Trican Well Service Ltd. Q2 2012 Update and Outlook

July 03 2012 - 6:42PM

Marketwired

Trican Well Service Ltd. (TSX:TCW) anticipates that consolidated

financial results for the second quarter will fall below our

expectations based on management's preliminary review of our second

quarter operating results. We estimate earnings per share and

operating income for the second quarter to be as follows:

Diluted loss per share $0.32 to $0.42

Consolidated Operating Income/(Loss) $(24) million to $(34) million

These estimates are subject to completion and approval of our

second quarter interim financial report by our Audit Committee,

which we expect to release on July 30, 2012. Our Audit Committee

has reviewed the financial outlook and information provided in this

document.

Canadian Operations

Wet weather in May and June led to lower industry activity

levels throughout Western Canada and had a negative impact on our

second quarter Canadian results. In addition, a large Horn River

project was initially expected to start in early June but was

delayed until the end of June due to wet weather, which also

contributed to second quarter Canadian results that were below

expectations.

As some customers have reduced their budgets and new pressure

pumping equipment enters the Canadian market, we expect pricing to

decline in the second half of 2012 relative to the first quarter of

2012 and lead to reduced operating margins in Canada. However, we

expect demand to remain strong and support solid utilization levels

and operating margins for our Canadian operations during the second

half of 2012. We will continue to monitor the capital budgets and

cash flows of our customers in light of low gas prices and the

recent weakness in oil prices. We expect that any additional

reductions in capital spending by our customers will decrease

Canadian rig count and place further pricing pressure on the

Canadian pressure pumping market.

US Operations

We expect our U.S. operations to incur an operating loss during

the second quarter due largely to pricing declines and continued

increases in guar costs. Second quarter pricing has decreased by

approximately 10% sequentially as new pressure pumping equipment

continues to enter the U.S. market and equipment from dry gas

regions migrates to oil and liquids-rich gas plays. In addition,

average guar costs increased sequentially in the second quarter and

we were largely unable to pass these costs on to our customers due

to the competitive pricing environment.

We have initiated a number of cost cutting measures that are

expected to reduce our product costs but we do not expect to see

the benefit from these measures until the second half of 2012.

These measures include the introduction of a new hybrid fluid

system that is expected to reduce guar usage. We have started to

see a reduction in guar prices and we expect guar prices to

continue to decrease throughout the remainder of 2012 as a result

of the development of hybrid systems and guar substitutes, and the

new guar crop that is expected to increase supply later in

2012.

Given the current weakness in the U.S. pressure pumping market,

we are currently evaluating our options and will consider parking

crews that are experiencing low utilization and low operating

margins. We expect to have better visibility on this matter when we

release our second quarter financial and operating results on July

30, 2012.

International Operations

Second quarter results for our International operations are

expected to be below our expectations due to delays in our Russian

customers' work programs. We expect operating results to improve in

the second half of 2012 but annual results for our International

operations are expected to be slightly below expectations due to

weaker-than-expected results during the first half of the year.

FORWARD-LOOKING INFORMATION

This document contains information that constitutes

forward-looking information and financial outlook within the

meaning of applicable securities legislation. This forward-looking

information and financial outlook is identified by the use of terms

and phrases such as "anticipate," "achieve", "achievable,"

"believe," "estimate," "expect," "intend", "plan", "planned", and

other similar terms and phrases. This outlook and information

speaks only as of the date of this document and other than the

update in respect of our second quarter earnings per share and

operating income that will be provided upon the release of our

complete financial results for the second quarter 2012, we do not

undertake to publicly update the forward-looking information

contained in this document except in accordance with applicable

securities laws. This forward-looking information and financial

outlook includes, among others:

-- Expectation that consolidated second quarter financial results will fall

below our expectations;

-- Expectations that diluted loss per share will be between $0.32 and $0.42

and our consolidated operating income/(loss) will be between $(24)

million and $(34) million;

-- Expectation that our complete financial results will be released on July

30, 2012;

-- Expectation that Canadian pricing will decline in the second half of

2012 relative to the first quarter of 2012 and lead to reduced operating

margins in Canada;

-- Expectation that Canadian demand will remain strong and support solid

utilization levels and operating margins for our Canadian operations

during the second half of 2012;

-- Expectation that further reductions in our customers' capital spending

would decrease Canadian rig count and place further pricing pressure on

the Canadian pressure pumping market;

-- Expectation that our U.S. operations will incur an operating loss during

the second quarter due largely to pricing declines and continued

increases in guar costs;

-- Expectation that cost cutting measures will reduce our product costs but

that we will not see the benefit from these measures until the second

half of 2012;

-- Expectation that the introduction of our new hybrid fluid system will

reduce guar usage;

-- Expectation that with the development of guar substitutes and the new

guar crop that is expected to increase supply later in 2012, guar prices

will decrease throughout the remainder of 2012;

-- Expectation that we will have better visibility on our options in the

U.S. when we release our second quarter financial and operating results

on July 30, 2012;

-- Expectation that our second quarter results for our International

operations will be slightly below expectations; and

-- Expectation that operating results for our International operations will

improve in the second half of 2012 but that annual results for our

International operations will be slightly below expectations due to the

weaker-than-expected first half of the year.

Forward-looking information and financial outlook is based on

current expectations, estimates, projections and assumptions, which

we believe are reasonable but which may prove to be incorrect and

therefore such forward-looking information and financial outlook

should not be unduly relied upon. In addition to other factors and

assumptions which may be identified in this document, assumptions

have been made regarding, among other things: industry activity;

the general stability of the economic and political environment;

effect of market conditions on demand for the Company's products

and services; the ability to obtain qualified staff, equipment and

services in a timely and cost efficient manner; the ability to

operate its business in a safe, efficient and effective manner; the

performance and characteristics of various business segments; the

effect of current plans; the timing and costs of capital

expenditures; future oil and natural gas prices; currency, exchange

and interest rates; the regulatory framework regarding royalties,

taxes and environmental matters in the jurisdictions in which the

Company operates; and the ability of the Company to successfully

market its products and services. Trican has provided financial

outlook regarding its second quarter earnings per share and

operating income for the purpose of updating investors in respect

of the potential impacts of recent changes in market conditions on

Trican's 2012 second quarter and annual financial results. Readers

are cautioned that this financial outlook may not be appropriate

for other purposes.

Forward-looking information and financial outlook is subject to

a number of risks and uncertainties, which could cause actual

results to differ materially from those anticipated. These risks

and uncertainties include: fluctuating prices for crude oil and

natural gas; changes in drilling activity; general global economic,

political and business conditions; weather conditions; regulatory

changes; the successful exploitation and integration of technology;

customer acceptance of technology; success in obtaining issued

patents; the potential development of competing technologies by

market competitors; and availability of products, qualified

personnel, manufacturing capacity and raw materials. In addition,

actual results could differ materially from those anticipated in

the forward-looking information and financial outlook provided

herein as a result of the risk factors set forth under the section

entitled "Business Risks" in our Annual Information Form dated

March 22, 2012.

Additional information regarding Trican including Trican's most

recent Annual Information Form is available under Trican's profile

on SEDAR (www.sedar.com).

Headquartered in Calgary, Alberta, Trican has operations in

Canada, the United States, Russia, Kazakhstan, Australia and North

Africa. Trican provides a comprehensive array of specialized

products, equipment and services that are used during the

exploration and development of oil and gas reserves.

Contacts: Trican Well Service Ltd. Dale Dusterhoft Chief

Executive Officer (403) 266 - 0202 (403) 237 - 7716

(FAX)ddusterhoft@trican.ca Trican Well Service Ltd. Michael Baldwin

Vice President, Finance & CFO (403) 266 - 0202 (403) 237 - 7716

(FAX)mbaldwin@trican.ca Trican Well Service Ltd. Gary Summach

Director of Reporting and Investor Relations (403) 266 - 0202 (403)

237 - 7716 (FAX)gsummach@trican.ca Trican Well Service Ltd. 2900,

645 - 7th Avenue S.W. Calgary, Alberta T2P 4G8 www.trican.ca

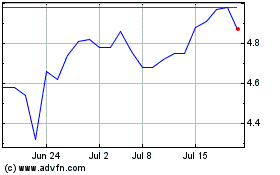

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Oct 2024 to Nov 2024

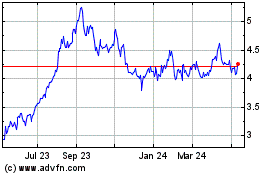

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Nov 2023 to Nov 2024