Zoom, Delta, Moderna: What to Watch When the Stock Market Opens Today

November 12 2020 - 9:39AM

Dow Jones News

By Jem Bartholomew

Here's what we are watching as markets kick into gear

Thursday.

-- Stock futures slipped as new restrictions to curb the spread

of coronavirus sparked concerns about further damage to the

economy. Futures tied to the S&P 500 fell 0.5%, pointing to a

decline in the gauge after the opening bell. Read our full market

wrap here.

-- Unemployment data. Jobless claims remained high at around

709,000 last week, but slipped to their lowest level since March,

suggesting some workers are finding jobs even as coronavirus cases

climb.

-- What's coming up. Palantir Technologies, Walt Disney and

Cisco Systems will report earnings this afternoon.

Market Movers to Watch

-- Moderna climbed 3.2% in offhours trading after the biotech

company said the first batch of data from its late-stage test of an

experimental Covid-19 vaccine candidate was ready for analysis.

-- Travel companies that performed well during Monday's market

rotation after promising vaccine news slipped offhours, with Delta

Air Lines sliding 3.1%, United Airlines Holdings dropping 3.2%,

Norwegian Cruise Line Holdings down 3.8% and Royal Caribbean Group

falling 4.4%.

-- Stocks benefiting from a work-from-home world rose premarket

with Zoom Video Communications gaining 2.3%, Slack Technologies up

1.3% and DocuSign rising 1.5%.

-- Boeing Company dropped 2.4% out of hours after the company

said it expects a weaker global market amid the coronavirus

pandemic, despite also releasing strong forecasts for China's

aircraft demand.

-- Occidental Petroleum fell a further 2.7% in offhours trading

after dropping 3.9% Wednesday. J.P. Morgan analyst Phil Gresh gave

the company a bearish rating yesterday citing concerns over the oil

price needed to cover its capital expenditures.

-- Bitcoin briefly surged over $16,000 for the first time since

2018 before peeling back.

-- Hillenbrand surged 5.4% ahead of the bell, after diversified

industrial company swung to a loss in its latest quarter as

expenses grew, but sales surged due to its acquisition of Milacron

Holdings.

-- Sundial Growers plunged over 10% premarket after the cannabis

company reported a drop in third-quarter revenue that disappointed

investors.

-- XPeng's U.S.-listed shares advanced around 5% offhours, as

the China-based electric vehicle maker reported a more than

fourfold jump in third-quarter revenue that beat analysts'

predictions despite posting an overall loss. Other U.S.-listed

Chinese tech firms were also climbing, including JD.com and

Pinduoduo.

-- Five Prime Therapeutics jumped over 21% premarket, after the

company reported promising results in preclinical data for its

FPA157 anti-tumor treatment.

-- ServiceNow gained 3.3% before the bell after Morgan Stanley

said its share price would rise to $652 a share. The company closed

Wednesday at $503.36.

Must Reads Since You Went To Bed

Pfizer's Vaccine Is a Pick-Me-Up for Value Stocks

Oil-Demand Recovery Unlikely for Months Despite Vaccine

Hopes

Global Food Supplies Weather Coronavirus Pandemic

Biden's Penchant for Bold Stimulus to Test His Deal-Making

Skills

U.K. Economy Rebounds but New Lockdowns Slow Recovery

CFOs Watch for a Possible Minimum Wage Hike Under Biden

(END) Dow Jones Newswires

November 12, 2020 09:24 ET (14:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

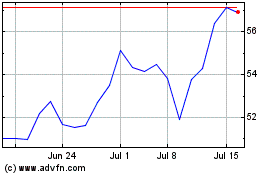

DocuSign (NASDAQ:DOCU)

Historical Stock Chart

From Oct 2024 to Nov 2024

DocuSign (NASDAQ:DOCU)

Historical Stock Chart

From Nov 2023 to Nov 2024