UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: March 15, 2016

|

YaSheng Group

|

|

(Name of small business issuer as specified in its charter)

|

|

California

|

000-31899

|

33-0788293

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

| |

|

|

|

805 Veterans Blvd., #228, Redwood City, CA

|

|

94063

|

|

(Address of principal executive offices

|

|

(Zip code)

|

|

(650) 363-8345

|

|

(Issuer’s telephone number, including area code

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

EXHIBITS

| ITEM 9.01 |

Financial Statements and Exhibits |

| |

|

| (d) |

Exhibits |

| |

|

| |

The financial statements for the years 2012, 2013, 2014 for Gansu YaSheng Agro-Industrial Commerce Group Co. Ltd., and unaudited financial information for Gansu YaSheng Agro-Industrial Commerce Group Co. Ltd. as of Sept 30, 2015 are attached hereto. Proforma financials are not included, because the transaction described in the 8-K filed January 5, 2016, was a swap transaction and as a result, Yasheng Group swapped out all of its assets and business. Hence, proforma financials would be identical to the actual results reflected in the financial statements filed as an exhibit to this 8-K/A. |

| |

|

| EXHIBIT 23.1 |

Consent of Auditors, Gansu-HongXin Certified Public Accountants Co. Ltd. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

YASHENG GROUP |

|

| |

|

|

|

|

Dated: March 15, 2016

|

By:

|

/s/ Haiyun Zhuang |

|

| |

|

Name: Haiyun Zhuang |

|

| |

|

Title: Chief Financial Officer |

|

| |

|

|

|

EXHIBIT 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the inclusion in Form 8-K/A filed March 15, 2016, Commission File 000-31899 of YASHENG GROUP of our report dated January 15, 2016, relating to audited financial statements for the years ended December 31, 2012, 2013 and 2014 and unaudited financial statements for the 9 months ended September 30, 2015 for Gansu Yasheng Agro-Industrial and Commerce Group Co. Ltd., which appear in the 8-K/A of YASHENG GROUP.

/s/ GANSU-HONGXIN Certified Public Accountants Co., Ltd.

Lanzhou, China

March 10, 2016

EXHIBIT 99.1

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd,

We have audited the accompanying consolidated balance sheets of Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd (the “Company”) as of December, 31st, 2014, 2013, and 2012, and the related consolidated statements of operations, stockholders’ equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd as of December 31, 2014, 2013 and 2012, and the results of their operations and their cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Gansu Hongxin Certified Public Accountants Co., Ltd.

Lanzhou, China

January 15th, 2016

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

|

Balance sheet

|

| |

|

|

$

|

| |

December, 31st, 2014

|

December, 31st, 2013

|

December, 31st, 2012

|

|

Current assets

|

|

|

|

|

Cash and cash equivalent

|

|

1,627,458.65

|

1,695,472.15

|

|

Accounts receivable

|

911,732.31

|

793,337.21

|

789,059.46

|

|

Inventories

|

1,327,592.45

|

1,398,435.25

|

1,472,710.25

|

|

Prepayments

|

3,002,941.65

|

2,349,882.72

|

2,495,425.98

|

|

Deferred income tax assets

|

|

|

|

|

Other

|

|

|

|

|

Total Current Assets

|

6,725,132.90

|

6,169,113.83

|

6,452,667.84

|

|

Non-current assets

|

|

|

|

|

Long-term investments

|

|

|

|

|

Property, plant, and equipment

|

41,842,654.54

|

34,867,675.85

|

25,923,409.69

|

|

Construction in progress

|

|

|

|

|

Land use rights, net

|

114,479,490.02

|

122,554,084.53

|

126,306,578.50

|

|

Deferred income tax assets

|

|

|

|

|

Total Assets

|

163,047,277.46

|

163,590,874.21

|

158,682,656.03

|

|

Current Liabilities

|

|

|

|

|

Accounts payable

|

18,415.46

|

-

|

-

|

|

Accrued employee compensation and benefits

|

|

|

|

|

Current maturities of long-term debt

|

|

|

|

|

Accrued expenses and other current liabilities

|

87,012.22

|

58,394.26

|

57,060.83

|

|

Long-term Liabilities

|

|

|

|

|

long-term debt

|

|

|

|

|

Obligations under capital leases

|

|

|

|

|

Deferred income tax liabilities

|

|

|

|

|

Other non-current liabilities

|

|

|

|

|

Total Liabilities

|

105,427.68

|

58,394.27

|

57,060.84

|

|

Stockholder’s equity

|

|

|

|

|

Paid in on capital stock Common

|

146,022,434.04

|

146,022,434.04

|

146,022,434.04

|

|

Additional paid-in capital

|

|

|

|

|

Other comprehensive income

|

16,919,415.74

|

17,510,045.90

|

12,603,161.15

|

|

Retained earnings

|

|

|

|

|

Total Equity & Liabilities

|

163,047,277.46

|

163,590,874.21

|

158,682,656.03

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

|

Statements of Income

|

| |

|

|

$

|

| |

|

|

|

| |

|

|

|

|

Sales revenue

|

190,536,897.98

|

179,885,898.08

|

173,021,275.25

|

|

Cost of goods sold

|

41,432,360.77

|

35,276,635.02

|

34,623,710.61

|

|

Gross profit

|

149,104,537.21

|

144,609,263.06

|

138,397,564.64

|

|

General and administrative expense

|

9,282,831.93

|

9,295,490.70

|

9,103,371.56

|

|

Income from operations

|

139,821,705.28

|

135,313,772.36

|

129,294,193.08

|

|

Interest revenue

|

254,110.75

|

184,198.02

|

116,882.62

|

|

Other income (loss), net

|

|

|

|

|

Income from continuing operations before income tax

|

140,075,816.03

|

135,497,970.38

|

129,411,075.70

|

|

Income tax

|

|

|

|

|

Income from continuing operations

|

140,075,816.03

|

135,497,970.38

|

129,411,075.70

|

|

Discontinued operations

|

|

|

|

|

Net income

|

140,075,816.03

|

135,497,970.38

|

129,411,075.70

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

|

Statements of Cash Flow(Rising)

|

| |

|

$

|

|

| |

2014

|

2013

|

2012

|

|

Cash flows from operating activities:

|

|

|

|

|

Net income

|

140,075,816.03

|

135,497,970.38

|

129,411,075.70

|

|

Depreciation, amortization, and other

|

7,942,609.32

|

7,953,246.60

|

7,844,738.88

|

|

(Gains) losses on investments and other, net

|

1,067,035.52

|

1,071,067.14

|

-5,463,014.74

|

|

Accounts receivable

|

-119,356.62

|

19,817.80

|

-703,493.63

|

|

Inventories

|

64,759.15

|

117,968.15

|

1,625,107.22

|

|

Accounts payable

|

-247,294.52

|

526,060.45

|

|

|

Net cash provided by operating activities

|

148,783,568.87

|

145,186,130.52

|

138,177,428.17

|

| |

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

Purchases of investments

|

|

|

|

|

Proceeds from sales of investments

|

|

|

|

|

Proceeds from maturities of investments

|

|

|

|

|

Purchase of property, plant and equipment

|

8,590,178.57

|

9,622,549.85

|

7,643,658.10

|

|

Proceeds from sales of property and equipment

|

|

|

|

|

Other

|

|

|

|

|

Net cash used in investing activities

|

|

|

|

| |

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

Issuances of common stock

|

|

|

|

|

Issuances of debt

|

|

|

|

|

Repayments of debt

|

|

|

|

|

Dividends paid

|

140,075,816.03

|

135,497,970.38

|

129,411,075.70

|

|

Other

|

|

|

|

|

Net cash used in financing activities

|

|

|

|

| |

|

|

|

|

Effect of exchange rate changes on cash

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

-144,592.16

|

-68,013.50

|

-367,179.63

|

|

Cash and cash equivalents, beginning of period

|

1,627,458.65

|

1,695,472.15

|

2,062,651.78

|

|

Cash and cash equivalents, end of period

|

1,482,866.49

|

1,627,458.65

|

1,695,472.15

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

Statements of Stockholders' Equity

|

| |

|

|

|

|

$

|

| |

Common Stock

|

Additional paid-in capital

|

Retained Earnings

|

Accumulated other Comprehensive Income

|

Total

|

|

Balance as of December, 31st, 2012

|

|

|

173,021,275.25

|

|

173,021,275.25

|

|

Net income

|

|

|

129,411,075.70

|

|

129,411,075.70

|

|

Foreign currency translation

|

|

|

|

12,603,161.15

|

12,603,161.15

|

| |

|

|

|

|

|

|

Balance as of December, 31st, 2013

|

|

|

179,885,898.08

|

|

179,885,898.08

|

|

Net income

|

|

|

135,497,970.38

|

|

135,497,970.38

|

|

Foreign currency translation

|

|

|

|

17,510,045.90

|

17,510,045.90

|

| |

|

|

|

|

|

|

Balance as of December, 31st, 2014

|

|

|

190,536,897.98

|

|

190,536,897.98

|

|

Net income

|

|

|

140,075,816.03

|

|

140,075,816.03

|

|

Foreign currency translation

|

|

|

|

16,919,415.74

|

16,919,415.74

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

Notes to Financial Statement

1. Organization and nature of operations

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd (“The Company”) was set on 5th March 1998 in China. The paid in capital is RMB 16,880,000 Yuan, 100% hold by Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd. The main business of the Company is including, Agricultural technology development, new product development, agricultural sideline products (excluding food wholesale), chemical products, and raw materials (excluding dangerous goods) sales; livestock products sales; chemical fertilizer, agricultural film, agricultural machinery, and oil sales. Planting and selling of agricultural, forestry fruits, and vegetables.

2. Summary of significant accounting policies

(a) Accounting standards

The financial statements have been prepared on a historical cost basis to reflect the financial position and results of operations of the Company in accordance with accounting principles generally accepted in the United States of America.

(b) Fiscal year

The Company’s fiscal year ends on the 31st of December of each calendar year.

3. The Company mainly accounting policies, accounting estimates and prior period errors

(a) Use of estimates

The Company’s discussion and analysis of its financial condition and results of operations are based upon its financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, the Company evaluates its estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

(b) Revenue recognition

We mainly sell products. We recognize revenue when title and risk of loss are transferred to our customers. This generally happens upon delivery of our product.

(c) Shipping and handling costs

The Company records outward freight, purchasing and receiving costs in selling expenses; inspection costs and warehousing costs are recorded as general and administrative expenses.

(d) Cash and cash equivalents

Cash and cash equivalents include cash on hand, demand deposits held by banks, and securities with maturities of three months or less. The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Cash equivalents are composed primarily of investments in money market accounts stated at cost, which approximates fair value.

(e) Inventories

Inventories are recorded using the weighted average method and are valued at the lower of cost or market.

(f) Accounts receivable, net

The carrying amount of accounts receivable is reduced by a valuation allowance that reflects the Company’s best estimate of the amounts that will not be collected. In addition to reviewing delinquent accounts receivable, the Company considers many factors in estimating its general allowance, including aging analysis, historical bad debt records, customer credit analysis and any specific known troubled accounts.

(g) Property, plant and equipment

Property, plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the assets. Amortization of leasehold improvements is calculated on a straight-line basis over the life of the asset or the term of the lease, whichever is shorter. Major renewals and betterments are capitalized and depreciated; maintenance and repairs that do not extend the life of the respective assets are charged to expense as incurred. Upon disposal of assets, the cost and related accumulated depreciation are removed from the accounts and any gain or loss is included in income. Depreciation related to property and equipment used in production is reported in cost of sales. Property and equipment are depreciated over their estimated useful lives as follows:

|

Types of PPE

|

Depreciation period

|

Residual Rate (%)

|

|

Buildings and improvements

|

30

|

1

|

|

Machinery and equipment

|

5

|

3

|

|

Transportation

|

10

|

3

|

|

Office equipment and others

|

5

|

3

|

Long-term assets of the Company are reviewed annually to assess whether the carrying value has become impaired, according to the guidelines established in Statement of Accounting Standards (SFAS) No. 144, "Accounting for the Impairment of Disposal of Long-Lived Assets." The Company also evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. No impairment of assets was recorded in the periods reported.

(h) Intangible assets

Intangible assets consist of 30 years use right of Fruit vegetable franchise base and are recorded at cost. The cost of fruit vegetable franchise base use right was amortized over 20 years using the straight-line method.

(i) Impairment of long-lived assets

The carrying amounts of long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of assets to future undiscounted net cash flows expected to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less cost to sell.

(j) Investments

Investments consist primarily of less than 20% equity positions in non-marketable securities and are recorded at lower of cost or market.

(k) Foreign currency translation

The accompanying financial statements are presented in United States (US) dollars. The functional currency is the RMB. The financial statements are translated into US dollars from RMB at year-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

Gains and losses resulting from foreign currency translation are recorded in a separate component of shareholders’ equity. Foreign currency translation adjustments are included in accumulated other comprehensive income in the statements of shareholders’ equity for the years presented.

RMB is not freely convertible into the currency of other nations. All such exchange transactions must take place through authorized institutions. There is no guarantee the RMB amounts could have been, or could be, converted into US dollars at rates used in translation.

(l) Income taxes

As a state-owned agricultural enterprise, the Company and all of its agricultural subsidiaries are exempted from enterprise income taxes with approval from the Gansu Provincial Bureau of Local Taxation.

(m) Earnings per share

Basic earnings per share are computed using the weighted average number of common shares outstanding during the year. Diluted earnings per share are computed using the weighted average number of common and, if dilutive, potential common shares outstanding during the year. The Company has no potentially dilutive shares for the periods shown.

(n) Economic and Political Risks

The Company faces a number of risks and challenges as a result of having primary operations and markets in the PRC. Changing political climates in the PRC could have a significant effect on the Company's business.

(o) Comprehensive income

Comprehensive income is defined as the change in equity of a company during a period from transactions and other events and circumstances excluding transactions resulting from investments from owners and distributions to owners. Accumulated other comprehensive income, as presented on the accompanying consolidated balance sheets, consists of mainly the cumulative foreign currency translation adjustment.

(p) Recently Issued Accounting Standards

Recently Adopted Accounting Pronouncements

In December 2011, the Financial Accounting Standards Board (“FASB”) issued guidance enhancing disclosure requirements about the nature of an entity’s right to offset and related arrangements associated with its financial instruments. The new guidance requires the disclosure of the gross amounts subject to rights of set-off, amounts offset in accordance with the accounting standards followed, and the related net exposure. In January 2013, the FASB clarified that the scope of this guidance applies to derivatives, repurchase agreements, and securities lending arrangements that are either offset or subject to an enforceable master netting arrangement, or similar agreements. We have adopted this new guidance.

In February 2013, the FASB issued guidance on disclosure requirements for items reclassified out of accumulated other comprehensive income (“AOCI”). This new guidance requires entities to present (either on the face of the income statement or in the notes to financial statements) the effects on the line items of the income statement for amounts reclassified out of AOCI. We have adopted this new guidance.

In September 2011, the Financial Accounting Standards Board (“FASB”) issued guidance on testing goodwill for impairment. The new guidance provides an entity the option to first perform a qualitative assessment to determine whether it is more likely than not that the fair value of are porting unit is less than its carrying amount. If an entity determines that this is the case, it is required to perform the two-step goodwill impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment loss to be recognized for that reporting unit (if any). If an entity determines that the fair value of a reporting unit is greater than its carrying amount, the two-step goodwill impairment test is not required. We adopted this new guidance.

Recent accounting guidance not yet adopted

In March 2013, the FASB issued guidance on a parent’s accounting for the cumulative translation adjustment upon de-recognition of a subsidiary or group of assets within a foreign entity. This new guidance requires that the parent release any related cumulative translation adjustment into net income only if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided. The new guidance will be effective for us beginning December 31, 2014. We do not anticipate material impacts on our financial statements upon adoption.

(q) Fair Value of Financial Instruments

The carrying amounts of accounts receivable, accounts payable, other liabilities, and short-term borrowings approximate their fair value due to the short-term maturity of these instruments. Long term debt approximates fair value as its interest rates approximates market interest rates

4. Accounts receivable

Accounts receivable are recognized and carried at original invoice amount outstanding less an allowance for doubtful accounts. The activity in the Accounts Receivable was as follows:

|

December, 31st

|

Gross Balance

attend of year($)

|

Allowance for

doubtful accounts

|

Net Balance at

end of year($)

|

|

2012

|

789059.46

|

0

|

789059.46

|

|

2013

|

793337.21

|

0

|

793337.21

|

|

2014

|

911732.31

|

0

|

911732.31

|

Top 5 companies for Accounts receivable

|

Company Name

|

Relationship

|

Balance($)

|

Years

|

Proportion of total accounts receivable

|

|

Zi Jin Xiang Ecological Agricultural Development Company

|

Buying and selling units

|

270,174.87

|

In one year

|

29.63%

|

|

Da Tong Ecommerce. Ltd.

|

150,678.22

|

16.53%

|

|

Xian Ju water chestnut Planting Technology Co. Ltd.

|

110,116.03

|

12.08%

|

|

Hui Nong Fruit Industry Development Co. Ltd.

|

183,853.57

|

20.17%

|

|

Kai Le Melamine Products Co. Ltd.

|

53,585.55

|

5.88%

|

|

Total

|

|

768,408.24

|

|

84.28%

|

5. Inventories

The major classes of inventory: raw materials, packaging materials, products in process, finished goods, stocks, low-value consumable goods, materials in transit as well as others.

The following is a breakdown of the major categories of inventories.

|

Breakdown of Inventories

|

|

|

$

|

| |

December, 31st, 2014

|

December, 31st, 2013

|

December, 31st, 2012

|

|

Compound fertilizer

|

434,238.26

|

436,976.23

|

481,704.40

|

|

Agricultural Medicine

|

244,230.66

|

253,389.52

|

270,927.27

|

|

Biological drugs

|

236,171.58

|

218,602.70

|

261,987.26

|

|

Farm tools

|

270,661.62

|

346,308.78

|

300,247.37

|

|

Low value consumable

|

142,290.33

|

143,158.03

|

157,843.95

|

|

Total for the year

|

1,327,592.45

|

1,398,435.26

|

1,472,710.25

|

6. Property, plant and equipment & depreciation

The major classes of property, plant and equipment include building and improvements, machinery and equipment, transportation facilities, agricultural facilities, etc. They are carried at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. The following is a breakdown of fixed assets and accumulated depreciation by fiscal year.

| |

December, 31st, 2014

|

December, 31st, 2013

|

December, 31st, 2012

|

|

Buildings and improvements

|

6,902,663.97

|

6,927,684.70

|

4,991,239.06

|

|

Machinery and equipment

|

2,136,385.45

|

1,532,774.85

|

1,459,740.67

|

|

Transportation

|

2,580,528.71

|

1,508,276.60

|

1,411,555.24

|

|

Others

|

137,142.69

|

137,639.80

|

130,324.74

|

|

Total

|

11,756,720.82

|

10,106,375.95

|

7,992,859.71

|

| |

|

|

|

|

Accumulated Depreciation

|

907,241.20

|

471,614.07

|

50,805.33

|

|

Total

|

10,849,479.62

|

9,634,761.88

|

7,942,054.38

|

The breakdown of construction in progress as below,

| |

December, 31st, 2014

|

December, 31st, 2013

|

December, 31st, 2012

|

|

Revetment

|

6,573,844.81

|

5,579,653.34

|

4,135,711.72

|

|

Ditch

|

9,092,092.79

|

7,907,490.58

|

5,754,033.71

|

|

Road

|

6,714,507.57

|

5,581,772.90

|

4,135,711.73

|

|

Floodwall

|

8,612,729.75

|

6,163,997.15

|

3,955,898.15

|

|

Total

|

30,993,174.92

|

25,232,913.97

|

17,981,355.31

|

7. Intangible assets

The intangible asset main is the 30 years use right of Fruit vegetable franchise base.

The movement of the use right value as below.

|

$

|

December, 31st, 2014

|

December, 31st, 2013

|

December 31st, 2012

|

|

Gross

|

152,000,000.00

|

152,000,000.00

|

152,000,000.00

|

|

Accumulated Amortization

|

37,520,509.98

|

29,445,915.47

|

25,693,421.50

|

|

Intangible assets, net

|

114,479,490.02

|

122,554,084.53

|

126,306,578.50

|

The original cost of Fruit vegetable franchise base use right is $152 million.

8. China contribution plan

The Company participates in a government-mandated multi-employer defined contribution plan pursuant to which certain retirement, medical and other welfare benefits are provided to employees. Chinese labor regulations require the Company’s subsidiaries to pay to the local labor bureau a monthly contribution at a stated contribution rate based on the monthly basic compensation of qualified employees. The relevant local labor bureau is responsible for meeting all retirement benefit obligations; the Company has no further commitments beyond its monthly contribution.

9. Concentration of risks

The operations of the Company are substantially located in the PRC and accordingly, investing in the shares of the Company is subject to among others, the PRC’s political, economic and legal risks.

10. Income taxes

The Company and all of its agricultural subsidiaries are exempt from income taxes in the PRC.

11. Employee benefit plans

The Company provides the following benefits for all employees:

(a). Employee Welfare Fund: An amount equal to 14% of payroll is set aside by the Company for standard employee benefits. This fund is managed and controlled by the Company. All required payments current.

(b). Open Policy Pension: The Company pays to national and community insurance agents an amount equal to 20% of payroll. This insurance continues to cover the employee subsequent to retirement.

(c). Unemployment Insurance: The Company pays to the national employment administrative entities an amount equal to 1% of payroll. Any dismissed employee thereby receives a specified amount of family-support funds for a designated period.

(d). Housing Surplus Reserve: The Company pays to the national housing fund administrative entities an amount equal to 10% of payroll for deposit into the employees' future housing allowance accounts.

The aforesaid items are for employee's benefits and should be accounted for as the Company's expenses.

12. Segment information

The segments are presented in the tables below.

| |

2014

|

2013

|

2012

|

|

Revenue

|

|

|

|

|

Bamboo

|

10,423,704.28

|

10,172,447.20

|

9,624,866.76

|

|

Orange

|

90,510,858.03

|

83,997,000.58

|

81,490,996.78

|

|

Red bayberry

|

45,591,139.85

|

42,701,530.71

|

41,236,024.29

|

|

Broccoli

|

44,011,195.82

|

43,014,919.59

|

40,669,387.42

|

|

Total

|

190,536,897.98

|

179,885,898.08

|

173,021,275.25

|

| |

|

|

|

|

Cost

|

|

|

|

|

Bamboo

|

3,135,797.70

|

3,147,645.81

|

2,854,936.87

|

|

Orange

|

17,291,033.68

|

14,445,173.42

|

14,313,690.45

|

|

Red bayberry

|

9,423,635.76

|

6,484,435.82

|

7,119,725.54

|

|

Broccoli

|

11,581,893.64

|

11,199,379.97

|

10,335,357.74

|

|

Total

|

41,432,360.78

|

35,276,635.02

|

34,623,710.61

|

13. General and management expense

The breakdown of general and management expense are as below. The Fruit vegetable franchise base had not been put into use, so its management cost was recorded into management expense.

| |

2014

|

2013

|

2012

|

|

Salaries

|

752,800.85

|

750,752.54

|

725,126.27

|

|

Social insurance

|

94,736.42

|

92,688.69

|

110,272.66

|

|

Entertainment expense

|

172,554.85

|

172,935.04

|

151,982.43

|

|

Office expenses

|

28,166.63

|

26,917.20

|

27,064.00

|

|

Travel expenses

|

179,630.25

|

183,197.44

|

64,232.87

|

|

Communication fee

|

4,741.14

|

4,787.38

|

9,378.34

|

|

Depreciation

|

430,464.42

|

412,718.28

|

414,940.14

|

|

Amortization

|

7,512,144.90

|

7,540,528.32

|

7,429,798.74

|

|

Traffic expense

|

4,675.91

|

6,308.25

|

13,874.11

|

|

Others

|

102,916.56

|

104,657.56

|

156,702.00

|

|

Total

|

9,282,831.93

|

9,295,490.70

|

9,103,371.56

|

14. Other income

None

15. Operating leases

The Company has no operating leases for the periods shown.

16. Subsequent Events and new Subsidiaries

None

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

| |

|

$

|

| |

September,

30th, 2015

|

December,

31st, 2014

|

|

Current assets

|

|

|

|

Cash and cash equivalent

|

1,414,477.52

|

1,482,866.49

|

|

Accounts receivable

|

766,410.25

|

911,732.31

|

|

Inventories

|

1,944,297.82

|

1,327,592.45

|

|

Prepayments

|

2,662,097.80

|

3,002,941.65

|

|

Other receivables

|

67,145,821.22

|

|

|

Deferred income tax assets

|

|

|

|

Other

|

|

|

|

Total Current Assets

|

73,933,104.61

|

6,725,132.90

|

| |

|

|

|

Non-current assets

|

|

|

|

Long-term investments

|

|

|

|

Property, plant, and equipment

|

16,577,912.09

|

10,849,479.62

|

|

Construction in progress

|

45,404,599.76

|

41,842,654.54

|

|

Intangible assets

|

|

|

|

Deferred income tax assets

|

|

|

|

Total Assets

|

223,940,888.95

|

163,047,277.46

|

| |

|

|

|

Current Liabilities

|

|

|

|

Accounts payable

|

|

18,415.46

|

|

Accrued employee compensation and benefits

|

|

|

|

Current maturities of long-term deb

|

|

|

|

Accrued expenses and other current liabilities

|

74,323.74

|

87,012.23

|

| |

|

|

|

Long-term Liabilities

|

|

|

|

long-term debt

|

|

|

|

Obligations under capital leases

|

|

|

|

Deferred income tax liabilities

|

|

|

|

Other non-current liabilities

|

|

|

|

Total Liabilities

|

74,323.74

|

105,427.68

|

| |

|

|

|

Stockholder’s equity

|

|

|

|

Paid in on capital stock Common

|

146,022,434.04

|

146,022,434.04

|

|

Additional paid-in capital

|

|

|

|

Other comprehensive income

|

10,698,227.97

|

16,919,415.74

|

|

Retained earnings

|

67,145,903.20

|

|

|

Total Equity & Liabilities

|

223,940,888.95

|

163,047,277.46

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

Statements of Income

| |

|

$

|

| |

2015-1-9

|

2014

|

| |

|

|

|

Sales revenue

|

102,449,362.93

|

190,536,897.98

|

|

Cost of goods sold

|

28,724,964.77

|

41,432,360.77

|

|

Gross profit

|

73,724,398.16

|

149,104,537.21

|

|

General and administrative expense

|

6,820,594.37

|

9,282,831.93

|

|

Income from operations

|

66,903,803.79

|

139,821,705.28

|

| |

|

|

|

Interest revenue

|

242,099.42

|

254,110.75

|

|

Other income (loss), net

|

|

|

|

Income from continuing operations before income tax

|

67,145,903.21

|

140,075,816.03

|

|

Income tax

|

|

|

|

Income from continuing operations

|

67,145,903.21

|

140,075,816.03

|

|

Discontinued operations

|

|

|

|

Net income

|

67,145,903.21

|

140,075,816.03

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

|

Statements of Cash Flow (Rising)

|

| |

|

$

|

| |

September,

30th, 2015

|

December,

31st, 2014

|

|

Cash flows from operating activities:

|

|

|

|

Net income

|

67,145,903.20

|

140,075,816.03

|

|

Depreciation, amortization, and other

|

5,820,905.52

|

7,942,609.32

|

|

(Gains) losses on investments and other, net

|

|

1,067,035.52

|

|

Accounts receivable

|

-66,716,888.69

|

-119,356.62

|

|

Inventories

|

-667,393.41

|

64,759.15

|

|

Accounts payable

|

-18,415.46

|

-247,294.53

|

|

Net cash provided by operating activities

|

5,564,111.16

|

148,783,568.87

|

|

Cash flows from investing activities:

|

|

|

|

Purchases of investments

|

|

|

|

Proceeds from sales of investments

|

|

|

|

Proceeds from maturities of investments

|

|

|

|

Purchase of property, plant and equipment

|

5,575,883.67

|

8,590,178.57

|

|

Proceeds from sales of property and equipment

|

|

|

|

Other

|

|

|

|

Net cash used in investing activities

|

|

|

| |

|

|

|

Cash flows from financing activities:

|

|

|

|

Issuances of common stock

|

|

|

|

Issuances of debt

|

|

|

|

Repayments of debt

|

|

|

|

Dividends paid

|

|

140,075,816.03

|

|

Other

|

|

|

|

Net cash used in financing activities

|

|

|

| |

|

|

|

Effect of exchange rate changes on cash

|

56,616.46

|

|

|

Net increase (decrease) in cash and cash equivalents

|

-68,388.97

|

-144,592.16

|

|

Cash and cash equivalents, beginning of period

|

1,482,866.49

|

1,627,458.65

|

|

Cash and cash equivalents, end of period

|

1,414,477.52

|

1,482,866.49

|

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

Statements of Stockholders' Equity

|

| |

|

|

|

|

$

|

| |

Common Stock

|

Additional paid-in capital

|

Retained Earnings

|

Accumulated other Comprehensive Income

|

Total

|

|

Balance as of December 30th 2015

|

|

|

102,449,362.93

|

|

102,449,362.93

|

|

Net income

|

|

|

67,145,903.21

|

|

67,145,903.21

|

|

Foreign currency translation

|

|

|

|

10,698,227.97

|

10,698,227.97

|

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd

Notes to Financial Statement

1. Organization and nature of operations

Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd (“The Company”) was set on 5th March 1998 in China. The paid in capital is RMB 16,880,000 Yuan, 100% hold by Gansu Yasheng Agro – Industrial and Commerce (group) Co. Ltd. The main business of the Company is including, Agricultural technology development, new product development, agricultural sideline products (excluding food wholesale), chemical products, and raw materials (excluding dangerous goods) sales; livestock products sales; chemical fertilizer, agricultural film, agricultural machinery, and oil sales. Planting and selling of agricultural, forestry fruits and vegetables.

2. Summary of significant accounting policies

(a) Accounting standards

The financial statements have been prepared on a historical cost basis to reflect the financial position and results of operations of the Company in accordance with accounting principles generally accepted in the United States of America.

(b) Fiscal year

The Company’s fiscal year ends on the 31st of December of each calendar year.

3. The Company mainly accounting policies, accounting estimates and prior period errors

(a) Use of estimates

The Company’s discussion and analysis of its financial condition and results of operations are based upon its financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, the Company evaluates its estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

(b) Revenue recognition

We mainly sell products. We recognize revenue when title and risk of loss are transferred to our customers. This generally happens upon delivery of our product.

(c) Shipping and handling costs

The Company records outward freight, purchasing and receiving costs in selling expenses; inspection costs and warehousing costs are recorded as general and administrative expenses.

(d) Cash and cash equivalents

Cash and cash equivalents include cash on hand, demand deposits held by banks, and securities with maturities of three months or less. The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Cash equivalents are composed primarily of investments in money market accounts stated at cost, which approximates fair value.

(e) Inventories

Inventories are recorded using the weighted average method and are valued at the lower of cost or market.

(f) Accounts receivable, net

The carrying amount of accounts receivable is reduced by a valuation allowance that reflects the Company’s best estimate of the amounts that will not be collected. In addition to reviewing delinquent accounts receivable, the Company considers many factors in estimating its general allowance, including aging analysis, historical bad debt records, customer credit analysis and any specific known troubled accounts.

(g) Property, plant and equipment

Property, plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the assets. Amortization of leasehold improvements is calculated on a straight-line basis over the life of the asset or the term of the lease, whichever is shorter. Major renewals and betterments are capitalized and depreciated; maintenance and repairs that do not extend the life of the respective assets are charged to expense as incurred. Upon disposal of assets, the cost and related accumulated depreciation are removed from the accounts and any gain or loss is included in income. Depreciation related to property and equipment used in production is reported in cost of sales. Property and equipment are depreciated over their estimated useful lives as follows:

|

Types of PPE

|

Depreciation period

|

Residual rate (%)

|

|

Buildings and improvements

|

30

|

1

|

|

Machinery and equipment

|

5

|

3

|

|

Transportation

|

10

|

3

|

|

Office equipment and others

|

5

|

3

|

Long-term assets of the Company are reviewed annually to assess whether the carrying value has become impaired, according to the guidelines established in Statement of Accounting Standards (SFAS) No. 144, "Accounting for the Impairment of Disposal of Long-Lived Assets." The Company also evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. No impairment of assets was recorded in the periods reported.

(h) Intangible assets

Intangible assets consist of 30 years use right of Fruit vegetable franchise base and are recorded at cost. The cost of fruit vegetable franchise base use right was amortized over 20 years using the straight-line method.

(i) Impairment of long-lived assets

The carrying amounts of long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of assets to future undiscounted net cash flows expected to be generated by the assets. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less cost to sell.

(j) Investments

Investments consist primarily of less than 20% equity positions in non-marketable securities and are recorded at lower of cost or market.

(k) Foreign currency translation

The accompanying financial statements are presented in United States (US) dollars. The functional currency is the RMB. The financial statements are translated into US dollars from RMB at year-end exchange rates for assets and liabilities, and weighted average exchange rates for revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

Gains and losses resulting from foreign currency translation are recorded in a separate component of shareholders’ equity. Foreign currency translation adjustments are included in accumulated other comprehensive income in the statements of shareholders’ equity for the years presented.

RMB is not freely convertible into the currency of other nations. All such exchange transactions must take place through authorized institutions. There is no guarantee the RMB amounts could have been, or could be, converted into US dollars at rates used in translation.

(l) Income taxes

As a state-owned agricultural enterprise, the Company and all of its agricultural subsidiaries are exempted from enterprise income taxes with approval from the Gansu Provincial Bureau of Local Taxation.

(m) Earnings per share

Basic earnings per share are computed using the weighted average number of common shares outstanding during the year. Diluted earnings per share are computed using the weighted average number of common and, if dilutive, potential common shares outstanding during the year. The Company has no potentially dilutive shares for the periods shown.

(n) Economic and Political Risks

The Company faces a number of risks and challenges as a result of having primary operations and markets in the PRC. Changing political climates in the PRC could have a significant effect on the Company's business.

(o) Comprehensive income

Comprehensive income is defined as the change in equity of a company during a period from transactions and other events and circumstances excluding transactions resulting from investments from owners and distributions to owners. Accumulated other comprehensive income, as presented on the accompanying consolidated balance sheets, consists of mainly the cumulative foreign currency translation adjustment.

(p) Recently Issued Accounting Standards

Recently Adopted Accounting Pronouncements

In December 2011, the Financial Accounting Standards Board (“FASB”) issued guidance enhancing disclosure requirements about the nature of an entity’s right to offset and related arrangements associated with its financial instruments. The new guidance requires the disclosure of the gross amounts subject to rights of set-off, amounts offset in accordance with the accounting standards followed, and the related net exposure. In January 2013, the FASB clarified that the scope of this guidance applies to derivatives, repurchase agreements, and securities lending arrangements that are either offset or subject to an enforceable master netting arrangement, or similar agreements. We have adopted this new guidance.

In February 2013, the FASB issued guidance on disclosure requirements for items reclassified out of accumulated other comprehensive income (“AOCI”). This new guidance requires entities to present (either on the face of the income statement or in the notes to financial statements) the effects on the line items of the income statement for amounts reclassified out of AOCI. We have adopted this new guidance.

In September 2011, the Financial Accounting Standards Board (“FASB”) issued guidance on testing goodwill for impairment. The new guidance provides an entity the option to first perform a qualitative assessment to determine whether it is more likely than not that the fair value of are porting unit is less than its carrying amount. If an entity determines that this is the case, it is required to perform the two-step goodwill impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment loss to be recognized for that reporting unit (if any). If an entity determines that the fair value of a reporting unit is greater than its carrying amount, the two-step goodwill impairment test is not required. We adopted this new guidance.

Recent accounting guidance not yet adopted

In March 2013, the FASB issued guidance on a parent’s accounting for the cumulative translation adjustment upon de-recognition of a subsidiary or group of assets within a foreign entity. This new guidance requires that the parent release any related cumulative translation adjustment into net income only if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided. The new guidance will be effective for us beginning December 31, 2014. We do not anticipate material impacts on our financial statements upon adoption.

(q) Fair Value of Financial Instruments

The carrying amounts of accounts receivable, accounts payable, other liabilities, and short-term borrowings approximate their fair value due to the short-term maturity of these instruments. Long term debt approximates fair value as its interest rates approximates market interest rates

4. Accounts receivable

Accounts receivable are recognized and carried at original invoice amount outstanding less an allowance for doubtful accounts. The activity in the Accounts Receivable was as follows:

| |

Gross Balance at end of year($)

|

Allowance for doubtful accounts

|

Net Balance at end of year($)

|

|

31st-Dec-14

|

911,732.31

|

0

|

911,732.31

|

|

30th-Sep-15

|

766,410.25

|

0

|

766,410.25

|

| |

|

|

|

|

Top 5 companies for Accounts receivable

|

|

Company Name

|

Relationship

|

Balance($)

|

Years

|

Proportion of total accounts receivable

|

|

Zi Jin Xiang Ecological Agricultural Development Company

|

Buying and selling units

|

120,062.40

|

In one year

|

15.07%

|

|

Da Tong Ecommerce. Ltd.

|

41,405.87

|

5.20%

|

|

Xian Ju water chestnut Planting Technology Co. Ltd.

|

24,572.38

|

3.08%

|

|

Hui Nong Fruit Industry Development Co. Ltd.

|

202,725.60

|

25.44%

|

|

Kai Le Melamine Products Co. Ltd.

|

33,249.50

|

4.17%

|

|

Total

|

|

422,015.75

|

|

52.96%

|

5. Inventories

The major classes of inventory: raw materials, packaging materials, products in process, finished goods, stocks, low-value consumable goods, materials in transit as well as others.

The following is a breakdown of the major categories of inventories.

Breakdown of Inventories

| |

September, 30th, 2015

|

December, 31st, 2014

|

|

Chemical fertilizer

|

621,878.41

|

434,238.26

|

|

Agricultural Medicine

|

403,164.99

|

244,230.66

|

|

Biological drugs

|

413,213.89

|

236,171.58

|

|

Farm tools

|

310,650.16

|

270,661.62

|

|

Low value consumable

|

195,390.37

|

142,290.33

|

|

Total for the year

|

1,944,297.82

|

1,327,592.45

|

6. Property, plant and equipment & depreciation

The major classes of property, plant and equipment include building and improvements, machinery and equipment, transportation facilities, agricultural facilities, etc. They are carried at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. The following is a breakdown of fixed assets and accumulated depreciation by fiscal year.

| |

30th-Sep-15

|

31st-Dec-14

|

|

Buildings and improvements

|

13,097,262.26

|

6,902,663.98

|

|

Machinery and equipment

|

2,054,817.36

|

2,136,385.45

|

|

Transportation

|

2,482,003.05

|

2,580,528.71

|

|

Others

|

131,906.53

|

137,142.69

|

|

Total

|

17,765,989.20

|

11,756,720.83

|

| |

|

|

|

Accumulated Depreciation

|

1,188,077.11

|

907,241.20

|

|

Total

|

16,577,912.09

|

10,849,479.63

|

The breakdown of construction in progress as below,

| |

30th-Sep-15

|

31st-Dec-14

|

|

Revetment

|

8,090,423.48

|

6,573,844.81

|

|

Ditch

|

10,152,498.52

|

9,092,092.79

|

|

Road

|

1,472,482.00

|

6,714,507.57

|

|

Floodwall

|

9,111,283.67

|

8,612,729.75

|

|

Total

|

28,826,687.67

|

30,993,174.92

|

7. Intangible assets

The intangible asset main is the 20 years use right of Fruit vegetable franchise base.

The movement of the use right value as below.

|

$

|

30th-Sep-15

|

31st-Dec-14

|

|

Gross

|

152,000,000.00

|

152,000,000.00

|

|

Accumulated Amortization

|

47,396,815.42

|

37,520,509.98

|

|

Change of fair value

|

|

|

|

Intangible assets, net

|

104,603,184.58

|

114,479,490.02

|

The original cost of Fruit vegetable franchise base use right is $152 million.

8. China contribution plan

The Company participates in a government-mandated multi-employer defined contribution plan pursuant to which certain retirement, medical and other welfare benefits are provided to employees. Chinese labor regulations require the Company’s subsidiaries to pay to the local labor bureau a monthly contribution at a stated contribution rate based on the monthly basic compensation of qualified employees. The relevant local labor bureau is responsible for meeting all retirement benefit obligations; the Company has no further commitments beyond its monthly contribution.

9. Concentration of risks

The operations of the Company are substantially located in the PRC and accordingly, investing in the shares of the Company is subject to among others, the PRC’s political, economic and legal risks.

10. Income taxes

The Company and all of its agricultural subsidiaries are exempt from income taxes in the PRC.

11. Employee benefit plans

The Company provides the following benefits for all employees:

(a). Employee Welfare Fund: An amount equal to 14% of payroll is set aside by the Company for standard employee benefits. This fund is managed and controlled by the Company. All required payments current.

(b). Open Policy Pension: The Company pays to national and community insurance agents an amount equal to 20% of payroll. This insurance continues to cover the employee subsequent to retirement.

(c). Unemployment Insurance: The Company pays to the national employment administrative entities an amount equal to 1% of payroll. Any dismissed employee thereby receives a specified amount of family-support funds for a designated period.

(d). Housing Surplus Reserve: The Company pays to the national housing fund administrative entities an amount equal to 10% of payroll for deposit into the employees' future housing allowance accounts.

The aforesaid items are for employee's benefits and should be accounted for as the Company's expenses.

12. Segment information

The segments are presented in the tables below.

| |

30th-Sep-15

|

31st-Dec-14

|

|

Revenue

|

|

|

|

Bamboo

|

5,699,076.38

|

10,423,704.28

|

|

Orange

|

48,252,451.63

|

90,510,858.03

|

|

Red bayberry

|

24,416,675.99

|

45,591,139.85

|

|

Broccoli

|

24,081,158.93

|

44,011,195.82

|

|

Total

|

102,449,362.93

|

190,536,897.98

|

| |

|

|

|

Cost

|

|

|

|

Bamboo

|

2,368,549.17

|

3,135,797.70

|

|

Orange

|

11,875,106.59

|

17,291,033.68

|

|

Red bayberry

|

5,906,757.59

|

9,423,635.76

|

|

Broccoli

|

8,574,551.42

|

11,581,893.64

|

|

Total

|

28,724,964.77

|

41,432,360.78

|

13. General and management expense

The breakdown of general and management expense are as below. The Fruit vegetable franchise base had not been put into use, so its management cost was recorded into management expense.

| |

30th-Sep-15

|

31st-Dec-14

|

|

Salaries

|

565,311.74

|

752,800.85

|

|

Social insurance

|

58,894.72

|

94,736.42

|

|

Entertainment expense

|

9,236.92

|

172,554.85

|

|

Office expenses

|

26,404.42

|

28,166.63

|

|

Travel expenses

|

19,094.42

|

179,630.25

|

|

Communication fee

|

3,055.53

|

4,741.14

|

|

Depreciation

|

315,474.75

|

430,464.42

|

|

Amortization

|

5,505,430.77

|

7,512,144.90

|

|

Traffic expense

|

3,415.92

|

4,675.91

|

|

Others

|

314,275.18

|

102,916.56

|

|

Total

|

6,820,594.37

|

9,282,831.93

|

14. Other income

None

15. Operating leases

The Company has no operating leases for the periods shown.

None

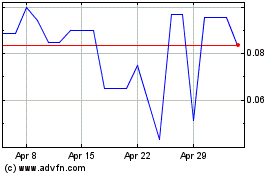

Yasheng (PK) (USOTC:HERB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Yasheng (PK) (USOTC:HERB)

Historical Stock Chart

From Feb 2024 to Feb 2025