Hole IC-17-65 returns 422 meters grading

1.04 g/T Gold and 0.32% CopperHole IC-17-66

returns 64 meters grading 4.77 g/T

Gold Exceptional gold/copper values could

accelerate plans for Iron Cap block cave

Seabridge Gold (TSX:SEA) (NYSE:SA) announced today that results

from the first five holes drilled this year into the Iron Cap

Deposit at KSM could warrant significant changes to the project’s

mine plan which could substantially improve project economics. Four

of the five holes have long intercepts with gold grades above one

gram per tonne. The KSM project, located in north western British

Columbia, Canada is 100%-owned by Seabridge and hosts four large

porphyry gold-copper deposits including Iron Cap.

Seabridge Chairman and CEO Rudi Fronk noted that

the Company chose to pursue the Iron Cap program because of its

potential for accelerated development at a comparatively low

capital cost. “Iron Cap is the closest deposit to project

infrastructure and is permitted as a cost-efficient block cave

operation but the current plan has it being mined after the Kerr

deposit. Iron Cap could be developed years earlier than the Kerr

deposit at a much lower cost. Also, Iron Cap has historically

reported higher gold grades than the Kerr deposit. The gold

potential was reinforced last year by hole 62 which reported an

amazing 555 meters of 0.83 grams of gold per tonne and 0.24% copper

and an additional 61 meters of 1.20 grams per tonne gold and 0.95%

copper,” said Fronk.

“We see the potential to make another

substantial improvement to KSM’s projected economics if we can grow

the gold-rich Iron Cap deposit. The first five holes drilled this

year are confirming this potential. The widths of mineralization

are excellent and the gold grades are much higher than

expected.”

This year’s +10,000 meter drill program has been

planned to off-set and step-out from IC-16-62. The 10 to 12 hole

program has been designed to test a volume of about 600 meters wide

by 500 meters long and up to 1000 meters deep surrounding hole 62

and extending to the current resource in order to potentially add

several hundred million tonnes of mineralized material with

sufficient pierce points to report an inferred resource.

The original target concept for follow-up

drilling contemplated pursuing both a lower zone representing the

down plunge continuity of the existing Iron Cap resource, and a new

blind discovery found in the upper 200 meters of hole 62. This

concept of two target zones was based on what appeared to be an

intrusive unit not previously recognized at Iron Cap juxtaposed

along a fault to the main Iron Cap deposit. With the benefit of

additional drill holes, we now believe the upper blind discovery is

a previously unrecognized mineralized intrusion potentially

expanding the size of the Iron Cap deposit significantly. The

interpreted fault zone identified at the base of the upper zone is

now recognized as the sheared margin of a breccia pipe whose limits

have not been fully defined. The breccia pipe appears to represent

a younger high-level or epithermal event superimposed on the Iron

Cap Porphyry Gold-Copper deposit, implying additional porphyry

potential at depth. The upper intrusive unit is resolving as a

dike-like body parallel with other intrusions that form the Iron

Cap deposit and showing continuity with the main resource at

depth.

“As the geology of the Iron Cap deposit becomes

clearer to us, we are increasingly confident that it will rival the

plus billion tonne Kerr and Mitchell deposits in size,” said

Fronk.

The wide zones of higher gold values in holes

IC-17-65, 66 and 67 reflect the impact of an epithermal mineral

system superimposed on the main Iron Cap porphyry gold-copper

system within and adjacent to a large phreatic breccia pipe. The

breccia pipe was likely generated by a younger porphyry

mineralizing system at depth. These gold-rich zones were previously

recognized in the surface exposure of Iron Cap but erosion appears

to have removed most of the upper portions of this occurrence. Our

model for Iron Cap predicts that elevated gold values are likely to

persist down plunge but the epithermal mineralization will probably

give way to more traditional porphyry-style mineralization with

copper grades that may be enriched by the second porphyry

system.

Results from the first five drill holes in the

2017 Iron Cap program are:

|

Drill Hole ID |

Total Depth (meters) |

From (meters) |

To (meters) |

Interval (meters) |

Gold (g/T) |

Copper % |

Silver(g/T) |

| IC-17-63 |

957.4Including |

146.9 |

625.4 |

478.5 |

0.43 |

0.45 |

4.0 |

|

566.4 |

624.5 |

58.1 |

1.12 |

0.23 |

5.7 |

| IC-17-64 |

776.3Including |

105.5 |

700.3 |

594.8 |

0.52 |

0.38 |

4.5 |

|

642.4 |

683.4 |

41.0 |

0.93 |

0.18 |

3.4 |

| IC-17-65 |

686.0Including |

197.0 |

619.5 |

422.5 |

1.04 |

0.32 |

4.2 |

|

346.4 |

484.1 |

137.7 |

1.56 |

0.29 |

3.4 |

| IC-17-66 |

1050.4 includingincluding |

62.5 |

126.1 |

63.6 |

4.77 |

0.01 |

0.9 |

|

173.5 |

1050.4 |

876.9 |

0.32 |

0.37 |

2.8 |

|

173.5 |

277.1 |

103.6 |

0.58 |

0.68 |

2.8 |

|

975.4 |

1027.4 |

52.0 |

1.04 |

0.28 |

3.4 |

| IC-17-67 |

689.3including |

224.3 |

641.4 |

417.1 |

1.02 |

0.33 |

3.6 |

|

352.0 |

459.4 |

107.4 |

1.58 |

0.38 |

4.2 |

Drill holes were oriented using historical

information and were designed to intercept the mineralized target

at right angles to the strike of the zone as close as topographic

constraints permitted. The orientation will be refined with

additional drilling but current information indicates the intervals

listed above approximate the true thickness of the mineralized

zones. For cross-sections please click this link.

Exploration activities by Seabridge at the KSM

Project are conducted under the supervision of William E.

Threlkeld, Registered Professional Geologist, Senior Vice President

of the Company and a Qualified Person as defined by National

Instrument 43-101. Mr. Threlkeld has reviewed and approved this

news release. An ongoing and rigorous quality control/quality

assurance protocol is employed in all Seabridge drilling campaigns.

This program includes blank and reference standards, and in

addition all copper assays that exceed 0.25% Cu are re-analyzed

using ore grade analytical techniques. Cross-check analyses are

conducted at a second external laboratory on at least 10% of the

drill samples. Samples are assayed at ISO and ASTM certified

laboratories in Vancouver, B.C., using fire assay atomic adsorption

methods for gold and ICP methods for other elements.

Seabridge Gold holds a 100% interest in several

North American gold resource projects. The Company’s principal

assets are the KSM and Iskut properties located near Stewart,

British Columbia, Canada and the Courageous Lake gold project

located in Canada’s Northwest Territories. For a breakdown of

Seabridge’s mineral reserves and resources by project and category

please visit the Company’s website at

http://www.seabridgegold.net/resources.php.

Neither the Toronto Stock Exchange, New York

Stock Exchange, nor their Regulation Services Providers accepts

responsibility for the adequacy or accuracy of this release.

All reserve and resource estimates

reported by the Corporation were calculated in accordance with the

Canadian National Instrument 43-101 and the Canadian Institute of

Mining and Metallurgy Classification system. These standards differ

significantly from the requirements of the U.S. Securities and

Exchange Commission. Mineral resources which are not mineral

reserves do not have demonstrated economic viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to: (i) the potential

for the Iron Cap deposit to be developed earlier than planned under

the existing mine plan and at lower capital cost than the Kerr

deposit resulting in the potential for substantially improved

projected economics for the KSM Project; (ii) the potential to add

several hundred tonnes of mineralized material to the Iron Cap

deposit with sufficient pierce points to report an inferred

resource; (iii) the potential, given time for further exploration,

for the Iron Cap deposit to rival the Mitchell and Deep Kerr

deposits and contain over 1 billion tonnes; (iv) the interpretation

of the drilling results reflecting a shear margin of a breccia pipe

that represents a younger high level or epithermal mineralized

system overlying the Iron Cap porphyry gold copper deposit and the

resulting prediction that elevated gold values are likely to

persist down plunge but the epithermal mineralization will probably

give way to more traditional porphyry-style mineralization with

copper grades that may be enriched by the second porphyry system;

and (v) the estimated amount and grade of mineral resources at KSM.

Any statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives

or future events or performance (often, but not always, using words

or phrases such as "expects", "anticipates", "plans", "projects",

"estimates", "envisages", "assumes", "intends", "strategy",

"goals", "objectives" or variations thereof or stating that certain

actions, events or results "may", "could", "would", "might" or

"will" be taken, occur or be achieved, or the negative of any of

these terms and similar expressions) are not statements of

historical fact and may be forward-looking statements.

All forward-looking statements are based

on Seabridge's or its consultants' current beliefs as well as

various assumptions made by them and information currently

available to them. The principle assumptions are listed above, but

others include: (i) the ability to grow the Iron Cap deposit at

grades more valuable than the Kerr deposit; (ii) the presence of

and continuity of metals at the Project between drill holes,

including at modeled grades; (ii) the capacities of various

machinery and equipment; (iii) the availability of personnel,

machinery and equipment at estimated prices; (iv) exchange rates;

(v) metals sales prices; (vi) block net smelter return values;

(vii) conceptual cave footprints, draw points and heights; (viii)

appropriate discount rates; (ix) tax rates and royalty rates

applicable to the proposed mining operation; (x) financing

structure and costs; (xi) anticipated mining losses and dilution;

(xii) metallurgical performance; (xiii) reasonable contingency

requirements; (xiv) success in realizing proposed operations; (xv)

receipt of regulatory approvals on acceptable terms; and (xvi) the

negotiation of satisfactory terms with impacted Treaty and First

Nations groups. Although management considers these assumptions to

be reasonable based on information currently available to it, they

may prove to be incorrect. Many forward-looking statements are made

assuming the correctness of other forward looking statements, such

as statements of net present value and internal rates of return,

which are based on most of the other forward-looking statements and

assumptions herein. The cost information is also prepared using

current values, but the time for incurring the costs will be in the

future and it is assumed costs will remain stable over the relevant

period.

By their very nature, forward-looking

statements involve inherent risks and uncertainties, both general

and specific, and risks exist that estimates, forecasts,

projections and other forward-looking statements will not be

achieved or that assumptions do not reflect future experience. We

caution readers not to place undue reliance on these

forward-looking statements as a number of important factors could

cause the actual outcomes to differ materially from the beliefs,

plans, objectives, expectations, anticipations, estimates

assumptions and intentions expressed in such forward-looking

statements. These risk factors may be generally stated as the risk

that the assumptions and estimates expressed above do not occur,

but specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

mineral reserves or mineral resources from that predicted;

variations in rates of recovery and extraction; developments in

world metals markets; risks relating to fluctuations in the

Canadian dollar relative to the US dollar; increases in the

estimated capital and operating costs or unanticipated costs;

difficulties attracting the necessary work force; increases in

financing costs or adverse changes to the terms of available

financing, if any; tax rates or royalties being greater than

assumed; changes in development or mining plans due to changes in

logistical, technical or other factors; changes in project

parameters as plans continue to be refined; risks relating to

receipt of regulatory approvals or settlement of an agreement with

impacted First Nations groups; the effects of competition in the

markets in which Seabridge operates; operational and infrastructure

risks and the additional risks described in Seabridge's Annual

Information Form filed with SEDAR in Canada (available at

www.sedar.com) for the year ended December

31, 2016 and in the Corporation's Annual Report Form 40-F filed

with the U.S. Securities and Exchange Commission on EDGAR

(available at

www.sec.gov/edgar.shtml). Seabridge

cautions that the foregoing list of factors that may affect future

results is not exhaustive.

When relying on our forward-looking statements to make

decisions with respect to Seabridge, investors and others should

carefully consider the foregoing factors and other uncertainties

and potential events. Seabridge does not undertake to update any

forward-looking statement, whether written or oral, that may be

made from time to time by Seabridge or on our behalf, except as

required by law.

ON BEHALF OF THE BOARD"Rudi Fronk" Chairman

& C.E.O.

For further information please contact:

Rudi P. Fronk, Chairman and C.E.O.

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

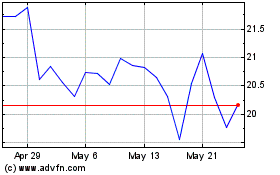

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

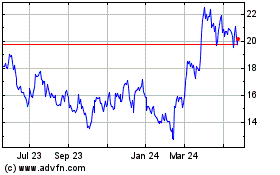

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2023 to Dec 2024