Western Asset Municipal High Income Fund Inc. Portfolio Composition as of June 30, 2013

July 24 2013 - 8:00AM

Business Wire

Western Asset Municipal High Income Fund Inc. (NYSE: MHF)

announces its portfolio composition as of June 30, 2013.

Investment Objective: The Fund seeks high current income

exempt from Federal income taxes.

Portfolio Composition*:

Asset

Allocation

Municipal

99.8%

Variable Rate Demand Notes

0.2%

Top Ten Municipal

Sectors

Industrial Revenue 32.3% Health Care 19.5% Transportation 12.8%

Education 9.2% Lease Backed 6.8% Special Tax Obligation 6.5% Water

& Sewer 4.3% Power 4.0% Solid Waste/Res Recovery 2.5% Other

0.9%

Credit Quality

Allocation**

AAA 0.1% AA 2.9% A 34.0% BBB 36.8% BB 5.0% B 3.0% Not Rated 18.3%

Call

Statistics

Not Callable 9.1% 2013 10.5% 2014 3.8% 2015 2.7% 2016 8.8% 2017

9.0% 2018 5.5% 2019 9.6% 2020 15.7% 2021 11.7% 2022 9.6% 2023 3.9%

Average Life (years)

15.3

Effective Duration (years)

9.0

Average Coupon (%)

6.0

Subject to AMT (%)

16.4

Portfolio Statistics:

Inception Date

November 28, 1988

Inception Price

$10.00

Total Assets

$167,280,977

Market Price

$7.17

NAV

$7.72 (Daily NAV is available on market quotation systems using the

symbol XMHFX.)

Distribution Rate

$0.0310 per share

Frequency

Monthly (Declared quarterly, paid monthly)

* Portfolio holdings and weightings are historical and are

presented here for informational purposes only. They are subject to

change at any time.

** Credit quality is a measure of a bond issuer's ability to

repay interest and principal in a timely manner. The credit ratings

shown are based on each portfolio security’s rating as provided by

Standard and Poor’s, Moody’s Investors Service and/or Fitch

Ratings, Ltd. and typically range from AAA (highest) to D (lowest),

or an equivalent and/or similar rating. For this purpose, when two

or more of the agencies have assigned differing ratings to a

security, the highest rating is used. Securities that are unrated

by all three agencies are reflected as such. The credit quality of

the investments in the Fund's portfolio does not apply to the

stability or safety of the Fund. These ratings are updated monthly

and may change over time. Please note, the Fund itself has not

been rated by an independent rating agency.

Western Asset Municipal High Income Fund Inc., a diversified

closed-end investment management company, is advised by Legg Mason

Partners Fund Advisor, LLC, a wholly owned subsidiary of Legg

Mason, Inc., and is sub-advised by Western Asset Management

Company, an affiliate of the advisor.

An investment in the Fund involves risk, including loss of

principal. Investment return and the value of shares will

fluctuate. Fixed income securities are subject to credit risk,

inflation risk, call risk, and interest rate risk. As interest

rates rise, bond prices fall, reducing the value of the Fund's

share price. Certain investors may be subject to the alternative

minimum tax (AMT). State and local taxes may apply. The Fund may

invest in derivative instruments. Derivative instruments can be

illiquid, may disproportionately increase losses, and have a

potentially large impact on Fund performance.

Data and commentary provided in this press release are for

informational purposes only. Legg Mason and its affiliates do not

engage in selling shares of the Fund.

For more information, please call Fund Investor Services at

888-777-0102 or consult the Fund’s web site at

www.leggmason.com/cef.

FN1112214

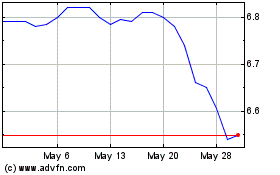

Western Asset Municipal ... (NYSE:MHF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Western Asset Municipal ... (NYSE:MHF)

Historical Stock Chart

From Nov 2023 to Nov 2024