3 Energy ETFs to Watch After Oil Service Stock Earnings - ETF News And Commentary

April 22 2014 - 10:00AM

Zacks

Though still remaining in the bottom 7% zone in the Zacks Industry

Rank list, the oil-field services industry moved up 9 places last

week. Lower oil prices are definitely a concern in the space, which

seems poised for a decent growth on the revival of the global

economy (read: Play the U.S. Oil Boom with These Energy ETFs).

Two sector bellwethers,

Schlumberger Ltd.

(

SLB) and

Baker Hughes

(BHI) came out with

their Q1 earnings results on April 17 though they

witnessed different pricing impacts following their earnings

releases.

Schlumberger 1Q Earnings in Detail

The world's largest oilfield services provider doled out a mixed Q1

by reporting adjusted earnings of $1.21 per share (excluding

special items) beating the Zacks Consensus Estimate by a penny and

improving from the year-ago number of $1.01. Total revenue of $11.2

billion was up 6.3% year over year but fell short of the Zacks

Consensus Estimate of $11.5 billion.

Contribution from international market remained muted.

Geo-political tension in Russia, slowdown in China and severe

winter weather in North America which disturbed

drillings partially outweighed the company’s growing new

technology sales and integration activity. Also, there was no twist

in the guidance point of view as the one of projection remained

intact for the most part (read: A Beginner's Guide to Alternative

Energy ETFs).

Baker Hughes 1Q Earnings in Detail

Baker Hughes’ first quarter 2014 adjusted earnings from continuing

operations of $0.8 a share, which beat the Zacks Consensus Estimate

of $0.79 thanks to improved North America business, also grew 29.2%

year over year.

Its total revenue of $5.73 billion jumped 9.6% from the

year-ago level beating the Zacks Consensus Estimate of $5.71

billion. Recommencement in Iraq activity and surging demand for

high technology services in Africa, the Middle East and Asia

Pacific led this oilfield stock’s outperformance.

Market Impact

Quite expectedly, Schlumberger‘s mixed results had an adverse

impact on its prices, as SLB shares were down 1.02% on the day of

the earnings release with somewhat elevated volumes compared to a

normal day while Baker Hughes’ shares were up 3.05% on all-star

performance in the quarter. The volumes traded on Baker Hughes’

earnings day was twice a normal day.

In fact, the overall energy sector perked up on BHI’s earnings and

bullish underlying fundamentals which overruled SLB’s top-line

weakness. Also, increased trading could have a huge impact on ETFs

that are heavily invested in these two renowned oil-service

companies.

Below, we have highlighted three oil-services ETFs with

considerable allocation to SLB and BHI that could see some gains in

a few upcoming trading sessions (read: 3 Energy ETFs Marching

Higher in the Past Week):

iShares US Oil

Equipment & Services ETF

(IEZ)

This ETF – tracking the Dow Jones U.S. Select Oil Equipment &

Services Index – invests about $546.9 million in assets in 52

securities, focusing solely on the energy world. In-focus SLB takes

up the first position here with 21.14% of holdings while BHI

occupies the fourth position with about 6.57% of holdings. IEZ is a

cheaper fund, charging 0.45% in expenses. This ETF gained about

0.58% in Thursday’s trading. The fund has surged 7.76% so far this

year.

Market Vectors Oil Services ETF

(OIH)

OIH tracks the Market Vectors US Listed Oil Services 25 Index. The

index invests $1.37 billion of assets in 26 holdings. OIH devotes

as much as 20.62% weight to SLB and 5.24% to BHI. OIH is cheap

in the space with an expense ratio of 0.35%. The fund was up about

0.35% on the day, and has returned about 6.30% so far this

year.

PowerShares Dynamic Oil & Gas Services Fund

(PXJ)

This product offers exposure to 30 energy stocks with BHI and SLB

at the third and fourth positions, allocating 5.11% and 5.09% of

total assets. PXJ tracks the Dynamic Oil & Gas Services

Intellidex Index and has amassed about $134.4 million thus

far. The ETF charges 62 bps in fees which makes it an

expensive choice in the energy ETF space.

The fund added about 0.76% on the day of SLB and BHI's earnings

releases and 7.08% in year-to-date frame.

Bottom Line

Though Schlumberger’s missed on revenues, the ETFs with big

holdings in it did not suffer, and instead benefited from BHI’s

huge gains. Although the prospect of bullishness in the oil-field

services sector is still not quite capable thanks mainly to the

supply glut issues, the sector will likely gain in the near term on

nagging Russian geo-political concerns, supply outages in Nigeria

and Libya, and signs of recovery in the global economy (read: 3

Energy ETFs to Buy on the Ukraine Crisis).

So, risk-tolerant investors can buy the aforementioned ETFs on the

still-muted sentiment surrounding the space. The products seem to

be undervalued as well at the current level with trailing four

quarters’ P/E ratios of OIH and IEZ falling behind the

SPDR

S&P 500 (SPY),

suggesting they should be solid value picks too.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

BAKER-HUGHES (BHI): Free Stock Analysis Report

ISHARS-US OIL E (IEZ): ETF Research Reports

MKT VEC-OIL SVC (OIH): ETF Research Reports

PWRSH-DYN OIL&G (PXJ): ETF Research Reports

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

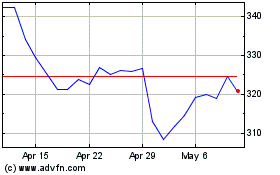

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Nov 2024 to Dec 2024

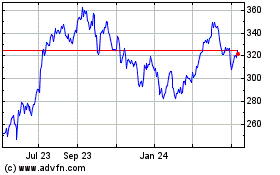

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Dec 2023 to Dec 2024