Company Raises Full Year Revenue Outlook

SoundHound AI, Inc. (Nasdaq: SOUN), a global leader in voice

artificial intelligence, today reported its financial results for

the first quarter 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240509392903/en/

SoundHound AI Reports 73% Q1 Revenue

Growth to $11.6 Million; First Quarter Closes With $226 Million in

Cash (Graphic: Business Wire)

“Our first quarter sets the tone for 2024 as another year of

strong growth for SoundHound. Voice AI is fast becoming a must-have

tool for customer service, and that’s reflected in the demand we’re

seeing for subscriptions,” said Keyvan Mohajer, CEO and Co-Founder

of SoundHound AI. "As an AI company, we combine our 20+ years of

technology innovation and billions of customer interactions to

create the best voice AI technology on the market. Across

automotive and customer service, global brands are increasingly

looking to us to provide an exceptional experience."

First Quarter Financial Highlights

- Reported revenue was $11.6 million, an increase of 73%

year-over-year

- GAAP gross margin was 60%; non-GAAP gross margin was 66%

- GAAP earnings per share was a loss of ($0.12); non-GAAP

earnings per share was a loss of ($0.07)

- GAAP net loss was ($33.0) million; non-GAAP net loss was

($19.9) million

- Adjusted EBITDA was ($15.4) million

- The consolidated results include the operational and

transactional impacts from the acquisition of SYNQ3, which closed

in the first quarter; non-GAAP metrics1 exclude certain one-time

transaction expenses, amortization of intangibles and fair value of

contingent liabilities as described in more detail below.

- Cumulative subscriptions & bookings backlog2 customer

metric was $682 million and grew by approximately 80% year over

year

- Annual run rate of over 4 billion queries, first quarter up

more than 60% year-over-year

- Strong cash balance of $226 million at the end of the first

quarter

“We were pleased to start the year with a robust top line

performance, in our strongest Q1 ever,” said Nitesh Sharan, CFO of

SoundHound AI. ”Our business momentum continues to accelerate with

a growing pipeline across all businesses.”

First Quarter Business Highlights

Customer Service

- The company closed the acquisition of SYNQ3 in the quarter. The

combination creates the largest voice AI provider for restaurants

with over 10,000 active locations.

- Dynamic Interaction, SoundHound’s next generation drive thru AI

interface, is now live with a top global QSR brand.

- Agreements have also been executed with a number of other large

QSR brands, including Church's Chicken.

- Applebee’s has expanded its use of voice AI ordering across

multiple franchisees resulting in an additional 500 live

locations.

- Another major QSR with over 2,000 locations uses SoundHound’s

AI for drive thru and continues to expand this to more locations as

they add drive-thru capabilities.

- SoundHound’s Smart Answering has extended the company’s

customer service offering beyond restaurants, with new

multi-location customers including a major Planet Fitness

franchisee.

Automotive+

- SoundHound partnered with NVIDIA to deliver in-vehicle

voice-enabled generative AI responses that don’t require

connectivity, with large language models running on NVIDIA

DRIVE.

- SoundHound Chat AI, the world’s first voice assistant with

integrated generative AI continues to ramp with Stellantis. In

addition to Opel, Peugeot, Vauxhall and DS Automobiles,

announcements were made by Alfa Romeo, and Lancia.

- Stellantis’s DS Automobiles became the first vehicle on the

road in Japan with voice-enabled generative AI, via SoundHound Chat

AI.

- Signed a multi-year agreement to license our software with a

large broadcaster and telecommunications company that provides

television, internet, fixed line and mobile telephone services to

consumers and businesses in Austria, Germany, Ireland, Italy and

the UK.

- Later this summer another prominent US-based EV maker will go

live into production with SoundHound voice assistants across its

full fleet of market-leading vehicles.

- A new deal with a leading Asian electric car manufacturer to

embed SoundHound’s software into its expanding lineup of affordable

luxury cars.

Other partnerships

- SoundHound partnered with Perplexity to bring cutting-edge

online LLMs to SoundHound Chat AI. This will expand the type and

complexity of the questions the assistant is able to answer across

phones, cars, and IoT devices.

- The company joined ARM's partner program where it anticipates

being able to showcase new advancements of its leading voice AI

platform.

(1)

Please see table below for a

reconciliation from GAAP to non-GAAP.

(2)

See section ‘Certain Defined Terms’ at the

end of this press release for additional information.

First Quarter 2024 Financial

Measures1

Three Months Ended

(thousands, except per share data)

March

31, 2024

March

31, 20232

Change

Revenues

$

11,594

$

6,707

73

%

GAAP gross profit

$

6,925

$

4,731

46

%

Non-GAAP gross profit

$

7,598

$

4,846

57

%

GAAP gross margin

59.7

%

70.5

%

-10.8pp

Non-GAAP gross margin

65.5

%

72.3

%

-6.8pp

GAAP operating loss

$

(28,529

)

$

(25,203

)

-13

%

Non-GAAP adjusted EBITDA

$

(15,404

)

$

(14,914

)

-3

%

GAAP net loss

$

(33,009

)

$

(27,430

)

-20

%

Non-GAAP net loss

$

(19,884

)

$

(17,141

)

-16

%

GAAP net loss per share

$

(0.12

)

$

(0.14

)

0.02

Non-GAAP net loss per share

$

(0.07

)

$

(0.08

)

0.01

(1)

Please see table below for a

reconciliation from GAAP to non-GAAP.

(2)

Note: the Company identified corrections

related to historical financial transactions for certain prior

periods, which have been revised. These amounts were primarily

related to other income and expenses. Specifically, general and

admin was adjusted by $165 and net loss, which further included the

result of changes to other income and expenses by $896, was

impacted by $1,061 for the period ending March 31, 2023. Further

details will be provided when the company's 10-Q is filed.

Liquidity and Cash Flows

The company’s total cash was $226 million at March 31, 2024.

Condensed Cash Flow Statement

Three Months Ended

(thousands)

March

31, 2024

March

31, 2023

Cash flows:

Net cash used in operating activities

$

(21,948

)

$

(14,540

)

Net cash used in investing activities

(3,788

)

(15

)

Net cash provided by financing

activities

142,698

51,641

Effects of exchange rate changes on

cash

103

-

Net change in cash and cash

equivalents

$

117,065

$

37,086

Business Outlook

SoundHound updates full year 2024 revenue outlook to be in a

range of $65 to $77 million.

Additional Information

For more information please see the company’s SEC filings which

can be obtained on the company’s website at

investors.soundhound.com. The financial statements will be posted

on the website, and will be included when we file our 10-Q. The

financial data presented in this press release should be considered

preliminary until the company files its 10-Q.

The company will hold its Annual Shareholder Meeting on June 12,

2024 and more information can be found here: Annual Meeting.

Conference Call and Webcast

Keyvan Mohajer, Co-Founder and CEO, and Nitesh Sharan, CFO will

host a live audio conference call and webcast today at 2:00 p.m.

Pacific Time/5:00 p.m. Eastern Time. A live webcast and replay will

also be accessible at investors.soundhound.com.

About SoundHound AI

SoundHound (Nasdaq: SOUN), a global leader in conversational

intelligence, offers voice AI solutions that let businesses offer

incredible conversational experiences to their customers. Built on

proprietary technology, SoundHound’s voice AI delivers

best-in-class speed and accuracy in numerous languages to product

creators across automotive, TV, and IoT, and to customer service

industries via groundbreaking AI-driven products like Smart

Answering, Smart Ordering, and Dynamic Drive-Thru, an AI-powered

multimodal food ordering solution. Along with SoundHound Chat AI, a

powerful voice assistant with integrated Generative AI, SoundHound

powers millions of products and services, and processes billions of

interactions each year for world class businesses.

www.soundhound.com

Forward Looking Statements and Other Disclosures

This press release contains forward-looking statements, which

are not historical facts, within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. In some cases, you can

identify forward-looking statements by the use of words such as

“may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,”

“likely,” “will,” “would” and variations of these terms and similar

expressions, or the negative of these terms or similar expressions.

These forward-looking statements include, but are not limited to,

statements concerning our expected financial performance, our

ability to implement our business strategy and anticipated business

and operations, the potential utility of and market for our

products and services, our ability to achieve revenue from our

cumulative bookings backlog and subscription bookings backlog, and

guidance for financial results for 2024. Such forward-looking

statements are necessarily based upon estimates and assumptions

that, while considered reasonable by us and our management, are

inherently uncertain. As a result, readers are cautioned not to

place undue reliance on these forward-looking statements. Our

actual results may differ materially from those expressed or

implied by these forward-looking statements as a result of risks

and uncertainties impacting SoundHound’s business including, our

ability to successfully launch and commercialize new products and

services and derive significant revenue, our ability to develop the

bespoke products and services required under the contracts included

in our bookings backlog and subscription backlog, including, but

not limited to, our ability to convert customer adoption of Smart

Ordering into realized revenue, our ability to predict or measure

supply chain disruptions at our customers, our market opportunity

and our ability to acquire new customers and retain existing

customers, unexpected costs, charges or expenses resulting from the

acquisition of SYNQ3, the ability of the SYNQ3 acquisition to be

accretive on the company's financial results, the timing and impact

of our growth initiatives, level of product service failures that

could lead our customers to use competitors’ services, our ability

to predict direct and indirect customer demand for our existing and

future products, our ability to hire, retain and motivate

employees, the effects of competition, including price competition

within our industry segment, technological, regulatory and legal

developments that uniquely or disproportionately impact our

industry segment, developments in the economy and financial markets

and those other factors described in our risk factors set forth in

our filings with the Securities and Exchange Commission from time

to time, including our Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. We do not

intend to update or alter our forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by applicable law.

Certain Defined Terms

Cumulative Subscriptions & Bookings Backlog, includes our

bookings backlog and subscriptions backlog in one holistic metric.

Cumulative bookings backlog is derived from committed customer

contracts and takes into account the prior quarter end balance of

bookings backlog plus new bookings in the current quarter minus

associated revenue recognized from bookings from prior periods.

Subscriptions backlog refers to potential revenue achievable for

the company with current customers where the company is the leading

or exclusive provider, and assuming a 4-year ramp up during which

time our technologies are being implemented and assuming a

successful full roll out of our technologies over a total 5-year

duration. Reasonable assumptions about adoption percentages are

included, with lower percentages applied to pilot and

proof-of-concept customers.

Non-GAAP Measures of Financial Performance

To supplement the company’s financial statements, which are

presented on the basis of U.S. generally accepted accounting

principles (GAAP), the following non-GAAP measures of financial

performance are included in this release: non-GAAP gross profit,

non-GAAP gross margin, adjusted EBITDA, non-GAAP net loss and

non-GAAP earnings per share.

The company believes that providing this non-GAAP information in

addition to the GAAP financial information, allows investors to

view the financial results in the way the company views its

operating results. The company also believes that providing this

information allows investors to not only better understand the

company's financial performance, but also, better evaluate the

information used by management to evaluate and measure such

performance.

As such, the company believes that disclosing non-GAAP financial

measures to the readers of its financial statements provides the

reader with useful supplemental information that allows for greater

transparency in the review of the company’s financial and

operational performance.

We define the company's non-GAAP measures by excluding certain

items:

We arrive at non-GAAP gross profit and non-GAAP gross margin by

excluding (i) amortization of intangibles (including acquired

intangible assets) and (ii) stock-based compensation.

We arrive at adjusted EBITDA by excluding (i) total interest and

other income/(expense), net, (ii) income taxes, (iii) depreciation

and amortization expense (including acquired intangible assets),

(iv) stock-based compensation, (v) restructuring expense, (vi)

change in fair value of contingent consideration for business

acquisition, and (vii) acquisition-related costs.

We arrive at non-GAAP net loss and non-GAAP net loss per share

by excluding (i) depreciation and amortization expense (including

acquired intangible assets), (ii) stock-based compensation, (iii)

restructuring expense, (iv) change in fair value of contingent

consideration for business acquisition, and (v) acquisition-related

costs.

Reconciliations of GAAP to these adjusted non-GAAP financial

measures are included in the tables below. When analyzing the

company's operating results, investors should not consider non-GAAP

measures as substitutes for the comparable financial measures

prepared in accordance with GAAP.

To the extent that the Company presents any forward-looking

non-GAAP financial measures, the Company does not present a

quantitative reconciliation of such measures to the most directly

comparable GAAP financial measure (or otherwise present such

forward-looking GAAP measures) because it is impractical to do

so.

First Quarter Reconciliation of GAAP Gross Profit to Non-GAAP

Gross Profit and GAAP Gross Margin to Non-GAAP Gross Margin

Three Months Ended

(thousands)

March 31, 2024

March 31, 2023

GAAP gross profit1

$

6,925

$

4,731

Adjustments:

Amortization of Intangibles

521

-

Stock-based compensation

152

115

Non-GAAP gross profit

$

7,598

$

4,846

GAAP gross margin

59.7

%

70.5

%

Non-GAAP gross margin

65.5

%

72.3

%

(1)

GAAP gross profit is calculated by

subtracting the cost of revenues from revenues.

First Quarter Reconciliation of GAAP Net Loss to Non-GAAP

Adjusted EBITDA

Three Months Ended

(thousands)

March 31, 2024

March 31, 2023

GAAP net loss

$

(33,009

)

$

(27,430

)

Adjustments:

Interest and other income/(expense),

net1

4,185

1,898

Income taxes

295

329

Depreciation and amortization

1,471

708

Stock-based compensation

6,979

5,996

Restructuring

-

3,585

Change in fair value of contingent

acquisition liabilities

4,162

-

Acquisition-related expenses

513

-

Non-GAAP adjusted EBITDA

$

(15,404

)

$

(14,914

)

(1)

Includes other income/(expense) of $1.5 and $(0.8) million for

the three months ended March 31, 2024 and 2023, respectively.

First Quarter Reconciliation of GAAP Net Loss to Non-GAAP Net

Loss and Non-GAAP Net Loss Per Share

Three Months Ended (thousands)

March 31, 2024

March 31, 2023

GAAP net loss

$

(33,009

)

(27,430

)

Adjustments:

Depreciation and amortization

1,471

708

Stock-based compensation

6,979

5,996

Restructuring

-

3,585

Change in fair value of contingent

acquisition liabilities

4,162

-

Acquisition-related expenses

513

-

Non-GAAP net loss

$

(19,884

)

(17,141

)

GAAP net loss per share1

(0.12

)

(0.14

)

Adjustments

0.05

0.06

Non-GAAP Net loss per share1

(0.07

)

(0.08

)

(1)

Weighted average common shares outstanding (basic and diluted)

for the three months ended March 31, 2024 and March 31, 2023 were

286,596,559 and 205,082,328, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509392903/en/

Investors: Scott Smith 408-724-1498 IR@SoundHound.com

Media: Fiona McEvoy 415-610-6590 PR@SoundHound.com

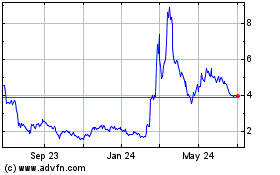

SoundHound AI (NASDAQ:SOUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

SoundHound AI (NASDAQ:SOUN)

Historical Stock Chart

From Dec 2023 to Dec 2024