false0001451809August 07, 2024Santa ClaraCalifornia(408)328-440000014518092024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________

FORM 8-K

_________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | |

Date of Report (Date of earliest event reported): August 07, 2024 |

_________________________________________________________

SiTime Corporation

(Exact name of Registrant as Specified in Its Charter)

_________________________________________________________

| | | | | | | | |

| Delaware | 001-39135 | 02-0713868 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 5451 Patrick Henry Drive | | |

Santa Clara, California | | 95054 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Registrant’s Telephone Number, Including Area Code: (408) 328-4400 |

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | SITM | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, the Company issued a press release announcing its financial results for the second quarter of 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information under Item 2.02 of this report, including Exhibit 99.1 hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information and the accompanying exhibit shall not be incorporated by reference into filings with the U.S. Securities and Exchange Commission (the "SEC") made by the Company, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | SiTime Corporation |

| | | |

| Date: | August 7, 2024 | By: | /s/ Elizabeth A. Howe |

| | | Elizabeth A. Howe |

| | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

SiTime Reports Second Quarter 2024 Financial Results

SANTA CLARA, Calif., August 7, 2024 – SiTime Corporation, (Nasdaq: SITM), the Precision Timing company, today announced financial results for the second quarter ended June 30, 2024.

Net revenue in the second quarter of 2024 was $43.9 million, a 33% increase from $33.0 million in the prior quarter and an increase of 58% from the year ago period.

“Q2 results exceeded our outlook,” said Rajesh Vashist, CEO and chairman of SiTime. “Demand grew across all market segments, fueled by the highest growth segment, communications, enterprise and datacenters (CED). Our investments over the past five years have given us a diversified product portfolio — one that meets the industry’s precision timing needs. This, coupled with our strong customer relationships, positions us well to continue capitalizing on the rising demand for AI.”

In the second quarter of 2024, GAAP gross profit was $21.5 million, or 49.1% of revenue, GAAP operating expenses were $53.8 million, GAAP loss from operations was $32.3 million, and GAAP net loss was $26.8 million, or $1.16 per diluted share.

In the second quarter of 2024, non-GAAP gross profit was $25.3 million, or 57.7% of revenue, non-GAAP operating expenses were $28.1 million, non-GAAP loss from operations was $2.8 million and non-GAAP net income was $2.8 million, or $0.12 per diluted share.

Total cash, cash equivalents and short-term investments were $452.5 million on June 30, 2024. The second quarter of 2024 also included the payment of $68.6 million related to the Aura transaction.

Use of Non-GAAP Financial Information

This press release and its attachments include certain non-GAAP supplemental performance measures. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

SiTime believes that the presentation of non-GAAP financial measures provides important supplemental information to management and investors regarding financial and business trends relating to SiTime’s financial condition and results of operations. SiTime believes that these non-GAAP financial measures provide additional insight into SiTime’s ongoing performance and core operational activities and has chosen to provide these measures for more consistent and meaningful comparison between periods. These measures should only be used to evaluate SiTime’s results of operations in conjunction with the corresponding GAAP measures. The non-GAAP financial measures exclude stock based compensation expense, amortization of acquired intangibles, and acquisition-related expenses which include transaction and certain other cash costs associated with business acquisition as well as changes in the estimated fair value of contingent consideration and earn out liabilities. The reconciliation between GAAP and non-GAAP financial results is provided in the financial statements portion of this release.

Inducement Plan Grants

SiTime granted restricted stock unit awards (“RSUs”) on August 5, 2024 that were approved by the Compensation Committee of its Board of Directors under SiTime’s 2022 Inducement Award Plan, as a material inducement to employment of 15 newly hired non-executive individuals globally. The RSUs were approved in accordance with Nasdaq Listing Rule 5635(c)(4). The inducement grants consisted of an aggregate of 36,366 RSUs. One-fourth of the RSUs will vest on the first February 20, May 20, August 20, or November 20 falling in the one-year anniversary quarter of the applicable vesting start date, and then 1/16th of the RSUs vest in equal quarterly installments on each February 20, May 20, August 20, and November 20, thereafter, subject to each such employee’s continued service on each vesting date. The inducement grants are subject to the terms and conditions of award agreements covering the grants and SiTime’s 2022 Inducement Award Plan.

Conference Call

SiTime will broadcast the financial results for its second quarter of 2024 via conference call today, August 7, 2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). To join the conference call via phone, participants are required to complete the following registration form to receive a dial-in number and dedicated PIN for accessing the conference call. The conference call will also be available via a live audio webcast on the investor relations section of the SiTime website at investor.sitime.com. Please access the website at least a few minutes prior to the start of the call to download and install any necessary audio software. An archived webcast replay of the call will be available on the website.

About SiTime

SiTime Corporation is the Precision Timing company. Our semiconductor MEMS programmable solutions offer a rich feature set that enables customers to differentiate their products with higher performance, smaller size, lower power, and better reliability. With more than 3 billion devices shipped, SiTime is changing the timing industry. For more information, visit www.sitime.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Security Exchange Act of 1934, as amended. These forward-looking statements involve risks, uncertainties, assumptions, and other factors that may cause actual results or outcomes to differ materially from those anticipated in such forward-looking statements. The risks, uncertainties, assumptions, and other factors include, but not limited to the impact of acquisitions. More information about these and other risks, uncertainties, and other factors that may cause actual outcomes and results to differ materially from those included in the forward-looking statements contained in this release are included under the caption “Risk Factors” and elsewhere in our most recent Form 10-Q filed with the Securities and Exchange Commission and other filings SiTime makes with the Securities and Exchange Commission from time to time, including the Form 10-K that has been filed for the fiscal year ended December 31, 2023. The financial information set forth in this release reflects estimates based on information available at this time. While SiTime believes these estimates to be reasonable, these amounts could differ materially from reported amounts in SiTime’s Form 10-Q for the fiscal period ending June 30, 2024 and SiTime’s other filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statements are made and are based on information available to SiTime at the time those statements are made and/or management's good faith belief as of that time with respect to future events. Except as required by law, SiTime undertakes no obligation, and does not intend, to update these forward-looking statements.

SiTime Corporation

Unaudited GAAP Condensed Consolidated Statements of Operations

| | | | | | | | | | | |

| Three Months Ended |

| June 30, 2024 | | March 31, 2024 |

| | | |

| (in thousands, except per share data) |

| Revenue | $ | 43,866 | | | $ | 33,022 | |

| Cost of revenue | 22,343 | | | 15,361 | |

| Gross profit | 21,523 | | | 17,661 | |

| Operating expenses: | | | |

| Research and development | 25,490 | | | 25,544 | |

| Selling, general and administrative | 25,190 | | | 23,913 | |

| Acquisition related costs | 3,163 | | | 3,242 | |

| Total operating expenses | 53,843 | | | 52,699 | |

| Loss from operations | (32,320) | | | (35,038) | |

| Interest income | 5,736 | | | 6,560 | |

| Other expense, net | (203) | | | (213) | |

| Loss before income taxes | (26,787) | | | (28,691) | |

| Income tax benefit (expense) | 18 | | | (13) | |

| Net loss | $ | (26,769) | | | $ | (28,704) | |

| Net loss attributable to common stockholders and comprehensive loss | $ | (26,769) | | | $ | (28,704) | |

| Net loss per share attributable to common stockholders, basic | $ | (1.16) | | | $ | (1.26) | |

| Net loss per share attributable to common stockholders, diluted | $ | (1.16) | | | $ | (1.26) | |

| Weighted-average shares used to compute basic net loss per share | 22,997 | | 22,765 |

| Weighted-average shares used to compute diluted net loss per share | 22,997 | | 22,765 |

SiTime Corporation

Unaudited Reconciliation of Non-GAAP Adjustments

| | | | | | | | | | | |

| Three Months Ended |

| June 30, 2024 | | March 31, 2024 |

| (in thousands, except per share data) |

| Reconciliation of GAAP gross profit and margin to non-GAAP | | | |

| Revenue | $ | 43,866 | | | $ | 33,022 | |

| GAAP gross profit | 21,523 | | | 17,661 | |

| GAAP gross margin | 49.1 | % | | 53.5 | % |

| Amortization of acquired intangibles | 3,463 | | | 1,284 | |

| Stock-based compensation | 327 | | | 179 | |

| Non-GAAP gross profit | $ | 25,313 | | | $ | 19,124 | |

| Non-GAAP gross margin | 57.7 | % | | 57.9 | % |

| | | |

| Reconciliation of GAAP operating expenses to non-GAAP | | | |

| GAAP research and development expenses | $ | 25,490 | | | $ | 25,544 | |

| Stock-based compensation | (9,414) | | | (9,177) | |

| Non-GAAP research and development expenses | $ | 16,076 | | | $ | 16,367 | |

| | | |

| GAAP sales, general and administrative expenses | $ | 25,190 | | | $ | 23,913 | |

| Stock-based compensation | (13,176) | | | (12,347) | |

| Acquisition related integration costs | — | | | (550) | |

| Non-GAAP sales, general and administrative expenses | $ | 12,014 | | | $ | 11,016 | |

| | | |

| GAAP acquisition related costs | $ | 3,163 | | | $ | 3,242 | |

| Acquisition related costs | (3,163) | | | (3,242) | |

| Non-GAAP acquisition related costs | $ | — | | | $ | — | |

| Total Non-GAAP operating expenses | $ | 28,090 | | | $ | 27,383 | |

| | | |

| Reconciliation of GAAP loss from operations to non-GAAP loss from operations | | | |

| GAAP loss from operations | $ | (32,320) | | | $ | (35,038) | |

| Acquisition related costs | 3,163 | | | 3,242 | |

| Acquisition related integration costs | — | | | 550 | |

| Amortization of acquired intangibles | 3,463 | | | 1,284 | |

| Stock-based compensation | 22,917 | | | 21,703 | |

| Non-GAAP loss from operations | $ | (2,777) | | | $ | (8,259) | |

| Non-GAAP loss from operations as a percentage of revenue | (6.3 | %) | | (25.0 | %) |

| | | |

| Reconciliation of GAAP net loss to non-GAAP net income (loss) | | | |

| GAAP net loss | $ | (26,769) | | | $ | (28,704) | |

| Acquisition related costs | 3,163 | | | 3,242 | |

| Acquisition related integration costs | — | | | 550 | |

| Amortization of acquired intangibles | 3,463 | | | 1,284 | |

| Stock-based compensation | 22,917 | | | 21,703 | |

| Non-GAAP net income (loss) | $ | 2,774 | | | $ | (1,925) | |

| Weighted-average shares used to compute diluted net income (loss) per share | 22,997 | | 22,765 |

| | | |

| GAAP net loss per share diluted | $ | (1.16) | | | $ | (1.26) | |

| Non-GAAP adjustments detailed above | 1.28 | | | 1.18 | |

| Non-GAAP net income (loss) per share diluted | $ | 0.12 | | | $ | (0.08) | |

SiTime Corporation

Unaudited GAAP Condensed Consolidated Balance Sheets

| | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| | | |

| (in thousands) |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 16,637 | | | $ | 9,468 | |

| Short-term investments in held-to-maturity securities | 435,881 | | | 518,733 | |

| Accounts receivable, net | 20,986 | | | 21,861 | |

| Inventories | 70,785 | | | 65,539 | |

| Prepaid expenses and other current assets | 9,278 | | | 7,641 | |

| Total current assets | 553,567 | | | 623,242 | |

| Property and equipment, net | 58,689 | | | 54,685 | |

| Intangible assets, net | 171,149 | | | 177,079 | |

| Right-of-use assets, net | 7,056 | | | 8,262 | |

| Goodwill | 87,098 | | | 87,098 | |

| Other assets | 996 | | | 1,317 | |

| Total assets | $ | 878,555 | | | $ | 951,683 | |

| Liabilities and Stockholders' Equity: | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 14,489 | | | $ | 8,690 | |

| Accrued expenses and other current liabilities | 65,874 | | | 112,704 | |

| Total current liabilities | 80,363 | | | 121,394 | |

| Other non-current liabilities | 105,680 | | | 122,237 | |

| Total liabilities | 186,043 | | | 243,631 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Common stock | 2 | | | 2 | |

| Additional paid-in capital | 836,383 | | | 796,450 | |

| Accumulated deficit | (143,873) | | | (88,400) | |

| Total stockholders’ equity | 692,512 | | | 708,052 | |

| Total liabilities and stockholders’ equity | $ | 878,555 | | | $ | 951,683 | |

Investor Relations Contacts:

Shelton Group

Leanne Sievers | Brett Perry

1-949-224-3874 | 1-214-272-0070

sheltonir@sheltongroup.com

SiTime Corporation

Beth Howe

Chief Financial Officer

investor.relations@sitime.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

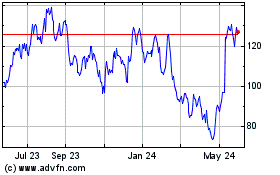

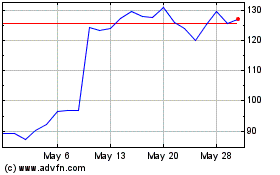

SiTime (NASDAQ:SITM)

Historical Stock Chart

From Oct 2024 to Nov 2024

SiTime (NASDAQ:SITM)

Historical Stock Chart

From Nov 2023 to Nov 2024