TIDMEOG

RNS Number : 1293X

Europa Oil & Gas (Holdings) PLC

24 April 2023

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG /

Sector: Oil & Gas

24 April 2023

Europa Oil & Gas (Holdings) plc

("Europa" or the "Company")

Interim Results

Europa Oil & Gas (Holdings) plc, the AIM quoted UK and

Ireland focused oil and gas exploration, development and production

company , announces its unaudited interim results for the six-month

period ended 31 January 2023.

Financial Performance

-- Highest interim revenues recorded in Company's history as a

result of continued excellent operational performance and a strong

oil price

-- Revenue GBP3.7 million (H1 2022: GBP2.2 million)

-- Gross profit GBP1.5 million (H1 2022: GBP0.9 million)

-- Pre-tax loss of GBP1.3 million (H1 2022: pre-tax profit

GBP0.7 million) after exploration impairment charge of GBP1.7

million (H1 2022: impairment reversal GBP0.4 million)

-- Net cash from operating activities GBP1.7 million (H1 2022: GBP0.9 million)

-- Unrestricted cash balance at 31 January 2023: GBP5.1 million (31 July 2022: GBP1.4 million)

Operational Highlights

Onshore UK - Wressle oilfield continues to exceed expectations,

generating strong levels of revenues and production

-- Total production net to Europa averaged 268 bopd during the

H1 period, a 29% increase on H1 last year

-- Wressle net production to Europa increased 55% from 134 bopd

to 207 bopd as the field performed better than expected

-- Wressle now the second most productive onshore UK oilfield

-- The well continues to produce under natural flow with zero

water cut and remains highly cash generative

-- A new seismic interpretation and mapping exercise across the

Wressle field has highlighted a potentially significant increase in

resources from the Ashover Grit and the results of the analysis are

now being incorporated into the field development plan. The

intention is that the next development well will be drilled from

the existing Wressle site and planning and permitting work for the

well is ongoing. The well will be drilled at the earliest

opportunity, subject to receipt of regulatory approval

-- Ongoing work to utilise the associated gas being produced

from Wressle which is expected to lead to further increases in oil

production during H2 2023

-- An independent technical report has been commissioned which

will incorporate the new field interpretation, historical

production performance data and the field development plan. The

report is expected to be completed during June 2023

Offshore Ireland - Low risk / high reward infrastructure-led

exploration in the proven Slyne Basin gas play

-- The FEL 4/19 licence extension was granted by the Irish

Government, extending the initial phase to January 2024

-- Licence FEL 4/19 contains the Inishkea gas exploration

prospect, estimated by ERCE, a third-party reserves auditor to hold

1.5 tcf of recoverable gas

-- A farm-out process has begun which is expected to conclude by

year end 2023, with the aim of bringing in a partner to assist with

the drilling of the prospect

-- Given the security of supply issues that Ireland faces, the

Board believes that it is in the interest of Ireland that this

prospect is drilled as soon as reasonably possible, especially as

local existing infrastructure would make any development a low

carbon intensity project

Offshore UK

-- Progress continues with the development of the Serenity oil

discovery in the Central North Sea alongside our partner i3

Energy

-- Despite drilling an appraisal well in October 2022 that

failed to encounter hydrocarbons, the partners believe that

Serenity offers a commercially viable development opportunity with

a number of potential development scenarios available given local

infrastructure

-- A future development could result in approximately 1,000 bopd net to Europa's 25% interest

Morocco

-- The extension to the Initial Period of the Inezgane Licence

offshore Morocco announced on 21 October 2020 came to an end in

November 2022, and Europa decided not to progress to the First

Extension Period

ESG

-- Initiated ESG review focused on integrating the ESG

principles adopted by Europa into the Company's planning and wider

strategy

-- Europa contributes to the Wressle Community Fund, which has

been operating since early 2022 and provides funds to meet the

needs of local charities and community groups. The Company and its

Wressle JV partners make an annual contribution of GBP100,000 to

the fund

Post Period

-- In March 2023, the Company announced that Simon Oddie was

stepping down as CEO, with Will Holland moving from his role as CFO

to replace him with immediate effect

-- The operator of Wressle announced that gross revenues from

the field since August 2021 had reached US$35.0 million by late

March 2023, representing approximately US$10.5 million net to

Europa

-- On 3 April 2023 Alastair Stuart, a petroleum engineer with

over 30 years of experience, was appointed Chief Operating Officer

and an Executive Director of the Company. Mr Stuart has been a

consultant at Europa since 2012 and more recently has been

intimately involved in the development of the Wressle Field

-- In order to ensure that the finance function within Europa is

suitably resourced, the Company has increased its existing mandate

with Clifton Financial Solutions Limited ("Clifton"). Clifton

already provides accounting services to Europa and from April 2023

will also provide administrative services that would typically fall

under the remit of a CFO

Will Holland, CEO of Europa, said :

"I am pleased to report my first set of interim results as CEO

showing record operational numbers which resulted in Europa

continuing to be in a strong financial position. These numbers were

all generated whilst Simon Oddie was CEO and are a testament to the

excellent job that he has done at Europa since 2018.

The Wressle oilfield's continued excellent performance has

underpinned our significant growth in revenues during the period,

and a number of projects are underway to enable increased oil

production and gas monetisation from the field. The first phase of

the gas utilisation project was completed in January 2023, whereby

three microturbines were connected to provide site power which have

resulted in a c. 10% increase in oil production. The second stage

is the installation of a gas engine to generate 1.4 MW of

electricity into a local private power network.

In addition to building on our corporate ESG framework, the

cornerstone of our long-term commitment to the global energy

transition, we initiated a farm-out process for our Irish offshore

licence FEL 4/19. Within the licence is the extensive Inishkea gas

prospect containing an estimated 1.5 tcf of gas, and we recognise

the significant potential of FEL 4/19 to help alleviate Ireland's

energy security concerns by providing the nation with a dependable

source of gas produced with low carbon emissions.

Europa remains a highly cash generative business, and our robust

financial foundations will enable us to continue to work towards

optimising our existing assets in the second half of the year,

whilst we also pursue potential UK offshore and onshore

opportunities to add to our well-balanced portfolio and deliver

further value for shareholders. "

* *S * *

For further information, please visit www.europaoil.com or

contact:

William Holland / Murray Europa Oil & Gas (Holdings) mail@europaoil.com

Johnson plc

Strand Hanson Limited

- Nominated & Financial +44 (0) 20 7409

James Dance / James Spinney Adviser 3494

+44 (0) 20 7186

Peter Krens Tennyson Securities 9033

Patrick d'Ancona / Finlay + 44 (0) 20 7390

Thomson / Kendall Hill Vigo Consulting 0230

Notes to Editors

Europa Oil & Gas (Holdings) plc has a diversified portfolio

of multi-stage hydrocarbon assets which includes production,

development and exploration interests, in countries that are

politically stable, have transparent licensing processes, and offer

attractive terms. Average production for the 6-month period ending

31 January 2023 was 268 bopd. In April 2022, Europa farmed into

P.2358, Block 13/23c ("Serenity") in the Outer Moray Firth area of

the North Sea. The licence contains the 2019 Serenity oil

discovery, in which Europa now has a 25% interest. The Company

holds one exploration licence offshore Ireland, which has the

potential to host gross mean un-risked prospective resources of 1.5

trillion cubic feet ("tcf") gas. Inishkea is a near field gas

prospect in the Slyne Basin which the Company classifies as lower

risk due to its close proximity to the producing Corrib gas field

and associated gas processing infrastructure.

Chairman's Statement

The first half of the financial year was a significant period

for Europa, and the outstanding performance of Wressle, our

flagship producing asset, has enabled us to strengthen our

financial foundations by continuing to deliver material cashflow,

facilitating further investment in our existing assets. Europa

welcomed the UK Government's 33(rd) offshore oil and gas licensing

round, and we remain in a favourable position to pursue

opportunities in the North Sea, as well as onshore UK, to add

domestic projects with minimal emissions to our already diverse

asset portfolio.

In the period, we delivered revenue growth of 68% to GBP3.7

million (H1 2022: GBP2.2 million), driven by Wressle's impressive

daily production rate of 689 bopd during the period. Compared to H1

2022, n et cash increased substantially to GBP5.1 million in the

first half of the financial year (H1 2022: GBP0.6 million), whilst

the average realised oil price increased by 13% to US$88 per

barrel. Planned gas monetisation solutions for Wressle, coupled

with the planned drilling of a development well scheduled for H2

2023, demonstrates our continued commitment to upgrading this key

asset to augment production and generate additional revenues,

whilst also eliminating gas flaring from the field.

We are actively focused on finding a partner to farm-in to our

FEL 4/19 licence located off the west coast of Ireland. The licence

contains the extensive, low-risk Inishkea prospect and could

potentially play an integral role in the energy transition by

providing Ireland with a dependable source of indigenous energy

that is projected to have a much lower carbon footprint than gas

imported from Europe. Inihskea could provide over 60% of the

forecast Irish gas demand for up to 10 years and the development of

a discovery would form an essential element of Ireland's energy

security. As well as providing for c.180 high quality secure jobs

for another c.15 years, Inishkea gas also has an extremely low

emissions intensity. It is estimated that Inishkea gas production

would be one twelfth of the emissions intensity of UK imported gas,

and less than one fiftieth of the emissions intensity of LNG

imported from the USA. In H1 2023, the Irish Government granted an

extension to the first phase of our licence, which now runs until

January 2024, and we look forward to working constructively with

the Department of the Environment, Climate and Communications as we

seek to progress FEL 4/19 to drilling .

Although our appraisal well at Serenity did not encounter

oil-bearing sands, Europa continues to explore options for the

development of the oilfield in the Central North Sea. We are

currently evaluating with our partners the possibility of

developing the discovered reserve via the Repsol Sinopec's Tain

field, which could be as a unified development and potentially

highly material to Europa.

On behalf of the Board, I would like to express my sincere

thanks to Simon Oddie for his hard work and leadership as CEO of

Europa and wish him well as he begins his well-earned retirement. I

am glad that he has agreed to continue as a non-executive director

at Europa and look forward to continuing to work with him in a

non-executive capacity. I would also like to thank our management

team, employees, and consultants for their hard work and dedication

over the course of the reporting period and beyond. We also thank

our shareholders for their continued support and look forward to

updating the market on our operational and business activities

during this exciting period for the Company.

Mr Brian O'Cathain (Non-Executive Chairman)

24 April 2023

Operational Review

Financials

Average daily H1 2023 production was 268 boepd compared to 208

boepd in H1 2022. There was a 13% increase in average realised oil

price to US$88 per barrel (H1 2022: US$77.84). Foreign exchange

movements had a slight positive impact on revenues as US dollar

sales converted to pound sterling at US$1.18 (H1 2022:

US$1.35).

-- Revenue was GBP3.7 million (H1 2022: GBP2.2 million)

-- Net cash received from operating activities was GBP1.7 million (H1 2022: GBP0.9 million)

-- The Group's unrestricted cash balance as at 31 January 2023

was GBP5.1 million (31 July 2022: GBP1.4 million)

Based upon the Group cashflow forecasts, the Directors have

concluded that there is a reasonable expectation that the Group

will be able to continue in operational existence for the

foreseeable future, which is deemed to be at least 12 months from

the date of signing the consolidated financial information. Further

comments on going concern are included in note 1 to the financial

statements below.

Conclusion and Outlook

We delivered a strong H1 2023 financial performance, underpinned

by the high levels of revenue generated from our UK onshore

producing assets, particularly the Wressle oilfield. In addition to

substantially increasing our revenues to GBP3.7 million (H1 2022:

GBP2.2 million) and achieving a gross profit of GBP1.5 million (H1

2022: GBP0.9 million), we also considerably strengthened our

balance sheet, resulting in net cash of GBP5.1 million at the end

of the period. Wressle, currently the second most productive

onshore UK oilfield, continues to surpass all expectations, and we

remain committed to further enhancing the field's efficiency and

increasing production through gas monetisation solutions, alongside

advancing the development drilling to enable further

production.

During H1 2023, the first phase of our 100%-owned offshore

Ireland licence FEL 4/19, which contains two prospects that have

the potential to deliver over 2 tcf of gas, was extended by the

Irish authorities. With the Inishkea prospect located only 11km

from the producing Corrib gas field, we believe FEL 4/19 has the

potential to provide Ireland with a reliable fast track gas

development to supply low carbon emission energy, helping satisfy

the nation's energy security demands alongside accommodating the

transition to net zero. Following the extension, we are well

positioned to continue conducting technical studies of the licence

as we focus on securing a partner to farm-in to the project.

Bolstered by the UK Government's continued commitment to

investing in the exploration of North Sea hydrocarbons, we continue

to assess development options for the offshore UK Serenity oilfield

alongside partner i3 Energy. With Serenity strategically located

nearby existing infrastructure, one cost-effective solution we are

exploring is to develop the discovered reserve via Repsol Sinopec's

Tain Field. A potential unitised development could deliver

significant benefits to Europa and our shareholders, with net

production to Europa anticipated to be c.1,000 bopd.

During the period, we continued to work on our ESG strategy to

ensure that the ESG principles adopted by Europa Board are

integrated into our planning and wider strategy. We have pledged to

go beyond the necessary ESG-related requirements of an AIM-quoted

company and look forward to building on the significant ESG

progress generated in H1 2023 to help contribute to the 2050 Net

Zero target.

With a balanced portfolio of producing, appraisal, and

exploration assets, Europa is ideally placed to explore further

opportunities to develop and acquire high potential assets which

could facilitate the energy transition and generate additional

value for our shareholders. Management looks ahead to the second

half of the financial year with confidence and remains fully

focused on delivering our strategic priorities.

Will Holland

CEO

22 April 2023

Qualified Person Review

This release has been reviewed by Alastair Stuart, Chief

Operating Officer, who is a petroleum engineer with over 35 years'

experience and a member of the Society of Petroleum Engineers and

has consented to the inclusion of the technical information in this

release in the form and context in which it appears.

Licence Interests Table

Country Area Licence Field/ Operator Equity Status

Prospect

Ireland Slyne Basin FEL 4/19 Inishkea, Europa 100% Exploration

Inishkea

West

-------------- -------------- -------------- --------- ------- ------------

UK East Midlands DL 003 West Firsby Europa 100% Production

-------- -------------- -------------- -------------- --------- ------- ------------

DL 001 Crosby Warren Europa 100% Production

-------- -------------- -------------- -------------- --------- ------- ------------

PL199/215 Whisby-4 BPEL 65% Production

199/215

-------------- -------------- --------- ------- ------------

PEDL180 Wressle Egdon 30% Development

-------------- -------------- --------- ------- ------------

PEDL181 Europa 50% Exploration

-------------- -------------- --------- ------- ------------

PEDL182 Broughton Egdon 30% Exploration

North

-------------- -------------- --------- ------- ------------

PEDL299 Hardstoft Ineos 25% Appraisal

-------------- -------------- --------- ------- ------------

PEDL343 Cloughton Egdon 40% Appraisal

-------------- -------------- -------------- --------- ------- ------------

Central P.2358, BLOCK Serenity i3 25% Exploration

North Sea 13/23C

-------- -------------- -------------- -------------- --------- ------- ------------

Financials

Unaudited condensed consolidated statement of comprehensive

income

Year to

31 July

2022

6 months 6 months

to 31 January to 31 January

2023 2022 (audited)

GBP000 GBP000 GBP000

Continuing

operations

Revenue 3,695 2,191 6,584

------------------ --------------------------------------------- --------------------------------------------- --------------------------------------

Cost of sales (2,135) (1,246) (3,806)

Impairment of

producing fields (18) - (570)

------------------ --------------------------------------------- --------------------------------------------- --------------------------------------

Total cost of

sales (2,153) (1,246) (4,376)

------------------------------------- ------------------------------------- ---------------------------------

Gross profit 1,542 945 2,208

Exploration (write

off)/write back

(note 3) (1,685) 360 -

Administrative

expenses (846) (463) (821)

Finance income 1 20 239

Finance expense (299) (119) (238)

------------------------------------- ------------------------------------- ---------------------------------

(Loss)/profit

before taxation (1,287) 743 1,388

Taxation (note 5) - - (32)

------------------------------------- ------------------------------------- ---------------------------------

(Loss)/profit for

the period (1,287) 743 1,356

Other

comprehensive

income

Items that will

not be

reclassified

to loss, net of

tax

Loss on investment

revaluation (8) (17) (18)

------------------------------------- ------------------------------------- -------------------------------------

Total

comprehensive

(loss)/income

for the period

attributed to the

equity

shareholders of

the parent (1,295) 726 1,338

======================== ======================== ========================

Pence per Pence per Pence per

share share share

Earnings/(loss)

per share (EPS)

attributable

to the equity

shareholders of

the parent

Attributable to

the equity

shareholders

of the

Basic EPS (note 4) (0.13)p 0.13p 0.19p

Diluted EPS (note

4) (0.13)p 0.13p 0.18p

Unaudited condensed consolidated statement of financial

position

31 July

2022

31 January 31 January

2023 2022 (audited)

GBP000 GBP000 GBP000

Assets

Non-current assets

Intangible assets (note 6) 6,769 2,960 3,785

Property, plant and equipment

(note

7) 2,526 4,006 3,021

------------------------------------- ------------------------------------- -------------------------------------

Total non-current assets 9,295 6,966 6,806

------------------------------------- ------------------------------------- -------------------------------------

Current assets

Investments 16 25 24

Inventories 26 50 36

Trade and other receivables 1,509 822 1,866

Restricted cash - 238 6,884

Cash and cash equivalents 5,146 624 1,394

------------------------------------- ------------------------------------- -------------------------------------

Total current assets 6,697 1,759 10,204

------------------------------------- ------------------------------------- -------------------------------------

Total assets 15,992 8,725 17,010

==================== ==================== ========================

Liabilities

Current liabilities

Borrowing (note 8) - (10) (40)

Trade and other payables (1,602) (1,177) (1,573)

------------------------------------- ------------------------------------- -------------------------------------

Total current liabilities (1,602) (1,187) (1,613)

------------------------------------- ------------------------------------- -------------------------------------

Non-current liabilities

Borrowings (note 8) - (35) -

Trade and other payables (15) (11) (4)

Long-term provisions (note 9) (4,372) (3,510) (4,164)

---------------------------------- ---------------------------------- -------------------------------------

Total non-current liabilities (4,387) (3,556) (4,168)

---------------------------------- ---------------------------------- -------------------------------------

Total liabilities (5,989) (4,743) (5,781)

----------------------------------- ----------------------------------- -------------------------------------

Net assets 10,003 3,982 11,229

==================== ==================== ========================

Capital and reserves

attributable

to equity holders of the

parent

Share capital 9,592 5,665 9,565

Share premium 23,682 21,157 23,660

Merger reserve 2,868 2,868 2,868

Retained deficit (26,139) (25,708) (24,864)

---------------------------------- ---------------------------------- -------------------------------------

Total equity 10,003 3,982 11,229

===================== ======================== =======================

Unaudited condensed consolidated statement of changes in

equity

Share Share Merger Retained Total

capital premium reserve deficit equity

GBP000 GBP000 GBP000 GBP000 GBP000

Unaudited

Balance at 1

August

2022 9,565 23,660 2,868 (24,864) 11,229

Comprehensive

income

for the period

Loss for the

period

attributable

to the

equity

shareholders

of the parent - - - (1,287) (1,287)

Other

comprehensive

loss

attributable

to the equity

shareholders

of the parent - - - (8) (8)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Total

comprehensive

income for

the period - - - (1,295) (1,295)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Contributions

by

and

distributions

to owners

Issue of share

capital 27 22 - - 49

Share-based

payments - - - 20 20

---------------------------------- ---------------------------------- ---------------------------------- --------------------------------- ------------------------------

Total

transactions

with owners 27 22 - 20 69

----------------------------------- ----------------------------------- ----------------------------------- ----------------------------------- -----------------------------------

Balance at 31

January

2023 9,592 23,682 2,868 (26,139) 10,003

======================= ======================= ======================= ======================= =======================

Unaudited

Balance at 1

August

2021 5,665 21,157 2,868 (26,441) 3,249

Profit for the

period

attributable

to the

equity

shareholders

of the parent - - - 743 743

Other

comprehensive

loss

attributable

to the equity

shareholders

of the parent - - - (17) (17)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Total

comprehensive

loss for the

period - - - 726 726

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Contributions

by

and

distributions

to owners

Share-based

payments - - - 7 7

---------------------------------- ---------------------------------- ---------------------------------- --------------------------------- ------------------------------

Total

transactions

with owners - - - 7 7

----------------------------------- ----------------------------------- ----------------------------------- ----------------------------------- -----------------------------------

Balance at 31

January

2022 5,665 21,157 2,868 (25,708) 3,982

======================= ======================= ======================= ======================= =======================

Audited

Balance at 1

August

2021 5,665 21,157 2,868 (26,441) 3,249

Profit for the

year

attributable

to the

equity

shareholders

of the parent - - - 1,356 1,356

Other

comprehensive

loss

attributable

to the equity

shareholders

of the parent - - - (18) (18)

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Total

comprehensive

loss for the

year - - - 1,338 1,338

--------------------------------- --------------------------------- -------------------------------- ------------------------------ -------------------------------

Contributions

by

and

distributions

to owners

Issue of share

capital 3,900 2,722 - - 6,622

Issue of share

warrants - (219) - 219 -

Share-based

payments - - - 20 20

---------------------------------- ---------------------------------- ---------------------------------- --------------------------------- ------------------------------

Total

transactions

with owners 3,900 2,503 - 239 6,642

---------------------------------- ---------------------------------- --------------------------------- ------------------------------ -------------------------------

Balance at 31

July

2022 9,565 23,660 2,868 (24,864) 11,229

================================== ================================== ================================== =============================== ==============================

Unaudited condensed consolidated statement of cash flows

Year to

31 July

6 months 6 months

to to 2022

31 January 31 January

2023 2022 (audited)

GBP000 GBP000 GBP000

Cash flows generated from

operating

activities

(Loss)/profit after

taxation (1,287) 743 1,356

Adjustments for:

Share-based payments 20 7 20

Depreciation 551 627 1,618

Taxation charge

recognised in

profit

and loss - - 32

Impairment of

producing fields 18 - 570

Exploration

write-off 1,685 - -

Reversal of cost

accrual on

relinquishment

of licences - (360) -

Finance income - (20) -

Finance expense 299 119 238

Decrease/(increase)

in trade and

other receivables 356 (300) (1,344)

(Increase)/decrease

in inventories 10 (27) (13)

Decrease in trade

and other payables 54 90 18

----------------------------------- ----------------------------------- -------------------------------------

Net cash generated from

operations 1,706 879 2,495

Income taxes paid - - (32)

----------------------------------- ----------------------------------- -------------------------------------

Net cash generated from

operating

activities 1,706 879 2,463

======================== ======================== ========================

Cash flows from/(used in)

investing

activities

Purchase of property,

plant & equipment (74) (406) (403)

Purchase of intangibles (4,669) (487) (1,246)

Cash guarantee re Morocco 260 - -

Cash escrow deposit re

Serenity 6,622 - (6,621)

Interest received - - -

------------------------------------- ------------------------------------- -----------------------------------------------

Net cash from/(used in)

investing

activities 2,139 (893) (8,270)

======================== ======================== ========================

Cash flows (used in)/from

financing

activities

Gross proceeds from issue

of share

capital 49 - 7,020

Costs incurred on issue

of share

capital - - (398)

New borrowings 1,000 - -

Repayment of borrowings (1,040) (5) (10)

Lease liability payments (14) (7) (14)

Lease liability interest

payments (2) (1) (2)

Finance costs (89) (2) (3)

------------------------------------- ------------------------------------- --------------------------------------

Net cash (used in)/from

financing

activities (96) (15) 6,593

======================== ======================== ========================

Net increase/(decrease)

in cash

and cash equivalents 3,749 (29) 786

Exchange gain/(loss) on

cash and

cash equivalents 3 12 (33)

Cash and cash equivalents

at beginning

of period 1,394 641 641

------------------------------------- ------------------------------------- -------------------------------------

Cash and cash equivalents

at end

of period 5,146 624 1,394

======================== ======================== ========================

Notes to the consolidated interim statement

1 Nature of operations and general information

Europa Oil & Gas (Holdings) plc ("Europa Oil & Gas") and

subsidiaries' (the "Group") principal activities consist of

investment in oil and gas exploration, development and

production.

Europa Oil & Gas is the Group's ultimate parent Company. It

is incorporated and domiciled in England and Wales. The address of

Europa Oil & Gas's registered office head office is 30 Newman

Street, London, W1T 1PT. Europa Oil & Gas's shares are admitted

to trading on the AIM market of the London Stock Exchange.

Basis of preparation

The Group's condensed consolidated interim financial information

is presented in Pounds Sterling (GBP), which is also the functional

currency of the Europa Oil & Gas.

The condensed consolidated interim financial information has

been approved for issue by the Board of Directors on [22] April

2023.

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Group has chosen not to adopt IAS

34 "Interim Financial Statements" in preparing this interim

financial information.

The condensed consolidated interim financial information for the

period 1 August 2022 to 31 January 2023 is unaudited. In the

opinion of the Directors, the condensed consolidated interim

financial information for the period presents fairly the financial

position, and results from operations and cash flows for the period

in conformity with the generally accepted accounting principles

consistently applied. The condensed consolidated interim financial

information incorporates unaudited comparative figures for the

interim period 1 August 2021 to 31 January 2022 and the audited

financial year to 31 July 2022.

The financial information contained in this interim report does

not constitute statutory accounts as defined by section 435 of the

Companies Act 2006. The report should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 31 July 2022.

The comparatives for the full year ended 31 July 2022 are not

the Group's full statutory accounts for that year. A copy of the

statutory accounts for that year has been delivered to the

Registrar of Companies. The auditors' report on those accounts was

unqualified and did not contain a statement under section 498 (2) -

(3) of the Companies Act 2006.

Going concern

The Directors have prepared a cash flow forecast, which

considers the continuing and forecast cash inflow from the Group's

producing assets, the cash held by the Group at the half year end,

less administrative expenses and planned capital expenditure. The

Directors have concluded, at the time of approving the financial

statements, that there is a reasonable expectation, based on the

Group's cash flow forecasts, that the forecasts are achievable and

accordingly the Group will be able to continue as a going concern

and meet its obligations as and when they fall due for a period of

at least 12 months from the date of signing the consolidated

financial information. Accordingly, they continue to adopt the

going concern basis in preparing the condensed consolidated interim

financial information.

Critical accounting estimates

The preparation of condensed consolidated interim financial

information requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities at the

end of the reporting period. Significant items subject to such

estimates are set out in Note 1 of the Group's 2022 Annual Report

and Financial Statements. During the interim period significant

additional expenditure was incurred on the drilling of the Serenity

farm-in appraisal well (note 6). Although the appraisal well was

not successful the original discovery is still deemed to be

commercial and significant work on evaluating the development

potential of the discovered hydrocarbon accumulations at Serenity

was ongoing as at 31 January 2023. As such the carrying value of

the Serenity evaluation asset is justified by reference to

indicators of impairment as set out in IFRS 6 and the Group's

accounting policy for exploration and evaluation assets. Based on

judgements at 31 January 2023 there was no write-off capitalised

exploration and evaluation costs. The nature and amounts of other

estimates have not changed significantly during the interim

period.

2 Summary of significant accounting policies

The condensed consolidated financial information has been

prepared using policies based on UK adopted International

Accounting Standards. Except as described below, the condensed

consolidated financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial information for the year ended 31 July 2022.

(a) Accounting developments during 2022

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 31 January 2023 but

did not result in any material changes to the financial statements

of the Group.

(b) New standards, amendments and interpretations in issue but

not yet effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the Group has decided

not to adopt early. The Group is evaluating the impact of the new

and amended standards which are not expected to have a material

impact on the Group's results or shareholders' funds.

3 Exploration write back/(write off)

31 Jan 2023 31 Jan 2022 31 July 2022

GBP000 GBP000 GBP000

Release of cost

accrual on

relinquishment

of licences - 360 -

Exploration

write-off -

Morocco (1,685) - -

----------------------------------- ----------------------------------- -----------------------------------

(1,685) 360 -

=================================== =================================== ===================================

The Initial Period of the Inezgane licence in Morocco expired in

November 2022 and Group decided not to progress to the First

Extension Period. All previously capitalised costs in relation to

this licence was written-off during the period.

4 Earnings per share (EPS)

Basic EPS has been calculated on the loss after taxation divided

by the weighted average number of shares in issue during the

period. Diluted EPS uses an average number of shares adjusted to

allow for the issue of shares, on the assumed conversion of all

in-the-money options.

As the Group made a loss from continuing operations during the

interim period ending 31 January 2023, any potentially dilutive

instruments were considered to be anti-dilutive. Therefore, the

diluted EPS is equal to the basic EPS.

The calculation of the basic and diluted earnings per share is

based on the following:

6 months 6 months to Year to

to 31 January 31 July 2022

31 January 2022 (audited)

2023

GBP000 GBP000 GBP000

(Loss)/profit

(Loss)/profit for the period

attributable

to the equity shareholders of the

parent (1,287) 743 1,356

================== ================== ==================

Number of shares

Weighted average number of ordinary

shares for the purposes of basic

EPS 957,457,085 566,466,985 700,028,629

==== ===== ==== ===== ============

===== ==================== ===== ==================== ===========

==========

=

Number of shares

Weighted average number of ordinary

shares for the purposes of diluted

EPS 957,457,085 569,753,951 737,636,450

==== ===== ======= === ============

===== ==================== ======================== ===========

==========

=

5 Taxation

Consistent with the year-end treatment, current and deferred tax

assets and liabilities have been calculated at tax rates which were

expected to apply to their respective period of realisation at the

period end. Due to incurring qualifying expenditure on drilling the

Serenity well, the Group did not generate profits subject to the

Energy Profits Levy during the interim period.

6 Intangible assets

31 Jan 2023 31 Jan 2022 31 July 2022

GBP000 GBP000 GBP000

At 1 August 3,785 6,438 6,438

Additions 4,669 416 1,246

Transfer to

property,

plant &

equipment - (3,894) (3,899)

Exploration

write-off (1,685) - -

----------------------------------- ----------------------------------- -----------------------------------

At period

end 6,769 2,960 3,785

=================================== =================================== ===================================

Intangible assets comprise the Group's pre-production

expenditure on licence interests as follows:

31 Jan 2023 31 Jan 2022 31 July 2021

GBP000 GBP000 GBP000

Serenity 4,647 - 410

Ireland FEL 4/19

(Inishkea) 1,890 1,698 1,789

Morocco Inezgane - 1,037 1,379

UK PEDL180 - - -

(Wressle)

UK PEDL181 106 105 81

UK PEDL182

(Broughton North) 34 34 34

UK PEDL343

(Cloughton) 92 86 92

------------- ------------- ------------

----------------------------------- ----------------------------------- -----------------------------------

Total 6,769 2,960 3,785

============================ ================================ ================================

31 Jan 2023 31 Jan 2022 31 July 2022

GBP000 GBP000 GBP000

Transfer to

Property, plant &

equipment

UK PEDL180

(Wressle) - 3,894 3,899

----------------------------- ------------------------------- --------------------------------

Total - 3,894 3,899

============================ ================================ ================================

======= ======== ========

7 Tangible assets

Property, plant & equipment

Furniture Producing Right of Total

& computers fields use assets

GBP000 GBP000 GBP000 GBP000

Cost

At 1 August 2021 5 10,887 67 10,959

Additions 13 928 - 941

Transferred from

intangible

assets - 3,899 - 3,899

----------------------- -------------------------- ------------------------ -----------------------

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 July 2022 18 15,714 67 15,799

Additions 35 15 24 74

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January 2023 53 15,729 91 15,873

==================== ==================== ================= ======================

Depreciation,

depletion and

impairment

At 1 August 2021 3 10,552 35 10,590

Charge for year 1 1,601 16 1,618

Impairment - 570 - 570

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 July 2022 4 12,723 51 12,778

Charge for period 10 532 9 551

Impairment - 18 - 18

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January 2023 14 13,273 60 13,347

=================== ====================== ================= ====================

Net Book Value

At 31 January 2023 39 2,456 31 2,526

=============================== =============================== =============================== ===============================

At 31 July 2022 14 2,991 16 3,021

=============================== =============================== =============================== ===============================

Cost

At 1 August 2021 5 10,887 67 10,959

Transferred from

intangible

assets - 3,894 - 3,894

Additions - 370 - 370

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January 2022 5 15,151 67 15,223

=================== ====================== ================= ====================

Depreciation,

depletion and

impairment

At 1 August 2021 3 10,552 35 10,590

Charge for period 1 617 9 627

------------------------------- ------------------------------- ------------------------------- -------------------------------

At 31 January 2022 4 11,169 44 11,217

=================== ====================== ================= ====================

Net Book Value

At 31 January 2022 1 3,982 23 4,006

=============================== =============================== =============================== ===============================

8 Borrowings

31 Jan 2023 31 Jan 2022 31 July 2022

GBP000 GBP000 GBP000

Loans

repayable

in less

than

1 year

Bounce back

loan - 10 40

----------------------------------- ----------------------------------- -----------------------------------

Total short

term

borrowings - 10 40

================================== ================================== =================================

Loans

repayable

in 1 to 2

years

Bounce - 10 -

back loan

Loans

repayable

in 2 to 5

years

Bounce - 25 -

back loan

----------------------------------- ----------------------------------- -----------------------------------

Total long - 35 -

term

borrowings

================================== ================================== =================================

In June 2020, the Group received a Bounce Back loan for

GBP50,000 under the Government's Covid-19 policies. The annual rate

of interest is 2.5%. The loan was repaid in full in August

2022.

In September 2022, the Group entered into a loan agreement with

Union Jack Oil, a joint venture partner in the Group's Wressle oil

field to borrow a total of GBP1,000,000 at an annual rate of

interest of 11%. The purpose of the loan was to provide the Group

with additional contingent liquidity for Serenity well operations

conducted in 2022. The additional liquidity was not required and

therefore the loan was repaid in full, with interest, in October

2022.

9 Long term provisions

31 Jan 2023 31 Jan 2022 31 July 2022

GBP000 GBP000 GBP000

At 1 August 4,164 3,393 3,393

Change in

estimated

phasing of

cash

flows - - 538

Charged to the

statement of

comprehensive

income 208 117 233

----------------------------------- ----------------------------------- -----------------------------------

At period end 4,372 3,510 4,164

=================================== =================================== ===================================

10 Post reporting date

On 15 March 2023, the Company announced the retirement, with

immediate effect, of Simon Oddie and the appointment of William

Holland as Chief Executive Officer of the Company. William Holland

previously held the office of Chief Financial Officer. Simon Oddie

remains on the Board of the Company as a non-executive

director.

On 3 April 2023, the Company appointed Alastair Stuart as Chief

Operating Officer and Executive Director of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UAAWROOUSUAR

(END) Dow Jones Newswires

April 24, 2023 02:00 ET (06:00 GMT)

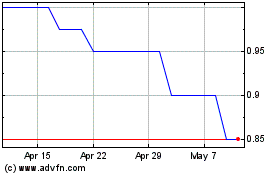

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Nov 2023 to Nov 2024