Ultragenyx Announces Pricing of Public Offering of Common Stock and Pre-Funded Warrants

June 13 2024 - 8:49PM

Ultragenyx Pharmaceutical Inc. (NASDAQ: RARE), a biopharmaceutical

company focused on the development and commercialization of novel

therapies for serious rare and ultrarare genetic diseases, today

announced the pricing of its underwritten public offering of

7,435,898 shares of its common stock at a price to the public of

$39.00 per share. In addition, in lieu of issuing common stock to

certain investors, the company is offering pre-funded warrants to

purchase 1,538,501 shares of its common stock at a purchase price

of $38.999 per pre-funded warrant, which equals the public offering

price per share of the common stock less the $0.001 exercise price

per share of each pre-funded warrant. The aggregate gross proceeds

to the company from this offering is expected to be $350 million,

before deducting underwriting discounts and commissions and other

offering expenses, and excluding the exercise of any pre-funded

warrants. In addition, the company has granted the underwriters of

the offering an option for a period of 30 days to purchase up to an

additional 1,346,153 shares of the company's common stock at the

public offering price, less the underwriting discount.

The offering is expected to close on or about June 17, 2024,

subject to satisfaction of customary closing conditions. J.P.

Morgan, Goldman Sachs & Co. LLC, BofA Securities, and TD Cowen

are acting as joint book-running managers for the offering.

A registration statement relating to these securities has been

filed with the Securities and Exchange Commission and became

automatically effective on February 21, 2024. This offering is

being made solely by means of a prospectus supplement and

accompanying prospectus. When available, copies of the final

prospectus supplement and the accompanying prospectus related to

the offering may be obtained from J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717 or by email at prospectus-eq_fi@jpmchase.com; Goldman

Sachs & Co. LLC, Prospectus Department, 200 West Street, New

York, NY 10282, telephone: 1-866-471-2526, facsimile: 212-902-9316

or by emailing Prospectus-ny@ny.email.gs.com; BofA Securities,

NC1-002-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001,

Attention: Prospectus Department, or by email at

dg.prospectus_requests@bofa.com; and TD Securities (USA) LLC, 1

Vanderbilt Avenue, New York, NY 10017, by telephone at (855)

495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Ultragenyx

Ultragenyx is a biopharmaceutical company committed to bringing

novel products to patients for the treatment of serious rare and

ultrarare genetic diseases. The company has built a diverse

portfolio of approved therapies and product candidates aimed at

addressing diseases with high unmet medical need and clear biology

for treatment, for which there are typically no approved therapies

treating the underlying disease.

The company is led by a management team experienced in the

development and commercialization of rare disease therapeutics.

Ultragenyx’s strategy is predicated upon time- and cost-efficient

drug development, with the goal of delivering safe and effective

therapies to patients with the utmost urgency.

Forward-Looking Statements

Except for the historical information contained herein, the

matters set forth in this press release, including statements

regarding the expected closing of the public offering, are

forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements involve substantial risks and

uncertainties that could cause the company’s clinical development

programs, future results, performance or achievements to differ

significantly from those expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, the uncertainties related to market conditions and

the completion of the public offering on the agreed terms or at

all, and the satisfaction of customary closing conditions related

to the proposed public offering. Ultragenyx undertakes no

obligation to update or revise any forward-looking statements. For

a further description of the risks and uncertainties that could

cause actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to the

business of Ultragenyx in general, see Ultragenyx's Registration

Statement on Form S-3 filed with the Securities and Exchange

Commission on February 21, 2024, as may be amended from time to

time, together with its preliminary prospectus supplement and

accompanying prospectus and, when available, its final prospectus

supplement, and the documents incorporated by reference therein,

including its Annual Report on Form 10-K filed with the Securities

and Exchange Commission on February 21, 2024, and its subsequent

periodic reports filed with the Securities and Exchange

Commission.

Contact Ultragenyx Pharmaceutical Inc.Investors &

MediaJoshua Higair@ultragenyx.com

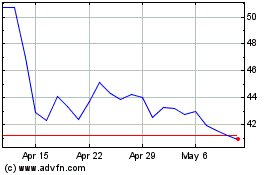

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Historical Stock Chart

From Oct 2024 to Nov 2024

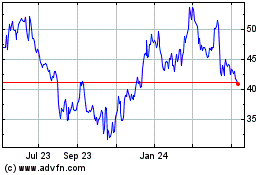

Ultragenyx Pharmaceutical (NASDAQ:RARE)

Historical Stock Chart

From Nov 2023 to Nov 2024