UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File No. 001-38691

AURORA CANNABIS INC.

(Translation of registrant's name into English)

2207 90B St. SW

Edmonton, Alberta T6X 1V8

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

This Form 6-K is hereby filed and incorporated by reference in the registrant’s Registration Statement on Form F-10 (File No. 333-271479).

SUBMITTED HEREWITH

| | | | | |

| Exhibits | Description |

| Condensed Consolidated Interim Financial Statements for the three and six months ended September 30, 2024 and 2023 |

| Interim Management’s Discussion and Analysis for the three and six months ended September 30, 2024 and 2023 |

| Certification of Chief Executive Officer |

| Certification of Chief Financial Officer |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AURORA CANNABIS INC.

/s/ Simona King

Simona King

Chief Financial Officer

Date: November 6, 2024

AURORA CANNABIS INC.

Condensed Consolidated Interim Financial Statements

(Unaudited)

For the three and six months ended September 30, 2024 and 2023

(in Canadian Dollars)

Table of Contents

| | | | | |

| |

| |

Condensed Consolidated Interim Statements of Financial Position | |

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss | |

Condensed Consolidated Interim Statements of Changes in Equity | |

Condensed Consolidated Interim Statements of Cash Flows | |

Notes to the Condensed Consolidated Interim Financial Statements | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Note 1 | Nature of Operations | | | Note 10 | Share Capital | | | | | |

| Note 2 | Material Accounting Policies and Judgments | | | Note 11 | Share-Based Compensation | | | | | |

| Note 3 | Biological Assets | | | Note 12 | Income (Loss) Per Share | | | | | |

| Note 4 | Inventory | | | Note 13 | Supplemental Cash Flow Information | | | | | |

| Note 5 | Property, Plant and Equipment | | | Note 14 | Commitments and Contingencies | | | | | |

| Note 6 | Assets and Liabilities Held for Sale and Discontinued Operations | | | Note 15 | Revenue | | | | | |

| Note 7 | Intangible Assets and Goodwill | | | Note 16 | Segmented Information | | | | | |

| Note 8 | Loans and Borrowings | | | Note 17 | Fair Value of Financial Instruments | | | | | |

| Note 9 | Lease Liabilities | | | Note 18 | Financial Instruments Risk | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

AURORA CANNABIS INC.

Condensed Consolidated Interim Statements of Financial Position

As at September 30, 2024 and March 31, 2024

(Amounts reflected in thousands of Canadian dollars)

| | | | | | | | | | | |

| | | |

| Note | September 30, 2024 | March 31, 2024 |

| | $ | $ |

| Assets | | | |

| Current | | | |

| Cash and cash equivalents | | 84,921 | | 113,439 | |

| Restricted cash | 13 | 66,678 | | 65,782 | |

| Accounts receivable | 18(a) | 40,153 | | 45,411 | |

| | | |

| Marketable securities | | — | | 4,036 | |

| Derivative asset | | — | | 760 | |

| Biological assets | 3 | 41,212 | | 42,774 | |

| Inventory | 4 | 170,986 | | 143,602 | |

| Prepaids and other current assets | | 11,046 | | 9,402 | |

| Assets held for sale | 6(a) | 2,679 | | 1,399 | |

| | 417,675 | | 426,605 | |

| | | |

| Property, plant and equipment | 5 | 276,482 | | 294,324 | |

| | | |

| Deposits and other long-term assets | | 10,130 | | 12,028 | |

| | | |

| | | |

| Lease receivable | | 4,588 | | 6,343 | |

| Intangible assets | 7 | 42,098 | | 40,850 | |

| Goodwill | 7 | 43,180 | | 43,180 | |

| Deferred tax assets | | 14,621 | | 15,343 | |

| Total assets | | 808,774 | | 838,673 | |

| | | |

| Liabilities | | | |

| Current | | | |

| Accounts payable and accrued liabilities | 18(b) | 39,032 | | 58,563 | |

| Income taxes payable | 18(b) | 2,404 | | 1,547 | |

| Deferred revenue | | 2,019 | | 1,687 | |

| | | |

| Loans and borrowings | 8 | 53,689 | | 52,361 | |

| Lease liabilities | 9 | 5,063 | | 4,856 | |

| | | |

| Provisions | | 5,607 | | 5,606 | |

| | | |

| Liabilities held for sale | 6(a) | 1,281 | | — | |

| | 109,095 | | 124,620 | |

| | | |

| | | |

| Loans and borrowings | 8 | 3,821 | | 4,898 | |

| Lease liabilities | 9 | 38,397 | | 42,676 | |

| Derivative liabilities | 10(c), 11(e), 17 | 4,927 | | 2,309 | |

| | | |

| Other long-term liability | 17 | 54,047 | | 46,110 | |

| Deferred tax liability | | 15,514 | | 16,190 | |

| Total liabilities | | 225,801 | | 236,803 | |

| | | |

| Shareholders’ equity | | | |

| Share capital | 10 | 6,977,043 | | 6,971,416 | |

| Reserves | | 161,860 | | 162,351 | |

| Accumulated other comprehensive loss | | (214,287) | | (206,058) | |

| Deficit | | (6,381,444) | | (6,367,936) | |

| Total equity attributable to Aurora Cannabis Inc. shareholders | | 543,172 | | 559,773 | |

| Non-controlling interests | | 39,801 | | 42,097 | |

| Total equity | | 582,973 | | 601,870 | |

| Total liabilities and equity | | 808,774 | | 838,673 | |

Nature of Operations (Note 1)

Commitments and Contingencies (Note 14)

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

AURORA CANNABIS INC.

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

| | | | | | | | | | | | | | | | | |

| | | | |

| | |

| | | | | |

| | Three months ended September 30, | Six months ended September 30, |

| Note | 2024 | 2023(1) | 2024 | 2023(1) |

| | $ | $ | $ | $ |

| Revenue | 15 | 88,933 | 70,183 | 180,970 | 151,381 |

| | | | | |

| Excise taxes | 15 | (7,811) | (7,064) | (16,413) | (13,530) |

| | | | | |

| Net revenue | | 81,122 | 63,119 | 164,557 | 137,851 |

| | | | | |

| Cost of sales | 4 | 41,929 | 44,535 | 95,239 | 104,668 |

| | | | | |

| Gross profit before fair value adjustments | | 39,193 | 18,584 | 69,318 | 33,183 |

| | | | | |

Changes in fair value of inventory and biological assets sold | 3, 4 | 36,027 | 18,636 | 69,075 | 36,088 |

| Unrealized gain on changes in fair value of biological assets | 3 | (38,999) | (34,453) | (86,468) | (63,326) |

| | | | | |

| Gross profit | | 42,165 | 34,401 | 86,711 | 60,421 |

| | | | | |

| Expense | | | | | |

| General and administration | | 22,036 | 22,527 | 44,560 | 43,876 |

| Sales and marketing | | 13,721 | 12,611 | 27,745 | 25,281 |

| Acquisition costs | | 991 | 563 | 1,992 | 789 |

| Research and development | | 975 | 946 | 1,962 | 2,047 |

| Depreciation and amortization | 5, 7 | 2,366 | 4,011 | 4,480 | 6,825 |

| Share-based compensation | 11 | 4,468 | 4,568 | 7,487 | 6,849 |

| | 44,557 | 45,226 | 88,226 | 85,667 |

| | | | | |

Income (loss) from operations | | (2,392) | (10,825) | (1,515) | (25,246) |

| | | | | |

| Other income (expenses) | | | | |

| | | | | |

| Interest and other income | | 2,968 | 3,250 | 6,314 | 6,601 |

| Finance and other costs | | (2,136) | (4,099) | (3,872) | (9,307) |

| Foreign exchange gain (loss) | | 2,116 | 1,844 | 3,959 | (1,606) |

| Other gains | | 47 | 12,096 | 3,547 | 12,155 |

| Restructuring charges | | — | (469) | — | (901) |

| Impairment of property, plant and equipment | 5, 6(a) | — | (1,230) | (129) | (1,230) |

| | | | | |

| | | | | |

| | | | | |

| | 2,995 | 11,392 | 9,819 | 5,712 |

| | | | | |

| Income (loss) before taxes | | 603 | 567 | 8,304 | (19,534) |

| | | | | |

| Income tax recovery (expense) | | | | | |

| Current | | (964) | (224) | (1,785) | (439) |

| Deferred, net | | 2,036 | 96 | — | 215 |

| | 1,072 | (128) | (1,785) | (224) |

| | | | | |

| Net income (loss) from continuing operations | | 1,675 | 439 | 6,519 | (19,758) |

Net loss from discontinued operations, net of tax | 6(b) | (14,640) | (2,566) | (14,336) | (10,700) |

| | | | | |

Net loss | | (12,965) | (2,127) | (7,817) | (30,458) |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

(1) Comparative information has been adjusted due to discontinued operations see Note 6(b).

AURORA CANNABIS INC.

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

(Continued)

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | Three months ended September 30, | Six months ended September 30, |

| | | | | |

| Note | 2024 | 2023(1) | 2024 | 2023(1) |

| | $ | $ | $ | $ |

| Net income (loss) from continuing operations | | 1,675 | 439 | 6,519 | (19,758) |

| Net loss from discontinued operations, net of tax | 6(b) | (14,640) | (2,566) | (14,336) | (10,700) |

| | | | | |

| Net loss | | (12,965) | (2,127) | (7,817) | (30,458) |

Other comprehensive income (loss) (“OCI”) that will not be reclassified to net income (loss) | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Other comprehensive income (loss) that may be reclassified to net income (loss) | | | | | |

| | | | | |

| Foreign currency translation gain (loss) | | (5,989) | (893) | (8,229) | 936 |

| | | | | |

Total other comprehensive income (loss) | | (5,989) | (893) | (8,229) | 936 |

| | | | | |

Comprehensive loss from continuing operations | | (4,314) | (454) | (1,710) | (18,822) |

Comprehensive loss from discontinued operations | | (14,640) | (2,566) | (14,336) | (10,700) |

Comprehensive loss | | (18,954) | (3,020) | (16,046) | (29,522) |

| | | | | |

| Net income (loss) from continuing operations attributable to: | | | | | |

| Aurora Cannabis Inc. | | 2,599 | 2,043 | 8,815 | (16,721) |

| Non-controlling interests | | (924) | (1,604) | (2,296) | (3,037) |

| | | | | |

Net loss from discontinued operations attributable to: | | | | | |

| Aurora Cannabis Inc. | 6(b) | (14,640) | (2,566) | (14,336) | (10,700) |

| Non-controlling interests | | — | — | — | — |

| | | | | |

Comprehensive loss attributable to: | | | | | |

| Aurora Cannabis Inc. | | (18,030) | (1,416) | (13,750) | (26,485) |

| Non-controlling interests | | (924) | (1,604) | (2,296) | (3,037) |

| | | | | |

| Income (loss) per share - basic and diluted | | | | | |

| Continuing operations | 12 | $0.05 | $0.05 | $0.16 | | ($0.45) | |

| Discontinued operations | 12 | ($0.27) | | ($0.07) | | ($0.26) | | ($0.29) | |

| Total operations | 12 | ($0.22) | | ($0.01) | ($0.10) | | ($0.74) | |

| | | | | |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

(1) Comparative information has been adjusted due to discontinued operations see Note 6(b).

AURORA CANNABIS INC.

Condensed Consolidated Interim Statements of Changes in Equity

Six months ended September 30, 2024

(Amounts reflected in thousands of Canadian dollars, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Share Capital | | Reserves | | AOCI | | | |

| Note | Common Shares | Amount | | Share-Based Compensation | Compensation

Options/

Warrants/Shares Issued | Convertible Notes | Change in

Ownership

Interest | Obligation to Issue Shares | Total

Reserves | | Fair

Value | Deferred

Tax | Associate OCI Pick-up | Foreign Currency Translation | Total

AOCI | Earnings (Deficit) | Non-Controlling Interests | Total |

| | # | $ | | $ | $ | $ | $ | $ | $ | | $ | $ | $ | $ | $ | $ | $ | $ |

| Balance, March 31, 2024 | | 54,545,797 | | 6,971,416 | | | 217,498 | | 27,667 | | 419 | | (86,800) | | 3,567 | | 162,351 | | | (209,866) | | 18,919 | | 208 | | (15,319) | | (206,058) | | (6,367,936) | | 42,097 | | 601,870 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Share issuance costs | | — | | (106) | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | — | | — | | (106) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Shares issued under share-based compensation plans | 11 | 317,161 | | 5,733 | | | (5,606) | | — | | — | | — | | — | | (5,606) | | | — | | — | | — | | — | | — | | — | | — | | 127 | |

| Share-based compensation | 11 | — | | — | | | 5,115 | | — | | — | | — | | — | | 5,115 | | | — | | — | | — | | — | | — | | — | | — | | 5,115 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Put option liability | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | (7,987) | | — | | (7,987) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Comprehensive loss for the period | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | (8,229) | | (8,229) | | (5,521) | | (2,296) | | (16,046) | |

| | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2024 | | 54,862,958 | | 6,977,043 | | | 217,007 | | 27,667 | | 419 | | (86,800) | | 3,567 | | 161,860 | | | (209,866) | | 18,919 | | 208 | | (23,548) | | (214,287) | | (6,381,444) | | 39,801 | | 582,973 | |

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

AURORA CANNABIS INC.

Condensed Consolidated Interim Statements of Changes in Equity

Six months ended September 30, 2023

(Amounts reflected in thousands of Canadian dollars, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Share Capital | | Reserves | | AOCI | | | |

| Note | Common Shares(1) | Amount | | Share-Based Compensation | Compensation

Options/

Warrants | Convertible Notes | Change in

Ownership

Interest | Obligation to issue shares | Total

Reserves | | Fair

Value | Deferred

Tax | Associate OCI Pick-up | Foreign Currency Translation | Total

AOCI | Deficit | Non-Controlling Interests | Total |

| | # | $ | | $ | $ | $ | $ | $ | $ | | $ | $ | $ | $ | $ | $ | $ | $ |

Balance, March 31, 2023 | | 34,526,931 | | 6,841,234 | | | 212,340 | | 27,667 | | 419 | | (86,800) | | 414 | | 154,040 | | | (214,599) | | 18,919 | | 208 | | (16,893) | | (212,365) | | (6,296,833) | | 31,061 | | 517,137 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Shares issued for convertible debenture repurchases | | 7,259,329 | | 54,680 | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | — | | — | | 54,680 | |

| Shares issued under equity financing | | 258,035 | | 2,271 | | | — | | — | | — | | — | | (414) | | (414) | | | — | | — | | — | | — | | — | | — | | — | | 1,857 | |

| Share issuance costs | | — | | (722) | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | — | | — | | (722) | |

| Deferred tax on share issuance costs | | — | | (215) | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | — | | — | | (215) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Shares issued under share-based compensation plans | 11 | 16,619 | | 1,643 | | | (1,643) | | — | | — | | — | | — | | (1,643) | | | — | | — | | — | | — | | — | | — | | — | | — | |

| Share-based compensation | 11 | — | | — | | | 5,929 | | — | | — | | — | | — | | 5,929 | | | — | | — | | — | | — | | — | | — | | — | | 5,929 | |

| | | | | | | | | | | | | | | | | | | |

| Put option liability | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | (2,668) | | — | | (2,668) | |

| | | | | | | | | | | | | | | | | | | |

| Change in ownership interests in subsidiaries | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | (14,671) | | 17,243 | | 2,572 | |

| | | | | | | | | | | | | | | | | | | |

| Comprehensive loss for the period | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | | — | | — | | 936 | | 936 | | (27,421) | | (3,037) | | (29,522) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2023 | | 42,060,914 | | 6,898,891 | | | 216,626 | | 27,667 | | 419 | | (86,800) | | — | | 157,912 | | | (214,599) | | 18,919 | | 208 | | (15,957) | | (211,429) | | (6,341,593) | | 45,267 | | 549,048 | |

(1) Comparative information has been adjusted due to 1:10 reverse stock split.

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

AURORA CANNABIS INC.

Condensed Consolidated Interim Statements of Cash Flows

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars)

| | | | | | | | | | | | | | | | | |

| | | | | |

| | Three months ended September 30, | Six months ended September 30, |

| | | | |

| Note | 2024 | 2023(1) | 2024 | 2023(1) |

| | $ | $ | $ | $ |

| Operating activities | | | | | |

| Net income (loss) from continuing operations | | 1,675 | | 439 | | 6,519 | | (19,758) | |

| Adjustments for non-cash items: | | | | | |

| Unrealized gain on changes in fair value of biological assets | | (38,999) | | (34,453) | | (86,468) | | (63,326) | |

Changes in fair value of inventory and biological assets sold | | 36,027 | | 18,636 | | 69,075 | | 36,088 | |

| Depreciation of property, plant and equipment | | 5,170 | | 7,255 | | 10,803 | | 16,934 | |

| Amortization of intangible assets | 7 | 254 | | 274 | | 361 | | 519 | |

| Share-based compensation | 11 | 4,468 | | 4,568 | | 7,487 | | 6,849 | |

| Impairment of property, plant and equipment | 5 | — | | 1,230 | | 129 | | 1,230 | |

| | | | | |

| | | | | |

| | | | | |

| Net interest accrual and accretion | | 583 | | 1,732 | | 1,296 | | 5,402 | |

| | | | | |

| Deferred tax recovery | | (2,038) | | (4) | | (2) | | (235) | |

| Other losses | | (1,027) | | (12,524) | | (3,548) | | (12,636) | |

| Foreign exchange loss (gain) | | (1,646) | | (988) | | (3,959) | | 1,141 | |

| | | | | |

| Deferred compensation amortization | | 828 | | 952 | | 1,780 | | 1,904 | |

| Cash provided by (used in) operating activities from continuing operations before changes in non-cash working capital | | 5,295 | | (12,883) | | 3,473 | | (25,888) | |

| Changes in non-cash working capital | 13 | (29,588) | | (14,781) | | (18,906) | | (10,967) | |

| Net cash used in operating activities from continuing operations | | (24,293) | | (27,664) | | (15,433) | | (36,855) | |

| Net cash used in operating activities from discontinued operations | | (598) | | (3,218) | | (1,083) | | (5,264) | |

| Net cash used in operating activities | | (24,891) | | (30,882) | | (16,516) | | (42,119) | |

| | | | | |

| Investing activities | | | | | |

| | | | | |

| | | | | |

| Proceeds from disposal of marketable securities | | 788 | | — | | 5,488 | | — | |

| | | | | |

| Purchase of property, plant and equipment and intangible assets | | (4,543) | | (4,186) | | (9,696) | | (8,483) | |

| Proceeds from disposal of property, plant and equipment and assets held for sale | 6(a) | 117 | | 207 | | 1,384 | | 2,601 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities | | (3,638) | | (3,979) | | (2,824) | | (6,137) | |

| | | | | |

| Financing activities | | | | | |

| Proceeds from loans and borrowings | 8 | 5,675 | | 3,982 | | 6,346 | | 3,982 | |

| | | | | |

| Repayment of loans and borrowings | 8 | (515) | | (516) | | (6,108) | | (1,032) | |

| Repayment of convertible debenture | | — | | — | | — | | (61,867) | |

| Net principal payments of lease liabilities | | (1,193) | | (1,316) | | (2,577) | | (2,754) | |

| Restricted cash | 13 | — | | 1,759 | | (898) | | 2,004 | |

| | | | | |

| Shares issued for cash, net of issuance costs | | 126 | | (174) | | 126 | | 1,548 | |

| | | | | |

| | | | | |

| Net cash used in financing activities from discontinued operations | | (131) | | — | | (131) | | (89) | |

| Net cash provided by (used) in financing activities | | 3,962 | | 3,735 | | (3,242) | | (58,208) | |

| Effect of foreign exchange on cash and cash equivalents | | (5,999) | | 2,188 | | (5,936) | | 439 | |

| Decrease in cash and cash equivalents | | (30,566) | | (28,938) | | (28,518) | | (106,025) | |

| | | | | |

| Cash and cash equivalents, beginning of period | | 115,487 | | 157,855 | | 113,439 | | 234,942 | |

| Cash and cash equivalents, end of period | | 84,921 | | 128,917 | | 84,921 | | 128,917 | |

Supplemental cash flow information (Note 13)

The accompanying notes are an integral part of these Condensed Consolidated Interim Financial Statements.

(1) Comparative information has been adjusted due to discontinued operations see Note 6(b).

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 1 Nature of Operations

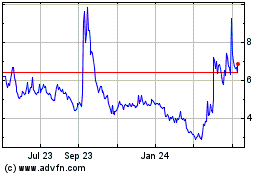

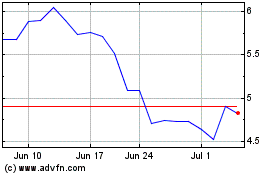

Aurora Cannabis Inc. (the “Company” or “Aurora”) was incorporated under the Business Corporations Act (British Columbia) on December 21, 2006 as Milk Capital Corp. Effective October 2, 2014, the Company changed its name to Aurora Cannabis Inc. The Company’s shares are listed on the Nasdaq Capital Market (“Nasdaq”) and the Toronto Stock Exchange (“TSX”) under the trading symbol “ACB”, and on the Frankfurt Stock Exchange (“FSE”) under the trading symbol “21P1”.

The Company’s head office and principal address is 2207 90B St. SW Edmonton, Alberta T6X 1V8. The Company’s registered and records office address is Suite 1700, 666 Burrard Street, Vancouver, British Columbia, Canada, V6C 2X8.

The Company’s principal strategic business lines are focused on the production, distribution and sale of cannabis related products in Canada and internationally. Aurora currently conducts the following key business activities in the jurisdictions listed below:

•Production, distribution and sale of medical and consumer cannabis products in Canada pursuant to the Cannabis Act;

•Distribution of wholesale medical cannabis in the European Union (“EU”) pursuant to the German Medicinal Products Act and German Narcotic Drugs Act; and

•Distribution of wholesale medical cannabis in various international markets, including Australia, New Zealand, the Caribbean, South America and Israel.

The Company has a 50.1% controlling interest in Bevo Agtech Inc. (“Bevo”), the sole parent of Bevo Farms Ltd., a key supplier of propagated vegetables and ornamental plants in North America.

These condensed consolidated interim financial statements were approved and authorized for issue by the Audit Committee of the Company on November 5, 2024.

Note 2 Material Accounting Policies and Judgments

(a) Basis of Presentation and Measurement

The condensed consolidated interim financial statements of the Company have been prepared in accordance with International Financial Reporting Standards (“IFRS”), and International Accounting Standards (“IAS”) 34, Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”). Unless otherwise noted, all amounts are presented in thousands of Canadian dollars, except share and per share data.

The condensed consolidated interim financial statements are presented in Canadian dollars and are prepared in accordance with the same accounting policies, critical estimates and methods described in the Company’s annual consolidated financial statements, except for the adoption of new accounting policies (Note 2(d)). Given that certain information and footnote disclosures, which are included in the annual audited consolidated financial statements, have been condensed or excluded in accordance with IAS 34, these condensed consolidated interim financial statements should be read in conjunction with our annual audited consolidated financial statements as at and for the year ended March 31, 2024, including the accompanying notes thereto.

(b) Basis of Consolidation

The condensed consolidated interim financial statements include the financial results of the Company and its subsidiaries. Subsidiaries include entities which are wholly-owned as well as entities over which Aurora has the authority or ability to exert control over the investee’s financial and/or operating decisions (i.e. control), which in turn may affect the Company’s exposure or rights to the variable returns from the investee. The condensed consolidated interim financial statements include the operating results of acquired or disposed entities from the date control is obtained or the date control is lost, respectively. All intercompany balances and transactions are eliminated upon consolidation.

The Company’s principal subsidiaries during the three and six months ended September 30, 2024 are as follows:

| | | | | | | | |

| Major subsidiaries | Percentage Ownership | Functional Currency |

| | |

| Aurora Cannabis Enterprises Inc. (“ACE”) | 100% | Canadian Dollar |

| Aurora Deutschland GmbH (“Aurora Deutschland”) | 100% | European Euro |

| TerraFarma Inc. | 100% | Canadian Dollar |

| Whistler Medical Marijuana Corporation (“Whistler”) | 100% | Canadian Dollar |

| Bevo Agtech Inc. (“Bevo”) | 50.1% | Canadian Dollar |

| CannaHealth Therapeutics Inc. | 100% | Canadian Dollar |

| ACB Captive Insurance Company Inc. | 100% | Canadian Dollar |

| Indica Industries Pty Ltd. (“MedReleaf Australia”) | 100% | Australian Dollar |

All shareholdings are of ordinary shares or other equity. Other subsidiaries, while included in the condensed consolidated interim financial statements, are not material and have not been reflected in the table above.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

(c) Discontinued Operations

The Company reports financial results for discontinued operations separately from continuing operations to distinguish the financial impact of disposal transactions from ongoing operations. Discontinued operations reporting occurs when the disposal of a component or a group of components of the Company represents a strategic shift that will have an impact on the Company’s operations and financial results, and where the operations and cash flows can be clearly distinguished, operationally and for financial reporting purposes, from the rest of the Company.

The results of discontinued operations are excluded from both continuing operations and business segment information in the condensed consolidated interim financial statements and the notes to the condensed consolidated interim financial statements, unless otherwise noted, and are presented net of tax in the condensed consolidated interim statements of income (loss) and comprehensive income (loss) for the current and comparative periods. Refer to Note 6(b) Discontinued Operations.

(d) Adoption of New Accounting Pronouncements

Amendments to IAS 1: Classification of Liabilities as Current or Non-current

The amendment clarifies the requirements relating to determining if a liability should be presented as current or non-current in the statement of financial position. Under the new requirement, the assessment of whether a liability is presented as current or non-current is based on the contractual arrangements in place as at the reporting date and does not impact the amount or timing of recognition. The amendment applies retrospectively for annual reporting periods beginning on or after January 1, 2024. The Company has applied the amendments effective April 1, 2024, retrospectively and it did not impact the classification of current or non-current liabilities.

(e) New Accounting Pronouncements Not Yet Adopted

The following IFRS standards have been recently issued by the IASB. Pronouncements that are irrelevant or not expected to have a significant impact have been excluded.

IFRS 18 Presentation and Disclosures in Financial Statements

IFRS 18, Presentation and Disclosures in Financial Statements, replaces IAS 1, Presentation of Financial Statements for reporting periods beginning on or after January 1, 2027, including for interim financial statements with retrospective application. IFRS 18, introduces a specified structure for the income statement by requiring income and expenses to be presented into the three defined categories of operating, investing and financing, and by specifying certain defined totals and subtotals.

Where company-specific measures related to the income statement are provided, IFRS 18 requires companies to disclose explanations around these measures, which are referred to as management defined performance measures. IFRS 18 also provides additional guidance on principles of aggregation and disaggregation which apply to the primary financial statements and the notes. IFRS 18 will not affect the recognition and measurement of items in the financial statements, nor will it affect which items are classified in other comprehensive income and how these items are classified. The Company is currently assessing the effect of this new standard on its financial statements.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 3 Biological Assets

The following is a breakdown of biological assets:

| | | | | | | | |

| September 30, 2024 | March 31, 2024 |

| $ | $ |

| Indoor cannabis production facilities | 22,995 | | 21,522 | |

| Plant propagation production facilities | 17,757 | | 21,252 | |

| Outdoor cannabis production facilities | 460 | | — | |

| 41,212 | | 42,774 | |

The changes in the carrying value of biological assets during the period are as follows:

| | | | | | |

| | |

| $ | |

| Balance, March 31, 2024 | 42,774 | | |

Production costs capitalized | 51,664 | | |

| | |

| Sale of biological assets | (30,617) | | |

| | |

| Foreign currency translation | 15 | | |

Changes in fair value less cost to sell due to biological transformation | 86,468 | | |

Transferred to inventory upon harvest | (109,092) | | |

| Balance, September 30, 2024 | 41,212 | | |

During the three and six months ended September 30, 2024, biological assets expensed to cost of sales of $8.0 million and $30.6 million, respectively, (three and six months ended September 30, 2023 – $6.0 million and $20.5 million, respectively) included $1.0 million and $4.9 million, respectively (three and six months ended September 30, 2023 – $2.7 million and $4.3 million, respectively) related to the changes in fair value of biological assets sold.

a) Indoor cannabis production facilities

The following table highlights the sensitivities and impact of changes in significant assumptions on the fair value of biological assets grown at indoor cannabis production facilities:

| | | | | | | | | | | | | | | | | |

| Significant inputs & assumptions | Range of inputs | Sensitivity | Impact on fair value |

September 30,

2024 | March 31, 2024 | September 30,

2024 | March 31, 2024 |

| Average selling price per gram | $5.74 | | $4.88 | | Increase or decrease of $1.00 per gram | $5,039 | | $5,490 | |

| Weighted average yield (grams per plant) | 70.48 | | 68.61 | | Increase or decrease by 5 grams per plant | $1,607 | | $1,538 | |

| Weighted average effective yield | 100 | % | 100 | % | Increase or decrease by 5% | $1,133 | | $1,057 | |

| Cost per gram to complete production | $1.20 | | $0.99 | | Increase or decrease of $1.00 per gram | $5,158 | | $5,619 | |

As of September 30, 2024, the weighted average fair value less cost to complete and cost to sell a gram of dried cannabis produced at the Company’s indoor cannabis cultivation facilities was $4.39 per gram (March 31, 2024 – $3.76 per gram).

During the three and six months ended September 30, 2024, the Company’s indoor cannabis biological assets produced 11,364,308 and 23,108,385 kilograms, respectively, of dried cannabis (September 30, 2023 – 12,691,568 and 22,276,724 kilograms, respectively).

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

b) Plant propagation production facilities

The following table highlights the sensitivities and impact of changes in significant assumptions on the fair value of biological assets grown at plant propagation production facilities:

| | | | | | | | | | | | | | | | | |

| Significant inputs & assumptions | Range of inputs | Sensitivity | Impact on fair value |

September 30,

2024 | March 31, 2024 | September 30,

2024 | March 31, 2024 |

| | | | | |

| Average selling price per floral/bedding plant | $10.06 | | $7.77 | | Increase or decrease by 10% | $1,513 | | $2,360 | |

| Average stage of completion in the production process | 57 | % | 59 | % | Increase or decrease by 10% | $1,204 | | $3,464 | |

As of September 30, 2024, the weighted average fair value less cost to complete and cost to sell per propagation plant was $2.87 per plant (March 31, 2024 – $2.87).

Note 4 Inventory

The following is a breakdown of inventory:

| | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | March 31, 2024 |

| Capitalized

cost | Fair value

adjustment | Carrying

value | Capitalized

cost | Fair value

adjustment | Carrying

value |

| $ | $ | $ | $ | $ | $ |

Harvested cannabis | | | | | | |

Work-in-process | 44,461 | | 50,141 | | 94,602 | | 25,977 | | 32,519 | | 58,496 | |

Finished goods | 21,600 | | 16,809 | | 38,409 | | 34,871 | | 10,782 | | 45,653 | |

| 66,061 | | 66,950 | | 133,011 | | 60,848 | | 43,301 | | 104,149 | |

Extracted cannabis | | | | | | |

Work-in-process | 10,316 | | 3,394 | | 13,710 | | 8,674 | | 4,428 | | 13,102 | |

Finished goods | 7,266 | | 557 | | 7,823 | | 8,749 | | 590 | | 9,339 | |

| 17,582 | | 3,951 | | 21,533 | | 17,423 | | 5,018 | | 22,441 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Supplies and consumables | 14,443 | | — | | 14,443 | | 14,987 | | — | | 14,987 | |

| | | | | | |

| Merchandise and accessories | 1,999 | | — | | 1,999 | | 2,025 | | — | | 2,025 | |

| | | | | | |

| | | | | | |

| Ending balance | 100,085 | | 70,901 | | 170,986 | | 95,283 | | 48,319 | | 143,602 | |

During the three and six months ended September 30, 2024, inventory expensed to cost of sales was $70.0 million and $133.7 million, respectively, (three and six months ended September 30, 2023 – $57.2 million and $120.2 million, respectively), which included $35.0 million and $64.2 million, respectively (three and six months ended September 30, 2023 – $16.0 million and $31.8 million, respectively) related to the changes in fair value of inventory sold.

During the three and six months ended September 30, 2024, the Company recognized $15.0 million and $30.8 million, respectively, in inventory provisions (three and six months ended September 30, 2023 – $21.1 million and $39.5 million, respectively) consisting of cost of sales of $3.5 million and $5.6 million, respectively (three and six months ended September 30, 2023 – $11.1 million and $19.1 million, respectively) and changes in fair value of inventory sold of $11.5 million and $25.2 million, respectively (three and six months ended September 30, 2023 – $10.0 million and $20.4 million, respectively).

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 5 Property, Plant and Equipment

The following summarizes the carrying values of property, plant and equipment for the periods reflected:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | March 31, 2024 |

| Cost | Accumulated depreciation | Impairment | Net book value | Cost | Accumulated depreciation | Impairment | Net book value |

| Owned assets | | | | | | | | |

| Land | 44,007 | | — | | — | | 44,007 | | 43,914 | | — | | — | | 43,914 | |

| Buildings | 240,460 | | (104,965) | | — | | 135,495 | | 242,052 | | (97,885) | | (300) | | 143,867 | |

| Construction in progress | 29,932 | | — | | — | | 29,932 | | 26,330 | | — | | (645) | | 25,685 | |

Computer software & equipment | 31,483 | | (30,496) | | — | | 987 | | 31,333 | | (30,135) | | — | | 1,198 | |

| Furniture & fixtures | 7,463 | | (6,505) | | — | | 958 | | 7,900 | | (6,444) | | — | | 1,456 | |

| Production & other equipment | 146,905 | | (111,613) | | (129) | | 35,163 | | 154,042 | | (106,370) | | (202) | | 47,470 | |

| Total owned assets | 500,250 | | (253,579) | | (129) | | 246,542 | | 505,571 | | (240,834) | | (1,147) | | 263,590 | |

| | | | | | | | |

| Right-of-use leased assets | | | | | | | | |

| Land | 13,890 | | (1,729) | | — | | 12,161 | | 13,890 | | (1,601) | | — | | 12,289 | |

| Buildings | 38,126 | | (20,647) | | — | | 17,479 | | 37,252 | | (16,640) | | (2,512) | | 18,100 | |

| Production & other equipment | 5,372 | | (5,072) | | — | | 300 | | 5,290 | | (4,945) | | — | | 345 | |

| Total right-of-use lease assets | 57,388 | | (27,448) | | — | | 29,940 | | 56,432 | | (23,186) | | (2,512) | | 30,734 | |

| Total property, plant and equipment | 557,638 | | (281,027) | | (129) | | 276,482 | | 562,003 | | (264,020) | | (3,659) | | 294,324 | |

The following summarizes the changes in the net book values of property, plant and equipment for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, March 31, 2024 | Additions | | Disposals | Other (1) | Depreciation | Impairment | Foreign currency translation | Balance, September 30, 2024 |

| Owned assets | | | | | | | | | |

| Land | 43,914 | | — | | | — | | — | | — | | — | | 93 | | 44,007 | |

| Buildings | 143,867 | | 465 | | | — | | (2,445) | | (6,192) | | — | | (200) | | 135,495 | |

| Construction in progress | 25,685 | | 7,393 | | | — | | (3,163) | | — | | — | | 17 | | 29,932 | |

Computer software & equipment | 1,198 | | 141 | | | — | | (3) | | (366) | | — | | 17 | | 987 | |

| Furniture & fixtures | 1,456 | | 33 | | | (12) | | (298) | | (249) | | — | | 28 | | 958 | |

Production & other equipment | 47,470 | | 603 | | | (55) | | (7,274) | | (5,533) | | (129) | | 81 | | 35,163 | |

| Total owned assets | 263,590 | | 8,635 | | | (67) | | (13,183) | | (12,340) | | (129) | | 36 | | 246,542 | |

| | | | | | | | | |

| Right-of-use leased assets | | | | | | | | |

| Land | 12,289 | | — | | | — | | — | | (128) | | — | | — | | 12,161 | |

| Buildings | 18,100 | | 5,991 | | | (562) | | (4,714) | | (1,495) | | — | | 159 | | 17,479 | |

Production & other equipment | 345 | | 115 | | | — | | (25) | | (141) | | — | | 6 | | 300 | |

Total right-of-use lease assets | 30,734 | | 6,106 | | | (562) | | (4,739) | | (1,764) | | — | | 165 | | 29,940 | |

Total property, plant and equipment | 294,324 | | 14,741 | | | (629) | | (17,922) | | (14,104) | | (129) | | 201 | | 276,482 | |

(1)Includes reclassification of construction in progress cost when associated projects are complete, transfers to assets held for sale, and remeasurement of right-of-use assets. (Note 6).

Depreciation relating to manufacturing equipment and production facilities for owned and right-of-use leased assets is capitalized to inventory and is expensed to cost of sales upon the sale of goods. During the three and six months ended September 30, 2024, the Company recognized $7.0 million and $14.1 million, respectively (three and six months ended September 30, 2023 – $8.9 million and $18.6 million, respectively) of depreciation expense of which $4.0 million and $8.4 million, respectively, (three and six months ended September 30, 2023 – $5.1 million and $10.6 million, respectively) was reflected in cost of sales.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 6 Assets and Liabilities Held for Sale and Discontinued Operations

(a) Assets and Liabilities Held for Sale

Assets held for sale are comprised of the following:

| | | | | | | | | |

| | | | | Total |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Balance, March 31, 2024 | | | | | 1,399 |

| | | | | |

| | | | | |

| Additions | | | | | 14,089 | |

| Impairment | | | | | (11,643) | |

| Foreign exchange | | | | | 34 | |

| Proceeds from disposal | | | | | (1,200) | |

| | | | | |

| Balance, September 30, 2024 | | | | | 2,679 |

In June 2024, the Company made a formal decision to exit from its operations in Uruguay that are operated through its wholly-owned subsidiary ICC Labs Inc. (“ICC”). Accordingly, ICC’s property, plant and equipment were reclassified to assets held for sale and its lease liability of $1.3 million was classified as liabilities held for sale.

On October 8, 2024, the Company entered into an Asset Sale Agreement for the sale of the majority of ICC’s property, plant and equipment in Uruguay. As at September 30, 2024, the Company is in advanced discussions to sell the remaining assets and liabilities held for sale by way of a share sale of ICC’s wholly owned operating subsidiary. As a result, the Company recognized an impairment loss of $11.6 million during the six months ended September 30, 2024 to record the assets held for sale at their fair value less costs to sell. ICC was previously included in the Cannabis operating segment. The impairment was recorded to net loss from discontinued operations on the interim consolidated statements of loss and comprehensive loss.

(b) Discontinued Operations

In connection with the closures of the Aurora Nordic facility, Reliva, the dissolution of its partnership in Growery B.V., and the decision to exit its ICC operations in Uruguay, the Company has reported these previously designated cash generating units as discontinued operations.

The following table summarizes the Company's condensed consolidated interim discontinued operations for the respective periods:

| | | | | | | | | | | | | | |

| Three months ended September 30, | Six months ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

| Revenue | 129 | | 419 | | 328 | | 875 | |

| | | | |

| Cost of sales | 2,018 | | 1,941 | | 1,714 | | 5,872 | |

| | | | |

| Changes in fair value of inventory and biological assets sold | — | | 5,269 | | — | | 5,632 | |

| Unrealized loss (gain) on changes in fair value of biological assets | — | | (5,175) | | — | | (4,411) | |

| Gross profit (loss) | (1,889) | | (1,616) | | (1,386) | | (6,218) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Operating expenses | 925 | | 1,247 | | 1,189 | | 2,259 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other expenses (income) | 183 | | (351) | | 118 | | (278) | |

| Impairment of property, plant, and equipment | 11,643 | | — | | 11,643 | | 85 | |

| Loss on disposal of discontinued operations | — | | — | | — | | 2,411 | |

| | | | |

| | | | |

| Income taxes | — | | 54 | | — | | 5 | |

| | | | |

| 12,751 | | 950 | | 12,950 | | 4,482 | |

| Net loss from discontinued operations | (14,640) | | (2,566) | | (14,336) | | (10,700) | |

| | | | |

| | | | |

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 7 Intangible Assets and Goodwill

The following is a continuity schedule of intangible assets and goodwill:

| | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | March 31, 2024 |

| Cost | Accumulated amortization | | Net book value | Cost | Accumulated amortization | Impairment | Net book value |

| Definite life intangible assets: | | | | | | | | |

| Customer relationships | 42,529 | | (37,490) | | | 5,039 | | 42,439 | | (37,349) | | — | | 5,090 | |

| Permits and licenses | 54,008 | | (53,971) | | | 37 | | 54,002 | | (43,305) | | (10,652) | | 45 | |

| Patents | 990 | | (793) | | | 197 | | 982 | | (793) | | — | | 189 | |

| Intellectual property and know-how | 52,590 | | (52,590) | | | — | | 52,590 | | (52,590) | | — | | — | |

| Software | 19,639 | | (18,102) | | | 1,537 | | 18,661 | | (16,408) | | (1,504) | | 749 | |

| Indefinite life intangible assets: | | | | | | | | |

| Brand | 7,500 | | — | | | 7,500 | | 28,200 | | — | | (20,700) | | 7,500 | |

| Permits and licenses | 27,788 | | — | | | 27,788 | | 27,277 | | — | | — | | 27,277 | |

| Total intangible assets | 205,044 | | (162,946) | | | 42,098 | | 224,151 | | (150,445) | | (32,856) | | 40,850 | |

| Goodwill | 43,180 | | — | | | 43,180 | | 43,180 | | — | | — | | 43,180 | |

| Total | 248,224 | | (162,946) | | | 85,278 | | 267,331 | | (150,445) | | (32,856) | | 84,030 | |

The following summarizes the changes in the net book value of intangible assets and goodwill for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | |

| Balance,

March 31, 2024 | | Additions | Other | Amortization | | Foreign currency translation | Balance, September 30, 2024 |

| Definite life intangible assets: | | | | | | | | |

| Customer relationships | 5,090 | | | — | | 90 | | (141) | | | — | | 5,039 | |

| Permits and licenses | 45 | | | — | | 35 | | (43) | | | — | | 37 | |

| Patents | 189 | | | 6 | | — | | — | | | 2 | | 197 | |

| | | | | | | | |

| Software | 749 | | | 1,055 | | (90) | | (177) | | | — | | 1,537 | |

Indefinite life intangible assets: | | | | | | | | |

| Brand | 7,500 | | | — | | — | | — | | | — | | 7,500 | |

| Permits and licenses | 27,277 | | | — | | (138) | | — | | | 649 | | 27,788 | |

| Total intangible assets | 40,850 | | | 1,061 | | (103) | | (361) | | | 651 | | 42,098 | |

| Goodwill | 43,180 | | | — | | — | | — | | | — | | 43,180 | |

| Total | 84,030 | | | 1,061 | | (103) | | (361) | | | 651 | | 85,278 | |

Goodwill arising from business combinations were allocated to the Cannabis segment and Plant Propagation segment for $24.5 million and $18.7 million, respectively (March 31, 2024 – $24.5 million and $18.7 million, respectively).

On February 7, 2024, a wholly owned subsidiary of the Company acquired the remaining 90.43% interest in Indica Industries Pty Ltd (“MedReleaf Australia” or “MRA”) an Australian domiciled company, for total purchase price consideration of approximately $44.7 million (AUS$51.0 million), comprised of cash consideration of approximately $8.2 million (AUS$9.5 million) and issuance of Common Shares of 6,948,994 with a fair value of $36.5 million (AUS$41.6 million). As at March 31, 2024 the initial purchase price was provisionally allocated based on the Company’s estimated fair value of the identifiable assets acquired and the liabilities assumed on the acquisition date. As at September 30, 2024, the purchase price allocation has been finalized with no material adjustments.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 8 Loans and Borrowings

On August 25, 2022, through the acquisition of a controlling interest of 50.1% in Bevo, the Company acquired the loans under Bevo’s credit facility (the “Credit Agreement”). The Credit Agreement includes two term loans (“Term Facility 1” and “Term Facility 2”) for a total of $52.6 million and a revolver of $18.0 million.

The changes in the carrying value of current and non-current credit facilities are as follows:

| | | | | | |

| Credit facilities | |

| $ | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Balance, March 31, 2024 | 57,259 | | |

| | |

| Drawings | 6,346 | | |

| | |

| | |

| Interest accretion | 13 | | |

| | |

| Principal repayments | (6,108) | | |

Balance, September 30, 2024 | 57,510 | | |

| Current portion | (53,689) | | |

| Long-term portion | 3,821 | | |

Term Facility 1

Term Facility 1 represents the three tranches of advances which are now consolidated and have been fully drawn upon. The Company makes quarterly principal payments of $0.5 million. Any remaining principal balance will be due at maturity on January 21, 2025. As at September 30, 2024, the total amount drawn from Term Facility 1 was $34.5 million (March 31, 2024 – $35.5 million) with a borrowing rate of 7.7%. The Company is currently in discussions with the lender to enter into an amendment for the Term Facility 1 to extend the maturity date.

Term Facility 2

On October 20, 2023, the Company entered into an amendment to the Credit Agreement to include an additional term loan (“Term Facility 2”) with multiple advances for up to $16.0 million and a maturity date of October 20, 2026, specifically to fund capital expansion. The Company makes quarterly principal payments based on the amount withdrawn. As at September 30, 2024, the total amount drawn from Term Facility 2 was $4.0 million (March 31, 2024 – $2.8 million) with a borrowing rate of 7.6%.

Revolver

The revolver provides available aggregate borrowings of up to $18.0 million. Interest payments are based on prime plus a margin that ranges between 0.25% and 1.75%. As at September 30, 2024, the total amount drawn from the revolver was $16.5 million (March 31, 2024 – $16.8 million), with a borrowing rate of 7.7%.

Creditor Agreement

On March 18, 2024, the Company entered into an unsecured Pari Passu Creditor Agreement (“Creditor Agreement”) with Bevo, in which participating shareholders of Bevo provided funds pursuant to the Creditor Agreement. The Creditor Agreement was for a total loan of $5.0 million and bears interest at a rate of 14.0% per annum. The principal and accrued interest are due on May 31, 2025. The Company advanced funds of $2.5 million, which are eliminated upon consolidation.

During the three and six months ended September 30, 2024, total interest expense for loans and borrowings of $1.3 million and $2.6 million, respectively (three and six months ended September 30, 2023 – $0.8 million and $1.6 million, respectively) was recognized as finance and other costs in the condensed consolidated interim statements of loss and comprehensive loss. Accrued interest of $0.2 million (March 31, 2024 - nil) is recorded in accounts payable and accrued liabilities on the condensed consolidated interim statements of financial position.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 9 Lease Liabilities

The changes in the carrying value of current and non-current lease liabilities are as follows:

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Balance, March 31, 2024 | | 47,532 | |

| Lease additions | | 6,106 | |

| | |

| Lease payments | | (4,187) | |

Transfer to liabilities held for sale (Note 6(a)) | | (1,326) | |

| Lease modifications | | (6,418) | |

| Foreign exchange | | 158 | |

| Interest accretion | | 1,595 | |

| | |

| Balance, September 30, 2024 | | 43,460 | |

| Current portion | | (5,063) | |

| Long-term portion | | 38,397 | |

Note 10 Share Capital

(a) Authorized

The authorized share capital of the Company is comprised of the following:

i.Unlimited number of common voting shares without par value.

ii.Unlimited number of Class “A” Shares each with a par value of $1.00.

iii.Unlimited number of Class “B” Shares each with a par value of $5.00.

(b) Shares Issued and Outstanding

At September 30, 2024, 54,862,958 Common Shares (March 31, 2024 – 54,545,797) were issued and outstanding. As at September 30, 2024, no Class “A” Shares and no Class “B” Shares were issued and outstanding.

(c) Share Purchase Warrants

A summary of warrants outstanding is as follows:

| | | | | | | | |

| Warrants | Weighted Average Exercise Price |

| # | $ |

| | |

| | |

| | |

| Balance, March 31, 2024 | 7,074,348 | | 44.34 |

| | |

| | |

| Expired | (8,321) | | 487.95 |

| Balance, September 30, 2024 | 7,066,027 | | 43.74 |

The following summarizes the warrant derivative liabilities:

| | | | | | | | | | | | | | | | | |

| | | | | | | | U.S.$ equivalent |

| | | June

2022 Offering | | | | | June

2022 Offering | |

| | | $ | | | | | $ | |

| Balance, March 31, 2024 | | | 476 | | | | | | 353 | | |

| | | | | | | | | |

| | | | | | | | | |

| Unrealized gain on derivative liability | | | (1) | | | | | | — | | |

Balance, September 30, 2024 | | | 475 | | | | | | 353 | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

The following table summarizes the warrants that remain outstanding as at September 30, 2024:

| | | | | | | | |

| Exercise Price ($) | Expiry Date | Warrants (#) |

$43.25 | June 1, 2025 | 7,040,875 | |

$111.06 - $418.80 | October 21, 2024 - November 30, 2025 | 25,152 | |

| | 7,066,027 | |

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 11 Share-Based Compensation

At the Company’s Annual General and Special Meeting held on November 13, 2017 (“2017 AGM”), shareholders approved the adoption of the Option Plan, the Restricted Share Unit Plan (the “RSU Plan”), the Deferred Share Unit Plan (the “DSU Plan”) and the Performance Share Unit Plan (the “PSU Plan”), together the “Share-based Compensation Plans”, which were subsequently amended and approved by shareholders at the Company’s Annual General and Special Meeting held on August 9, 2024 (“2024 AGM”). The amendments include reducing the Share-based Compensation Plans from 10.0% “rolling” plan to 9.5% “rolling” plan, and therefore, the number of Common Shares issuable under all Share based Compensation Plans cannot exceed 9.5% of the total number of issued and outstanding Common Shares and a rolling limit for all full value award plans of the Company of 5.0%, which includes RSU, PSU and DSU plans.

(a) Stock Options

The Option Plan amendments provides the right for directors, officers, employees and consultants to purchase shares at a specified price (exercise price) in the future. The stock options have a service requirement of three years and are amortized on an accelerated basis over that period and expire after five years.

A summary of stock options outstanding is as follows:

| | | | | | | | |

| Stock

options (#) | Weighted average exercise price ($) |

| | |

| | |

| | |

| | |

| | |

| Balance, March 31, 2024 | 1,186,824 | | 104.90 |

| Granted | 749,161 | | 7.60 | |

| Exercised | (27,465) | | 7.60 | |

| Expired | (33,704) | | 696.96 | |

| Forfeited | (20,284) | | 13.12 | |

| Balance, September 30, 2024 | 1,854,532 | | 60.56 |

The following table summarizes the stock options that are outstanding as at September 30, 2024:

| | | | | | | | | | | | | | |

| Exercise Price ($) | Expiry Date | Weighted average remaining life | Options outstanding (#) | Options exercisable (#) |

7.59 - 23.80 | May 31, 2027 - September 19, 2029 | 4.05 | 1,642,837 | | 395,838 | |

48.60 - 272.40 | January 10, 2025 - February 28, 2027 | 1.59 | 147,848 | | 147,848 | |

565.20 - 667.20 | October 3, 2024 - November 13, 2024 | 0.10 | 63,847 | | 63,847 | |

| | | | |

| | | 1,854,532 | | 607,533 | |

During the three and six months ended September 30, 2024, stock option expense of $0.8 million and $1.6 million, respectively (three and six months ended September 30, 2023 – $1.0 million and $1.5 million, respectively) was recognized in share-based compensation on the condensed consolidated interim statement of loss and comprehensive loss.

Stock options granted during the respective periods highlighted below were fair valued based on the following weighted average assumptions:

| | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Six months ended September 30, |

| 2024 | 2023 | | | 2024 | 2023 |

Risk-free annual interest rate (1) | 2.84 | % | n/a | | | 3.70 | % | 4.34 | % |

| Expected annual dividend yield | — | % | n/a | | | — | % | — | % |

Expected stock price volatility (2) | 97.23 | % | n/a | | | 81.19 | % | 85.06 | % |

Expected life of options (years) (3) | 2.88 | n/a | | | 2.97 | 2.67 |

| Forfeiture rate | 10.50 | % | n/a | | | 11.20 | % | 19.63 | % |

| Weighted Average Value | $ | 4.80 | | n/a | | | $ | 4.12 | | $ | 4.10 | |

| | | | | | |

(1)The risk-free rate is based on Canada government bonds with a remaining term equal to the expected life of the options.

(2)Volatility was estimated by using the average historical volatilities of the Company and certain companies in the same industry.

(3)The expected life in years represents the period of time that options granted are expected to be outstanding.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

(b) Restricted Share Units (“RSU”)

The RSU Plan was designed to provide certain executive officers and other key employees of the Company and its subsidiaries with the opportunity to acquire RSUs of the Company in order to enable them to participate in the long-term success of the Company and to promote a greater alignment of their interests with the interests of the shareholders. Under the terms of the RSU Plan, officers, employees and consultants of the Company may be granted RSUs that are released as Common Shares upon completion of the vesting period. Each RSU gives the participant the right to receive one common share of the Company. The RSUs have a service requirement of three years and are amortized on an accelerated basis over that period and expire after three years.

A summary of the RSUs outstanding are as follows:

| | | | | | |

| RSUs | |

| # | |

| | |

| | |

| | |

| | |

| | |

| Balance, March 31, 2024 | 797,689 | | |

| Granted | 378,369 | | |

| Vested | (310,996) | | |

| Forfeited | (31,938) | | |

| | |

| Balance, September 30, 2024 | 833,124 | | |

During the three and six months ended September 30, 2024, RSU expense of $1.5 million and $2.7 million, respectively (three and six months ended September 30, 2023 – $2.1 million and $3.4 million, respectively) was recognized in share-based compensation on the condensed consolidated interim statements of loss and comprehensive loss.

(c) Deferred Share Units (“DSU”)

Under the terms of the Company’s 2024 DSU Plan, non-employee directors of the Company may be granted DSUs. Each non-employee director is entitled to redeem their DSUs for period of 90 days following their termination date, being the date of their retirement from the Board. The DSUs can be redeemed, at the Company’s sole discretion, for (i) cash; (ii) Common Shares issued from treasury; (iii) common shares purchased in the open market; or (iv) any combination of the foregoing. DSUs vest immediately upon grant and have no expiry date.

| | | | | | |

| DSUs | |

| # | |

| | |

| | |

| | |

| | |

| | |

| Balance, March 31, 2024 | 277,206 | | |

| Issued | 72,695 | | |

| | |

| | |

| | |

| Balance, September 30, 2024 | 349,901 | | |

During the three and six months ended September 30, 2024, the Company recognized a total DSU expense of $0.7 million and $1.1 million, respectively (three and six months ended September 30, 2023 – $0.4 million and $0.7 million, respectively) in share-based compensation on the condensed consolidated interim statements of loss and comprehensive loss.

(d) Performance Share Units (“PSUs”)

Under the terms of the Company’s 2024 PSU Plan, officers, employees and consultants of the Company may be granted PSUs that are released as Common Shares or are paid in cash to the participant equal to the market price of common shares on the entitlement date multiplied by the number of performance share units being settled. In each case upon the 3-year cliff vesting date the performance shares units are subject to performance conditions multiplied by the achieved performance ratio. If the performance criteria are not met at the time of vesting the PSU will be deemed as expired. The PSUs have a three years cliff vesting structure and are amortized on a straight line basis over the three year period and expire after three years.

A summary of the PSUs outstanding is as follows:

| | | | | | |

| PSUs | |

| # | |

| | |

| | |

| | |

| | |

| | |

| Balance, March 31, 2024 | 700,880 | | |

Granted(1) | 606,115 | | |

| | |

| Cancelled | (25,450) | | |

| Expired | (3,309) | | |

| Balance, September 30, 2024 | 1,278,236 | | |

(1)Includes PSUs issued under cash settlement plan Note 11(e).

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

During the three and six months ended September 30, 2024, the Company recognized a total PSU expense of $1.4 million and $2.1 million, respectively (three and six months ended September 30, 2023 – $1.0 million and $1.2 million, respectively) in share-based compensation on the condensed consolidated interim statements of loss and comprehensive loss.

PSUs granted during the respective periods highlighted below were fair valued based on the following weighted average assumptions:

| | | | | | | | | | | | | | |

| Three months ended September 30, | Six months ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

Risk-free annual interest rate (1) | 3.54 | % | n/a | 3.75 | % | 4.76 | % |

| Dividend yield | — | % | n/a | — | % | — | % |

Expected stock price volatility (2) | 98.23 | % | n/a | 96.20 | % | 90.65 | % |

Expected stock price volatility of peer group (2) | 80.18 | % | n/a | 89.27 | % | 91.51 | % |

Expected life of options (years) (3) | 3 | n/a | 3 | 3 |

| Forfeiture rate | 3.63 | % | n/a | 15.14 | % | 12.45 | % |

Equity correlation against peer group (4) | 39.90 | % | n/a | 38.73 | % | 39.14 | % |

| | | | |

(1)The risk-free rate is based on Canada government bonds with a remaining term equal to the expected life of the PSUs.

(2)Volatility was estimated by using the 20-day VWAP historical volatility of Aurora and the peer group of companies.

(3)The expected life in years represents the period of time that the PSUs granted are expected to be outstanding.

(4)The equity correlation is estimated by using 1-year historical equity correlations for the Company and the peer group of companies.

The weighted average fair value of PSUs granted during the three and six months ended September 30, 2024 was $10.77 and $10.92 per unit, respectively (three and six months ended September 30, 2023 – $11.14 per unit and $11.14 per unit).

(e) Cash Settled DSUs and PSUs

During the three and six months ended September 30, 2024, the Company issued DSU’s and PSU’s which will be settled in cash, pursuant to the Performance Share Unit and Restricted Share Unit Long-Term Cash Settled Plan and Non-Employee Directors Deferred Share Unit Cash Plan, respectively. The DSUs and PSUs issued under these plans are included in the continuities above.

The DSUs subject to cash settlement are classified as a derivative liability in the condensed consolidated interim statement of financial position and are initially measured at fair value. DSUs are issued in recognition of past service for Directors and are expensed immediately at fair value to share-based compensation expense in the condensed consolidated interim statements of loss and comprehensive loss. The DSUs are remeasured each reporting period with the difference recorded to share-based compensation expense. Upon settlement, the DSU’s are remeasured and the derivative liability is extinguished at the remeasured amount. As at September 30, 2024, the related derivative liability was $2.3 million (March 31, 2024 - $1.2 million).

The PSUs subject to cash settlement are classified as a derivative liability in the condensed consolidated interim statement of financial position. They are initially measured at fair value using a Monte Carlo simulation model. The PSUs have a service requirement of three years and are amortized ratably over that period. The PSUs are remeasured at fair value each reporting period with the change in value reflected in share-based compensation expense. As at September 30, 2024, the related derivative liability was $1.9 million (March 31, 2024 - $0.6 million).

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 12 Income (Loss) Per Share

The following is a reconciliation of basic loss per share:

| | | | | | | | | | | | | | |

| Three months ended September 30, | Six months ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

| Net income (loss) from continuing operations attributable to Aurora shareholders | $2,599 | | $2,043 | | $8,815 | | ($16,721) | |

Net loss from discontinued operations attributable to Aurora shareholders | ($14,640) | | ($2,566) | | ($14,336) | | ($10,700) | |

Net loss attributable to Aurora shareholders | ($12,041) | | ($523) | | ($5,521) | | ($27,421) | |

| | | | |

| Weighted average number of Common Shares outstanding | 54,682,990 | | 38,397,066 | | 54,617,817 | | 36,876,464 | |

| | | | |

Basic and diluted earnings (loss) per share, continuing operations | $0.05 | | $0.05 | | $0.16 | | ($0.45) | |

Basic loss per share, discontinued operations | ($0.27) | | ($0.07) | | ($0.26) | | ($0.29) | |

Basic loss per share | ($0.22) | | ($0.01) | | ($0.10) | | ($0.74) | |

The following is a reconciliation of diluted earnings per share:

| | | | | | | | | | | | | | |

| Three months ended September 30, | Six months ended September 30, |

| 2024 | 2023 | 2024 | 2023(1) |

| Net income (loss) from continuing operations attributable to Aurora shareholders | $2,599 | | $2,043 | | $8,815 | | ($16,721) | |

| | | | |

| | | | |

| | | | |

| Weighted average number of Common Shares outstanding | 54,682,990 | | 38,397,066 | | 54,617,817 | | 36,876,464 | |

| | | | |

| Dilutive shares outstanding | | | | |

| Stock options | 84,275 | | 18,912 | | 94,447 | | — | |

| RSUs | 1,052,474 | | 943,998 | | 999,113 | | — | |

| DSUs | 71,398 | | 336,545 | | 71,398 | | — | |

| PSUs | 427,971 | | 104,049 | | 375,092 | | — | |

| | | | |

| 1,636,118 | | 1,403,504 | | 1,540,050 | | — | |

| | | | |

| Weighted average dilutive Common Shares | 56,319,108 | | 39,800,570 | | 56,157,867 | | 36,876,464 | |

| | | | |

Diluted earnings per share, continuing operations(2) | $0.05 | | $0.05 | | $0.16 | | ($0.45) | |

(1)Diluted earnings per share is not applicable when the impact will decrease loss per share or increase earnings per share.

(2)Diluted earnings per share is not applicable on discontinued operations.

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

Note 13 Supplemental Cash Flow Information

The changes in non-cash working capital are as follows:

| | | | | | | | | | | | | | |

| Three months ended September 30, | Six months ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

| | | $ | $ |

| Accounts receivable | (8,736) | | (7,265) | | 9,086 | | 977 | |

| Biological assets | (16,477) | | (12,389) | | (20,928) | | (16,726) | |

| Inventory | 9,369 | | 14,976 | | 14,746 | | 30,820 | |

| Prepaid and other current assets | (1,859) | | 2,130 | | (1,903) | | 477 | |

| Accounts payable and accrued liabilities | (12,225) | | (11,386) | | (21,094) | | (26,211) | |

| Income taxes payable | 363 | | (285) | | 857 | | — | |

| Deferred revenue | 167 | | (562) | | 332 | | (367) | |

| | | | |

| Provisions | (190) | | — | | (2) | | — | |

| | | | |

| Other current liabilities | — | | — | | — | | 63 | |

| Changes in non-cash working capital | (29,588) | | (14,781) | | (18,906) | | (10,967) | |

Additional supplementary cash flow information is as follows:

| | | | | | | | | | | | | | |

| Three months ended September 30, | Six months ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

| | | $ | $ |

Property, plant and equipment in accounts payable | (682) | | 221 | | (682) | | (1,839) | |

| Right-of-use asset additions | 58 | | — | | 6,106 | | (859) | |

Capitalized borrowing costs | — | | — | | — | | 7,110 | |

| Amortization of prepaids | 3,145 | | 3,769 | | 6,184 | | 8,753 | |

| Interest paid | 514 | | 4,506 | | 1,701 | | 6,922 | |

Interest received | (1,767) | | (661) | | (4,268) | | (1,524) | |

| Income taxes paid | 928 | | — | | 928 | | — | |

Included in restricted cash as of September 30, 2024 is $3.4 million (March 31, 2024 – $3.4 million) attributed to collateral held for letters of credit and corporate credit cards, $0.8 million (March 31, 2024 – $0.8 million) related to the MedReleaf Australia acquisition, $22.6 million (March 31, 2024 – $22.7 million) for self-insurance, $0.1 million (March 31, 2024 – $0.1 million) attributed to international subsidiaries, and $39.7 million (March 31, 2024 – $38.8 million) of funds reserved for the segregated cell program for insurance coverage.

Note 14 Commitments and Contingencies

(a)Claims and Litigation

From time to time, the Company and/or its subsidiaries may become defendants in legal actions and the Company intends to take appropriate action with respect to any such legal actions, including by defending itself against such legal claims as necessary. Other than the claims described below, as of the date of this report, Aurora is not aware of any other material or significant claims against the Company.

On November 21, 2019, a purported class action proceeding was commenced in the United States District Court for the District of New Jersey against the Company and certain of its current and former directors and officers on behalf of persons or entities who purchased, or otherwise acquired, publicly traded Aurora securities between October 23, 2018 and February 6, 2020. The parties have received preliminary approval of a $8 million settlement, which will be covered by insurance.

On June 16, 2020, the Company and its subsidiary, ACE, were named in a purported class action proceeding in the Province of Alberta in relation to the alleged mislabeling of cannabis products with inaccurate THC/CBD content. The class action involved a number of other parties including Aleafia Health Inc., Hexo Corp, Tilray Canada Ltd., among others. The plaintiffs have filed a Discontinuance of Claim for this matter, as such, this claim is no longer active.

On June 15, 2020, a claim was filed with the King's Bench of Alberta by a party to a former term sheet against Aurora and a former officer alleging a claim of breach of obligations under said term sheet, with the plaintiff seeking $18.0 million in damages. While this matter is ongoing, the Company believes the action to be without merit and intends to defend the claim.

On August 10, 2020, a purported class action lawsuit was filed with the King's Bench of Alberta against Aurora and certain executive officers in the Province of Alberta on behalf of persons or entities who purchased, or otherwise acquired, publicly traded Aurora securities and allegedly

AURORA CANNABIS INC.

Notes to the Condensed Consolidated Interim Financial Statements

Three and six months ended September 30, 2024 and 2023

(Amounts reflected in thousands of Canadian dollars, except share and per share amounts)

suffered losses as a result of Aurora releasing statements containing misrepresentations during the period of September 11, 2019 and December 21, 2019. Plaintiff and Defendant have each prepared factums for a leave application. Prior to the hearing, Defendants filed a request for adjournment and leave to amend their pleadings. The amended Statement of Claim was filed on March 8, 2024. The Company has filed a motion to strike the amendment. The Company’s motion to strike will be heard the week of November 18, 2024. The Company disputes the allegations and intends to vigorously defend against the claims. Estimating an amount or range of possible losses resulting from litigation proceedings is inherently difficult, particularly where the matters involve indeterminate claims for monetary damages and are in the stages of the proceedings where key factual and legal issues have not been resolved. For these reasons, the Company is currently unable to predict the ultimate timing or outcome of or reasonably estimate the possible losses or a range of possible losses resulting from the matter described above.