Flushing Financial Corporation Declares Quarterly Dividend of $0.22 per Share

November 22 2022 - 5:00PM

Flushing Financial Corporation (the “Company”) (Nasdaq-GS: FFIC),

the parent holding company for Flushing Bank (the “Bank”), today

announced that the Board of Directors (the “Board”) declared a

quarterly dividend on its common stock of $0.22 per common share,

payable on December 23, 2022 to shareholders of record at the close

of business on December 9, 2022.

John R. Buran, the Company’s President and Chief

Executive Officer, stated: “This quarter’s dividend marks the 106th

consecutive quarterly dividend and highlights our commitment to

shareholders while supporting our customers over the short and long

term. The Company has a long history of profitable growth and a

conservative, low risk business model.”

FLUSHING FINANCIAL CORPORATION (Nasdaq: FFIC) is

the holding company for Flushing Bank®, an FDIC insured, New York

State—chartered commercial bank that operates banking offices in

Queens, Brooklyn, Manhattan, and on Long Island. The Bank has been

building relationships with families, business owners, and

communities since 1929. Today, it offers the products, services,

and conveniences associated with large commercial banks, including

a full complement of deposit, loan, equipment finance, and cash

management services. Rewarding customers with personalized

attention and bankers that can communicate in the languages

prevalent within these multicultural markets is what makes the Bank

uniquely different. As an Equal Housing Lender and leader in real

estate lending, the Bank’s experienced lending teams create

mortgage solutions for real estate owners and property managers

both within and outside the New York City metropolitan area. The

Bank also fosters relationships with consumers nationwide through

its online banking division with the iGObanking® and BankPurely®

brands. Additional information on Flushing Financial Corporation

and Flushing Bank may be obtained by visiting the Company’s web

site at FlushingBank.com.

“Safe Harbor” Statement under the Private

Securities Litigation Reform Act of 1995: Statements in this Press

Release relating to plans, strategies, economic performance and

trends, projections of results of specific activities or

investments and other statements that are not descriptions of

historical facts may be forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking information is

inherently subject to risks and uncertainties, and actual results

could differ materially from those currently anticipated due to a

number of factors, which include, but are not limited to, risk

factors discussed in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2021 and in other documents

filed by the Company with the Securities and Exchange Commission

from time to time. Forward-looking statements may be identified by

terms such as “may”, “will”, “should”, “could”, “expects”, “plans”,

“intends”, “anticipates”, “believes”, “estimates”, “predicts”,

“forecasts”, “goals”, “potential” or “continue” or similar terms or

the negative of these terms. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. The Company has no obligation to

update these forward-looking statements.

#FF

CONTACT:

Susan K. CullenSenior Executive Vice President, Chief Financial

Officer and TreasurerFlushing Financial Corporation(718)

961-5400

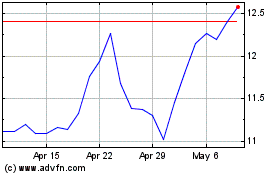

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

From Oct 2024 to Nov 2024

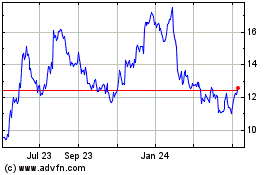

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

From Nov 2023 to Nov 2024