Mirion Announces Completion of Redemption of its Outstanding Public Warrants

May 23 2024 - 4:05PM

Business Wire

Mirion ("we" or the "Company") (NYSE: MIR), a global provider of

radiation detection, measurement, analysis and monitoring solutions

to the medical, nuclear, defense, and research end markets, today

announced that it completed the redemption of its outstanding

publicly traded warrants (the “Public Warrants”) to purchase shares

of the Company’s common stock, par value $0.0001 per share (the

“Common Shares”), that remained outstanding at 5:00 pm New York

City time on Monday, May 20, 2024 (the “Redemption Date”), for a

redemption price of $0.10 per Public Warrant (the “Redemption

Price”).

On April 18, 2024, Mirion issued a press release stating that,

pursuant to the Warrant Agreement dated as of June 29, 2020 (the

“Warrant Agreement”), by and between Mirion (f/k/a GS Acquisition

Holdings Corp II) and Continental Stock Transfer & Trust

Company, as warrant agent, it would redeem all of its Public

Warrants that remained outstanding following 5:00 pm New York City

Time on the Redemption Date at the Redemption Price. Of the

18,749,779 Public Warrants that were outstanding as of March 31,

2024, 2,131 were exercised for cash at an exercise price of $11.50

per Common Share in exchange for an aggregate of 2,131 Common

Shares and 18,074,285 were exercised on a cashless basis in

exchange for an aggregate of 3,976,287 Common Shares, in each case

in accordance with the terms of the Warrant Agreement, representing

approximately 96.4% of the outstanding Public Warrants in the

aggregate. A total of 673,363 Public Warrants remained unexercised

as of the Redemption Date, and the Company redeemed those Public

Warrants for an aggregate redemption price of $67,336.30. Following

the Redemption Date, the Company had no Public Warrants

outstanding. The 8,500,000 warrants to purchase Common Shares that

were issued under the Warrant Agreement in a private placement

simultaneously with Mirion’s (f/k/a GS Acquisition Holdings Corp

II) initial public offering and still held by the initial holders

thereof or their permitted transferees remain outstanding and are

not affected by the redemption of the Public Warrants.

In connection with the redemption, the Public Warrants ceased

trading on the New York Stock Exchange (“NYSE”) and were delisted,

with the suspension of trading effective before market open on May

20, 2024. The Common Shares continue to trade on NYSE under the

symbol “MIR”.

Additional information can be found on Mirion’s Investor

Relations website: https://ir.mirion.com/

About Mirion

Mirion (NYSE: MIR) is a global leader in radiation safety,

science and medicine, empowering innovations that deliver vital

protection while harnessing the transformative potential of

ionizing radiation across a diversity of end markets. The Mirion

Technologies group provides proven radiation safety technologies

that operate with precision – for essential work within R&D

labs, critical nuclear facilities, and on the front lines. The

Mirion Medical group solutions help enhance the delivery and ensure

safety in healthcare, powering the fields of Nuclear Medicine,

Radiation Therapy QA, Occupational Dosimetry, and Diagnostic

Imaging. Headquartered in Atlanta (GA – USA), Mirion employs

approximately 2,700 people and operates in 12 countries. Learn more

at mirion.com.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any Mirion securities and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended. Words such as “anticipate,” “believe,” “continue,”

“could,” “estimate”, “expect”, “hope”, “intend”, “may”, “might”,

“should”, “would”, “will”, “understand” and similar words are

intended to identify forward looking statements. These

forward-looking statements include, but are not limited to,

statements regarding redemption of the warrants. Further

information on risks, uncertainties and other factors that could

affect our financial results are included in the filings we make

with the Securities and Exchange Commission (the “SEC”) from time

to time, including our Annual Report on Form 10-K, our Quarterly

Reports on Form 10-Q and other periodic reports filed or to be

filed with the SEC.

You should not rely on these forward-looking statements, as

actual outcomes and results may differ materially from those

contemplated by these forward-looking statements as a result of

such risks and uncertainties. All forward-looking statements in

this press release are based on information available to us as of

the date hereof, and we do not assume any obligation to update the

forward-looking statements provided to reflect events that occur or

circumstances that exist after the date on which they were

made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240523172133/en/

For investor inquiries: Jerry Estes ir@mirion.com

For media inquiries: Erin Schesny media@mirion.com

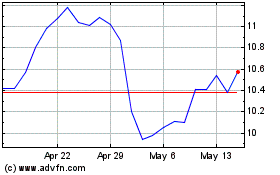

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Nov 2023 to Nov 2024