Current Report Filing (8-k)

November 02 2020 - 7:34AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

July

20, 2020

Date

of Report (Date of earliest event reported)

Kinetic

Group Inc.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

333-216047

|

|

47-4685650

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

15

Walker Avenue, Suite 101

Baltimore,

MD 21208

(Address

of Principal Executive Offices)

(443)

738-4051

(Registrant’s

telephone number, including area code)

665

Fifth Avenue, New York, New York 10022

(Former

Name or Former Address, if Changed Since Last Report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class:

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered:

|

|

Common

|

|

KNIT

|

|

None

|

Item

1.01 Entry into a Material Definitive Agreement

On

November 1, 2020, Kinetic Group Inc. (the “Company”) entered into a Notice of Termination and Release agreement with

Cantek Holdings (2020) Ltd., an Israeli company (“Cantek”) and the shareholders of Cantek (the “Cantek Shareholders”)

pursuant to which the Company Company released any and all claims against Cantek, the Cantek Shareholders and other parties (the

“Related Parties”) and the and the Company agreed to indemnify Cantek and the Cantek Shareholders against any and

all claims, losses, damages, fees, expenses that arise out of or are in any connected to its association with the Company, including,

but not limited to, the Exchange Agreement and Note (each as defined below) any indebtedness of the Company.

Item

1.02 Termination of a Material Definitive Agreement

On

November 1, 2020, in accordance with the terms of the Exchange Agreement, dated March 24, 24, 2020, among the Company, Cantek

and the Cantek Shareholders (the “Exchange Agreement”), the Company and Cantek mutually agreed to immediately reverse

the transactions thereunder. Under the Exchange Agreement, the Company agreed to acquire 100% of the outstanding shares of Cantek

in exchange for the issuance of 26,349,800 shares of common stock of the Company to the Cantek Shareholders and the Company’s

commitment to issue 4,115,020 shares of preferred stock of the Company, each convertible into ten shares of Common Stock of the

Company to the Cantek Shareholders in the future (the “Exchange Agreement”) and reversed the transactions contemplated

thereby. As a result, the Company no longer has any ownership or other interest in Cantek and the Cantek Shareholders no longer

have any ownership interest in the Company.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

(b)

Departure of Officers and Directors

Effective

immediately after the filing of this report, Shmuel Capuano resigned as a Director of the Company.

Item

8.01 Other Events

As

previously disclosed in the current report on Form 8-K filed by the Company on March 24, 2020 (the “March 24 8-K”),

the Company (i) entered into a rescission agreement (the “Rescission Agreement”) with Corette, LLC (“Corette”)

pursuant to which the acquisition by the Company of Solstice Marketing Concepts LLC was rescinded and rendered void ab initio

and (ii) the $1,200,000 convertible note (the “Note”) issued by the Company to Shaidim Enterprises, LLC (“Shaidim”)

was assumed by Fairway, LLC, an affiliate of Corette.

Contrary

to what the Company understood at the time of the March 24 8-K, Shaidim formally declared on July 20, 2020 that it did not, in

fact, consent to the assignment of the Note. Therefore, the Note remains a direct obligation of the Company. As a further result

of the lack of consent from Shaidim to assign the Note to Fairway, (i) the Company is in breach of its obligation under the Rescission

Agreement to obtain the written consent of Shaidim to such assignment and (ii) the Company

is breach of its representations and warranties to Cantek and the Cantek Shareholders under the Exchange Agreement.

SECTION

9 – FINANCIAL STATEMENTS AND EXHIBITS

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

KINETIC

GROUP inc.

a

Nevada corporation

|

|

|

|

|

|

Dated:

November 2, 2020

|

By:

|

/s/

Aitan Zacharin

|

|

|

|

Chief

Executive Officer and Sole Director

|

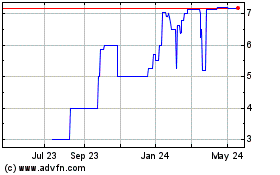

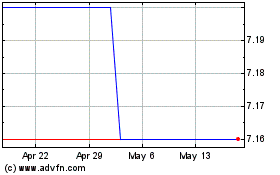

Kinetic (PK) (USOTC:KNIT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kinetic (PK) (USOTC:KNIT)

Historical Stock Chart

From Nov 2023 to Nov 2024