AZINCOURT ENERGY CORP.

(“

Azincourt” or the “

Company”)

(TSX.V: AAZ, OTC: AZURF), is pleased to announce

that it has begun historic data compilation on it’s recently

acquired Snegamook uranium project, located in the Province of

Newfoundland and Labrador.

The Project is strategically located to the

southeast of Snegamook Lake within Labrador’s Central Mineral Belt

and less than 1 km south of the Two Time Zone (Indicated and

Inferred resource of 5.55 Mlb U3O8, June 2008)*, formerly held by

Silver Spruce Resources Inc. as part of a larger land package, and

consists of a mineral licence block comprised of 17 contiguous

claims covering 423 hectares.

The Central Mineral Belt in Labrador also hosts

Paladin Energy Limited’s recently acquired Michelin deposit

(Measured and Indicated resource of 82.2Mlb U3O8).*

Uranium was first discovered in the Central Mineral Belt in 1951.

Readers are cautioned that past results or discoveries on

properties in proximity to the Project are not necessarily

indicative of the presence of similar mineralization on the

Project.

Exploration work conducted on the Project by

Silver Spring Resources Inc. between 2006 and 2008 consisted of

airborne radiometric and magnetic surveys, follow-up prospecting,

lake sediment and soil sampling, radon gas surveys, geological

mapping, trenching, and diamond drilling. The exact number of

diamond drill holes completed within the current Project has not

yet been verified.

Drilling to follow up a radon gas anomaly

identified the “Snegamook Zone” uranium occurrence

located 1.3 km along strike to the southeast of the Two Time Zone.

17 drill holes intersected a 20 to 50 m wide section of uranium

bearing brecciated and altered monzodiorite with moderate to strong

chlorite, hematite and carbonate alteration, the same geological

setting as the Two Time Zone. The Snegamook Zone is located near

several large-scale uranium discoveries including the Two Time,

Moran, Kitts, and Jacques Lake deposits.

Four mineralized lenses were traced over a

strike length of 300 meters and to a vertical depth of 200 meters.

The lenses are shallow dipping (15 to 20 degrees west) and vary in

width from five to 53 meters with values ranging from 225 to 771

ppm U3O8. Individual one meter sample values range from 50 to 1,110

ppm U3O8, with the widest section in drill hole SN-08-8 averaging

206 ppm U3O8 over 73 meters. Mineralization and related

hydrothermal alteration appears to be structurally controlled

within lineaments cross-cutting the host intrusive gneissic units.

The zones appear to be disrupted to the south and down dip by

steeply dipping fault structures that displace the basement gneiss

but remain open to the north.

Two drill holes (SN-08-18 and SN-08-20) tested a

radon gas anomaly 500 meters to the south of the Snegamook Zone.

They intersected nine meters (210 to 219 m) of 552 ppm U3O8 and

five meters (191 to 196 m) of 224 ppm U3O8. Higher grade zones,

0.11% U3O8 over 3 m and 0.11% U3O8 over 2 m, were located within

the highlighted zone in SN-08-18.

No work has been conducted on the land currently

within the Snegamook Project since 2008, with the mineral licences

being allowed to lapse in 2017. Despite a recent increase in

activity and discoveries in the Central Mineral Belt, the project

area remains relatively underexplored. The initial focus for

Azincourt is a compilation of all available information and data

for the historical exploration work in the area. Much of the data

available is from assessment reports filed with the Government of

Newfoundland and Labrador, and therefore must be digitised to be

useful in a 3D-GIS environment. Once this is complete, any

available historical drill core can be examined, and a drill

program can be developed to confirm and expand the historical

mineralization.

Figure 1: Snegamook Project Location Map –

Central Mineral Belt, Labrador, Canada.

Figure 2: Snegamook and Two Time Zone

mineralization map

Non-Brokered Private

Placement

The company also announces that its non-brokered

private placement to raise gross proceeds of up to C$1,000,000 (see

news release dated October 29, 2024) will now consist of both

flow-through units (the “FT Units”) and non-flow through units (the

“NFT Units”) offered at a price of $0.015 per NFT Unit (the

“Offering”).

Each FT Unit will be comprised of one

flow-through common share (a “FT Share”) and one common share

purchase warrant (a “Warrant”) and each NFT Unit will be comprised

of one common share (a “Share”) and one Warrant. Each Warrant will

be exercisable at a price of $0.05 into one common share for a

period of 36 months from the date of issue.

The gross proceeds of the Private Placement will

be used for general working capital and exploration work on the

Company’s Snegamook Project. The gross proceeds will not be used

for any payments to non-arm’s length parties of the Company nor for

any payment relating to persons conducting investor relations

activities.

In connection with the Private Placement, the

Company may pay finders’ fees to eligible third parties that have

assisted in introducing subscribers to the Company. All Common

Shares to be issued in connection with the Private Placement will

be subject to a four-month-and-one-day statutory hold period in

accordance with applicable securities laws. Completion of the

Private Placement remains subject to the approval of the Exchange.

It is expected that the Private Placement will not result in the

creation of a new control person of the Company.

The FT Shares will qualify as “flow-through

shares” (within the meaning of subsection 66(15) of the Income Tax

Act (Canada) (the “Tax Act”)). An amount equal to the gross

proceeds from the issuance of the FT Shares will be used to incur

eligible resource exploration expenses which will qualify as (i)

“Canadian exploration expenses” (as defined in the Tax Act), and

(ii) as “flow-through critical mineral mining expenditures” (as

defined in subsection 127(9) of the Tax Act) (collectively, the

“Qualifying Expenditures”). Qualifying Expenditures in an aggregate

amount not less than the gross proceeds raised from the issue of

the FT Shares will be incurred (or deemed to be incurred) by the

Company on or before December 31, 2025 and will be renounced by the

Company to the initial purchasers of the FT Shares with an

effective date no later than December 31, 2024.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

Qualified Person

The technical information in this news release

has been prepared in accordance with the Canadian regulatory

requirements set out in National Instrument 43-101 and reviewed on

behalf of the company by C. Trevor Perkins, P.Geo., Vice President,

Exploration of Azincourt Energy, and a Qualified Person as defined

by National Instrument 43-101.

About Azincourt Energy

Corp.

Azincourt is a Canadian-based resource company

specializing in the strategic acquisition, exploration, and

development of alternative energy/fuel projects. The Company has

been a uranium explorer for over a decade and is currently active

at its majority-owned joint venture East Preston uranium project

located in the Athabasca Basin, Saskatchewan.

*The historical interpretation and drill

intersections described here in have not been verified and are

extracted from news releases issued by Silver Spruce Resources Inc

on April 24, 2008, and August 12, 2008, as well as annual

Management Discussion and Analysis documents filed on

www.sedarplus.ca, and disclosure published on the website for

Paladin Energy Limited (www.paladinenergy.com.au). The Company has

not completed sufficient work to confirm and validate any of the

historical data from the Snegamook occurrence. The

Company considers the historical work a reliable indication of the

potential of the Project and the information may be of assistance

to readers.

ON BEHALF OF THE BOARD OF AZINCOURT

ENERGY CORP.

“Alex Klenman”Alex Klenman, President

& CEO

For further information please

contact:

Alex Klenman, President &

CEOTel: 778-726-3356info@azincourtenergy.com

Azincourt Energy Corp.1012 – 1030 West Georgia

StreetVancouver, BC V6E

2Y3www.azincourtenergy.com

Cautionary Statement Regarding

Forward-Looking Statements

This news release contains “forward-looking

statements” or “forward-looking information” (collectively,

“forward-looking statements”) within the meaning of applicable

securities legislation. All statements, other than statements of

historical fact, are forward-looking statements and are based on

expectations, estimates and projections as of the date of this news

release. Forward-looking statements include, but are not limited

to, statements relating to the use of proceeds and completion of

the Private Placement.

Forward-looking statements are subject to a

variety of known and unknown risks, uncertainties and other factors

that could cause actual events or results to differ from those

expressed or implied by forward-looking statements contained

herein. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Certain

important factors that could cause actual results, performance or

achievements to differ materially from those in the forward-looking

statements are highlighted in the “Risks and Uncertainties” in the

Company’s management discussion and analysis for the fiscal year

ended September 30, 2023, dated January 24, 2024, and also include

the risks that the Offering does not complete as contemplated, or

at all; that the Company does not complete any further offerings;

that the Company does not carry out exploration activities in

respect of its mineral project as planned (or at all); and that the

Company may not be able to carry out its business plans as

expected.

Forward-looking statements are based upon a

number of estimates and assumptions that, while considered

reasonable by the Company at this time, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies that may cause the Company’s actual financial

results, performance, or achievements to be materially different

from those expressed or implied herein. Some of the material

factors or assumptions used to develop forward-looking statements

include, without limitation: the future price of minerals;

anticipated costs and the Company’s ability to raise additional

capital if and when necessary; volatility in the market price of

the Company’s securities; future sales of the Company’s securities;

the Company’s ability to carry on exploration and development

activities; the success of exploration, development and operations

activities; the timing and results of drilling programs; the

discovery of mineral resources on the Company’s mineral properties;

the costs of operating and exploration expenditures; the presence

of laws and regulations that may impose restrictions on mining;

employee relations; relationships with and claims by local

communities and indigenous populations; availability of increasing

costs associated with mining inputs and labour; the speculative

nature of mineral exploration and development (including the risks

of obtaining necessary licenses, permits and approvals from

government authorities); uncertainties related to title to mineral

properties; assessments by taxation authorities; fluctuations in

general macroeconomic conditions.

The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

Any forward-looking statements and the assumptions made with

respect thereto are made as of the date of this news release and,

accordingly, are subject to change after such date. The Company

disclaims any obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities laws. There can

be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/bbdca3b5-5786-450f-9d03-b66d2060904f

https://www.globenewswire.com/NewsRoom/AttachmentNg/ed46cf9e-5d91-4879-a09c-ea5acca5190d

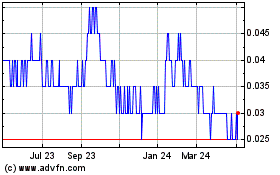

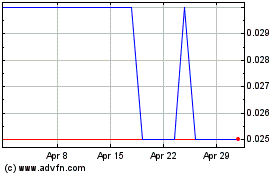

Azincourt Energy (TSXV:AAZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Azincourt Energy (TSXV:AAZ)

Historical Stock Chart

From Feb 2024 to Feb 2025