Ares Dynamic Credit Allocation Fund, Inc. (NYSE:ARDC) and

Ares Multi-Strategy Credit Fund, Inc. (NYSE:ARMF) (each a

“Fund” and together, the “Funds”) will hold a joint special meeting

of stockholders (the “Special Meeting”) on July 14, 2015, beginning

at 12:00 p.m. Pacific time at the offices of Ares Capital

Management II LLC (the “Adviser”). Stockholders of each Fund of

record as of the close of business on May 22, 2015 are entitled to

vote at the Special Meeting or any adjournment, postponement or

delay thereof.

The purpose of the Special Meeting is to request stockholder

approvals related to the proposed reorganization of ARMF into ARDC,

whereby ARDC would acquire all of the assets and assume the stated

liabilities of ARMF in exchange for newly issued shares of ARDC,

with ARDC being the surviving Fund (the “Reorganization”), as

described in the Joint Proxy Statement/Prospectus for the Special

Meeting (the “Joint Proxy Statement/Prospectus”). The consummation

of the Reorganization is contingent on the approval by ARDC

stockholders of other proposals relating to amendments to certain

of ARDC’s fundamental investment restrictions and 80% investment

policy as described in the Joint Proxy Statement/Prospectus.

It is currently expected that the Reorganization will be

completed during the third quarter of 2015, subject to required

stockholder approvals and the satisfaction of applicable regulatory

requirements and other customary closing conditions. The changes to

ARDC’s fundamental investment restrictions and 80% investment

policy would take effect immediately if approved by

stockholders.

Additional Information about the Reorganization and Where to

Find It

This press release is not intended to, and does not constitute

an offer to purchase or sell shares of the Funds nor is this press

release intended to solicit a proxy from any stockholder of any of

the Funds. The solicitation of proxies to effect the Reorganization

and changes to ARDC’s investment restrictions and policies will

only be made by the definitive Joint Proxy Statement/Prospectus for

the Special Meeting, which was declared effective by the U.S.

Securities and Exchange Commission (“SEC”) on June 15, 2015.

The Funds and their respective directors, officers and

employees, and the Adviser and its shareholders, officers and

employees and other persons may be deemed to be participants in the

solicitation of proxies with respect to the Reorganization and the

separate proposals relating to ARDC. Investors and stockholders may

obtain more detailed information regarding the direct and indirect

interests of the Funds' respective directors, officers and

employees, and the Adviser and its shareholders, officers and

employees and other persons by reading the Joint Proxy

Statement/Prospectus which has been filed with the SEC.

INVESTORS AND SECURITY HOLDERS OF THE FUNDS ARE URGED TO READ

THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THESE DOCUMENTS

CONTAIN IMPORTANT INFORMATION ABOUT THE REORGANIZATION AND THE

SEPARATE PROPOSALS RELATING TO ARDC. INVESTORS SHOULD CONSIDER THE

INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES OF THE FUNDS

CAREFULLY. THE JOINT PROXY STATEMENT/PROSPECTUS CONTAINS

INFORMATION WITH RESPECT TO THE INVESTMENT OBJECTIVES, RISKS,

CHARGES AND EXPENSES OF THE FUNDS.

The Joint Proxy Statement/Prospectus does not constitute an

offer to buy or sell securities in any state where such offer or

sale is not permitted.

Security holders may obtain free copies of the Joint Proxy

Statement/Prospectus and other documents filed with the SEC at the

SEC's web site at www.sec.gov. In addition, free copies of the

Joint Proxy Statement/Prospectus and other documents filed with the

SEC may also be obtained by directing a request to D.F. King &

Co., Inc., the Funds’ proxy solicitor, at (866) 796-7186.

About Ares Dynamic Credit Allocation Fund, Inc.

Ares Dynamic Credit Allocation Fund, Inc. (“ARDC”) is a

non-diversified, closed-end management company that is externally

managed by Ares Capital Management II LLC, a subsidiary of Ares

Management, L.P. ARDC seeks to provide an attractive level of total

return, primarily through current income and, secondarily, through

capital appreciation. ARDC invests in a broad, dynamically-managed

portfolio of credit investments. There can be no assurance that

ARDC will achieve its investment objective. ARDC’s net asset value

may be accessed through its NASDAQ ticker symbol, XADCX. Additional

information is available at www.arespublicfunds.com.

About Ares Multi-Strategy Credit Fund, Inc.

Ares Multi-Strategy Credit Fund, Inc. (“ARMF”) is a

non-diversified, closed-end management company that is externally

managed by Ares Capital Management II LLC, a subsidiary of Ares

Management, L.P. ARMF seeks to provide an attractive risk-adjusted

level of total return, primarily through current income and,

secondarily, through capital appreciation. ARMF invests in a broad,

dynamically managed portfolio of credit investments. There can be

no assurance that ARMF will achieve its investment objective.

ARMF’s net asset value may be accessed through its NASDAQ ticker

symbol, XAMFX. Additional information is available at

www.arespublicfunds.com.

About Ares Management, L.P.

Ares Management, L.P. (NYSE:ARES) is a leading global

alternative asset manager with approximately $87 billion1 of assets

under management and more than 15 offices in the United States,

Europe and Asia as of March 31, 2015. Since its inception in 1997,

Ares has adhered to a disciplined investment philosophy that

focuses on delivering strong risk-adjusted investment returns

throughout market cycles. Ares believes each of its four distinct

but complementary investment groups in Tradable Credit, Direct

Lending, Private Equity and Real Estate is a market leader based on

assets under management and investment performance. Ares was built

upon the fundamental principle that each group benefits from being

part of the greater whole.

Forward-Looking Statements

Statements included herein may constitute “forward-looking

statements” within the meaning of the U.S. securities laws, and may

relate to future events or our future performance or financial

condition. These statements are not guarantees of future

performance, condition or results and involve a number of risks and

uncertainties. Actual results may differ materially from those in

the forward-looking statements as a result of a number of factors,

including those described from time to time in our filings with the

Securities and Exchange Commission and others beyond the Fund’s

control. Ares Dynamic Credit Allocation Fund and Ares

Multi-Strategy Credit Fund undertake no duty to update any

forward-looking statements made herein.

This document is not an offer to sell securities and is not

soliciting an offer to buy securities in any jurisdiction where the

offer or sale is not permitted. An investor should consider the

investment objective, risks, charges and expenses of ARDC and/or

ARMF, as applicable, carefully before investing.

ARDC and ARMF are closed-end funds, which do not engage in

continuous offerings of their shares. Since their respective

initial public offerings, ARDC and ARMF have traded on the New York

Stock Exchange under the symbols ARDC and ARMF,

respectively. Investors wishing to purchase or sell shares may do

so by placing orders through a broker dealer or other

intermediary.

1 As of March 31, 2015, AUM amounts include capital available to

vehicles managed or co-managed by Ares, including funds managed by

Ivy Hill Asset Management, L.P.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150618005207/en/

Mendel Communications LLCBill Mendel,

212-397-1030bill@mendelcommunications.comorDestra Capital

Investments877-855-3434ARDC@destracapital.comwww.arespublicfunds.com

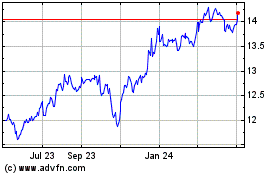

Ares Dynamic Credit Allo... (NYSE:ARDC)

Historical Stock Chart

From Oct 2024 to Nov 2024

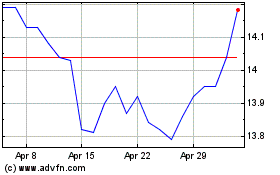

Ares Dynamic Credit Allo... (NYSE:ARDC)

Historical Stock Chart

From Nov 2023 to Nov 2024