TIDMSPA

RNS Number : 6802P

1Spatial Plc

14 October 2019

14 October 2019

1Spatial plc (AIM: SPA)

("1Spatial", the "Group" or the "Company")

Interim Results for the six-month period ended 31 July 2019

Continued strategic progress - confident on delivering full year

results

Highlights

-- Good progress during the period, with underlying growth in

existing Solutions business, completion of strategic acquisition

Geomap-Imagis ("GI") and further investment in its strategic

cloud-based SaaS platform

-- Acquisition of GI in France for GBP6m coupled with the

signing of a significant global commercial partnership agreement

with Esri Inc. The acquisition, partly funded by an oversubscribed

placing of GBP2.9m, is immediately earnings-enhancing and

integrating well.

-- Adjusted EBITDA at GBP1.7m, an increase of 170% YoY

(including 3 months of GI post-acquisition results and IFRS 16

'Leases' adjustments)

-- Development of strategic multi-tenancy cloud-based SaaS

platform for LMDM Application Services

-- As a result we are confident of delivering full year results in line with expectations

Half-year Half-year

to to

31 July 31 July variance variance

19 18

GBPm GBPm GBPm %

Continuing operations

Revenue 10.9 8.8 2.1 23%

Gross profit 5.7 4.6 1.1 25%

Adjusted* EBITDA 1.7 0.6 1.1 170%

Operating loss (0.6) (0.7) 0.1 (14%)

Loss after tax (0.6) (0.6) 0.0 9%

Continuing operations on a like-for-like ("LFL") basis

Revenue - existing business 8.9 8.8 0.1 1%

Revenue - acquisition (3 months) 2.0 -

Total revenue 10.9 8.8

Adjusted* EBITDA - existing

business 0.8 0.6 0.2 25%

Adjusted* EBITDA - acquisition 0.5 -

(3 months)

Adjusted* EBITDA impact of 0.4 -

IFRS 16 'Leases'

Total Adjusted EBITDA 1.7 0.6

* Adjusted for strategic, integration, other irregular items and

share-based payment charge

Commenting on the results, 1Spatial CEO, Claire Milverton,

said:

"Today's results demonstrate that 1Spatial is coming to the end

of the three-year turnaround phase of our vision for the business.

We have improved visibility of recurring revenues and growth in

profits. We are improving our technology and customer service

proposition, and the acquisition of GI coupled with the significant

commercial partnership with Esri has allowed us to align our French

& Belgian business to the rest of the group, thereby executing

on one of the last major strategic issues of the turnaround.

Looking forward we believe the future is extremely exciting. We

are looking to accelerate growth, improve our customer proposition

and invest in repeatable spatial solutions. Our goal is to become a

market leader in Location Master Data Management through our

strategic cloud-based SaaS platform. The platform we have now laid

provides the Company with opportunities perfectly suited to our

heritage and innovation abilities, providing significant potential

for accelerating growth."

Financial highlights

Revenues

-- Higher-quality revenues:

o Strategic shift from perpetual revenues in prior half-year to

term revenues

o Good visibility on future results with over 43% of run-rate

revenue now recurring with both a strong pipeline and a significant

order backlog at 31 July 2019

-- Revenue growth in existing business of GBP0.1m despite

strategic shift from perpetual to term licencing. The revenue can

be split into two streams as follows:

o Core spatial Solutions revenues of GBP6.4m (72% of total

existing business revenue) increased by GBP0.5m (8%) - progress in

all geographies

o Non-core GIS (Geographic Information System) revenues of

GBP2.5m (28% of total existing business revenue) decreased by

GBP0.4m (13%) in line with management expectations, and will

transition to Solutions revenues following the acquisition of

GI

-- 3-month revenue contribution from the acquisition of GI of GBP2m

Profitability

-- Like-for-like Adjusted* EBITDA of GBP0.8m in existing

business (both Solutions and GIS) in line with management's

expectations for the half-year

-- Significant contribution from GI acquisition to adjusted*

EBITDA of GBP0.5m in the first 3 months.

-- Operating loss improved by GBP0.1m to GBP0.6m despite an

increased share-based payment charge for new share-based plans

issued in September 2018, an increase in amortisation of intangible

assets and one-off deal costs in relation to the acquisition of

GI

Cash

-- Cash and cash equivalents of GBP4m at 31 July 2019 with net cash of GBP3.3m

-- GBP2.9m (net) raised from shareholders and GBP1.5m of own

cash resources used to fund the initial acquisition payment for GI

(GBP4.4m in total)

-- Cash used in operations, including one-off deal costs for acquisition, of GBP1.8m

o Operating cash outflow of GBP1.9m before strategic,

integration and other exceptional items, reflecting our seasonal

renewal cycle and a concentration of sales being delivered/closed

in June/July with resulting cash being received in the second

half

-- In August and September 2019, EUR1.8m of bank loans were

secured to provide additional working capital during seasonal

cycles and support the integration phases of the French

acquisition

Acquisition of Geomap-Imagis group

-- Total consideration of GBP6m of which GBP4.4m paid in cash

and GBP0.6m of shares issued upon completion in May 2019. A further

GBP0.6m to be paid in cash 13 months following completion and

GBP0.4m of shares to be issued in March 2023

-- GI is a geospatial solutions company based in France and an

Esri Gold partner. GI have a number of innovative solutions built

on the Esri platform and a 4D infrastructure solution on their own

platform

-- The strategic acquisition supported the Global partner

agreement that 1Spatial signed with Esri in May 2019, which

provided a migration path for existing 1Spatial customers in France

and Belgium as well as training on the Esri platform

Operational highlights

Continued investment in technology and multi-tenancy cloud-based

SaaS platform to maintain our leading position in the industry

-- Dedicated team focussed on the development of our strategic

multi-tenancy cloud-based SaaS platform for Application Services

including Location Master Data Management (LMDM)

-- Continued development of our core solutions and consolidation

of technology suite post-acquisition of GI

Spatial Solutions business

-- Growth in Spatial Solutions business continued, driven by

strategy of "land and expand" within the three key sectors of

Government, Utilities and Transportation

-- The integration of GI is on track, with initial cost

synergies already actioned and taking effect. Additional cost and

revenue synergies have been identified and the majority of these

are expected to take effect from the start of the next financial

year

-- New significant customer wins in:

-- Government

o France- Sale of Arcopole software solution to a number of local governments for EUR0.4m

o UK and Ireland - software and services contract for GBP0.9m to

support Ireland's Property Registration Authority ("PRA") with the

digital transformation of its land records

o UK - No1 Aeronautical Information Documents Unit ("No1 AIDU")

contract for over GBP1m for software and services

-- Utilities

o UK - Contract with Enterprise Innovation Centre for

development of a proof of concept for our Traffic Management Plan

Automation solution for GBP0.4m

o France (GI*) - Sale of Telco network management solutions to

Mont-Blanc Tunnel Company for EUR0.2m

-- Transportation

o France (GI*) - Road and street management solutions to county councils for EUR0.4m

o USA - Expansion contract with Caltrans (California Department

of Transport) for US$0.4 to improve their Transport Asset

Management database

*Sales made since acquisition by 1Spatial

Post balance sheet events

-- Significant contract wins across all geographies including a

strategic win with the Greater London Authority on the London

Underground Asset Register (LUAR) pilot contract, following a

competitive tender process

-- EUR1.8m of bank loans were secured in August and September

2019 providing additional working capital during seasonal cycles

and supporting the integration phases of the French acquisition

For further information, please contact:

1Spatial plc 01223 420 414

Andrew Roberts / Claire Milverton

/ Nicole Payne

N+1 Singer 020 7496 3000

Shaun Dobson / Lauren Kettle (Corporate

Finance)

Tom Salvesen (Corporate Broking)

FTI Consulting 020 3727 1000

Dwight Burden / Alex Le May 1spatial@fticonsulting.com

1Spatial

1Spatial is a technology-enabled solutions provider supplying

vertically-focussed business applications to industry sectors where

the accuracy of location and geospatial data is key. It is a global

leader in managing geospatial data, with the goal to be a market

leader in Location Master Data Management through its cloud-based

SaaS platform.

1Spatial provides its customers with business-focussed

applications where there is a reliance on location or geospatial

data. It delivers real value by using its patented 1Integrate tool

to ensure that the underlying data is current, complete and

consistent using automated processes. This ensures that decisions

are always based on the highest quality information available.

Our global clients include national mapping and land management

agencies, utilities, transportation organisations, government

departments, emergency services, defence and census bureaus.

Today - as location data from smartphones, the Internet of

Things and great lakes of commercial Big Data increasingly drive

commercial decision-making - our technology is used by a wide range

of commercial and government organisations from utilities and

transport businesses, to facilities management companies.

1Spatial plc is AIM-listed, headquartered in Cambridge, UK, with

operations in the UK, Ireland, France, Belgium, Australia and

USA.

To find our more, visit www.1spatial.com

Half-year review

The first half has been a period of good progress for 1Spatial

as we approach the end of our three-year turnaround plan announced

in January 2017. In this plan, we set out to establish a strong

financial and operational platform for the business, evidenced

through improved cash generation, growing adjusted EBITDA and

sustainable growth.

During the period, we addressed a key strategic issue for

1Spatial, in aligning our French and Belgian businesses with the

rest of the Group as solutions providers. We entered into a new

contract with global GIS provider Esri Inc. and we acquired an

Esri-based solutions provider, Geomap-Imagis (GI). The Board

believes this deal, in addition to aligning our French and Belgian

business, represents a significant opportunity for the Group and

there are several synergistic benefits still to come through,

notwithstanding that GI made an Adjusted EBITDA profit of GBP0.5m

on a standalone basis in the three months to July 2019.

Our existing Solutions business continues to progress well with

improved underlying growth and a focus on quality of revenue with

our strategic shift from perpetual licencing to term licencing.

Our strategy is to maintain strong profitable growth within our

Solutions business in our target sectors of Government, Utilities

and Transportation, with a longer-term goal of establishing a

leading position in Location Master Data Management through our

cloud-based SaaS platform. This platform started to take shape

during the period with a dedicated team on the project and senior

management focus. We anticipate that the first component will be

available for general release by the end of the calendar year.

These half-year results demonstrate good progress against our

strategic goals, and we are confident that we will meet market

expectations for the full year.

Our strategy for growth

Innovative Spatial Solutions (77% of revenues)

1Spatial's growth strategy is to provide repeatable innovative

spatial solutions to our blue-chip, international client base with

a key focus around data management, quality and enhancement using

our patented, rules-based technology, 1Integrate.

During the period, excluding the acquisition of GI group,

Solutions revenues increased by 8% to GBP6.4m. The acquisition of

GI in the period bought GBP2m of new revenues to the Group in the

first 3 months following acquisition, which includes recurring

licence and support and maintenance solutions as well as services.

These revenues fit in our key sectors of Government, Utilities and

Transportation and include solutions built on the market leading

Esri platform.

Sectors and geographic spread

Our focus is the sale of our Geospatial solutions in three key

sectors, being Government, Utilities and Transportation, operating

across the UK & Ireland, USA, France & Belgium, and

Australia.

Partners

We have a valuable partnership network with key operators in the

Geospatial market to drive growth. Our own software architectures

are 'Open' - allowing us to integrate our solutions with Esri, Open

Source and other vendors' technology.

Following the recent acquisition of GI and the global deal with

Esri, we will be building more solutions based on the Esri

platform. Esri is the global market leader in geographic

information system (GIS) software, location intelligence, and

mapping. Building solutions on the Esri platform provides 1Spatial

with greater market reach and access as well as ensuring customers

have solutions which meet their business needs.

Technology

One of our key projects under the leadership of our Cambridge

innovation team is the development of our multi-tenancy SaaS

platform for Application Services including Location Master Data

Management (LMDM). This ensures that the 1Spatial solutions,

underpinned by our rules engine, are more accessible to our current

and potential customers. Our first component of this platform is

scheduled to be available by the end of this calendar year.

A core strategic benefit of the acquisition of GI was the chance

to acquire an additional portfolio of technology. During the GI

integration phase, we will continue to assess our technology

portfolio to understand solutions which we can take to market

globally or where there is a duplication of technology, which ones

we will retire/invest in going forwards. 1Spatial's heritage is

around management of data quality and we still seek to leverage

this position going forward within our technology suite. Where

possible we will be looking to ensure 1Integrate is part of our

solution portfolio.

During the period we have also made good progress with other key

projects including 3D, mobile and other innovative solutions in

order to drive new customer conversion and support our "land and

expand" strategy.

Geomap-Imagis - acquisition, integration and synergies

-- In early May 2019, 1Spatial France acquired GI, a geospatial

solutions company based in France and an Esri Gold partner. GI have

a number of innovative solutions built on the Esri platform and a

4D infrastructure solution on their own platform. The strategic

acquisition supported the Global partner agreement that 1Spatial

signed with Esri in May 2019, which provided a migration path for

existing 1Spatial customers in France and Belgium as well as

training on the Esri platform. GI have experience in the same

industry markets as 1Spatial (Government, Utilities and

Transportation) and have a customer base of around 500. They have a

127-strong workforce, including a flexible offshore workforce in

Tunisia. GI has strong recurring revenues and contributed GBP2m to

revenue and GBP0.5m to adjusted* EBITDA in the first three months

of ownership.

-- A full integration plan was put together for the acquisition.

This was split between Day 1 readiness, first 100 days and then 100

days to two years. The first 100 days have now been completed and

all findings and integration work has been positive. Key actions

that have taken place are - onsite introductions, team building,

onsite functional audits, customer engagement, new organisational

structure and confirmed target operating model. A key deliverable

of the combined new French business and the rest of the Group is to

develop global business applications on the Esri platform where a

market need is identified in our key markets of government,

utilities and transportation.

-- There are a number of synergies arising from the acquisition

that have already been identified and achieved and those that are

planned for the next financial year. The synergies include both

cost and revenue synergies. The revenue synergies are unlikely to

impact the business until the next financial year. Training on the

Esri platform for the 1Spatial team started in September 2019 and

the kick-off meeting for technology innovation is planned for

mid-October at the Esri Head office in Redlands, California.

The future

We now have a solid operating platform and much of the work we

now need to do will be positioning ourselves for the future

scalable growth. The majority of this will be in our key

territories and also with respect to the potential growth with our

cloud-based SaaS platform for Application Services including

LMDM.

Financial performance

Revenue

Overall, total revenues are GBP10.9m, which includes GBP2m of GI

revenues. Existing Group revenues therefore, were GBP8.9m, with

organic growth of GBP0.1m (1%) on the previous period but, as

noted, we split this into two revenue streams being Spatial

Solutions and GIS. The GIS revenues are mainly from our existing

French/Belgian business and as noted earlier in this report, we are

looking to transition these revenues to Solutions revenues through

the acquisition of GI. The split of Solution and GIS revenues is

set out below:

-- Spatial Solutions business (77% of revenue):

o Revenues have grown by GBP0.5m (8%) on the prior period taking

the revenues before GI to GBP6.4m, with progress in all

territories. In particular, the underlying revenue in our US

Solutions business* has increased by 75% from GBP0.6m to GBP1m

o This is against a backdrop of GBP0.6m of perpetual licences

included in the prior period (before the Group shifted to a term

licence model)

o GI adds a further GBP2m of revenue to the Solutions

business

-- GIS business (23% of revenue):

o Recurring revenues in our GIS business are down by GBP0.3m to

GBP1.3m, which is offset by a GBP0.2m increase in licence

revenue

* Excludes large cyclical US Census Bureau revenues

Gross profit margin

Gross profit margin for the existing business (before GI) of 53%

is slightly up on last half-year's 52% margin, as the revenue mix

this half-year has not changed significantly from the prior

half-year. GI's gross profit margin of 50% combined with the margin

of the existing business weights the overall margin at 52%. We

expect to see improvements in gross margin as the benefits of

integration with the wider Group flow through.

Adjusted* EBITDA

Total adjusted* EBITDA is GBP1.7m which includes GBP0.5m

reflecting three months' trade in GI.

On a like-for-like basis (before GBP0.4m of adjustments for IFRS

16 'Leases'), the adjusted* EBITDA of the existing business (before

GI) has increased by GBP0.2m to GBP0.8m, with GBP0.1m of this

improvement driven from additional revenues and GBP0.1m driven from

administration cost savings.

Operating loss

Total operating loss of GBP0.6m is after including GI's GBP0.1m

operating profit. Therefore, on a like-for-like basis, the

operating loss of the existing business is GBP0.7m, in line with

last half-year's operating loss of GBP0.7m.

The increase in the existing business' Adjusted* EBITDA of

GBP0.2m was offset by GBP0.2m of share-based payment charges

following the share incentive scheme established in September 2018

(there were no charges in the last half-year). In addition to this,

amortisation charges are up GBP0.1m following the business

combination accounting for GI, and one-off deal costs related to

the acquisition of GI are up GBP0.1m compared to the last

half-year.

Note that the depreciation charge of GBP0.5m includes a GBP0.4m

charge following the application of IFRS 16 'Leases', which became

effective this half-year (see note 14 for further detail) so the

residual cost of GBP0.1m in the existing business is in line with

last half-year's charge.

Cash flow

Net cash at the period end of GBP3.3m comprises cash and cash

equivalents of GBP4m and bank loans of GBP0.7m. The bank loan was

acquired on the purchase of the Geomap-Imagis Group during the

period.

During the period we completed an oversubscribed placing to

raise GBP2.9m and used GBP1.5m of our own cash resources to fund

the initial acquisition payment for GI (GBP4.4m in total). GI had

GBP2.2m of their own cash and cash equivalents so the cash position

at acquisition as stated in the statement of cash flows is

GBP2.2m.

Cash used in operations in the period of GBP1.9m represents

GBP1.2m from ordinary activities, and GBP0.7m from strategic,

integration and other exceptional items and share-based payment

charges. The outflow is in line with our half-year expectations

given the Group's seasonal working capital cycle and cashflow from

continuing operations is expected to unwind in the second half.

In addition, following the submission of our year end annual

report to January 2019, our group credit rating improved which is a

result of the strengthened balance sheet, through the August 2018

fund raise, and improved results. This is a good position for us to

be in for customer acquisition purposes going forwards.

Subsequent to the half-year in August and September 2019,

EUR1.8m of bank loans were secured on attractive terms to provide

additional working capital during seasonal cycles and support the

integration phases of the French acquisition.

Balance sheet

At 31 July 2019, net assets were up GBP3.4m, most of which is

attributable to the French acquisition: GBP5.9m of non-current

assets including goodwill and intangible assets were created on

acquisition, net of GBP0.9m deferred tax liabilities on the

acquired intangible assets. Deferred consideration of GBP1m on the

French acquisition offsets this, as does the acquired defined

benefit pension obligation of GBP0.8m.

Outlook

The start of the second half has seen continued progress against

our growth strategy and additional new contract wins in our target

sectors of Government, Utilities and Transportation. This underpins

the Group's confidence of delivery on market expectations for the

full year. We remain aware of the wider geo-political issues, but

diversified portfolio of solutions, including some market-leading

IP assets gives us confidence for the future.

Looking forward

1Spatial is ideally positioned in the Geospatial market with a

clear strategy, and a solid underlying business. We have cutting

edge, patented technology with market-leading intellectual

property, high quality staff and a blue-chip customer base, and as

such are confident in our plans for the future.

Looking ahead, we are well placed to grow a substantial,

profitable and cash-generative business over the long-term.

Condensed consolidated statement of comprehensive income

Six months ended 31 July 2019

Audited Unaudited

Unaudited * *

Six

Six months months

ended Year ended ended

31 July 31 January 31 July

2019 2019 2018

Continuing operations Note GBP'000 GBP'000 GBP'000

-------------------------------------------------------------- ----- ----------- ------------ ----------

Revenue 10,861 17,624 8,833

Cost of sales (5,138) (8,449) (4,243)

-------------------------------------------------------------- ----- ----------- ------------ ----------

Gross profit 5,723 9,175 4,590

Administrative expenses (6,363) (10,803) (5,336)

-------------------------------------------------------------- ----- ----------- ------------ ----------

(640) (1,628) (746)

Adjusted* EBITDA 1,655 1,188 613

Less: depreciation (506) (141) (78)

Less: amortisation and impairment of intangible assets 8 (974) (1,785) (890)

Less: share-based payment charge (222) (218) -

Less: strategic, integration and other irregular items 7 (593) (672) (391)

-------------------------------------------------------------- ----- ----------- ------------ ----------

Operating loss (640) (1,628) (746)

Finance income 36 8 18

Finance cost (62) (199) (98)

-------------------------------------------------------------- ----- ----------- ------------ ----------

Net finance cost (26) (191) (80)

Loss before tax (666) (1,819) (826)

Income tax credit 40 389 254

-------------------------------------------------------------- ----- ----------- ------------ ----------

Loss for the period from continuing operations (626) (1,430) (572)

Discontinued operations

Loss for the year from discontinued operations (attributable

to equity holders of the company) - (270) (266)

-------------------------------------------------------------- ----- ----------- ------------ ----------

Loss for the period attributable to:

Equity shareholders of the parent (626) (1,700) (838)

(626) (1,700) (838)

============================================================== ===== =========== ============ ==========

Other comprehensive loss

Items that may subsequently be reclassified

to profit or loss:

Exchange differences on translating foreign operations 358 80 (21)

Other comprehensive profit/(loss) for the period,

net of tax 358 80 (21)

============================================================== ===== =========== ============ ==========

Total comprehensive loss for the period (268) (1,620) (859)

============================================================== ===== =========== ============ ==========

Total comprehensive loss attributable to:

Equity shareholders of the parent (268) (1,620) (859)

(268) (1,620) (859)

============================================================== ===== =========== ============ ==========

Total comprehensive loss attributable

to equity shareholders of the Parent

arises from:

Continuing operations (268) (1,350) (593)

Discontinued operations - (270) (266)

(268) (1,620) (859)

============================================================== ===== =========== ============ ==========

* Not adjusted for the impact of IFRS 16: 'Leases', adopted for the first time

in the six months ended 31 July 2019 (note 14).

Loss per ordinary share from continuing and discontinued operations

attributable to the owners of the parent during the year (expressed

in pence per ordinary share):

Basic loss per share 4 (0.60) (1.97) (1.10)

From continuing operations (0.60) (1.65) (0.75)

From discontinued operations (0.00) (0.31) (0.35)

Diluted loss per share 4 (0.60) (1.97) (1.10)

From continuing operations (0.60) (1.65) (0.75)

From discontinued operations (0.00) (0.31) (0.35)

* Adjusted for strategic, integration and other irregular items

(note 7) and share-based payment.

Condensed consolidated statement of financial position

As at 31 July 2019

Audited Unaudited

Unaudited * *

As at As at As at

31 July 31 January 31 July

2019 2019 2018

-------------------------------------- ----- ---------- ------------ ----------

Note GBP'000 GBP'000 GBP'000

-------------------------------------- ----- ---------- ------------ ----------

Assets

Non-current assets

Intangible assets including goodwill 8 16,331 10,194 10,234

Property, plant and equipment 442 285 304

Right-of-use assets 14 3,365 - -

Total non-current assets 20,138 10,479 10,538

-------------------------------------- ----- ---------- ------------ ----------

Current assets

Trade and other receivables 9 9,431 4,998 5,443

Current income tax receivable 156 125 200

Cash and cash equivalents 4,001 6,358 734

-------------------------------------- ----- ---------- ------------ ----------

Total current assets 13,588 11,481 6,377

-------------------------------------- ----- ---------- ------------ ----------

Total assets 33,726 21,960 16,915

-------------------------------------- ----- ---------- ------------ ----------

Liabilities

Current liabilities

Bank borrowings (732) - (2,188)

Lease liabilities 14 (931) - -

Trade and other payables 10 (9,641) (7,901) (8,108)

Deferred consideration 12 (613) - -

Current income tax liabilities - - (32)

Provisions (81) - (6)

Total current liabilities (11,998) (7,901) (10,334)

-------------------------------------- ----- ---------- ------------ ----------

Non-current liabilities

Lease liabilities 14 (2,432) - -

Deferred consideration 12 (380) - -

Defined benefit pension obligation (1,504) (677) (645)

Deferred tax (836) (192) (233)

Total non-current liabilities (5,152) (869) (878)

-------------------------------------- ----- ---------- ------------ ----------

Total liabilities (17,150) (8,770) (11,212)

Net assets 16,576 13,190 5,703

====================================== ===== ========== ============ ==========

Share capital and reserves

Share capital 11 20,150 18,971 16,705

Share premium account 30,479 28,661 22,931

Own shares held (303) (303) (303)

Equity-settled employee benefits

reserve 3,156 2,934 2,716

Merger reserve 16,465 16,030 16,030

Reverse acquisition reserve (11,584) (11,584) (11,584)

Currency translation reserve 662 304 203

Accumulated losses (41,972) (41,346) (40,518)

Purchase of non-controlling interest

reserves (477) (477) (477)

-------------------------------------- ----- ---------- ------------ ----------

Equity attributable to shareholders

of the parent company 16,576 13,190 5,703

-------------------------------------- ----- ---------- ------------ ----------

Total equity 16,576 13,190 5,703

====================================== ===== ========== ============ ==========

* Not adjusted for the impact of IFRS 16: 'Leases', adopted

for the first time in the six months ended 31 July 2019 (note

14).

Condensed

consolidated

statement

of changes in

equity

Period ended

31 July 2019

Purchase

Equity-settled of

Share Own employee Reverse Currency non-controlling Non-

Share premium shares benefits Merger acquisition translation interest Accumulated Total controlling Total

GBP'000 capital account held reserve reserve reserve reserve reserve losses * interest equity

Balance at 1

February 2018 16,705 22,931 (303) 2,716 16,030 (11,584) 224 (477) (39,452) 6,790 - 6,790

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Adjustment on

initial

application

of IFRS 15

'Revenue from

contracts

with

customers' (194) (194) (194)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Balance at 31

January 2018 16,705 22,931 (303) 2,716 16,030 (11,584) 224 (477) (39,646) 6,596 - 6,596

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Comprehensive

income/(loss)

Loss for the

year - - - - - - - - (1,700) (1,700) - (1,700)

Other

comprehensive

(loss)/income

Exchange

differences

on

translating

foreign

operations - - - - - - 80 - - 80 - 80

Total other

comprehensive

income - - - - - - 80 - - 80 - 80

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Total

comprehensive

(loss)/income - - - - - - 80 - (1,700) (1,620) - (1,620)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Transactions

with owners

recognised

directly in

equity

Issue of share

capital, net

of share

issue costs 2,266 5,730 - - - - - - - 7,996 - 7,996

Recognition of

share-based

payments - - - 218 - - - - - 218 - 218

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

2,266 5,730 - 218 - - - - - 8,214 - 8,214

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Balance at

31 January

2019

(Audited) 18,971 28,661 (303) 2,934 16,030 (11,584) 304 (477) (41,346) 13,190 - 13,190

=============== ======== ======== ======= =============== ======== ============ ============ ================ ============ ======== ============= ========

Comprehensive

loss

Loss for the

period - - - - - - - - (626) (626) - (626)

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - - - - - 358 - - 358 - 358

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Total other

comprehensive

income - - - - - - 358 - - 358 - 358

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Total

comprehensive

(loss)/income - - - - - - 358 - (626) (268) - (268)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Transactions

with owners

recognised

directly in

equity

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Issue of share

capital 1,179 1,818 - - 435 - - - - 3,432 - 3,432

Recognition of

share-based

payments - - - 222 - - - - - 222 - 222

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

1,179 1,818 - 222 435 - - - - 3,654 - 3,654

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ -------- ------------- --------

Balance at

31 July 2019

(Unaudited) 20,150 30,479 (303) 3,156 16,465 (11,584) 662 (477) (41,972) 16,576 - 16,576

=============== ======== ======== ======= =============== ======== ============ ============ ================ ============ ======== ============= ========

* Total equity attributable to the equity shareholders of the

parent.

Condensed consolidated statement of changes in equity

Period ended 31 July 2018

Purchase

Equity-settled of

Share Own employee Reverse Currency non-controlling Non-

Share premium shares benefits Merger acquisition translation interest Accumulated Total controlling Total

GBP'000 capital account held reserve reserve reserve reserve reserve losses * interest equity

Balance at 1

February 2018 16,705 22,931 (303) 2,716 16,030 (11,584) 224 (477) (39,452) 6,790 - 6,790

--------------- --------- --------- -------- --------------- --------- ------------ ------------ ----------------- ------------ -------- ------------- ---------

Change in

accounting

policy (228) (228) (228)

--------------- --------- --------- -------- --------------- --------- ------------ ------------ ----------------- ------------ -------- ------------- ---------

Restated total

equity as

at 1 February

18 16,705 22,931 (303) 2,716 16,030 (11,584) 224 (477) (39,680) 6,562 - 6,562

--------------- --------- --------- -------- --------------- --------- ------------ ------------ ----------------- ------------ -------- ------------- ---------

Comprehensive

income/(loss)

Loss for the

period - - - - - - - - (838) (838) - (838)

Other

comprehensive

income/(loss)

Exchange

differences

on

translating

foreign

operations - - - - - - (21) - - (21) - (21)

--------------- --------- --------- -------- --------------- --------- ------------ ------------ ----------------- ------------ -------- ------------- ---------

Total other

comprehensive

income - - - - - - (21) - - (21) - (21)

--------------- --------- --------- -------- --------------- --------- ------------ ------------ ----------------- ------------ -------- ------------- ---------

Total

comprehensive

(loss) - - - - - - (21) - (838) (859) - (859)

--------------- --------- --------- -------- --------------- --------- ------------ ------------ ----------------- ------------ -------- ------------- ---------

Balance at 31

July 2018

(Unaudited) 16,705 22,931 (303) 2,716 16,030 (11,584) 203 (477) (40,518) 5,703 - 5,703

=============== ========= ========= ======== =============== ========= ============ ============ ================= ============ ======== ============= =========

* Total equity attributable to the equity shareholders of the

parent.

Condensed consolidated statement of cash flows

Period ended 31 July 2019

Audited Unaudited

Unaudited * *

31 July 31 January 31 July

2019 2019 2018

Note GBP'000 GBP'000 GBP'000

---------------------------------------- ------ ---------- ----------- ----------

Cash flows from operating activities

Cash used in operations a) (1,927) (749) (1,278)

Interest received - 24 1

Interest paid (62) (199) (101)

Tax received 149 410 221

Net cash used in operating activities (1,840) (514) (1,157)

------------------------------------------------ ---------- ----------- ----------

Cash flows from investing activities

Acquisition of subsidiaries (net (2,151) - -

of cash acquired)

Purchase of property, plant and

equipment (70) (94) (43)

Expenditure on product development

and intellectual property capitalised (874) (1,300) (547)

Net cash used in investing activities (3,095) (1,394) (590)

------------------------------------------------ ---------- ----------- ----------

Cash flows from financing activities

Repayment of obligations under - -

leases (431)

Net proceeds of share issue 2,915 7,996 -

Net cash generated from financing

activities 2,484 7,996 -

------------------------------------------------ ---------- ----------- ----------

Net (decrease)/increase in cash

and cash equivalents (2,451) 6,088 (1,747)

Cash and cash equivalents at start

of period 6,358 268 268

Effects of foreign exchange on

cash and cash equivalents 94 2 25

Cash and cash equivalents at end

of period 4,001 6,358 (1,454)

------------------------------------------------ ---------- ----------- ----------

* Not adjusted for the impact of IFRS 16: 'Leases', adopted for

the first time in the six months ended 31 July 2019 (note 14).

Notes to the condensed consolidated statement of cash flows

a) Cash used in operations

Unaudited Audited Unaudited

As at 31 As at

As at January 31 July

31 July 2019 2019 2018

GBP'000 GBP'000 GBP'000

---------------------------------------- -------------- --------- ----------

Loss before tax including discontinued

operations (666) (2,085) (1,092)

Adjustments for:

Net finance cost 62 175 100

Depreciation 506 141 78

Amortisation and impairment 974 1,785 890

Share-based payment (credit)/charge 222 218 -

(Increase)/Decrease in trade and

other receivables (1,366) (184) (531)

(Increase)/Decrease in trade and

other payables (1,498) (656) (517)

Increase/(Decrease) in provisions 38 (148) (142)

Increase in defined benefit pension - 44 -

obligation

Net foreign exchange movement (199) (39) (64)

Cash used in operations (1,927) (749) (1,278)

---------------------------------------- -------------- --------- ----------

b) Reconciliation of net cash flow to movement in net funds

Unaudited Audited Unaudited

As at 31 As at

As at January 31 July

31 July 2019 2019 2018

GBP'000 GBP'000 GBP'000

---------------------------------------- -------------- --------- ----------

(Decrease)/Increase in cash in the

period (2,451) 6,088 (1,747)

---------------------------------------- -------------- --------- ----------

Changes resulting from cash flows (2,451) 6,088 (1,747)

Loans taken on, on acquisition of (732) - -

subsidiary

Effect of foreign exchange 94 2 25

---------------------------------------- -------------- --------- ----------

Change in net funds (3,089) 6,090 (1,722)

Net funds at beginning of period 6,358 268 268

----------------------------------------

Net funds at end of period 3,269 6,358 (1,454)

---------------------------------------- -------------- --------- ----------

Analysis of net funds

Cash and cash equivalents classified

as:

Current assets 4,001 6,358 734

Bank and other loans (732) - (2,188)

Net funds at end of period 3,269 6,358 (1,454)

---------------------------------------- -------------- --------- ----------

Notes to the Interim Financial Statements

1. Principal activity

1Spatial plc is a public limited company which is listed on the

AIM London Stock Exchange and is incorporated and domiciled in the

UK. The address of the registered office is Tennyson House,

Cambridge Business Park, Cowley Road, Cambridge, CB4 0WZ. The

registered number of the Company is 5429800.

The principal activity of the Group is the development and sale

of IT software along with related consultancy and support. The

principal activity of the Company is that of a parent holding

company which manages the Group's strategic direction and

underlying subsidiaries.

2. Basis of preparation

The condensed consolidated interim financial information for the

six months ended 31 July 2019, has been prepared in accordance with

the accounting policies that are expected to be adopted in the

Group's full financial statements for the year ended 31 January

2020 and are not expected to be significantly different to those

set out in the Group's audited financial statements for the year

ended 31 January 2019, except for the adoption of IFRS 16 'Leases'

which became effective in the half-year ended 31 July 2019 (see

note 14).

The financial information for the half-years ended 31 July 2019

and 31 July 2018 is neither audited nor reviewed and does not

constitute statutory financial statements within the meaning of

section 434(3) of the Companies Act 2006 for 1Spatial plc or for

any of the entities comprising the 1Spatial Group. Statutory

financial statements for the preceding financial year ended 31

January 2019 were filed with the Registrar and included an

unqualified auditors' report.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing the half-yearly condensed consolidated financial

statements.

3. Taxation

The tax expense on the result for the six months ended 31 July

2019 is based on the estimated tax rates in the jurisdictions in

which the Group operates, for the year ending 31 January 2020.

4. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2019 2019 2018

GBP'000 GBP'000 GBP'000

----------------------------------------- ---------- ------------ ----------

Loss attributable to equity holders

of the Parent (626) (1,700) (838)

Less: Loss from discontinued operations - (270) (266)

----------------------------------------- ---------- ------------ ----------

Loss from continuing operations (626) (1,430) (572)

Adjustments:

Income tax credit (9) (389) (200)

Deferred tax credit (31) - (54)

Net finance cost 26 191 80

Depreciation 506 141 78

Amortisation and impairment of

intangible assets 974 1,785 890

Share-based payment charge 222 218 -

Strategic, integration and other

irregular items 593 672 391

----------------------------------------- ---------- ------------ ----------

Adjusted EBITDA from continuing

operations 1,655 1,188 613

----------------------------------------- ---------- ------------ ----------

Number Number Number

000s 000s 000s

----------------------------------------- ---------- ------------ ----------

Basic and Diluted weighted average

number of ordinary shares 104,332 86,425 76,365

----------------------------------------- ---------- ------------ ----------

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2019 2019 2018

Pence Pence pence

------------------------------------------ ---------- ------------ ----------

Basic loss per share (0.60) (1.97) (1.10)

* from continuing operations (0.60) (1.65) (0.75)

* from discontinued operations (0.00) (0.31) (0.35)

------------------------------------------ ---------- ------------ ----------

Diluted loss per share (0.60) (1.97) (1.10)

* from continuing operations (0.60) (1.65) (0.75)

* from discontinued operations (0.00) (0.31) (0.35)

------------------------------------------ ---------- ------------ ----------

Basic adjusted EBITDA per share 1.59 1.06 0.45

* from continuing operations 1.59 1.37 0.80

* from discontinued operations 0.00 (0.31) (0.35)

------------------------------------------ ---------- ------------ ----------

Diluted adjusted EBITDA per share 1.59 1.06 0.45

* from continuing operations 1.59 1.37 0.80

* from discontinued operations 0.00 (0.31) (0.35)

------------------------------------------ ---------- ------------ ----------

The H1 FY19 EPS figures have been re-presented to reflect the

share consolidation which occurred in August 2018. As the option

awards are anti-dilutive, they have been excluded from the

calculation of diluted weighted average number of ordinary

shares.

5. Dividends

No dividend is proposed for the six months ended 31 July 2019

(31 January 2019: nil; 31 July 2018: nil).

6. Segmental information

Central IT Managed

costs Geospatial Services Total

31 July 2019 GBP'000 GBP'000 GBP'000 GBP'000

Revenue - 10,861 - 10,861

Cost of sales - (5,138) - (5,138)

--------------------------------------- --------- ----------- ----------- ---------

Gross profit - 5,723 - 5,723

Administrative expenses (975) (5,388) - (6,363)

Adjusted EBITDA (620) 2,275 - 1,655

Less: depreciation - (506) - (506)

Less: amortisation and impairment

of intangible assets - (974) - (974)

Less: share-based payment charge (65) (157) - (222)

Less: strategic, integration

and other irregular items (290) (303) - (593)

--------------------------------------- --------- ----------- ----------- ---------

Total operating (loss)/profit (975) 335 - (640)

Finance income 3 33 - 36

Finance cost (2) (60) - (62)

--------------------------------------- --------- ----------- ----------- ---------

Net finance (cost) / income 1 (27) - (26)

(Loss)/profit before tax (974) 308 - (666)

Tax - 40 - 40

(Loss)/profit for the period

from continuing operations (974) 348 - (626)

Loss for the period from discontinued - - - -

operations

--------------------------------------- --------- ----------- ----------- ---------

(Loss)/profit for the period (974) 348 - (626)

--------------------------------------- --------- ----------- ----------- ---------

Central IT Managed

costs Geospatial Services Total

31 January 2019 GBP'000 GBP'000 GBP'000 GBP'000

Revenue - 17,624 - 17,624

Cost of sales - (8,449) - (8,449)

--------------------------------------- --------- ----------- ----------- ---------

Gross profit - 9,175 - 9,175

Administrative expenses (1,971) (8,829) (3) (10,803)

Adjusted EBITDA (1,460) 2,651 (3) 1,188

Less: depreciation - (141) - (141)

Less: amortisation and impairment

of intangible assets - (1,785) - (1,785)

Less: share-based payment charge (53) (165) - (218)

Less: strategic, integration

and other irregular items (458) (214) - (672)

--------------------------------------- --------- ----------- ----------- ---------

Total operating (loss)/profit (1,971) 346 (3) (1,628)

Finance income 4 4 - 8

Finance cost (122) (77) - (199)

--------------------------------------- --------- ----------- ----------- ---------

Net finance cost (118) (73) - (191)

(Loss)/profit before tax (2,089) 273 (3) (1,819)

Tax - 387 2 389

(Loss)/profit for the period

from continuing operations (2,089) 660 (1) (1,430)

Loss for the period from discontinued

operations (163) - (107) (270)

--------------------------------------- --------- ----------- ----------- ---------

(Loss)/profit for the period (2,252) 660 (108) (1,700)

--------------------------------------- --------- ----------- ----------- ---------

6. Segmental information (continued)

Central IT Managed

costs Geospatial Services Total

31 July 2018 GBP'000 GBP'000 GBP'000 GBP'000

Revenue - 8,833 - 8,833

Cost of sales - (4,243) - (4,243)

--------------------------------------- --------- ----------- ----------- ---------

Gross profit - 4,590 4,590

Administrative expenses (1,040) (4,296) - (5,336)

-

--------------------------------------- --------- ----------- ----------- ---------

Adjusted EBITDA (773) 1,386 - 613

Less: depreciation - (78) - (78)

Less: amortisation and impairment

of intangible assets - (890) - (890)

Less: share-based payment charge - - - -

Less: strategic, integration

and other irregular items (267) (124) - (391)

--------------------------------------- --------- ----------- ----------- ---------

Total operating (loss)/profit (1,040) 294 - (746)

Finance income - 18 - 18

Finance cost (87) (11) - (98)

--------------------------------------- --------- ----------- ----------- ---------

Net finance (cost) / income (87) 7 - (80)

(Loss)/profit before tax (1,127) 301 - (826)

Tax - 254 - 254

(Loss)/profit for the period

from continuing operations (1,127) 555 - (572)

Loss for the period from discontinued

operations - - (266) (266)

--------------------------------------- --------- ----------- ----------- ---------

(Loss)/profit for the period (1,127) 555 (266) (838)

--------------------------------------- --------- ----------- ----------- ---------

7. Strategic, integration and other irregular items

In accordance with the Group's policy for strategic, integration

and other irregular items, the following charges were included in

this category for the period:

Six months Six months

ended Year ended ended

31 July 31 January 31 July

2019 2019 2018

GBP'000 GBP'000 GBP'000

---------------------------------------------- ----------- ------------ -----------

Costs associated with corporate transactions

and other strategic costs 15 332 238

Restructuring and redundancy costs - 213 153

Costs relating to the acquisition of 506 - -

the Geomap-Imagis group

Fees relating to the Employee Share Plan - 82 -

implemented in the year

Other 72 45 -

---------------------------------------------- ----------- ------------

Total 593 672 391

---------------------------------------------- ----------- ------------ -----------

8. Intangible assets including goodwill

Goodwill Brands Customers Software Development Website Intellectual Total

and related costs costs property

contracts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February

2019 16,161 232 2,843 4,421 15,012 30 66 38,765

Arising on

acquisition

(note 12) 2,316 - - 3,412 - - - 5,728

Additions - - - - 874 - - 874

Effect of foreign

exchange 327 - 77 259 288 - - 951

----------------------

At 31 July 2019 18,804 232 2,920 8,092 16,174 30 66 46,318

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February

2019 11,533 165 2,754 3,850 10,232 30 7 28,571

Amortisation - 12 89 283 590 - - 974

Effect of foreign

exchange 130 - 77 59 176 - - 442

At 31 July 2019 11,663 177 2,920 4,192 10,998 30 7 29,987

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Net book amount

at

31 July 2019 7,141 55 - 3,900 5,176 - 59 16,331

====================== ========= ======== ============= ========= ============ ======== ============= ========

8. Intangible assets including goodwill (continued)

Goodwill Brands Customers Software Development Website Intellectual Total

and related costs costs property

contracts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February 2018 16,008 232 2,847 4,420 13,737 30 51 37,325

Additions - - - - 1,285 - 15 1,300

Effect of foreign

exchange 153 - (4) 1 (10) - - 140

----------------------

At 31 January 2019 16,161 232 2,843 4,421 15,012 30 66 38,765

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February 2018 11,511 142 2,582 3,625 8,893 30 2 26,785

Amortisation - 23 176 228 1,353 - 5 1,785

Effect of foreign

exchange 22 - (4) (3) (14) - - 1

At 31 January 2019 11,533 165 2,754 3,850 10,232 30 7 28,571

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Net book amount

at

31 January 2019 4,628 67 89 571 4,780 - 59 10,194

====================== ========= ======== ============= ========= ============ ======== ============= ========

9. Trade and other receivables

As at As at

31 July 31 January

2019 2019

Current GBP'000 GBP'000

----------------------------------------- --------- ------------

Trade receivables 4,634 2,545

Less: provision for impairment of trade

receivables - (13)

----------------------------------------- --------- ------------

4,634 2,532

Other taxes and social security 168 102

Other receivables 1,739 1,106

Prepayments and accrued income 2,890 1,258

----------------------------------------- --------- ------------

9,431 4,998

----------------------------------------- --------- ------------

10. Trade and other payables

As at As at

31 July 31 January

2019 2019

Current GBP'000 GBP'000

------------------------------------ --------- ------------

Trade payables 2,295 1,439

Other taxation and social security 2,571 1,766

Other payables 498 441

Accrued liabilities 455 621

Deferred income 3,822 3,634

------------------------------------ --------- ------------

9,641 7,901

------------------------------------ --------- ------------

11. Share capital

As at As at

31 July 31 January

2019 2019

GBP'000 GBP'000

---------------------------------------------- --------- ------------

Allotted, called up and fully paid

110,805,795 (Jan 2019: 99,031,889) ordinary

shares of 10p each 11,082 9,903

226,699,878 (Jan 2019: 226,699,878) deferred

shares of 4p each 9,068 9,068

---------------------------------------------- --------- ------------

20,150 18,971

---------------------------------------------- --------- ------------

12. Business combinations

On 7 May 2019, the Company entered into two share purchase

agreements (each a "SPA") to acquire the entire issued share

capital of Geomap-Imagis Participations ("Geomap-Imagis") (the

"Acquisition"), for a total consideration of EUR7.0m (the

"Consideration").

The first SPA, between 1Spatial plc, its wholly owned subsidiary

1Spatial France SAS ("1Spatial France"), and certain individual

shareholders (the "Majority Vendors"), relates to 80 per cent. of

the voting rights of Geomap-Imagis (the "Majority SPA") and the

second SPA, between 1Spatial France and Esri France, relates to the

remaining 20 per cent. of the voting rights of Geomap-Imagis (the

"Esri SPA"). The SPAs have been entered into concurrently and are

inter-conditional.

Under the terms of the Majority SPA, the Group shall pay to the

Majority Vendors total consideration of EUR5,600,136, of which

EUR4,433,137 is to be satisfied in cash (the "Majority Cash

Consideration") by 1Spatial France with the balance of EUR1,166,999

to be satisfied by the issue by 1Spatial plc of new ordinary shares

in the capital of the Company (the "Consideration Shares").

Of the Majority Cash Consideration, EUR4,024,135 is to be paid

by 1Spatial France to the Majority Vendors immediately upon

completion of the Acquisition ("Completion"), with the balance of

EUR409,002 to be held in escrow until the first anniversary of

Completion.

Of the consideration to be satisfied by the issue of the

Consideration Shares, EUR726,459 was satisfied immediately upon

Completion and the balance of EUR440,540 will be satisfied on 30

March 2023. Accordingly, the Company has issued, conditional on

Completion, 1,902,686 new ordinary shares (the "Initial

Consideration Shares") at an effective price of 32.68 pence per

Initial Consideration Share. The Initial Consideration Shares are

subject to a lock up obligation until 31 December 2021.

Under the terms of the Esri SPA, 1Spatial France shall pay cash

consideration of EUR1.4 million; half upon Completion (the "First

Instalment") and half no later than 13 months following the

Completion date (the "Second Instalment"). 1Spatial has granted a

guarantee to Esri France to secure the payment of the Second

Instalment.

12. Business combinations (continued)

Alongside and in conjunction with the Acquisition, 1Spatial

France and 1Spatial Belgium ("1Spatial Europe") have entered into a

new partnership agreement with Esri Inc. ("Esri") (the "Partnership

Agreement"). The combination of the Partnership Agreement and

Acquisition is expected to significantly benefit the Company's

existing European customers in providing them with access to Esri's

market leading global GIS platform.

In addition to being immediately earnings enhancing, the

Acquisition offers a combination of specialised vertical business

applications and significant know-how in the Group's target

sectors, which can be delivered through the combination of 1Spatial

Europe and Geomap-Imagis.

GBP'000

Majority Cash Consideration - on completion (EUR4,433,137) 3,823

Initial Consideration Shares - on completion (EUR726,459) 626

Deferred Consideration Shares - issued on 30 March

2023 (EUR440,540) 380

Majority SPA total consideration 4,829

Cash Consideration - First Instalment - on completion

(EUR700,000) 604

Deferred cash consideration - Second Instalment 13

months following completion (EUR711,375) 613

Esri SPA total consideration 1,217

Total purchase consideration 6,046

------------------------------------------------------------ --------

Provisional fair values of assets and liabilities

at the date of acquisition: GBP'000

Intangible assets * 3,412

Property, plant and equipment 147

Indemnification asset 154

Right of use asset 805

Cash and cash equivalents 2,276

Trade and other receivables 2,831

Tax asset 167

Trade and other payables (3,109)

Borrowings (732)

Lease liability (805)

Deferred tax liability (665)

Defined benefit pension obligation (751)

Total identifiable net assets 3,730

--------------------------------------------------- --------

Goodwill * 2,316

--------------------- ------

Total consideration 6,046

--------------------- ------

Satisfied by:

- Majority Cash Consideration - on completion (EUR4,433,137) 3,823

- Cash Consideration - First Instalment - on completion

(EUR700,000) 604

- Deferred cash consideration - Second Instalment

13 months following completion (EUR711,375) 613

- Equity instruments - on completion (1,902,686 ordinary

shares of 1Spatial plc) 626

- Equity instruments (ordinary shares of 1Spatial

plc to the value of EUR440,540) 380

-------------------------------------------------------------- --------

Total consideration transferred 6,046

-------------------------------------------------------------- --------

Cash consideration on completion 4,427

Less: cash and cash equivalents acquired (2,276)

Net cash outflow arising on completion 2,151

Deferred cash consideration 613

Net cash purchase consideration 2,764

-------------------------------------------------------------- --------

* This represents the provisional accounting for the split

between intangible assets and goodwill which will be finalised in

the annual report for the year ending 31 January 2020.

13. Post balance sheet events

In August and September 2019, EUR1.8m of bank loans were secured

to support the integration phases of the French acquisition and

provide additional working capital during seasonal cycles.

Integration loan:

On 19 August 2019, 1Spatial France SAS secured a EUR1,000,000

loan from Le Credit Lyonnais (LCL) to support the integration

phases of the French acquisition. The loan is for a duration of 4

years and 9 months, at a fixed rate of interest of 1.3% per year

(increased to 1.89% including insurance and warranty fees) and paid

quarterly. Funds can be withdrawn up until 16 May 2020 and any

funds not withdrawn by that date will be lost. As such, the total

loan may not be fully utilised. 1Spatial France SAS has not drawn

down any funds on this loan to date. Repayment of the loan will

commence from 16 August 2020, with 16 quarterly instalments ending

on 16 May 2024, assuming withdrawals are made.

Innovation loan:

On 10 September 2019, 1Spatial France SAS secured a EUR800,000

loan (less a EUR40,000 guarantee and EUR3,200 administrative costs)

from French Public Investment Bank, BPI France, to provide

additional working capital during seasonal cycles. The loan is for

a duration of 7 years, at a fixed rate of interest of 2.82% per

year. Quarterly interest payments are required from December 2019

up until December 2021. From 30 December 2021 until September 2026,

20 quarterly instalments of EUR40,000 will be repaid along with the

interest, with the final payment scheduled for 30 September

2026.

14. Changes in accounting policies

IFRS 16 'Leases' is effective for accounting periods beginning

on or after 1 February 2019 and replaces IAS 17 'Leases'. It

eliminates the classification of leases as either operating leases

or finance leases and, instead, introduces a single lessee

accounting model. The adoption of IFRS 16 resulted in the Group

recognising lease liabilities, and corresponding 'Right-of-use'

assets for arrangements that were previously classified as

operating leases.

The Group's principal lease arrangements are for property, most

notably a portfolio of office premises, and for a global car fleet,

utilised primarily by our sales and marketing teams. The Group has

adopted IFRS 16 using the simplified approach with the cumulative

effect of initially applying the standard as an adjustment to the

opening balance of retained earnings at 1 February 2019. The

standard permits a choice on initial adoption, on a lease-by-lease

basis, to measure the right-of-use asset at either its carrying

amount as if IFRS 16 had been applied since the commencement of the

lease, or an amount equal to the lease liability, adjusted for

accruals or prepayments. The Group has elected to measure the

right-of-use asset equal to the lease liability, with the result of

no net impact on opening retained earnings and no restatement of

prior period comparatives.

Initial adoption resulted in the recognition of right-of-use

assets of GBP3.8m and lease liabilities of GBP3.8m. The weighted

average incremental borrowing rate applied to the lease liabilities

on 1 February 2019 was 3.84%.

The Group is using one or more practical expedients on

transition to leases previously classified as operating leases,

including electing to apply a single discount rate to portfolios of

leases with similar characteristics, reliance on previous

assessments on whether arrangements contain a lease and whether

leases are onerous, excluding initial direct costs from the initial

measurement of the right-of-use asset, and using hindsight in

determining the lease term where the contract contains options to

extend or terminate the lease.

Key judgements made in calculating the initial impact of

adoption include determining the lease term where extension or

termination options exist. In such instances, all facts and

circumstances that may create an economic incentive to exercise an

extension option, or not exercise a termination option, have been

considered to determine the lease term. Extension periods (or

periods after termination options) are only included in the lease

term if the lease is reasonably certain to be extended (or not

terminated). Estimates include calculating the discount rate which

is based on the incremental borrowing rate.

The Group is applying IFRS 16's low-value and short-term

exemptions. While the IFRS 16 opening lease liability is calculated

differently from the previous operating lease commitment calculated

under the previous standard, there are no material differences

between the positions. The adoption of IFRS 16 has had no impact on

the Group's net cash flows, although a presentation change has been

reflected whereby cash outflows of GBP431k are now presented as

financing, instead of operating. Lease costs previously reported in

administrative expenses, now reported in depreciation and interest

charges result in a GBP472k benefit to adjusted EBITDA, with a

corresponding increase of GBP431k in the depreciation charge and a

GBP41k increase in the interest charge (the benefit to operating

loss is GBP41k with a corresponding increase in the interest

charge). Profit before tax, taxation and EPS have not been

significantly impacted.

Consolidated values affecting the P&L and Balance sheet from

1 February 2019 to 31 July 2019

Measurement of lease liabilities and right-of-use asset:

GBP'000

Operating lease commitments disclosed as at 31 January

2019 (840)

Add: finance lease liabilities recognised as at 31

January 2019 (2,118)

Lease liability recognised as at 31 January 2019 * (2,958)

Of which are:

Current lease liabilities (817)

Non-current lease liabilities (2,141)

Liabilities acquired on acquisition of the Geomap-Imagis

Group (852)

Lease liability recognised as at initial adoption (3,810)

Right-of-use asset recognised as at initial adoption 3,810

* This does not include the Geomap-Imagis Group's leases, as

they became part of the Group in May 2019

P&L impact for six months to 31 July 2019:

GBP'000

Depreciation charge (431)

Interest charge (41)

Foreign exchange charge (13)

Carrying amounts at 31 July 2019:

GBP'000

Right-of-use asset 3,365

Lease liability (3,363)

Split of Right-of-use asset at 31 July 2019 by type of

asset:

GBP'000

Buildings 3,089

Cars 207

Other 69

Total 3,365

Split of lease liability at 31 July 2019 by geography:

GBP'000

Europe (3,262)

USA (95)

Australia (6)

Total (3,363)

Split of lease liability at 31 July 2019 - current and

non-current:

GBP'000

Current (931)

Non-current (2,432)

Total (3,363)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DMMMGDMNGLZM

(END) Dow Jones Newswires

October 14, 2019 02:00 ET (06:00 GMT)

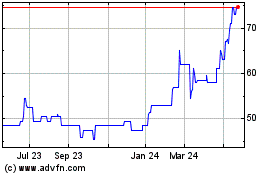

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

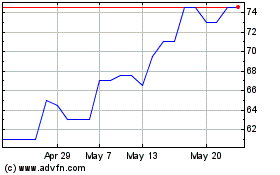

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025