By Frances Yoon and Joanne Chiu

For years, Hong Kong has been one of the world's most profitable

banking markets. That status is now under threat.

The city is a money-spinner for HSBC Holdings PLC, Standard

Chartered PLC, Bank of China (Hong Kong) Ltd. and others, such as

Bank of East Asia Ltd. and HSBC's local subsidiary, Hang Seng Bank

Ltd. It is lucrative in part because Hong Kong is a major financial

center, and handles a lot of business for mainland Chinese

clients.

Banks' profit per employee last year was higher in Hong Kong

than in any other market tracked by Citigroup analysts -- roughly

double the U.S. figure.

But now Hong Kong's economy is shrinking, hit by the U.S.-China

trade war, slowing Chinese growth and months of antigovernment

protests. Earlier this month, the city's chief executive, Carrie

Lam, said Hong Kong was in a "technical recession," typically

defined as at least two straight quarters of economic

contraction.

A weaker economy is likely to mean more loans going sour and

less credit demand from households and businesses.

Meanwhile, lending is becoming less profitable, as the city's

currency peg with the U.S. dollar forces it to match interest-rate

cuts by the Federal Reserve. Lower interest rates typically reduce

the margins banks earn, by narrowing the gap between the rates at

which they lend and borrow. To make things worse, there is new

competition from upstart online banks.

"It's the start of the end of an era of super profitability in

Hong Kong, " said Ronit Ghose, the Dubai-based global head of bank

research at Citigroup.

Quarterly results this week -- from HSBC on Monday and Standard

Chartered on Wednesday -- will give investors an early indication.

The two are both listed on the London Stock Exchange as well as in

Hong Kong.

The banks face other challenges, too. For HSBC, these include

uncertainty over the U.K.'s planned exit from the European Union

and trouble with officials in China, angry over its giving U.S.

prosecutors information about client Huawei Technologies Co.

But Hong Kong matters hugely: It provided roughly half of HSBC's

pretax profit in the second quarter.

For the third quarter, consensus forecasts compiled by HSBC

point to an 11% drop in net profit from a year earlier, to US$3.47

billion. Expected credit losses and other credit-impairment charges

are forecast to be up by nearly one-third, to US$673 million.

One focus for HSBC watchers will be cost-cutting plans, said

Gary Greenwood, a U.K.-based analyst at Shore Capital Group, since

the bank has pledged to increase revenue faster than costs this

year.

Now comes the virtual competition. The Hong Kong government this

year granted eight licenses for online banks, which won't need

physical branches. Backers include powerful technology companies --

among them Tencent Holdings Ltd. and Ant Financial, an affiliate of

Alibaba Group Holding Ltd. -- as well as such traditional lenders

as Bank of China (HK), Standard Chartered, and Industrial and

Commercial Bank of China Ltd.

Felix Lam, a portfolio manager at BNP Paribas Asset Management,

said traditional banks' defense of market share could lower fee

income and raise the cost of attracting new deposits.

Hang Seng, HSBC, and Standard Chartered will feel the most

pressure from stiffer competition in the retail market, Morgan

Stanley analysts wrote in a note to clients, since about half their

Hong Kong earnings come from retail.

Shares of Hong Kong-focused banks have underperformed the

broader Hong Kong market this year. HSBC trades at 0.91 times the

forecast book value of its assets, according to FactSet, below a

10-year average of 1.05 times. Trading below book value can signal

investor concerns about capital strength or future

profitability.

Despite the low valuation, analysts and investors don't see the

stock as a bargain. Refinitiv tallies analysts' recommendations on

a five-point scale: 1 is a strong buy, 3 a hold and 5 a sell. HSBC

is currently at 3.3, the most negative since 2002.

Analysts don't expect overall profit to fall at HSBC, but

neither do they expect rapid growth. The consensus of the forecasts

collected by the bank is for an income rise of just 0.3% next year,

to US$14.44 billion, and about 5.2% in 2021.

Mr. Lam at BNP Paribas Asset Management said many bank shares

aren't yet cheap enough to compensate for negatives such as rising

credit costs. "It's not a favorable time to make a bet," on Hong

Kong-related banking stocks, he said.

Daryl Liew, head of portfolio management at REYL Singapore, said

his fund doesn't hold any banks with heavy exposure to Hong

Kong.

Prolonged unrest could further hurt the economy, he said, and

"it's hard to see how the banks can continue to thrive when the

broader economy is in the doldrums."

Write to Frances Yoon at frances.yoon@wsj.com and Joanne Chiu at

joanne.chiu@wsj.com

(END) Dow Jones Newswires

October 27, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

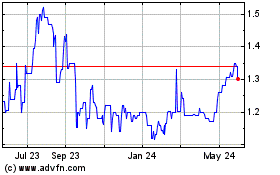

Bank East Asia (PK) (USOTC:BKEAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bank East Asia (PK) (USOTC:BKEAY)

Historical Stock Chart

From Dec 2023 to Dec 2024