CMC Markets Plc Notice of GM (0680S)

July 11 2022 - 10:54AM

UK Regulatory

TIDMCMCX

RNS Number : 0680S

CMC Markets Plc

11 July 2022

11 July 2022

CMC MARKETS PLC

NOTICE OF GENERAL MEETING TO APPROVE PROPOSED RELATED PARTY

TRANSACTION AND AUDITOR'S STATEMENT OF REASONS

CMC Markets plc (the "Company"), announces that the following

documents are being posted or otherwise made available to

shareholders:

-- Notice of General Meeting to approve proposed related party transaction ("GM");

-- Auditor's statement of their reasons for ceasing to hold

office ("Statement of Reasons"); and

-- Notice of Availability.

Pursuant to Listing Rule 9.6.1R, copies of the Notice of GM,

Statement of Reasons and Notice of Availability have been submitted

to the National Storage Mechanism and will shortly be available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The Notice of GM, Statement of Reasons and Notice of

Availability can also be viewed on the Company's website at

www.cmcmarketsplc.com/investors .

The GM will be held at 133 Houndsditch, London, EC3A 7BX on

Thursday 28 July 2022 at 10.30 a.m. (or as soon thereafter as the

Annual General Meeting of the Company convened for 10.00 a.m. on

that day has been concluded or adjourned).

The Board of CMC Markets plc ("the Board") is looking forward to

welcoming shareholders in person to the GM. However, in the event

that government restrictions on public gatherings or other social

distancing measures are reintroduced, the Company may be required

to change the arrangements for the Meeting at short notice. Any

changes to the arrangements set out in the Notice of GM will be

communicated to shareholders via the Company's website

www.cmcmarketsplc.com/investors/shareholder-information/#AGM and

announced via a regulatory news service. Further information can be

found in the Notice of GM.

As noted in the Directors' Report for the year ended 31 March

2022, the Board has discovered a procedural oversight in respect of

the Company's processes for the payment of certain past dividends,

namely that the FY17 interim dividend paid on 23 December 2016, the

FY18 interim dividend paid on 22 December 2017 and the FY21 interim

dividend paid on 18 December 2020 (together, the "Relevant

Dividends") were made otherwise than in accordance with the strict

formalities of the Companies Act 2006 (the "Act").

In relation to the Relevant Dividends, the interim accounts were

not filed at Companies House as required by the Act, although in

each case interim accounts were prepared which demonstrated

sufficient distributable reserves. The omission of filing interim

accounts constitutes a procedural breach of the Act. In aggregate,

the unlawful component of all three Relevant Dividends is

GBP33,968,171.

The Company has been advised that, as a consequence of the

Relevant Dividends having procedurally been made otherwise than in

accordance with the Act, it may have claims against past and

present shareholders who were recipients of the Relevant Dividends

and against persons who were directors of the Company at the time

of the payment of the Relevant Dividends. It is therefore proposed

that the Company enter into deeds of release such that the Company

will be unable to make any claims against:

1) past and present shareholders of the Company who were

recipients of the Relevant Dividends, including Lord Peter Cruddas,

Lady Fiona Cruddas and other members of the Cruddas family (who are

related parties of the Company as substantial shareholders);

and

2) the directors of the Company (excluding Susanne Chishti) and

the former directors of the Company in office at the time of any

Relevant Dividend, in each case in respect of the payment of the

Relevant Dividend otherwise than in accordance with the Act. The

current directors are related parties of the Company, being James

Richards, David Fineberg, Peter Cruddas, Sarah Ing, Clare Salmon,

Paul Wainscott., Euan Marshall and Matthew Lewis.

The Company has today published a Notice of GM convening a

General Meeting at which a resolution will be proposed which will,

if passed, give the Board authority to enter into a directors' deed

of release (the "Directors' Deed of Release") and a shareholders'

deed of release (the "Shareholders' Deed of Release") and put all

potentially affected parties so far as possible in the position in

which they were always intended to be had the Relevant Dividends

been made in accordance with the procedural requirements of the Act

(the "Resolution"). The Company's entry into the Directors' Deed of

Release and the Shareholders' Deed of Release will not have any

effect on the Company's financial position.

The entry into the Directors' Deed of Release and the

Shareholders' Deed of Release constitute related party transactions

under the FCA's Listing Rules, and specifically fall within Listing

Rule 11.1.10R. Therefore the Resolution will also seek the specific

approval for the entry into the Directors' Deed of Release and

Shareholders' Deed of Release as related party transactions, in

accordance with the Listing Rules.

The approach that the Company is proposing is in line with the

approach taken by other UK incorporated listed companies which have

discovered past dividends were made otherwise than in strict

accordance with the Act.

For further information contact:

Patrick Davis

General Counsel & Company Secretary

CMC Markets plc

+ 44 (0) 20 7170 8200

LEI Number: 213800VB75KAZBFH5U07

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGKZGMNDMMGZZM

(END) Dow Jones Newswires

July 11, 2022 10:54 ET (14:54 GMT)

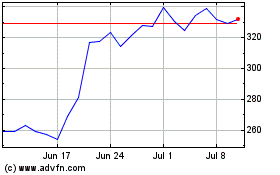

Cmc Markets (LSE:CMCX)

Historical Stock Chart

From Oct 2024 to Nov 2024

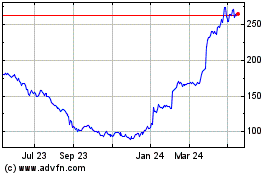

Cmc Markets (LSE:CMCX)

Historical Stock Chart

From Nov 2023 to Nov 2024