Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405

October 01 2024 - 4:45PM

Edgar (US Regulatory)

| |

|

SEC

FILE NUMBER |

| |

UNITED

STATES |

000-23329 |

| |

SECURITIES AND

EXCHANGE COMMISSION |

CUSIP |

| |

Washington, D.C.

20549 |

159765205 |

FORM 12b-25

NOTIFICATION OF LATE

FILING

| (Check one): |

|

x

Form 10-K ¨ Form 20-F ¨

Form 11-K ¨ Form 10-Q ¨ Form 10-D

¨ Form N-CEN

¨

Form N-CSR |

| |

|

|

| |

|

For Period

Ended: June 30, 2024 |

|

| |

|

☐ Transition

Report on Form 10-K |

| |

|

☐ Transition

Report on Form 20-F |

| |

|

☐ Transition

Report on Form 11-K |

| |

|

☐ Transition

Report on Form 10-Q |

| |

|

|

| |

|

For the Transition

Period Ended: _____________ |

| |

| Nothing in this form shall be construed

to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above,

identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

| Charles &

Colvard, Ltd. |

|

| Full Name of Registrant |

|

| |

|

| N/A |

Former Name if Applicable

|

| 170

Southport Drive |

| Address of Principal Executive Office (Street

and Number) |

| |

| Morrisville,

NC 27560 |

| City, State and Zip Code |

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort

or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| ¨ |

(a) |

The reasons described in reasonable detail in Part III

of this form could not be eliminated without unreasonable effort or expense; |

| |

(b) |

The subject annual report, semi-annual report, transition

report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN, or N-CSR, or portion thereof, will be filed on or before

the fifteenth calendar day following the prescribed due date; or the subject quarterly report of transition report on Form 10-Q

or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following

the prescribed date; and |

| |

(c) |

The accountant's statement or other exhibit required

by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail the reasons why Form 10-K, 20-F,

11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report portion thereof, could not be filed within the prescribed time period.

Charles &

Colvard, Ltd. (the “Company”) is filing this Notification of Late Filing on Form 12b-25 with respect to its Annual

Report on Form 10-K for the fiscal year ended June 30, 2024 (the “Form 10-K”). The Company was unable to file

its Form 10-K within the prescribed time period without unreasonable effort or expense because it requires additional time to complete

procedures relating to its year-end financial statements and the potential determination of the pending outcome of the confidential arbitration

against the Company initiated by Wolfspeed, Inc. resulting from the breach of contract claiming damages, plus interest, costs and

attorney’s fees which the Company disputes, as disclosed in its Quarterly Report on Form 10-Q for the nine months ended March 31,

2024, filed with the Securities and Exchange Commission on May 6, 2024 (the “Q3 Form 10-Q”). The hearing for the

arbitration began September 30, 2024.

While the Company

intends to file the Form 10-K as soon as practicable, the Company does not anticipate being able to file its Form 10-K

within the fifteen-day grace period provided by Rule 12b-25 under the Securities Exchange Act of 1934, as amended.

PART IV — OTHER INFORMATION

| (1) |

Name and telephone number of person to contact in regard

to this notification |

| |

Clint

J. Pete |

|

(919) |

|

468-0399 |

| |

(Name) |

|

(Area Code) |

|

(Telephone Number) |

| (2) |

Have all other periodic reports required under Section 13

or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding

12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify

report(s). |

| |

Yes x

No ¨

|

| (3) |

Is it anticipated that any significant change in results

of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof? |

| |

Yes x No¨ |

If so, attach an explanation of the anticipated change, both

narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

Consistent

with the Company’s results for the first, second and third quarters of the fiscal year ended June 30, 2024, the

Company expects to report net sales decreased by 25% to $22.5 million for the fiscal year ended June 30, 2024 compared to net

sales of $29.9 million for the fiscal year ended June 30, 2023.

Consistent

with the Company’s results for the first, second and third quarters of the fiscal year ended June 30, 2024, the Company

will report a net loss for the fiscal year ended June 30, 2024 that is a significant change compared to net loss of $19.6

million reported for the year ended June 30, 2023. A reasonable net loss estimate for the fiscal year ended June 30,

2024 cannot be made at this time until the completion of the year-end financial statement review and auditing process. The

significant change in net loss is primarily due to (1) the impact of no income tax expense for the fiscal year ended June 30,

2024 versus the $5.9 million income tax expense for the fiscal year ended June 30, 2023 due to the establishment of a full valuation

allowance against the Company’s deferred tax assets in the fiscal year ended June 30, 2023; and (2) the impact of

a $5.9 million inventory write-down during the fiscal year ended June 30, 2023 due to the pricing

pressures and constrained consumer demand versus no such inventory write-down during the fiscal year ended June 30, 2024.

The

foregoing figures are preliminary and unaudited and are prepared in accordance with U.S. generally accepted accounting principles.

While the Company does not expect any significant changes to the aforementioned preliminary unaudited financial information,

such preliminary financial information remains subject to change pending the completion of the year-end financial statement review

and audit.

Forward-Looking

Statements

This

filing contains a number of forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words

such as “plan,” “expect,” “will,” “working,” and variations of such words and similar

future or conditional expressions are intended to identify forward-looking statements. These forward-looking statements include,

but are not limited to, statements regarding our beliefs and expectations relating to the filing of the Form 10-K and the estimated

reporting of financial results. These forward-looking statements are not guarantees of future results and are subject to a number

of risks and uncertainties, many of which are difficult to predict and beyond our control. Actual results could differ materially

from those contemplated by the forward-looking statements as a result of certain factors detailed in the Company’s filings

with the Securities and Exchange Commission. The Company disclaims and does

not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law

or regulation. |

Charles &

Colvard, Ltd.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: October 1, 2024 |

By: |

/s/

Clint J. Pete |

|

Name: |

Clint J. Pete |

|

Title: |

Chief Financial Officer |

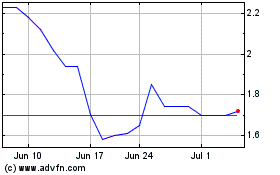

Charles and Colvard (NASDAQ:CTHR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Charles and Colvard (NASDAQ:CTHR)

Historical Stock Chart

From Dec 2023 to Dec 2024