TIDMTORO

RNS Number : 4357T

Toro Limited

17 July 2015

Toro Limited

Results of issue

Toro Limited ("Toro" or the "Company") announces that it raised

gross proceeds of EUR16,403,100 million in the placing that closed

at 3.00 p.m. today (the "July Placing"). 16,050,000 new Shares were

issued at a price of EUR1.022 per Share.

The issue price was determined by reference to the NAV per Share

as at 30 June 2015, of EUR1.0017 per Share, as increased by a

premium of two per cent.

Application has been made for the new Shares to be admitted to

trading on the Specialist Funds Market of the London Stock Exchange

and to listing and trading on the Official List of the Channel

Islands Securities Exchange Authority Limited ("Admission") and it

is expected that Admission will occur at 8.00 a.m. on 21 July

2015.

The proceeds of the issue will be used for investment in

accordance with the investment policy and for general corporate

purposes.

The July Placing is the first issue of new Shares under the

Placing Programme. The terms and conditions of the Placing

Programme are described in the prospectus dated 28 April 2015 (the

"Prospectus").

Included in the above figures are a total of 21,817 new Shares

issued in lieu of directors' fees to Frederic Hervouet and John

Whittle on the same terms as other investors.

About the Company

Toro, incorporated in Guernsey, is a closed-ended investment

company and was admitted to trading on the Specialist Fund Market

of the London Stock Exchange and to the Official List of the

Channel Islands Securities Exchange Authority Limited on 8 May

2015.

The investment objective of Toro is to deliver an absolute

return from investing and trading in Asset Backed Securities and

other structured credit investments in liquid markets, and

investing directly or indirectly in asset backed transactions

including, without limitation, through the origination of credit

portfolios. Toro continues and extends the credit strategy

successfully managed by the Chenavari Financial Group since

mid-2009 via its flagship fund Toro Capital IA and IB, whose

shareholders voted to transition their holdings to Toro for its

launch. www.torolimited.gg

About Chenavari

Chenavari is part of the Chenavari Financial Group, a specialist

alternative asset management group focusing on European & Asian

markets. With over 100 professionals and USD5.1 billion of assets

under management, funds managed by Chenavari target investment

strategies across Credit (Corporate and High yield, Financials,

Credit Derivatives), Structured Finance (ABS, CMBS, Regulatory

Capital) and Illiquid Opportunities (Private Debt, Real Estate,

Consumer Finance, Private Equity). Chenavari Financial Group

contains entities authorized and regulated by several regulators

globally, including the UK FCA, the Luxembourg CSSF, the US SEC,

the US CFTC and the Hong Kong SFC. www.chenavari.com

Enquiries:

Kirstie McLaren

Chenavari Investment Managers

Email: Investor-relations@chenavari.com

Telephone: +44 20 7259 3600

Ravi Anand / Robert Peel

Dexion Capital plc

Telephone: +44 20 7832 0900

IMPORTANT INFORMATION

This document has been issued by Toro, and should not be taken

as an inducement to engage in any investment activity and is for

the purpose of providing information about the Company. This

document does not constitute or form part of, and should not be

construed as, any offer for sale or subscription of, or

solicitation of any offer to buy or subscribe for, any share in the

Company or securities in any other entity, in any jurisdiction,

including the United States, Canada, Japan, South Africa nor shall

it, or any part of it, or the fact of its distribution, form the

basis of, or be relied on in connection with, any contract or

investment decision whatsoever, in any jurisdiction.

This document, and the information contained therein, is not for

viewing, release, distribution or publication in or into the United

States, Canada, Japan, South Africa or any other jurisdiction where

applicable laws prohibit its release, distribution or publication,

and will not be made available to any national, resident or citizen

of the United States, Canada, Japan or South Africa. The

distribution of this document in other jurisdictions may be

restricted by law and persons into whose possession this document

comes must inform themselves about, and observe, any such

restrictions. Any failure to comply with the restrictions may

constitute a violation of the federal securities law of the United

States and the laws of other jurisdictions.

The shares issued and to be issued by the Company (the "Shares")

have not been and will not be registered under the US Securities

Act of 1933, as amended (the "Securities Act"), or with any

securities regulatory authority of any state or other jurisdiction

of the United States. The Shares may not be offered, sold, resold,

pledged, delivered, distributed or otherwise transferred, directly

or indirectly, into or within the United States, or to, or for the

account or benefit of, US persons (as defined in Regulation S under

the Securities Act). No public offering of the Shares is being made

in the United States.

The Company has not been and will not be registered under the US

Investment Company Act of 1940, as amended (the "Investment Company

Act") and, as such, holders of the Shares will not be entitled to

the benefits of the Investment Company Act. No offer, sale, resale,

pledge, delivery, distribution or transfer of the Shares may be

made except under circumstances that will not result in the Company

being required to register as an investment company under the

Investment Company Act. Neither the U.S. Securities and Exchange

Commission (the "SEC") nor any state securities commission has

approved or disapproved of the Shares or passed upon or endorsed

the merits of the offering of the Shares or the adequacy or

accuracy of the Company's prospectus. Any representation to the

contrary is a criminal offence in the United States. In addition,

the Shares are subject to restrictions on transferability and

resale in certain jurisdictions and may not be transferred or

resold except as permitted under applicable securities laws and

regulations. Investors may be required to bear the financial risks

of their investment in the Shares for an indefinite period of time.

Any failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdictions.

No liability whatsoever (whether in negligence or otherwise)

arising directly or indirectly from the use of this document is

accepted and no representation, warranty or undertaking, express or

implied, is or will be made by the Company, or any of their

respective directors, officers, employees, advisers,

representatives or other agents ("Agents") for any information or

any of the opinions contained herein or for any errors, omissions

or misstatements. None of the Agents makes or has been authorised

to make any representation or warranties (express or implied) in

relation to the Company or as to the truth, accuracy or

completeness of this document, or any other written or oral

statement provided. In particular, no representation or warranty is

given as to the achievement or reasonableness of, and no reliance

should be placed on any, targets, estimates or forecasts contained

in this document and nothing in this document is or should be

relied on as a promise or

Unless otherwise indicated, the information provided herein is

based on matters as they exist as of the date of preparation and

not as of any future date.

All investments are subject to risk, including the loss of the

principal amount invested. Past performance is no guarantee of

future returns. All investments to be held by the Company involve a

substantial degree of risk, including the risk of total loss. The

value of shares and the income from them is not guaranteed and can

fall as well as rise due to stock market and currency movements.

When you sell your investment you may get back less than you

originally invested. You should always seek expert legal,

financial, tax and other professional advice before making any

investment decision.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROILLFEEDEIDLIE

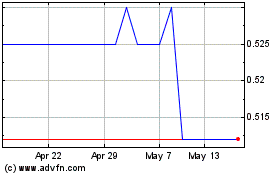

Chenavari Toro Income (LSE:TORO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Chenavari Toro Income (LSE:TORO)

Historical Stock Chart

From Nov 2023 to Nov 2024