0001514443

true

0001514443

2023-01-01

2023-03-31

0001514443

dei:BusinessContactMember

2023-01-01

2023-03-31

0001514443

2022-12-31

0001514443

2021-12-31

0001514443

2022-01-01

2022-12-31

0001514443

2021-01-01

2021-12-31

0001514443

hraad:SecurityServicesMember

2022-01-01

2022-12-31

0001514443

hraad:SecurityServicesMember

2021-01-01

2021-12-31

0001514443

hraad:OtherRelatedIncomeMember

2022-01-01

2022-12-31

0001514443

hraad:OtherRelatedIncomeMember

2021-01-01

2021-12-31

0001514443

hraad:SalariesAndRelatedTaxesMember

2022-01-01

2022-12-31

0001514443

hraad:SalariesAndRelatedTaxesMember

2021-01-01

2021-12-31

0001514443

hraad:EmployeeBenefitsMember

2022-01-01

2022-12-31

0001514443

hraad:EmployeeBenefitsMember

2021-01-01

2021-12-31

0001514443

hraad:SubContractorPaymentsMember

2022-01-01

2022-12-31

0001514443

hraad:SubContractorPaymentsMember

2021-01-01

2021-12-31

0001514443

hraad:GuardTrainingMember

2022-01-01

2022-12-31

0001514443

hraad:GuardTrainingMember

2021-01-01

2021-12-31

0001514443

hraad:VehiclesAndEquipmentExpensesMember

2022-01-01

2022-12-31

0001514443

hraad:VehiclesAndEquipmentExpensesMember

2021-01-01

2021-12-31

0001514443

us-gaap:CommonStockMember

2020-12-31

0001514443

us-gaap:PreferredStockMember

2020-12-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001514443

hraad:StockholdersEquityMember

2020-12-31

0001514443

2020-12-31

0001514443

us-gaap:CommonStockMember

2021-12-31

0001514443

us-gaap:PreferredStockMember

2021-12-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001514443

hraad:StockholdersEquityMember

2021-12-31

0001514443

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001514443

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001514443

hraad:StockholdersEquityMember

2021-01-01

2021-12-31

0001514443

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001514443

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001514443

hraad:StockholdersEquityMember

2022-01-01

2022-12-31

0001514443

us-gaap:CommonStockMember

2022-12-31

0001514443

us-gaap:PreferredStockMember

2022-12-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001514443

hraad:StockholdersEquityMember

2022-12-31

0001514443

2021-11-01

2021-11-14

0001514443

srt:ChiefExecutiveOfficerMember

2021-11-01

2021-11-14

0001514443

hraad:LillianFloresMember

2021-11-01

2021-11-14

0001514443

hraad:CustodianVenturesMember

2021-07-07

0001514443

2021-09-08

0001514443

2022-11-01

2022-11-14

0001514443

srt:ChiefExecutiveOfficerMember

2022-11-01

2022-11-14

0001514443

hraad:LillianFloresMember

2022-11-01

2022-11-14

0001514443

2023-03-31

0001514443

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001514443

us-gaap:VehiclesMember

2022-12-31

0001514443

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001514443

us-gaap:VehiclesMember

2023-03-31

0001514443

us-gaap:LeaseholdImprovementsMember

2023-03-31

0001514443

2021-07-01

2021-07-07

0001514443

us-gaap:LeaseholdImprovementsMember

2021-12-31

0001514443

us-gaap:MachineryAndEquipmentMember

2021-12-31

0001514443

us-gaap:VehiclesMember

2021-12-31

0001514443

us-gaap:MachineryAndEquipmentMember

2023-03-31

0001514443

hraad:SBALoanMember

2020-06-30

0001514443

hraad:SBALoanMember

2020-06-01

2020-06-30

0001514443

hraad:SBALoanMember

2022-01-01

2022-12-31

0001514443

hraad:SBALoanMember

2021-01-01

2021-12-31

0001514443

hraad:SBALoanMember

2022-12-31

0001514443

hraad:SBALoanMember

2021-12-31

0001514443

hraad:MasterSecurityCompanyMember

2020-01-30

0001514443

hraad:MasterSecurityCompanyMember

2020-01-01

2020-01-30

0001514443

hraad:MasterSecurityCompanyMember

2022-12-31

0001514443

hraad:MasterSecurityCompanyMember

2021-12-31

0001514443

hraad:SecureTransportationIncMember

2021-12-31

0001514443

hraad:SecureTransportationIncMember

2021-12-01

2021-12-31

0001514443

hraad:SecureTransportationIncMember

2022-12-31

0001514443

hraad:SecureTransportationIncMember

2021-12-31

0001514443

hraad:LillianFloresMember

2022-07-07

0001514443

hraad:LillianFloresMember

2020-12-01

2020-12-31

0001514443

hraad:LillianFloresMember

2022-07-01

2022-07-07

0001514443

hraad:SBALoanMember

2023-01-01

2023-03-31

0001514443

hraad:SBALoanMember

2023-03-31

0001514443

2022-03-31

0001514443

hraad:NotesAndLoansPayableMember

2022-12-31

0001514443

hraad:NotesAndLoansPayableMember

2021-12-31

0001514443

hraad:NotesAndLoansPayableMember

2023-03-31

0001514443

hraad:AmeriguardSecurityServicesMember

2020-01-01

2020-12-31

0001514443

hraad:GuardServiceMember

2022-01-01

2022-12-31

0001514443

hraad:GuardServiceMember

2021-01-01

2021-12-31

0001514443

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

hraad:GuardServiceMember

2022-01-01

2022-12-31

0001514443

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

hraad:GuardServiceMember

2021-01-01

2021-12-31

0001514443

hraad:GuardServiceMember

2023-01-01

2023-03-31

0001514443

hraad:GuardServiceMember

2022-01-01

2022-03-31

0001514443

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

hraad:GuardServiceMember

2022-01-01

2022-03-31

0001514443

us-gaap:SubsequentEventMember

2023-03-01

2023-03-23

0001514443

2022-01-01

2022-03-31

0001514443

hraad:SecurityServicesMember

2023-01-01

2023-03-31

0001514443

hraad:SecurityServicesMember

2022-01-01

2022-03-31

0001514443

hraad:OtherRelatedIncomeMember

2023-01-01

2023-03-31

0001514443

hraad:OtherRelatedIncomeMember

2022-01-01

2022-03-31

0001514443

hraad:SalariesAndRelatedTaxesMember

2023-01-01

2023-03-31

0001514443

hraad:SalariesAndRelatedTaxesMember

2022-01-01

2022-03-31

0001514443

hraad:EmployeeBenefitsMember

2023-01-01

2023-03-31

0001514443

hraad:EmployeeBenefitsMember

2022-01-01

2022-03-31

0001514443

hraad:SubContractorPaymentsMember

2023-01-01

2023-03-31

0001514443

hraad:SubContractorPaymentsMember

2022-01-01

2022-03-31

0001514443

hraad:GuardTrainingMember

2023-01-01

2023-03-31

0001514443

hraad:GuardTrainingMember

2022-01-01

2022-03-31

0001514443

hraad:VehiclesAndEquipmentExpensesMember

2023-01-01

2023-03-31

0001514443

hraad:VehiclesAndEquipmentExpensesMember

2022-01-01

2022-03-31

0001514443

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001514443

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001514443

hraad:StockholdersEquityMember

2023-01-01

2023-03-31

0001514443

us-gaap:CommonStockMember

2023-03-31

0001514443

us-gaap:PreferredStockMember

2023-03-31

0001514443

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001514443

hraad:StockholdersEquityMember

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the Securities and Exchange Commission on July 11, 2023

Registration

No. 333-271200

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No.2

FORM

S-1/A

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

AMERIGUARD SECURITY SERVICES, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

7200 |

|

99-0363866 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification Number) |

5470 W. Spruce Avenue, Suite 102

Fresno,

CA

(559) 271-5984

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

NEVADA AGENCY AND TRANSFER COMPANY

Registered

Agent

50 West Liberty Street Suite 880, Reno, NV, 8950

(775) 322-0626

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

copies to:

Matthew

McMurdo

McMurdo

Law Group, LLC

1185

Avenue of the Americas, 3rd Floor

New

York, NY 10036

(917)

318-2865

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| |

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

| |

|

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the Company

is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Selling

Shareholder Preliminary Prospectus

Subject

to completion July 11, 2023

AMERIGUARD

SECURITY SERVICES, INC.

3,585,946 Shares

of Common Stock

This prospectus

relates to the resale of up to 3,585,946 shares of common stock, $.001 par value, of Ameriguard Security Services, Inc., a Nevada corporation

(the “Company” or “AGSS”), by certain shareholders, as described herein (the “Selling Shareholders”).

A portion of the Selling Shareholders held their shares for approximately ten (10) years, with them currently restricted under the Securities

Act of 1933, as amended. A certain Selling Shareholder was issued his shares in 2014 with a Rule 144 legend on it. Certain shareholders

were issued an aggregate of 675,000 shares upon the conversion of preferred shares. The remaining Selling Shareholders were issued their

shares of common stock on or about December 9, 2022, pursuant to a Definitive Share Exchange Agreement (the “AGSS Merger Agreement”)

with Ameriguard Security Services, Inc., a California corporation, (“Ameriguard”) and Lawrence Garcia (“Garcia”)

the majority shareholder of Ameriguard (the “Majority Shareholder”) and the minority shareholders of Ameriguard (“Minority

Shareholders”). Under the AGSS Merger Agreement, One Hundred Percent (100%) of the ownership interest of Ameriguard was exchanged

for an aggregate of 90,000,000 shares of common stock of AGSS issued to the Majority Shareholders and the Minority Shareholders, in accordance

with the AGSS Merger Agreement (the “AGSS Merger”). The former stockholders of Ameriguard acquired a majority of the issued

and outstanding common stock as a result of the share exchange transaction. Lawrence Garcia currently owns 86.26% of the issued and outstanding

voting stock of the Company and will be able to exert significant influence and control over the Company for the foreseeable future.

We

have 10,000,000 authorized and designated Series A-1 Preferred Stock which are entitled to seventy-two (72) votes per share of Series

A-1 Preferred Stock on all matters on which stockholders may vote. While we currently have no such shares issued and outstanding, the

voting rights afforded these Series A-1 Preferred Stock would give any future holders a disparate voting interest and allow them to potentially

exert control over the actions of the Company.

The total

amount of shares of common stock, which may be sold pursuant to this prospectus, would constitute approximately 6.22% of our issued and

outstanding common stock as of May 5, 2023.

The Selling

Shareholders are selling all the shares of common stock offered by this prospectus. It is anticipated that the Selling Shareholders will

sell these shares of common stock from time to time in one or more transactions, at $1.18 per share. We will not receive any proceeds

from the sale of shares by the Selling Shareholders.

The Selling

Shareholders are each an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended,

or the Securities Act. In the event all shares are sold by the Selling Shareholders, each Selling Shareholder will realize net proceeds

of $1.1799 per share and the aggregate net proceeds to the Selling Shareholders would be $4,231,416.28.

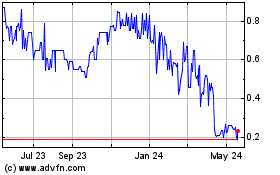

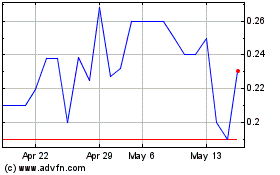

Our common

stock is quoted on the OTC Markets Pink under the symbol “AGSS.” On May 17, 2023, the closing price of our common stock was

$.92255 per share on the OTC Pink. These prices will fluctuate based on the demand for our common stock.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision. The Company is not a blank check company

because it has a specific business purpose and has no plans or intention to merge with an operating company. To our knowledge, none of

the Company’s shareholders have plans to enter a change of control or change of management. None of our current management has

previously been involved with a development stage company that did not implement its business plan, that generated no or minimal revenues

or was engaged in a change of control.

The

shares being offered. See “Risk Factors” beginning on page 5.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is subject to completion July 11, 2023.

TABLE

OF CONTENTS

You

may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide

you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities

other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an

offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus

nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change

in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any

time after its date.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that

you should consider before investing in the common stock of Ameriguard Security Services, Inc. (referred to herein as “we,”

“our,” “us,” “AGSS” or the “Company”). You should carefully read the entire Prospectus,

including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and the accompanying financial statements and the related notes to the Financial Statements before making an investment decision.

The

information presented is a brief overview of the key aspects of the offering. The prospectus summary contains a summary of information

contained elsewhere in this prospectus. You should carefully read all information in the prospectus, including the financial statements

and the notes to the financial statements under the Financial Statements section beginning on page F-1 prior to making an investment

decision.

Corporate

History

The

Company was incorporated in Nevada on December 13, 2010.

The

Company intended to become a provider of revenue cycle services to a broad range of healthcare providers. We offer our customers integrated

solutions designed around their specific business needs, including revenue cycle data analysis, contract and outsourced coding, billing,

coding and compliance audits, coding education, coding consulting, physician coding services and ICD-10 education and transition services.

On

February 10, 2012, the Company entered into an Agreement and Plan of Merger and Reorganization (the “HRAA Merger Agreement”)

with Health Revenue Assurance Holdings, Inc. (formerly known as Anvex International, Inc., “HRAH”), a Nevada company, and

its wholly-owned subsidiary Health Revenue Acquisition Corporation (“Acquisition Sub”), which was treated for accounting

purposes as a reverse recapitalization with HRAA, considered the accounting acquirer. Each share of HRAA’s common stock was exchanged

for the right to receive approximately 1,271 shares of HRAH’s common stock. Before their entry into the HRAA Merger Agreement,

no material relationship existed between HRAH and Acquisition Sub or HRAA. On April 27, 2012, the Company completed a 12.98 to 1

forward stock split. On May 2, 2012, the Company changed its ticker symbol from ANVX to HRAA.

The

Company then went dormant in August 2014.

On

July 14, 2020, as a result of a custodianship in Clark County, Nevada, Case Number: A816259, Custodian Ventures LLC (“Custodian”)

was appointed Custodian of the Company.

On

July 15, 2020 Custodian appointed David Lazar as the Company’s Chief Executive Officer, President, Secretary, Chief Financial

Officer, Chief Executive Officer and Chairman of the Board of Directors.

On

September 8, 2021, under the terms of a private stock purchase agreement, 10,000,000 shares of Series A-1 Preferred Stock, $0.001

par value per share (the “Shares”) of the Company, were transferred from Custodian Ventures, LLC to Ameriguard Security Services,

Inc. California corporation (Ameriguard). As a result, Ameriguard became holder of approximately 91% of the voting rights of the issued

and outstanding share capital of the Company on a fully-diluted basis of the Company, and became the controlling shareholder. The consideration

paid for the 10,000,000 shares of Series A-1 Preferred Stock was $500,000. In connection with the transaction, David Lazar forgave the

Company from all debts owed to him and/or Custodian Ventures, LLC.

On

September 8, 2021, the Company accepted the resignations from David Lazar as the Company’s Chief Executive Officer, Chief

Financial Officer, Treasurer, Secretary and as a Member of the Board of Directors. Effective on the same date to fill the vacancies created

by Mr. Lazar’s resignations, the Company appointed Lawrence Garcia as the Company’s President, CEO, CFO, Treasurer, Secretary,

and Chairman of the Board of Directors. These resignations are in connection with the consummation of the private stock purchase agreement

and was not the result of any disagreement with Company on any matter relating to Company’s operations, policies or practices.

On

March 11, 2022, the Company, amended its articles of incorporation to change its name to Ameriguard Security Services, Inc. from

Health Revenue Assurance Holdings, Inc. The name was deemed effective by FINRA on March 17, 2022.

We

have 10,000,000 authorized and designated Series A-1 Preferred Stock which are entitled to seventy-two (72) votes per share of Series

A-1 Preferred Stock on all matters on which stockholders may vote. While we currently have no such shares issued and outstanding, the

voting rights afforded these Series A-1 Preferred Stock would give any future holders a disparate voting interest and allow them to potentially

exert control over the actions of the Company.

Pursuant

to the AGSS Merger Agreement, we acquired the business of Ameriguard and will continue the existing business of Ameriguard as our wholly

owned subsidiary.

Ameriguard

was formed on November 14, 2002. The corporation was incorporated with the issuance of 1,000 common shares formerly held by Lawrence

Garcia, President and CEO with 550 shares and Lillian Flores, former VP of Operations with 450 shares. On July 12, 2022 under the

terms of a Settlement Agreement, Flores exchanged her 450 shares for consideration of $3,384,950 and a promissory note in that amount

secured by a stock pledge. Ameriguard provides armed guard services as a federal contractor with licenses in 7 states and provides commercial

guard services in California.

Lawrence

Garcia currently owns 86.26% of the issued and outstanding voting stock of the Company and will be able to exert significant influence

and control over the Company for the foreseeable future.

Ameriguard

principally provides guard services to governmental, quasi-governmental and commercial property management. Guard services generated

$24.6 million in revenues for the fiscal year ended December 31, 2022. Guard services include, providing armed and unarmed uniformed

security personnel for access control, mobile patrols, traffic control, security console/system operators, fire safety directors, communication,

reception, concierge and front desk/doorman operations.

Corporation

Information

Our

principal executive offices are currently located at 5470 W Spruce Ave Suite 102 Fresno CA 93722.

Our

website; www.ameriguardsecurity.com.

Employees

As

of March 31, 2022, we had 313 full-time employees, 237 of these employees are represented by collective bargaining agreements and the

Company considers it relations with its employees to be very good.

Our

Industry

Security

guard and related services in the US is comprised of over 11,000 companies and 900,000 officers. We compete with top firms, such

as Allied Universal, Securitas, G4S and Prosegur Security, which control the majority of the industry. Ameriguard’s approximately

$24.6 million in annual revenue places it in a strong competitive position.

We

believe that the top 40 companies have the resources to harness technology, to expand their business into related services other than

guard services. Companies with over $50 million in revenue have, over the last 10 years, experienced steady growth while those guard

companies under $20 million, the remaining 9,900 firms, have experienced declining revenues. We believe that the principal reason for

this is the steady diversification of security services away from the traditional guard services to areas of utilization of technology

requiring capital. Along with this, we believe that the profitability challenges below $20 million annual sales are much more difficult

that above $50 million is sales, largely due to the significant economies of scale achieve at the higher revenue levels.

The

proliferation of technology while increasing efficacy in performance and inevitably lower costs in the future, the impact on the contract

security industry will likely have mixed results – positive for companies who harness technology into their service delivery strategies

– and negative for those companies who fail to invest in or adopt these service-enhancing capabilities. Despite the advances in

the U.S. contract guarding business over recent years, there remains a question as to the industry’s viability in view of the increasing

trend for integrating manned services with security systems (i.e. security video, access control and monitoring) along with the emergence

of other new smart technology options and solutions (i.e. robotics, drones, cybersecurity and crowd sharing alert notification).

The

recent merger and acquisition trend, primarily by the major national and international security organizations and fueled by investment

and funding from private equity firms, is continuing. The underlying reason for this shift is less obvious and suggests an increasing

number of sellers who concluded that their better option was to exit and sell rather than remain in the marketplace and try to compete

and organically grow their market share.

Despite

its low barriers of entry and nominal capital requirements, the security guard business has become more challenging for the smaller owner/operator.

The traditionally historic advantage of the smaller operator’s ability to offer relationship-driven customized services is no longer

totally sufficient for sustainable growth – especially with the increasing regulatory challenges of the Affordable Care Act, federal

and state minimum wage laws, Family Medical Leave Act and state laws (i.e. meal and rest break reporting and now, predictive scheduling).

Even

stronger local and smaller regional companies are finding it more difficult to protect their client base and grow revenues under increasing

regulatory as well as competitive pressures. Larger regional and national organizations are dealing with the regulatory climate while

growing market share by leveraging infrastructure, technology, economies of scale with more aggressive pricing and better service reliability.

This approach appears to offer a more compelling value proposition from the client’s perspective, which seems evident by the higher

client retention rates reported by the major security companies.

However,

this consolidating trend may not be inevitable for the future as newer, more tech-savvy owner/operators enter the business and recognize

how to adopt best practices with a variety of sophisticated third-party software platforms and applications to help level the playing

field. These include talent management and on-boarding applications to attract, hire and maintain a more skilled and reliable workforce;

integrated labor management platforms to control scheduling, compliance, operations, payroll, billing and financial reporting; and state-of-the-art

social media marketing applications.

The

contract security industry should now be able to more effectively capitalize on and penetrate opportunities in a $20 billion in-house

market – especially for those companies who have invested and integrated technology into a more highly reliable ecosystem of protective

services.

For

the foreseeable future, the U.S. manned guarding business seems likely for continued sustainable growth. While the technology/manpower

ratio may shift the revenue mix going forward, based on today’s currently expanding U.S. economy, the prospects for an aggregate

growth rate of four percent or more seem realistic and perhaps even conservative, especially for ownership who have prudently invested

in technology enhancements to their core guarding operations.

Providing

these strategies can yield an attractive ROI, increase operating profits (EBITDA ranges of four to six percent and higher) and enterprise

valuations, this industry seems not only viable but also opportune for further investment consideration.

(The

above industry data taken from https://www.nasco.org/wp-content/uploads/2021/08/2021-Bob-Perry-Contract-Security-Industry-White-Paper-1.pdf)

Regulatory

Matters/Compliance

Each

State has specific licensing requirements companies must meet to perform guard services, especially armed guard services. To date, the

Company holds firearm licenses in over twelve States and does not foresee any license or governmental requirements preventing us from

continuing to operate in any State a contract is awarded to us. As a company with over 300 employees, we are subject to all of the standard

federal and state labor laws and have consistently met those requirements to date, including ERISA.

Properties

The

Company’s corporate headquarters is located at 5470 W. Spruce Avenue, Suite 102, Fresno CA. The lease is currently month to month.

Landlord has not indicated a desire for a new lease. Our lease payments are a total of $55,767 for the entire term (or, $4,230 per month).

Legal

Proceedings

While

we have not been involved in any litigation related to the performance of our guard services, armed or otherwise, to date, as an armed

guard Company with contracts with Governmental entities is a possibility of legal proceedings that could be more serious than the average

business. From time to time, the Company is involved in matters relating to claims arising from the ordinary course of business, but

those claims have been labor and union related and have been settled on an administrative level not in court.

While

the results of such claims and legal actions cannot be predicted with certainty, the Company’s management does not believe that

there are claims or actions, pending or threatened against the Company, the ultimate disposition of which would have a material adverse

effect on our business, results of operations, financial condition or cash flows.

The

Terms of the Offering

| Securities Being Offered: |

|

3,585,946 shares of common stock

being registered on behalf of the Selling Shareholders. |

| |

|

|

| Offering Period: |

|

Until all shares are sold by the

Shareholders or until 12 months from the date that the registration statement becomes effective, whichever comes first. |

| |

|

|

| Offering Price |

|

The Selling Shareholders

will sell our shares at a fixed price of $1.18 per share. This price was determined by us based on the current market price. |

| |

|

|

| Risk of Factors: |

|

The Securities offered hereby involve

a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk

Factors.” |

| |

|

|

| Common

Stock Issued and Outstanding Before Offering: |

|

93,418,291 shares of our common

stock are issued and outstanding as of the date of this Prospectus. |

| |

|

|

| Common Stock Issued and Outstanding

After Offering: |

|

93,418,291 shares of common stock. |

| |

|

|

| Use of Proceeds: |

|

We will not

receive any proceeds from the sale of the common stock by the Selling Shareholders. See “Use of Proceeds.” |

RISK

FACTORS

An

investment in our securities is highly speculative and subject to numerous and substantial risks. These risks are set forth below. You

should not invest in the Company unless you can afford to lose your entire investment. Readers are encouraged to review these risks carefully

before making any investment decision.

Risks

Related to Our Corporate Business:

Concentration

of Revenue

The

company receives over 87% of its total revenue from four Federal contracts. These contracts have specific terms, typically five years

with the opportunity for extension, but there are no assurances they will be extended. Although we have had several extended in the past,

there is no guarantee this will again happened in the future. However, there are significant direct expenses for each contract that also

are removed from operations at the end of a contract. As a result, the revenue lost from a completed contract does not affect the bottom-line

profits in an amount equal to the revenue lost. The actual net income impact depends on the contract. To mitigate this risk the company

actively pursues additional contracts on an ongoing basis.

Long

process in acquiring contracts

The

process required to acquire a government contract takes several months to complete prior to delivery of the proposal to the contracting

agency. Due to the time span required to prepare a proposal and wining the contract is not guaranteed, the company maintains a department

of individuals who monitor and write proposals for all government contracts that fit our operating criteria that become open for bid

on a continuing basis. It is important to the company that new contracts are acquired consistently to maintain and grow annual revenue

The

growth of the Company is dependent on acquisition opportunities

With our

revenue materially concentrated and our timeline to organic growth very drawn out, we are dependent on closing acquisitions over the

next eighteen months in order to grow. Failure to close on acquisitions, or a lack of synergy with our target companies, could stall

growth and, eventually, cause a material decline in our financial situation. The Company does not currently have any agreements with

potential acquisition targets.

Transitioning

from carve out contracts to open market contracts

Currently

the company benefits from several ownership criteria and business size contract qualifications, referred to as contract carveouts, that

increases the probability of contract awards. The company meets the contracting qualifications of disabled veteran and minority owned

business. Another aspect of contract opportunities is set aside for small businesses. This is defined as those who have operating revenue

on average over the past five (5) years under $25.5 million. Currently the company is below this threshold, yet our strategic plan is

to move past the average revenue limits within the next 24 months. This should not be seen as a negative in that we will only exceed

this limit once we reach annual revenue of $40 million or more during the next 24 months, putting us in an excellent financial position

to compete with the much larger companies who operate in the $50-$100 million revenue level. Another aspect of our strategy is to acquire

similar guard companies who already have small business contracts with the government, which add significantly to our bottom line putting

us in even a better position to win additional large government contracts.

Currently we

have four federal contracts that approximate 87% of our total guard service revenue for the year ended December 31,2022. All federal

contracts are awarded with a term of 5 years, with annual renewals. At the end of each contract year the government has the option to

renew, cancel or renegotiate. Our four contracts and their respective terms are as follows:

| |

● |

Social Security Administration, NSC |

|

- |

September 2022 through September 2027

Annual Revenue of approx. $3.145M |

| |

|

|

|

|

|

| |

● |

Social security Administration, SSC |

|

- |

June 2022 through June 2027

Annual Revenue of approx. $4.932M |

| |

|

|

|

|

|

| |

● |

Social Security Administration, WBDOC |

|

- |

June 2021 through July 2026

Annual Revenue of approx. $5.838M |

| |

|

|

|

|

|

| |

● |

National Institute of Health- EPA |

|

- |

May 2020 through March 2025

Annual Revenue of approx. $7.514M |

Staffing

Shortages

The guard

industry suffers from staffing shortages. This is an ongoing challenge and in its worst case can impact our ability to meet the requirements

of the contracts awarded.

Impact

of COVID

Initially the

impact of the COVID pandemic was positive for the guard industry. Our industry is considered essential and with less activity at the

sites we protect, we were able to meet and exceed the contract requirements with fewer staff and little to no overtime. As a result,

each contract became more profitable than normal full operations. The challenges have actually come after the critical year of 2020.

As the government began to require vaccinations for all employees and contractors, along with quarantine requirements, staffing became

a big problem. Starting in 2021, these policies implemented by the federal government have made it very difficult for us to meet the

staffing needs. COVID restriction rules on the local, state and national levels recruitment results are ending. Moving forward we anticipate

any related recruitment issues to end.

Accelerating

Inflation

All

industries struggle when operating in times of inflation like we are experiencing in 2022. The results are increased pressure on salaries,

operational costs increase due to higher fuel prices and the increased cost of all supplies. The one silver lining for the company is

that federal contacts require that the salary increases that we negotiate with the labor union must be covered by increasing the monthly

contracted rate. This of course is stipulated by contract that we do not exceed what is customary in the area with related contracts.

This is significant in that guard salaries account for over 90% of operational costs, reducing the impact of inflation.

Key

employees are essential to expanding our business.

Lawrence

Garcia and other key employees are essential to our ability to continue to grow and expand our business. Mr. Garcia, as CEO and majority

shareholder, allows the company to bid on the restricted contracts that we discussed, in the “Transitioning from carve out contracts

to open market contract” paragraph on the previous page. Other long-term employees have significant impact on the success of operations

and understanding of the industry. They have established relationships within the industry in which we operate. If Mr. Garcia or any

of the long-term employees were to leave the company, our growth strategy might be hindered, which could materially affect our business

and limit our ability to increase revenue. However, we are taking steps to implement process and procedure to insure no single person

lost would be detrimental to our long- term success.

If

we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting

obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and

sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for

shares of our Common Stock.

Effective

internal controls are necessary for us to provide reliable financial reports and to effectively prevent fraud. We maintain a system of

internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive

officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management

and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles.

As

a public company, we have significant requirements for enhanced financial reporting and internal controls. We will be required to document

and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002,

which requires annual management assessments of the effectiveness of our internal controls over financial reporting. The process of designing

and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business

and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate

to satisfy our reporting obligations as a public company.

Although

our management team, CEO and CFO, have not specifically managed a publicly traded company, we do have experience with the issues and

requirements of Sarbanes-Oxley Act. The company CFO is a California CPA with over 30 years of experience in business operations and has

been through multiple financial statement audits that required compliance with the Sarbanes-Oxley Act.

Technology

innovations in the markets that we serve may create alternatives to our products and result in reduced sales.

Technology

innovations to which our current and potential customers might have access to, could reduce or eliminate their need for our

services. New or other disruptive technology that reduces or eliminates the use of one or more of our services could negatively

impact the need for our services. However, our management team and board of directors are aware of this challenge and are very

innovative and forward thinking. Yet, our failure to develop, introduce or enhance our services able to compete with new

technologies in a timely manner could have an adverse effect on our business, results of operation and financial condition. The

management team is continually focused on improvements and new technology to insure we are not left behind.

We

may engage in a business combination that causes tax consequences to us and our shareholders.

Federal

and state tax consequences can be a significant factor in considering any business combination that we may undertake. As a result, such

transactions may be subject to significant taxation to the buyer and its shareholders under applicable federal and state tax laws. While

we intend to structure any business combination so as to minimize the federal and state tax consequences to the extent practicable in

accordance with our business objectives, there can be no assurance that any business combination we undertake will meet the statutory

or regulatory requirements of a tax-free reorganization or similar favorable treatment or that the parties to such a transaction will

obtain the tax treatment intended or expected upon a transfer of equity interests or assets. A non-qualifying reorganization, combination

or similar transaction could result in the imposition of significant taxation, both at the federal and state levels, which may have an

adverse effect on both parties to the transaction, including our shareholders.

It

is unlikely that our shareholders will have any opportunity to evaluate or approve a business combination.

Our

shareholders will not have the opportunity to evaluate and approve the business combination. In most cases, business combinations do

not require shareholder approval under applicable law, and our Articles of Incorporation and Bylaws do not afford our shareholders with

the right to approve such a transaction. Further, Mr. Garcia, our Chief Executive Officer and sole director, is the holder of over 86%

of the voting rights of the Company on a fully diluted basis. Accordingly, our shareholders will be relying almost exclusively on the

judgement of our board of directors (“Board”) and Chief Executive Officer and any persons on whom they may rely with respect

to a potential business combination. To develop and implement our business plan, may in the future hire lawyers, accountants, technical

experts, appraisers, or other consultants to assist with determining the Company’s direction’ and consummating any transactions

contemplated thereby. We may rely on such persons in making difficult decisions in connection with the Company’s future business

and prospects. The selection of any such persons will be made by our Board, and any expenses incurred, or decisions made based on any

of the foregoing could prove to be averse to the Company in hindsight, the result of which could be diminished value to our shareholders.

Risks

Related to Our Stockholders and Purchasing Shares of Common Stock

We

have not voluntarily implemented various corporate governance measures.

Federal

legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed

to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response

to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as

the NYSE or The NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required

under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight

and the adoption of a Code of Ethics. Our Board of Directors expects to adopt a Code of Ethics at its next Board meeting. The Company

has not adopted exchange-mandated corporate governance measures and, since our securities are not listed on a national securities exchange,

we are not required to do so. It is possible that if we were to adopt some or all these corporate governance measures, stockholders would

benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies

had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised

of at least most independent directors, decisions concerning matters such as compensation packages to our senior officers and recommendations

for director nominees may be made by most directors who have an interest in the outcome of the matters being decided. Prospective investors

should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

We

may be exposed to potential risks relating to our internal control over financial reporting.

As

directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the SEC has adopted rules requiring public companies

to include a report of management on the Company’s internal control over financial reporting in its annual reports. While we expect

to expend significant resources in developing the necessary documentation and testing procedures required by SOX 404, there is a risk

that we will not comply with all the requirements imposed thereby. At present, there is no precedent available with which to measure

compliance adequately. In the event we identify significant deficiencies or material weaknesses in our internal control over financial

reporting that we cannot remediate in a timely manner, investors and others may lose confidence in the reliability of our financial statements

and our ability to obtain equity or debt financing could suffer.

We

have many authorized but unissued shares of our common stock.

We

have many authorized but unissued shares of common stock, which our management may issue without further stockholder approval, thereby

causing dilution of your holdings of our common stock. Our management will continue to have broad discretion to issue shares of our common

stock in a range of transactions, including capital-raising transactions, mergers, acquisitions and other transactions, without obtaining

stockholder approval, unless stockholder approval is required. If our management determines to issue shares of our common stock

from the large pool of authorized but unissued shares for any purpose in the future, your ownership position would be diluted without

your further ability to vote on that transaction.

While

we have no preferred shares issued and outstanding, we have authorized and designated 10,000,000 shares as Series A-1 Preferred Shares

with super-voting and conversion rights.

While there

are no shares of Preferred stock outstanding, the Company has authorized and designated 10,000,000 shares as Series A-1 Preferred Stock,

which (i) have preferred equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board

of Directors of the Company; (ii) hold distribution preferences upon liquidation, dissolution or winding up of the affairs of the Company

(iii) convert into seventy-two (72) shares, for each share of Series A-1 Preferred Stock, at the discretion of the holder; and (iv) are

entitled to seventy-two (72) votes per share of Series A-1 Preferred Stock on all matters on which stock holders may vote. This dual-class

structure may render our shares ineligible for inclusion in certain stock market indices, and thus adversely affect share price and liquidity,

and may adversely affect public sentiment. Furthermore, any future issuances of Series A-1 preferred stock may be dilutive to the voting

power and value of our common stock shareholders.

Shares

of our common stock may become illiquidity because our shares may begin to be thinly traded and may never become eligible for trading

on a national securities exchange.

While

we may at some point be able to meet the requirements necessary for our common stock to be listed on a national securities exchange,

we cannot assure you that we will ever achieve a listing of our common stock on a national securities exchange. Our shares are currently

only eligible for quotation on the OTC Pink, which is not an exchange. Initial listing on a national securities exchange is subject to

a variety of requirements, including minimum trading price and minimum public “float” requirements, and could also be affected

by the general skepticism of such markets concerning companies that are the result of mergers with inactive publicly-held companies.

There are also continuing eligibility requirements for companies listed on public trading markets. If we are unable to satisfy the initial

or continuing eligibility requirements of any such market, then our stock may not be listed or could be delisted. This could result in

a lower trading price for our common stock and may limit your ability to sell your shares, any of which could result in you losing some

or all your investments.

The

market valuation of our business may fluctuate due to factors beyond our control and the value of your investment may fluctuate correspondingly.

The

market valuation of smaller reporting companies, such as us, frequently fluctuate due to factors unrelated to the past or present operating

performance of such companies. Our market valuation may fluctuate significantly in response to several factors, many of which are beyond

our control, including:

| |

i. |

changes in

securities analysts’ estimates of our financial performance, although there are currently no analysts covering our stock; |

| |

ii. |

fluctuations

in stock market prices and volumes, particularly among securities of smaller reporting companies; |

| |

iii. |

changes in

market valuations of similar companies; |

| |

iv. |

announcements

by us or our competitors of significant contracts, new technologies, acquisitions, commercial relationships, joint ventures or capital

commitments; |

| |

v. |

variations

in our quarterly operating results; |

| |

vi. |

fluctuations

in related commodities prices; and |

| |

vii. |

additions or

departures of key personnel. |

As

a result, the value of your investment in us may fluctuate.

We

have never paid dividends on our common stock.

We

have never paid cash dividends on our common stock and do not presently intend to pay any dividends in the foreseeable future. Investors

should not look to dividends as a source of income.

In

the interest of reinvesting initial profits back into our business, we do not intend to pay cash dividends in the foreseeable future.

Consequently, any economic return will initially be derived, if at all, from appreciation in the fair market value of our stock, and

not because of dividend payments.

Future

sales or perceived sales of our common stock could depress our stock price.

This

resale prospectus covers 3,585,946 shares of common stock. If the holders of these shares were to attempt to sell a substantial amount

of their holdings at once, the market price of our common stock could decline. Moreover, the perceived risk of this potential dilution

could cause shareholders to attempt to sell their shares and investors to short the common stock, a practice in which an investor sells

shares that he or she does not own at prevailing market prices, hoping to purchase shares later at a lower price to cover the sale. As

each of these events would cause the number of shares of our common stock being offered for sale to increase, our common stock market

price would likely further decline. All these events could combine to make it very difficult for us to sell equity or equity-related

securities in the future at a time and price that we deem appropriate.

Due

to factors beyond our control, our stock price may be volatile.

Any

of the following factors could affect the market price of our common stock:

| |

● |

The continued COVID-19 pandemic and its adverse impact

upon the capital markets; |

| |

● |

The loss of one or more members of our management team; |

| |

● |

Our failure to generate material revenues; |

| |

● |

Regulatory changes including new laws and rules which

adversely affect companies in our line of business; |

| |

● |

Our public disclosure of the terms of any financing

which we consummate in the future; |

| |

● |

An announcement that we have effected a reverse split

of our common stock; |

| |

● |

Our failure to become profitable; |

| |

● |

Our

failure to raise working capital; |

| |

● |

Any acquisitions we may consummate; |

| |

● |

Announcements by us or our competitors of significant

contracts, new services, acquisitions, commercial relationships, joint ventures or capital commitments; |

| |

● |

Cancellation of key contracts; |

| |

● |

Our failure to meet financial forecasts we publicly

disclose; |

| |

● |

Short selling activities; or |

| |

● |

Changes in market valuations of similar companies. |

In

the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has

often been instituted. A securities class action suit against us could result in substantial costs and divert our management’s

time and attention, which would otherwise be used to benefit our business.

Offers

or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

The

existence of shares of common stock issuable upon conversion of outstanding shares of Preferred Stock, creates a circumstance commonly

referred to as an “overhang” which can act as a depressant to our common stock price. The existence of an overhang, whether

sales have occurred or are occurring, also could make our ability to raise additional financing through the sale of equity or equity-linked

securities more difficult in the future at a time and price that we deem reasonable or appropriate. If our existing shareholders and

investors seek to sell a substantial number of shares of our common stock, such selling efforts may cause significant declines in the

market price of our common stock.

Because

we may issue preferred stock without the approval of our shareholders and have other anti-takeover defenses, it may be more difficult

for a third party to acquire us and could depress our stock price.

In

general, our Board may issue, without a vote of our shareholders, one or more additional series of preferred stock that have more than

one vote per share. Additionally, issuance of preferred stock could block an acquisition resulting in both a drop in our stock price

and a decline in interest of our common stock. This could make it more difficult for shareholders to sell their common stock. This could

also cause the market price of our common stock shares to drop significantly, even if our business is performing well.

Because

certain of our stockholders control a significant number of shares of our voting capital stock, they have effective control over actions

requiring stockholder approval.

As

of March 27, 2023, Lawrence Garcia, our Chief Executive Officer, effectively held 86.26% of the Company’s issued and outstanding

common stock. As a result, Mr. Garcia can control the outcome of matters submitted to our stockholders for approval, including the election

of directors and any merger, consolidation or sale of all or substantially all our assets. In addition, Mr. Garcia can control the management

and affairs of our company. Accordingly, any investors who purchase shares will be minority shareholders and as such will have little

to no say in the direction of us and the election of directors. Additionally, this concentration of ownership might harm the market price

of our common stock by:

| |

● |

delaying, deferring or

preventing a change in corporate control; |

| |

● |

impeding a merger, consolidation,

takeover or other business combination involving us; or |

| |

● |

discouraging a potential

acquirer from making a tender offer or otherwise attempting to obtain control of us |

Our

common stock is considered a “penny stock.”

The

SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less

than $5.00 per share, subject to specific exemptions. The market price of our common stock is currently less than $5.00 per share and

therefore may be a “penny stock.” Brokers and dealers effecting transactions in “penny stock” must disclose certain

information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably

suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect

your ability to sell shares.

Shareholders

may be limited to a specific forum for bringing actions against the Company.

The Company

has selected the Eighth Judicial District Court of Clark County, Nevada, to be the sole and exclusive forum for each of the following:

(a) any derivative action or proceeding brought in the name or right of the Corporation or on its behalf, (b) any action asserting a

claim for breach of any fiduciary duty owed by any director, officer, employee or agent of the Corporation to the Corporation or the

Corporation’s stockholders, (c) any action arising or asserting a claim arising pursuant to any provision of NRS Chapters 78 or

92A or any provision of the Articles of Incorporation or these By-laws or (d) any action asserting a claim governed by the internal affairs

doctrine, including, without limitation, any action to interpret, apply, enforce or determine the validity of the Articles of Incorporation

or these By-laws. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the corporation shall

be deemed to have notice of and consented to this provision. This could make it harder for a shareholder to bring an action against the

Company or any of the officers or directors of the Company.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements. All statements other than statements of historical facts contained in this prospectus,

including statements regarding our future financial position, business strategy and plans and objectives of management for future operations,

are forward-looking statements. The words “believe,” “may,” “estimate,” “continue,” “anticipate,”

“intend,” “should,” “plan,” “expect” and similar expressions, as they relate to us, are

intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and

projections about future events and financial trends that we believe may affect our financial condition, results of operations, business

strategy and financial needs. These forward-looking statements are subject to several risks, uncertainties and assumptions described

in “Risk Factors” and elsewhere in this prospectus.

Other

sections of this prospectus may include additional factors that could adversely affect our business and financial performance. Moreover,

we operate in a highly regulated, very competitive and rapidly changing environment. New risk factors emerge from time to time and it

is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

We

undertake no obligation to update publicly or revise any forward-looking statements. You should not rely upon forward-looking statements

as predictions of future events or performance. We cannot assure you that the events and circumstances reflected in the forward-looking

statements will be achieved or will occur. Although we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We have an ongoing obligation to continually

disclose material future changes in the Company and its operations.

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale of the common stock by the Selling Shareholders.

DETERMINATION

OF OFFERING PRICE

The

offering price of $1.18 per share was determined based upon a premium to the current market price. The Selling Shareholder will sell

their shares pursuant to the Company’s Registration Statement at the fixed price of $1.18. We will not receive any proceeds from

the sale of shares by the Selling Shareholder.

THE

SELLING SHAREHOLDERS

A

portion of the Selling Shareholders held their shares for approximately ten (10) years, with them currently restricted under the Securities

Act of 1933, as amended. A certain Selling Shareholder was issued his shares in 2014 with a Rule 144 legend on it. Certain shareholders

were issued an aggregate of 675,000 shares upon the conversion of preferred shares. The remaining Selling Shareholders were issued their

shares of common stock on or about December 9, 2022, pursuant to the AGSS Merger Agreement, whereby Ameriguard became a wholly owned

subsidiary of AGSS, and AGSS its only shareholder. The Selling Shareholders relinquished all of their Ameriguard common shares, in exchange

for the shares of common stock being registered in this registration statement on Form S-1.

All

expenses incurred with respect to the registration of the common stock will be borne by the Company, but we will not be obligated to

pay any underwriting fees, discounts, commission or other expenses incurred by Selling Shareholders in connection with the sale of such

shares.

Other than

Martha Garcia, Lawrence Garcia, Jr., and Laura Garcia, none of the Selling Shareholders nor any of their associates or affiliates has

held any position, office, or other material relationship with us in the past three years. Martha Garcia is the mother of Lawrence Garcia

Lawrence Garcia, Jr. is the son of Mr. Garcia. Laura Garcia is sister of Mr. Garcia. None of these three individuals would be deemed

affiliates, as each is an adult individual, living in a separate residence from Lawrence Garcia, our CEO.

The

following table sets forth the name of the Selling Shareholders, the number of shares of common stock beneficially owned by the Selling

Shareholders as of the date hereof and the number of shares of common stock being offered by the Selling Shareholders. The offer and

sale of the shares are being registered herein. The Selling Shareholders are under no obligation to sell all or any portion of such shares.

All information with respect to share ownership has been furnished by the Selling Shareholders, respectively. The “Amount Beneficially

Owned After the Offering” column assumes the sale of all shares offered herein.

| Name | |

Shares of

Common Stock

Beneficially

Owned prior to

Offering | | |

Maximum

Number of

Shares of

Common Stock

to be Offered | | |

Number of

Shares of

Common

Stock

Beneficially

Owned after

Offering | | |

Percent

Ownership

after Offering | |

| STEPHANIE POPE(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| STACEY VARGAS(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| MICHAEL ROMERO(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| MARTHA GARCIA(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| LEO REIJNDERS(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| LAWRENCE GARCIA JR.(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| LAURA GARCIA(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| HARLAN HARTMAN(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| GCT EQUITY HOLDINGS, LLC(1) | |

| 1,125,000 | | |

| 1,125,000 | | |

| 0 | | |

| 0 | % |

| ALI MUSLEH(1) | |

| 140,625 | | |

| 140,625 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| ALMORLI ADVISORS, INC.(2) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| WALD BLOISE(2) | |

| 2,500 | | |

| 2,500 | | |

| 0 | | |

| 0 | % |

| INTERED, INC(2) | |

| 2,500 | | |

| 2,500 | | |

| 0 | | |

| 0 | % |

| JOSEPH BROPHY(2) | |

| 16,983 | | |

| 16,983 | | |

| 0 | | |

| 0 | % |

| CARL ABBONIZIO(2) | |

| 2,500 | | |

| 2,500 | | |

| 0 | | |

| 0 | % |

| DANNY FEDER(2) | |

| 6,250 | | |

| 6,250 | | |

| 0 | | |

| 0 | % |

| ROBERT FREEDMAN(2) | |

| 7,500 | | |

| 7,500 | | |

| 0 | | |

| 0 | % |

| SERGE MILMAN(2) | |

| 1,250 | | |

| 1,250 | | |

| 0 | | |

| 0 | % |

| ROY LANTZ(2) | |

| 517 | | |

| 517 | | |

| 0 | | |

| 0 | % |

| ALAN DRUCKER(2) | |

| 1,429 | | |

| 1,429 | | |

| 0 | | |

| 0 | % |

| JIA LI(2) | |

| 179 | | |

| 179 | | |

| 0 | | |

| 0 | % |

| SUSAN HUDDLESTON(2) | |

| 715 | | |

| 715 | | |

| 0 | | |

| 0 | % |

| RONNIE EBANKS(2) | |

| 1,250 | | |

| 1,250 | | |

| 0 | | |

| 0 | % |

| VALERIE A. RINKLE(2) | |

| 1,000 | | |

| 1,000 | | |

| 0 | | |

| 0 | % |

| GREGORY S. DAHL(2) | |

| 90 | | |

| 90 | | |

| 0 | | |

| 0 | % |

| JAMES MCCORMACK(2) | |

| 36,667 | | |

| 36,667 | | |

| 0 | | |

| 0 | % |

| JOSEPH E. TOENISKOETER(2) | |

| 100 | | |

| 100 | | |

| 0 | | |

| 0 | % |

| KEITH LUNEBURG(2) | |

| 36,667 | | |

| 36,667 | | |

| 0 | | |

| 0 | % |

| ROBERTA A. ANDERSON(2) | |

| 1,000 | | |

| 1,000 | | |

| 0 | | |

| 0 | % |

| DEAN BOYER(2) | |

| 32,250 | | |

| 32,250 | | |

| 0 | | |

| 0 | % |

| BRUCE A OSBORN(2) | |

| 554 | | |

| 554 | | |

| 0 | | |

| 0 | % |

| DANIEL J HAPNER(2) | |

| 893 | | |

| 893 | | |

| 0 | | |

| 0 | % |

| DENISE WILLIAMS(2) | |

| 1,647 | | |

| 1,647 | | |

| 0 | | |

| 0 | % |

| GARRY BACHER(2) | |

| 200 | | |

| 200 | | |

| 0 | | |

| 0 | % |

| MARILYN HAPNER(2) | |

| 179 | | |

| 179 | | |

| 0 | | |

| 0 | % |

| PEGGY M HAPNER(2) | |

| 358 | | |

| 358 | | |

| 0 | | |

| 0 | % |

| SECURE INVESTIGATION CONSULTING(2) | |

| 900 | | |

| 900 | | |

| 0 | | |

| 0 | % |

| MARIO SCINICARIELLO(2) | |

| 10,078 | | |

| 10,078 | | |

| 0 | | |

| 0 | % |

| FINEST MANAGEMENT LLC(2) | |

| 2,500 | | |

| 2,500 | | |

| 0 | | |

| 0 | % |

| LOUIS J. ALIMENA(2) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| ANTHONY MANGANARO(2) | |

| 2,692 | | |

| 2,692 | | |

| 0 | | |

| 0 | % |

| DONNA RUDOLPH(2) | |

| 274 | | |

| 274 | | |

| 0 | | |

| 0 | % |

| ELEANOR EDELSTEIN(2) | |

| 138 | | |

| 138 | | |

| 0 | | |

| 0 | % |

| EMILY EDELSTEIN(2) | |

| 410 | | |

| 410 | | |

| 0 | | |

| 0 | % |

| GARRY CONNELL(2) | |

| 2,692 | | |

| 2,692 | | |

| 0 | | |

| 0 | % |

| JUGNA SHAH(2) | |

| 4,543 | | |

| 4,543 | | |

| 0 | | |

| 0 | % |

| KAREL GINSBERG(2) | |

| 1,363 | | |

| 1,363 | | |

| 0 | | |

| 0 | % |

| LINDA PRESTO(2) | |

| 410 | | |

| 410 | | |

| 0 | | |

| 0 | % |

| LINDA RUBINOWITZ(2) | |

| 1,363 | | |

| 1,363 | | |

| 0 | | |

| 0 | % |

| PEGGY HAPNER(2) | |

| 1,363 | | |

| 1,363 | | |

| 0 | | |

| 0 | % |

| S&S FISCHER HOLDINGS, LP(2) | |

| 6,814 | | |

| 6,814 | | |

| 0 | | |

| 0 | % |

| SAM CZYSZ(2) | |

| 274 | | |

| 274 | | |

| 0 | | |

| 0 | % |

| SAM WAKSMAN(2) | |

| 2,726 | | |

| 2,726 | | |

| 0 | | |

| 0 | % |

| CHRISTIE RAMPONE(2) | |

| 1,250 | | |

| 1,250 | | |

| 0 | | |

| 0 | % |

| FIDELIS HOLDINGS LLC(2) | |

| 4,499 | | |

| 4,499 | | |

| 0 | | |

| 0 | % |

| BRADLEY JAMES COHEN(2) | |

| 10,384 | | |

| 10,384 | | |

| 0 | | |

| 0 | % |

| EDWARD ROSENTHAL(2) | |

| 3,750 | | |

| 3,750 | | |

| 0 | | |

| 0 | % |

| MARTIN J. HASEY(2) | |

| 15,117 | | |

| 15,117 | | |

| 0 | | |

| 0 | % |

| RICHARD COHEN & WILLA COHEN TEN ENT(2) | |

| 10,385 | | |

| 10,385 | | |

| 0 | | |

| 0 | % |

| VINCENT BURKE AND TONI BURKE TEN ENT(2) | |

| 2,017 | | |

| 2,017 | | |

| 0 | | |

| 0 | % |

| DIRING HOLDING LLC(2) | |

| 341 | | |

| 341 | | |

| 0 | | |

| 0 | % |

| DON LUNEBURG(2) | |

| 70,697 | | |

| 70,697 | | |

| 0 | | |

| 0 | % |

| GLENN COTTON(2) | |

| 101,639 | | |

| 101,639 | | |

| 0 | | |

| 0 | % |

| WILLIAM E. SCHIFFER(2) | |

| 59,024 | | |

| 59,024 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| HERBERT C POHLMANN, JR. TR(3) | |

| 37,500 | | |

| 37,500 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| BIOMEDICAL INSTITUTIONAL VALUE FUND, L.P.(4) | |

| 75,262 | | |

| 75,262 | | |

| 0 | | |

| 0 | % |

| BIOMEDICAL OFFSHORE VALUE FUND, LTS.(4) | |

| 166,137 | | |

| 166,137 | | |

| 0 | | |

| 0 | % |

| BIOMEDICAL VALUE FUND, L.P.(4) | |

| 293,132 | | |

| 293,132 | | |

| 0 | | |

| 0 | % |

| CLASS D SERIES GEF-PS, L.P.(4) | |

| 122,788 | | |

| 122,788 | | |

| 0 | | |

| 0 | % |

| WS INVESTMENTS II, LLC(4) | |

| 17,682 | | |

| 17,682 | | |

| 0 | | |

| 0 | % |

| (1) | These

Selling Shareholders were issued their 2,390,625 shares of common stock on or about December

9, 2022, pursuant to the AGSS Merger Agreement, whereby Ameriguard became a wholly owned

subsidiary of AGSS, and AGSS its only shareholder. |

| (2) | These