Acquisition of Leading Edge Technology Assets Proving Immensely Valuable in Lucrative Lithium Space

January 17 2018 - 12:50PM

InvestorsHub NewsWire

MarketNewsUpdates.com News

Commentary

PALM BEACH, FL -- January 17, 2018 -- InvestorsHub NewsWire

According to Grand

View Research, the global forecast for the Lithium-ion

battery market is estimated to be worth an impressive $93.1

Billion by 2025, demonstrating a CAGR of 17%. Technological

advancements to reduce the weight of batteries, cost and increase

their power output, is expected to augment industry expansion. In

addition, competent distribution channels are likely to be an

important way to gain a competitive advantage. In the mining aspect

of the market, significant industry players are acquiring assets to

enhance technological advancements and mining methods, as well as

increase their overall coverage of lithium-rich mining sites. The

demand for lithium is only expected to continue to rise as

peripheral research aids the improvement of lithium-ion batteries

and the general public continues to adopt electric vehicles. All of

these factors lead to an active market, headlined by leaders in the

space acquiring both assets and competitors evidenced by Triton

Minerals recently indicating it had started due diligence on

the Western Australia lithium assets and royalties that

it planned to acquire from Westgold Resources to enhance Triton's

access to the fast-growing lithium-ion battery and battery storage

markets. Industry Active companies in the news this week

include Alternet Systems, Inc. (OTC:

ALYI), Lithium X Energy Corp. (OTC:

LIXXF) (TSX-V: LIX), QMC Quantum Minerals Corp. (OTC:

QMCQF) (TSX-V: QMC), NRG Metals Inc. (OTC: NRGMF) (TSX-V:

NGZ), Rio Tinto Plc (NYSE: RIO).

Alternet Systems, Inc. (OTC:

ALYI) and Lithium Exploration Group, Inc. (OTC:

LEXGD) today announced entering into a letter of intent (LOI)

agreement whereby Alternet Systems will acquire the Sonic

Cavitation (SonCav) technology assets to include existing SonCav

contracts. The preliminary deal structure has Alternet forming

a new subsidiary dedicated to serving the lithium mining industry

and having the new subsidiary acquire the Lithium Exploration Group

SonCav assets. To facilitate a dedicated capital campaign to

finance the new subsidiary, Alternet plans to spin the subsidiary

off as an independent publicly traded company issuing stock in the

spinoff to shareholders of both Alternet Systems and Lithium

Exploration Group.

Read this and more news for Alternet Systems at http://www.marketnewsupdates.com/news/alyi.html

In July of last year, Alternet acquired an exclusive license

agreement with Air Products and Chemicals, Inc. (APD) for ten U.S.

Patented lithium battery technologies with an option to acquire the

ten U.S. Patents. The company is applying its portfolio of

patented lithium battery technologies to enhance the value of

electric powered products to include electric vehicles and military

support systems. The company is implementing a strategy to

optimize shareholder value in the application of its lithium

technologies by spinning off applications into independently listed

public companies and issuing stock in the independently listed

companies to Alternet shareholders through dividend distributions.

The deal with Lithium Exploration group accounts for one of the two

planned spinoffs and dividend distributions recently announced by

Alternet management. To learn more about Alternet's spinoff and

dividend strategy, see the company's online

presentation: Alternet Spinoff And Dividend Strategy To Unlock

Shareholder Value

In the industry developments and happenings in the

market this week

include:

Lithium X Energy Corp. (OTCQX: LIXXF) (TSX-V: LIX.V) last week

filed on SEDAR and mailed to Lithium X shareholders and

warrantholders the notice of special meeting, management

information circular, letter of transmittal and related proxy

materials in respect of the company's special meeting of

shareholders and warrantholders to be held at 10

a.m.Vancouver time on Feb. 6, 2018, at Suite 1700, 666

Burrard St., Vancouver, B.C., V6C 2X8. At the special

meeting, shareholders and warrantholders will be asked to approve

the company's previously announced transaction with NextView New

Energy Lion Hong Kong Ltd., whereby NextView will acquire all of

the issued and outstanding common shares and common share purchase

warrants of Lithium X by way of plan of arrangement under Section

288 of the Business Corporations Act (British Columbia), as

described in the news release of Dec. 18, 2017, filed on

Lithium X's SEDAR profile. Upon the arrangement becoming effective,

each shareholder will receive cash consideration

of $2.61 per share and each warrantholder will receive

cash consideration of one cent per warrant.

QMC Quantum Minerals Corp. (OTC:

QMCQF) (TSX-V: QMC.V) recently announced it acquired, through

staking, an additional 9 contiguous mineral claims which increases

the number of claims comprising the property to 13 and the area

extent of the Irgon Lithium Mine Property to encompass 6,538 acres

(2,647 hectares) from 1,729 acres (700 hectares) an increase of

378%. Numerous pegmatite dikes, in addition to the main Irgon Dike,

are known to exist on the Irgon Lithium Mine Property. Two major

dikes, located south of Cat Lake that have undergone

exploration in the past are the Mapetre Dike and the Central Dike.

Both were explored in the late 1970's by the Tantalum Mining

Corporation of Canada ("TANCO") which focused solely on

their tantalum-bearing potential. At the time, TANCO appears

to have had no interest in the lithium potential of these dikes.

The Central Dike is also reported (Cerny et al, 1981, pg. 97) to

host cesium-bearing biotite mineralization (to 0.57% Cs2O) along

the pegmatite contact with the host rock.

NRG Metals Inc. (OTCQB: NRGMF) (TSX-V: NGZ.V) recently

announced that it had held its Annual General and Special Meeting

on December 22, 2017. All motions received shareholder

approval. As announced on November 16, 2017, the Company

completed various agreements to give effect to its strategic

alliance with Chemphys to advance the exploration and development

of the Company's Hombre Muerto North Lithium Project (the "HMN

Project") located in the Salta and Catamarca Provinces area where

most of the lithium production occurs in Argentina. Included

with the strategic alliance is an off-take agreement for any future

lithium produced by the Company at the HMN Project.

Rio Tinto Plc (NYSE: RIO) - According to an article

recently published by Mining.com , Global miner Rio

Tinto is said to have ditched plans to own a stake

in Chile's Chemical and Mining Society (SQM), the world's

largest lithium producer, due to a mix of tricky politics and the

fact that such miner is currently the target of several claims.

Rio's decision withdraw an offer for Nutrien's 32% stake in

the Santiago-based lithium miner, worth about $5

billion at current market prices, doesn't mean the company has

abandoned plans to capitalize on the electric-car boom, the article

says. The firm is already working on developing its 100%-owned

lithium and borates mineral asset in Jadar, Serbia. The project,

which is in the early stages of development, could meet about 10%

of current global demand for the white metal. Read

the full article here

DISCLAIMER: MarketNewsUpdates.com (MNU) is a third party publisher

and news dissemination service provider, which disseminates

electronic information through multiple online media

channels. MNU is NOT affiliated in any manner with any company

mentioned herein. MNU and its affiliated companies are a news

dissemination solutions provider and are NOT a registered

broker/dealer/analyst/adviser, holds no investment licenses and may

NOT sell, offer to sell or offer to buy any security. MNU's market

updates, news alerts and corporate profiles are NOT a solicitation

or recommendation to buy, sell or hold securities. The

material in this release is intended to be strictly informational

and is NEVER to be construed or interpreted as research

material. All readers are strongly urged to perform research

and due diligence on their own and consult a licensed financial

professional before considering any level of investing in stocks.

All material included herein is republished content and details

which were previously disseminated by the companies mentioned in

this release. MNU is not liable for any investment decisions

by its readers or subscribers. Investors are cautioned that

they may lose all or a portion of their investment when investing

in stocks. For current services performed MNU has been

compensated forty one hundred dollars for news coverage

of the current press release issued by Alternet Systems, Inc. by a

non-affiliated third party. MNU HOLDS NO SHARES OF ANY COMPANY

NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and MNU undertakes no

obligation to update such statements.

Contact Information:

info@marketnewsupdates.com

+1(561)325-8757

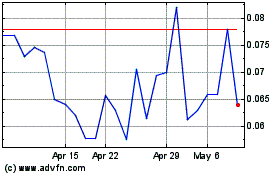

QMC Quantum Minerals (PK) (USOTC:QMCQF)

Historical Stock Chart

From Nov 2024 to Dec 2024

QMC Quantum Minerals (PK) (USOTC:QMCQF)

Historical Stock Chart

From Dec 2023 to Dec 2024