Signify reports third quarter sales of EUR 1.9 billion, comparable

sales growth of 4.3% and an operational profitability of 10.4%

Press Release

October 28, 2022

Signify reports third quarter sales of EUR 1.9 billion,

comparable sales growth of 4.3% and an operational profitability of

10.4%

Third quarter

20221

- Signify's installed base of connected light points increased

from 103 million in Q2 22 to 109 million in Q3 22

- Sales of EUR 1,912 million; nominal sales increase of 16.3% and

CSG of 4.3%

- LED-based sales represented 83% of total sales (Q3 21:

83%)

- Adj. EBITA margin of 10.4% (Q3 21: 11.1%)

- Net income of EUR 112 million (Q3 21: EUR 94 million)

- Free cash flow of EUR 135 million (Q3 21: EUR 85 million)

- Net debt/EBITDA ratio of 1.5x (Q3 21: 1.8x)

Eindhoven, the Netherlands – Signify (Euronext:

LIGHT), the world leader in lighting, today announced the company’s

third quarter 2022 results.

“In the third quarter, we delivered solid topline growth in an

increasingly volatile environment. The strong performance of our

professional business compensated lower consumer demand and the

continued slowdown in China. We managed to improve profitability

compared to the second quarter despite the impact of energy costs

and currency movements. As expected, our free cash flow generation

strengthened, driven by improved profitability and the

stabilization of our working capital. Given the uncertain near-term

outlook, the continued softness of the consumer segment and of the

Chinese market, we now expect to achieve comparable sales growth

between 2% and 3% for the full year 2022. Regarding the adjusted

EBITA margin and free cash flow, we are targeting the lower end of

both guidance ranges,” said CEO Eric Rondolat.

“As we enter the final quarter of 2022, we have shifted gears to

adapt the company to a structurally weaker external environment in

the coming quarters, when current headwinds and volatility are

likely to persist. We will therefore focus on measures to control

costs and cash flow, in line with our track record of delivering

margin expansion and strong free cash flow generation in difficult

environments. While some areas will be more affected, connected

energy efficient lighting solutions will continue to benefit from

strong demand given the energy prices surge.”

Brighter Lives, Better World 2025

In the third quarter of the year, Signify continued to deliver

on its Brighter Lives, Better World 2025 sustainability program

commitments that contribute to doubling its positive impact on the

environment and society.

- Double

the pace of the Paris Agreement:Cumulative carbon

reduction over the value chain is on track, mainly driven by

energy-efficient and connected LED lighting

- Double Circular revenues

to 32%:Circular revenues were at 30% and on track. This

positive trend is driven by serviceable and circular

luminaires

- Double Brighter lives

revenues to 32%:Brighter lives revenues increased to 28%,

mainly driven by the Safety & security and consumer well-being

portfolios

- Double the percentage of

women in leadership positions to 34%:The percentage of

women in leadership positions was 27%, stable with Q2. Signify

continued to create action plans to address gaps and accelerate its

progress. In addition, Signify published its first-ever Diversity,

Equity, and Inclusion report.

Outlook

Given the uncertain near-term outlook and the continued softness

both of the consumer segment and of the Chinese market, we now

expect to achieve comparable sales growth between 2% and 3% for the

full year 2022. We are targeting the lower end of the range for

both the 11.0-11.4% Adjusted EBITA margin guidance and the 5-7%

free cash flow guidance.

Financial review

|

Third quarter |

|

Nine months |

|

2021 |

2022 |

change |

in millions of EUR, except percentages |

2021 |

2022 |

change |

|

|

|

4.3 % |

Comparable sales growth |

|

|

5.3 % |

| |

|

8.1 % |

Effects of currency movements |

|

|

6.6 % |

| |

|

4.0 % |

Consolidation and other changes |

|

|

2.2 % |

|

1,643 |

1,912 |

16.3 % |

Sales |

4,852 |

5,536 |

14.1 % |

|

634 |

713 |

12.6 % |

Adjusted gross margin |

1,909 |

2,072 |

8.6 % |

|

38.6% |

37.3% |

|

Adj. gross margin (as % of sales) |

39.3% |

37.4% |

|

| |

|

|

|

|

|

|

|

-415 |

-471 |

|

Adj. SG&A expenses |

-1,262 |

-1,392 |

|

|

-68 |

-75 |

|

Adj. R&D expenses |

-210 |

-219 |

|

|

-483 |

-546 |

-13.0 % |

Adj. indirect costs |

-1,473 |

-1,611 |

-9.4 % |

|

29.4% |

28.6% |

|

Adj. indirect costs (as % of sales) |

30.4% |

29.1% |

|

| |

|

|

|

|

|

|

|

182 |

199 |

9.1 % |

Adjusted EBITA |

530 |

560 |

5.8 % |

|

11.1% |

10.4% |

|

Adjusted EBITA margin |

10.9% |

10.1% |

|

|

-34 |

-6 |

|

Adjusted items |

-130 |

118 |

|

|

149 |

193 |

29.7 % |

EBITA |

399 |

678 |

69.9 % |

| |

|

|

|

|

|

|

|

118 |

161 |

36.3 % |

Income from operations (EBIT) |

309 |

582 |

88.5 % |

|

-4 |

-17 |

|

Net financial income/expense |

-20 |

-12 |

|

|

-20 |

-32 |

|

Income tax expense |

-52 |

-123 |

|

|

94 |

112 |

18.4 % |

Net income |

236 |

447 |

89.0 % |

| |

|

|

|

|

|

|

|

85 |

135 |

|

Free cash flow |

357 |

81 |

|

|

0.72 |

0.86 |

|

Basic EPS (€) |

1.84 |

3.52 |

|

|

37,069 |

34,273 |

|

Employees (FTE) |

37,069 |

34,273 |

|

Third quarterSales increased by 16.3% to EUR

1,912 million, with a comparable sales growth of 4.3%, as continued

strength in the professional channel more than offset weaker

consumer channel sales. Nominal sales included a positive currency

effect of 8.1%, mainly from the appreciation of the USD, and a

positive effect of 4.0% from the Q2 acquisitions of Fluence and

Pierlite.

The Adjusted gross margin decreased by 130 bps to 37.3%. While

continued price increases more than offset the input cost increases

and the surge in energy costs, the Adjusted gross margin was

impacted by an adverse currency effect. Adjusted indirect costs as

a percentage of sales decreased by 80 bps to 28.6%, driven by

operating leverage and strengthened cost discipline.

Adjusted EBITA was EUR 199 million, up 9.1% vs. Q3 2021. The

Adjusted EBITA margin decreased by 70 bps to 10.4%, with price

increases more than offsetting higher input costs. Yet, the

Adjusted EBITA margin was negatively affected by a 220bps currency

effect, being the combination both from the weakening of the EUR

versus the USD and CNY, and from a temporary FX hedging headwind.

Excluding this temporary adverse hedging effect, the Adjusted EBITA

margin was stable vs Q3 21.

Adjusted items were EUR -6 million. Restructuring costs

decreased year on year to EUR -6 million, while acquisition-related

charges of EUR -10 million were fully compensated by incidental

items of EUR 10 million. The incidental items benefited from a

release of tax indemnification liabilities. Net income increased by

18.4% from EUR 94 million to EUR 112 million.

The number of employees (FTE) decreased from 37,069 at the end

of Q3 21 to 34,273 at the end of Q3 22. The employee base was

exceptionally high in Q3 21, due to the strong volume recovery and

additional staff requirements in factories, following the peak of

the COVID-19 pandemic. The number of FTEs is affected by

fluctuations in volume and seasonality.

1 This press release contains certain

non-IFRS financial measures and ratios, such as comparable sales

growth, EBITA, adjusted EBITA and free cash flow, and related

ratios, which are not recognized measures of financial performance

or liquidity under IFRS. For a reconciliation of these non-IFRS

financial measures to the most directly comparable IFRS financial

measures, see appendix B, Reconciliation of non-IFRS financial

measures, of this press release.

For the full and original version of the press release click

hereFor the presentation click here

Conference call and audio webcastEric Rondolat

(CEO) and Javier van Engelen (CFO) will host a conference call for

analysts and institutional investors at 9:00 a.m. CET to discuss

the third quarter 2022 results. A live audio webcast of the

conference call will be available via the Investor Relations

website.

Financial calendar 2023January

27, 2023 Fourth quarter and full-year results

2022February 28, 2023 Annual Report 2022

For further information, please

contact:Signify Investor RelationsThelke

GerdesTel: +31 6 1801 7131E-mail: thelke.gerdes@signify.com

Signify Corporate

CommunicationsLeanne CarmodyTel: +31 6 3928 0201

E-mail: leanne.carmody@signify.com

Abigail LeveneTel: +31 6 2939 3895E-mail:

abigail.levene@signify.com

About SignifySignify (Euronext: LIGHT) is the

world leader in lighting for professionals and consumers and

lighting for the Internet of Things. Our Philips products, Interact

connected lighting systems and data-enabled services, deliver

business value and transform life in homes, buildings and public

spaces. In 2021, we had sales of EUR 6.9 billion, approximately

37,000 employees and a presence in over 70 countries. We unlock the

extraordinary potential of light for brighter lives and a better

world. We achieved carbon neutrality in 2020, have been in the Dow

Jones Sustainability World Index since our IPO for five consecutive

years and were named Industry Leader in 2017, 2018 and 2019. News

from Signify is located at the Newsroom, Twitter, LinkedIn and

Instagram. Information for investors can be found on the Investor

Relations page.

Important Information

Forward-Looking Statements and Risks &

UncertaintiesThis document and the related oral

presentation contain, and responses to questions following the

presentation may contain, forward-looking statements that reflect

the intentions, beliefs or current expectations and projections of

Signify N.V. (the “Company”, and together with its subsidiaries,

the “Group”), including statements regarding strategy, estimates of

sales growth and future operational results.

By their nature, these statements involve risks and

uncertainties facing the Company and its Group companies, and a

number of important factors could cause actual results or outcomes

to differ materially from those expressed in any forward-looking

statement as a result of risks and uncertainties. Such risks,

uncertainties and other important factors include but are not

limited to: adverse economic and political developments, in

particular the impacts of the Russia-Ukraine conflict, the energy

crisis in Europe, the impacts of COVID-19, supply chain

constraints, component shortages, cost inflation, rapid

technological change, competition in the general lighting market,

development of lighting systems and services, successful

implementation of business transformation programs, impact of

acquisitions and other transactions, reputational and adverse

effects on business due to activities in Environment, Health &

Safety, compliance risks, ability to attract and retain talented

personnel, adverse currency effects, pension liabilities, and

exposure to international tax laws.

Additional risks currently not known to the Group or that the

Group has not considered material as of the date of this document

could also prove to be important and may have a material adverse

effect on the business, results of operations, financial condition

and prospects of the Group or could cause the forward-looking

events discussed in this document not to occur. The Group

undertakes no duty to and will not necessarily update any of the

forward-looking statements in light of new information or future

events, except to the extent required by applicable law.

Market and Industry InformationAll references

to market share, market data, industry statistics and industry

forecasts in this document consist of estimates compiled by

industry professionals, competitors, organizations or analysts, of

publicly available information or of the Group’s own assessment of

its sales and markets. Rankings are based on sales unless otherwise

stated.

Non-IFRS Financial MeasuresCertain parts of

this document contain non-IFRS financial measures and ratios, such

as comparable sales growth, adjusted gross margin, EBITA, adjusted

EBITA, and free cash flow, and other related ratios, which are not

recognized measures of financial performance or liquidity under

IFRS. The non-IFRS financial measures presented are measures used

by management to monitor the underlying performance of the Group’s

business and operations and, accordingly, they have not been

audited nor reviewed. Not all companies calculate non-IFRS

financial measures in the same manner or on a consistent basis and

these measures and ratios may not be comparable to measures used by

other companies under the same or similar names. A reconciliation

of these non-IFRS financial measures to the most directly

comparable IFRS financial measures is contained in this document.

For further information on non-IFRS financial measures, see

“Chapter 18 Reconciliation of non-IFRS measures” in the Annual

Report 2021.

PresentationAll amounts are in millions of

euros unless otherwise stated. Due to rounding, amounts may not add

up to totals provided. All reported data are unaudited. Unless

otherwise indicated, financial information has been prepared in

accordance with the accounting policies as stated in the Annual

Report 2021 and the Semi-Annual Report 2022.

Market Abuse RegulationThis press release

contains information within the meaning of Article 7(1) of the EU

Market Abuse Regulation.

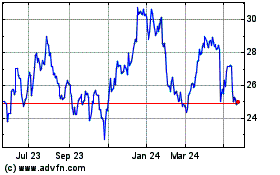

Signify NV (EU:LIGHT)

Historical Stock Chart

From Oct 2024 to Nov 2024

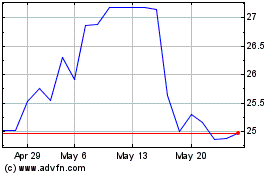

Signify NV (EU:LIGHT)

Historical Stock Chart

From Nov 2023 to Nov 2024