At today’s Annual Shareholders' Meeting of the Sartorius

technology group, CEO and Executive Board Chairman Dr. Joachim

Kreuzburg presented the consolidated results for the first three

months of 2010. The Biotechnology Division, which operates under

the name Sartorius Stedim Biotech and contributes a good two-thirds

to consolidated sales, started off the year 2010 by reporting

growth and further profitability gains again. After enduring a

sharp decline in its business during the year of crisis in 2009 and

undergoing extensive restructuring and realignment, the

Mechatronics Division also reported positive results. The division

posted a significant uptick in order intake, a slight increase in

sales and positive earnings. “These first-quarter business results

show that both divisions developed entirely within the range of our

expectations, and we confirm our positive outlook for the full

year,” commented CEO Dr. Joachim Kreuzburg.

Quarterly Results in Detail

Sales Revenue and Order Intake

The Biotechnology Division generated substantial first-quarter

gains in order intake and sales revenue. Order intake rose 5.8%

(constant currencies: +6.7%) to 110.4 million euros; sales revenue

grew 3.7% to 100.1 million euros (constant currencies: +4.8%). As

expected, Sartorius Stedim Biotech received sizeable orders

specifically for large bioreactors systems (equipment business),

primarily from the Asian region. Accordingly, the Biotechnology

Division posted its highest growth rates in Asia/Pacific.

Following a difficult year-earlier quarter, the Mechatronics

Division also achieved profitable growth in the first three months

of 2010. Order intake rose significantly by 7.9% (constant

currencies: +9.2%) to 56.8 million euros, and sales revenue climbed

from 49.5 million euros to 50.4 million euros (+1.8%; constant

currencies: +2.8%). While demand for industrial weighing and

control equipment was still flat, orders for laboratory instruments

took off. Regional analysis shows that the Mechatronics Division

was especially successful in North America and Asia/Pacific.

At the Group level, order intake for the first quarter of 2010

grew from 157.0 million euros to 167.2 million euros and thus was

up 6.5% or, in constant currencies, up 7.6%. Consolidated sales

revenue rose 3.0% (constant currencies: +4.1%) to 150.4 million

euros.

Earnings

Both divisions contributed to the positive development of

operating earnings (earnings adjusted for interest, taxes and

amortization and adjusted for extraordinary expenses = underlying

EBITA). The Biotechnology Division increased its operating earnings

from 12.8 million euros in the year-earlier quarter to 14.6 million

euros and improved its corresponding margin to 14.6% (13.3%).

Following losses of -1.9 million euros in the prior-year quarter,

the Mechatronics Division generated positive operating earnings of

1.8 million euros for the first quarter of 2010 and increased its

EBITA margin from -3.9% to +3.7%.

For the entire Group, operating earnings for the first three

months of business were at 16.4 million euros, up from 10.9 million

for the same period a year ago. This equates to a surge in earnings

of 50.4%. The consolidated operating EBITA margin improved from

7.5% to 10.9%. Consolidated net profit adjusted for extraordinary

expenses and excluding amortization rose from 2.4 million euros to

6.9 million euros. The respective earnings per share were at 0.41

euro, up from 0.14 euro for the year-earlier quarter.

Outlook

Based on business results reported for the first quarter of

2010, management confirms its positive forecast for the full year.

According to its prognosis, revenue growth in constant currencies

for the Biotechnology Division is likely to be in the upper

single-digit percentage range and its operating EBITA margin is

expected to rise slightly.

For the Mechatronics Division, which is more strongly dependent

on business cycles, management plans to achieve growth in constant

currencies in the lower single-digit percentage range, amid a

slight upturn in business as anticipated. Given the division’s

significantly reduced cost base as a result of extensive

restructuring measures implemented in 2009, its operating EBITA

margin should attain around 5%.

For the entire Group, management accordingly expects sales

growth in constant currencies to be slightly above 5% and its

operating EBITA margin to continue to improve by one to two

percentage points (2009: 10.1%). Furthermore, management

anticipates a significantly positive operating cash flow.

Resolutions of the Annual Shareholders’ Meeting

In line with the proposal submitted by the Supervisory Board and

the Executive Board, the Annual Shareholders’ Meeting of Sartorius

AG today resolved to pay dividends of 0.42 euro per preference

share and 0.40 euro per ordinary share (previous year: prf. 0.42

euro; ord. 0.40 euro). The Supervisory Board and the Executive

Board were granted discharge by a large majority. Some 400

shareholders attended the Annual Shareholders’ Meeting in

Goettingen, Germany.

Presentation at the 2010 Annual Shareholders’ Meeting

Dr. Joachim Kreuzburg’s presentation at the 2010 Annual

Shareholders’ Meeting will be streamed on our website at

www.sartorius.com.

Current Image Files:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius:

http://www.sartorius.com/media/content/press/support/Dr_Kreuzburg_4.jpg

Sartorius | Biotechnology Division:

http://www.sartorius.com/media/content/press/support/SSB_Integrated_Solutions.jpg

Sartorius | Mechatronics Division:

http://www.sartorius.com/media/content/press/support/Sartorius_Kontrolltechnik.jpg

Conference Call and Webcast:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius, will discuss the first-quarter figures with analysts and

investors today, April 21, 2010, at 4:30 p.m. Central European Time

(CET), in a webcast teleconference. You may dial into the

teleconference starting at 4:15 p.m. CET at the following

numbers:

Germany: +49 (0)69 9897 2623;France: +33 (0)1 70 99 42 85;U.K.:

+44 (0)20 7138 0843;USA: +1 212 444 0495.

The dial-in code is 9427275; to view the webcast, log onto

www.sartorius.com.

Upcoming Financial Dates:

July 2010 Publication of first-half figures (Jan. – June

2010)

October 2010 Publication of the nine-month figures (Jan. – Sept.

2009) 2010

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties. This is a translation

of the original German-language press release. Sartorius shall not

assume any liability for the correctness of this translation. The

original German press release is the legally binding version.

Furthermore, Sartorius reserves the right not to be responsible for

the topicality, correctness, completeness or quality of the

information provided. Liability claims regarding damage caused by

the use of any information provided, including any kind of

information which is incomplete or incorrect, will therefore be

rejected.

A Profile of Sartorius

The Sartorius Group is a leading international laboratory and

process technology provider covering the segments of biotechnology

and mechatronics. In 2009, the technology group earned sales

revenue of 602.1 million euros. Founded in 1870, the

Goettingen-based company currently employs approximately 4,350

persons. The major areas of activity in its biotechnology segment

focus on filtration, fluid management, fermentation, purification

and laboratory applications. In the mechatronics segment, the

company primarily manufactures equipment and systems featuring

weighing, measurement and automation technology for laboratory and

industrial applications. Key Sartorius customers are from the

pharmaceutical, chemical and food industries and from numerous

research and educational institutes of the public sector. Sartorius

has its own production facilities in Europe, Asia and America as

well as sales subsidiaries and local commercial agencies in more

than 110 countries.

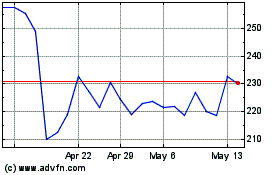

Sartorius (TG:SRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

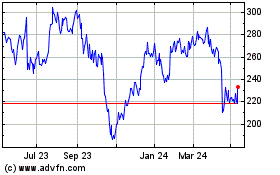

Sartorius (TG:SRT)

Historical Stock Chart

From Nov 2023 to Nov 2024