false

0001491419

0001491419

2024-08-29

2024-08-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 29, 2024

LIVEONE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38249 |

|

98-0657263 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

269 South Beverly Drive, Suite 1450

Beverly Hills, CA 90212

(Address of principal executive offices) (Zip Code)

(310) 601-2505

(Registrant’s telephone number, including

area code)

n/a

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value per share |

|

LVO |

|

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

LiveOne, Inc. (the “Company”)

intends, from time to time, to present and/or distribute to the investment community and utilize at various industry and other conferences

the Company’s Corporate Presentation (the “Corporate Presentation”), which is attached hereto as Exhibit 99.1 and incorporated

herein by reference.

The information in this Item

7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except

as shall be expressly set forth by reference in such a filing.

The Company cautions you

that the Corporate Presentation contains “forward-looking statements.” Statements in the Corporate Presentation that are not

purely historical are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which

may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements. These risks,

uncertainties and factors include, but are not limited to: the Company’s reliance on one key customer for a substantial percentage

of its revenue; the Company’s ability to consummate any proposed financing, acquisition, spin-out, special dividend, merger, distribution

or transaction, the timing of the consummation of any such proposed event, including the risks that a condition to the consummation of

any such event would not be satisfied within the expected timeframe or at all, or that the consummation of any proposed financing, acquisition,

spin-out, merger, special dividend, distribution or transaction will not occur or whether any such event will enhance shareholder value;

the Company’s ability to continue as a going concern; the Company’s ability to attract, maintain and increase the number of

its users and paid members; the Company identifying, acquiring, securing and developing content; the Company’s intent to repurchase

shares of its and/or PodcastOne’s common stock from time to time under the Company’s announced stock repurchase program and

the timing, price, and quantity of repurchases, if any, under the program; the Company’s ability to maintain compliance with certain

financial and other covenants; the Company successfully implementing its growth strategy, including relating to its technology platforms

and applications; management’s relationships with industry stakeholders; the Company’s ability to generate sufficient cash

flow to make payments on its indebtedness and payables; uncertain and unfavorable outcomes in legal proceedings; changes in economic conditions;

competition; risks and uncertainties applicable to the businesses of the Company’s subsidiaries; and other risks, uncertainties

and factors including, but not limited to, those described in the Company’s Annual Report on Form 10-K for the fiscal year ended

March 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 1, 2024, Quarterly Report on Form

10-Q for the fiscal quarter ended June 30, 2024, filed with the SEC on August 13, 2024, and in the Company’s other filings and submissions

with the SEC. These forward-looking statements speak only as of the date hereof, and the Company disclaims any obligations to update these

statements, except as may be required by law. The Company intends that all forward-looking statements be subject to the safe-harbor provisions

of the Private Securities Litigation Reform Act of 1995.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit No. |

|

Description |

| 99.1* |

|

Corporate Presentation. |

| 104* |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LIVEONE, INC. |

| |

|

| Dated: August 29, 2024 |

By: |

/s/ Aaron Sullivan |

| |

Name: |

Aaron Sullivan |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Investor Presentation AUGUST 2024 1

The information in this presentation is provided to you by LiveOne, Inc . (the “Company” or “LiveOne”) solely for informational purposes and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security or instrument of the Company, or to participate in any investment activity or trading strategy, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment in the United States or anywhere else . By viewing or participating in this presentation, you acknowledge and agree that (i) the information contained in this presentation is intended for the recipient of this information only and shall not be disclosed, reproduced or distributed in any way to anyone else, (ii) no part of this presentation or any other materials provided in connection herewith may be copied, retained, taken away, reproduced or redistributed following this presentation, and (iii) all participants must return all materials provided in connection herewith to the Company at the completion of the presentation . By viewing, accessing or participating in this presentation, you agree to be bound by the foregoing limitations . No representations, warranties or undertakings, express or implied, are made and no reliance should be placed on the accuracy, fairness or completeness of the information, sources or opinions presented or contained in this presentation, or in the case of projections contained herein, as to their attainability or the accuracy and completeness of the assumptions from which they are derived, and it is expected that each prospective investors will pursue his, her or its own independent investigation . The statistical and industry data included herein was obtained from various sources, including certain third parties, and has not been independently verified . By viewing or accessing the information contained in this presentation, the recipient hereby acknowledges and agrees that neither the Company nor any representatives of the Company accepts any responsibility for or makes any representation or warranty, express or implied, with respect to the truth, accuracy, fairness, completeness or reasonableness of the information contained in, and omissions from, these materials and that neither the Company nor any of its affiliates, employees, officers, directors, advisers, placement agents or representatives accepts any liability whatsoever for any loss howsoever arising from any information presented or contained in these materials . This presentation contains forward - looking statements, including descriptions about the intent, belief or current expectations of the Company and its management about future performance and results . All statements other than statements of historical facts contained in this press release are "forward - looking statements," which may often, but not always, be identified by the use of such words as "may," "might," "will," "will likely result," "would," "should," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "continue," "target" or the negative of such terms or other similar expressions . These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements, including : the Company's reliance on one key customer for a substantial percentage of its revenue ; the Company's ability to consummate any proposed financing, acquisition, spin - out, special dividend, merger, distribution or transaction, including the proposed spin - out and special dividend of the Company’s pay - per - view business, the timing of the consummation of any such proposed event, including the risks that a condition to the consummation of any such event would not be satisfied within the expected timeframe or at all, or that the consummation of any proposed financing, acquisition, spin - out, merger, special dividend, distribution or transaction will not occur or whether any such event will enhance shareholder value ; the Company's ability to continue as a going concern ; the Company's ability to attract, maintain and increase the number of its users and paid members ; the Company identifying, acquiring, securing and developing content ; the Company's intent to repurchase shares of its and/or PodcastOne’s common stock from time to time under its announced stock repurchase program and the timing, price, and quantity of repurchases, if any, under the program ; the Company's ability to maintain compliance with certain financial and other covenants ; the Company successfully implementing its growth strategy, including relating to its technology platforms and applications ; management's relationships with industry stakeholders ; uncertain and unfavorable outcomes in legal proceedings ; changes in economic conditions ; competition ; risks and uncertainties applicable to the businesses of the Company's subsidiaries ; and other risks, uncertainties and factors including, but not limited to, those described in the Company's Annual Report on Form 10 - K for the fiscal year ended March 31 , 2024 , filed with the U . S . Securities and Exchange Commission (the "SEC") on July 1 , 2024 , Quarterly Report on Form 10 - Q for the fiscal quarter ended June 30 , 2024 , filed with the SEC on August 13 , 2024 , and in the Company's other filings and submissions with the SEC . These forward - looking statements speak only as of the date hereof, and the Company disclaims any obligation to update these statements, except as may be required by law . The Company intends that all forward - looking statements be subject to the safe - harbor provisions of the Private Securities Litigation Reform Act of 1995 . This presentation speaks as of August 29 , 2024 . The information presented or contained in this presentation is subject to change without notice and its accuracy is not guaranteed . Neither the delivery of this presentation nor any further discussion of the Company or any of its affiliates, shareholders, officers, directors, employees, agents or advisors with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since that date . 2 Legal Disclaimer

An award - winning, creator - first, music, entertainment and technology platform focused on delivering premium experiences and content worldwide through memberships and live and virtual events. We give fans, brands, and bands the best seat in the house List e n Wat c h A t t e n d E n g a ge Tra n s a ct AT A GLANCE… 3

Financial Highlights LIVEONE, INC. ANNUAL REVENUE (Fiscal Year ends March 31st) 2018 - $7.2M 2019 - $33.7M 2020 - $38.7M 2021 - $65.2M 2022 - $117M 2023 - $99.6M 2024 - $118.4M 2025 - $140M - $155M* At the recent LiveOne stock price of $1.56 per share (~$154.4M Market Capitalization) • Reported Q1 FY2025 (ended 06/30/2024) Consolidated Revenue of $33.1M and Adjusted EBITDA* of $2.9M • Reported Full Year FY2024 (ended 03/31/2024) Consolidated Revenue of $118.4M and Adjusted EBITDA* of $11.0M • Full FY2025 (ending 3/31/2025) Guidance for Consolidated Revenue of $140M - $155M and Adjusted EBITDA* of $20M - $25M • Audio Division (Slacker and PodcastOne) Reported Full Year FY2024 Revenue of $109.3M and Adjusted EBITDA* of $20.6M • Audio Division Full FY2025 Guidance for Revenue of $130M - $140M and Adjusted EBITDA* of $20M - $25M • Repurchased 4.38 million shares of common stock under LiveOne’s Share Stock Repurchase Program as of August 14, 2024, leaving capacity to repurchase an additional ~ $6.3M worth of shares • Shares of common stock outstanding as of August 14, 2024 was 95.1M • Analyst Coverage: ROTH, Ladenburg, Alliance Global Partners, and Litchfield Hills * See About Non - GAAP Financial Measures in LiveOne’s SEC filings and press releases 4

Peer Group Valuations 5 EV/Revenue Revenue (TTM) Enterprise Value (EV) 1.38 $123.8M $170.63M • LiveOne (LVO) 2.34 $8.9B $20.84B • Sirius Radio (SIRI) 4.59 $13.8B $63.28B • Spotify (SPOT) 1.54 $3.8B $5.86B • iHeart Radio (IHRT) 2.60 $356M $927.61M • Stingray (RAY - A.TO) Peer Group Average EV/Revenue: 2.76 All Data pulled from Yahoo Finance on August 14, 2024

Complementary Portfolio of Subsidiaries and Brands PPV ONE DAYONE Music Publ i sh i ng Splitmind 6

Source: Houlihan Lokey Fall 2023 Report, MRI - Simmons, IFPI, BBC, Billboard, eMarketer, Facebook Live, Forbes, The Verge, Statista, Nielsen, Broker research, Grand View Resource, Morder Intelligence LiveOne’s Model Addresses Five Large Market Verticals • Over 660 million paid music subscribers globally in 2023 – estimated to grow to 1.1 billion by 2030 • 177 million listen to podcasts • Podcast ad spend to exceed $2B in 2026 M U S IC P U B L ISHI N G LIVESTREAM & PPV MERCHANDISE MUSIC S U B S C R I P T I O N S Over 6.8 billion smar t ph o ne users projected globally by this year 660 M i ll i on 1.1 Bil l ion 2 0 30 2 0 23 Global video streaming market expected to be $252B by 2029 global while live streaming pay - per - view market is expected to expand at a CAGR of 15% from 2020 to 2027, reaching $2.3 billion by 2027 Global licensed merchandise market expected to reach $500B by 2030 43% of podcast listeners agree that ads on this media make them more likely to purchase products/services advertised POD C A S T S 7 Music publishing is valued at $ 6 . 4 B and is expected to grow at a CAGR of 5 . 8 % to $ 9 . 2 B in next five years .

6.6B+ Audio Listens since 01/01/20 148 Livestreamed Music Events since 04/01/21 2,900+ Artists S tre am ed since 01/01/20 220+ Countries and territories by Live Music Streaming 334M+ Livestream views 2,200+ Hours of Live Music since 01/01/20 Platforms T ik T ok T w itt e r I n st a g ram Fac e b o o k O&O Tesla S T IRR Y o u T u b e PodcastOne Over 187 exclusive shows with over 2.4+ billion podcast downloads annually across – 350+ hours distributed weekly 1 See the Company’s press release dated August 13, 2024 8 Freemium Membership Content Paired with Distribution Platform Memb e r s hip Plans from $0 to $9.99 Per Month 951K+ Free Ad - S u p p o rted Members ~3.9M Free and Paid Members 1 (06/30/24)

Growing Library of Franchises Highly - rated Originals Podcasts Partnerships ContentOne studio to develop and distribute new originals and tentpole events across the platform 9

LiveOne’s Slacker Radio is a membership music streaming service offering songs and access to expertly crafted stations, podcasts from PodcastOne, livestreamed video and on - demand programming, and livestreamed festivals, concerts and pay - per - view (PPV) events • Full - Year Fiscal 2025 Guidance for Slacker’s Revenue of $80M, with $20M of Adjusted EBITDA* • As of 06/30/24, Total Members (paid and free ad - supported) have reached ~3.9M. 1 • Nearly all new Tesla EVs sold in the U.S. come with a paid membership to LiveOne’s Slacker which is paid by Tesla. Tesla's annual agreement with Slacker was recently renewed for the 10th consecutive year. • Tesla Paid Members Have Increased 15X Since LiveOne’s Acquisition of Slacker in 2017. 1 • Mgmt. currently focused on establishing new B - to - B relationships – in discussions with up to 63 potential partners in 5 different verticals having memberships of between 10 million and 2.5 billion. • Ranked as the best quality music app and “Editor’s Choice” by PC Magazine, outpacing better known brands such as Spotify and SiriusXM. • Estimated music subscription global TAM currently at over 660 million music subscribers - estimated to grow to 1.1 billion by 2030. 2 30M+ Songs in catalogue 500+ Expertly crafted stations, podcasts, concerts, PPV events 6.6B+ Audio Listens since 01/01 / 20 81B+ Audio listens since inception 85+ Automobiles partnerships for in - built music streaming $ ~3.9M+ 1 T ota l Me m bers (06/30/2024) 1 See the Company's press release dated August 13, 2024 2 Houlihan Lokey Fall 2023 Report * See About Non - GAAP Financial Measures in LiveOne’s SEC filings and press releases 9

OV E RVI E W PodcastOne (Nasdaq: PODC) is a leading advertiser - supported podcast company offering a 360 - degree solution for both content creators and advertisers. 350+ Episodes Produced Weekly 600M+ Annual Downloads 18 M + (IAB) Monthly Downloads 200+ Advertisers 5.5M+ Monthly Unique Listeners INDUSTRY STATS • 177M people listen to podcasts • Analysts predict podcast ad spending to exceed $2 Billion in 2026 • 67% of podcast audience feel close to the hosts of podcasts • 61% consider podcasts as part of their daily routine • LiveOne owns ~71.9% of PODC’s common stock and will continue to consolidate PODC’s financial results. • PODC reported Q1 FY 2025 (Ended 06/30/2024) Revenue of $13.2M and Adjusted EBITDA** of - $316K 1 • Full Year FY2024 Revenue of $43.3M and Adjusted EBITDA** of $663K 1 • PODC was 11 th in PODTRAC’s Podcast Industry Top Publishers Rankings for July 2024. • Currently have over 100 new podcasts in the pipeline and over 10 potential acquisitions. • PODC is now featured in over 1 million Tesla cars. • As of 8/14/2024, PODC had ~23.99M common shares outstanding. KEY PodcastOne UPDATES 1 See PodcastOne’s press release dated August 13, 2024 ** See About Non - GAAP Financial Measures in PodcastOne’s SEC filings and press releases #11 Rank on Podtrac’s Top Podcast Publishers 11

TOP SHOWS & ADVERTISERS 12

PPVOne Business Model 126+ PPV EVENTS* 217K + TICKETS SOLD* PPV EVENTS TO DATE REVENUE SOURCES • PPV Ticke t Sal e s with Re v enu e Share • Sponsorship and Advertising/Product Placement • V I P Exclu s i v e U p g rade Options • Digita l Mee t an d Gre e t Op p ortuniti e s • N FT s an d E - C ommer c e • Arti s t Merch a ndis e Sal e s • I n - App Purcha s e s 13 • PPVOne’s Business Model Leverages LiveOne’s existing proprietary tech stack and expertise with more than seven years of livestreaming experience and scalable product. • Direct to consumer billing relationship enhances both PPVOne and LiveOne’s flywheels for increased monetization opportunities . Expands far beyond just PPV ticket transactions to include music subscriptions, virtual meet and greets/VIP access, merchandise and NFT e - commerce offerings and virtual tipping . • Leveraging’s LiveOne’s marketing engine with in - app messaging, social media, paid marketing program, email blasts to our fan database of 38M+ music fans; promoted across our LiveOne platform and partner network. • Leveraging relationships with thousands of possible PPV entertainers and personalities through ongoing business activities of LiveOne. • Strong connection between PPV participants and social followers enables for a stronger business model through lower marketing spend as artists and talent actively promote PPV events directly to their social media resulting in lower customer acquisition costs. • PPVOne’s execution capabilities are turnkey ranging from artist/talent signings, event marketing, sponsorship/advertising monetization, event production, digital and linear distribution through to settlement. *Since inception

▪ Direct - to - consumer eCommerce merchandise platform ▪ Provides additional monetization opportunities for both LiveOne & PodcastOne ▪ Partners with artists and stars from the music, podcast and entertainment industry with massive social media and marketing reach to develop and distribute celebrity - backed and branded products ▪ LiveOne recently launched its first celebrity - back product, "Birthday Sex" chardonnay, in collaboration with R&B star Jeremih and renowned wine maker Russell Bevan. 14 $8.4M CPS Fiscal Year 2024 Revenue $400B Expected global licensed merchandise market in 2023

Ad - s upp o rted ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ S u bs c ript i on ٷ ٷ ٷ ٷ ٷ ٷ P o dca s ts ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ Originals ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ L i ve v i d eo streaming ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ T ic k eted show ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ Linear / OTT channels ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ Live events ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ ٷ Merchandise Sources: Company filings, Company websites A ud i o s trea m ing Live music streaming Audio streaming Live music streaming M us i c events M us i c events Unrivaled Capabilities Across Audio, Video, and Live Events g m in a tr e s o u di A Audio streaming g in a m st re o e Vi d Video streaming 15

Global Network of Distribution and Channel Partners Desktop Mobile OTT Over 220 countries reached by Live Music Streaming 16

Robert Ellin Chairman & CEO Over 30 years of investment and turnaround experience, deep relationships in media and entertainment, prior public company experience as Executive Chairman of Mandalay Digital Kit Gray Pre s i d e n t Po d c as tOne (Nasdaq: PODC) Founded PodcastOne 10 years ago. 20+ years audio experience. Selected to 22 Top Influencers in Podcasting (Podcast Magazine 2022) Brad Konkol Head of Slacker Radio 20+ years experience leading content & tech companies. Joined Slacker in 2015. Has led product and engineering teams at LiveOne through the launch of several applications. Management Team Aaron Sullivan CFO Seasoned executive with extensive financial, mergers and acquisitions and operational experience in managing and scaling organizations, as well with financial reporting and internal controls Sue McNamara Chief Revenue Officer Po dc a s tOne (Na s d a q: PODC) 20+ years in Radio & Podcast Sales. Formerly CBS Radio’s Senior Vide President of Advertising Sales John Semmelhack President , CPS 30+ years leading direct marketing companies. Founded Custom Personalization 10 years ago. Josh Hallbauer Head of Music Publishing 10 + years in the music industry working with such stars as Justin Bieber, Selena Gomez, John Legend, DJ Snake and Anitta . Aiden Crotinger Head of Drumify & Splitmind Founded Drumify in 2019 . Curated and placed songs for artist like Drake and Anuel AA. 17

Ramin Arani In d e p e n d e n t Dir e c t or Former lead manager of Fidelity’s Puritan Fund and current Board member of Vice Media, Ellen Digital and Opportunity Network Patrick Wachsberger In d e p e n d e n t Dir ec tor Founder and CEO of Picture Perfect Entertainment and former Chairman of Lionsgate Films Steven Bornstein Former CEO of ESPN and NFL Network Jason Flom CEO of Lava Records Distinguished & Experienced Board of Directors Strong Suite of Formal Advisors Ken n et h Sol o mon In d e p e n d e n t Dir e c t or Chairman and CEO of The Tennis Channel, partner at Arcadia Investment Partners and Chairman of Ovation TV Craig Foster In d e p e n d e n t Dir e c t or Former Chief Financial Officer and Chief Accounting Officer of Amobee, Inc. Chris McGurk Former CEO of MGM and Universal Pictures Roger Werner Former CEO and President of ESPN and Speedvision Jay Krigsman In d e p e n d e n t Dir e c t or Executive Vice President and Asset Manager of The Krausz Companies Bridget Baker In d e p e n d e n t Dir ec tor Former President of Content and TV Network Distribution of Comcast and NBCUniversal Jules Haimovitz Former President of Viacom and founder of Showtime Distinguished Board of Directors and Advisors with Industry Experience Kris Wright In d e p e n d e n t Dir e c t or Vice President, Jordan Footwear, Product & Merchandising at Nike 18

Investment Highlights Multiple membership records as total members grew to ~3.9M at 06/30/24 Tesla is Largest Customer as Nearly Every New Tesla Sold in U.S. Comes with a LiveOne Membership Paid by Tesla 3 5 7 Reported Q1 Fiscal Year 2025 (ended 06/30/2024) Consolidated Revenue of $33.1M and Adjusted EBITDA* of $2.9M 1 2 8 Repurchased 4.38 million shares of common stock under LiveOne’s Share Stock Repurchase Program as of August 14, 2024, leaving capacity to repurchase an additional ~ $6.3M worth of shares 4 Full - Year Fiscal 2025 (ending 3/21/2025) Guidance for Consolidated Revenue of $130 - $140M and Adjusted EBITDA* of $20M - $25M 6 19 25.7% Institutional Ownership at 8/14/2024, with Fidelity owning ~7.0 million shares. -- In addition, insiders beneficially own ~20% of LiveOne’s common shares * See About Non - GAAP Financial Measures in LiveOne’s SEC filings and press releases LiveOne Posted Record Consolidated Adjusted EBITDA* of $11.0M for Full - Year Fiscal 2024 (ended 3/31/2024) Completed Spinout of PodcastOne (Nasdaq: PODC) as a Separate Public Company with Special Dividend of PodcastOne Shares to LiveOne Shareholders

NASDAQ: LVO | IR@LIVEONE.COM

v3.24.2.u1

Cover

|

Aug. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 29, 2024

|

| Entity File Number |

001-38249

|

| Entity Registrant Name |

LIVEONE, INC.

|

| Entity Central Index Key |

0001491419

|

| Entity Tax Identification Number |

98-0657263

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

269 South Beverly Drive

|

| Entity Address, Address Line Two |

Suite 1450

|

| Entity Address, City or Town |

Beverly Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90212

|

| City Area Code |

310

|

| Local Phone Number |

601-2505

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

LVO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

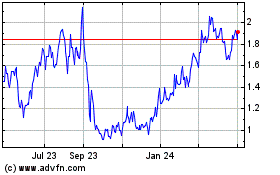

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

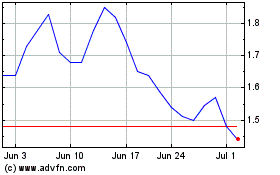

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Nov 2023 to Nov 2024