Beam Therapeutics Inc. (Nasdaq: BEAM), a biotechnology company

developing precision genetic medicines through base editing, today

announced the pricing of an underwritten offering of 16,151,686

shares of its common stock at an offering price of $28.48 per

share, and, in lieu of common stock to certain investors,

pre-funded warrants to purchase 1,404,988 shares of common stock at

an offering price of $28.47 per pre-funded warrant, before

deducting underwriter discounts and commissions and estimated

offering expenses. Each pre-funded warrant will have an exercise

price of $0.01 per share, will be exercisable immediately and will

be exercisable until exercised in full. Gross proceeds from the

offering are expected to be approximately $500.0 million. All of

the securities in the offering are to be sold by Beam Therapeutics.

The offering is expected to close on or about March 11, 2025,

subject to customary closing conditions.

Beam Therapeutics intends to use the net proceeds from the

offering for continued advancement of its platform technology, for

continued research, development and pre-commercialization

activities for its current portfolio of base editing programs and

for other potential programs, including biologics license

application submission and pre-commercial activities for BEAM-101,

for clinical trials, including advancement of a potential pivotal

trial for BEAM-302 for treatment of alpha-1 antitrypsin deficiency

and of a potential Phase 1/2 clinical trial of the ESCAPE

conditioning platform in patients with sickle cell disease, and for

general corporate purposes.

J.P. Morgan, Jefferies, Cantor, Citigroup and Wells Fargo

Securities are acting as joint book-running managers for the

offering.

An automatically effective shelf registration statement relating

to the securities offered in the offering described above was filed

with the Securities and Exchange Commission (SEC) on February 28,

2024. The offering is being made only by means of a prospectus

supplement and accompanying prospectus that form part of the

registration statement. A preliminary prospectus relating to and

describing the terms of the offering has been filed with the SEC

and is available at www.sec.gov. A final prospectus supplement

relating to the offering will be filed with the SEC. When

available, copies of the final prospectus supplement and the

accompanying prospectus relating to this offering may be obtained

by contacting J.P. Morgan Securities LLC, c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, New York 11717 or by

email at prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com; Jefferies LLC, Attn: Equity

Syndicate Prospectus Department, 520 Madison Avenue, New York, New

York 10022, by telephone at (877) 821-7388 or by email at

Prospectus_Department@Jefferies.com; Cantor Fitzgerald & Co.,

Attention: Capital Markets, 110 East 59th Street, 6th Floor, New

York, NY 10022, or by e-mail at prospectus@cantor.com; Citigroup

Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, NY 11717 or by telephone at

1-800-831-9146; or Wells Fargo Securities, 90 South 7th Street, 5th

Floor, Minneapolis, MN 55402, at 800-645-3751 (option #5) or email

a request to WFScustomerservice@wellsfargo.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Beam TherapeuticsBeam Therapeutics

(Nasdaq: BEAM) is a biotechnology company committed to establishing

the leading, fully integrated platform for precision genetic

medicines. To achieve this vision, Beam has assembled a platform

with integrated gene editing, delivery and internal manufacturing

capabilities. Beam’s suite of gene editing technologies is anchored

by base editing, a proprietary technology that is designed to

enable precise, predictable and efficient single base changes, at

targeted genomic sequences, without making double-stranded breaks

in the DNA. This has the potential to enable a wide range of

potential therapeutic editing strategies that Beam is using to

advance a diversified portfolio of base editing programs. Beam is a

values-driven organization committed to its people, cutting-edge

science, and a vision of providing life-long cures to patients

suffering from serious diseases.

Cautionary Note Regarding Forward-Looking

StatementsStatements in this press release about future

expectations, plans and prospects, as well as any other statements

regarding matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. The words “anticipate,”

“expect,” “suggest,” “plan,” “vision,” “strategy,” “possibility,”

“promise,” “believe,” “intend,” “project,” “estimates,” “targets,”

“projections,” “potential,” “should,” “could,” “would,” “may,”

“might,” “will,” the negative thereof and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words.

Investors are cautioned not to place undue reliance on these

forward-looking statements, including, but not limited to,

statements relating to the size, structure and completion of the

offering; the anticipated use of proceeds of the offering; the

therapeutic applications and potential of our technology; and our

ability to develop life-long, curative, precision genetic medicines

for patients through base editing. Each forward-looking statement

is subject to important risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in such statement, including, without limitation, risks and

uncertainties related to: market conditions and the completion of

the offering on the anticipated terms or at all; our ability to

develop, obtain regulatory approval for, and commercialize our

product candidates, which may take longer or cost more than

planned; our ability to raise additional funding, which may not be

available; our ability to obtain, maintain and enforce patent and

other intellectual property protection for our product candidates;

the uncertainty that our product candidates will receive regulatory

approval necessary to initiate human clinical trials; that

preclinical testing of our product candidates and preliminary or

interim data from preclinical studies and clinical trials may not

be predictive of the results or success of ongoing or later

clinical trials; that initiation and enrollment of, and anticipated

timing to advance, our clinical trials may take longer than

expected; that our product candidates or the delivery modalities we

rely on to administer them may cause serious adverse events; that

our product candidates may experience manufacturing or supply

interruptions or failures; risks related to competitive products;

and the other risks and uncertainties identified under the headings

“Risk Factors Summary” and “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2024, and in any

subsequent filings with the Securities and Exchange Commission.

These forward-looking statements speak only as of the date of this

press release. Factors or events that could cause our actual

results to differ may emerge from time to time, and it is not

possible for us to predict all of them. We undertake no obligation

to update any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by applicable law.

Contacts:

Investors:Holly ManningBeam

Therapeuticshmanning@beamtx.com

Media:Dan Budwick1ABdan@1abmedia.com

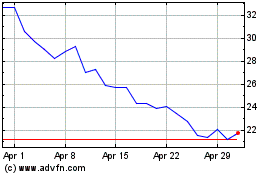

Beam Therapeutics (NASDAQ:BEAM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Beam Therapeutics (NASDAQ:BEAM)

Historical Stock Chart

From Mar 2024 to Mar 2025