CONSOLIDATED HIGHLIGHTS

Second Quarter 2024(1)

- Total revenue increased 4.6% to $2,900 million

- Property revenue increased 4.6% to $2,853 million

- Net income increased 96.8% to $908 million(2)(3)

- Adjusted EBITDA increased 8.1% to $1,890 million

- Net income attributable to AMT common stockholders increased

89.3% to $900 million(2)(3)

- AFFO attributable to AMT common stockholders increased 13.5% to

$1,306 million

American Tower Corporation (NYSE: AMT) today reported financial

results for the quarter ended June 30, 2024.

Steven Vondran, American Tower’s Chief Executive Officer,

stated, “The momentum from the start of the year extended into Q2,

with core results highlighting the strong underlying demand for our

portfolio of communications assets. Positive collection trends

further accelerated in India, our U.S. & Canada segment

delivered over 5% Organic Tenant Billings Growth and CoreSite

achieved its second highest quarter of signed new business on

record, all supporting over 13% Attributable AFFO per Share growth

in the quarter, and our ability to raise the midpoints of the key

financial measures in our updated 2024 outlook.

Furthermore, we continue to demonstrate our commitment to a

disciplined approach to capital allocation. We’ve successfully

accelerated certain proceeds associated with our pending sale of

India ahead of our anticipated closing, and prudently managed our

discretionary investments towards developed markets, while

leveraging our global capabilities to maximize margins and

profitability across our emerging markets footprint. We believe the

successful execution of our strategic priorities, combined with the

strong, durable secular trends underpinning our business, has

American Tower positioned to deliver a best-in-class experience for

our customers, and sustained growth with higher quality of earnings

for our shareholders over the long-term.”

CONSOLIDATED OPERATING RESULTS OVERVIEW

American Tower generated the following operating results for the

quarter ended June 30, 2024 (all comparative information is

presented against the quarter ended June 30, 2023).

($ in millions, except per share

amounts.)

Q2 2024

Growth Rate(1)

Total revenue

$

2,900

4.6

%

Total property revenue

$

2,853

4.6

%

Total Tenant Billings Growth

$

119

6.1

%

Organic Tenant Billings Growth

$

103

5.3

%

Property Gross Margin

$

2,053

7.0

%

Property Gross Margin %

72.0

%

Net income(2)(3)

$

908

96.8

%

Net income attributable to AMT common

stockholders(2)(3)

$

900

89.3

%

Net income attributable to AMT common

stockholders per diluted share(2)(3)

$

1.92

88.2

%

Adjusted EBITDA

$

1,890

8.1

%

Adjusted EBITDA Margin %

65.2

%

Nareit Funds From Operations (FFO)

attributable to AMT common stockholders(2)

$

1,350

19.2

%

AFFO attributable to AMT common

stockholders

$

1,306

13.5

%

AFFO attributable to AMT common

stockholders per Share

$

2.79

13.4

%

Cash provided by operating activities

$

1,339

10.7

%

Less: total cash capital

expenditures(4)

$

328

(21.4

)%

Free Cash Flow

$

1,011

27.5

%

_______________

(1)

Q2 2024 growth rates, excluding Total

Tenant Billings, Organic Tenant Billings and total cash capital

expenditures, impacted by revenue reserve reversals of

approximately $67 million associated with VIL (as defined below) in

India in the current period as compared to VIL-related revenue

reserves of approximately $35 million in the prior-year period.

(2)

Q2 2024 growth rates impacted by foreign

currency losses of $21.7 million in the current period as compared

to foreign currency losses of $107.6 million in the prior-year

period.

(3)

Q2 2024 growth rates positively impacted

by the Company’s extension of the estimated useful lives of its

tower assets and the estimated settlement dates for its asset

retirement obligations, expected to result in a decrease of

approximately $730 million in depreciation and amortization expense

and a decrease of approximately $75 million in accretion expense

for the twelve months ended December 31, 2024 as compared to the

twelve months ended December 31, 2023. The Company estimates that

such decreases will be relatively evenly distributed by quarter

throughout the current year.

(4)

Q2 2024 cash capital expenditures includes

$8.7 million of finance lease and perpetual land easement payments

reported in cash flows from financing activities in the condensed

consolidated statements of cash flows.

Please refer to “Non-GAAP and Defined Financial Measures” below

for definitions and other information regarding the Company’s use

of non-GAAP measures. For financial information and reconciliations

to GAAP measures, please refer to the “Unaudited Selected

Consolidated Financial Information” below.

CAPITAL ALLOCATION OVERVIEW

Distributions – During the quarter ended June 30, 2024,

the Company declared the following regular cash distributions to

its common stockholders:

Common Stock Distributions

Q2 2024(1)

Distributions per share

$

1.62

Aggregate amount (in millions)

$

756.7

Year-over-year per share growth

3.2

%

_______________

(1)

The distribution declared on May 23, 2024

was paid on July 12, 2024 to stockholders of record as of the close

of business on June 14, 2024.

Capital Expenditures – During the second quarter of 2024,

total capital expenditures were approximately $328 million, of

which $37 million was for non-discretionary capital improvements

and corporate capital expenditures. For additional capital

expenditure details, please refer to the supplemental disclosure

package available on the Company’s website.

Other Events – On March 23, 2024, the Company converted

an aggregate face value of 14.4 billion Indian Rupees (“INR”)

(approximately $172.7 million) of the optionally convertible

debentures issued by a customer in India, Vodafone Idea Limited

(“VIL,” and the optionally convertible debentures, the “VIL OCDs”)

into 1,440 million shares of equity of VIL (the “VIL Shares”).

On April 29, 2024, the Company completed the sale of 1,440

million VIL Shares at a price of 12.78 INR per share. The net

proceeds for this transaction were approximately 18.0 billion INR

(approximately $216.0 million at the date of settlement) after

deducting commissions and fees. On June 5, 2024, the Company

completed the sale of the remaining aggregate face value of 1.6

billion INR (approximately $19.2 million) of the VIL OCDs. The net

proceeds for this transaction were approximately 1.8 billion INR

(approximately $22.0 million at the date of settlement) after

deducting fees.

During the three months ended June 30, 2024, the Company

recognized a gain of $46.4 million on the sales of the VIL Shares

and the VIL OCDs, which are recorded in Other income (expense) in

the consolidated statements of operations in the current period. As

of June 30, 2024, none of the VIL Shares or the VIL OCDs remained

outstanding.

LEVERAGE AND FINANCING OVERVIEW

Leverage – For the quarter ended June 30, 2024, the

Company’s Net Leverage Ratio was 4.8x net debt (total debt less

cash and cash equivalents) to second quarter 2024 annualized

Adjusted EBITDA.

Calculation of Net Leverage Ratio

($ in millions, totals may not add due to rounding.)

As of June 30, 2024

Total debt

$

38,968

Less: Cash and cash equivalents

2,492

Net Debt

$

36,476

Divided By: Second quarter annualized

Adjusted EBITDA(1)

7,562

Net Leverage Ratio

4.8x

_______________

(1)

Q2 2024 Adjusted EBITDA multiplied by

four.

Liquidity and Financing Activities – As of June 30, 2024,

the Company had approximately $9.2 billion of total liquidity,

consisting of approximately $2.5 billion in cash and cash

equivalents plus the ability to borrow an aggregate of

approximately $6.7 billion under its revolving credit facilities,

net of any outstanding letters of credit.

On May 21, 2024, the Company repaid all amounts outstanding

under its €825 million unsecured term loan, as amended in December

2021 (the “2021 EUR Three Year Delayed Draw Term Loan”).

On May 29, 2024, the Company issued an aggregate of €1.0 billion

(approximately $1.1 billion at the date of issuance) in senior

unsecured notes. The net proceeds of the offering were used to

repay existing indebtedness under its $6.0 billion senior unsecured

multicurrency revolving credit facility, to the extent it had been

drawn upon in euros to, among other things, repay existing

indebtedness under the 2021 EUR Three Year Delayed Draw Term

Loan.

FULL YEAR 2024 OUTLOOK

The following full year 2024 estimates are based on a number of

assumptions that management believes to be reasonable and reflect

the Company’s expectations as of July 30, 2024. Actual results may

differ materially from these estimates as a result of various

factors, and the Company refers you to the cautionary language

regarding “forward-looking statements” included in this press

release when considering this information.

The Company’s outlook is based on the following average foreign

currency exchange rates to 1.00 U.S. Dollar for July 30, 2024

through December 31, 2024: (a) 1,063 Argentinean Pesos; (b) 1.50

Australian Dollars; (c) 121.10 Bangladeshi Taka; (d) 5.45 Brazilian

Reais; (e) 1.37 Canadian Dollars; (f) 950 Chilean Pesos; (g) 4,130

Colombian Pesos; (h) 0.93 Euros; (i) 15.35 Ghanaian Cedis; (j)

83.50 Indian Rupees; (k) 134 Kenyan Shillings; (l) 18.30 Mexican

Pesos; (m) 1.63 New Zealand Dollars; (n) 1,600 Nigerian Naira; (o)

7,570 Paraguayan Guarani; (p) 3.80 Peruvian Soles; (q) 58.70

Philippine Pesos; (r) 18.60 South African Rand; (s) 3,810 Ugandan

Shillings; and (t) 610 West African CFA Francs.

The Company’s outlook reflects estimated negative impacts of

foreign currency exchange rate fluctuations to property revenue,

Adjusted EBITDA and AFFO attributable to AMT common stockholders of

approximately $51 million, $33 million and $28 million,

respectively, relative to the Company’s prior 2024 outlook. The

impact of foreign currency exchange rate fluctuations on net income

metrics is not provided, as the impact on all components of the net

income measure cannot be calculated without unreasonable

effort.

The Company’s updated 2024 outlook assumes a full year

contribution from the India business, including updated revenue

reserve assumptions reflecting the positive collection trends

realized year to date, and improved expectations for the remainder

of the year. The updated 2024 outlook assumes a $96 million revenue

reserve reversal for the India business, consisting of revenue

reserve reversals of $29 million and $67 million in Q1 2024 and Q2

2024, respectively, with no additional revenue reserves, or

reversals, assumed for the remainder of the year. The Company’s

prior 2024 outlook had assumed a revenue reserve of $20 million for

the full year. The Company’s outlook reflects India contributions

of $1,270 million, $500 million and $410 million for property

revenue, Adjusted EBITDA and Unlevered AFFO attributable to AMT

common stockholders, respectively. The Company expects the closing

of the sale of its India business (the “Pending ATC TIPL

Transaction”) to occur in the second half of 2024, subject to

customary closing conditions, including government and regulatory

approval. Additional information pertaining to Unlevered AFFO

attributable to AMT common stockholders and the expected

contributions from India to the Company’s 2024 outlook has been

provided on page 24 of the Company’s second quarter 2024 earnings

presentation available on the Company’s website.

The Company is raising the midpoints of its full year 2024

outlook for property revenue, net income, net income attributable

to AMT common stockholders, Adjusted EBITDA, AFFO attributable to

AMT common stockholders and AFFO attributable to AMT common

stockholders per Share by $20 million, $145 million, $135 million,

$130 million, $85 million and $0.18, respectively. Excluding

updates associated with the India business, and excluding the

impacts of foreign exchange rate fluctuations, the Company’s

updated 2024 outlook includes increases of $5 million, $62 million,

$27 million and $0.06 for property revenue, Adjusted EBITDA, AFFO

attributable to AMT common stockholders and AFFO attributable to

AMT common stockholders per Share, respectively, and a decrease of

$45 million to property revenue, an increase of $30 million in

Adjusted EBITDA and no change to AFFO attributable to AMT common

stockholders and AFFO attributable to AMT common stockholders per

Share when including foreign exchange rate fluctuations.

Additional information pertaining to the impact of foreign

currency and Secured Overnight Financing Rate fluctuations on the

Company’s outlook has been provided in the supplemental disclosure

package available on the Company’s website.

2024 Outlook ($ in millions, except

per share amounts.)

Full Year 2024

Midpoint Growth Rates vs.

Prior Year

Total property revenue(1)

$

11,100

to

$

11,280

1.7%

Net income

3,225

to

3,315

139.2%

Net income attributable to AMT common

stockholders

3,200

to

3,290

118.8%

Adjusted EBITDA

7,250

to

7,360

3.1%

AFFO attributable to AMT common

stockholders

4,905

to

5,015

7.6%

AFFO attributable to AMT common

stockholders per Share

$

10.48

to

$

10.72

7.4%

_______________

(1)

Includes U.S. & Canada segment

property revenue of $5,225 million to $5,285 million, international

property revenue of $4,965 million to $5,065 million and Data

Centers segment property revenue of $910 million to $930 million,

reflecting midpoint growth rates of 0.7%, 1.3% and 10.2%,

respectively. The U.S. & Canada growth rate includes an

estimated negative impact of over 3% associated with a decrease in

non-cash straight-line revenue recognition. The international

growth rate includes an estimated negative impact of over 4% from

the translational effects of foreign currency exchange rate

fluctuations. International property revenue reflects the Company’s

Africa, Asia-Pacific, Europe and Latin America segments. Data

Centers segment property revenue reflects revenue from the

Company’s data center facilities and related assets.

2024 Outlook for Total Property

revenue, at the midpoint, includes the following components(1):

($ in millions, totals may not add due to rounding.)

U.S. & Canada

Property(2)

International

Property(3)

Data Centers

Property(4)

Total Property

International pass-through revenue(5)

N/A

$

1,606

N/A

$

1,606

Straight-line revenue(6)

227

26

11

264

_______________

(1)

For additional discussion regarding these

components, please refer to “Revenue Components” below.

(2)

U.S. & Canada property revenue

includes revenue from all assets in the United States and Canada,

other than data center facilities and related assets.

(3)

International property revenue reflects

the Company’s Africa, Asia-Pacific, Europe and Latin America

segments.

(4)

Data Centers property revenue reflects

revenue from the Company’s data center facilities and related

assets.

(5)

Includes $588 million in international

pass-through revenue related to the Company’s India operations.

(6)

Includes $(2) million in straight-line

revenue related to the Company’s India operations.

2024 Outlook for Total Tenant Billings

Growth, at the midpoint, includes the following components(1):

(Totals may not add due to rounding.)

U.S. & Canada

Property

International

Property(2)

Total Property

Organic Tenant Billings

~4.7%

~5%

~5%

New Site Tenant Billings

~0%

~2%

~1%

Total Tenant Billings Growth

~4.7%

~7%

~6%

_______________

(1)

For additional discussion regarding the

component growth rates, please refer to “Revenue Components” below.

Tenant Billings Growth is not applicable to the Data Centers

segment. For additional details related to the Data Centers

segment, please refer to the supplemental disclosure package

available on the Company’s website.

(2)

International property Tenant Billings

Growth reflects the Company’s Africa, Asia-Pacific, Europe and

Latin America segments.

Outlook for Capital

Expenditures(1): ($ in millions, totals may not add due to

rounding.)

Full Year 2024

Discretionary capital projects(2)

$

800

to

$

830

Ground lease purchases

125

to

145

Start-up capital projects

65

to

85

Redevelopment

415

to

445

Capital improvement

185

to

195

Corporate

10

—

10

Total

$

1,600

to

$

1,710

_______________

(1)

Outlook for Capital Expenditures includes

approximately $105 million related to the Company’s India

operations, largely associated with discretionary capital projects,

redevelopment and capital improvements of $20 million, $50 million

and $35 million, respectively.

(2)

Includes the construction of 2,500 to

3,500 communications sites globally, including approximately 800 in

India, and $480 million of development spend in the Company’s Data

Centers segment.

Reconciliation of Outlook for Adjusted

EBITDA to Net income: ($ in millions, totals may not add due to

rounding.)

Full Year 2024

Net income

$

3,225

to

$

3,315

Interest expense

1,475

to

1,455

Depreciation, amortization and

accretion

2,185

to

2,205

Income tax provision

430

to

440

Stock-based compensation expense

190

—

190

Other, including other operating expenses,

interest income, (gain) loss on retirement of long-term obligations

and other (income) expense

(255

)

to

(245

)

Adjusted EBITDA

$

7,250

to

$

7,360

Reconciliation of Outlook for AFFO

attributable to AMT common stockholders to Net income: ($ in

millions, except share and per share data, totals may not add due

to rounding.)

Full Year 2024

Net income

$

3,225

to

$

3,315

Straight-line revenue

(264

)

—

(264

)

Straight-line expense

52

—

52

Depreciation, amortization and

accretion

2,185

to

2,205

Stock-based compensation expense

190

—

190

Deferred portion of income tax and other

income tax adjustments

90

—

90

Other, including other operating expense,

amortization of deferred financing costs, debt discounts and

premiums, (gain) loss on retirement of long-term obligations, other

(income) expense and long-term deferred interest charges

(42

)

to

(32

)

Capital improvement capital

expenditures

(185

)

to

(195

)

Corporate capital expenditures

(10

)

—

(10

)

Adjustments and distributions for

unconsolidated affiliates and noncontrolling interests

$

(336

)

—

$

(336

)

AFFO attributable to AMT common

stockholders

$

4,905

to

$

5,015

Divided by weighted average diluted shares

outstanding (in thousands)

468,000

—

468,000

AFFO attributable to AMT common

stockholders per Share

$

10.48

to

$

10.72

Conference Call Information

American Tower will host a conference call today at 8:30 a.m. ET

to discuss its financial results for the quarter ended June 30,

2024 and its updated outlook for 2024. Supplemental materials for

the call will be available on the Company’s website,

www.americantower.com. The conference call dial-in numbers are as

follows:

U.S./Canada dial-in: (877) 692-8955

International dial-in: (234) 720-6979 Passcode: 3589117

When available, a replay of the call can be accessed until 11:59

p.m. ET on August 13, 2024. The replay dial-in numbers are as

follows:

U.S./Canada dial-in: (866) 207-1041

International dial-in: (402) 970-0847 Passcode: 8141550

American Tower will also sponsor a live simulcast and replay of

the call on its website, www.americantower.com.

About American Tower

American Tower, one of the largest global REITs, is a leading

independent owner, operator and developer of multitenant

communications real estate with a portfolio of over 224,000

communications sites and a highly interconnected footprint of U.S.

data center facilities. For more information about American Tower,

please visit the “Earnings Materials” and “Investor Presentations”

sections of our investor relations hub at

www.americantower.com.

Non-GAAP and Defined Financial

Measures

In addition to the results prepared in accordance with generally

accepted accounting principles in the United States (GAAP) provided

throughout this press release, the Company has presented the

following Non-GAAP and Defined Financial Measures: Gross Margin,

Operating Profit, Operating Profit Margin, Adjusted EBITDA,

Adjusted EBITDA Margin, Nareit Funds From Operations (FFO)

attributable to American Tower Corporation common stockholders,

Adjusted Funds From Operations (AFFO) attributable to American

Tower Corporation common stockholders, AFFO attributable to

American Tower Corporation common stockholders per Share, Unlevered

AFFO attributable to AMT common stockholders, Free Cash Flow, Net

Debt and Net Leverage Ratio. In addition, the Company presents:

Tenant Billings, Tenant Billings Growth, Organic Tenant Billings

Growth and New Site Tenant Billings Growth.

During the three months ended March 31, 2024, the Company

updated its presentation of Nareit FFO attributable to American

Tower Corporation common stockholders and AFFO attributable to

American Tower Corporation common stockholders to remove separate

presentation of Consolidated AFFO. The Company believes this

presentation better aligns its reporting with management’s current

approach of allocating capital and resources, managing growth and

profitability and assessing the operating performance of its

business. The change in presentation has no impact on the Company’s

Nareit FFO attributable to American Tower Corporation common

stockholders or AFFO attributable to American Tower Corporation

common stockholders for any periods. Historical financial

information included below has been adjusted to reflect the change

in presentation.

These measures are not intended to replace financial performance

measures determined in accordance with GAAP. Rather, they are

presented as additional information because management believes

they are useful indicators of the current financial performance of

the Company's core businesses and are commonly used across its

industry peer group. As outlined in detail below, the Company

believes that these measures can assist in comparing company

performance on a consistent basis irrespective of depreciation and

amortization or capital structure, while also providing valuable

incremental insight into the underlying operating trends of its

business.

Depreciation and amortization can vary significantly among

companies depending on accounting methods, particularly where

acquisitions or non-operating factors, including historical cost

basis, are involved. The Company's Non-GAAP and Defined Financial

Measures may not be comparable to similarly titled measures used by

other companies.

Revenue Components

In addition to reporting total revenue, the Company believes

that providing transparency around the components of its revenue

provides investors with insight into the indicators of the

underlying demand for, and operating performance of, its real

estate portfolio. Accordingly, the Company has provided disclosure

of the following revenue components: (i) Tenant Billings, (ii) New

Site Tenant Billings; (iii) Organic Tenant Billings; (iv)

International pass-through revenue; (v) Straight-line revenue; (vi)

Pre-paid amortization revenue; (vii) Foreign currency exchange

impact; and (viii) Other revenue.

Tenant Billings: The majority of the Company’s revenue is

generated from non-cancellable, long-term tenant leases. Revenue

from Tenant Billings reflects several key aspects of the Company’s

real estate business: (i) “colocations/amendments” reflects new

tenant leases for space on existing sites and amendments to

existing leases to add additional tenant equipment; (ii)

“escalations” reflects contractual increases in billing rates,

which are typically tied to fixed percentages or a variable

percentage based on a consumer price index; (iii) “cancellations”

reflects the impact of tenant lease terminations or non-renewals

or, in limited circumstances, when the lease rates on existing

leases are reduced; and (iv) “new sites” reflects the impact of new

property construction and acquisitions.

New Site Tenant Billings: Day-one Tenant Billings

associated with sites that have been built or acquired since the

beginning of the prior-year period. Incremental

colocations/amendments, escalations or cancellations that occur on

these sites after the date of their addition to our portfolio are

not included in New Site Tenant Billings. In certain cases, this

could also include the net impact of certain divestitures. The

Company believes providing New Site Tenant Billings enhances an

investor’s ability to analyze the Company’s existing real estate

portfolio growth as well as its development program growth, as the

Company’s construction and acquisition activities can drive

variability in growth rates from period to period.

Organic Tenant Billings: Tenant Billings on sites that

the Company has owned since the beginning of the prior-year period,

as well as Tenant Billings activity on new sites that occurred

after the date of their addition to the Company’s portfolio.

International pass-through revenue: A portion of the

Company’s pass-through revenue is based on power and fuel expense

reimbursements and therefore subject to fluctuations in fuel

prices. As a result, revenue growth rates may fluctuate depending

on the market price for fuel in any given period, which is not

representative of the Company’s real estate business and its

economic exposure to power and fuel costs. Furthermore, this

expense reimbursement mitigates the economic impact associated with

fluctuations in operating expenses, such as power and fuel costs

and land rents in certain of the Company’s markets. As a result,

the Company believes that it is appropriate to provide insight into

the impact of pass-through revenue on certain revenue growth

rates.

Straight-line revenue: Under GAAP, the Company recognizes

revenue on a straight-line basis over the term of the contract for

certain of its tenant leases. Due to the Company’s significant base

of non-cancellable, long-term tenant leases, this can result in

significant fluctuations in growth rates upon tenant lease signings

and renewals (typically increases), when amounts billed or received

upfront upon these events are initially deferred. These signings

and renewals are only a portion of the Company’s underlying

business growth and can distort the underlying performance of our

Tenant Billings Growth. As a result, the Company believes that it

is appropriate to provide insight into the impact of straight-line

revenue on certain growth rates in revenue and select other

measures.

Pre-paid amortization revenue: The Company recovers a

portion of the costs it incurs for the redevelopment and

development of its properties from its tenants. These upfront

payments are then amortized over the initial term of the

corresponding tenant lease. Given this amortization is not

necessarily directly representative of underlying leasing activity

on its real estate portfolio (i.e. does not have a renewal option

or escalation as our tenant leases do), the Company believes that

it is appropriate to provide insight into the impact of pre-paid

amortization revenue on certain revenue growth rates to provide

transparency into the underlying performance of our real estate

business.

Foreign currency exchange impact: The majority of the

Company’s international revenue and operating expenses are

denominated in each country’s local currency. As a result, foreign

currency fluctuations may distort the underlying performance of our

real estate business from period to period, depending on the

movement of foreign currency exchange rates versus the U.S. Dollar.

The Company believes it is appropriate to quantify the impact of

foreign currency exchange rate fluctuations on its reported growth

to provide transparency into the underlying performance of its real

estate business.

Other revenue: Other revenue represents revenue not

captured by the above listed items and can include items such as

customer settlements, fiber solutions revenue and data centers

revenue.

Non-GAAP and Defined Financial Measure

Definitions

Tenant Billings Growth: The increase or decrease

resulting from a comparison of Tenant Billings for a current period

with Tenant Billings for the corresponding prior-year period, in

each case adjusted for foreign currency exchange rate fluctuations.

The Company believes this measure provides valuable insight into

the growth in recurring Tenant Billings and underlying demand for

its real estate portfolio.

Organic Tenant Billings Growth: The portion of Tenant

Billings Growth attributable to Organic Tenant Billings. The

Company believes that organic growth is a useful measure of its

ability to add tenancy and incremental revenue to its assets for

the reported period, which enables investors and analysts to gain

additional insight into the relative attractiveness, and therefore

the value, of the Company’s property assets.

New Site Tenant Billings Growth: The portion of Tenant

Billings Growth attributable to New Site Tenant Billings. The

Company believes this measure provides valuable insight into the

growth attributable to Tenant Billings from recently acquired or

constructed properties.

Gross Margin: Revenues less operating expenses, excluding

depreciation, amortization and accretion, selling, general,

administrative and development expense and other operating

expenses. The Company believes this measure provides valuable

insight into the site-level profitability of its assets.

Operating Profit: Gross Margin less selling, general,

administrative and development expense, excluding stock-based

compensation expense and corporate expenses. The Company believes

this measure provides valuable insight into the site-level

profitability of its assets while also taking into account the

overhead expenses required to manage each of its operating

segments.

Operating Profit and Gross Margin are before interest income,

interest expense, gain (loss) on retirement of long-term

obligations, other income (expense), net income (loss) attributable

to noncontrolling interest and income tax benefit (provision).

Operating Profit Margin: The percentage that results from

dividing Operating Profit by revenue.

Adjusted EBITDA: Net income before income (loss) from

equity method investments, income tax benefit (provision), other

income (expense), gain (loss) on retirement of long-term

obligations, interest expense, interest income, other operating

income (expense), including Goodwill impairment, depreciation,

amortization and accretion and stock-based compensation expense.

The Company believes this measure provides valuable insight into

the profitability of its operations while at the same time taking

into account the central overhead expenses required to manage its

global operations. In addition, it is a widely used performance

measure across the telecommunications real estate sector.

Adjusted EBITDA Margin: The percentage that results from

dividing Adjusted EBITDA by total revenue.

Nareit Funds From Operations (FFO), as defined by the

National Association of Real Estate Investment Trusts (Nareit),

attributable to American Tower Corporation common stockholders:

Net income before gains or losses from the sale or disposal of real

estate, real estate related impairment charges, real estate related

depreciation, amortization and accretion including adjustments and

distributions for unconsolidated affiliates and noncontrolling

interests. The Company believes this measure provides valuable

insight into the operating performance of its property assets by

excluding the charges described above, particularly depreciation

expenses, given the high initial, up-front capital intensity of the

Company’s operating model. In addition, it is a widely used

performance measure across the telecommunications real estate

sector.

Adjusted Funds From Operations (AFFO) attributable to

American Tower Corporation common stockholders: Nareit FFO

attributable to American Tower Corporation common stockholders

before (i) straight-line revenue and expense, (ii) stock-based

compensation expense, (iii) the deferred portion of income tax and

other income tax adjustments, (iv) non-real estate related

depreciation, amortization and accretion, (v) amortization of

deferred financing costs, debt discounts and premiums and long-term

deferred interest charges, (vi) other income (expense), (vii) gain

(loss) on retirement of long-term obligations, and (viii) other

operating income (expense), less cash payments related to capital

improvements and cash payments related to corporate capital

expenditures and including adjustments and distributions for

unconsolidated affiliates and noncontrolling interests, which

includes the impact of noncontrolling interests on both Nareit FFO

and the corresponding adjustments included in AFFO. The Company

believes this measure provides valuable insight into the operating

performance of its assets by further adjusting the Nareit AFFO

attributable to American Tower Corporation common stockholders

metric to exclude the factors outlined above, which if unadjusted,

may cause material fluctuations in Nareit FFO attributable to

American Tower Corporation stockholders growth from period to

period that would not be representative of the underlying

performance of the Company’s property assets in those periods. In

addition, it is a widely used performance measure across the

telecommunications real estate sector. The Company believes

providing this metric, excluding the impacts of noncontrolling

interests, enhances transparency, given the minority interests in

its Europe business and its U.S. data center business.

AFFO attributable to American Tower Corporation common

stockholders per Share: AFFO attributable to American Tower

Corporation common stockholders divided by the diluted weighted

average common shares outstanding.

Unlevered AFFO attributable to AMT common stockholders:

AFFO attributable to AMT common stockholders before deducting net

interest charges. The Company believes this measure provides

valuable insight into the India business’ contributions to the

Company’s AFFO attributable to AMT common stockholders metric,

before making assumptions on the use of proceeds for the Pending

ATC TIPL Transaction.

Free Cash Flow: Cash provided by operating activities

less total cash capital expenditures, including payments on finance

leases and perpetual land easements. The Company believes that Free

Cash Flow is useful to investors as the basis for comparing our

performance and coverage ratios with other companies in its

industry, although this measure of Free Cash Flow may not be

directly comparable to similar measures used by other

companies.

Net Debt: Total long-term debt, including current portion

and for periods beginning in the first quarter of 2019, finance

lease liabilities, less cash and cash equivalents.

Net Leverage Ratio: Net debt (total long-term debt,

including current portion, and for periods beginning in the first

quarter of 2019, finance lease liabilities, less cash and cash

equivalents) divided by the quarter’s annualized Adjusted EBITDA

(the quarter’s Adjusted EBITDA multiplied by four). The Company

believes that including this calculation is important for investors

and analysts given it is a critical component underlying its credit

agency ratings.

Cautionary Language Regarding

Forward-Looking Statements

This press release contains “forward-looking statements”

concerning our goals, beliefs, expectations, strategies,

objectives, plans, future operating results and underlying

assumptions and other statements that are not necessarily based on

historical facts. Examples of these statements include, but are not

limited to, statements regarding our full year 2024 outlook and

other targets, foreign currency exchange rates, our expectations

regarding the potential impacts of the Adjusted Gross Revenue court

ruling in India, including impacts on our customers’ payments, and

factors that could affect such expectations, the creditworthiness

and financial strength of our customers, the expected impacts of

strategic partnerships on our business, our expectations for the

closing of signed agreements, including the Pending ATC TIPL

Transaction, and the expected impacts of such agreements on our

business, our expectations regarding potential additional

impairments in India and factors that could affect our expectations

and our expectations regarding the leasing demand for

communications real estate. Actual results may differ materially

from those indicated in our forward-looking statements as a result

of various important factors, including: (1) a significant decrease

in leasing demand for our communications infrastructure would

materially and adversely affect our business and operating results,

and we cannot control that demand; (2) a substantial portion of our

current and projected future revenue is derived from a small number

of customers, and we are sensitive to adverse changes in the

creditworthiness and financial strength of our customers; (3) if

our customers consolidate their operations, exit their businesses

or share site infrastructure to a significant degree, our growth,

revenue and ability to generate positive cash flows could be

materially and adversely affected; (4) increasing competition

within our industries may materially and adversely affect our

revenue; (5) our expansion initiatives involve a number of risks

and uncertainties, including those related to integrating acquired

or leased assets, that could adversely affect our operating

results, disrupt our operations or expose us to additional risk;

(6) new technologies or changes, or lack thereof, in our or a

customer’s business model could make our communications

infrastructure leasing business less desirable and result in

decreasing revenues and operating results; (7) competition to

purchase assets could adversely affect our ability to achieve our

return on investment criteria; (8) strategic partnerships, and

divestitures, such as the Pending ATC TIPL Transaction, may

materially and adversely affect our financial condition, results of

operations or cash flows; (9) our leverage and debt service

obligations, including during a rising interest rates environment,

may materially and adversely affect our ability to raise additional

financing to fund capital expenditures, future growth and expansion

initiatives and may reduce funds available to satisfy our

distribution requirements; (10) rising inflation may adversely

affect us by increasing costs beyond what we can recover through

price increases; (11) restrictive covenants in the agreements

related to our securitization transactions, our credit facilities

and our debt securities could materially and adversely affect our

business by limiting flexibility, and we may be prohibited from

paying dividends on our common stock, which may jeopardize our

qualification for taxation as a REIT; (12) our foreign operations

are subject to economic, political and other risks that could

materially and adversely affect our revenues or financial position,

including risks associated with fluctuations in foreign currency

exchange rates; (13) our business, and that of our customers, is

subject to laws, regulations and administrative and judicial

decisions, and changes thereto, that could restrict our ability to

operate our business as we currently do or impact our competitive

landscape; (14) we may be adversely affected by regulations related

to climate change; (15) if we fail to remain qualified for taxation

as a REIT, we will be subject to tax at corporate income tax rates,

which may substantially reduce funds otherwise available, and even

if we qualify for taxation as a REIT, we may face tax liabilities

that impact earnings and available cash flow; (16) complying with

REIT requirements may limit our flexibility or cause us to forego

otherwise attractive opportunities; (17) we could have liability

under environmental and occupational safety and health laws; (18)

our towers, fiber networks, data centers or computer systems may be

affected by natural disasters (including as a result of climate

change) and other unforeseen events for which our insurance may not

provide adequate coverage or result in increased insurance

premiums; (19) if we, or third parties on which we rely, experience

technology failures, including cybersecurity incidents or the loss

of personally identifiable information, we may incur substantial

costs and suffer other negative consequences, which may include

reputational damage; (20) our costs could increase and our revenues

could decrease due to perceived health risks from radio emissions,

especially if these perceived risks are substantiated; (21) if we

are unable to protect our rights to the land under our towers and

buildings in which our data centers are located, it could adversely

affect our business and operating results; and (22) if we are

unable or choose not to exercise our rights to purchase towers that

are subject to lease and sublease agreements at the end of the

applicable period, our cash flows derived from those towers will be

eliminated. For additional information regarding factors that may

cause actual results to differ materially from those indicated in

our forward-looking statements, we refer you to the information

that is provided in the section entitled “Risk Factors” in our most

recent annual report on Form 10-K, and other risks described in

documents we subsequently file from time to time with the

Securities and Exchange Commission. We undertake no obligation to

update the information contained in this press release to reflect

subsequently occurring events or circumstances.

UNAUDITED CONSOLIDATED BALANCE

SHEETS

(In millions)

June 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

2,492.1

$

1,973.3

Restricted cash

126.5

120.1

Accounts receivable, net

712.3

669.7

Prepaid and other current assets

783.2

946.9

Total current assets

4,114.1

3,710.0

PROPERTY AND EQUIPMENT, net

19,927.7

19,788.8

GOODWILL

12,483.1

12,639.0

OTHER INTANGIBLE ASSETS, net

15,759.1

16,520.7

DEFERRED TAX ASSET

139.2

179.1

DEFERRED RENT ASSET

3,649.5

3,521.8

RIGHT-OF-USE ASSET

9,012.1

8,878.8

NOTES RECEIVABLE AND OTHER NON-CURRENT

ASSETS

753.0

789.4

TOTAL

$

65,837.8

$

66,027.6

LIABILITIES

CURRENT LIABILITIES:

Accounts payable

$

206.0

$

258.7

Accrued expenses

1,166.2

1,280.6

Distributions payable

778.1

906.2

Accrued interest

314.1

387.0

Current portion of operating lease

liability

703.4

794.6

Current portion of long-term

obligations

3,329.2

3,187.5

Unearned revenue

391.7

434.7

Total current liabilities

6,888.7

7,249.3

LONG-TERM OBLIGATIONS

35,639.2

35,734.0

OPERATING LEASE LIABILITY

7,717.7

7,438.7

ASSET RETIREMENT OBLIGATIONS

2,562.3

2,158.2

DEFERRED TAX LIABILITY

1,399.3

1,361.4

OTHER NON-CURRENT LIABILITIES

1,207.1

1,220.6

Total liabilities

55,414.3

55,162.2

COMMITMENTS AND CONTINGENCIES

EQUITY:

Common stock

4.8

4.8

Additional paid-in capital

14,955.0

14,872.9

Distributions in excess of earnings

(3,340.8

)

(3,638.8

)

Accumulated other comprehensive loss

(6,461.8

)

(5,739.5

)

Treasury stock

(1,301.2

)

(1,301.2

)

Total American Tower Corporation

equity

3,856.0

4,198.2

Noncontrolling interests

6,567.5

6,667.2

Total equity

10,423.5

10,865.4

TOTAL

$

65,837.8

$

66,027.6

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except share and per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

REVENUES:

Property

$

2,852.9

$

2,728.6

$

5,656.8

$

5,443.1

Services

47.4

43.1

77.6

95.8

Total operating revenues

2,900.3

2,771.7

5,734.4

5,538.9

OPERATING EXPENSES:

Costs of operations (exclusive of items

shown separately below):

Property

799.9

810.1

1,574.3

1,597.1

Services

22.0

17.2

35.9

36.3

Depreciation, amortization and

accretion

561.7

764.6

1,111.1

1,558.7

Selling, general, administrative and

development expense(1)

234.3

244.4

491.3

508.3

Other operating (income) expense

(1.9

)

61.7

0.9

189.2

Total operating expenses

1,616.0

1,898.0

3,213.5

3,889.6

OPERATING INCOME

1,284.3

873.7

2,520.9

1,649.3

OTHER INCOME (EXPENSE):

Interest income

43.7

30.6

91.7

61.4

Interest expense

(365.4

)

(348.1

)

(732.1

)

(688.3

)

Loss on retirement of long-term

obligations

—

(0.3

)

—

(0.3

)

Other income (expense) (including foreign

currency (losses) gains of $(21.7), $(107.6), $105.9, and $(191.7),

respectively

65.8

(81.2

)

178.8

(179.0

)

Total other expense

(255.9

)

(399.0

)

(461.6

)

(806.2

)

INCOME FROM CONTINUING OPERATIONS BEFORE

INCOME TAXES

1,028.4

474.7

2,059.3

843.1

Income tax provision

(120.0

)

(13.2

)

(229.2

)

(66.6

)

NET INCOME

908.4

461.5

1,830.1

776.5

Net (income) loss attributable to

noncontrolling interests

(8.1

)

14.2

(12.4

)

35.0

NET INCOME ATTRIBUTABLE TO AMERICAN TOWER

CORPORATION COMMON STOCKHOLDERS

$

900.3

$

475.7

$

1,817.7

$

811.5

NET INCOME PER COMMON SHARE AMOUNTS:

Basic net income attributable to American

Tower Corporation common stockholders

$

1.93

$

1.02

$

3.89

$

1.74

Diluted net income attributable to

American Tower Corporation common stockholders

$

1.92

$

1.02

$

3.89

$

1.74

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

(in thousands):

BASIC

467,038

466,087

466,778

465,915

DILUTED

467,781

466,979

467,793

466,939

_______________

(1)

Selling, general, administrative and

development expense includes stock-based compensation expense in

aggregate amounts of $46.3 million and $111.2 million for the three

and six months ended June 30, 2024, respectively, and $49.4 million

and $114.9 million for the three and six months ended June 30,

2023, respectively.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In millions)

Six Months Ended June

30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

1,830.1

$

776.5

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation, amortization and

accretion

1,111.1

1,558.7

Stock-based compensation expense

111.2

114.9

Loss on early retirement of long-term

obligations

—

0.3

Other non-cash items reflected in

statements of operations

(34.5

)

366.0

Increase in net deferred rent balances

(152.7

)

(232.8

)

Right-of-use asset and Operating lease

liability, net

31.3

(62.7

)

Changes in unearned revenue

(32.3

)

46.5

Increase in assets

(119.2

)

(238.1

)

Decrease in liabilities

(122.9

)

(49.4

)

Cash provided by operating activities

2,622.1

2,279.9

CASH FLOWS FROM INVESTING ACTIVITIES:

Payments for purchase of property and

equipment and construction activities

(721.9

)

(882.8

)

Payments for acquisitions, net of cash

acquired

(55.0

)

(91.2

)

Proceeds from sales of short-term

investments and other non-current assets(1)

251.5

6.9

Deposits and other

0.1

250.6

Cash used for investing activities

(525.3

)

(716.5

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from short-term borrowings,

net

8.7

146.2

Borrowings under credit facilities

5,097.9

4,780.0

Proceeds from issuance of senior notes,

net

2,374.1

4,182.3

Proceeds from issuance of securities in

securitization transaction

—

1,300.0

Repayments of notes payable, credit

facilities, senior notes, secured debt, term loans and finance

leases(2)

(7,189.7

)

(10,409.6

)

Contributions from noncontrolling interest

holders

102.5

1.9

Distributions to noncontrolling interest

holders

(189.2

)

(22.7

)

Proceeds from stock options and employee

stock purchase plan

23.7

10.3

Distributions paid on common stock

(1,559.2

)

(1,461.3

)

Deferred financing costs and other

financing activities(3)

(86.9

)

(100.9

)

Cash used for financing activities

(1,418.1

)

(1,573.8

)

Net effect of changes in foreign currency

exchange rates on cash and cash equivalents, and restricted

cash

(153.5

)

19.1

NET INCREASE IN CASH AND CASH EQUIVALENTS,

AND RESTRICTED CASH

525.2

8.7

CASH AND CASH EQUIVALENTS, AND RESTRICTED

CASH, BEGINNING OF PERIOD

2,093.4

2,140.7

CASH AND CASH EQUIVALENTS, AND RESTRICTED

CASH, END OF PERIOD

$

2,618.6

$

2,149.4

CASH PAID FOR INCOME TAXES, NET(4)

$

179.2

$

131.1

CASH PAID FOR INTEREST

$

803.1

$

681.4

_______________

(1)

Six months ended June 30, 2024 includes

$238.0 million from the sale of the VIL Shares and the VIL

OCDs.

(2)

Six months ended June 30, 2024 and June

30, 2023 include $2.2 million and $4.1 million of finance lease

payments, respectively.

(3)

Six months ended June 30, 2024 and June

30, 2023 include $16.2 million and $21.6 million of perpetual land

easement payments, respectively.

(4)

Six months ended June 30, 2024 includes

withholding taxes paid in India of $33.5 million, which were

incurred as a result of the Pending ATC TIPL Transaction.

UNAUDITED CONSOLIDATED RESULTS FROM

OPERATIONS, BY SEGMENT

($ in millions, totals may not add due to

rounding.)

Three Months Ended June 30,

2024

Property

Services

Total

U.S. & Canada

Latin America

Asia- Pacific

Africa

Europe

Total International(1)

Data Centers(2)

Total Property

Segment revenues

$

1,315

$

449

$

361

$

294

$

203

$

1,307

$

231

$

2,853

$

47

$

2,900

Segment operating expenses

221

136

174

96

73

480

99

800

22

822

Segment Gross Margin

$

1,095

$

312

$

187

$

198

$

130

$

827

$

132

$

2,053

$

25

$

2,078

Segment SG&A(3)

40

22

16

15

15

69

19

128

5

132

Segment Operating Profit

$

1,055

$

291

$

171

$

182

$

115

$

758

$

113

$

1,925

$

21

$

1,946

Segment Operating Profit Margin

80

%

65

%

47

%

62

%

56

%

58

%

49

%

67

%

44

%

67

%

Growth Metrics

Revenue Growth

0.9

%

2.1

%

37.9

%

(8.5

)%

2.5

%

7.1

%

12.6

%

4.6

%

10.0

%

4.6

%

Total Tenant Billings Growth

5.0

%

2.4

%

2.5

%

19.8

%

7.2

%

7.6

%

N/A

6.1

%

Organic Tenant Billings Growth

5.1

%

2.2

%

2.1

%

13.2

%

5.7

%

5.5

%

N/A

5.3

%

Revenue Components(4)

Prior-Year Tenant Billings

$

1,157

$

299

$

161

$

201

$

131

$

793

$

—

$

1,951

Colocations/Amendments

45

8

4

14

5

31

—

76

Escalations

35

12

3

19

4

39

—

73

Cancellations

(19

)

(13

)

(5

)

(6

)

(1

)

(26

)

—

(44

)

Other

(3

)

(1

)

1

0

(0

)

0

—

(2

)

Organic Tenant Billings

$

1,216

$

306

$

165

$

228

$

139

$

837

$

—

$

2,053

New Site Tenant Billings

(1

)

1

1

13

2

17

—

16

Total Tenant Billings

$

1,215

$

306

$

165

$

241

$

141

$

854

$

—

$

2,069

Foreign Currency Exchange Impact(5)

(0

)

(1

)

(2

)

(42

)

(1

)

(47

)

—

(47

)

Total Tenant Billings (Current Period)

$

1,215

$

305

$

163

$

200

$

140

$

807

$

—

$

2,023

Straight-Line Revenue

63

(3

)

0

13

1

11

3

77

Pre-paid Amortization Revenue

20

1

—

(0

)

5

5

—

25

Other Revenue

17

30

28

(5

)

8

60

228

305

International Pass-Through Revenue

—

122

172

94

51

440

—

440

Foreign Currency Exchange Impact(6)

0

(5

)

(3

)

(8

)

(1

)

(16

)

—

(16

)

Total Property Revenue (Current

Period)

$

1,315

$

449

$

361

$

294

$

203

$

1,307

$

231

$

2,853

_______________

(1)

Total International reflects the Company’s

international operations excluding Canada.

(2)

For additional details related to the Data

Centers segment, please refer to the supplemental disclosure

package available on the Company’s website.

(3)

Excludes stock-based compensation

expense.

(4)

All components of revenue, except those

labeled current period, have been translated at prior-period

foreign currency exchange rates.

(5)

Reflects foreign currency exchange impact

on all components of Total Tenant Billings.

(6)

Reflects foreign currency exchange impact

on components of revenue, other than Total Tenant Billings.

UNAUDITED CONSOLIDATED RESULTS FROM

OPERATIONS, BY SEGMENT (CONTINUED)

($ in millions, totals may not add due to

rounding.)

Three Months Ended June 30,

2023

Property

Services

Total

U.S. & Canada

Latin America

Asia- Pacific

Africa

Europe

Total International(1)

Data Centers(2)

Total Property

Segment revenues

$

1,303

$

439

$

262

$

321

$

198

$

1,221

$

205

$

2,729

$

43

$

2,772

Segment operating expenses

217

140

180

113

77

510

84

810

17

827

Segment Gross Margin

$

1,086

$

300

$

82

$

208

$

121

$

711

$

121

$

1,919

$

26

$

1,944

Segment SG&A(3)

42

24

17

19

15

75

19

135

5

140

Segment Operating Profit

$

1,045

$

276

$

65

$

190

$

106

$

636

$

103

$

1,784

$

21

$

1,804

Segment Operating Profit Margin

80

%

63

%

25

%

59

%

53

%

52

%

50

%

65

%

48

%

65

%

Growth Metrics

Revenue Growth

5.4

%

3.3

%

(12.2

)%

12.5

%

10.9

%

2.8

%

7.2

%

4.4

%

(27.9

)%

3.6

%

Total Tenant Billings Growth

5.1

%

5.6

%

8.8

%

18.1

%

10.2

%

10.3

%

N/A

7.2

%

Organic Tenant Billings Growth

5.1

%

5.4

%

5.6

%

12.9

%

8.3

%

7.9

%

N/A

6.2

%

Revenue Components(4)

Prior-Year Tenant Billings

$

1,101

$

276

$

158

$

196

$

117

$

747

$

—

$

1,848

Colocations/Amendments

59

10

11

14

3

38

—

97

Escalations

32

22

3

23

7

55

—

88

Cancellations

(33

)

(17

)

(6

)

(12

)

(1

)

(36

)

—

(69

)

Other

(2

)

0

0

1

(0

)

1

—

(1

)

Organic Tenant Billings

$

1,158

$

290

$

167

$

221

$

127

$

806

$

—

$

1,963

New Site Tenant Billings

(0

)

1

5

10

2

18

—

18

Total Tenant Billings

$

1,157

$

291

$

172

$

231

$

129

$

824

$

—

$

1,981

Foreign Currency Exchange Impact(5)

(0

)

8

(11

)

(30

)

2

(30

)

—

(31

)

Total Tenant Billings (Current Period)

$

1,157

$

299

$

161

$

201

$

131

$

793

$

—

$

1,951

Straight-Line Revenue

101

(2

)

1

17

1

17

5

123

Pre-paid Amortization Revenue

21

0

—

0

4

5

—

26

Other Revenue

24

23

(21

)

(14

)

8

(4

)

200

219

International Pass-Through Revenue

—

116

127

134

53

430

—

430

Foreign Currency Exchange Impact(6)

(0

)

2

(7

)

(17

)

1

(21

)

—

(21

)

Total Property Revenue (Current

Period)

$

1,303

$

439

$

262

$

321

$

198

$

1,221

$

205

$

2,729

_______________

(1)

Total International reflects the Company’s

international operations excluding Canada.

(2)

For additional details related to the Data

Centers segment, please refer to the supplemental disclosure

package available on the Company’s website.

(3)

Excludes stock-based compensation

expense.

(4)

All components of revenue, except those

labeled current period, have been translated at prior-period

foreign currency exchange rates.

(5)

Reflects foreign currency exchange impact

on all components of Total Tenant Billings.

(6)

Reflects foreign currency exchange impact

on components of revenue, other than Total Tenant

Billings.

UNAUDITED SELECTED CONSOLIDATED

FINANCIAL INFORMATION

($ in millions, except share and per share

data, totals may not add due to rounding.)

The reconciliation of Adjusted EBITDA

to net income and the calculation of Adjusted EBITDA Margin are as

follows:

Three Months Ended June

30,

2024

2023

Net income

$

908.4

$

461.5

Income tax provision

120.0

13.2

Other (income) expense

(65.8

)

81.2

Loss on retirement of long-term

obligations

—

0.3

Interest expense

365.4

348.1

Interest income

(43.7

)

(30.6

)

Other operating (income) expense

(1.9

)

61.7

Depreciation, amortization and

accretion

561.7

764.6

Stock-based compensation expense

46.3

49.4

Adjusted EBITDA

$

1,890.4

$

1,749.4

Total revenue

$

2,900.3

$

2,771.7

Adjusted EBITDA Margin

65

%

63

%

The reconciliation of Nareit FFO

attributable to American Tower Corporation common stockholders to

net income and the calculation of AFFO attributable to American

Tower Corporation common stockholders and AFFO attributable to

American Tower Corporation common stockholders per Share are as

follows:

Three Months Ended June

30,

2024

2023

Net income

$

908.4

$

461.5

Real estate related depreciation,

amortization and accretion

521.9

703.0

Losses from sale or disposal of real

estate and real estate related impairment charges(1)

9.0

50.3

Adjustments and distributions for

unconsolidated affiliates and noncontrolling interests(2)

(89.2

)

(82.2

)

Nareit FFO attributable to AMT common

stockholders

$

1,350.1

$

1,132.6

Straight-line revenue

(73.7

)

(120.8

)

Straight-line expense

13.1

7.6

Stock-based compensation expense

46.3

49.4

Deferred portion of income tax and other

income tax adjustments(3)

29.0

(55.6

)

Non-real estate related depreciation,

amortization and accretion

39.8

61.6

Amortization of deferred financing costs,

debt discounts and premiums and long-term deferred interest

charges

13.3

12.5

Other (income) expense(4)

(65.8

)

81.2

Loss on retirement of long-term

obligations

—

0.3

Other operating expense(5)

(10.9

)

11.4

Capital improvement capital

expenditures

(34.1

)

(30.0

)

Corporate capital expenditures

(3.2

)

(4.2

)

Adjustments and distributions for

unconsolidated affiliates and noncontrolling interests(6)

1.9

4.6

AFFO attributable to AMT common

stockholders

$

1,305.8

$

1,150.6

Divided by weighted average diluted shares

outstanding (in thousands)

467,781

466,979

AFFO attributable to AMT common

stockholders per Share

$

2.79

$

2.46

_______________

(1)

There are no material impairment charges

for the three months ended June 30, 2024. Three months ended June

30, 2023 includes impairment charges of approximately $37.5

million.

(2)

Includes distributions to noncontrolling

interest holders, distributions related to the outstanding

mandatorily convertible preferred equity in connection with the

Company’s agreements with certain investment vehicles affiliated

with Stonepeak Partners LP and adjustments for the impact of

noncontrolling interests on Nareit FFO attributable to American

Tower Corporation common stockholders.

(3)

Three months ended June 30, 2024 include

an adjustment for withholding taxes paid in India of $21.7 million,

which were incurred as a result of the Pending ATC TIPL

Transaction. We believe that these withholding tax payments are

nonrecurring, and do not believe these are an indication of our

operating performance. Accordingly, we believe it is more

meaningful to present AFFO attributable to American Tower

Corporation common stockholders excluding these amounts.

(4)

Three months ended June 30, 2024 and June

30, 2023 include losses on foreign currency exchange rate

fluctuations of $21.7 million and $107.6 million, respectively.

(5)

Primarily includes acquisition-related

costs, integration costs and disposition costs.

(6)

Includes adjustments for the impact of

noncontrolling interests on other line items, excluding those

already adjusted for in Nareit FFO attributable to American Tower

Corporation common stockholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730943766/en/

Adam Smith Senior Vice President, Investor Relations and

FP&A Telephone: (617) 375-7500

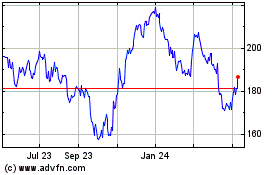

American Tower (NYSE:AMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

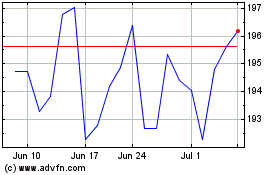

American Tower (NYSE:AMT)

Historical Stock Chart

From Nov 2023 to Nov 2024