NetworkNewsWire

Editorial Coverage: For those on the connected side of the

digital divide, the internet has created a borderless society where

everything is within reach of a mouse click. For the approximately

44 million

American homes still without broadband, President Joe Biden has

tasked

Congress with approving a budget that helps bridge that divide.

From a business standpoint, that’s an opportunity for a bevy of

companies, including streaming services, advertisers, e-commerce

brands and more to reach large pockets of the country currently

unattended. That means more opportunity for Friendable Inc.

(OTC: FDBL) (Profile) and its Fan Pass live-streaming

mobile and web-based platform to further accelerate its growth

trajectory by providing unprecedented access to artists ranging

from up-and-comers to some of the world’s biggest music artists and

celebrity talent. Those connected can hardly fathom a non-streaming

world anymore where, with just a tap on a device, live concerts,

podcasts, movies and music are instantly available from an array of

providers, including Spotify

Technology S.A (NYSE: SPOT), Apple

Inc. (NASDAQ: AAPL), Disney

(NYSE: DIS), Amazon

(NASDAQ: AMZN) and more.

- S. market has more streaming service subscriptions than people

(340 million vs. 330 million).

- With its Fan Pass app, Friendable addresses a gap in the live

video-streaming market by providing users exclusive engagement with

musicians and celebrities.

- All critical growth metrics are surging for Fan Pass, including

artist sign-ups spiking from 317 in February to 575 in March.

- FDBL just announced its foray into exploding NFT market,

offering limited-edition NFTs with benefits subscribers can’t find

anywhere else.

Click here to view

the custom infographic of the Friendable

editorial.

Opportune Time to Support Music Artists

With traditional media in decline, the trend towards streaming

has created a massive marketplace with no signs of slowing down.

Underpinned by growing adoption of cloud-based solutions to

increase the reach of video content, with blockchain and artificial

intelligence technologies improving video quality and ever-growing

popularity of mobile devices, analysts at Grand View Research peg

the global video

streaming market at $50.11 billion in 2020 with robust 21.0%

compound annual growth expected to 2028.

In its series

titled, “New Normal, New Opportunities,” RBC Wealth Management

examined secular trends magnified by the coronavirus pandemic,

including cord cutting and video streaming, trends that are likely

to stay intact in a post-COVID economy. As determined by Roku,

nearly one in three U.S. household cancelled cable or satellite

subscriptions in favor of alternatives to view movies and other

content and another 25% of households trimmed their traditional

television services, a trend known as cord shaving.

Against that backdrop, the last year has been an opportune time

for Friendable

Inc. (OTC: FDBL) to launch its Fan Pass mobile and

desktop platform as a novel entertainment service for both artists

and their fans/consumers. Created by Robert Rositano Jr. and Dean

Rositano, serial entrepreneurs with a track record of success,

Friendable’s Fan Pass platform addresses a gap in the

video-streaming market by giving artists and fans what they want:

more insight into the ongoings of artists, musicians and

celebrities through exclusive content offered by the Fan Pass

service offerings.

Currently, services are front stage facing, as artists connect

with fans on the Fan Pass Virtual Stage. These events are

supplemented with merchandise offerings and various add-ons that

allow the fans to support their favorite artists by signing up for

the monthly subscription or simply purchasing merchandise or

live-event tickets, all shared with each artist on a revenue share

basis. As venues re-open, Friendable will engage in various VIP and

Backstage options for fans to gain access to exclusive

behind-the-scenes content as well.

Rather than competing with juggernauts such as Amazon, Netflix

or even Spotify, Fan Pass is a complementary partner that

capitalizes on the fact that 45% of respondents in a Livestream/New

York Magazine survey said they

would pay for live video from a favorite performer, speaker or

sports team. A stunning 87% of respondents said they prefer to

watch video online if it meant more behind-the-scenes content. That

is the sweet spot for Friendable’s Fan Pass live-streaming

platform.

Empowering Artists, Gaining Maximum

Exposure

Unlike other agencies that effectively want artists to sign

their lives away, Fan Pass is a true artist partner, designed to

launch, elevate and activate careers coming up through the

platform. Friendable also collaborates directly with artists,

booking agents, talent managers, live venues and even record labels

to gain access to special-event performers and ultimately their

fans, as they will be the ones shaking out the new or undiscovered

talent waiting to be discovered and elevated by these very same

fans.

Throughout the process, the artists remain in charge, benefiting

from numerous onboarding services provided free of charge by the

Fan Pass team and platform. Additional tools and fee-based pro

service offerings are also available to assist with logo creations,

merchandise design or lighting, and streaming packages to support

artists in building and managing their careers. These tools include

digital marketing avenues such as celebrity direct-to-fan and

digital-ad campaigns on social media, search and email. The

strategy is bidirectional, meaning Friendable and Fan Pass utilize

independent artists, celebrity and user-generated content to gain

maximum market reach.

As soon as the Fan Pass agent team has completed the onboarding

process and an artist’s channel goes live for fans to access, the

artist is encouraged and incentivized to promote themselves. These

promotions are designed by Fan Pass and approved by each artist

prior to social media postings, which dovetails perfectly with

opening up the VIP/Backstage experience and exclusive

behind-the-scenes content offerings as live venues schedule

re-openings.

To provide some color, consider an independent artist with a

million fans and followers across social media platforms — or a

celebrity artist with more than 50 million. As venues re-open and

fans compete for opportunities to attend a live show, Fan Pass

intends to be behind the scenes offering up livestream content.

Traditionally only a handful of fans could ever obtain a backstage

pass or participate in a backstage meet-and-greet; however, that

all changes when fans download the Fan Pass app or use their

website to gain access to exclusive experiences for a fraction of

the cost.

Fan Pass charges $3.99 per month (or $38.30 annually) for an

all-access pass to all artist content, streamed across various

music genres in the app and on the Fan Pass website. The artists

receive a portion of these fees, based on the type of content —

video, audio or image — as well as fan activity in each artist

channel. In the case of a live or special-event ticket, artists

have the option of selling tickets to these live shows as an

additional source of revenue, netting them 100% of ticket sales

processed by Fan Pass and paid out immediately.

In the example above, if only 1% of the independent artist’s one

million fans, or 10,000 fans, purchase an event ticket for $8, that

totals $80,000 in revenue for the artist — and that is in addition

to the ongoing or recurring subscriber revenue shared with the

artists.

And that’s not all. Friendable has been securing partnerships to

ensure Fan Pass expansion as additional platforms are coming soon.

The company is also targeting key relationships within the

entertainment industry as it evaluates further opportunities to

support and service Fan Pass artists and fans. Potential OTT

platform expansions include Apple TV, Android TV, Roku and

more.

Fans, Artists Loving It

Appetite is growing for the Fan Pass live-streaming platform as

measured by rising activity and growth data

related to artist sign-ups, monthly platform impressions, fan/user

sessions and increases in social media followers, likes and reach.

In February 2021, 317 new artists signed up for the platform, with

live-event streams numbering 32, up 64% from January. The company’s

reach on Facebook expanded 30% as likes for the Fan Pass page rose

19%, while the reach on Instagram jumped 55% as the number of

followers rose 9.3% month over month.

While those numbers are impressive, March’s

numbers ticked even higher as the word got out about what Fan

Pass brings to the table. An additional 575 new artists signed up

during the month, with live events and performances doubling from

February. Fan Pass impressions increased 19% and live-channel

impressions soared 69%. Facebook reach exploded by 120%, and

engagement was up another 19%. All the critical metrics for

Instagram also notched double-digit percentage increases.

Genius: Jumping in the Red Hot NFT Market

Friendable management is not missing a beat while getting in

front of emerging trends that fans crave. NFTs, or non-fungible

tokens, are one of the hottest markets around. NFTs are unique

digital assets stored on blockchain technology that can’t be

reproduced. Digital artwork has been prized, as illustrated by a

relatively unknown artist called Beeple raking in an

astonishing $102.2 million from selling 842 pieces of his work.

Jack Dorsey’s first tweet (autographed), short videos of pro

basketball players and other things digital are all the rage as the

NFT frenzy rages on.

Friendable and Fan Pass with its long list of artists are a

perfect fit for this market. This month, the company inked a letter

of intent with Santo Blockchain Labs and Santo Mining Corp. to

develop global entertainment and music artist-driven NFTs, along

with its own marketplace. Each NFT, expected to be limited-edition

digital and/or augmented-reality images, represents a unique

opportunity for revenue streams for the artists, Friendable and

Santo. NFTs can also include gold or platinum tickets that give the

owner exclusive benefits to a physical venue or event with the

artist. In totality, NFTs are a savvy way to generate revenue while

also building artist and Fan Pass brands by making the most of an

accelerating trend.

Others in the Streaming Space

The streaming industry is absolutely thriving, which could lead

to an increase in consolidation activity as companies look for any

potential edge to win consumers. Examples of M&A activity in

recent years include IAC-owned Vimeo

acquiring LiveStream and VHX for undisclosed amounts, as well

as Magisto for a reported $200 million and Stingray making several

acquisitions including Qello, Chatter, DJ-Matic and Yokee.

Spotify

Technology S.A. (NYSE: SPOT), a service first known

for music but now a global leader in streaming podcasts, turned the

industry on its head last year when it signed comedian and podcast

host Joe Rogan to a $100 million contract to get his content

exclusively publishing on its brand. Spotify CEO Daniel Ek has said

that “audio – not just music” is the future of the company. The

company moved with a

purpose in that direction, bolstering its podcast library from

just 185,000 choices in 2018 to over 2.2 million as of

February.

Apple

Inc. (NASDAQ: AAPL) has a knack unlike any other

to position itself as providing only the highest-quality products

and getting its loyal base to pony up big dollars for what they

want. The same could be said about its streaming services. A new

study by Self Financial examined IMDb scores with U.S. customer

data, and not surprisingly, Apple TV+ topped the

list of providing the highest-quality content providers,

outstripping Netflix, HBO Max, Prime Video, Disney+ and Hulu. Apple

only launched its streaming service last year and already

reportedly has more than 30 million TV+ subscribers.

Disney

(NYSE: DIS) is certainly a family show icon for big

and small screens alike, and now the astute entertainment provider

is mastering the streaming space too. The company’s “The Falcon and

the Winter Soldier” on Disney+ is a blockbuster, reportedly

scoring 495

minutes of viewing time when its premiere episode came out the week

of March 15, making it the biggest Disney debut ever. For

perspective, consider that the show outperformed both premieres of

seasons one and two of the Disney blockbuster, “The

Mandalorian.”

Amazon

(NASDAQ: AMZN) is more than just the go-to e-commerce

website. Once exclusively a book purveyor, the company has a

complex ecosystem today including streaming music and movies that

fall under its Prime label for members. Amazon was ahead of the

curve more than most realize, unveiling Amazon

Studios to produce, acquire and self-publish original movies

and other content.

With more streaming service subscriptions in the U.S. than there

are people (340 million vs.

330 million), it’s hard to believe that the market is still in

its infancy. Common sense suggests that the COVID-19 pandemic may

have artificially inflated subscribers as people were on lockdown,

but judging by robust corporate projections, all it did was

enlighten more people to the beauty of streaming compared to

traditional media.

For more information about Friendable Inc. (OTC:

FDBL), please visit Friendable

Inc.

About NetworkNewsWire

NetworkNewsWire

(“NNW”) is a financial news and content distribution company, one

of 50+ brands within the InvestorBrandNetwork (“IBN”), that

provides: (1) access to a network of wire

solutions via InvestorWire to

reach all target markets, industries and demographics in the most

effective manner possible; (2) article and

editorial syndication to 5,000+ news outlets; (3)

enhanced press release solutions to ensure maximum

impact; (4) social media distribution via IBN

millions of social media followers; and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience comprising

investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

To receive SMS text alerts from NetworkNewsWire, text

“STOCKS” to 77948 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is part of the InvestorBrandNetwork

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

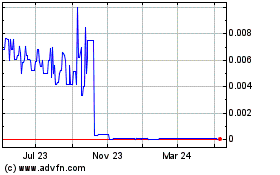

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Nov 2024 to Dec 2024

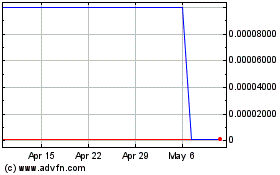

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Dec 2023 to Dec 2024