Ether Liquidity Plummets 40% On Exchanges After ETF Debut

September 07 2024 - 10:30PM

NEWSBTC

Liquidity of Ether on US exchanges has plunged as much as 40% since

the first spot Ether exchange-traded funds entered the market on

July 23, 2024. Related Reading: Cardano Bull Sees ADA Jumping

1,000% In An ‘Insane’ Rally That is a move rather expectedly coming

for traders and analysts that had previously viewed the ETFs as a

means to improve market liquidity and therefore stabilize prices.

Instead, what has taken place is rather different: the average

market depth of 5% for ETH pairs has fallen to around $14 million.

Meanwhile, offshore exchanges are posting a similar decline at

about $10 million in liquidity. Ether Liquidity Down Following the

launch of nine ETFs in July, Ether’s liquidity plummeted 20% on US

markets and 19% on offshore locations. The decline in liquidity is

one thing that raises concerns and, more importantly, it signals

greater sensitivity to large orders. With shallow market depth, it

follows that even minor trades can result in dramatic changes in

prices. Jacob Joseph, a research analyst at CCData, said that

liquidity is still better than at the beginning of the year but has

really dropped almost 45% since its peak in June. Poor market

conditions and seasonal effects are mainly responsible as summer

months will have fewer trading activities. Market Dynamics And ETF

Performance Their introduction was expected to increase liquidity,

much as it had done in the case of the Bitcoin ETFs introduced

earlier this year. However, the Ether market hasn’t responded as

well. In the period since their introduction, Ether ETFs have

suffered from over $500 million in cumulative outflows. That has

contributed to a general decline in liquidity, making markets even

more volatile. Surprisingly, ETFs have had their own performances.

For instance, Grayscale’s ETHE ETF witnessed an outflow as high as

$10.7 million, while BlackRock’s ETHA ETF saw an inflow as low as

$4.7 million. Such mixed results hint that Ether markets are yet to

come out of their troubled times, with investments reflecting

investors’ reluctance to commit capital in unsure times. Related

Reading: Aptos (APT) Dips 15% As New Innovations Fail To Spark

Momentum Implications For Traders And Investors A drop in liquidity

is a challenge for traders and investors alike, actually. In states

of low liquidity, the slippage is much higher, and the price for

the execution is costlier. The big problem lies in the fact that

the institutional investors like their markets stable and with good

liquidity. If these large players stop full operations, that could

create some kind of vicious cycle when the liquidity will be even

lower and prices go further down. For now, Ether trades hands at

about $2,258, down over 4% in the past 24 hours. The wider

cryptocurrency market is also under stress: All major altcoins,

including Solana and Ripple, are in the red, posting losses in a

range between 2% to 4%. Going forward, market participants will be

in a position where expected benefits of the ETF introductions have

not materialized for Ether. With potential interest rate cuts by

the Federal Reserve, market attention in the future might shift to

how these changes are going to affect liquidity and trading

activity in the months ahead. Featured image from Getty Images,

chart from TradingView

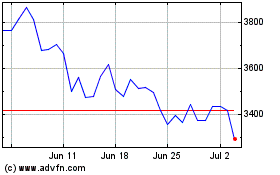

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024