Nevada Copper (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada

Copper” or the “Company”) is pleased to announce that it

has agreed to non-binding terms with its key financing partners to

provide up to US$93 million of liquidity to the Company in order to

support the restart and ramp-up of the Company’s Pumpkin Hollow

copper mine (the “Underground Mine”) located in Yerington, Nevada.

The Company also announced the key components of its newly

developed restart plan for the Underground Mine.

Randy Buffington, Chief Executive

Officer, stated: “I am very pleased with the substantial

ongoing support of all our key stakeholders. The significant

contribution by each of them is a testament to the conviction in

the quality of the Pumpkin Hollow project and its intrinsic value.

The current pause of production allows the Company to make

meaningful changes to address challenges that were impeding the

final stages of the Underground Mine ramp-up. This is intended to

de-risk the business plan and build a more profitable long-term

business from the Underground Mine. We also continue to advance the

open pit project at Pumpkin Hollow through the ongoing

pre-feasibility study update process. I would also like to thank

our team and key suppliers for the commitment and support through

the recent challenges and I look forward to working towards a

resumption of full operations.”

Restart Mine Plan

The Company has advanced planning for the

restart of operations at its Underground Mine. The restart plan is

intended to de-risk the path to full-scale production by focusing

on de-bottlenecking and completion of critical capital projects, in

addition to the build-up of significant stope ore inventory, to

facilitate a more efficient ramp-up upon mill restart and to reduce

cash burn during the ramp-up period.

Provided that the funding package described

below is completed on the expected timeline, the key components of

the restart plan will be as follows: (i) changes to the underground

mining contractor arrangements in order to improve performance of

ramp-up activities with an ultimate goal of transitioning certain

underground mining activities to be Company-performed, (ii) the

second dike crossing scheduled to be completed during the third

quarter of 2022 and the final dike crossing scheduled to be

completed by the end of 2022, (iii) stoping in the higher grade

East North mining zone scheduled to commence in the second quarter

of 2023, and (iv) the mill restart scheduled to commence in the

third quarter of 2023.

If the restart plan is executed as planned and

on schedule, management anticipates that underground production

will ramp-up to hoisting rates of approximately 3,000 tons per day

(“tpd”) in the third quarter of 2023 and then further increase to

5,000 tpd in the fourth quarter of 2023.

This revised operating plan is designed to

mitigate operating risks and enhance flexibility of the underground

operations.

Board Strengthening

In conjunction with the restart financing

package, the board of directors of the Company (the “Board”) will

be strengthened in a number of areas, including:

- Chief Executive

Officer Randy Buffington will join the Board as a director;

and

- Both Triple Flag

and Mercuria will each have the right to nominate a director and to

have a representative on the Technical Committee of the Board.

Financing Package

Highlights

Non-binding terms have been agreed with the

Company’s senior lender, KfW IPEX-Bank (“KfW”), its working capital

provider, Concord Resources Limited (“Concord”), its largest

shareholder, Pala Investments Limited (“Pala”), another significant

shareholder, Mercuria Energy (“Mercuria”), and its stream and

royalty partner, Triple Flag Precious Metals Corp. (“Triple Flag”)

for a restart funding package of up to US$93 million.

The proceeds of the restart financing package

are to be used primarily to fund the restart and ramp-up of the

Underground Mine. The highlights of the non-binding package are as

follows:

- Equity

Investments (US$40 million): Pala and Mercuria each to provide

US$20 million in exchange for common shares of the Company. Pala

has already provided an early disbursement of US$7.5 million from

its US$20 million commitment.

- Stream and

Royalty Financing (US$30 million): Triple Flag to increase its

existing net smelter returns royalty on the Company’s open pit

project (the “Open Pit”) from 0.7% to 2% for a purchase price of

US$26.2 million, subject to a full buyback of the increased royalty

percentage. In addition, Triple Flag to accelerate the US$3.8

million remaining to be funded under the Company’s existing metals

purchase and sale agreement with Triple Flag (the “Underground Mine

Stream Agreement”).

- KfW Facility

Extension (US$15 million committed): The Company’s senior credit

facility with KfW (the “KfW Facility”) to be amended to provide for

a new tranche of up to US$25 million, of which Pala, Triple Flag

and Mercuria would commit the first US$15 million as a

backstop.

- Deferrals under

Senior Project Facility and Working Capital Facility (expected to

be at least US$8 million): KfW to defer three interest payments

under the KfW Facility. Concord to defer interest and principal

payments under the Company’s working capital facility (the “Working

Capital Facility”).

Further Details of Restart Financing

Package

Extension and Deferrals under KfW

Facility

A new tranche under the KfW Facility would

provide for new funding of up to US$25 million (the “Extension

Tranche”), with such loans being eligible to be funded by any of

the parties that are part of the funding package, or any other

lenders approved by such parties. Pala, Triple Flag and Mercuria

have agreed to each backstop US$5 million under the Extension

Tranche. The Extension Tranche would be available to be drawn until

December 31, 2023, after (i) the above stream, royalty and equity

funds have been fully expended by the Company, and (ii) the Company

has less than US$10 million cash available for operating

expenses.

The Extension Tranche would be available on

substantially the same terms as the tranche A loan under the KfW

Facility and would mature on the same date as tranche A, July 31,

2029. The interest rate on the Extension Tranche funds would be the

SOFR + 5% and such loans would be secured by first lien security

that ranks pari passu with KfW’s existing security under the KfW

Facility.

In addition, KfW would defer three interest

payments under the tranche A and tranche B loans of the KfW

Facility, being the interest payments due in July 2022 (which was

previously deferred), January 2023 and July 2023. The deferred

interest payments would be capitalized and added to the outstanding

principal amount owing under the KfW Facility.

Working Capital Facility

Deferrals

Concord to defer the repayment of the current

principal balance under the Working Capital Facility until the

earlier of (i) the restart of copper deliveries from the

Underground Mine and the resumption of deliveries of concentrate to

Concord pursuant to the offtake arrangements between Concord and

the Company and (ii) a restart long-stop date to be determined.

Concord would also defer interest payments owing under the Working

Capital Facility until the restart of copper deliveries, after

which interest would be paid on the repayment date for each tranche

owing under the Working Capital Facility. New draws under the

Working Capital Facility would become available upon the resumption

of deliveries and satisfaction of certain other conditions.

These changes would be effected through

amendments to, and waivers under, the Working Capital Facility.

Equity Investments

Pala and Mercuria to provide a US$40 million

equity investment to the Company, with Pala and Mercuria to each

provide US$20 million. Mercuria will fund its equity investment in

two tranches, with US$10 million being funded at the closing of the

funding package and the remaining US$10 million to be put in escrow

on closing and funded upon the satisfaction or waiver of certain

conditions. Pala’s subscription and the first tranche of Mercuria’s

subscription will be at a subscription price equal to a 15%

discount to the five-day volume weighted average price (the “VWAP”)

of the Company’s common shares on the Toronto Stock Exchange (the

“TSX”) as of the trading day prior to the closing of the funding

package (the “Equity Subscription Price”). The second tranche of

Mercuria’s investment will be at a subscription price equal to a

15% discount to the five-day VWAP of the Company’s common shares on

the TSX as of the trading day prior to the draw-down of such

tranche by the Company.

In connection with Mercuria’s investment,

Mercuria would be granted the right to nominate one director to the

Board and it would also be granted the right to nominate one

individual to the Company’s technical committee.

Pala’s investment contribution would be

satisfied, in part, through the cancellation of the short-term debt

advanced to the Company by Pala as interim financing. Pala has

indicated that it intends to provide additional short-term

financing for the next few weeks to allow the Company time to close

the financing package.

The Company is in discussions with other

potential capital providers and may also pursue public and private

capital markets opportunities to raise additional funds to complete

the ramp-up process.

Stream and Royalty

Financing

Triple Flag to provide an aggregate of US$30

million through (i) an acceleration of the payment of its US$3.8

million unfunded deposit under the Underground Mine Stream

Agreement and (ii) an increase in its existing net smelter returns

royalty on the Open Pit from 0.7% to 2% for a purchase price of

US$26.2 million:

- As part of the

restart funding package, Triple Flag would accelerate the remaining

payment of the increased deposit in the amount of US$3.8 million to

be disbursed under the existing Underground Mine Stream

Agreement.

- In addition, the

Company and Triple Flag would amend the Open Pit royalty agreement

that was entered into in March 2020 to increase the total royalty

payable to 2% in exchange for a US$26.2 million purchase price. The

Company will have the option to buy back 100% of the increased Open

Pit royalty (being the 1.3% increased royalty amount) for US$33

million until the earlier of (i) 24 months from the date that the

amended and restated Open Pit royalty agreement is entered into; or

(ii) a change of control of the Company.

- Triple Flag

would fund its investment in two tranches, with US$20 million being

funded at the closing of the funding package and the remaining

US$10 million to be put in escrow on closing and funded upon the

satisfaction or waiver of certain conditions.

In connection with Triple Flag’s investment,

Triple Flag would be granted the right to nominate one director to

the Board (which it may opt to exercise at any time through a

nominee to the Company’s advisory board instead of the Board) and

it would also be granted the right to nominate one individual to

the Company’s technical committee.

Debt Consolidation

The Company and Pala to consolidate all of the

indebtedness currently owing to Pala by the Company into an amended

and restated credit facility (the “Amended Credit Facility”), which

would amend the existing credit agreement entered into by Pala and

the Company in November 2021 (the “Pala Facility”). The loans

outstanding to be consolidated into the Amended Credit Facility

would include (i) the total of US$53 million outstanding under the

Pala Facility, and (ii) US$20 million that was recently advanced to

the Company under a promissory note in June and July 2022. Amounts

owing under the Amended Credit Facility would be convertible into

common shares of the Company, at Pala’s option, at a conversion

price equal to a 20% premium to the Equity Subscription Price. (In

addition, Mercuria would be granted warrants to allow it to acquire

common shares pro rata with Pala’s conversion of its convertible

debt to preserve its equity position at the same exercise price as

the Pala convertible debt conversion price.) Pala would be granted

fourth-lien security to secure amounts owing under the Amended

Credit Facility (after KfW, Triple Flag and Concord) and the

Company’s wholly owned subsidiary, Nevada Copper, Inc. (“NCI”),

would become a guarantor of all amounts outstanding under the

Amended Credit Facility (NCI is the principal obligor under the KfW

Facility, the Underground Mine Stream Agreement and the Working

Capital Facility). The remaining commercial terms in the Amended

Credit Facility will remain substantially the same as the terms

under the Pala Facility. In addition, certain other amounts owing

to Pala by the Company would be satisfied through the issuance of

additional common shares to Pala at the Equity Subscription

Price.

In connection with the entering into of the

Amended Credit Facility, Pala and KfW would agree to amend Pala’s

existing guarantee of the US$15 million tranche B loan outstanding

under the KfW Facility to permit Pala to purchase the loan in

certain circumstances.

Definitive Documentation, Regulatory and

Other Matters

The closing of the funding package described

above is subject to, among other things, finalization of the

specific terms thereof, negotiation and execution of definitive

documentation and the satisfaction of various regulatory

requirements. The Company and its key financing partners intend to

enter into definitive documents in respect of the funding package

by mid-September. The completion of the financing package will be

subject to the approval of the TSX and, given the urgency of the

Company’s liquidity situation, the Company intends to rely on

certain exemptions from the shareholder approval requirement that

might otherwise apply under TSX rules and applicable securities

laws.

There can be no assurance that binding

agreements will be entered into or completed (or the required

regulatory approvals obtained) on terms satisfactory to the Company

and within the required timeframe, or at all. In addition, there

can be no assurance that the Company will be able to raise the

further funding to supplement the financing package described above

that will be required to complete the restart and ramp-up process.

If the restart funding package is not completed, absent other

financing, the Company will not be able to continue carrying on

business in the ordinary course and may need to pursue proceedings

for creditor protection. The Company’s creditors may also seek to

commence enforcement action, including realizing on their security

over the Company’s assets.

Effective August 26, 2022, Matt Anderson will

replace Kris Sims as the interim chief financial officer of the

Company. Mr. Anderson is a Certified Public Accountant and

previously served as the Director, Corporate Finance at Argonaut

Gold Inc. The Company thanks Mr. Sims for his valuable

contributions over his term as interim chief financial officer and

wishes him the best in his next endeavors.

Qualified Person

The technical information and data in this news

release has been reviewed by Steven Newman, Registered Member –

SME, Vice President, Technical Services for Nevada Copper, who is a

non-independent Qualified Person within the meaning of NI

43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer

and owner of the Pumpkin Hollow copper project. Located in Nevada,

USA, Pumpkin Hollow has substantial reserves and resources

including copper, gold and silver. Its two fully permitted projects

include the high-grade Underground Mine and processing facility,

that is in a ramp-up phase, and a large-scale open pit project,

which is advancing towards feasibility status.

Randy BuffingtonPresident &

CEO

For additional information, please see the

Company’s website at www.nevadacopper.com, or contact:

Tracey Thom | Vice President,

IR and Community Relationstthom@nevadacopper.com+1 775 391 9029

Cautionary Language on Forward Looking

StatementsThis news release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable Canadian securities laws. All statements in this news

release, other than statements of historical facts, are

forward-looking statements. Such forward-looking information and

forward-looking statements specifically include, but are not

limited to, statements that relate to the completion of the funding

package described above, including the terms and timing thereof,

the plans and requirement for supplementary financing, regulatory

requirements, creditor protection proceedings, and mine planning

and expected development schedule.

Forward-looking statements and information

include statements regarding the expectations and beliefs of

management. Often, but not always, forward-looking statements and

forward-looking information can be identified by the use of words

such as “plans”, “expects”, “potential”, “is expected”,

“anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates”, or “believes” or the

negatives thereof or variations of such words and phrases or

statements that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements or information should not be read as

guarantees of future performance and results. They are subject to

known and unknown risks, uncertainties and other factors which may

cause the actual results and events to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statements or information.

Such risks and uncertainties include, without

limitation, those relating to: requirements for additional capital

and no assurance can be given regarding the availability thereof;

the outcome of discussions with creditors and vendors; potential

creditor protection proceedings; the ability of the Company to

complete the ramp-up of the Underground Mine within the expected

cost estimates and timeframe; the impact of COVID-19 on the

business and operations of the Company; the state of financial

markets; history of losses; dilution; adverse events relating to

milling operations, construction, development and ramp-up,

including the ability of the Company to address underground

development and process plant issues; ground conditions; cost

overruns relating to development, construction and ramp-up of the

Underground Mine; loss of material properties; interest rates

increase; global economy; limited history of production; future

metals price fluctuations; speculative nature of exploration

activities; periodic interruptions to exploration, development and

mining activities; environmental hazards and liability; industrial

accidents; failure of processing and mining equipment to perform as

expected; labour disputes; supply problems; uncertainty of

production and cost estimates; the interpretation of drill results

and the estimation of mineral resources and reserves; changes in

project parameters as plans continue to be refined; possible

variations in ore reserves, grade of mineralization or recovery

rates from management’s expectations and the difference may be

material; legal and regulatory proceedings and community actions;

accidents; title matters; regulatory approvals and restrictions;

increased costs and physical risks relating to climate change,

including extreme weather events, and new or revised regulations

relating to climate change; permitting and licensing; dependence on

management information systems and cyber security risks; volatility

of the market price of the Company’s securities; insurance;

competition; hedging activities; currency fluctuations; loss of key

employees; other risks of the mining industry as well as those

risks discussed in the Company’s Management’s Discussion and

Analysis in respect of the year ended December 31, 2021 and the

quarter ended March 31, 2022 and in the section entitled “Risk

Factors” in the Company’s Annual Information Form dated March 31,

2022. The forward-looking statements and information contained in

this press release are based upon assumptions management believes

to be reasonable, including, without limitation: no adverse

developments in respect of the property or operations at the

project; no material changes to applicable laws; the ramp-up of

operations at the Underground Mine in accordance with management’s

plans and expectations; no worsening of the current COVID-19

related work restrictions; reduced impacts of COVID-19 going

forward; the Company will be able to obtain sufficient additional

funding to complete the ramp-up, no material adverse change to the

price of copper from current levels; and the absence of any other

factors that could cause actions, events or results to differ from

those anticipated, estimated or intended.

The forward-looking information and statements

are stated as of the date hereof. The Company disclaims any intent

or obligation to update forward-looking statements or information

except as required by law. Although the Company has attempted to

identify important factors that could cause actual actions, events,

or results to differ materially from those described in

forward-looking information and statements, there may be other

factors that could cause actions, events or results not to be as

anticipated, estimated or intended. Specific reference is made to

“Risk Factors” in the Company’s Management’s Discussion and

Analysis in respect of the year ended December 31, 2021 and the

quarter ended March 31, 2022 and “Risk Factors” in the Company’s

Annual Information Form dated March 31, 2022, for a discussion of

factors that may affect forward-looking statements and information.

Should one or more of these risks or uncertainties materialize,

should other risks or uncertainties materialize or should

underlying assumptions prove incorrect, actual results and events

may vary materially from those described in forward-looking

statements and information. For more information on the Company and

the risks and challenges of its business, investors should review

the Company’s filings that are available at www.sedar.com.

The Company provides no assurance that

forward-looking statements and information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information.

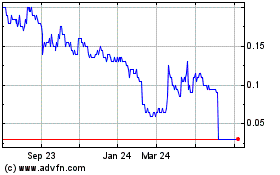

Nevada Copper (TSX:NCU)

Historical Stock Chart

From Jan 2025 to Feb 2025

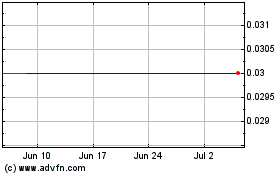

Nevada Copper (TSX:NCU)

Historical Stock Chart

From Feb 2024 to Feb 2025