, net of current portion | | $ | 328,468 | $ | (328,468) | (h) | $ | — | $ | — |

| Operating lease liability, net of current portion | Lease liabilities | $ | 139,124 | $ | 3,890 | (i) | $ | (2,115) | $ | 140,899 |

| Bank debt | $ | — | $ | 112,496 | (j) | $ | — | $ | 112,496 |

| Revolving credit facility | | $ | 64,000 | $ | (64,000) | (j) | $ | — | $ | — |

| Other non-current liabilities | $ | — | $ | 328,468 | (h) | $ | — | $ | 328,468 |

| | | | | | | | | | | | | | | | | | | | |

| Finance lease liability, net of current portion | | $ | 3,890 | $ | (3,890) | (i) | $ | — | $ | — |

| Debt issuance costs | $ | — | $ | (294) | (k) | $ | — | $ | (294) |

| Notes payable, net of debt issuance costs, less current portion | | $ | 48,202 | $ | (48,202) | (j) (k) | $ | — | $ | — |

| Non-controlling interests | Additional paid in capital | $ | 12,771 | $ | 110,643 | (l) | $ | (39,466) | $ | 83,948 |

| Retained earnings | $ | — | $ | (163,407) | (m) | $ | 8,763 | $ | (154,644) |

| Accumulated other comprehensive income | $ | — | $ | 12,783 | (n) | $ | — | $ | 12,783 |

| Partners' deficit | | $ | (39,981) | $ | 39,981 | (l) (m)(n) | $ | — | $ | — |

| | |

(a) Reclassification of $134.2 million of Unbilled fees, net to Accounts receivable, net. |

(b) Reclassification of $268.1 million of Goodwill and $80.3 million of Intangible assets, net to Goodwill and other intangible assets, net. |

| (c) Reclassification of $5.6 million of Right of use asset - Finance leases, net to Right-of-use assets, net. |

(d) Reclassification of $12.3 million of Accounts payable and accrued expenses to Accounts payable. |

| (e) Reclassification of $29.5 million of Accounts payable and accrued expenses to Accrued personnel costs. |

(f) Reclassification of $16.3 million of Accounts payable and accrued expenses, $16.7 million of Current portion of Note payable, $9.1 million of Current portion of projected benefit obligation, and $33.2 million of Deferred revenue to Other current liabilities. |

| (g) Reclassification of $1.7 million of Current portion of Finance lease liability to Operating lease liabilities. |

(h) Reclassification of $328.5 million of Projected benefit obligation, net of current portion to Other non-current liabilities. |

| (i) Reclassification of $3.9 million of Finance lease liability, net of current portion to Lease liabilities. |

(j) Reclassification of $64.0 million of Revolving Credit Facility, and $48.5 million of Notes payable, net of debt issuance costs, less current portion to Bank Debt. |

(k) Reclassification of $0.3 million of Notes payable, net of debt issuance costs to Debt issuance cost. |

(l) Reclassification of $110.6 million of Partners' deficit to Additional paid in capital. |

(m) Reclassification of $163.4 million of Partners' deficit to Retained earnings. |

(n) Reclassification of $12.8 million of Partners' deficit to Accumulated other comprehensive income. |

Refer to the table below for a summary of reclassification and perimeter adjustments made to present Marcum’s condensed consolidated statement of income for the six months ended June 30, 2024 to conform with that of the Company (in thousands):

| | | | | | | | | | | | | | | | | | | | |

Marcum LLP Historical Condensed Consolidated Statement of Income Line Items | CBIZ Inc. Historical Condensed Consolidated Statements of Income Line Items | Marcum LLP Historical Consolidated Balances six month ended June 30, 2024 |

Reclassification |

Note |

Perimeter Adjustment |

Marcum LLP Adjusted six month ended June 30, 2024 |

| Firm revenue | Revenue | $ | 682,903 | $ | — | | $ | (20,646) | $ | 662,257 |

| | Operating expenses | $ | — | $ | (330,008) | (a) | $ | 11,585 | $ | (318,423) |

| Costs of revenue | | $ | (262,388) | $ | 262,388 | (a) | $ | — | $ | — |

| Occupancy costs | | $ | (23,373) | $ | 23,373 | (a) | $ | — | $ | — |

| Technology | | $ | (15,636) | $ | 15,636 | (a) | $ | — | $ | — |

| Training and recruiting | | $ | (2,616) | $ | 2,616 | (a) | $ | — | $ | — |

| Depreciation and amortization | | $ | (9,915) | $ | 9,915 | (a) | $ | — | $ | — |

| Marketing and advertising | | $ | (6,875) | $ | 6,875 | (a) | $ | — | $ | — |

| General and administrative | Corporate general and administrative expenses | $ | (39,957) | $ | 9,205 | (a) | $ | 4,029 | $ | (26,723) |

| Interest expense | Interest expense | $ | (6,195) | $ | — | | $ | 769 | $ | (5,426) |

| Other income (expense) | Other income (expense), net | $ | 1,835 | $ | — | | $ | 1,128 | $ | 2,963 |

| Non-controlling interest | | $ | 751 | $ | — | | $ | (751) | $ | — |

(a) Reclassification of Technology, Costs of revenue, Depreciation and amortization, Marketing and advertising, Occupancy costs, Training and recruiting, and $9.2 million of General and administrative expense to Operating expenses.

Refer to the table below for a summary of reclassification and perimeter adjustments made to present Marcum’s condensed consolidated statement of income for the year ended December 31, 2023 to conform with that of the Company (in thousands):

| | | | | | | | | | | | | | | | | | | | |

Marcum LLP Historical Condensed Consolidated Statement of Income Line Items | CBIZ Inc. Historical Condensed Consolidated Statement of Income Line Items | Marcum LLP Historical Consolidated Balances year ended December 31, 2023 |

Reclassification |

Note |

Perimeter Adjustment |

Marcum LLP Adjusted year ended December 31, 2023 |

| Firm revenue | Revenue | $ | 1,173,590 | $ | — | | $ | (54,338) | $ | 1,119,252 |

| | Operating expenses | $ | — | $ | (680,553) | (a) | $ | 22,044 | $ | (658,509) |

| Costs of revenue | | $ | (542,787) | $ | 542,787 | (a) | $ | — | $ | — |

| Occupancy costs | | $ | (51,920) | $ | 51,920 | (a) | $ | — | $ | — |

| Technology | | $ | (27,480) | $ | 27,480 | (a) | $ | — | $ | — |

| Training and recruiting | | $ | (6,924) | $ | 6,924 | (a) | $ | — | $ | — |

| Depreciation and amortization | | $ | (18,201) | $ | 18,201 | (a) | $ | — | $ | — |

| Marketing and advertising | | $ | (13,494) | $ | 13,494 | (a) | $ | — | $ | — |

| General and administrative | Corporate general and administrative expenses | $ | (80,454) | $ | 19,747 | (a) | $ | 7,701 | $ | (53,006) |

| Interest expense | Interest expense | $ | (17,012) | $ | — | | $ | 2,451 | $ | (14,561) |

| Other income (expense) | Other income (expense), net | $ | (1,494) | $ | — | | $ | (1,869) | $ | (3,363) |

| Non-controlling interest | | $ | (10,220) | $ | — | | $ | 10,220 | $ | — |

(a)Reclassification of Technology, Costs of revenue, Depreciation and amortization, Marketing and advertising, Occupancy costs, Training and recruiting, and $19.7 million of General and administrative expense to Operating expenses.

Note 3 – Preliminary Purchase Price Allocation

Estimated Aggregate Transaction consideration

The following table summarizes the preliminary estimated aggregate Transaction consideration for Marcum, which is comprised of cash and deferred share consideration (in thousands):

| | | | | |

| Amount |

| Cash consideration (i) | $ | 1,067,076 |

| Share consideration (ii) | 934,700 |

| Preliminary estimated aggregate Transaction consideration | $ | 2,001,776 |

(i)Reflects the estimated amount of cash consideration, which is equal to the Cash Payment Amount of $1,142.4 million as defined in the Merger Agreement, adjusted for the expected assumed indebtedness of $80.9 million as outlined in the Merger Agreement, consisting of contingent consideration expected to be paid within 18 months of close, earned bonuses for Marcum employees, certain specific deferred revenue balances, and adjustments for certain lease liabilities, plus $5.6 million related to Marcum's finance lease obligations to be settled by the Company at close.

(ii)Reflects the estimated fair value of 13.6 million shares to be issued as Transaction consideration. As defined in the Merger Agreement, the total number of shares to be issued was calculated on November 1, 2024, using the Base Purchase Price of $2,247.7 million less the Cash Payment Amount, assumed liabilities of $12.4 million expected to be paid subsequent to 18-months after the closing date, and a $2.9 million adjustment for net working capital and deposit balances divided by $76.84, to arrive at 14.3 million shares. The total number of shares is fixed at November 1, 2024, the closing date of the Transaction. Of the 14.3 million shares, approximately 0.7 million shares represent the Performance Shares which are subject to continued service requirements and therefore are not included in Transaction consideration. The remaining 13.6 million shares constitute the share consideration and are included in Transaction consideration, of which approximately 2.9 million shares are to be delivered on January 2, 2025 (the “Initial Delivery”). The remaining 10.7 million shares will be delivered in 36 monthly installments after the Initial Delivery of shares. The estimated fair value of this deferred share consideration is preliminary and was estimated using a Monte Carlo simulation (“MC Simulation”). In the MC Simulation, the stock price is assumed to follow a Geometric Brownian Motion, using the following key assumptions: term of 3.1 years consistent with the issuance schedule outlined in the Merger Agreement, risk-free rate, stock price as of October 31, 2024, and volatility of 35% based on the weekly historic volatility observed in the Company and guideline companies.

Preliminary Aggregate Transaction Consideration Allocation

Under the acquisition method of accounting, the identifiable assets acquired, and liabilities assumed of Marcum will be recognized and measured at fair value as of November 1, 2024 and added to those of the Company. The fair value and useful lives of assets and liabilities of Marcum below have been measured based on various preliminary estimates using assumptions that the Company’s management believes are reasonable and are based on currently available information. For the preliminary estimate of fair values of assets acquired and liabilities assumed of Marcum, the Company primarily used income-based, market-based, and/or cost-based valuation approaches using preliminary information to conclude upon a preliminary estimate of fair values. The Company also used publicly available benchmarking information as well as a variety of other assumptions, including market participant assumptions when

estimating the fair value. The preliminary allocation of the purchase price to the acquired assets and assumed liabilities was based upon this preliminary estimate of fair values. Accordingly, the pro forma adjustments are preliminary and have been made solely for the purpose of providing this unaudited pro forma condensed combined financial information. The final determination of the purchase price allocation will be based on Marcum’s assets acquired and liabilities assumed as of November 1, 2024. The allocation is dependent upon certain valuation and other studies that have not yet been completed. Accordingly, the proforma purchase price allocation will be subject to further adjustments as additional information becomes available and as additional analyses and final valuations are completed. There can be no assurances that these additional analyses and final valuations will not result in significant changes to the estimates of fair value set forth below.

The following table sets forth a preliminary allocation of the Transaction consideration to the identifiable tangible and intangible assets acquired and liabilities assumed by the Company, as if the Transaction had been consummated on June 30, 2024, based on the unaudited consolidated balance sheet of Marcum as of June 30, 2024, with the excess recorded as goodwill (in thousands):

| | | | | | | | |

| | Amount |

| Total consideration transferred | | $ | 2,001,776 |

Assets acquired: | | |

| Cash and cash equivalents | | 5,946 |

| Accounts receivable, net | | 265,246 |

| Other current assets | | 34,985 |

| Property and equipment, net | | 32,549 |

| Other intangible assets, net | | 502,000 |

| Right-of-use assets, net | | 142,345 |

| Other non-current assets | | 3,876 |

| Total assets acquired | | 986,947 |

| Liabilities assumed: | | |

| Accounts payable | | 12,294 |

| Accrued personnel costs | | 52,014 |

| Operating lease liabilities | | 23,327 |

| Other current liabilities | | 49,296 |

| Contingent purchase price liabilities | | 51,250 |

| Lease liabilities | | 137,009 |

| Total liabilities assumed | | 325,190 |

| Net assets acquired | | 661,757 |

| Goodwill | | $ | 1,340,019 |

As the Transaction is related to the purchase of assets and the assumption of liabilities of Marcum, the Company will record the tax basis of the assets acquired and liabilities assumed at their fair values. While the purchase allocation methodology for tax is not complete and may differ from the allocation for book purposes, the overall consideration for book and tax purposes is assumed to be tax deductible for purposes of the unaudited pro forma condensed combined balance sheet. As a result, the net temporary differences upon closing of the Transaction are expected to net to zero.

Note 4 – Transaction Accounting Adjustments

Unaudited Pro Forma Condensed Combined Balance Sheet

(a)Reflects the adjustment to Cash and cash equivalents (in thousands):

| | | | | | | | | | | |

| | Amount |

| Pro forma transaction accounting adjustments: | | |

| Estimated cash consideration to Marcum Partners (i) | | $ | (1,061,506) |

| Estimated transaction costs of the Company (ii) | | (37,367) |

| Estimated prepayment of insurance costs (iii) | | (18,000) |

| Estimated payment of finance lease liabilities (iv) | | | (5,570) |

| Net pro forma transaction accounting adjustment to Cash and cash equivalents | | $ | (1,122,443) |

(i) Represents cash consideration for the Transaction, a portion of which will be used to settle a) $80.4 million of Marcum's existing debt, b) $104.6 million of Marcum's contingent purchase price liabilities and c) $337.6 million of Marcum's projected benefit obligation, each of which are not expected to be assumed by the Company.

(ii) Estimated transaction costs consist of financial advisory fees and other professional fees of the Company of $37.4 million expected to be paid through the closing date of the Transaction. The Company has already expensed and accrued $5.5 million of these costs as of June 30, 2024. See Notes 4(g)(k)(r). No adjustment has been reflected in this unaudited pro forma condensed combined financial information for an estimated $3.1 million of transaction costs that Marcum expects to incur through the closing of the Transaction.

(iii) Represents the payment made at close for a three-year errors and omissions, employment practices liability and cyber tail insurance policy (the “Tail Policy”) in connection with the Transaction.

(iv) Represents payment the Company made at close to settle Marcum's finance lease liabilities that the Company will not assume.

(b)Reflects an adjustment of $24.3 million to decrease Accounts receivable, net to conform Marcum's process of estimating the work-in-progress ("WIP") reserve associated with unbilled revenue, to the accounting policy utilized by the Company. The resulting Account receivable, net balance is reflective of fair value.

(c)Reflects an adjustment of $6.0 million to Other current assets to record the current portion of the prepaid asset for the three-year Tail Policy coverage. Refer to Note 4(a).

(d)Reflects an adjustment of $5.6 million to Properties and Equipment, net, to reflect the reclassification of Marcum's historical finance lease right of use asset to Properties and Equipment, net as a result of the Company's settlement of Marcum's finance lease liabilities.

(e)Reflects the preliminary acquisition accounting adjustment to eliminate Marcum’s historical intangible assets and goodwill, and to reflect the acquired identifiable intangible assets consisting of customer relationships, and non-competition agreements as well as the capitalization of the preliminary goodwill for the estimated Transaction consideration in excess of the fair value of the net assets acquired in connection with the Transaction. The fair value of the acquired customer relationship intangible asset is estimated based on a multi-period excess earnings method which calculates the present value of the estimated revenues and net cash flows derived from it. A with-and-without method is used to estimate the fair values of the non-competition agreements, whereby the asset value is determined by assessing the hypothetical impact on the projected cash flows of the non-competition agreements if they had not been put in place.

The following table summarizes the fair values of Marcum’s goodwill, identifiable intangible assets and their estimated average useful lives (in thousands):

| | | | | | | | | | | | | | |

| | Amount | | Estimated Weighted Average Useful Life (in years) |

| Pro forma transaction accounting adjustments: | | | | |

| Customer relationship | | $ | 486,000 | | 10 |

| Non-competition agreements | | 16,000 | | 3 |

Total preliminary fair value of acquired intangibles | | 502,000 | | — |

| Fair value of consideration transferred in excess of the preliminary fair value of assets acquired and liabilities assumed (i) | | 1,340,019 | | |

| Elimination of Marcum's historical intangible assets | | (74,546) | | |

| Elimination of Marcum's historical goodwill | | (237,586) | | |

| Net pro forma transaction accounting adjustment to Goodwill and intangibles, net | | $ | 1,529,887 | | |

(i) Refer to the table in Note 3 above for the calculation of the fair value of consideration transferred in excess of the preliminary fair value of assets acquired and liabilities assumed based on the preliminary allocation of the estimated Transaction consideration to the identifiable tangible and intangible assets acquired and liabilities assumed of Marcum.

A 10% change in the valuation of the intangible assets would result in a corresponding increase or decrease in the pro forma amortization expense of approximately $2.7 million and $5.6 million for the six months ended June 30, 2024 and for the twelve months ended December 31, 2023, respectively.

For purposes of the unaudited pro forma condensed combined statement of income, pro forma amortization expense is preliminary and based on the use of straight-line amortization over the estimated average useful life of the finite life intangible assets recognized in the Transaction. The customer relationship intangible asset acquired in this Transaction has a preliminary estimated useful life of 10 years. An increase of the estimated useful life of one year would decrease amortization expense by $2.2 million for the six months ended June 30, 2024 and $4.4 million for the twelve months ended December 31, 2023. A decrease of the estimated useful life of one year would increase amortization expense by $2.7 million for the six months ended June 30, 2024 and $5.4 million for the twelve months ended December 31, 2023.

The amount of amortization expense recognized following the closing may differ significantly between periods based upon the final fair value assigned, the estimated useful life assigned and the amortization methodology used for each identifiable intangible asset.

(f)Reflects an adjustment of $12.0 million to Other non-current assets to record the non-current portion of the prepaid asset for three-year Tail Policy coverage. Refer to Note 4(a) and Note 4(c).

(g)Reflects an adjustment of $4.0 million to Accounts payable to record the settlement of the portion of the Company’s transaction expenses which were recorded in Accounts payable as of June 30, 2024. Refer to Note 4(a) and Note 4(k).

(h)Reflects an adjustment to Accrued personnel costs for Marcum bonuses of $22.5 million that are expected to be assumed by the Company and paid subsequent to close.

(i)Reflects an adjustment to the current and non-current portion of Contingent purchase price liabilities of $29.8 million and $74.8 million, respectively, that are not assumed by the Company at closing.

(j)Reflects an adjustment to Operating lease liabilities for the current portion of finance lease liabilities of $1.7 million that are expected to be settled by the Company. No adjustments have been reflected in the unaudited pro forma condensed combined statements of income related to the lease adjustment as such impacts are immaterial.

(k)Reflects adjustments to Other current liabilities (in thousands):

| | | | | | | | |

| | Amount |

| Pro forma transaction accounting adjustments: | | |

| Settlement of Marcum's current portion of bank debt | | $ | 16,709 |

| Settlement of Marcum's current portion of pension benefit obligation | | 9,098 |

| Settlement of accrued transaction costs of the Company | | 1,487 |

| Net pro forma transaction accounting adjustment to Other current liabilities | | $ | 27,294 |

(l)Reflects adjustment to Other non-current liabilities for Marcum's non-current pension benefit obligation not being assumed of $328.5 million.

(m)Reflects adjustments to Bank debt and Debt issuance costs to reflect Marcum’s long-term debt not being assumed (in thousands):

| | | | | | | | |

| | Amount |

| Pro forma transaction accounting adjustments: | | |

| Settlement of long-term notes-payable | | $ | 48,496 |

| Settlement of Revolving credit facility | | 64,000 |

| Debt issuance cost | | (294) |

| Net pro forma transaction accounting adjustment to Bank debt and Debt issuance costs | | $ | 112,202 |

(n)Reflects an adjustment to Lease liabilities for the non-current portion of finance lease liabilities of $3.9 million that are expected to be settled by the Company at close. No adjustments have been reflected in the unaudited pro forma condensed combined statements of income related to the lease adjustment as such impacts are immaterial.

(o)Reflects the adjustments to Stockholders’ equity (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | APIC | | Retained Earnings | | AOCI |

| Pro forma transaction accounting adjustments: | | | | | | | |

| Elimination of Marcum's historical equity | $ | — | | $ | (83,948) | | $ | 154,644 | | $ | (12,783) |

| Shares issued to Marcum Partners (i) | — | | 934,700 | | — | | — |

| Estimated transaction costs of the Company (ii) | — | | — | | (31,861) | | — |

| Net pro forma transaction accounting adjustments to Stockholders’ equity | $ | — | | $ | 850,752 | | $ | 122,783 | | $ | (12,783) |

(i)Reflects the adjustment to recognize shares issued as Transaction consideration. While the shares are equity classified upon close of the Transaction, the shares are not going to be delivered until after the Transaction, and therefore no adjustment has been made to Common Stock. Refer to Note 3 for more information on timing of share delivery.

(ii)Reflects the adjustment to recognize estimated transaction costs incurred after June 30, 2024 and prior to closing, consisting of financial advisory fees and other professional fees resulting in an adjustment to Retained earnings.

Unaudited Pro Forma Condensed Combined Statement of Income

(p)Reflects an adjustment to Revenue of $24.3 million and $11.6 million for the six months ended June 30, 2024, and the twelve-months ended December 31, 2023, respectively. This adjustment is made to conform Marcum's estimation of WIP reserves associated with the Company’s accounting policy.

(q)Reflects the adjustments to Operating expenses (in thousands):

| | | | | | | | | | | |

| For the Six months ended June 30, 2024 | | For the Year ended December 31, 2023 |

| Pro forma transaction accounting adjustments: | | | |

| Estimated cash retention bonus expense (i) | $ | 3,092 | | $ | 6,183 |

| Estimated Performance Share expense (ii) | 6,144 | | 12,287 |

| Removal of Marcum's historical intangible asset amortization | (5,131) | | (9,130) |

| Estimated amortization of acquired intangible assets (iii) | 26,883 | | 55,767 |

| Estimated Marcum Partner salary and wage expense (iv) | 150,107 | | 246,968 |

| Net pro forma transaction accounting adjustment to Operating expenses | $ | 181,095 | | $ | 312,075 |

(i)Represents a cash retention bonus that was granted to certain Marcum employees at close of the Transaction. The bonus will be paid out in three equal annual installments, starting on the second anniversary of the date the cash retention bonus is granted.

(ii)Represents the expense associated with the Performance Shares, which are 5% of total shares issued for the Transaction and subject only to a four-year continued service requirement. The grant date fair value of these shares was calculated using the Company’s share price as of November 1, 2024 of $68.93.

(iii)Represents straight-line amortization of the estimated fair value of the intangible assets for customer relationships and non-competition agreements over the estimated weighted average useful life of 10 years and three years, respectively.

(iv)Represents an adjustment to recognize an estimate of the compensation expense attributable to Marcum’s partners that was recognized as an equity transaction in Marcum’s historical financial statements. Historically, Marcum partners were not compensated as employees; rather, they received distributions as owners of the firm that were reflected in Marcum’s historical Condensed Consolidated Statement of Changes. In a partnership structure, the net income of the partnership is allocated to the partners. Upon closing of the Transaction, the Marcum partners became employees of the Company and will be compensated as such. As the legal structure will change, for purposes of preparing the unaudited condensed combined pro forma information the Company combined a) the income distribution to partners from Marcum’s Condensed Consolidated Statement of Changes in Deficit with b) the service cost component of the net pension benefit cost for Marcum’s partners less c) the income distribution to Marcum’s partners that relates to the Excluded Subsidiaries that were not acquired by the Company. While the Company is not assuming any liabilities relating to the pension benefit obligation, the Company believes the service cost component represents an element of historical compensation to Marcum’s partners. While Marcum did historically pay interest to the partners on their capital in the partnership, the interest paid to the partners is not included as an expense in the unaudited pro forma condensed combined statements of income as the partnership structure will not continue.

(r)Reflects the adjustments to Corporate general and administrative expenses (in thousands):

| | | | | | | | | | | |

| For the Six months ended June 30, 2024 | | For the Year ended December 31, 2023 |

| Pro forma transaction accounting adjustments: | | | |

| Expected transaction expenses (i) | $ | — | | $ | 31,861 |

| Insurance expenses (ii) | 3,000 | | 6,000 |

| Net pro forma transaction accounting adjustment to Corporate general and administrative expenses | $ | 3,000 | | $ | 37,861 |

(i)Represents the estimated transaction costs incurred after June 30, 2024 and prior to closing, consisting of financial advisory fees and other professional fees.

(ii)Represents the Company’s expense associated with the cash payment made on the closing date for a three-year Tail Policy coverage.

(s)Reflects the adjustments to Interest expense related to the elimination of the historical interest and amortization of debt issuance costs from Marcum notes payable and revolving credit facility that will not be assumed (in thousands):

| | | | | | | | | | | | | | |

| | For the Six months ended June 30, 2024 | | For the Year ended December 31, 2023 |

| Pro forma transaction accounting adjustments: | | | | |

| Removal of interest expense on Marcum Bank debt and contingent purchase price liabilities | | $ | (4,241) | | $ | (11,759) |

Removal of unamortized deferred financing costs on Marcum Bank debt | | (294) | | (349) |

| Net pro forma transaction accounting adjustment to Interest expense | | $ | (4,535) | | $ | (12,108) |

(t)Represents the application of the estimated statutory income tax rate of 28.3% to both the Marcum LLP Historical & Reclassed results and the Transaction Accounting Adjustments for both the six months ended June 30, 2024, and the twelve-months ended December 31, 2023, respectively. Marcum has historically been treated as a partnership for income tax purposes and was not subject to income taxes as a corporate entity. The statutory tax rate of the combined company could be significantly different (either higher or lower) depending on post-merger activities, including cash needs, the geographical mix of income and changes in tax law. Because the tax rates used for the unaudited pro forma condensed combined financial information are estimated, the blended statutory tax rate will likely vary from the actual effective tax rate in periods subsequent to the closing date. This determination is preliminary and subject to change based upon the final determination of the fair value of the acquired assets and liabilities assumed.

(u)The pro forma basic net income per share attributable to common stock is calculated using (i) the historical basic weighted average shares of the Company’s Common Shares issued and outstanding and (ii) the new shares outstanding in connection with the Transaction, excluding Performance Shares. Pro forma diluted net income per share attributable to common stock is calculated using (i) the historical diluted weighted average shares of the Company’s Common Stock issued and outstanding, (ii) and new shares outstanding in connection with the Transaction, including Performance Shares that would have vested during the period assuming that the Transaction closed as of January 1, 2023. The pro forma basic and diluted weighted average shares outstanding are as follows (in thousands):

| | | | | | | | | | | | | | |

| | For the Six months ended June 30, 2024 | | For the Year ended December 31, 2023 |

| Pro forma transaction accounting adjustments: | | | | |

| Pro forma net income | | $ | 146,171 | | | $ | 86,966 | |

| Historical outstanding shares of the Company used in computing pro forma earnings per share | | | | |

| Basic outstanding shares | | 50,079 | | 49,989 |

| Diluted outstanding shares | | 50,248 | | 50,557 |

| | | | |

| Issuance of share consideration to Marcum partners | | 13,548 | | | 13,548 | |

| Pro forma basic weighted average shares outstanding | | 63,627 | | | 63,537 | |

| 5% Performance Shares | | 267 | | | 178 | |

| Pro forma diluted weighted average shares outstanding | | 63,894 | | | 63,715 | |

| | | | | |

| Pro forma earnings per share: | | | | |

| Basic | | $ | 2.30 | | | $ | 1.37 | |

| Diluted | | $ | 2.29 | | | $ | 1.36 | |

Represents 13.6 million shares included in Transaction consideration, of which approximately 2.9 million shares are to be delivered on January 2, 2025. The remaining 10.7 million shares will be delivered in 36 monthly installments after the initial delivery of shares on January 2, 2025. For the purposes of pro forma earnings per share, the 13.6 million shares are considered outstanding in both basic and diluted earnings per share for accounting purposes as of the closing date of the Transaction given there are no contingencies to their delivery other than the passage of time.

Note 5 – Debt Financing Adjustments

On November 1, 2024, the Company entered into a Credit Agreement (the “Credit Agreement”) with Bank of America, as administrative agent, and the lenders named therein. Pursuant to the Credit Agreement, the lenders provided for senior secured credit facilities (the “Credit Facilities”) in an aggregate principal amount of $2.0 billion, consisting of a five-year senior secured term loan facility (“Term Facility”) in an aggregate principal amount equal to $1.4 billion and a $600 million five-year senior secured revolving credit facility (“Revolving Facility”). The Credit Facilities are expected to bear interest at a rate equal to Term SOFR plus the Applicable Margin, which ranges from 1.375% to 2.50% depending on the Company’s Total Net Leverage Ratio. For purposes of the unaudited pro forma condensed combined financial information, the Company drew on the full amount of the Term Facility ($1.4 billion), and $124.4 million on the Revolving Facility at closing. The actual amount drawn on the Revolving Facility may differ based on the Company’s financial position at the closing date. The Company used the proceeds of the Credit Facilities to (i) pay the cash consideration in the Transaction, including payment for certain indebtedness of Marcum, (ii) pay transaction costs, which include financial advisory fees and other professional fees of $37.4 million and (iii) settlement of the Company’s historical Bank debt which has been accounted for as a debt modification.

Unaudited Pro Forma Condensed Combined Balance Sheet

a)Reflects the adjustments to Cash and cash equivalents (in thousands):

| | | | | | | | |

| | Amount |

| Pro forma debt financing adjustments: | | |

| Estimated borrowings from the Credit Facilities, net of deferred financing costs of $21 million | | $ | 1,503,443 |

| Cash paid to settle the Company's historical Bank debt | | (381,000) |

| Net pro forma debt financing adjustment to Cash and cash equivalents | | $ | 1,122,443 |

b)Reflects an increase in Other current liabilities of $70 million for the current portion of the additional expected borrowings from the Credit Facilities.

c)Reflects adjustments to Bank debt and Debt issuance costs to reflect the issuance from the Senior Credit facilities and the cash repayment of the Company's historical Bank debt (in thousands):

| | | | | | | | |

| | Amount |

| Pro forma debt financing adjustments: | | |

| Estimated borrowings from the Credit Facilities | | $ | 1,454,449 |

| Settlement of the Company's historical Bank debt | | (381,000) |

| Debt issuance cost for the Credit Facilities | | (21,006) |

| Net pro forma debt financing adjustment to Bank debt and Debt issuance costs | | $ | 1,052,443 |

Unaudited Pro Forma Condensed Combined Statement of Income

d)Reflects the adjustment to Interest expense for the interest and amortization of the debt issuance costs associated with the estimated borrowings from the Credit Facilities (in the thousands in the table below). The interest rate used in calculating the unaudited pro forma adjustments for the Credit Facilities is 6.92%, based on the prevailing rate at close. The costs incurred to secure the Credit Facilities are amortized on a straight-line basis over the five-year term of the commitment.

| | | | | | | | | | | | | | |

| |

For the Six months ended June 30, 2024 | | For the Year ended December 31, 2023 |

Removal of the Company's historical interest expense | | $ | (10,395) | | $ | (20,131) |

| New interest expense on Debt Financing: | | | | |

| Credit Facilities | | 50,034 | | 103,701 |

Amortization of debt issuance costs related to the Credit Facilities | | 2,101 | | 4,201 |

| Net pro forma debt financing adjustments to Interest expense | | $ | 41,740 | | $ | 87,771 |

A hypothetical 12.5 basis points increase/decrease in the interest rate used would result in an increase/decrease of approximately $0.9 million in pro forma interest expense for the six months ended June 30, 2024 and $1.9 million in pro forma interest expense for the twelve months ended December 31, 2023.

v3.24.3

Cover

|

Nov. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Nov. 01, 2024

|

| Entity Registrant Name |

CBIZ, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-32961

|

| Entity Tax Identification Number |

22-2769024

|

| Entity Address, Address Line One |

5959 Rockside Woods, Blvd. N. Suite 600

|

| Entity Address, City or Town |

Independence

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44131

|

| City Area Code |

216

|

| Local Phone Number |

447-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

CBZ

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000944148

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |