Sartorius, a leading international laboratory and process

equipment provider, successfully closed the year 2010. Sales

revenue and earnings substantially surpassed the year-earlier

figures. Financial guidance for the Group, which was raised during

the course of 2010, was met and even exceeded for some targets. For

the current fiscal year as well, management expects to continue on

the growth track: Sartorius is projected to grow considerably in

both of its divisions and to further increase its

profitability.

Group CEO Dr. Joachim Kreuzburg, satisfied with the company’s

results, said: “Considering all key financials, 2010 was a very

successful year for Sartorius. The Biotechnology Division showed

excellent development in Asia and North America and is operating at

a strong level of profitability. Our Mechatronics Division grew

more dynamically on a broad basis than expected and has returned to

robust profitability that can be further increased. Looking ahead

to 2011, we are confident. We got off to a good start in the

current year and are expecting to achieve further profitable growth

in both divisions.”

Business Development of the Sartorius GroupAccording to

preliminary figures, Sartorius generated consolidated sales revenue

of 659.3 million in fiscal 2010. This equates to an increase of

9.5% (constant currencies: 6.4%). The gain in order intake was even

stronger: It jumped 10.7% to 681.1 million euros (constant

currencies: 7.5%). Both Group divisions and all regions contributed

to this dynamic business development.

Regionally, Sartorius grew the strongest in Asia/Pacific. Here,

sales revenue surged 17.6% in constant currencies; order intake

soared 26.6%. These figures reaffirm the company's strategy of

actively participating in growth regions such as China and India

early on. In North America as well, Sartorius posted significant

gains: Sales rose at a double-digit rate of 11.0% in constant

currencies; order intake, at 4.5%. Because of an extraordinary

effect on business in the year before, sales revenue in Europe

edged up only by 0.3% in constant currencies; order intake in this

region grew 4.9%.

Strong development of sales revenue was accompanied by

overproportionate gains in earnings and in operating EBITA margin.

Sartorius uses earnings before interest, taxes and amortization

(EBITA) as the key profitability measure. To enable a more

meaningful comparison with the year-earlier figures, the company

reports earnings adjusted for extraordinary items (= operating

EBITA or operating earnings) in addition to EBITA.

In the reporting period, the Group’s operating earnings surged

40.4% to 85.5 million euros from 60.9 million euros a year ago. The

respective margin climbed by nearly three percentage points from

10.1% to 13.0% and thus reached a new high. Both Group divisions

contributed to this strong development of earnings. The

Biotechnology Division further increased its already high

profitability. The Mechatronics Division achieved substantial

improvements following a weak 2009 due to the global economic

crisis. Favorable exchange rates had a positive impact of half of a

percentage point on the margin.

Extraordinary items stood at -6.3 million euros compared with

the previous year’s figure of -30.0 million euros, which were

predominantly expenses incurred for restructuring. Including these

extraordinary items, consolidated EBITA increased more than 2.5

times from 30.9 million euros to 79.2 million euros.

The Group’s relevant net profit rose 87.7% from 20.8 million

euros a year ago to 39.0 million euros. The corresponding earnings

per share are 2.29 euros, well up from 1.22 euros a year ago. The

unadjusted consolidated net profit after minority interest totals

31.0 million euros. In the previous year, it was negative, at -7.3

million euros, on account of the considerable expenses incurred for

restructuring the Mechatronics Division.

Despite the share buyback program for its biotechnology

subgroup, Sartorius was able to pare back its net debt, based on

its strong operating cash flow in the reporting year, by 27.8

million euros, or a good 12%, from 224.7 million euros to 196.9

million euros. The key debt service coverage ratio, the ratio of

net debt to operating EBITDA, significantly improved and was at 1.8

at year-end compared with 2.6 as of December 31, 2009.

Business Development of the Divisions

Sartorius Stedim BiotechThe Biotechnology Division, which

operates under the name of Sartorius Stedim Biotech (SSB),

increased its sales revenue in the reporting period by 8.0% from

400.4 million euros to 432.6 million euros (constant currencies:

5.1%). Order intake also considerably jumped 8.1% from 409.2

million euros to 442.3 million euros (constant currencies: 5.0%).

Again, the company’s business with single-use products for the

biopharmaceutical industry substantially fueled this growth.

Business with bioreactors and other biotechnological production

systems also added positive momentum. Relatively large orders for

these products were received from the Asian region, where local

biopharmaceutical companies in particular have been investing in

the installation of new systems.

A regional comparison shows that primarily in Asia|Pacific,

business expanded very dynamically, with order intake up 51.7% and

sales revenue up 25.4%. In North America as well, sales grew

strongly by 12.1% and order intake rose 3.8%. In Europe, by

contrast, business was flat (order intake: +0.2%; sales revenue:

-3.3% / all regional figures given in constant currencies). This

development was not only the result of sluggish demand. It was also

significantly due to a base effect: The comparative year-earlier

figures were higher than average as a result of extraordinary

business generated with producers of the H1N1 vaccine.

Overall positive development of sales revenue is reflected by

the division’s earnings. The division succeeded in further

increasing its already high profitability. Its operating earnings

improved overproportionately by 16.6% from 60.2 million euros to

70.2 million euros. The respective margin rose from 15.0% to

16.2%.

Sartorius MechatronicsWhile the global economy recovered,

business for the Mechatronics Division expanded dynamically in all

segments and regions. The division increased its sales revenue in

2010 by 12.4% from 201.7 million euros to 226.7 million euros

(constant currencies: 8.9%). The gain in order intake was even

stronger. It jumped 16.0% to 238.8 million euros (constant

currencies: 12.4%). Both of the division's businesses with

laboratory instruments and industrial weighing and control

equipment, respectively, contributed to this encouraging

development. Service business, which was hardly impacted by the

economic crisis in 2009, also grew.

Regarding regional development, the Mechatronics Division

reported high growth rates in all of its business regions. In

Europe, order intake climbed 14.8% and sales revenue rose 7.9%. In

North America, order intake increased 6.6% and sales were up 7.5.

In Asia/Pacific, the division’s order intake grew 9.8% and its

revenue rose 9.6% (all regional figures given in constant

currencies).

After the year of crisis in 2009, the Mechatronics Division

substantially improved its earnings in the reporting year and

returned to robust profitability. In addition to the significant

rise in volume, efficiency gains made during restructuring in 2009

also contributed to this strong rebound in profitability. The

division’s operating earnings soared, reaching 15.3 million euros

compared with 0.7 million euros the year before. Accordingly, the

division’s operating EBITA margin improved from 0.4% a year ago to

6.8%.

Outlook for 2011Positive business development is

anticipated to continue in the current year as well. For 2011,

Sartorius expects sales to grow between 6% and 8% in constant

currencies for both divisions and thus for the entire Group. Along

with growth in sales, profitability is projected to further

increase. Without any currency effects considered, the operating

EBITA margin at Group level is forecasted to increase to around

14%. The Biotechnology Division is expected to contribute an

operating margin of approximately 17% and the Mechatronics Division

a margin of around 8% to this result. Furthermore, management

anticipates a significantly positive operating cash flow.

Key Figures at a Glance

€ in millions(unless otherwise specified)

Sartorius

Group Biotechnology Division

Mechatronics Division 2010 2009

Change

in %

2010 2009 Change

in %

2010 2009 Change

in %

Order intake

681.1 615.1 10.7

442.3 409.2 8.1

238.8 205.9 16.4 Sales revenue

659.3 602.1 9.5

432.6 400.4 8.0

226.7 201.7 12.4 Operating earnings

(underlying EBITA)1)

85.5 60.6 40.4

70.2 60.2 16.6

15.3 0.7

EBITA margin1)

13% 10.1%

16.2% 15.0%

6.8% 0.4% Extraordinary items

6.3 30.0

Consolidated net

profit1)2)

39.0 20.8 87.7

Earnings per share)2) in €

2.29 1.22 87.7

1) Adjusted for extraordinary items2) Relevant consolidated net

profit = adjusted consolidated net profit after minority interest

and excluding non-cash amortization and, in 2009, additionally

excluding interest for share price warrants.

The numbers mentioned above are still subject to final review by

the auditors. The final figures will be announced at the annual

press conference on March 14, 2011.

Current Image Files:Dr. Joachim Kreuzburg, CEO and

Executive Board Chairman of Sartorius

AG:http://www.sartorius.com/media/content/press/support/Kreuzburg_2011.jpg

Sartorius | Biotechnology Division (Sartorius Stedim

Biotech):http://www.sartorius.com/media/content/press/support/Sartoflow_2011.jpg

Sartorius | Mechatronics

Division:http://www.sartorius.com/media/content/press/support/Laboratory_2011.jpg

Conference Call and Webcast:Dr. Joachim Kreuzburg, CEO

and Executive Board Chairman of Sartorius, will discuss the

preliminary results of 2010 with analysts and investors on

Wednesday, February 9, 2011, at 4:00 p.m. Central European Time

(CET) in a webcast teleconference. You may dial into the

teleconference starting at 3:45 p.m. CET at the following

numbers:

Germany: +49 (0)69 5007 1305France: +33 (0)1 70 99 4298UK: +44

(0)20 7806 1950USA: +1 718 354 1385The dial-in code is as follows:

9225134; to view the webcast, log onto: www.sartorius.com

Upcoming Financial Dates:March 14, 2011 Annual press

conference in Goettingen, GermanyApril 20, 2011 Annual

Shareholders’ Meeting in Goettingen, GermanyApril 2011 Publication

of the first-quarter figures (Jan. – March 2011)

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties.

This is a translation of the original German-language press

release. Sartorius shall not assume any liability for the

correctness of this translation. The original German press release

is the legally binding version. Furthermore, Sartorius reserves the

right not to be responsible for the topicality, correctness,

completeness or quality of the information provided. Liability

claims regarding damage caused by the use of any information

provided, including any kind of information which is incomplete or

incorrect, will therefore be rejected.

A Profile of SartoriusThe Sartorius Group is a leading

international laboratory and process technology provider covering

the segments of biotechnology and mechatronics. In 2010, the

technology group earned sales revenue of 659.3 million euros

according to its preliminary figures. Founded in 1870, the

Goettingen-based company currently employs more than 4,500 persons.

The major areas of activity in its biotechnology segment focus on

filtration, fluid management, fermentation and cell cultivation,

purification, and laboratory applications. In the mechatronics

segment, the company primarily manufactures equipment and systems

featuring weighing, measurement and automation technology for

laboratory and industrial applications. Key Sartorius customers are

from the pharmaceutical, chemical and food industries and from

numerous research and educational institutes of the public sector.

Sartorius has its own production facilities in Europe, Asia and

America as well as sales subsidiaries and local commercial agencies

in more than 110 countries.

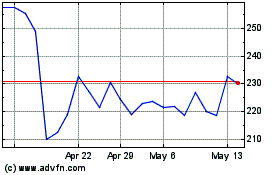

Sartorius (TG:SRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

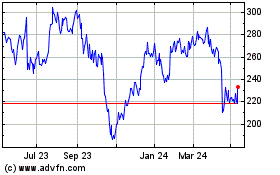

Sartorius (TG:SRT)

Historical Stock Chart

From Nov 2023 to Nov 2024