TIDMPXS

RNS Number : 2479Y

Provexis PLC

29 December 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

29 December 2023

Provexis plc

UNAUDITED INTERIM RESULTS FOR SIX MONTHS TO 30 SEPTEMBER

2023

Provexis plc ("Provexis" or the "Company"), the business that

develops, licenses and sells the proprietary, scientifically-proven

Fruitflow(R) heart-health functional food ingredient, announces its

unaudited interim results for the six months ended 30 September

2023.

Highlights

-- DSM's existing and prospective pipeline customers for

Fruitflow as a straight ingredient transferred to become direct

customers of Provexis WEF 1 January 2023, and the customer transfer

process has continued to progress well, with strong and growing

interest in the Company's Fruitflow II SD ingredient.

-- Total revenue for the period GBP388k (2022: GBP179k), to

include GBP299k from Fruitflow II SD (2022: DSM Alliance Agreement

income of GBP97k) and GBP89k (2022: GBP82k) from Fruitflow+

Omega-3.

-- Fruitflow II SD sales of more than GBP270k have been made in

the quarter ending on 31 December 2023, and confirmed sales orders

for Fruitflow II SD in excess of GBP320k are currently being

processed. The Company is dealing with numerous sales enquiries

from existing and new customers for further direct sales of

Fruitflow in 2024 and beyond.

-- The new long term partnership with DSM based on the use of

Fruitflow to confer health benefits in modulating the gut

microbiome of humans has continued to progress well. Strong launch

of this new technology by DSM in January 2023, with widespread

trade press coverage and encouraging early interest from some

significant global customers.

-- Planned launch by BYHEALTH, a circa GBP4bn listed Chinese

dietary supplement business, of a number of Fruitflow based

products in the Chinese market has been progressing well, with

potential sales volumes remaining at a significant multiple of

existing Fruitflow sales.

-- BYHEALTH has been working since 2015 on an extensive

regulatory submission to the Chinese State Administration for

Market Regulation (SAMR) for Fruitflow, seeking to establish a new

permitted health function claim for foods such as Fruitflow that

can demonstrate an anti-platelet effect.

-- In August 2023 BYHEALTH submitted: i) the first application

under the new SAMR Implementation Rules, seeking to obtain a new

permitted health function claim for foods such as Fruitflow which

help to 'maintain normal platelet aggregation function and benefit

blood flow health'; and ii) some related product registration

applications. BYHEALTH stated publicly that it has been working on

the project since 2015, with 'tens of millions of funds' (RMB)

invested by BYHEALTH in the research and development work.

-- The exclusive Fruitflow supply and distribution agreement

which was agreed with BYHEALTH in 2021 took full effect from 1

January 2023, with exclusive supply and distribution rights for

BYHEALTH to commercialise Fruitflow in China and Australia.

Provexis Chairman Dawson Buck and CEO Ian Ford commented:

'The Company is pleased to report on another strong period of

progress, to include GBP388k of revenue in the period from sales of

the Company's Fruitflow II SD ingredient and its consumer product

Fruitflow+ Omega-3.

Fruitflow II SD sales of more than GBP270k have been made in the

quarter ending on 31 December 2023, and confirmed sales orders for

Fruitflow II SD in excess of GBP320k are currently being processed.

The Company is dealing with numerous sales enquiries from existing

and new customers for further direct sales of Fruitflow in 2024 and

beyond.

The new long term partnership with DSM based on the use of

Fruitflow to confer health benefits in modulating the gut

microbiome of humans has continued to progress well, with a strong

launch of this new technology by DSM in January 2023 to include

widespread trade press coverage. There has been some encouraging

interest in this technology from some significant global

customers.

The Company has been delighted to welcome and serve the majority

of DSM's existing customers for Fruitflow from January this year,

and was pleased to take over control of the supply chain /

production process for Fruitflow at the same time.

There have been some clear synergies from January 2023 as the

Company has been looking to sell Fruitflow to: (i) former DSM

customers for Fruitflow; (ii) DSM and its Premix and Market-Ready

Solutions businesses; (iii) new customers for Fruitflow as a

straight ingredient; and (iv) BYHEALTH and its customers, through

the Company's long term supply and distribution agreement for

Fruitflow with BYHEALTH. Provexis will continue to sell its

Fruitflow+ Omega-3 dietary supplement product direct to consumers,

and serve its Chinese Cross-Border e-commerce distributor for this

product in China.

Provexis has been working with BYHEALTH for more than seven

years to support the planned launch of a number of Fruitflow based

products in the Chinese market. Clinical studies conducted in China

are typically required to obtain the necessary regulatory

clearances in China, and a significant investment in eight separate

Fruitflow studies has been undertaken at BYHEALTH's expense.

Completed studies have shown excellent results in use for

Fruitflow, and they provide strong evidence for the efficacy of

Fruitflow on platelet function.

The Chinese regulatory system for functional health food

ingredients, such as Fruitflow, is governed by the State

Administration for Market Regulation (the 'SAMR') and it is based

on a defined list of permitted health function claims which brand

owners are permitted to use on product labels.

In August 2023 the Company was delighted to report that BYHEALTH

had submitted: i) the first application for a new permitted health

function claim and ii) some related product registration

applications.

The significance of these major developments for Fruitflow in

China is further outlined here

www.nutraingredients-asia.com/Article/2023/09/05/china-set-to-approve-new-function-claims-for-health-foods#.

BYHEALTH has noted that it has been working on the project since

2015, with 'tens of millions of funds' (RMB) invested by BYHEALTH

in the research and development work.

Fruitflow is well placed to play an important role in the

Chinese cardiovascular health market under the permitted health

function claim legislation, and we look forward to working closely

with BYHEALTH seeking to maximise the commercial success of this

agreement for the benefit of both companies.

The Company has developed a strong, long lasting and

wide-ranging patent portfolio for Fruitflow, and it owns outright

four existing patent families for Fruitflow. The new microbiome

patent application takes this to a potential total of five patent

families, with potential patent protection now running out to 2042.

The four existing patent families have a truly global footprint,

and the Company also holds other valuable intellectual property and

trade secrets for Fruitflow. The intellectual property for

Fruitflow is of fundamental importance to the Company and its

current and future commercial partners, to include DSM and

BYHEALTH, and it underpins the numerous commercial opportunities

which the Company and its partners are pursuing for Fruitflow.

The Company expects that the new gut microbiome patent

application, the significant changes to the sales and supply chain

structure for Fruitflow from January 2023, and the recent BYHEALTH

regulatory developments in China, will have a strongly beneficial

effect on the current and future commercial prospects for Fruitflow

and the business worldwide.

The Company would like to thank its customers and shareholders

for their continued support, and the Board remains strongly

positive about the outlook for Fruitflow and the Provexis business

for the coming year and beyond.'

For further information please contact:

Provexis plc Tel: 07490 391888

Ian Ford, CEO enquiries@provexis.com

Dawson Buck, Non-executive Chairman

Allenby Capital Limited (Nominated Adviser Tel: 020 3328 5656

and Broker)

Nick Naylor / Lauren Wright / Liz Kirchner

Chairman and CEO's statement

The Company has had an extremely active first six months of the

year, and it has made some further significant progress with the

commercial prospects of its innovative, patented Fruitflow(R)

heart-health ingredient.

DSM Nutritional Products - new agreements for Fruitflow(R)

Provexis entered into a long-term Alliance Agreement with DSM

Nutritional Products in 2010 to commercialise Fruitflow through

sales as an ingredient to brand owners in the food, beverage and

dietary supplement categories, with a contractual term for the

Agreement which ran to 31 December 2022.

More than 100 regional consumer healthcare brands have now been

launched by direct customers of DSM, and a number of further

regional brands have been launched through DSM's distributor

channels. An increasing number of commercial projects have been

initiated by DSM with prospective customers in recent years,

including some prospective customers which are part of global

businesses, and the total projected annual sales value of the

prospective sales pipeline for Fruitflow, which is now shared

across Provexis and DSM, continues to stand at a substantial

multiple of existing annual sales.

In June 2022 Provexis announced it had secured two new

agreements with DSM for Fruitflow, to replace the Alliance

Agreement: (i) a Transfer of Business agreement and (ii) a Premix

and Market-Ready Solutions supply agreement, which both took effect

on 1 January 2023.

The Company also announced the filing of a new patent

application in June 2022 relating to the use of Fruitflow to confer

health benefits in modulating the gut microbiome of humans. This

followed the completion of a successful human study, the results of

which strongly support the use of Fruitflow for modulating gut

microbiota to confer a number of health benefits, to include a

reduction in TMAO (trimethylamine-n-oxide).

Under the terms of the two new agreements with DSM, and the new

patent application:

-- DSM's existing and prospective pipeline customers for

Fruitflow as a straight ingredient (not a Premix or Market-Ready

solution) transferred to become direct customers of Provexis WEF 1

January 2023, and the Company took over the wholly outsourced

supply chain / production process for Fruitflow from DSM at that

time.

-- A royalty will be payable to DSM on the gross profits

generated from Fruitflow sales to customers transferred from DSM

over the first four years of the Transfer of Business

agreement.

-- From 1 January 2023 the net profit accruing to Provexis on

sales of Fruitflow in the calendar year - on a pro-forma basis,

assuming like for like sales and margins - would be materially

ahead of the net share of the profit that would have accrued to

Provexis with like for like sales and margins under the 2010

Alliance Agreement. On the same pro-forma basis, assuming like for

like sales and margins, the net profit accruing to Provexis would

further increase in each of the subsequent three calendar

years.

-- A new partnership was agreed with DSM in 2022 relating to the

gut microbiome patent, giving DSM preferential access to the use,

marketing, and sale of Fruitflow based products which are based on

the patent, subject to certain milestones which have been agreed

between the parties.

-- In addition to the patent's core claim for Fruitflow, for

modulating gut microbiota to confer a number of health benefits,

the patent also sets out some potential new uses for Fruitflow in

treating a wide variety of human health conditions, beyond

Fruitflow's existing established use in heart-health. The global

digestive health market size was US$38 billion in 2019 and it is

projected to grow to US$72 billion in 2027 at a high single-digit

CAGR in the 2020-2027 period (see

www.fortunebusinessinsights.com/digestive-health-market-104750

).

-- The results of the successful gut microbiome human study have

been submitted for publication in a peer reviewed scientific

journal www.sciencedirect.com/science/article/pii/S0022316622131275

.

-- DSM conducted a strong launch of the new microbiome technology in January 2023 ( www.dsm.com/human-nutrition/en/talking-nutrition/press-releases/2023-01-20-new-study-reveals-dsms-fruitflow-activates-gut-heart.html ), with widespread trade press coverage and encouraging early interest shown from some significant global customers.

-- Provexis will sell Fruitflow as a straight ingredient to DSM

exclusively for use in DSM's Premix Solutions and Market-Ready

Solutions businesses, with DSM then looking to sell the resulting

Premix and Market-Ready Solutions products on to its customers.

DSM's Premix and Market-Ready Solutions businesses are part of

DSM's Customized Solutions business which also offers personalised

nutrition solutions to customers, a rapidly developing growth area.

The Company looks forward to supporting DSM and its Premix and

Market-Ready Solutions customers for many years to come.

-- A number of DSM's customers for Fruitflow which have been

transferred to Provexis have been Fruitflow customers for several

years, including some distributor customers which sell Fruitflow on

to third parties. The Company has been progressing these sales

relationships since the Transfer of Business agreement was

announced in June 2022, and confirms it will be able to generate

new customers for Fruitflow outside the royalty arrangements with

DSM, in addition to its existing supply and distribution agreement

for Fruitflow with BYHEALTH.

From 1 January 2023 the Group's sales channels for Fruitflow

therefore included:

1. Former DSM customers for Fruitflow;

2. DSM and its Premix and Market-Ready Solutions businesses,

which will leverage the resources and relationships of DSM in some

of the major global markets;

3. New customers for Fruitflow as a straight ingredient;

4. BYHEALTH and its customers, through the Company's long term

supply and distribution agreement for Fruitflow with BYHEALTH;

and

5. The Group's Fruitflow+ Omega-3 dietary supplement product

which is sold direct to consumers, the Group will also look to

serve its Chinese Cross-Border e-commerce distributor for this

product in China.

The Company is in discussions with a number of third parties

seeking to progress new sales and distribution opportunities for

Fruitflow, and it can be contacted for all Fruitflow sales

enquiries by email at fruitflow@provexis.com .

Fruitflow(R) transfer arrangements from 1 January 2023, and

trading for the year

The customer transfer process from DSM to Provexis has continued

to progress well, with sales commencing to customers for Fruitflow

II SD (Fruitflow II SD is Fruitflow as an ingredient, in Spray

Dried powder form) in February 2023, when the first batch of

Fruitflow inventory was transferred from DSM's fulfilment centre in

The Netherlands to the Company's outsourced fulfilment centre in

the UK.

Total revenue:

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Fruitflow II SD ingredient - from

1 January 2023 298,879 - 74,239

DSM Alliance Agreement - up to 31

December 2022 - 97,194 170,269

Fruitflow+ Omega-3 88,655 82,175 145,408

387,534 179,369 389,916

----------------------------------- ------------- ------------- ---------

Fruitflow II SD sales of more than GBP270k have been made in the

quarter ending on 31 December 2023, and confirmed sales orders for

Fruitflow II SD in excess of GBP320k are currently being processed.

The Company is dealing with numerous sales enquiries from existing

and new customers for further direct sales of Fruitflow in 2024 and

beyond.

Fruitflow II SD is currently manufactured in the EU. Rules of

origin under the BREXIT trade deal announced in December 2020 have

meant that shipments of Fruitflow II SD from a UK fulfilment centre

for re-export and sale to EU customers are at potential risk of

additional tariffs on re-entry into the EU (see

www.bbc.co.uk/news/55648201 ). Consequently, the Company is in the

process of setting up a new Irish subsidiary company, which will

use an outsourced fulfilment centre in Ireland to serve EU

customers for Fruitflow. This is expected to be an attractive new

sales channel for EU customers, facilitating greater sales of

Fruitflow II SD into the EU.

BYHEALTH Co., Ltd.

In November 2021 the Company announced it had entered into a

supply and distribution agreement (the 'BYHEALTH Agreement') for

Fruitflow with BYHEALTH, a listed Chinese dietary supplement

business with a market capitalisation of approximately GBP4

billion.

The BYHEALTH Agreement, which followed the Company's extensive

work with BYHEALTH over the last seven years, took full effect from

1 January 2023 and it gives BYHEALTH exclusive supply and

distribution rights to commercialise Fruitflow in Mainland China,

Hong Kong, Macau, Taiwan and Australia (the 'Territories').

Under the BYHEALTH Agreement Provexis will be responsible for

the manufacture, supply and sale of Fruitflow to BYHEALTH, and

BYHEALTH will be responsible for the manufacture, marketing, and

sale of Fruitflow based functional food and dietary supplement

finished products in the Territories, through BYHEALTH's extensive

sales network. BYHEALTH will also have exclusive rights to act as

the distributor of Fruitflow as an ingredient in the

Territories.

Provexis and BYHEALTH will seek to collaborate on research and

development projects which may result in the development and

approval of Fruitflow as a drug, for potential sale and

distribution in the Territories.

Regulatory progress in China - new permitted health function

claim

Provexis has been working with BYHEALTH for more than seven

years to support the planned launch of a number of Fruitflow based

products in the Chinese market. Clinical studies conducted in China

are typically required to obtain the necessary regulatory

clearances in China, and a significant investment in eight separate

Fruitflow studies has been undertaken at BYHEALTH's expense.

Completed studies have shown excellent results in use for

Fruitflow, and they provide strong evidence for the efficacy of

Fruitflow on platelet function.

The Chinese regulatory system for functional health food

ingredients, such as Fruitflow, is governed by the State

Administration for Market Regulation (the 'SAMR') and it is based

on a defined list of permitted health function claims which brand

owners are permitted to use on product labels.

The SAMR provides the possibility of adding new health function

claims to the list, with claims needing to demonstrate a

relationship between a food or nutrient and a consequent health

improvement, subject to evaluation and verification by the

SAMR.

SAMR certified functional health foods are required to use a

blue cap / blue hat logo on their product packaging, which

identifies products as approved functional health foods in

China.

BYHEALTH has been working on an extensive regulatory submission

to the SAMR seeking to establish a new permitted health function

claim for foods such as Fruitflow that can demonstrate an

anti-platelet effect, inhibiting platelet function and conferring

beneficial health effects.

On 28 August 2023 the SAMR announced in China that the

'Implementation Rules for Health Food New Functions and Product

Technology Evaluation' (the 'Implementation Rules') had been agreed

by the SAMR in June 2023, with these new rules to take effect from

28 August 2023.

On 29 August 2023 it was announced in China that BYHEALTH had

submitted: i) the first application under the Implementation Rules,

seeking to obtain a new permitted health function claim for foods

such as Fruitflow which help to 'maintain normal platelet

aggregation function and benefit blood flow health'; and ii) some

related product registration applications.

The significance of these major developments for Fruitflow in

China is further outlined here

www.nutraingredients-asia.com/Article/2023/09/05/china-set-to-approve-new-function-claims-for-health-foods#

. BYHEALTH has noted that it has been working on the project since

2015, with 'tens of millions of funds' (RMB) invested by BYHEALTH

in the research and development work.

The Company has previously stated that if BYHEALTH is successful

in obtaining a new permitted health function claim in China for

functional health foods, such as Fruitflow, that can demonstrate an

anti-platelet effect, it is expected that this would result in some

significant orders for Fruitflow, potentially at a multiple of

current total sales values.

Intellectual property

The Company is responsible for filing and maintaining patents

and trade marks for Fruitflow, and patent coverage for Fruitflow

now includes the following patent families which are all owned

outright by Provexis:

Patent family Developments in the period from

Sep-23 to Dec-23

Improved Fruitflow / Fruit Extracts A patent is expected to issue in Brazil in Q1 2024.

Improved Fruitflow / Fruit Extracts, with patents granted

by the European Patent Office in

January 2017, September 2020 and April 2023.

Patents have been granted in eleven other major

territories to include China and USA; and

applications are at a late stage of progression in a

further five global territories, with

potential patent protection out to November 2029.

----------------------------------------------------------

Antihypertensive (blood pressure lowering) effects Patent applications are pending in China and Japan.

This patent was originally developed in collaboration

with the University of Oslo, and it

has now been granted for Fruitflow in Europe, the US and

four other territories. Patent applications

are being progressed in China and Japan, with potential

patent protection out to April 2033.

In August 2020 the Company announced it had agreed to

purchase the background and joint foreground

blood pressure lowering IP owned by Inven2 AS, the

technology transfer office at the University

of Oslo, and Provexis now owns these important patents

outright.

----------------------------------------------------------

Fruitflow with nitrates in mitigating exercise-induced Patent applications are pending in Europe, Hong Kong and

inflammation and for promoting recovery the US.

from intense exercise

Patents have been granted around Europe and in the US,

Australia, Brazil, Canada, China, Hong

Kong, India, Israel, Japan, South Korea, the Philippines,

New Zealand and Mexico.

Further patent protection is being sought in three

territories, with potential patent protection

out to December 2033.

----------------------------------------------------------

Fruitflow for air pollution Brazilian and Malaysian Grant certificates issued.

The use of Fruitflow in protecting against the adverse

effects of air pollution on the body's

cardiovascular system.

Laboratory work has shown that Fruitflow can reduce the

platelet activation caused by airborne

particulate matter, such as that from diesel emissions,

by approximately one third.

US, Australian, Brazilian, Indonesian, Israeli, Japanese

and Malaysian patents have been secured

and there are pending applications in 10 jurisdictions

(including the US where a further application

has been filed) which extends potential patent protection

for Fruitflow out to November 2037.

----------------------------------------------------------

Fruitflow to confer health benefits in modulating the gut The international Patent Application published in

microbiome of humans December 2023.

The Company also announced the filing of a new patent

application in June 2022 relating to

the use of Fruitflow to confer health benefits in

modulating the gut microbiome of humans.

This followed the completion of a successful human study,

the results of which strongly support

the use of Fruitflow for modulating gut microbiota to

confer a number of health benefits.

An international Patent Application was filed in June

2023 (covering all major jurisdictions),

with potential patent protection out to June 2043.

----------------------------------------------------------

Outlook

The Company is pleased to report on another strong period of

progress, to include GBP388k of revenue in the period from sales of

the Company's Fruitflow II SD ingredient and its consumer product

Fruitflow+ Omega-3.

Fruitflow II SD sales of more than GBP270k have been made in the

quarter ending on 31 December 2023, and confirmed sales orders for

Fruitflow II SD in excess of GBP320k are currently being processed.

The Company is dealing with numerous sales enquiries from existing

and new customers for further direct sales of Fruitflow in 2024 and

beyond.

The new long term partnership with DSM based on the use of

Fruitflow to confer health benefits in modulating the gut

microbiome of humans has continued to progress well, with a strong

launch of this new technology by DSM in January 2023 to include

widespread trade press coverage. There has been some encouraging

interest in this technology from some significant global

customers.

The Company has been delighted to welcome and serve the majority

of DSM's existing customers for Fruitflow from January this year,

and was pleased to take over control of the supply chain /

production process for Fruitflow at the same time.

There have been some clear synergies from January 2023 as the

Company has been looking to sell Fruitflow to: (i) former DSM

customers for Fruitflow; (ii) DSM and its Premix and Market-Ready

Solutions businesses; (iii) new customers for Fruitflow as a

straight ingredient; and (iv) BYHEALTH and its customers, through

the Company's long term supply and distribution agreement for

Fruitflow with BYHEALTH. Provexis will continue to sell its

Fruitflow+ Omega-3 dietary supplement product direct to consumers,

and serve its Chinese Cross-Border e-commerce distributor for this

product in China.

Provexis has been working with BYHEALTH for more than seven

years to support the planned launch of a number of Fruitflow based

products in the Chinese market. Clinical studies conducted in China

are typically required to obtain the necessary regulatory

clearances in China, and a significant investment in eight separate

Fruitflow studies has been undertaken at BYHEALTH's expense.

Completed studies have shown excellent results in use for

Fruitflow, and they provide strong evidence for the efficacy of

Fruitflow on platelet function.

The Chinese regulatory system for functional health food

ingredients, such as Fruitflow, is governed by the State

Administration for Market Regulation (the 'SAMR') and it is based

on a defined list of permitted health function claims which brand

owners are permitted to use on product labels.

In August 2023 the Company was delighted to report that BYHEALTH

had submitted: i) the first application for a new permitted health

function claim and ii) some related product registration

applications.

The significance of these major developments for Fruitflow in

China is further outlined here

www.nutraingredients-asia.com/Article/2023/09/05/china-set-to-approve-new-function-claims-for-health-foods#

. BYHEALTH has noted that it has been working on the project since

2015, with 'tens of millions of funds' (RMB) invested by BYHEALTH

in the research and development work.

Fruitflow is well placed to play an important role in the

Chinese cardiovascular health market under the permitted health

function claim legislation, and we look forward to working closely

with BYHEALTH seeking to maximise the commercial success of this

agreement for the benefit of both companies.

The Company has developed a strong, long lasting and

wide-ranging patent portfolio for Fruitflow, and it owns outright

four existing patent families for Fruitflow. The new microbiome

patent application takes this to a potential total of five patent

families, with potential patent protection now running out to 2042.

The four existing patent families have a truly global footprint,

and the Company also holds other valuable intellectual property and

trade secrets for Fruitflow. The intellectual property for

Fruitflow is of fundamental importance to the Company and its

current and future commercial partners, to include DSM and

BYHEALTH, and it underpins the numerous commercial opportunities

which the Company and its partners are pursuing for Fruitflow.

The Company expects that the new gut microbiome patent

application, the significant changes to the sales and supply chain

structure for Fruitflow from January 2023, and the recent BYHEALTH

regulatory developments in China, will have a strongly beneficial

effect on the current and future commercial prospects for Fruitflow

and the business worldwide.

The Company would like to thank its customers and shareholders

for their continued support, and the Board remains strongly

positive about the outlook for Fruitflow and the Provexis business

for the coming year and beyond.

Dawson Buck Ian Ford

Chairman CEO

Consolidated statement of comprehensive

income Unaudited Unaudited Audited

Six months ended 30 September 2023 six months six months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP GBP GBP

Notes

----------------------------------------- ------ ------------- ------------- ----------

Revenue 387,534 179,369 389,916

Cost of goods (249,870) (26,730) (95,497)

----------------------------------------- ------ ------------- ------------- ----------

Gross profit 137,664 152,639 294,419

Selling and distribution costs (32,744) (23,974) (51,609)

Research and development costs (140,225) (107,398) (237,221)

Administrative costs - share based

payment charges (60,526) (11,318) (40,591)

Administrative costs - other (180,504) (183,955) (385,925)

----------------------------------------- ------ ------------- ------------- ----------

Loss from operations (174,006) (420,927)

Finance income 1,029 264 1,011

Loss before taxation (275,306) (173,742) (419,916)

Taxation - R&D tax relief: receivable

tax credit 8,200 16,108 32,800

Loss and total comprehensive loss for

the period (267,106) (157,634) (387,116)

------------------------------------------------- ------------- ------------- ----------

Attributable to:

Owners of the parent (267,106) (155,759) (385,241)

Non-controlling interest - (1,875) (1,875)

Loss and total comprehensive loss for

the period (267,106) (157,634) (387,116)

------------------------------------------------- ------------- ------------- ----------

Loss per share to owners of the

parent

Basic and diluted - pence 3 (0.01) (0.01) (0.02)

----------------------------------------- ------ ------------- ------------- ----------

Consolidated statement of financial

position Unaudited Unaudited Audited

30 September 2023 30 September 30 September 31 March

2023 2022 2023

Notes GBP GBP GBP

------------------------------------- ------- ------------- ------------- -------------

Assets

Current assets

Inventories 145,863 63,964 327,797

Trade and other receivables 264,410 140,809 61,114

Corporation tax asset 41,000 61,268 77,960

Cash and cash equivalents 318,819 744,551 379,121

-------------

Total current assets 770,092 1,010,592 845,992

---------------------------------------------- ------------- ------------- -------------

Total assets 770,092 1,010,592 845,992

---------------------------------------------- ------------- ------------- -------------

Liabilities

Current liabilities

Trade and other payables (319,017) (152,728) (188,337)

Total current liabilities (319,017) (152,728) (188,337)

---------------------------------------------- ------------- ------------- -------------

Total liabilities (319,017) (152,728) (188,337)

---------------------------------------------- ------------- ------------- -------------

Total net assets 451,075 857,864 657,655

---------------------------------------------- ------------- ------------- -------------

Capital and reserves attributable

to

owners of the parent company

Share capital 2,217,822 2,217,822 2,217,822

Share premium reserve 18,703,321 18,703,321 18,703,321

Merger reserve 6,599,174 6,599,174 6,599,174

Retained earnings (26,537,368) (26,130,579) (26,330,788)

---------------------------------------------- ------------- ------------- -------------

982,949 1,389,738 1,189,529

Non-controlling interest (531,874) (531,874) (531,874)

Total equity 451,075 857,864 657,655

---------------------------------------------- ------------- ------------- -------------

Consolidated statement of cash flows Unaudited Unaudited Audited

30 September 2023 six months six months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP GBP GBP

Cash flows from operating activities

Loss after tax (267,106) (157,634) (387,116)

Adjustments for:

Finance income (1,029) (264) (1,011)

Tax credit receivable (8,200) (16,108) (32,800)

Share-based payment charge - share options 60,526 11,318 40,591

Changes in inventories 181,934 21,844 (241,989)

Changes in trade and other receivables (203,436) (36,292) 43,453

Changes in trade and other payables 130,680 (5,181) 30,428

----------

Net cash flow from operations (106,631) (182,317) (548,444)

-------------------------------------------- ------------- ------------- ----------

Tax credits received 45,160 27,705 27,705

Total cash flow from operating activities (61,471) (154,612) (520,739)

-------------------------------------------- ------------- ------------- ----------

Cash flow from investing activities

Interest received 1,169 190 887

Total cash flow from investing activities 1,169 190 887

-------------------------------------------- ------------- ------------- ----------

Cash flow from financing activities

Proceeds from issue of share capital

- share options - 35,100 35,100

Total cash flow from financing activities - 35,100 35,100

-------------------------------------------- ------------- ------------- ----------

Net change in cash and cash equivalents (60,302) (119,322) (484,752)

Opening cash and cash equivalents 379,121 863,873 863,873

----------

Closing cash and cash equivalents 318,819 744,551 379,121

-------------------------------------------- ------------- ------------- ----------

Consolidated statement Total

of changes in equity Share Share Merger Retained equity Non- Total

30 September 2023 attributable

to owners controlling

capital premium reserve earnings of interests equity

the parent

GBP GBP GBP GBP GBP GBP GBP

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

At 31 March 2022 2,210,822 18,675,221 6,599,174 (25,986,138) 1,499,079 (529,999) 969,080

Share-based charges -

share options - - - 11,318 11,318 - 11,318

Issue of shares - share

options exercised

23-May-22 7,000 28,100 - - 35,100 - 35,100

Total comprehensive

expense

for the period - - - (155,759) (155,759) (1,875) (157,634)

At 30 September 2022 2,217,822 18,703,321 6,599,174 (26,130,579) 1,389,738 (531,874) 857,864

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

Share-based charges -

share options - - - 29,273 29,273 - 29,273

Total comprehensive

expense

for the period - - - (229,482) (229,482) - (229,482)

At 31 March 2023 2,217,822 18,703,321 6,599,174 (26,330,788) 1,189,529 (531,874) 657,655

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

Share-based charges -

share options - - - 60,526 60,526 - 60,526

Total comprehensive

expense

for the period - - - (267,106) (267,106) - (267,106)

At 30 September 2023 2,217,822 18,703,321 6,599,174 (26,537,368) 982,949 (531,874) 451,075

------------------------ ---------- ----------- ---------- ------------- ------------- ------------- ----------

1. General information, basis of preparation and accounting

policies

General information

Provexis plc is a public limited company incorporated and

domiciled in the United Kingdom (registration number 05102907). The

address of the registered office is 2 Blagrave Street, Reading,

Berkshire RG1 1AZ, UK.

The main activities of the Group are those of developing,

licensing and selling the proprietary, scientifically-proven

Fruitflow(R) heart-health functional food ingredient.

Basis of preparation

This condensed financial information has been prepared using

accounting policies consistent with International Financial

Reporting Standards in the European Union (IFRS).

The same accounting policies, presentation and methods of

computation are followed in this condensed financial information as

are applied in the Group's latest annual audited financial

statements, except as set out below. While the financial figures

included in this half-yearly report have been computed in

accordance with IFRS applicable to interim periods, this

half-yearly report does not contain sufficient information to

constitute an interim financial report as that term is defined in

IAS 34.

Use of non-GAAP profit measure - underlying operating profit

The directors believe that the operating loss before share based

payments measure provides additional useful information for

shareholders on underlying trends and performance. This measure is

used for internal performance analysis. Underlying operating loss

is not defined by IFRS and therefore may not be directly comparable

with other companies' adjusted profit measures. It is not intended

to be a substitute for, or superior to IFRS measurements of

profit.

The interim financial information does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006 and

has been neither audited nor reviewed by the Company's auditors

Shipleys pursuant to guidance issued by the Auditing Practices

Board.

The results for the year ended 31 March 2023 are not statutory

accounts. The statutory accounts for the last year ended 31 March

2023 were approved by the Board on 29 September 2023 and are filed

at Companies House. The report of the auditors on those accounts

was unqualified, contained an emphasis of matter with respect to

going concern, and did not contain a statement under section 498 of

the Companies Act 2006.

The interim report for the six months ended 30 September 2023

can be downloaded from the Company's website www.provexis.com.

Further copies of the interim report and copies of the 2023 annual

report and accounts can be obtained by writing to the Company

Secretary, Provexis plc, 2 Blagrave Street, Reading, Berkshire RG1

1AZ, UK.

This announcement was approved by the Board of Provexis plc for

release on 29 December 2023.

Going concern

Under the terms of the DSM Transfer of Business agreement which

was announced in June 2022, DSM's existing and prospective pipeline

customers for Fruitflow II SD as a straight ingredient (not a DSM

Premix or DSM Market-Ready solution) transferred to become direct

customers of Provexis WEF 1 January 2023.

The Company has needed to hold Fruitflow II SD in stock from 1

January 2023 onwards, to sell to new and existing customers, and

the Company therefore agreed to purchase from DSM the remaining

stocks of Fruitflow which DSM held on 31 December 2022.

It was originally intended that the Company would pay DSM for

this inventory over the course of a three month sale back period,

commencing on 1 January 2023, with the Company having the option to

purchase some but not all of DSM's remaining stocks of Fruitflow at

31 December 2022.

The Company and DSM have been in further negotiations around the

inventory transfer throughout the course of 2023, and the parties

expect to be able to conclude these further negotiations in the

coming months. The amount of stock which the Company will finally

elect to purchase from DSM remains uncertain, and it will

ultimately depend on (i) the best before dates of this inventory,

which remain favourable / long dated in light of recent production

runs of new Fruitflow material, (ii) recent stability data which

suggests that the best before dates could be further extended,

(iii) estimated customer demand in 2024 and beyond, (iv) the

comparative costs and timing of a potential production run for a

new batch of material and (v) the Company's financial resources at

that time.

Based on its current level of cash it is expected that the Group

may therefore need to raise further equity finance, or potentially

new loan finance, in the coming months, a situation which is deemed

to represent a material uncertainty related to going concern.

Considering the success of previous fundraisings and the current

performance of the business, the Directors have a reasonable

expectation of raising sufficient additional equity capital or new

loan finance to continue in operational existence for the

foreseeable future. Subject to the outcome of ongoing negotiations

with a third party, the Company might also be able to hold some of

its future stock requirements on a consignment basis, only paying

for the stock when it was required for sale.

For these reasons the Directors are of the opinion that at 29

December 2023, the Group and Company's liquidity and capital

resources are adequate to deliver the current strategic objectives

and 2024 business plan and that the Group and Company remain a

going concern.

Accounting policies

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 March 2023, as

described in those annual financial statements.

2. Segmental reporting

The Group's operating segments are determined based on the

Group's internal reporting to the Chief Operating Decision Maker

(CODM). The CODM has been determined to be the Board of Directors

as it is primarily responsible for the allocation of resources to

segments and the assessment of performance of the segments. The

performance of operating segments is assessed on revenue.

The CODM uses revenue as the key measure of the segments'

results as it reflects the segments' underlying trading performance

for the financial period under evaluation. Revenue is reported

separately to the CODM and all other reports are prepared as a

single business unit.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Fruitflow II SD ingredient - from

1 January 2023 298,879 - 74,239

DSM Alliance Agreement - up to 31

December 2022 - 97,194 170,269

Fruitflow+ Omega-3 88,655 82,175 145,408

387,534 179,369 389,916

----------------------------------- ------------- ------------- ---------

3. Earnings per share

Basic earnings per share amounts are calculated by dividing the

profit attributable to owners of the parent by the weighted average

number of ordinary shares in issue during the period.

The loss attributable to equity holders of the Company for the

purpose of calculating the fully diluted loss per share is

identical to that used for calculating the basic loss per share.

The exercise of share options would have the effect of reducing the

loss per share and is therefore anti-dilutive under the terms of

IAS 33 'Earnings per Share'.

Basic and diluted loss per share amounts are in respect of all

activities.

There were 188,500,000 share options in issue at 30 September

2023 (2022: 171,500,000) that are currently anti-dilutive and have

therefore been excluded from the calculations of the diluted loss

per share.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Loss for the period attributable

to owners of the parent - GBP 267,106 155,759 385,241

Weighted average number of shares 2,217,821,523 2,215,794,201 2,216,805,085

Basic and diluted loss per share

- pence 0.01 0.01 0.02

----------------------------------- -------------- -------------- --------------

4. Share capital and Total Voting Rights

At 29 December 2023, the date of this announcement, the

Company's issued share capital comprises 2,217,821,523 ordinary

shares of 0.1 pence each, each with equal voting rights. The

Company does not hold any shares in treasury and therefore the

total number of ordinary shares and voting rights in the Company is

2,217,821,523.

The above figure may be used by shareholders in the Company as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or change to

their interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

5. Cautionary statement

This document contains certain forward-looking statements with

respect to the financial condition, results and operations of the

business. These statements involve risk and uncertainty as they

relate to events and depend on circumstances that will incur in the

future. Nothing in this interim report should be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGMCPUPWGPB

(END) Dow Jones Newswires

December 29, 2023 07:48 ET (12:48 GMT)

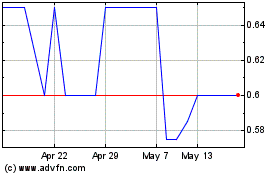

Provexis (LSE:PXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Provexis (LSE:PXS)

Historical Stock Chart

From Nov 2023 to Nov 2024