KE Holdings Inc. (“Beike” or the “Company”) (NYSE:

BEKE and HKEX: 2423), a leading integrated online and offline

platform for housing transactions and services, today announced its

unaudited financial results for the second quarter ended June 30,

2022.

Business and Financial Highlights for the Second Quarter of

2022

- Gross transaction value (GTV)1 was RMB639.5 billion

(US$95.5 billion), a decrease of 47.6% year-over-year. GTV of

existing home transactions was RMB393.5 billion (US$58.7

billion), a decrease of 39.6% year-over-year. GTV of new home

transactions was RMB222.7 billion (US$33.3 billion), a decrease

of 55.3% year-over-year. GTV of home renovation and

furnishing was RMB1.3 billion (US$0.2 billion), compared to

RMB47 million in the same period of 2021. GTV of emerging and

other services was RMB22.0 billion (US$3.3 billion), a decrease

of 68.8% year-over-year.

- Net revenues were RMB13.8 billion (US$2.1 billion), a

decrease of 43.0% year-over-year.

- Net loss was RMB1,866 million (US$279 million).

Adjusted net loss2 was RMB619 million (US$92 million).

- Number of stores was 42,831 as of June 30, 2022, a 19.0%

decrease from one year ago. Number of active stores3 was

41,118 as of June 30, 2022, a 16.2% decrease from one year

ago.

- Number of agents was 414,915 as of June 30, 2022, a

24.4% decrease from one year ago. Number of active agents4

was 380,284 as of June 30, 2022, a 23.9% decrease from one year

ago.

- Mobile monthly active users (MAU)5 averaged 43.0 million

for the three months ended June 30, 2022, compared to 52.1 million

in the same period of 2021.

Mr. Stanley Yongdong Peng, Chairman of the Board and Chief

Executive Officer of Beike, commented, “In the second quarter of

2022, promising changes began to take place in China’s real estate

market. The existing home market, in particular, benefited from the

easing on home purchase restrictions and effective pandemic

prevention and control measures. We focused on strengthening our

unique products and services to empower our service providers and

serve customers in broader and deeper ways, pivoting our growth

trajectory for the long-term.”

“As we weathered industry headwinds, our total GTV decreased by

47.6% year-over-year to RMB639.5 billion in the second quarter of

2022. We responded to the macro environment with comprehensive

improvements to our operating efficiency and simultaneously

stabilized the scale of agents and stores on our platform. For

existing home sales, we continued to iterate our ACN’s business

leads allocation mechanism to strengthen our infrastructure and

prioritize operating efficiency and profitability for Lianjia. For

new home sales, we actively carried out corporate-to-corporate

cooperation with selected developers and promoted

commission-in-advance and other focused sales strategies to

accelerate sell-through, becoming both promoter and benefactor of

the rising brokerage concentration for new home transactions in

this round of market adjustments. Our home renovation and

furnishing services once again bucked market trends and achieved

robust growth, owing to its full-service business model and the

advantages on customer trust and traffic which we’ve built through

our core businesses.”

“Leveraging our inclusive infrastructure along with our network

of community-based service providers and stores, and with an

unwavering and strengthened commitment to help service providers,

we are well positioned to capture the upside of market recovery and

serve the society as the one-stop platform for ‘living services’

that makes home a better place,” concluded Mr. Peng.

Mr. Tao Xu, Executive Director and Chief Financial Officer of

Beike, added, “During the second quarter, we achieved net revenues

of RMB13.8 billion, beating both the high-end of our guidance and

the street consensus. Despite the rocky market recovery, we were

able to take a series of cost-management measures and allocate

resources more efficiency-oriented in order to enhance

profitability. As a result, we’ve gained a larger operating

leverage for our housing transaction services business against the

challenging market environment, and we believe our profitability

for the housing transaction services will gradually recover in the

second half of this year. We will also continue to make necessary

investment in home renovation and furnishing services and Beike

rental services. We’d like to highlight that with home prices

stabilizing and the need for better living of the Chinese people

continuing to increase, the demand for home upgrade will serve as a

prominent driver, turbocharging a continued expansion of the market

and resulting higher derived demand for a range of services

including home renovation and furnishing, and rental services. We

firmly believe our unique competencies and solid business layout in

those sectors will support us to take the fast ride and achieve

rapid growth in the long run.”

Second Quarter 2022 Financial Results

Net Revenues

Net revenues decreased by 43.0% to RMB13.8 billion

(US$2.1 billion) in the second quarter of 2022, compared to RMB24.2

billion in the same period of 2021. The decrease was primarily

attributable to the decline in total GTV. Total GTV was RMB639.5

billion (US$95.5 billion) in the second quarter of 2022,

representing a 47.6% decrease compared to RMB1,220.8 billion in the

same period of 2021 due to the disruption on the recovery of the

market for existing home transactions caused by the emergence of

COVID-19 in certain regions and the corresponding restrictive

measures in the second quarter of 2022, and the market for new home

transactions remained weak since the second half of 2021 as many

real estate developers were facing liquidity and delivery

challenges.

- Net revenues from existing home transaction services

decreased by 42.5% to RMB5.5 billion (US$0.8 billion) in the second

quarter of 2022, compared to RMB9.6 billion in the same period of

2021, primarily due to a 39.6% decrease in GTV of existing home

transactions to RMB393.5 billion (US$58.7 billion) in the second

quarter of 2022 from RMB652.0 billion in the same period of 2021.

Among that, (i) commission revenue decreased by 45.9% to

RMB4.6 billion (US$0.7 billion) in the second quarter of 2022 from

RMB8.5 billion in the same period of 2021, primarily due to a

decrease in GTV of existing home transactions served by Lianjia

stores of 47.2% to RMB163.5 billion (US$24.4 billion) in the second

quarter of 2022 from RMB309.5 billion in the same period of 2021;

and (ii) the revenues derived from platform service, franchise

service and other value-added services, which are mostly

charged to connected stores and agents on the Company’s platform,

decreased by 16.5% to RMB0.9 billion (US$0.1 billion) in the second

quarter of 2022, from RMB1.1 billion in the same period of 2021,

mainly due to a 32.9% decrease of GTV of existing home transactions

served by connected agents on the Company’s platform to RMB229.9

billion (US$34.3 billion) in the second quarter of 2022 from

RMB342.5 billion in the same period of 2021. The lower decline rate

of revenues derived from platform service, franchise service and

other value-added services compared to that of the GTV of existing

home transactions served by connected agents was partially

attributable to the increased penetration level of value-added

services.

- Net revenues from new home transaction services

decreased by 52.0% to RMB6.7 billion (US$1.0 billion) in the second

quarter of 2022 from RMB13.9 billion in the same period of 2021,

primarily due to the decrease of GTV of new home transactions of

55.3% to RMB222.7 billion (US$33.3 billion) in the second quarter

of 2022 from RMB498.3 billion in the same period of 2021. Among

that, the GTV of new home transaction services completed on Beike

platform through connected agents, dedicated sales team with the

expertise on new home transaction services and other sales channels

was RMB183.8 billion (US$27.4 billion), compared to RMB414.5

billion in the same period of 2021, while the GTV of new home

transactions served by Lianjia brand was RMB38.9 billion (US$5.8

billion) in the second quarter of 2022, compared to RMB83.8 billion

in the same period of 2021.

- Net revenues from home renovation and furnishing were

RMB1.0 billion (US$0.2 billion) in the second quarter of 2022,

compared to RMB43 million in the same period of 2021, primarily

because the Company completed the acquisition of Shengdu Home

Renovation Co., Ltd. (“Shengdu”), a full-service home

renovation service provider in China, and began to consolidate its

financial results during the second quarter of 2022.

- Net revenues from emerging and other services decreased

by 9.6% to RMB557 million (US$83 million) in the second quarter of

2022 from RMB616 million in the same period of 2021, primarily

attributable to the decrease of net revenues from financial

services which was partially offset by the increase of net revenues

from rental property management services.

Cost of Revenues

Total cost of revenues decreased by 41.3% to RMB11.1

billion (US$1.7 billion) in the second quarter of 2022 from RMB18.8

billion in the same period of 2021.

- Commission - split. The Company’s cost of revenues for

commissions to connected agents and other sales channels was RMB4.7

billion (US$0.7 billion) in the second quarter of 2022, compared to

RMB9.4 billion in the same period of 2021, primarily due to the

decrease in the GTV of new home transactions completed through

connected agents and other sales channels in the second quarter of

2022 compared with the same period of 2021.

- Commission and compensation - internal. The Company’s

cost of revenues for internal commission and compensation was

RMB4.3 billion (US$0.6 billion) in the second quarter of 2022,

compared to RMB7.6 billion in the same period of 2021, primarily

due to the decrease in the GTV of exiting home and new home

transactions completed through Lianjia agents.

- Cost of home renovation and furnishing. The Company’s

cost of revenues for home renovation and furnishing was RMB724

million (US$108 million) in the second quarter of 2022, compared to

RMB43 million in the same period of 2021, primarily because the

Company completed the acquisition of Shengdu and began to

consolidate its financial results during the second quarter of

2022.

- Cost related to stores. The Company’s cost related to

stores decreased by 6.0% to RMB876 million (US$131 million) in the

second quarter of 2022 compared to RMB931 million in the same

period of 2021, mainly due to the decrease in the number of Lianjia

stores in the second quarter of 2022 compared to the same period of

2021.

- Other costs. The Company’s other costs decreased by

35.7% to RMB543 million (US$81 million) in the second quarter of

2022 from RMB844 million in the same period of 2021, mainly due to

a decrease of business taxes and surcharges along with the decrease

of net revenues, the decreased funding costs and provisions related

to financial services and the decreased offline activities costs

due to COVID-19 outbreaks in certain regions in the second quarter

of 2022.

Gross Profit

Gross profit was RMB2.7 billion (US$0.4 billion) in the

second quarter of 2022, compared to RMB5.3 billion in the same

period of 2021. Gross margin was 19.7% in the second quarter of

2022, compared to 22.1% in the same period of 2021. The decrease in

gross margin was mainly due to a relatively higher percentage of

cost related to stores of net revenues as a result of the decrease

of net revenues in the second quarter of 2022 compared to the same

period of 2021.

Income (Loss) from

Operations

Total operating expenses remained flat at RMB4.2 billion

(US$0.6 billion) in the second quarter of 2022 compared to the same

period of 2021.

- General and administrative expenses were RMB2,250

million (US$336 million) in the second quarter of 2022, compared to

RMB2,202 million in the same period of 2021, mainly due to the

increase of share-based compensation expenses and additional

severance costs incurred in the second quarter of 2022, which was

partially offset by the decrease of recurring personnel costs and

overheads along with the decreased headcount, as well as

conferences and travel expenses as a result of the COVID-19

outbreaks in certain regions in the second quarter of 2022 compared

to the same period of 2021.

- Sales and marketing expenses were RMB1,122 million

(US$167 million) in the second quarter of 2022, compared to

RMB1,241 million in the same period of 2021, mainly due to the

decrease of the brand advertising and promotional marketing

expenses for housing transaction services, which was partially

offset by sales and marketing expenses of Shengdu.

- Research and development expenses were RMB779 million

(US$116 million) in the second quarter of 2022, unchanged from

RMB775 million in the same period of 2021, mainly due to additional

severance costs incurred in the second quarter of 2022, which was

mainly offset by the decrease of recurring personnel costs and

share-based compensation as a result of decreased headcount in

research and development personnel in the second quarter of 2022

compared to the same period of 2021.

Loss from operations was RMB1,518 million (US$227

million) in the second quarter of 2022, compared to income from

operations of RMB1,116 million in the same period of 2021.

Operating margin was negative 11.0% in the second quarter of

2022, compared to 4.6% in the same period of 2021, primarily due to

a) a relatively lower gross profit margin, b) an increase of the

percentage of total recurring operating expenses of net revenues in

the second quarter of 2022, primarily due to decreased net revenues

and c) additional severance costs of RMB438 million incurred in the

second quarter of 2022 compared to the same period of 2021.

Adjusted loss from operations6 was RMB690 million (US$103

million) in the second quarter of 2022, compared to adjusted income

from operations of RMB1,669 million in the same period of 2021.

Adjusted operating margin7 was negative 5.0% in the second

quarter of 2022, compared to 6.9% in the same period of 2021.

Adjusted EBITDA8 was negative RMB104 million (US$16 million)

in the second quarter of 2022, compared to RMB2,555 million in the

same period of 2021.

Net Income (Loss)

Net loss was RMB1,866 million (US$279 million) in the

second quarter of 2022, compared to net income of RMB1,116 million

in the same period of 2021.

Adjusted net loss was RMB619 million (US$92 million) in

the second quarter of 2022, compared to adjusted net income of

RMB1,638 million in the same period of 2021.

Net Income (Loss) attributable to KE

Holdings Inc.’s ordinary shareholders

Net loss attributable to KE Holdings Inc.’s ordinary

shareholders was RMB1,868 million (US$279 million) in the

second quarter of 2022, compared to net income attributable to KE

Holdings Inc.’s ordinary shareholders of RMB1,112 million in the

same period of 2021.

Adjusted net loss attributable to KE Holdings Inc.’s ordinary

shareholders9 was RMB622 million (US$93 million) in the second

quarter of 2022, compared to adjusted net income attributable to KE

Holdings Inc.’s ordinary shareholders of RMB1,635 million in the

same period of 2021.

Net Income (Loss) per

ADS

Diluted net loss per ADS attributable to KE Holdings Inc.’s

ordinary shareholders10 was RMB1.57 (US$0.23) in the second

quarter of 2022, compared to diluted net income per ADS

attributable to KE Holdings Inc.’s ordinary shareholders of RMB0.93

in the same period of 2021.

Adjusted diluted net loss per ADS attributable to KE Holdings

Inc.’s ordinary shareholders11 was RMB0.52 (US$0.08) in the

second quarter of 2022, compared to adjusted diluted net income per

ADS attributable to KE Holdings Inc.’s ordinary shareholders of

RMB1.37 in the same period of 2021.

Cash, Cash Equivalents, Restricted Cash

and Short-Term Investments

As of June 30, 2022, the combined balance of the Company’s cash,

cash equivalents, restricted cash and short-term investments

amounted to RMB50.0 billion (US$7.5 billion).

Business Outlook

For the third quarter of 2022, the Company expects total net

revenues to be between RMB16.5 billion (US$2.5 billion) and RMB17.0

billion (US$2.5 billion), representing a decrease of approximately

6.1% to 8.8% from the same quarter of 2021. This forecast considers

the potential impact of the recent real estate related policies and

measures, the emergence of COVID-19 in certain regions and the

corresponding restrictive measures which remains uncertain and may

continue to adversely affect the Company’s operations, and the

Company’s current and preliminary view on the business situation

and market condition, all of which are subject to change.

Change in Segment

Reporting

Subsequent to the acquisition of Shengdu on April 20, 2022, the

Company changed its organizational structure, resulting in four

reportable segments: existing home transaction services, new home

transaction services, home renovation and furnishing, and emerging

and other services. Prior period segment results have been recast

to conform to the current presentation. Please see the

“Unaudited Segment Contribution Measure” included in this

press release for segment contribution results.

Annual General Meeting

On August 12, 2022, the Company held its annual general meeting

of shareholders (the “AGM”), together with the respective

class meetings of holders of Class A ordinary shares and Class B

ordinary shares (the “Class Meetings”) in Beijing, China.

Each of the proposed resolutions submitted for shareholders’

approval was adopted at the AGM and the Class Meetings, following

which the Sixth Amended and Restated Memorandum and Articles of

Association were adopted, a general mandate was granted to the

directors of the Company to issue shares, and a general mandate was

granted to the directors of the Company to repurchase its shares

(the “Repurchase General Mandate”).

Share Repurchase Program

The Company proposed to establish a share repurchase program

under which the Company may purchase up to US$1 billion of its

Class A ordinary shares and/or ADSs over a 12-month period.

Following the approval of the Repurchase General Mandate at the

AGM, the Company expects to carry out the repurchases as soon as

legally permissible. The Company’s proposed share repurchases under

the program may be effected from time to time in the open market at

prevailing market prices and/or through other legally permissible

means, depending on market conditions and in accordance with

applicable rules and regulations. The Company plans to fund any

such repurchases from its existing cash balance.

Conference Call Information

The Company will hold an earnings conference call on 8:00 AM

U.S. Eastern Time on Tuesday, August 23, 2022 (8:00 PM Beijing/Hong

Kong Time on Tuesday, August 23, 2022) to discuss the financial

results.

For participants who wish to join the call, please complete

online registration using the link provided below at least 20

minutes prior to the scheduled call start time. Upon registration,

participants will receive the conference call access information,

including dial-in numbers, a PIN and an e-mail with detailed

instructions to join the conference call.

PRE-REGISTER LINK:

https://register.vevent.com/register/BI1d14ef6c91f44696a550e19cd58f0d36

A live and archived webcast of the conference call will also be

available at the Company’s investor relations website at

https://investors.ke.com.

Exchange Rate

This press release contains translations of certain RMB amounts

into U.S. dollars (“US$”) at specified rates solely for the

convenience of the reader. Unless otherwise stated, all

translations from RMB to US$ were made at the rate of RMB6.6981 to

US$1.00, the noon buying rate in effect on June 30, 2022, in the

H.10 statistical release of the Federal Reserve Board. The Company

makes no representation that the RMB or US$ amounts referred could

be converted into US$ or RMB, as the case may be, at any particular

rate or at all. For analytical presentation, all percentages are

calculated using the numbers presented in the financial statements

contained in this earnings release.

Non-GAAP Financial Measures

The Company uses adjusted income (loss) from operations,

adjusted net income (loss), adjusted net income (loss) attributable

to KE Holdings Inc.'s ordinary shareholders, adjusted operating

margin, adjusted EBITDA and adjusted net income (loss) per ADS

attributable to KE Holdings Inc.’s ordinary shareholders, each a

non-GAAP financial measure, in evaluating its operating results and

for financial and operational decision-making purposes. Beike

believes that these non-GAAP financial measures help identify

underlying trends in the Company’s business that could otherwise be

distorted by the effect of certain expenses that the Company

includes in its net income (loss). Beike also believes that these

non-GAAP financial measures provide useful information about its

results of operations, enhance the overall understanding of its

past performance and future prospects and allow for greater

visibility with respect to key metrics used by its management in

its financial and operational decision-making. A limitation of

using these non-GAAP financial measures is that these non-GAAP

financial measures exclude share-based compensation expenses that

have been, and will continue to be for the foreseeable future, a

significant recurring expense in the Company’s business.

The presentation of these non-GAAP financial measures should not

be considered in isolation or construed as an alternative to gross

profit, net income (loss) or any other measure of performance or as

an indicator of its operating performance. Investors are encouraged

to review these non-GAAP financial measures and the reconciliation

to the most directly comparable GAAP measures. The non-GAAP

financial measures presented here may not be comparable to

similarly titled measures presented by other companies. Other

companies may calculate similarly titled measures differently,

limiting their usefulness as comparative measures to the Company’s

data. Beike encourages investors and others to review its financial

information in its entirety and not rely on a single financial

measure. Adjusted income (loss) from operations is defined

as income (loss) from operations, excluding (i) share-based

compensation expenses, (ii) amortization of intangible assets

resulting from acquisitions and business cooperation agreement, and

(iii) impairment of goodwill, intangible assets and other

long-lived assets. Adjusted operating margin is defined as

adjusted income (loss) from operations as a percentage of net

revenues. Adjusted net income (loss) is defined as net

income (loss), excluding (i) share-based compensation expenses,

(ii) amortization of intangible assets resulting from acquisitions

and business cooperation agreement, (iii) changes in fair value

from long term investments, loan receivables measured at fair value

and contingent consideration, (iv) impairment of goodwill,

intangible assets and other long-lived assets, (v) impairment of

investments, and (vi) tax effects of the above non-GAAP

adjustments. Adjusted net income (loss) attributable to KE

Holdings Inc.’s ordinary shareholders is defined as net income

(loss) attributable to KE Holdings Inc.’s ordinary shareholders,

excluding (i) share-based compensation expenses, (ii) amortization

of intangible assets resulting from acquisitions and business

cooperation agreement, (iii) changes in fair value from long term

investments, loan receivables measured at fair value and contingent

consideration, (iv) impairment of goodwill, intangible assets and

other long-lived assets, (v) impairment of investments, (vi) tax

effects of the above non-GAAP adjustments, and (vii) effects of

non-GAAP adjustments on net income (loss) attributable to

non-controlling interests shareholders. Adjusted EBITDA is

defined as net income (loss), excluding (i) income tax expense

(benefit), (ii) share-based compensation expenses, (iii)

amortization of intangible assets, (iv) depreciation of property

and equipment, (v) interest income, net, (vi) changes in fair value

from long term investments, loan receivables measured at fair value

and contingent consideration, (vii) impairment of goodwill,

intangible assets and other long-lived assets, and (viii)

impairment of investments. Adjusted net income (loss) per ADS

attributable to KE Holdings Inc.’s ordinary shareholders is

defined as adjusted net income (loss) attributable to KE Holdings

Inc.’s ordinary shareholders divided by weighted average number of

ADS outstanding during the periods used in calculating adjusted net

income (loss) per ADS, basic and diluted.

Please see the “Unaudited reconciliation of GAAP and non-GAAP

results” included in this press release for a full

reconciliation of each non-GAAP measure to its respective

comparable GAAP measure.

About KE Holdings Inc.

KE Holdings Inc. is a leading integrated online and offline

platform for housing transactions and services. The Company is a

pioneer in building infrastructure and standards to reinvent how

service providers and housing customers efficiently navigate and

complete housing transactions in China, ranging from existing and

new home sales, home rentals, to home renovation and furnishing,

and other services. The Company owns and operates Lianjia, China’s

leading real estate brokerage brand and an integral part of its

Beike platform. With more than 20 years of operating experience

through Lianjia since its inception in 2001, the Company believes

the success and proven track record of Lianjia pave the way for it

to build its infrastructure and standards and drive the rapid and

sustainable growth of Beike.

Safe Harbor Statement

This press release contains statements that may constitute

“forward-looking” statements pursuant to the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “likely to,”

and similar statements. Among other things, the business outlook

and quotations from management in this press release, as well as

Beike’s strategic and operational plans, contain forward-looking

statements. Beike may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission (the “SEC”) and The Stock Exchange of

Hong Kong Limited (the “Hong Kong Stock Exchange”), in its

annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about KE Holdings Inc.’s beliefs,

plans, and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: Beike’s

goals and strategies; Beike’s future business development,

financial condition and results of operations; expected changes in

the Company’s revenues, costs or expenditures; Beike’s ability to

empower services and facilitate transactions on Beike’s platform;

competition in the industry in which Beike operates; relevant

government policies and regulations relating to the industry;

Beike’s ability to protect the Company’s systems and

infrastructures from cyber-attacks; Beike’s dependence on the

integrity of brokerage brands, stores and agents on the Company’s

platform; general economic and business conditions in China and

globally; and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in KE Holdings Inc.’s filings with the SEC and the Hong

Kong Stock Exchange. All information provided in this press release

is as of the date of this press release, and KE Holdings Inc. does

not undertake any obligation to update any forward-looking

statement, except as required under applicable law.

Source: KE Holdings Inc.

KE Holdings Inc.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

(All amounts in thousands,

except for share, per share data)

As of December

31,

As of June 30,

2021

2022

RMB

RMB

US$

ASSETS

Current assets

Cash and cash equivalents

20,446,104

12,379,043

1,848,142

Restricted cash

6,286,105

7,001,360

1,045,276

Short-term investments

29,402,661

30,639,098

4,574,297

Short-term financing receivables, net of

allowance for credit losses of RMB131,558 and RMB133,664 as of

December 31, 2021 and June 30, 2022, respectively

702,452

515,104

76,903

Accounts receivable and contract assets,

net of allowance for credit losses of RMB2,151,271 and RMB2,317,194

as of December 31, 2021 and June 30, 2022, respectively

9,324,952

5,695,132

850,261

Amounts due from and prepayments to

related parties

591,342

394,216

58,855

Loan receivables from related parties

42,788

49,617

7,408

Prepayments, receivables and other

assets

3,129,950

3,741,472

558,587

Total current assets

69,926,354

60,415,042

9,019,729

Non-current assets

Property and equipment, net

1,971,707

2,042,609

304,953

Right-of-use assets

7,244,211

8,585,427

1,281,771

Long-term financing receivables, net of

allowance for credit losses of RMB204 and RMB60 as of December 31,

2021 and June 30, 2022, respectively

10,039

2,440

364

Long-term investments, net

17,038,171

25,328,412

3,781,432

Intangible assets, net

1,141,273

1,965,645

293,463

Goodwill

1,805,689

4,980,388

743,552

Long-term loan receivables from related

parties

-

30,461

4,548

Other non-current assets

1,181,421

1,015,758

151,649

Total non-current assets

30,392,511

43,951,140

6,561,732

TOTAL ASSETS

100,318,865

104,366,182

15,581,461

KE Holdings Inc.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS (Continued)

(All amounts in thousands,

except for share, per share data)

As of December 31,

As of June 30,

2021

2022

RMB

RMB

US$

LIABILITIES

Current liabilities

Accounts payable

6,008,765

5,485,495

818,963

Amounts due to related parties

584,078

405,011

60,467

Employee compensation and welfare

payable

9,834,247

9,380,733

1,400,507

Customer deposits payable

4,181,337

6,096,967

910,253

Income taxes payable

567,589

280,825

41,926

Short-term borrowings

260,000

356,670

53,249

Lease liabilities current portion

2,752,795

3,476,704

519,058

Short-term funding debts

194,200

133,400

19,916

Contract liabilities

1,101,929

3,122,374

466,158

Accrued expenses and other current

liabilities

3,451,197

3,561,129

531,664

Total current liabilities

28,936,137

32,299,308

4,822,161

Non-current liabilities

Deferred tax liabilities

22,920

293,164

43,768

Lease liabilities non-current portion

4,302,934

5,117,682

764,050

Other non-current liabilities

1,381

542

81

Total non-current liabilities

4,327,235

5,411,388

807,899

TOTAL LIABILITIES

33,263,372

37,710,696

5,630,060

KE Holdings Inc.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS (Continued)

(All amounts in thousands,

except for share, per share data)

As of December 31,

As of June 30,

2021

2022

RMB

RMB

US$

SHAREHOLDERS’ EQUITY

KE Holdings Inc. shareholders’

equity

Ordinary Shares (US$0.00002 par value;

25,000,000,000 ordinary shares authorized, comprising of

23,614,698,720 Class A ordinary shares, 885,301,280 Class B

ordinary shares and 500,000,000 shares each of such classes to be

designated; 2,705,911,235 and 3,635,326,756 Class A ordinary shares

issued and outstanding as of December 31, 2021 and June 30, 2022,

respectively; and 885,301,280 and 157,894,050 Class B ordinary

shares issued and outstanding as of December 31, 2021 and June 30,

2022, respectively)

489

491

73

Additional paid-in capital

78,972,169

79,929,628

11,933,179

Statutory reserves

483,887

483,887

72,242

Accumulated other comprehensive loss

(2,639,723)

(1,550,221)

(231,442)

Accumulated deficit

(9,842,846)

(12,329,140)

(1,840,692)

Total KE Holdings Inc. shareholders'

equity

66,973,976

66,534,645

9,933,360

Non-controlling interests

81,517

120,841

18,041

TOTAL SHAREHOLDERS' EQUITY

67,055,493

66,655,486

9,951,401

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

100,318,865

104,366,182

15,581,461

KE Holdings Inc.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(All amounts in thousands,

except for share, per share data, ADS and per ADS data)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Net revenues

Existing home transaction services

9,628,335

5,534,809

826,325

19,824,630

11,686,265

1,744,713

New home transaction services

13,885,811

6,666,249

995,245

23,814,158

12,576,293

1,877,591

Home renovation and furnishing

43,352

1,019,410

152,194

79,705

1,106,916

165,258

Emerging and other services

616,031

556,622

83,101

1,152,085

955,583

142,665

Total net revenues

24,173,529

13,777,090

2,056,865

44,870,578

26,325,057

3,930,227

Cost of revenues

Commission-split

(9,403,674)

(4,669,156)

(697,087)

(16,264,194)

(8,802,934)

(1,314,243)

Commission and compensation-internal

(7,618,419)

(4,256,545)

(635,485)

(14,954,955)

(8,983,795)

(1,341,245)

Cost of home renovation and furnishing

(42,700)

(724,347)

(108,142)

(74,735)

(791,046)

(118,100)

Cost related to stores

(931,324)

(875,769)

(130,749)

(1,777,638)

(1,759,832)

(262,736)

Others

(844,447)

(542,825)

(81,041)

(1,649,534)

(1,059,258)

(158,144)

Total cost of revenues(1)

(18,840,564)

(11,068,642)

(1,652,504)

(34,721,056)

(21,396,865)

(3,194,468)

Gross profit

5,332,965

2,708,448

404,361

10,149,522

4,928,192

735,759

Operating expenses

Sales and marketing expenses(1)

(1,240,608)

(1,121,541)

(167,442)

(2,297,778)

(1,982,513)

(295,981)

General and administrative expenses(1)

(2,201,634)

(2,250,007)

(335,917)

(4,309,749)

(3,777,808)

(564,011)

Research and development expenses(1)

(774,958)

(778,645)

(116,249)

(1,412,964)

(1,527,590)

(228,063)

Impairment of goodwill, intangible assets

and other long-lived assets

-

(76,244)

(11,383)

-

(76,244)

(11,383)

Total operating expenses

(4,217,200)

(4,226,437)

(630,991)

(8,020,491)

(7,364,155)

(1,099,438)

Income (loss) from operations

1,115,765

(1,517,989)

(226,630)

2,129,031

(2,435,963)

(363,679)

Interest income, net

68,906

160,096

23,902

150,764

273,454

40,826

Share of results of equity investees

14,387

(28,920)

(4,318)

34,107

31,470

4,698

Fair value changes in investments, net

371,937

(230,766)

(34,452)

346,163

(339,952)

(50,753)

Impairment loss for equity investments

accounted for using Measurement Alternative

-

(223,280)

(33,335)

-

(251,002)

(37,474)

Foreign currency exchange gain (loss)

(3,870)

(39,487)

(5,895)

7,588

(40,742)

(6,083)

Other income, net

317,315

445,946

66,578

699,229

896,648

133,866

Income (loss) before income tax

expense

1,884,440

(1,434,400)

(214,150)

3,366,882

(1,866,087)

(278,599)

Income tax expense

(768,838)

(431,310)

(64,393)

(1,192,509)

(619,255)

(92,452)

Net income (loss)

1,115,602

(1,865,710)

(278,543)

2,174,373

(2,485,342)

(371,051)

KE Holdings Inc.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (Continued)

(All amounts in thousands,

except for share, per share data, ADS and per ADS data)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Net income attributable to non-controlling

interests shareholders

(3,715)

(2,607)

(389)

(3,900)

(952)

(142)

Net income (loss) attributable to KE

Holdings Inc.

1,111,887

(1,868,317)

(278,932)

2,170,473

(2,486,294)

(371,193)

Net income (loss) attributable to KE

Holdings Inc.’s ordinary shareholders

1,111,887

(1,868,317)

(278,932)

2,170,473

(2,486,294)

(371,193)

Net income (loss)

1,115,602

(1,865,710)

(278,543)

2,174,373

(2,485,342)

(371,051)

Currency translation adjustments

(607,235)

1,525,663

227,775

(397,662)

1,398,895

208,850

Unrealized losses on available-for-sale

investments, net of reclassification

(2,709)

(143,329)

(21,398)

(2,709)

(309,393)

(46,191)

Total comprehensive income

(loss)

505,658

(483,376)

(72,166)

1,774,002

(1,395,840)

(208,392)

Comprehensive loss (income) attributable

to non-controlling interests shareholders

(3,715)

(2,607)

(389)

(3,900)

(952)

(142)

Comprehensive income (loss)

attributable to KE Holdings Inc.

501,943

(485,983)

(72,555)

1,770,102

(1,396,792)

(208,534)

Comprehensive income (loss)

attributable to KE Holdings Inc.’s ordinary shareholders

501,943

(485,983)

(72,555)

1,770,102

(1,396,792)

(208,534)

KE Holdings Inc.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (Continued)

(All amounts in thousands,

except for share, per share data, ADS and per ADS data)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Weighted average number of ordinary

shares used in computing net income (loss) per share, basic and

diluted

—Basic

3,522,427,632

3,571,976,403

3,571,976,403

3,521,948,998

3,569,657,105

3,569,657,105

—Diluted

3,586,824,279

3,571,976,403

3,571,976,403

3,590,416,704

3,569,657,105

3,569,657,105

Weighted average number of ADS used in

computing net income (loss) per ADS, basic and diluted

—Basic

1,174,142,544

1,190,658,801

1,190,658,801

1,173,982,999

1,189,885,702

1,189,885,702

—Diluted

1,195,608,093

1,190,658,801

1,190,658,801

1,196,805,568

1,189,885,702

1,189,885,702

Net Income (loss) per share

attributable to KE Holdings Inc.'s ordinary shareholders

—Basic

0.32

(0.52)

(0.08)

0.62

(0.70)

(0.10)

—Diluted

0.31

(0.52)

(0.08)

0.60

(0.70)

(0.10)

Net income (loss) per ADS attributable

to KE Holdings Inc.'s ordinary shareholders

—Basic

0.95

(1.57)

(0.23)

1.85

(2.09)

(0.31)

—Diluted

0.93

(1.57)

(0.23)

1.81

(2.09)

(0.31)

(1) Includes share-based compensation

expenses as follows:

Cost of revenues

124,880

89,860

13,416

234,272

175,385

26,184

Sales and marketing expenses

35,793

31,045

4,635

70,130

59,559

8,892

General and administrative expenses

153,914

408,143

60,934

338,977

548,032

81,819

Research and development expenses

121,650

76,136

11,367

225,473

174,483

26,050

KE Holdings Inc.

UNAUDITED RECONCILIATION of

GAAP AND NON-GAAP RESULTS

(All amounts in thousands,

except for share, per share data, ADS and per ADS data)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Income (loss) from operations

1,115,765

(1,517,989)

(226,630)

2,129,031

(2,435,963)

(363,679)

Share-based compensation expenses

436,237

605,184

90,352

868,852

957,459

142,945

Amortization of intangible assets

resulting from acquisitions and business cooperation agreement

116,885

146,366

21,852

235,119

262,459

39,184

Impairment of goodwill, intangible assets

and other long-lived assets

-

76,244

11,383

-

76,244

11,383

Adjusted income (loss) from

operations

1,668,887

(690,195)

(103,043)

3,233,002

(1,139,801)

(170,167)

Net income (loss)

1,115,602

(1,865,710)

(278,543)

2,174,373

(2,485,342)

(371,051)

Share-based compensation expenses

436,237

605,184

90,352

868,852

957,459

142,945

Amortization of intangible assets

resulting from acquisitions and business cooperation agreement

116,885

146,366

21,852

235,119

262,459

39,184

Changes in fair value from long term

investments, loan receivables measured at fair value and contingent

consideration

(30,496)

200,961

30,003

(138,660)

352,223

52,586

Impairment of goodwill, intangible assets

and other long-lived assets

-

76,244

11,383

-

76,244

11,383

Impairment of investments

-

223,280

33,335

-

251,002

37,474

Tax effects on non-GAAP adjustments

237

(5,739)

(857)

613

(5,830)

(870)

Adjusted net income (loss)

1,638,465

(619,414)

(92,475)

3,140,297

(591,785)

(88,349)

Net income (loss)

1,115,602

(1,865,710)

(278,543)

2,174,373

(2,485,342)

(371,051)

Income tax expense

768,838

431,310

64,393

1,192,509

619,255

92,452

Share-based compensation expenses

436,237

605,184

90,352

868,852

957,459

142,945

Amortization of intangible assets

123,693

150,940

22,535

247,739

271,506

40,535

Depreciation of property and equipment

210,122

233,920

34,923

375,621

468,048

69,878

Interest income, net

(68,906)

(160,096)

(23,902)

(150,764)

(273,454)

(40,826)

Changes in fair value from long term

investments, loan receivables measured at fair value and contingent

consideration

(30,496)

200,961

30,003

(138,660)

352,223

52,586

Impairment of goodwill, intangible assets

and other long-lived assets

-

76,244

11,383

-

76,244

11,383

Impairment of investments

-

223,280

33,335

-

251,002

37,474

Adjusted EBITDA

2,555,090

(103,967)

(15,521)

4,569,670

236,941

35,376

Net income (loss) attributable to KE

Holdings Inc.’s ordinary shareholders

1,111,887

(1,868,317)

(278,932)

2,170,473

(2,486,294)

(371,193)

Share-based compensation expenses

436,237

605,184

90,352

868,852

957,459

142,945

Amortization of intangible assets

resulting from acquisitions and business cooperation agreement

116,885

146,366

21,852

235,119

262,459

39,184

Changes in fair value from long term

investments, loan receivables measured at fair value and contingent

consideration

(30,496)

200,961

30,003

(138,660)

352,223

52,586

Impairment of goodwill, intangible assets

and other long-lived assets

-

76,244

11,383

-

76,244

11,383

Impairment of investments

-

223,280

33,335

-

251,002

37,474

Tax effects on non-GAAP adjustments

237

(5,739)

(857)

613

(5,830)

(870)

Effects of non-GAAP adjustments on net

income attributable to non-controlling interests shareholders

(7)

(7)

(1)

(14)

(14)

(2)

Adjusted net income (loss) attributable

to KE Holdings Inc.’s ordinary shareholders

1,634,743

(622,028)

(92,865)

3,136,383

(592,751)

(88,493)

KE Holdings Inc.

UNAUDITED RECONCILIATION of

GAAP AND NON-GAAP RESULTS (Continued)

(All amounts in thousands,

except for share, per share data, ADS and per ADS data)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Weighted average number of ADS used in

computing net income (loss) per ADS, basic and diluted

—Basic

1,174,142,544

1,190,658,801

1,190,658,801

1,173,982,999

1,189,885,702

1,189,885,702

—Diluted

1,195,608,093

1,190,658,801

1,190,658,801

1,196,805,568

1,189,885,702

1,189,885,702

Weighted average number of ADS used in

calculating adjusted net income (loss) per ADS

—Basic

1,174,142,544

1,190,658,801

1,190,658,801

1,173,982,999

1,189,885,702

1,189,885,702

—Diluted

1,195,608,093

1,190,658,801

1,190,658,801

1,196,805,568

1,189,885,702

1,189,885,702

Net income (loss) per ADS attributable

to KE Holdings Inc.'s ordinary shareholders

—Basic

0.95

(1.57)

(0.23)

1.85

(2.09)

(0.31)

—Diluted

0.93

(1.57)

(0.23)

1.81

(2.09)

(0.31)

Non-GAAP adjustments to net income

(loss) per ADS attributable to KE Holdings Inc.'s ordinary

shareholders

—Basic

0.44

1.05

0.15

0.82

1.59

0.24

—Diluted

0.44

1.05

0.15

0.81

1.59

0.24

Adjusted net income (loss) per ADS

attributable to KE Holdings Inc.'s ordinary shareholders

—Basic

1.39

(0.52)

(0.08)

2.67

(0.50)

(0.07)

—Diluted

1.37

(0.52)

(0.08)

2.62

(0.50)

(0.07)

KE Holdings Inc.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(All amounts in

thousands)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Net cash provided by operating

activities

1,001,317

2,973,280

443,899

3,474,372

3,808,031

568,524

Net cash provided by (used in) investing

activities

1,117,225

(7,081,027)

(1,057,170)

(10,396,836)

(11,338,319)

(1,692,766)

Net cash provided by (used in) financing

activities

(12,199)

(93,099)

(13,899)

(943,174)

35,872

5,355

Effect of exchange rate change on cash,

cash equivalents and restricted cash

(503,955)

170,973

25,526

(305,354)

142,610

21,291

Net increase (decrease) in cash and

cash equivalents and restricted cash

1,602,388

(4,029,873)

(601,644)

(8,170,992)

(7,351,806)

(1,097,596)

Cash, cash equivalents and restricted cash

at the beginning of the period

39,764,095

23,410,276

3,495,062

49,537,475

26,732,209

3,991,014

Cash, cash equivalents and restricted

cash at the end of the period

41,366,483

19,380,403

2,893,418

41,366,483

19,380,403

2,893,418

KE Holdings Inc.

UNAUDITED SEGMENT CONTRIBUTION

MEASURE

(All amounts in

thousands)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2021

2022

2022

2021

2022

2022

RMB

RMB

US$

RMB

RMB

US$

Existing home transaction

services

Net revenues

9,628,335

5,534,809

826,325

19,824,630

11,686,265

1,744,713

Less: Commission and compensation

(5,646,746)

(3,503,942)

(523,124)

(11,763,191)

(7,331,729)

(1,094,597)

Contribution

3,981,589

2,030,867

303,201

8,061,439

4,354,536

650,116

New home transaction services

Net revenues

13,885,811

6,666,249

995,245

23,814,158

12,576,293

1,877,591

Less: Commission and compensation

(11,300,400)

(5,095,477)

(760,735)

(19,306,429)

(9,925,142)

(1,481,785)

Contribution

2,585,411

1,570,772

234,510

4,507,729

2,651,151

395,806

Home renovation and furnishing

Net revenues

43,352

1,019,410

152,194

79,705

1,106,916

165,258

Less: Material costs, commission and

compensation costs

(42,700)

(724,347)

(108,142)

(74,735)

(791,046)

(118,100)

Contribution

652

295,063

44,052

4,970

315,870

47,158

Emerging and other services

Net revenues

616,031

556,622

83,101

1,152,085

955,583

142,665

Less: Commission and compensation

(74,947)

(326,282)

(48,713)

(149,529)

(529,858)

(79,106)

Contribution

541,084

230,340

34,388

1,002,556

425,725

63,559

_______________________ 1 GTV for a given period is calculated

as the total value of all transactions which the Company

facilitated on the Company’s platform and evidenced by signed

contracts as of the end of the period, including the value of the

existing home transactions, new home transactions, home renovation

and furnishing and emerging and other services, and including

transactions that are contracted but pending closing at the end of

the relevant period. For the avoidance of doubt, for transactions

that failed to close afterwards, the corresponding GTV represented

by these transactions will be deducted accordingly. 2 Adjusted net

income (loss) is a non-GAAP financial measure, which is defined as

net income (loss), excluding (i) share-based compensation expenses,

(ii) amortization of intangible assets resulting from acquisitions

and business cooperation agreement, (iii) changes in fair value

from long term investments, loan receivables measured at fair value

and contingent consideration, (iv) impairment of goodwill,

intangible assets and other long-lived assets, (v) impairment of

investments, and (vi) tax effects of the above non-GAAP

adjustments. Please refer to the section titled “Unaudited

reconciliation of GAAP and non-GAAP results” for details. 3 Based

on our accumulated operational experience, we have introduced the

number of active agents and active stores on our platform which can

better reflect the operational activeness of stores and agents on

our platform. “Active stores” as of a given date is defined as

stores on our platform excluding the stores which (i) have not

facilitated any housing transaction during the preceding 60 days,

(ii) do not have any agent who has engaged in any critical steps in

housing transactions (including but not limited to introducing new

properties, attracting new customers and conducting property

showings) during the preceding seven days, or (iii) have not been

visited by any agent during the preceding 14 days. Number of active

stores was 49,046 as of June 30, 2021. 4 “Active agents” as of a

given date is defined as agents on our platform excluding the

agents who (i) delivered notice to leave but have not yet completed

the exit procedures, (ii) have not engaged in any critical steps in

housing transactions (including but not limited to introducing new

properties, attracting new customers and conducting property

showings) during the preceding 30 days, or (iii) have not

participated in facilitating any housing transaction during the

preceding three months. Number of active agents was 499,690 as of

June 30, 2021. 5 “Mobile monthly active users” or “mobile MAU” are

to the sum of (i) the number of accounts that have accessed our

platform through our Beike or Lianjia mobile app (with duplication

eliminated) at least once during a month, and (ii) the number of

Weixin users that have accessed our platform through our Weixin

mini programs at least once during a month. Average mobile MAU for

any period is calculated by dividing (i) the sum of the Company’s

mobile MAUs for each month of such period, by (ii) the number of

months in such period. 6 Adjusted income (loss) from operations is

a non-GAAP financial measure, which is defined as income (loss)

from operations, excluding (i) share-based compensation expenses,

(ii) amortization of intangible assets resulting from acquisitions

and business cooperation agreement, and (iii) impairment of

goodwill, intangible assets and other long-lived assets. Please

refer to the section titled “Unaudited reconciliation of GAAP and

non-GAAP results” for details. 7 Adjusted operating margin is

adjusted income (loss) from operations as a percentage of net

revenues. 8 Adjusted EBITDA is a non-GAAP financial measure, which

is defined as net income (loss), excluding (i) income tax expense

(benefit), (ii) share-based compensation expenses, (iii)

amortization of intangible assets, (iv) depreciation of property

and equipment, (v) interest income, net, (vi) changes in fair value

from long term investments, loan receivables measured at fair value

and contingent consideration, (vii) impairment of goodwill,

intangible assets and other long-lived assets, and (viii)

impairment of investments. Please refer to the section titled

“Unaudited reconciliation of GAAP and non-GAAP results” for

details. 9 Adjusted net income (loss) attributable to KE Holdings

Inc.’s ordinary shareholders is a non-GAAP financial measure and

defined as net income (loss) attributable to KE Holdings Inc.’s

ordinary shareholders, excluding (i) share-based compensation

expenses, (ii) amortization of intangible assets resulting from

acquisitions and business cooperation agreement, (iii) changes in

fair value from long term investments, loan receivables measured at

fair value and contingent consideration, (iv) impairment of

goodwill, intangible assets and other long-lived assets, (v)

impairment of investments, (vi) tax effects of the above non-GAAP

adjustments, and (vii) effects of non-GAAP adjustments on net

income (loss) attributable to non-controlling interests

shareholders. Please refer to the section titled “Unaudited

reconciliation of GAAP and non-GAAP results” for details. 10 ADS

refers to American Depositary Share. Each ADS represents three

Class A ordinary shares of the Company. Diluted net income (loss)

per ADS attributable to KE Holdings Inc.’s ordinary shareholders is

net income (loss) attributable to ordinary shareholders divided by

weighted average number of diluted ADS. 11 Adjusted net income

(loss) per ADS attributable to KE Holdings Inc.’s ordinary

shareholders is a non-GAAP financial measure, which is defined as

adjusted net income (loss) attributable to KE Holdings Inc.’s

ordinary shareholders divided by weighted average number of ADS

outstanding during the periods used in calculating adjusted net

income (loss) per ADS, basic and diluted. Please refer to the

section titled “Unaudited reconciliation of GAAP and non-GAAP

results” for details.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220822005744/en/

For investor and media inquiries: In China: KE Holdings Inc.

Investor Relations Matthew Zhao Siting Li ir@ke.com

The Piacente Group, Inc. Yang Song +86-10-6508-0677

ke@tpg-ir.com

In the United States: The Piacente Group, Inc. Brandi Piacente

+1-212-481-2050 ke@tpg-ir.com

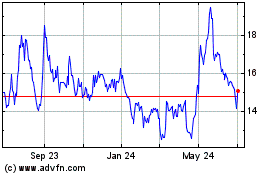

KE (NYSE:BEKE)

Historical Stock Chart

From Oct 2024 to Nov 2024

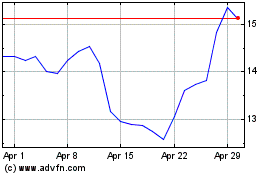

KE (NYSE:BEKE)

Historical Stock Chart

From Nov 2023 to Nov 2024