UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2014

or

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __________________ to _______________________

Commission

File Number: 002-74785-B

NEXT

GENERATION MANAGEMENT CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

88-0169543 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

| 44715

Prentice Dr. Unit 973, Ashburn, VA |

|

20146 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

703-372-1282

(Registrant’s

telephone number, including area code)

(Former

name, former address and former fiscal year, if changed since last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company

☒

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

No

APPLICABLE

ONLY TO CORPORATE ISSUERS:

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock. As of July 24, 2014 there were

245,996,094 shares of common stock, $0.001 par value issued and outstanding.

NEXT

GENERATION MANAGEMENT CORP.

FORM

10-Q REPORT INDEX

| PART

I. FINANCIAL INFORMATION |

3 |

| |

|

| Item 1. Financial

Statements |

3 |

| |

|

| Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operations. |

17 |

| |

|

| Item 3. Quantitative

and Qualitative Disclosures of Market Risk. |

20 |

| |

|

| Item 4. Controls

and Procedures. |

20 |

| |

|

| PART II. |

21 |

| |

|

| Item 1. Legal

Proceedings. |

21 |

| |

|

| Item 1A. Risk

Factors. |

21 |

| |

|

| Item 2. Unregistered

Sales of Equity Securities and Use of Proceeds. |

21 |

| |

|

| Item 3. Defaults

Upon Senior Securities. |

21 |

| |

|

| Item 4. Mine

Safety Disclosures. |

21 |

| |

|

| Item 5. Other

Information. |

21 |

| |

|

| Item 6. Exhibits. |

22 |

| |

|

| SIGNATURES |

23 |

PART

I. FINANCIAL INFORMATION

ITEM

1. FINANCIAL STATEMENTS

NEXT

GENERATION MANAGEMENT CORP.

BALANCE

SHEETS

JUNE

30, 2014 AND DECEMBER 31, 2013

| | |

(unaudited) | | |

(audited) | |

| | |

June 30, | | |

Dec. 31, | |

| | |

2014 | | |

2013 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and equivalents | |

$ | 120,358 | | |

$ | 1,173 | |

| Rents receivable-H2H | |

| 28,000 | | |

| - | |

| Consulting fees receivable-H2H | |

| 20,000 | | |

| - | |

| Prepaid rent | |

| 32,032 | | |

| - | |

| Advances to H2H | |

| 135,000 | | |

| - | |

| Total current assets | |

| 335,390 | | |

| 1,173 | |

| | |

| | | |

| | |

| OIL AND GAS PROPERTIES (FULL COST METHOD): | |

| | | |

| | |

| Mineral rights-Royalty interest | |

| 14,930 | | |

| 14,930 | |

| Evaluated-Leases | |

| 71,000 | | |

| 71,000 | |

| Gross oil and gas properties | |

| 85,930 | | |

| 85,930 | |

| | |

| | | |

| | |

| OTHER ASSETS: | |

| | | |

| | |

| Security deposit | |

| 24,000 | | |

| - | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 445,320 | | |

$ | 87,103 | |

| | |

| | | |

| | |

| LIABILITIES AND DEFICIENCY IN STOCKHOLDERS' EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 203,586 | | |

$ | 150,724 | |

| Accrued wages | |

| 225,096 | | |

| 238,596 | |

| Due to related party | |

| - | | |

| 40,000 | |

| Advances-Actual Investments | |

| 99,475 | | |

| - | |

| Other advances | |

| 129,900 | | |

| - | |

| Accrued interest payable | |

| 62,949 | | |

| 58,329 | |

| Beneficial conversion feature | |

| 41,714 | | |

| 44,386 | |

| Note Payable | |

| 30,000 | | |

| 60,000 | |

| Convertible notes payable, net of debt discount | |

| 120,505 | | |

| 133,000 | |

| Accounts payable & advances-related party | |

| 134,407 | | |

| 170,000 | |

| Total current liabilities | |

| 1,047,632 | | |

| 896,035 | |

| | |

| | | |

| | |

| Total long term liabilities | |

| - | | |

| - | |

| | |

| | | |

| | |

| Total liabilities | |

| 1,047,632 | | |

| 896,035 | |

See

notes to the consolidated financial statements

NEXT

GENERATION MANAGEMENT CORP.

BALANCE

SHEETS - continued

JUNE

30, 2014 AND DECEMBER 31, 2013

(continued)

| DEFICIENCY IN STOCKHOLDERS' EQUITY | |

| | |

| |

| Common stock, par value $0.001 per share; 999,000,000 shares authorized, 235,996,094 and 125,996,094 shares issued and outstanding | |

| 235,996 | | |

| 125,996 | |

| Preferred stock Series A, $0.001 par value, 500,000 shares authorized, zero issued and outstanding | |

| - | | |

| - | |

| Preferred stock Series B, $0.001 par value, 500,000 Shares authorized, zero issued and outstanding | |

| - | | |

| - | |

| Additional paid in capital | |

| 19,146,797 | | |

| 17,978,597 | |

| Accumulated deficit | |

| (19,985,105 | ) | |

| (18,913,525 | ) |

| Total stockholders' (deficit) | |

| (602,312 | ) | |

| (808,932 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 445,320 | | |

$ | 87,103 | |

See

notes to the consolidated financial statements

NEXT

GENERATION MANAGEMENT CORP.

STATEMENTS

OF OPERATIONS

FOR

THE THREE MONTHS ENDED JUNE 30, 2014 AND 2013

(UNAUDITED)

| | |

Three months ended

June 30, | |

| | |

2014 | | |

2013 | |

| REVENUES: | |

| | | |

| | |

| Royalty income | |

$ | 1,225 | | |

$ | 32 | |

| Consulting fees | |

| 20,000 | | |

| - | |

| Total revenue | |

| 21,225 | | |

| 32 | |

| | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | |

| General & administrative | |

| 143,582 | | |

| 82,679 | |

| Total operating expenses | |

| 143,582 | | |

| 82,679 | |

| | |

| | | |

| | |

| (LOSS) FROM OPERATIONS | |

| (122,357 | ) | |

| (82,647 | ) |

| | |

| | | |

| | |

| OTHER INCOME AND EXPENSES: | |

| | | |

| | |

| (Loss) on note conversion to stock | |

| - | | |

| (603,500 | ) |

| Rental income | |

| 28,000 | | |

| - | |

| (Loss) on beneficial conversion | |

| (37,379 | ) | |

| (1,032,078 | ) |

| Interest expense | |

| (4,839 | ) | |

| (6,758 | ) |

| Total other income and expenses | |

| (14,218 | ) | |

| (1,642,336 | ) |

| | |

| | | |

| | |

| Net Income (loss) before income taxes | |

| (136,575 | ) | |

| (1,724,893 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | |

| | |

| | | |

| | |

| NET (LOSS) | |

$ | (136,575 | ) | |

$ | (1,724,983 | ) |

| | |

| | | |

| | |

| Net income/(loss) per common share-basic (Note A) | |

$ | (0.00 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Net income/(loss) per common stock-assuming fully diluted (Note A) | |

(see Note A) | | |

(see Note A) | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding-basic | |

| 233,004,885 | | |

| 118,123,253 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding-fully diluted | |

(see Note A) | | |

(see Note A) | |

See

notes to the consolidated financial statements.

NEXT

GENERATION MANAGEMENT CORP.

STATEMENTS

OF OPERATIONS

FOR

THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013

(UNAUDITED)

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| REVENUES: | |

| | |

| |

| Royalty income | |

$ | 1,730 | | |

$ | 96 | |

| Consulting fees | |

| 20,000 | | |

| - | |

| Total revenue | |

| 21,730 | | |

| 96 | |

| | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Administrative | |

| 932,659 | | |

| 116,071 | |

| Total operating expenses | |

| 932,659 | | |

| 116,071 | |

| | |

| | | |

| | |

| (LOSS) FROM OPERATIONS | |

| (910,929 | ) | |

| (115,975 | ) |

| | |

| | | |

| | |

| OTHER INCOME AND EXPENSES: | |

| | | |

| | |

| Gain/(Loss) on note conversion to stock | |

| (181,328 | ) | |

| - | |

| Rental income | |

| 28,000 | | |

| - | |

| Gain (Loss) on beneficial conversion | |

| 2,672 | | |

| (425,912 | ) |

| Interest expense | |

| (9,995 | ) | |

| (14,381 | ) |

| Loss on debt restricting | |

| - | | |

| (4,420,171 | ) |

| Total other income and expenses | |

| (160,651 | ) | |

| (4,860,464 | ) |

| | |

| | | |

| | |

| Net Income (loss) before income taxes | |

| (1,071,580 | ) | |

| (4,976,439 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | |

| | |

| | | |

| | |

| NET (LOSS) | |

$ | (1,071,580 | ) | |

$ | (4,976,439 | ) |

| | |

| | | |

| | |

| Net income/(loss) per common share-basic (Note A) | |

$ | (0.005 | ) | |

$ | (0.04 | ) |

| | |

| | | |

| | |

| Net income/(loss) per common stock-assuming fully diluted (Note A) | |

(see Note A) | | |

(see Note A) | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding-basic | |

| 209,370,158 | | |

| 116,000,040 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding-fully diluted | |

(see Note A) | | |

(see Note A) | |

See

notes to consolidated financial statements.

NEXT

GENERATION MANAGEMENT CORPORATION

STATEMENTS

OF STOCKHOLDERS’ EQUITY

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

Paid In | | |

Accum. | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance December 31, 2013 | |

| 125,996,094 | | |

$ | 125,996 | | |

$ | 17,978,597 | | |

$ | (18,913,525 | ) | |

$ | (808,932 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for debt-Actual Investments | |

| 10,000,000 | | |

| 10,000 | | |

| 132,000 | | |

| - | | |

| 142,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for debt-Related party | |

| 20,000,000 | | |

| 20,000 | | |

| 240,000 | | |

| - | | |

| 260,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for consulting fee | |

| 30,000,000 | | |

| 30,000 | | |

| 262,000 | | |

| - | | |

| 292,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for consulting-related party | |

| 20,000,000 | | |

| 20,000 | | |

| 320,000 | | |

| - | | |

| 340,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of convertible notes | |

| 18,000,000 | | |

| 18,000 | | |

| 70,200 | | |

| - | | |

| 88,200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for accrued wages | |

| 12,000,000 | | |

| 12,000 | | |

| 144,000 | | |

| - | | |

| 156,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net (loss) | |

| - | | |

| - | | |

| - | | |

| (1,071,580 | ) | |

| (1,071,580 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance June 30, 2014 | |

| 125,996,094 | | |

| 235,996 | | |

| 19,146,797 | | |

| (19,985,105 | ) | |

| (602,312 | ) |

See

notes to the consolidated financial statements.

NEXT GENERATION MANAGEMENT CORPORATION

STATEMENTS OF CASH FLOWS

FOR THE SIX MONTH PERIODS ENDED JUNE 30, 2014 AND 2013 |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

2014 | | |

2013 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income (loss) | |

$ | (1,071,580 | ) | |

$ | (1,712,482 | ) |

| (Gain) loss on beneficial conversion | |

| (2,672 | ) | |

| 603,500 | |

| (Gain) loss on debt conversion | |

| 181,328 | | |

| 978,626 | |

| Shares issued for services | |

| 832,000 | | |

| - | |

| Shares issued for interest | |

| 12,377 | | |

| - | |

| Adjustments to reconcile net income to net cash Provided by operating activities: | |

| | | |

| | |

| (Increase) in assets | |

| | | |

| | |

| Prepaid expenses | |

| (32,032 | ) | |

| - | |

| Rent receivable | |

| (28,000 | ) | |

| - | |

| Consulting fees receivable | |

| (20,000 | ) | |

| - | |

| Security deposit | |

| (24,000 | ) | |

| - | |

| Increase (decrease) in liabilities | |

| | | |

| | |

| Accounts payable | |

| 52,862 | | |

| (404 | ) |

| Accounts payable related | |

| 39,407 | | |

| - | |

| Accrued interest | |

| 3,620 | | |

| 14,381 | |

| Accrued expenses | |

| (13,500 | ) | |

| 92,500 | |

| | |

| | | |

| | |

| Net cash flows (used) by operating activities | |

| (70,190 | ) | |

| (23,879 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Advance to H2H | |

| (135,000 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash flows (used) by investing activities | |

| (135,000 | ) | |

| - | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Notes payable | |

| - | | |

| 30,000 | |

| Advances | |

| 324,375 | | |

| | |

| Net cash flows provided by financing activities | |

| 324,375 | | |

| 30,000 | |

| | |

| | | |

| | |

| NET INCREASE IN CASH | |

| 119,185 | | |

| 6,121 | |

| | |

| | | |

| | |

| CASH, BEGINNING OF PERIOD | |

| 1,173 | | |

| 528 | |

| | |

| | | |

| | |

| CASH, END OF PERIOD | |

$ | 120,358 | | |

$ | 6,649 | |

See

notes to the consolidated financial statements.

NEXT GENERATION MANAGEMENT CORPORATION

STATEMENTS OF CASH FLOWS - continued

FOR THE SIX MONTH PERIODS ENDED JUNE 30, 2014 AND 2013 |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

2014 | | |

2013 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid during the period for: | |

$ | - | | |

$ | - | |

| Taxes | |

| - | | |

| - | |

| Interest | |

| - | | |

| - | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH TRANSACTIONS: | |

| | | |

| | |

| Shares issued in payment of notes payable | |

| 40,000 | | |

| - | |

| Shares issued for interest | |

| 12,377 | | |

| - | |

| Shares issued in conversion of convertible debt | |

| 88,200 | | |

| 17,000 | |

| Shares issued in payment of consulting fees | |

| 846,000 | | |

| - | |

| Shares issued in payment of debt | |

| 142,000 | | |

| - | |

| Shares issued in compensation | |

| 156,000 | | |

| - | |

See

notes to the consolidated financial statements.

NEXT GENERATION MANAGEMENT CORP.

NOTES

TO FINANCIAL STATEMENTS

June

30, 2014 (unaudited)

NOTE

A - SUMMARY OF ACCOUNTING POLICIES

General

The

accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally

accepted in the United States of America for interim financial information and with the instructions to Form 10-Q. Accordingly,

they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial

statements.

In

the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation

have been included. Accordingly, the results from operations for the three and six month periods ended June 30, 2014 are not necessarily

indicative of the results that may be expected for the year ended December 31, 2013. The unaudited consolidated financial statements

should be read in conjunction with the consolidated December 31, 2013 financial statements and footnotes thereto included in the

Company's SEC Form 10-K.

A

summary of the significant accounting policies applied in the preparation of the accompanying financial statements follows.

Business

and Basis of Presentation

Next

Generation Management Corporation was incorporated in the State of Nevada in November 1980 as Micro Tech Industries, with an official

name changes to Next Generation Media Corporation in April 1997. Changed Next Generation Energy Corporation in July 2010 and Next

Generation Management Corp. on June 19, 2014. The Company, an independent oil and natural gas company engaged in the exploration,

development, and production of predominantly natural gas properties located onshore in the United States. In March 2011, the Company

acquired 1,220 acres of mineral leases in Knox County, Kentucky, containing 10 shut-in wells, and is in the process of investigating

other acquisitions of oil and gas properties in the same area.

Use

of Estimates

The

preparation of the financial statement in conformity with generally accepted accounting principles requires management to make

estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities, if any, at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses

during the respective reporting periods. The Company bases its estimates and judgments on historical experience and on various

other assumptions and information that are believed to be reasonable under the circumstances. Estimates and assumptions about

future events and their effects cannot be perceived with certainty and, accordingly, these estimates may change as new events

occur, as more experience is acquired, as additional information is obtained and as the Company’s operating environment

changes. Actual results may differ from the estimates and assumptions used in the preparation of the Company’s condensed

consolidated financial statements.

Condensed

consolidated interim period results are not necessarily indicative of results of operations or cash flows for the full year and

accordingly, certain information normally included in financial statements prepared in accordance with accounting principles generally

accepted in the United States has been condensed or omitted. The Company has evaluated events or transactions through the date

of issuance of these condensed consolidated financial statements

NOTE

A - SUMMARY OF ACCOUNTING POLICIES - continued

Cash

Equivalents

For

the purpose of the accompanying financial statements, all highly liquid investments with a maturity of three months or less are

considered to be cash equivalents.

Property

and Equipment other than Oil and Natural Gas Properties

Property

and equipment are stated at cost. The cost of normal maintenance and repairs is charged to operating expense as incurred. Material

expenditures, which increase the life of an asset, are capitalized and depreciated over the estimated remaining useful life of

the asset. When retired or otherwise disposed, the related carrying value and accumulated depreciation are removed from the respective

accounts and the net difference less any amount realized from disposition, is reflected in earnings. For financial statement purposes,

property and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives as

follows:

| Furniture

and fixtures |

5 years |

| Office equipment |

3 to 5 years |

| Manufacturing equipment |

3 to 10 years |

| Buildings |

40 years |

Gas

and Oil Properties

At

March 31, 2011, the Company had completed the acquisition of 1,220 acres of mineral leases containing 10 shut-in well sin Knox

County, Kentucky. The Company is currently negotiating with an operator to convert the leases into a royalty agreement.

Asset

Retirement Obligations

Accounting

Standards Codification 410, Asset retirement and environmental obligations (“ASC 410”) was adopted by the Company.

ASC 410 requires that the fair value of a liability for an asset retirement obligation be recognized in the period in which it

is incurred if a reasonable estimate of fair value can be made, and that the associated asset retirement costs be capitalized

as part of the carrying amount of the long-lived asset. The Company has an option to purchase natural gas and oil properties which

may require expenditures to plug and abandon the wells when reserves in the wells are depleted. These expenditures under ASC 410

will be recorded in the period the liability is incurred (at the time the wells are drilled or acquired).

Depletion

Oil

and gas producing property costs are amortized using the unit of production method. The Company did not record any amortization

expense in the three and six month periods ended June 30, 2014 and 2013.

Research

and Development

The

Company accounts for research and development costs in accordance with the Accounting Standards Codification subtopic 730-10,

Research and Development (“ASC 730-10”). Under ASC 730-10, all research and development costs must be charged to expense

as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and developments

costs are expensed when the contracted work has been performed or as milestone results have been achieved. Company-sponsored research

and development costs related to both present and future products are expensed in the period incurred. The Company did not incur

expenditures on research and product development for the three and month periods ended June 30, 2014 and 2013.

NOTE

A - SUMMARY OF ACCOUNTING POLICIES - continued

Impairment

of Long-Lived Assets

The

Company has adopted Accounting Standards Codification subtopic 360-10, Property, plant and equipment (“ASC 360-10”).

The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events

relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted

inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived

assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible

assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of

the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value

less costs to sell. During the three and six month periods ended June 30, 2014 and 2013, the Company did not recognize any impairment.

Income

Taxes

The

Company has adopted Accounting Standards Codification 740 Income Taxes (ASC 740) which requires the recognition of deferred tax

liabilities and assets for the expected future tax consequences of events that have been included in the financial statement or

tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between financial statements

and the tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected

to reverse. Temporary differences between taxable income reported for financial reporting purposes and income tax purposes are

insignificant.

Advertising

The

Company follows the policy of charging the costs of advertising to expenses as incurred. The Company charged to operations no

advertising costs for the three and six month periods ended June 30, 2014 and 2013, respectively.

Comprehensive

Income

Accounting

Standards Codification 220 Comprehensive Income (ASC 220) establishes standards for reporting and displaying of comprehensive

income, its components and accumulated balances. Comprehensive income is defined to include all changes in equity except those

resulting from investments by owners and distributions to owners. Among other disclosures, ASC 220 requires that all items that

are required to be recognized under current accounting standards as components of comprehensive income be reported in a financial

statement that is displayed with the same prominence as other financial statements. The Company does not have any items of comprehensive

income in any of the periods presented.

Stock

Based Compensation

Effective

for the year beginning January 1, 2006, the Company has adopted Accounting Standards Codification subtopic 718-10, Compensation

(“ASC 718-10”). The Company made no employee stock-based compensation grants before December 31, 2005 and therefore

has no unrecognized stock compensation related liabilities or expense unvested or vested prior to 2006. Stock-based compensation

expense recognized under ASC 718-10 for the three and six month periods ended June 30, 2014 and 2013 was nil.

NOTE

A - SUMMARY OF ACCOUNTING POLICIES - continued

Net

income (loss) per share

The

weighted average shares outstanding used in the basic net income per share computations for the three and six month periods ended

June 30, 2014 was 233,004,885 and 209,370,158, respectively. The diluted shares outstanding for the three and six month periods

ended June 30, 2014 was 275,681,528 and 252,046,801. In determining the number of shares used in computing diluted loss per share

for the three month periods ended March 31, 2013 and 2012, common stock equivalents derived from shares issuable from the exercise

of stock options are not considered in the calculation of the weighted average number of common shares outstanding because they

would be antidilutive, thereby decreasing the net loss per share.

Liquidity

As

shown in the accompanying financial statements, the Company had a loss from operations of ($136,575) and ($1,071,582) during the

three and six month periods ended June 30, 2014. The Company's total liabilities exceeded its total assets by $602,312 as of June

30, 2014.

Concentration

of Credit Risk

Financial

instruments and related items, which potentially subject the Company to concentrations of credit risk, consist primarily of cash,

cash equivalents and trade receivables. The Company places its cash and temporary cash investments with high credit quality institutions.

At times, such investments may be in excess of the FDIC insurance limit. The Company periodically reviews its trade receivables

in determining its allowance for doubtful accounts.

Fair

Values

Accounting

Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”) requires disclosure of the fair value

of certain financial instruments. The carrying amount reported in the consolidated condensed balance sheets for accounts receivables,

accounts payable and accrued expenses and put liability approximates fair value because of the immediate or short-term maturity

of these financial instruments. The carrying amount reported in the accompanying condensed consolidated balance sheets for line

of credit approximates fair value because the actual interest rates do not significantly differ from current rates offered for

instruments with similar characteristics.

We

use fair value measurements to record fair value adjustments to certain assets and to determine fair value disclosures. Cash,

short term investment, warrants and reset derivatives are recorded at fair value on a recurring basis. In accordance with Accounting

Standards Codification Topic 820, Fair Value Measurements and Disclosures (“ASC 820”), we group our assets at fair

value in three levels, based on the markets in which the assets are traded and the reliability of the assumptions used to determine

fair value.

Reclassifications

Certain

reclassifications have been made in prior year's financial statements to conform to classifications used in the current year.

Principles

of Consolidation

The

accompanying consolidated financial statements include the accounts of the parent company, Next Generation Management Corp. and

its subsidiaries Next Generation Royalties, LLC and Next Generation Cannabis Consulting, LLC. All inter-company balances and transactions

have been eliminated in consolidation.

NOTE

B - NOTES PAYABLE

Notes

payable at June 30, 2014 and December 31, 2013 consists of the following:

| | |

June 30,

2014 | | |

December 31, 2013 | |

| | |

| | |

| |

| Note payable-Forge, LLC, bearing interest at 18.00% per annum, the loan is payable at maturity in July 2012 plus accrued interest. (1) | |

| 74,000 | | |

| 80,000 | |

| | |

| | | |

| | |

| Note payable – Actual Investments, LLC, bearing interest at 6% per annum, all principal and accrued interest is payable at maturity in October 2013. (2) | |

| 30,000 | | |

| 30,000 | |

| | |

| | | |

| | |

| Note payable – Actual Investments, LLC, bearing interest at 6% per annum, all principal and accrued interest is payable at maturity in March 2014. (3) | |

| - | | |

| 30,000 | |

| | |

| | | |

| | |

| Note payable – Actual Investments, LLC, bearing interest at 8% per annum, all principal and accrued interest is payable at maturity in September 2013. (4) | |

| 46,505 | | |

| 53,000 | |

| | |

| | | |

| | |

| Total notes payable | |

| 150,505 | | |

| 193,000 | |

| | |

| | | |

| | |

| Less: current maturities | |

| 150,505 | | |

| 193,000 | |

| | |

| | | |

| | |

| Long term portion | |

$ | - | | |

$ | - | |

| (1) |

Obligation

to Forge, LLC for $150,000, bearing interest at 18.00% per annum, the loan is payable at maturity in July 2012 plus accrued

interest. The note is secured by certain oil and gas properties owned by Knox Gas, LLC, a subsidiary of the Company. The

note is convertible to common stock at a conversion price equal to 75% of the average of the closing prices of the Common

Stock for the 10 trading days immediately preceding a conversion date. The balance outstanding at March 31, 2013

was $150,000 plus accrued interest of $40,563. Our obligation to Forge, LLC contains an embedded beneficial conversion feature

since the fair value of our common stock on the date of issuance was in excess of the effective conversion price. The

embedded beneficial conversion feature was recorded by allocating a portion of the proceeds equal to the intrinsic value of

the feature to “Additional paid-in-capital”. The intrinsic value of the feature is calculated on the issuance

date by multiplying the difference between the quoted market price of our common stock and the effective conversion price

by the number of common shares into which the note may be converted. The resulting discount on the immediately

convertible shares is recorded within “Additional paid-in capital” and is amortized over the period from the date

of issuance of the to the stated maturity date. The amount of the discount was $50,000, of which $22,055 was amortized

in 2010 and the balance in 2011. On May 24th, 2013, $70,000 of the note was sold and assigned to Actual

Investments, LLC. |

| |

|

| (2) |

The

company entered into a promissory note with Actual Investment, LLC on November 27, 2012. The note is unsecured and accrues

interest 6% per annum payable on maturity October 26, 2013. |

| |

|

| (3) |

The

company entered into a promissory note with Actual Investment, LLC on March 13, 2013. The note is

unsecured and accrues interest 6% per annum payable on maturity March 12, 2014. |

| |

|

| (4) |

On

May 24th, 2013 Actual Investments, LLC entered into a contemporaneous Agreement with Forge, LLC and the company. Actual

Investments, LLC purchased $70,000 of the outstanding obligation to Forge, LLC as describe in subscript (1) and the note is

subject to new terms agreed upon between the company and Actual Investments, LLC. Actual Investments, LLC has the

option to purchase the remainder of the Forge, LLC debt. The obligation between the company and Actual Investments,

LLC bears interest at 8% per annum and was payable at maturity in September 2013 plus accrued interest. |

NOTE

C – OPTIONS

Non-Employee

Stock Options

The

weighted average remaining contractual life of the options and warrants issued by the Company as of June 30, 2014 is set forth

below:

| Date of Issuance |

|

|

Number of Options/

Warrants |

|

|

Exercise

Price |

|

|

Contractual

Life |

|

Weighted Average Remaining Contractual Life (Years) |

|

| October 22, 2010 |

|

|

800,000 |

|

|

0.30 |

|

|

5 years |

|

.83 |

|

Transactions

involving stock options issued are summarized as follows:

| | |

Number of Shares | | |

Weighted Average Price Per Share | |

| Outstanding at December 31, 2013 | |

| 800,000 | | |

$ | 0.30 | |

| Granted | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | |

| Canceled or expired | |

| - | | |

$ | - | |

| | |

| | | |

| | |

| Outstanding at June 30, 2014 | |

| 800,000 | | |

$ | 0.30 | |

NOTE

D - INCOME TAXES

The

Company has adopted Accounting Standards Codification subtopic 740-10, Income Taxes ("ASC 740-10") which requires the

recognition of deferred tax liabilities and assets for the expected future tax consequences of events that have been included

in the financial statement or tax returns.

Under

this method, deferred tax liabilities and assets are determined based on the difference between financial statements and tax basis

of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Temporary

differences between taxable income reported for financial reporting purposes and income tax purposes are insignificant. Management

has provided a valuation allowance for the total net deferred tax assets as of September 30, 2012, as they believe it is more

likely than not that the entire amount of deferred assets will not be realized. The Company has provided a valuation reserve against

the full amount of the net operating loss benefit, since in the opinion of management based upon the earnings history of the Company;

it is more likely than not that the benefits will not be realized in the near future.

NOTE

E – COMMON STOCK

At

June 30, 2014, the Company's authorized capital stock was 999,000,000 shares of common stock, par value $0.001 per share, and

1,000,000 shares of preferred stock, par value $0.001 per share. On that date, the Company had outstanding 235,996,094 shares

of common stock, and no shares of preferred stock.

NOTE

F - CONVERTIBLE PROMISSORY NOTES PAYABLE

The

Company entered into a Convertible Promissory Note on July 23, 2010 with Forge, LLC. The Convertible Promissory Note accrues interest

at 18% per annum which is payable and due quarterly, and matured on July 23, 2012. The note holders have the option to convert

any unpaid note principal and accrued interest to the Company's common stock at a rate of 75% of the average closing price of

the last ten days of trading any time after the issuance date of the note.

On

May 24th, 2013 Actual Investments, LLC entered into a contemporaneous Agreement with Forge, LLC and the company. Actual

Investments, LLC purchased $70,000 of the outstanding obligation to Forge, LLC and the note is subject to new terms agreed upon

between the company and Actual Investments, LLC. Actual Investments, LL has the option to purchase the remainder of the Forge,

LLC debt. Modifications included adjusting the interest rate and conversion price to 8% per annum and $.0014 per share, respectively.

The restructuring resulting in the Company recognizing a loss on the restricting of $4,420,171 or ($.04) per common stock.

In

May of 2013, the note holder converted $17,000 of the note into 12,142,857 shares of common stock. In February of 2014, another

$6,000 was converted into 10,000,000 shares of common stock.

In

accordance ASC 470-20, the company allocated, on a relative fair value basis, the net proceeds amongst the common stock, convertible

notes and warrants issuable to the investors. During the six months ended June 30, 2014 and 2013 the Company recognized a gain

of $2,673 and a loss of $425,912 in the beneficial conversion feature, respectively.

NOTE

G – GOING CONCERN MATTERS

The

accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and

the satisfaction of liabilities in the normal course of business. As shown in the accompanying financial statements for the three

and six month periods ended June 30, 2014, the Company incurred an operating loss of ($136,575) and ($1,071,580). The loss was

primarily due to loss on the conversion of a portion of convertible notes payable to common stock and the issuance of shares of

common stock for services. The Company has a deficiency in stockholder’s equity of ($602,312) and ($808,932) at June 30,

2014 and December 31, 2013, respectively. These factors among others may indicate that the Company will be unable to continue

as a going concern.

NOTE

H – RELATED PARTY TRANSACTIONS

In

February of 2014, the Company issued 20,000,000 shares of common stock valued at $260,000 to the spouse of the President of the

Company to repay an advance of $46,000 and consulting fees of $214,000.

On

February 3, 2014, the Company issued 20,000,000 shares of common stock valued at $340,000 to the Company President’s brother

for consulting services.

On

February 14, 2014, the Company issued 2,000,000 shares to the Company President valued at $26,000 for accrued wages. In addition,

10,000,000 shares of common stock were issued to an employee for $130,000 of accrued wages.

NOTE

I- COMMITMENTS

In

April 2014, the Company entered into a lease for space to operate a dispensary. The lease calls for monthly rent payments of $8,000

and expires on April 30, 2016.

NOTE

J - SUBSEQUENT EVENTS

Management

has evaluated the Company’s activity since the end of the period on August 11, 2014, and in their opinion has determined

that the following material subsequent event occurred that would require disclosure in the financial statements. On July 22,

2014, Actual Investments LLC converted $14,000 of its convertible promissory note in exchange for 10,000,000 shares of the

Company’s common stock valued at $200,000.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Disclosure

Regarding Forward Looking Statements

This

Quarterly Report on Form 10-Q includes forward looking statements (“Forward Looking Statements”). All statements other

than statements of historical fact included in this report are Forward Looking Statements. In the normal course of its business,

the Company, in an effort to help keep its shareholders and the public informed about the Company’s operations, may from

time-to-time issue certain statements, either in writing or orally, that contain or may contain Forward-Looking Statements. Although

the Company believes that the expectations reflected in such Forward Looking Statements are reasonable, it can give no assurance

that such expectations will prove to have been correct. Generally, these statements relate to business plans or strategies, projected

or anticipated benefits or other consequences of such plans or strategies, past and possible future, of acquisitions and projected

or anticipated benefits from acquisitions made by or to be made by the Company, or projections involving anticipated revenues,

earnings, levels of capital expenditures or other aspects of operating results. All phases of the Company operations are subject

to a number of uncertainties, risks and other influences, many of which are outside the control of the Company and any one of

which, or a combination of which, could materially affect the results of the Company’s proposed operations and whether Forward

Looking Statements made by the Company ultimately prove to be accurate. Such important factors (“Important Factors”)

and other factors could cause actual results to differ materially from the Company’s expectations are disclosed in this

report. All prior and subsequent written and oral Forward Looking Statements attributable to the Company or persons acting on

its behalf are expressly qualified in their entirety by the Important Factors described below that could cause actual results

to differ materially from the Company’s expectations as set forth in any Forward Looking Statement made by or on behalf

of the Company.

General

Overview

During

the quarter ended March 31, 2010, the Company decided to cease operations at its United Marketing Solutions, Inc. subsidiary because

of continued operating losses and the termination of all franchise relationships. As a result of the termination of operations,

the Company decided to dispose of United Marketing Solutions, Inc. Accordingly, in 2011 the results of United Marketing Solutions,

Inc. are presented separately on the consolidated income statement as discontinued operations.

Since

termination of operations at United Marketing Solutions, Inc., the Company has decided to acquire a portfolio of properties that

contain valuable natural resources, such as natural gas, oil and coal. The Company’s strategy is to acquire properties that

are distressed, undervalued or underutilized at prices it believes are below fair market value. The Company will then provide

long term leases to leading natural gas, oil field development firms and coal extractors (lessees) to efficiently extract the

resources while Company focuses on growing its portfolio of properties. In the quarter ended March 31, 2011, the Company acquired

its first collection of oil and gas leases in Knox County, Kentucky.

We

continue to specialize in oil and natural gas assets, however, our Board of Directors recently approved a plan to redirect resources

and to focus our core business on the medical marijuana industry. The Company would focus on providing turnkey facilities including

management, accounting and security services. In addition, the Company's wholly owned subsidiary, NextGen Cannabis Consulting

LLC, entered into a lease for a new medical marijuana dispensary in Hollywood, California.

Results

of Operations

During

the three month periods ended June 30, 2014 and 2013, the Company's revenues were $21,225 and $32 respectively.

During

the three months ending June 30, 2014, our operating expenses were $143,582, as compared to $82,679 for the three months ending

June 30, 2013. As a result, the Company had operating losses of ($122,357) and ($82,647) in the three months ended June 30, 2014

and 2013, respectively.

In

the three months ended June 30, 2014 and 2013, the Company recorded other net income (expense) of ($14,218) and $(1,642,336),

respectively.

The

Company realized a net loss for the three months ended June 30, 2014 of ($136,575) as compared to a net loss of $(1,724,893) in

the three months ended June 30, 2013.

Liquidity

and Sources of Capital

The

Company's balance sheet as of June 30, 2014 reflects current assets of $445,320, current liabilities of $1,047,632 and a working

capital deficit of ($602,312).

The

Company will need to raise capital to meet its working capital and financing needs. Our ability to become profitable is dependent

on the receipt of revenues from our oil and gas wells greater than our operational expenses. We acquired our first oil and gas

properties in March 2011, which consist of ten shut-in wells which are not currently generating any revenues. Our wells are connected

to a gas gathering system that we share with approximately 125 other wells that are owned by the creditors of the former operator

of the field. We do not need any additional capital to resume operations at the shut-in wells; however, we are dependent on the

owner of the other 125 wells in the field resuming operations, over which we have no control, before we can resume operations

at our wells. In addition, our geologist estimates that more wells could be drilled on our leases, and we would need capital to

drill the wells if we decide to drill them ourselves. In 2011, we also acquired royalty interests in four wells on three properties,

which have produced minimal revenues for us to date.

We

need to raise additional capital in order to make additional acquisitions of oil and gas properties. In addition, we need to raise

additional capital to finance our ongoing legal, auditing and administrative costs until we generate sufficient revenues from

our oil and gas properties to pay those expenses. While we expect to pay for certain of our ongoing administrative expenses through

the deferral of salaries or the issuance of shares of common stock to satisfy the expense, there are some expenses that we cannot

defer and cannot satisfy from the issuance of common stock. We estimate that we will need to raise approximately $75,000 to pay

expenses that we will incur over the next year which cannot be deferred or satisfied with common stock.

Going

Concern

Our

financial statements have been presented on the basis that we continue as a going concern, which contemplates the realization

of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying financial statements,

we incurred a ($136,575 loss from operations in the three months ended June 30, 2014, and only have revenues of $32 for 2013.

These factors create an uncertainty about our ability to continue as a going concern. The financial statements do not include

any adjustments that might be necessary if we are unable to continue as a going concern.

Off-Balance

Sheet Arrangements

We

do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital

resources that are material to investors.

Critical

Accounting Estimates

Our

significant accounting policies are described in Note A of Notes to Financial Statements. At this time, we are not required to

make any material estimates and assumptions that affect the reported amounts and related disclosures of assets, liabilities, revenue,

and expenses. However, as we begin actual oil and gas operations, we will be required to make estimates and assumptions typical

of other companies in the oil and gas business.

For

example, we will be required to make critical accounting estimates related to future oil and gas prices, obligations for environmental,

reclamation, and closure matters, mineral reserves, and accounting for business combinations. The estimates will require us to

rely upon assumptions that were highly uncertain at the time the accounting estimates are made, and changes in them are reasonably

likely to occur from period to period. Changes in estimates used in these and other items could have a material impact on our

financial statements in the future.

Our

estimates will be based on our experience and our interpretation of economic, political, regulatory, and other factors that affect

our business prospects. Actual results may differ significantly from our estimates.

ITEM

3. QUANTITATIVE AND QUALITATIVE DISCLOSURES OF MARKET RISK.

Because

the Company is a smaller reporting company, it is not required to provide the information called for by this Item.

ITEM

4. CONTROLS AND PROCEDURES.

Evaluation

of Disclosure Controls and Procedures

Darryl

Reed, our chief executive officer and chief financial officer, is responsible for establishing and maintaining our disclosure

controls and procedures. Disclosure controls and procedures means controls and other procedures that are designed to ensure that

information we are required to disclose in the reports that we file or submit under the Securities Exchange Act of 1934 is recorded,

processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and

forms, and to ensure that information required to be disclosed by us in those reports is accumulated and communicated to the our

management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate

to allow timely decisions regarding required disclosure. Our chief executive officer and chief financial officer evaluated the

effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange

Act of 1934) as of June 30, 2014. Based on that evaluation, our chief executive officer and chief financial officer concluded

that, as of the evaluation date, such controls and procedures were not effective due to insufficient segregation of duties of

incompatible functions and the lack of specific fraud controls.

Changes

in internal controls

There

were no changes in our internal controls over financial reporting that occurred during the quarter ended June 30, 2014 that have

materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART

II.

ITEM

1. LEGAL PROCEEDINGS.

Our

financial statements have been presented on the basis that we continue as a going concern, which contemplates the realization

of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying financial statements,

we incurred a ($136,575 loss from operations in the three months ended June 30, 2014, and only have revenues of $32 for 2013.

These factors create an uncertainty about our ability to continue as a going concern. The financial statements do not include

any adjustments that might be necessary if we are unable to continue as a going concern.

ITEM

1A. RISK FACTORS.

Not

Applicable.

ITEM

2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

The

Company issued 10,000,000 shares of common stock to Actual Investments in exchange for debt.

The

Company issued 20,000,000 shares of common stock to a related party in exchange for debt.

The

Company issued 30,000,000 shares of common stock to a consultant as consideration for consulting services.

The

Company issued 20,000,000 shares of common stock to a related party as consideration for consulting services.

The

Company issued 18,000,000 shares of common stock in connection with the conversion of convertible notes.

The

Company issued 12,000,000 shares of common stock in exchange for the conversion of accrued wages.

The

above securities were offered and sold to the parties in private placement transactions made in reliance upon exemptions from

registration pursuant to Section 4(2) under the Securities Act of 1933 and/or Rule 506 promulgated thereunder. Each of the parties

are accredited investors as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933.

ITEM

3. DEFAULTS UPON SENIOR SECURITIES.

Not

Applicable.

ITEM

4. MINE SAFETY DISCLOSURES.

Not

Applicable

ITEM

5. OTHER INFORMATION.

Not

Applicable.

ITEM

6. EXHIBITS.

| 3.1 | |

Articles of Incorporation, under the name Micro Tech Industries, Inc. (incorporated by reference to the Company’s annual report on Form 10KSB filed on April 15, 1998) |

| | |

|

| 3.2 | |

Amendment to the Articles of Incorporation (incorporated by reference to the Company’s quarterly report filed on Form 10 Q filed on May 15, 1997) |

| | |

|

| 3.3 | |

Certificate of Change filed May 5, 2010 (incorporated by reference to the Form 8-K filed May 7, 2010) |

| | |

|

| 3.4 | |

Amendment to the Articles of Incorporation filed July 23, 2010 (incorporated by reference to the Form 10-Q filed August 23, 2010) |

| | |

|

| 3.5 | |

Amended and Restated Bylaws (incorporated by reference to the Company’s annual report on Form 10KSB filed on November 12, 1999) |

| | |

|

| 3.6 | |

Amendment to Bylaws (incorporated by reference to the Form 8-K filed May 7, 2010) |

| 4.1 | |

Agreement between Next Generation Energy Corp. and Actual Investments LLC incorporated by reference to the Form 8-K Current Report filed with the Securities and Exchange Commission on February 13, 2014 |

| | |

|

| 4.2 | |

6% Promissory Note dated March 13, 2013 between Next Generation Energy Corp. and Actual Investments, LLC (incorporated by reference to Form 10-K filed April 14, 2014) |

| | |

|

| 4.3 | |

Note Agreement dated May 24, 2013 between Next Generation Energy Corp. and Actual Investments, LLC (incorporated

by reference to the Form 8-K Current Report filed August 1, 2013).

|

| | |

|

| 4.4 | |

2014 Incentive Stock Plan (incorporated by reference to the Form S-8 filed on February 14, 2014) |

| | |

|

| 10.1 | |

Convertible Debenture Purchase Agreement by and among Next Generation Media Corp., Forge, LLC and Knox Gas, LLC dated July 23, 2010 (incorporated by reference to the Form 10-Q filed August 23, 2010) |

| | |

|

| 10.2 | |

2010 Employee, Consultant and Advisor Stock Compensation Plan (incorporated by reference to the Form S-8 filed October 22, 2010) |

| | |

|

| 10.3 | |

Form on Stock Payment Agreement (incorporated by reference to the Form S-8 filed October 22, 2010) |

| | |

|

| 10.4 | |

2010 Stock Option Plan (incorporated by reference to the Form S-8 filed October 22, 2010) |

| | |

|

| 10.5 | |

Form of Stock Option Agreement (incorporated by reference to the Form S-8 filed October 22, 2010) |

| | |

|

| 10.6 | |

Debt Forgiveness Note in the amount of $277,863 by Barbara Reed (incorporated by reference to Form 8-K filed March 23, 2011) |

| | |

|

| 10.7 | |

Debt Forgiveness Note in the amount of $277,863 by Joel Sens (incorporated by reference to Form 8-K filed March 23, 2011) |

| | |

|

| 10.8 | |

Promissory Note dated March 25, 2010 payable by Seawright Holdings, Inc. to Next Generation Media Corporation in the principal amount of $125,000 (incorporated by reference to Form 10-K filed May 16, 2010) |

| | |

|

| 10.9 | |

Transfer and Assignment dated March 23, 2011 by and among Barbara Reed, Joel Sens, Next Generation Energy Corp. and Knox Gas, LLC (incorporated by reference to Form 8-K filed March 23, 2011) |

| 10.10 | |

Memorandum of Oral Sublease between Next Generation Energy Corp. and Capitol Homes Remodeling, LLC (incorporated by reference to Form 10-K/A filed March 2, 2012) |

| 10.11 | |

Oil and Gas Lease dated June 3, 2010 by and among Billy Ray Smith, Stella Smith and Hammons Fork Ventures, LLC (100 acres) (incorporated by reference to Form 10-K/A filed March 2, 2012) |

| | |

|

| 10.12 | |

Oil and Gas Lease dated June 3, 2010 by and among Billy Ray Smith, Stella Smith and Hammons Fork Ventures, LLC (20.2acres) (incorporated by reference to Form 10-K/A filed March 2, 2012) |

| | |

|

| 10.13 | |

Oil and Gas Lease dated June 3, 2010 by and among Billy Ray Smith, Stella Smith, Stacey Smith, Heather Smith and Hammons Fork Ventures, LLC (700 acres) (incorporated by reference to Form 10-K/A filed March 2, 2012) |

| | |

|

| 10.14 | |

Oil and Gas Lease dated May 26, 2010 by and among William J. Patterson, Sr. and Sharron F. Patterson and Knox Gas, LLC (400 acres) (incorporated by reference to Form 10-K/A filed March 2, 2012) |

| | |

|

| 10.15 | |

2012 Employee, Consultant and Advisor Stock Compensation Plan (incorporated by reference to the Form S-8 filed March 22, 2012) |

| | |

|

| 10.16 | |

Agreement entered between Next Generation Energy Corp., Joel Sens, Knox County Minerals LLC and Seawright Holdings Inc. |

| | |

|

| 10.17 | |

Form on Stock Payment Agreement (incorporated by reference to the Form S-8 filed March 22, 2012) |

| | |

|

| 14 | |

Code of Business Conduct and Ethics (incorporated by reference to Form 10-K filed May 16, 2010) |

| | |

|

| 21 | |

List of subsidiaries (incorporated by reference to Form 10-K filed April 14, 2014) |

| | |

|

| 31* | |

Rule 13a-14(a)/15d-14(a) Certification by the Chief Executive Officer and Chief Financial Officer |

| | |

|

| 32* | |

Certification by the Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized:

| |

NEXT

GENERATION ENERGY CORP. |

| Date:

August 19, 2014 |

|

|

|

By: |

/s/

Darryl Reed |

| |

|

Darryl

Reed, Chief Executive Officer

(principal

executive officer and principal

financial

and accounting officer) |

23

Exhibit 10.16

AGREEMENT

This

Agreement (the "Agreement") is dated January 21, 2014 (the "Effective Date") and is made by and between Next

Generation Energy Corp. (the "Company"), on one hand, and Joel Sens ("Sens"), Knox County Minerals LLC ("Knox")

and Seawright Holdings Inc. ("Seawright" and collectively with the Sens and Knox, the "Sens Parties"), on the

other hand. The Sens Parties and the Company will individually be referred to as the Party and jointly as the Parties.

WHEREAS, Sens has

served as the director, secretary and treasurer of the Company since May 4, 2010.

WHEREAS, Sens presently

owns 14,650,000 shares of common stock of the Company of which 4.650,000 shares are owned directly by Sens (the "Direct Shares")

and 10,000,000 shares of common stock are owned by Seawright Holdings Inc. (the "Indirect Shares").

WHEREAS, Sens has

agreed to resign as an executive officer and director of the Company and to return the Direct Shares and Indirect Shares to the

Company for cancellation and return to treasury.

NOW, THEREFORE, in

consideration of the mutual conditions and covenants contained in this Agreement, and for other good and valuable consideration,

the sufficiency and receipt of which is hereby acknowledged, it is hereby stipulated, consented to and agreed by and between the

Company and Sens Parties as follows:

1. Sens hereby resigns

as an executive officer and director as of the date of this Agreement.

2. The Sens Parties

agree to return the Direct Shares to the Company for cancellation. Within five (5) days of signing this Agreement, the Sens Parties

will deliver the certificate representing the Direct Shares to the Company. The Sens Parties agrees that it will provide any additional

information or documentation requested by the Company in order that the Company may take all steps necessary to cancel the Direct

Shares.

3. The Sens

Parties agree to return the Indirect Shares to the Company for cancellation. Within five (5) days of signing this Agreement, the

Sens Parties will deliver the certificate representing the Indirect Shares to the Company. The Sens Parties agrees that it will

provide any additional information or documentation requested by the Company in order that the Company may take all steps necessary

to cancel the Indirect Shares.

4. The Sens

Parties relinquishes any right to any compensation owed to him by the Company.

5. In consideration

of returning the Indirect Shares to the Company for cancellation, the Company has agreed to reduce the debt Seawright owes the

Company by $25,000.

6. The

Parties release and discharge the other Party, including each Parties' officers, directors, affiliates, heirs, executors, successors,

administrators, attorneys, insurers, and assigns from all actions, cause of action, suits, debts, dues, sums of money, accounts,

reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises, variances, trespasses, damages,

judgments, extents, executions, claims, and demands whatsoever, in law, admiralty or equity, against the other Party, that the

releasing Party or its executors, administrators, successors and assigns ever had, now have or hereafter can, shall or may, have

for, upon, or by reason of any matter, cause or thing whatsoever, whether or not known or unknown, from the beginning of the world

to the day of the Effective Date of this Agreement. The Parties warrants and represents that no other person or entity has any

interest in the matters released herein, and that it has not assigned or transferred, or purported to assign or transfer. To any

person or entity all or any portion of the matters released herein. This release shall not apply to the outstanding debt payable

by Seawright Holdings, Inc to the Company.

7. The release

provisions of this Agreement will apply to the fullest extent of the law, whether in contract, statute, tort (such as negligence).

8. Each

party shall be responsible for their own attorneys' fees and costs.

9. Each

party acknowledges and represents that: (a) they have read the Agreement; (b) they clearly understand the Agreement and each of

its terms; (c) they fully and unconditionally consent to the terms of this Agreement; (d) they have had the benefit and advice

of counsel of their own selection; (e) they have executed this Agreement, freely, with knowledge, and without influence or duress;

(f) they have not relied upon any other representations, either written or oral, express or implied, made to them by any person;

and (g) the consideration received by them has been actual and adequate.

10. This

Agreement contains the entire agreement and understanding concerning the subject matter hereof between the parties and supersedes

and replaces all prior negotiations, proposed agreement and agreements, written or oral. Each of the parties hereto acknowledges

that neither any of the parties hereto, nor agents or counsel of any other party whomsoever, has made any promise, representation

or warranty whatsoever, express or implied, not contained herein concerning the subject hereto, to induce it to execute this Agreement

and acknowledges and warrants that it is not executing this Agreement in reliance on any promise, representation or warranty not

contained herein.

11. This

Agreement may not be modified or amended in any manner except by an instrument in writing specifically stating that it is a supplement,

modification or amendment to the Agreement and signed by each of the parties hereto.

12. Should any provision of this Agreement be declared or be determined

by any court or tribunal to be illegal or invalid, the validity of the remaining parts, terms or provisions shall not be affected

thereby and said illegal or invalid part, term or provision shall be severed and deemed not to be part of this Agreement.

13. The Parties

agree that this Agreement is governed by the Laws of the State of Virginia and that any and all disputes that may arise from the

provisions of this Agreement shall be tried in the Alexandria General District Court. The Parties agree to waive their right to

trial by jury for any dispute arising out of this Agreement.

14. This

Agreement may be executed in facsimile counterparts, each of which, when all parties have executed at least one such counterpart,

shall be deemed an original, with the same force and effect as if all signatures were appended to one instrument, but all of which

together shall constitute one and the same Agreement.

WITNESS WHEREOF, the

parties have duly executed this Agreement as of the date first indicated above.

| Next Generation Energy Corp. |

|

| |

|

|

| By: |

/s/ Darryl Reed |

|

| Name: |

Darryl Reed |

|

| Title: |

Chief Executive Officer |

|

| |

|

|

| /s/ Joel Sens |

|

| Joel Sens |

|

| Knox County Minerals

LLC |

|

| |

|

|

| By: |

/s/

Joel Sens |

|

| Name: |

Joel Sens |

|

| Title: |

Managing Member |

|

| |

|

|

| Seawright Holdings

Inc. |

|

| |

|

|

| By: |

/s/

Joel Sens |

|

| Name: |

Joel Sens |

|

| Title: |

CEO |

|

5

Exhibit 31

CERTIFICATIONS

I, Darryl Reed, hereby certify that:

| (1) |

I

have reviewed this quarterly report on Form 10-Q for the period ended June 30, 2014 (the “report”) of Next

Generation Energy Corp.; |

| (2) |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| (3) |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| (4) |

The registrant's other certifying officers and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| |

(a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| |

(b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| |

(c) |

Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

(d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| (5) |

The registrant's other certifying officers and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions): |

| |

(a) |

All significant deficiencies in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and |

| |

(b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. |

| Dated: August 19,

2014 |

/s/ Darryl Reed |

| |

Darryl Reed

Chief Executive Officer

(principal executive officer, and principal financial and

accounting officer) |

Exhibit 32

CERTIFICATION PURSUANT TO SECTION

906 OF THE SARBANES-OXLEY ACT OF 2002

Pursuant to section 906 of the Sarbanes-Oxley Act of 2002

(subsections (a) and (b) of section 1350, chapter 63 of title 18, United States Code), the undersigned officer of Next Generation

Energy Corp., a Nevada corporation (the "Company"), does hereby certify, to the best of his knowledge, that:

1. The

Quarterly Report on Form 10-Q for the period ending June 30, 2014 (the "Report") of the Company complies in all

material respects with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

2. The

information contained in the Report fairly presents, in all material respects, the financial condition and results of operations

of the Company.

| |

/s/ Darryl Reed |

| |

Darryl Reed, |

| |

Chief Executive Officer |

| |

(principal executive officer, and principal financial and accounting officer) |

Date: August 19, 2014

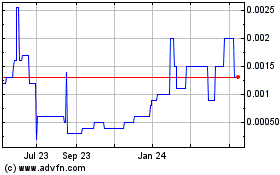

Next Gereration Management (PK) (USOTC:NGMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

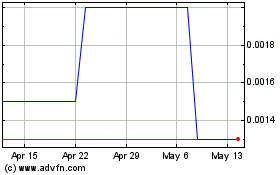

Next Gereration Management (PK) (USOTC:NGMC)

Historical Stock Chart

From Nov 2023 to Nov 2024