false

0001447380

0001447380

2024-06-12

2024-06-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 12, 2024

Mobivity

Holdings Corp.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53851 |

|

26-3439095 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3133

West Frye Road, #215

Chandler,

Arizona 85226

(Address

of principal executive offices)

(877)

282-7660

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

None |

|

None |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On

June 12, 2024, Mobivity Holdings Corp. (the “Company”) announced that the Board of Directors (the “Board”) of

the Company has appointed Bryce Daniels to serve as the President of the Company, effective as of June 12, 2024 and

the Company entered into an employment agreement with Mr. Daniels effective as of the same

date.

Mr.

Daniels, age 33, served as a portfolio manager at Talkot Capital, LLC since November 2018, where he oversaw a portfolio of private equity,

venture capital, and public market investments. Talkot Capital is a significant shareholder of the Company.

Mr.

Daniels brings a wealth of experience in investing and building companies in a board capacity from early through late stages of their

lifecycle. Prior to his role at Talkot, Mr. Daniels served as the chief investment officer at private equity-backed Encore Permian Holdings.

Before that, he spent time in private equity and investment banking, which provided him with a diverse skill set and experience leading

financings and, in an investor and board capacity, guiding companies through growth and monetization.

There

are no family relationships between Mr. Daniels and any other executive officer or director of the Company that require disclosure under

Item 401(d) of Regulation S-K. There are no transactions between Mr. Daniels or any member of his immediate family and the Company that

require disclosure under Item 404(a) of Regulation S-K.

The

employment agreement provides that Mr. Daniels will receive an annual salary of $300,000, and will be eligible to receive a bonus, as

determined in the sole discretion of and subject to objectives determined by the Board, paid on dates as determined by the Board. In

addition, Mr. Daniels is eligible to receive stock options to purchase shares of the Company’s Common Stock in connection with

his commencement of employment, subject to the terms of the Company’s current Stock Option Plan and a Stock Option Agreement between

Mr. Daniels and the Company. The foregoing descriptions of the employment agreement are qualified by reference to the text of the employment

agreement attached as Exhibit 10.1, to this Current Report on Form 8-K, which is incorporated by reference herein.

| Item

9.01 |

Financial

Statements and Exhibits |

(d)

Exhibits

The

following exhibits are being filed or furnished, as applicable, with this Current Report on Form 8-K:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

June 18, 2024 |

Mobivity

Holdings Corp. |

| |

|

|

| |

By: |

/s/

Skye Fossey-Tomaske |

| |

|

Skye

Fossey-Tomaske |

| |

|

Interim

Chief Financial Officer |

Exhibit

10.1

Execution

Version

EMPLOYMENT

AGREEMENT

THIS

EMPLOYMENT AGREEMENT (this “Agreement”) is made, entered into and effective as of June 12, 2024 (the “Effective

Date”) by and between Mobivity Holdings Corp., a Nevada corporation (the “Company”), and Bryce

Daniels, an individual resident of the State of Colorado (“Employee”).

WHEREAS,

the Company and Employee desire to set forth in a written agreement the terms and conditions pursuant to which Employee shall be employed

as President by the Company; and

WHEREAS,

the parties intend to supersede all prior oral and written communications, correspondence, letters and negotiations between them with

the terms set forth herein with regard to the terms of Employee’s employment.

NOW,

THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants, agreements and conditions

set forth herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending

to be legally bound hereby, each party hereby agrees as follows:

1.

Definitions. For purposes of this Agreement, the following capitalized terms shall have the definitions set forth below.

Other capitalized terms used in this Agreement that are not defined in this Section 1 shall have the definitions given

to them in this Agreement.

(a)

“Board” means the Board of Directors of the Company, including any authorized committee(s) thereof.

(b)

“Cause” means:

(i)

commission by Employee of a felony;

(ii)

Employee’s insobriety, use of illegal drugs, abuse of prescription drugs or abuse of alcohol which adversely and directly effects

the Company or its reputation;

(iii)

Employee’s engaging in fraud, misappropriation, embezzlement, deceit or other unlawful act or similar acts involving dishonesty

or moral turpitude on the part of Employee which adversely and directly effects the company or its reputation;

(iv)

Employee’s insubordination, commission of an act of dishonesty, gross negligence, self-dealing, willful misconduct, deceit or other

unlawful act in connection with the performance of Employee’s duties hereunder, including without limitation, misappropriation

of funds or property of the Company, securing or attempting to secure personally any profit in connection with any transaction entered

into on behalf of the Company;

(v)

Employee’s willful act or gross negligence having the effect of injuring the reputation, business or business relationships of

the Company and its subsidiaries or affiliates;

(vi)

Employee’s disregard of (A) any provision of any policy, work rule, procedure or standard of the Company; or (B) any directive

of the Company or the Board;

(vii)

Employee’s violation of any fiduciary obligation to the Company;

(viii)

Employee’s violation of any provision of the policies, work rules, procedures or standards of the Company;

(ix)

Employee’s failure to perform his duties under this Agreement; or

(x)

Employee’s violation of any covenant or obligation under this Agreement or any other agreement with the Company.

(c)

“Confidential Information” means any data or information concerning the Company, its parents, subsidiaries and affiliates,

or the operations of the Company or its parents, subsidiaries and affiliates, other than Trade Secrets, without regard to form, that

is valuable to the Company or its parents, subsidiaries or affiliates and is not generally known by the public or competitors of the

Company or its parents, subsidiaries or affiliates. To the extent consistent with the foregoing, Confidential Information includes, but

is not limited to, information about the business practices, customers of the Company, its parents, subsidiaries and affiliates (including,

without limitation, mailing lists and customer lists and records), lists of the current or potential customers, vendors and suppliers,

lists of and other information about the executives and employees, financial information, business strategies, business methods, product

information, contracts and contractual arrangements, marketing plans, the type and volume of the business of the Company, its parents,

subsidiaries and affiliates, personnel information, information about the Company’s vendors, suppliers and strategic partners,

price lists, pricing policies, pricing information, business methods, research and development techniques and activities of the Company,

its parents, subsidiaries and affiliates, and all information located in the books and records of the Company, its parents, subsidiaries

and affiliates. Confidential Information also includes any information or data described above which the Company or any parent, subsidiary

or affiliate of the Company obtains from another party and which the Company or such parent, subsidiary or affiliate treats as proprietary

or designates as confidential information whether or not owned or developed by the Company or such parent, subsidiary or affiliate.

(d)

“Disability” means that Employee qualifies for benefits under the long-term disability plan or policy maintained by

the Company, or, in the absence of such a plan or policy, a physical or mental impairment that renders Employee substantially incapable

of performing the essential functions of his job as determined by the Company, with or without reasonable accommodations as contemplated

by Americans with Disabilities Act.

(e)

“Territory” means the United States of America. The parties acknowledge and agree that the foregoing description of

the Territory is reasonable and embodies locations where the Company currently conducts its business and operations or reasonably expects

to conduct the business in accordance with the Company’s business plan.

(f)

“Trade Secret” means information of the Company or its parents, subsidiaries or affiliates, without regard to form,

including, but not limited to, technical or nontechnical data, a formula, a pattern, a compilation, a program, a device, a method, a

technique, a drawing, a design, a process, financial data, financial plans, product plans, technology plans, marketing plans, acquisition

strategies, strategic plans, or a list of actual or potential customers or suppliers which is not commonly known by or available to the

public and which information: (i) derives economic value, actual or potential, from not being generally known to, and not being readily

ascertainable by proper means by, other persons who can obtain economic value from its disclosure or use; and (ii) is the subject of

efforts that are reasonable under the circumstances to maintain its secrecy. Trade Secrets also includes any information or data described

above which the Company or any parent, subsidiary or affiliate of the Company obtains from another party and which the Company treats

as proprietary or designates as trade secrets, whether or not owned or developed by the Company or such parent, subsidiary or affiliate

of the Company.

(g)

“Work Product” means all discoveries, designs, artwork, Trade Secrets, Confidential Information, trademarks, data,

analyses, materials, formulas, strategic plans, acquisition strategies, research, documentation, computer programs, information technology

systems, communication systems, audio systems, manufacturing systems, system designs, inventions (whether or not patentable), copyrightable

subject matter, works of authorship, and other proprietary information or work product (including all worldwide rights therein under

patent, copyright, trademark, trade secret, confidential information, moral rights and other property rights), which Employee has made

or conceived, or may make or conceive, either solely or jointly with others, while providing services to the Company or its subsidiaries

or with the use of the time, material or facilities of the Company or its subsidiaries or relating to any actual or anticipated business

of the Company or its subsidiaries known to Employee while employed at the Company, or suggested by or resulting from any task assigned

to Employee or work performed by Employee for or on behalf of the Company.

2.

Employment, Duties and Term.

(a)

Subject to the terms hereof, the Company hereby employs Employee as President, and Employee accepts such employment with the Company

on the terms set forth in this Agreement. In such capacity, Employee shall perform the duties appropriate to such office or position,

and such other duties and responsibilities commensurate with such position as are assigned to him from time to time by the Board or its

designees. Employee shall report to the Chair of the Company’s Board.

(b)

Employee shall devote sufficient working time and best efforts to the performance of his duties under this Agreement for and on behalf

of the Company and shall not engage in any business activity in competition with the Company, or that otherwise prevents Employee from

performing his duties for the Company. Notwithstanding the foregoing, Employee shall be permitted to serve on corporate, civic or charitable

boards or committees, so long as he is currently serving in those positions at the time of execution of this Agreement, or the Board

consents in advance in writing to such activities, and such activities do not materially interfere with the performance of his responsibilities

as an employee of the Company in accordance with this Agreement. Employee represents that he is not subject to any non-competition, confidentiality,

trade secrets or other agreement(s) that would preclude, or restrict in any way, Employee from fully performing his services hereunder

during his employment with the Company.

(c)

Unless earlier terminated as provided herein, Employee’s employment under this Agreement shall be for a term commencing on the

Effective Date and ending on the date this Agreement is terminated pursuant to Section 4 below (the “Term”). Employee

acknowledges and agrees his employment with the Company is on an “at will” basis, meaning that either Employee or the Company

may terminate his employment at any time for any reason or no reason, without further obligation or liability, except as expressly set

forth in Section 4 below.

3.

Compensation.

(a)

Base Salary. In consideration of the services rendered by Employee, and subject to the terms and conditions hereof, the

Company shall pay Employee during the Term an annual base salary of $300,000.00 (the “Base Salary”). The Base Salary

shall be subject to increase, if at all, based on an annual salary review by the Board commencing on December 31, 2024, and each 12-month

period thereafter. The Base Salary shall be payable in accordance with the Company’s payroll practices as in effect from time to

time.

(b)

Bonuses. In addition to the Base Salary, Employee may be eligible to receive a bonus, as determined in the sole discretion

of and subject to objectives determined by the Board. Any bonus shall be paid on dates as determined by the Board and each bonus payment

is conditioned upon Employee’s continued employment with the Company on the date of payment.

(c)

Vacation. Employee shall be entitled to vacation time in accordance with the policies and practices of the Company.

(d)

Benefits. During the Term, Employee shall be entitled to participate in any other employee benefit plans generally provided

by the Company to its full-time employees from time to time, but only to the extent provided in such employee benefit plans and for so

long as the Company provides or offers such benefit plans. The Company reserves the right to modify, amend or terminate such benefit

plans at any time without prior notice.

(e)

Expense Reimbursement. During the Term, Employee shall be entitled to be reimbursed in accordance with the policies of

the Company, as adopted from time to time, for all reasonable and necessary expenses incurred by Employee in connection with the performance

of Employee’s duties of employment hereunder. Unless the expense policies provide otherwise, Employee shall submit written requests

for payment accompanied with such evidence of fees and expenses incurred as the Company reasonably may require no later than thirty (30)

days following the end of the calendar year in which such fees and expenses are incurred, and reimbursement payments shall be made within

thirty (30) days after the Company’s receipt of Employee’s written request.

(f)

Stock Options. Subject to the approval of the Board, Employee may be granted stock options to purchase shares of the Company’s

Common Stock in connection with his commencement of employment.. Any granted options will be subject to the terms of the Company’s

current stock option plan and a stock option agreement between Employee and Company.

4.

Termination.

(a)

This Agreement may be terminated during the Term as follows:

(i)

by mutual agreement of the Company and Employee;

(ii)

by the Company, immediately, without any advance notice from the Company, for Cause;

(iii)

by the Company, upon the death or Disability of Employee;

(iv)

by the Company, upon thirty (30) days prior written notice, without Cause; or

(v)

by Employee, upon thirty (30) days prior written notice.

(b)

Upon Employee’s separation from service following the termination of this Agreement (the date of such termination referred to herein

as the “Termination Date”), the Company shall pay to Employee the following: (i) all Base Salary earned or accrued through

the Termination Date; (ii) all accrued and unused vacation time for the calendar year in which the Termination Date occurs; and (iii)

reimbursement for any expenses under Section 3(e) that were incurred by Employee prior to the Termination Date.

(c)

If this Agreement is terminated pursuant to Section 4(a)(iv) (by the Company without Cause), then, in addition to the payments

set forth in Section 4(b) above, the Company shall pay Employee six months (6) months of Base Salary, at the rate in effect

as of the Termination Date, which payments shall commence within sixty (60) days following Employee’s separation from service,

payable as described in Section 4(d), and which shall be made in accordance with the regular payroll practices of the Company

(the “Separation Payments”).

(d)

To receive the Separation Payments described in Section 4(c), Employee must execute, not later than ten (10) days (or such

longer period provided under applicable law) following Employee’s separation from service a release of claims against the Company,

its affiliates and their respective managers, directors, officers and equity holders, in a form to be provided by the Company, and Employee

must not have thereafter revoked such release. If Employee has not executed the release of claims in favor of the Company and returned

it to the Company by the date the payment described in Section 4(c) becomes due or if Employee revokes an executed release,

Employee shall forfeit all rights to such payment under this Agreement.

(e)

“Separation from service” as used in this Section 4 to determine the date of any payment, shall mean

the date of Employee’s “separation from service” as defined by Section 409A of the Internal Code Revenue Code of 1986,

as amended, and the Treasury regulations and formal guidance issued thereunder.

5.

Confidential Relationship and Protection of Trade Secrets and Confidential Information. In the course of Employee’s

employment by the Company, Employee has had access to and shall have access to the Company’s most sensitive and most valuable Trade

Secrets, proprietary information, and Confidential Information concerning the Company and its subsidiaries, their present and future

business plans, development projects, artwork, designs, products, formulas, suppliers, customers, acquisition strategies and business

affairs which constitute valuable business assets of the Company and its subsidiaries, the use, application or disclosure of any of which

shall cause substantial and possible irreparable damage to the business and asset value of the Company. Accordingly, Employee accepts

and agrees to be bound by the following provisions:

(a)

At any time, upon the request of the Company and in any event upon any termination or expiration of this Agreement, Employee shall deliver

to the Company all analyses, strategies, plans, acquisition strategies, artwork, technology plans, memoranda, notes, records, drawings,

manuals, files or other documents, and all copies of each, concerning or constituting Confidential Information or Trade Secrets and any

other property or files belonging to the Company or any of its subsidiaries that are in the possession of Employee, whether made or compiled

by Employee or furnished to or acquired by Employee from the Company.

(b)

To protect the Trade Secrets and Confidential Information, Employee agrees that:

(i)

Employee shall hold in confidence the Trade Secrets. Except in the performance of services for the Company, Employee shall not at any

time use, disclose, reproduce, distribute, transmit, reverse engineer, decompile, disassemble, or transfer the Trade Secrets or any portion

thereof.

(ii)

Employee shall hold in confidence the Confidential Information. Except in the performance of services for the Company, Employee shall

not, at any time during the Term of this Agreement and for five (5) years thereafter, use, disclose, reproduce, distribute, transmit,

reverse engineer, decompile, disassemble, or transfer the Confidential Information or any portion thereof.

(c)

Employee understands that nothing in this Agreement is intended to prevent Employee from responding to a subpoena or other court order,

from filing a charge with the United States Equal Employment Opportunity Commission or any other governmental agency, from participating

in an investigation conducted by a governmental agency, from making a report to any governmental agency that Employee is entitled or

authorized to make under applicable laws, or restrict Employee’s ability to discuss or disclose, either orally or in writing, information

or underlying facts of any alleged discriminatory or unfair employment practice, or any other conduct as specifically permitted under

Colorado Revised Statutes Section 24-34-407.

(d)

Employee is hereby notified in accordance with the Defend Trade Secrets Act that Employee will not be held criminally or civilly liable

under any federal or state trade secret law for the disclosure of a trade secret that: (a) is made (i) in confidence to a federal, state,

or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating

a suspected violation of law; or (b) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding.

Employee is further notified that if Employee files a lawsuit for retaliation by the Company for reporting a suspected violation of law,

the Employee may disclose the Company’s trade secrets to Employee’s attorney and use the trade secret information in the

court proceeding if Employee: (a) files any document containing the trade secret under seal; and (b) does not disclose the trade secret,

except pursuant to court order.

6.

Restrictive Covenants. For purposes of this Section 6, the “Company” shall include the

Company and its parents and subsidiaries.

(a)

Restricted Period. For purposes hereof, the “Restricted Period” shall last until the two (2) year anniversary

of the Termination Date. If this Agreement is terminated pursuant to Section 4(a)(iv) (by the Company without Cause), then

the “Restricted Period” shall last until the date that is one week after the date of the last Separation Payment paid

by the Company.

(b)

Non-Solicitation. Employee agrees that for purposes hereof, during the Term of this Agreement and in the event of any termination

or expiration of this Agreement, until the expiration of the Restricted Period, Employee shall not, anywhere within the Territory, without

the prior written consent of the Company, either directly or indirectly, on his own behalf or in the service of or on behalf of others,

in the interests of protecting the Trade Secrets of the Company (i) solicit, contact, call upon, communicate with or attempt to communicate

with any supplier of goods or services to the Company, any customer of the Company or prospective customer of the Company, or any representative

of any customer or prospective customer of the Company with a view to selling or providing any product, deliverable or service competitive

or potentially competitive with any product, deliverable or service sold or provided or under development by the Company during the period

of two (2) years immediately preceding the Termination Date (provided that the foregoing restrictions shall apply only to customers

or prospective customers of the Company, or representatives of customers or prospective customers of the Company with which Employee

had material contact during the two (2) year period immediately preceding the Termination Date); (ii) solicit, induce or encourage any

supplier of the Company to terminate or modify any business relationship with the Company; or (iii) otherwise take any action which may

reasonably be anticipated to interfere with or disrupt any past, present or prospective business relationship, contractual or otherwise,

between the Company and any customer, supplier or agent of the Company. The actions prohibited by this Section 6(b) shall

not be engaged in by Employee directly or indirectly, whether as employee, independent contractor, manager, salesperson, agent, technical

support technician, sales or service representative, or otherwise.

(c)

Non-Recruitment. During the Term of this Agreement, and in the event of any termination or expiration of this Agreement

until the expiration of the Restricted Period, Employee shall not, without the prior written consent of the Company, either directly

or indirectly, on his own behalf or in the service of or on behalf of others, solicit or attempt to solicit for employment any person

employed by the Company in the Territory, whether or not such person is a full-time employee or a temporary employee of the Company,

and whether or not such employment is pursuant to a written agreement or independent contractor agreement and whether or not such employment

is for a determined period or is at will.

(d)

Non-Disparagement. Employee covenants and agrees not to make any statements of any kind, oral or written, that are derogatory

or disparaging toward the Company or the management, products, employees, customers or services of the Company; provided, however,

that nothing contained herein shall limit Employee’s obligation to give truthful testimony to a court or governmental agency, when

required to do so by subpoena, court order, law or administrative regulation.

(e)

Reasonableness. Employee acknowledges and agrees that the covenants contained in this Section 6 (“Restrictive

Covenants”) are reasonable and valid in all respects. Further, if any Restrictive Covenants, or portion thereof, are declared

to be invalid or unenforceable, Employee shall, as soon as possible, execute a supplemental agreement with the Company granting to the

Company, to the extent legally permissible, the protection intended to be afforded to the Company by the Restrictive Covenants, or portion

thereof, so declared invalid or unenforceable.

(f)

Tolling. Employee agrees that in the event the enforceability of any of the terms of this Section 6 shall

be challenged in court and Employee is not enjoined from breaching the Restrictive Covenants set forth in this Section 6,

then if a court of competent jurisdiction finds that the challenged covenants are enforceable, the time period restrictions specified

in this Section 6 shall be deemed tolled upon the filing of the lawsuit involving the enforceability of this Section

6 until the dispute is finally resolved and all periods of appeal have expired.

7.

Work Product. All Work Product shall be the exclusive property of the Company. If any of the Work Product may not, by operation

of law or otherwise, be considered the exclusive property of the Company, or if ownership of all right, title, and interest to the legal

rights therein shall not otherwise vest exclusively in the Company, Employee hereby assigns to the Company, and upon the future creation

thereof automatically assigns to the Company, without further consideration, the ownership of all Work Product. The Company shall have

the right to obtain and hold in its own name copyrights, patents, registrations, and any other protection available in the Work Product.

Employee shall promptly disclose any and all such Work Product to the Company. Employee agrees to perform, during or after termination

of Employee’s employment by the Company, and without requiring the Company to provide any further consideration therefore, such

further acts as may be necessary or desirable to transfer, perfect and defend the Company’s ownership of the Work Product as requested

by the Company.

8.

License. To the extent that any pre-existing materials are contained in the materials Employee delivers to the Company

or the Company’s customers, and such preexisting materials are not Work Product, Employee grants to the Company an irrevocable,

exclusive, worldwide, royalty-free license to: (i) use and distribute (internally or externally) copies of, and prepare derivative works

based upon, such pre-existing materials and derivative works thereof and (ii) authorize others to do any of the foregoing. Employee shall

notify the Company in writing of any and all pre-existing materials delivered to the Company by Employee. Employee acknowledges that

the Company does not wish to incorporate any unlicensed or unauthorized materials into its products or technology. Therefore, Employee

agrees that Employee shall not knowingly disclose to the Company, use in the Company’s business, or cause the Company to use, any

information or material which is confidential to any third party unless the Company has a written agreement with such third party or

the Company otherwise has the right to receive and use such information. Employee shall not incorporate into Employee’s work any

material which is subject to the copyrights, patent or other proprietary right of any third party unless the Company has a written agreement

with such third party or otherwise has the right to receive and use such material.

9.

Defense or Prosecution of Claims. Employee agrees that during his employment and following the termination of his employment

for any reason, he shall cooperate at the request of the Company in the defense or prosecution of any lawsuits or claims in which the

Company, its affiliates and their respective managers, directors, employees, officers or equity holders may be or become involved and

which relate to matters occurring while he was employed by the Company, unless and to the extent that (a) Employee receives a written

opinion of counsel, which is provided to the Company, that Employee shall suffer material harm or material prejudice as a result of such

cooperation or (b) a material conflict of interest arises or exists with respect to such cooperation, and in each such case Employee

shall cooperate to the maximum extent possible without incurring material harm or material prejudice or a material conflict of interest.

10.

Specific Enforcement. The Company and Employee agree that any violation of Sections 5, 6, 7,

8, or 9 of this Agreement shall cause irreparable injury to the Company and its affiliates and that, accordingly,

the Company shall be entitled, in addition to any other rights and remedies it may have at law or in equity, to seek an injunction enjoining

and restraining Employee from doing or planning to do any such act and any other violation or threatened violation of Sections

5, 6, 7, 8, or 9. Employee agrees that the Company shall be entitled

to recover from Employee all of the Company’s costs and expenses, including reasonable attorneys’ fees, incurred by the Company

in the course of successfully defending or enforcing this Agreement.

11.

No Conflicting Obligations. Each party represents and warrants to the other party that it or he is not now under any obligation

of a contractual or other nature to any person or entity which is inconsistent or in conflict with this Agreement, or which would prevent,

limit or impair in any way the performance by it or him of its or his obligations hereunder.

12.

Indemnity. Employee shall indemnify the Company and its subsidiaries, affiliates, successors and assigns from and against

any and all actions, suits, proceedings, liabilities, damages, losses, costs and expenses (including attorneys’ and experts’

fees) arising out of or in connection with any breach or threatened breach by Employee of any one or more provisions of this Agreement.

The existence of any claim, demand, action or cause of action of Employee against the Company shall not constitute a defense to the enforcement

by the Company of any of the covenants or agreements herein.

13.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Colorado,

without giving effect to principles of conflicts of laws.

14.

Consent to Jurisdiction and Venue; Waiver of Jury Trial.

(a)

Each party hereby irrevocably and unconditionally consents to submit to the exclusive jurisdiction of the courts of the United States

of America located in the State of Colorado, for any actions, suits or proceedings arising out of or relating to this Agreement (and

the parties agree not to commence any action, suit or proceeding relating thereto except in such courts), and further agrees that service

of any process, summons, notice or document by U.S. registered or certified mail to such party’s principal place of business shall

be effective service of process for any action, suit or proceeding arising out of or relating to this Agreement in any such court. Each

party hereby irrevocably and unconditionally waives any objection to the laying of venue of any action, suit or proceeding arising out

of this Agreement, in the above-named courts, and hereby further irrevocably and unconditionally waives his or its right and agrees not

to plead or claim in any such court that any such action, suit or proceeding brought in any such court has been brought in an inconvenient

forum.

(b)

TO THE EXTENT NOT PROHIBITED BY APPLICABLE LAW WHICH CANNOT BE WAIVED, EACH OF THE PARTIES HEREBY WAIVES AND COVENANTS NOT TO ASSERT

(WHETHER AS PLAINTIFF, DEFENDANT OR OTHERWISE) ANY RIGHT TO TRIAL BY JURY IN ANY FORUM IN RESPECT OF ANY ISSUE OR ACTION, CLAIM, CAUSE

OF ACTION OR SUIT (IN CONTRACT, TORT OR OTHERWISE), INQUIRY, PROCEEDING OR INVESTIGATION ARISING OUT OF OR BASED UPON THIS AGREEMENT

OR THE SUBJECT MATTER HEREOF OR IN ANY WAY CONNECTED WITH OR RELATED OR INCIDENTAL TO THE TRANSACTIONS CONTEMPLATED HEREBY, IN EACH CASE

WHETHER NOW EXISTING OR HEREAFTER ARISING. ANY PARTY HERETO MAY FILE AN ORIGINAL COUNTERPART OR A COPY OF THIS SECTION WITH ANY COURT

AS WRITTEN EVIDENCE OF THE CONSENT OF EACH SUCH PARTY TO THE WAIVER OF ITS RIGHT TO TRIAL BY JURY.

15.

Remedies Cumulative. The provisions of this Agreement do not in any way limit or abridge any rights of the Company or any

of its subsidiaries or other affiliates under the law of unfair competition, trade secret, copyright, patent, trademark or any other

applicable law(s), all of which are in addition to and cumulative of the Company’s rights under this Agreement.

16.

Severability. Each of the provisions of this Agreement shall be deemed separate and severable each from the other. In the

event that any provision or portion of this Agreement shall be determined to be invalid or unenforceable for any reason by final judgment

of a court of competent jurisdiction, the remaining provisions or portions of this Agreement shall be unaffected thereby and shall remain

in full force and effect to the fullest extent permitted by law. In the event that any provision or portion of this Agreement shall be

determined by any court of competent jurisdiction to be unreasonable or unenforceable, in whole or in part, as written, Employee hereby

consents to and affirmatively requests that such court reform such provision or portion of this Agreement so as to be reasonable and

enforceable and that such court enforce such provision or portion of this Agreement as so reformed.

17.

No Defense. The existence of any claim, demand, action or cause of action of Employee against the Company, whether or not

based upon this Agreement, shall not constitute a defense to the enforcement by the Company of any covenant or agreement of Employee

contained herein.

18.

No Attachment. Except as required by law, no right to receive payments under this Agreement shall be subject to anticipation,

commutation, alienation, sale, assignment, encumbrance, charge, pledge or hypothecation, or to execution, attachment, levy or similar

process or assignment by operation of law, and any attempt, voluntary or involuntary, to effect any such action shall be null, void and

of no effect; provided, however, that this provision shall not prevent Employee from designating one or more beneficiaries to receive

any amount after his death and shall not preclude his executor or administrator from assigning any right hereunder to the person or persons

entitled thereto, and in the event of Employee’s death or a judicial determination of Employee’s incompetence, Employee’s

rights under this Agreement shall survive and shall inure to the benefit of Employee’s heirs, beneficiaries and legal representatives.

19.

Source of Payments. All payments provided under this Agreement shall be paid in cash from the general funds of the Company,

and no special or separate fund shall be established and no other segregation of assets shall be made to assure payment.

20.

Tax Withholding. The Company may withhold from any compensation and benefits payable under this Agreement all federal,

state, city or other taxes as shall be required pursuant to any law or governmental regulation or ruling.

21.

Notices. All notices, requests, claims, demands and other communications hereunder shall be in writing and shall be deemed

to have been duly given when delivered in person, by any overnight courier or other service providing evidence of delivery, by registered

or certified mail (postage prepaid, return receipt requested), or by facsimile or e-mail with a copy delivered the next business day

by any overnight courier or other service providing evidence of delivery, to the respective parties at the following address:

| If

to the Company: |

|

Mobivity

Holdings Corp.

3133

West Frye Road, # 215

Chandler,

Arizona 85226

Attention:

Chair of Board of Directors

E-mail:

takin@talkot.com |

| |

|

|

| If

to Employee: |

|

The

Employee’s home address or email address then known by the Company |

22.

Amendment and Waiver. No provision of this Agreement may be amended or modified, unless such amendment or modification

is in writing and signed by the Company and by Employee. No waiver by either party hereto of any breach by the other party hereto of

any condition or any provisions of this Agreement to be performed by such other party shall be deemed a waiver of a subsequent breach

of such condition or provision or waiver of a similar or dissimilar condition or provision at the same time or any subsequent time.

23.

Assignment; Successors in Interest. No assignment or transfer by either party of such party’s rights and obligations

hereunder shall be made except with the prior written consent of the other party hereto. This Agreement shall be binding upon and shall

inure to the benefit of the parties and their respective successors and permitted assigns, and any reference to a party shall also be

a reference to the successors and permitted assigns thereof, including, without limitation, successors through merger, consolidation,

or sale of substantially all of the Company’s equity interests or assets, and shall be binding upon Employee.

24.

Prior Agreements. This Agreement supersedes all previous agreements between the Company and Employee concerning terms and

conditions of the employment of Employee by the Company, and all such previous agreements are hereby canceled by mutual consent.

25.

Entire Agreement. This Agreement contains the entire agreement between the parties relating to Employee’s employment

with the Company, and no statements, representations, promises or inducements made by any party hereto, or agreement of either party,

which is not contained in this Agreement or in a writing signed by both parties and expressly providing that it is supplemental to this

Agreement, shall be valid or binding.

26.

Counterparts. This Agreement may be executed in multiple counterparts, each of which shall for all purposes be deemed to

be an original and all of which, when taken together, shall constitute one and the same instrument. This Agreement may be executed and

delivered by facsimile or other electronic transmission.

27.

Section 409A. This Agreement shall be construed in a manner consistent with the applicable requirements of Section 409A

of the Internal Revenue Code of 1986, as amended, and the formal guidance issued thereunder (“Section 409A”), and

the Company, in its sole discretion and without the consent of Employee, may amend the provisions of this Agreement if and to the extent

the Company determines that such amendment is necessary or appropriate to comply with the applicable requirements of Section 409A. If

a payment date that complies with Section 409A is not otherwise provided herein for any payment (in cash or in-kind) or reimbursement

that would otherwise constitute a “deferral of compensation” under Section 409A, then such payment or reimbursement, to the

extent such payment or reimbursement becomes due hereunder, shall in all events be made not later than two and one-half (2½) months

after the end of the later of the fiscal year or the calendar year in which the payment or reimbursement is no longer subject to a substantial

risk of forfeiture. The Company shall only reimburse those amounts eligible to reimbursed under this Agreement for which Employee submits,

within thirty (30) days following the end of the calendar year in which the expense was incurred, written requests for payments accompanied

with such evidence of fees and expenses incurred as the Company may reasonably require and as may be needed to comply with applicable

IRS rules and Treasury regulations.

28.

Independent Review and Advice. Employee represents and warrants that he executes this Agreement with full knowledge of

the contents of this Agreement, the legal consequences thereof, and any and all rights which each party may have with respect to one

another; that Employee has had the opportunity to receive independent legal advice with respect to the matters set forth in this Agreement

and with respect to the rights and asserted rights arising out of such matters; and that Employee is entering into this Agreement of

his own free will.

29.

Survival. The obligations of the parties under Sections 3(d), 4(b), 4(c), 4(d),

, 5, 6, 7, 8, 9, 10, 12, 13,

14, 15, 16, 17, 18, 19, 20, 22,

23, 24, 25, 27 and 28 shall survive the termination or expiration

of this Agreement and shall not be extinguished thereby.

(Signatures

begin on next page)

IN

WITNESS WHEREOF, Employee has hereunder set his hand and seal, and the Company has caused this Employment Agreement to be executed

by its duly authorized officer, to be effective as of the Effective Date.

| |

COMPANY: |

| |

|

| |

MOBIVITY

HOLDINGS CORP. |

| |

|

|

| |

By: |

/s/

Thomas B. Akin |

| |

Name: |

Thomas

B. Akin |

| |

Title: |

Chairman

of the Board of Directors |

| |

|

|

| |

EMPLOYEE: |

| |

|

|

| |

By: |

/s/

Bryce D. Daniels |

| |

Name: |

Bryce

D. Daniels |

[Signature

Page to Employment Agreement]

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

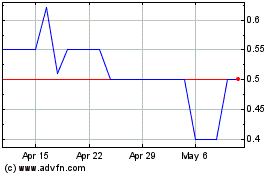

Mobivity (QB) (USOTC:MFON)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mobivity (QB) (USOTC:MFON)

Historical Stock Chart

From Dec 2023 to Dec 2024