Grew Net Sales 7.7% to $9.7 Billion

and Gross Profit 7.2% to $1.7 Billion

Increased Net Income 8.8% to $198

Million

Delivered Record Adjusted EBITDA of $489

Million and Record Adjusted EBITDA Margin of 5.0%

Repurchased $41 Million of Shares and

Reduced Net Leverage to 2.6x

US Foods Holding Corp. (NYSE: USFD), one of the largest

foodservice distributors in the United States, today announced

results for the second quarter fiscal year 2024.

Second Quarter Fiscal Year 2024

Highlights

- Net sales increased 7.7% to $9.7 billion

- Total case volume increased 5.2%; independent restaurant case

volume increased 5.7%

- Gross profit increased 7.2% to $1.7 billion

- Net income was $198 million

- Adjusted EBITDA increased 13.2% to $489 million

- Diluted EPS increased 9.6% to $0.80; Adjusted Diluted EPS

increased 17.7% to $0.93

“During the second quarter, we delivered record Adjusted EBITDA

and EBITDA margin in a softer macro environment. Our team’s success

further emphasizes the strength of our operating model and ability

to control the controllables,” said Dave Flitman, CEO. “Our

balanced approach to drive improved profitability through the

execution of our strategic initiatives was evident again this

quarter and we captured market share with independent restaurants

for the 13th consecutive quarter.”

“We also held an exciting investor day on June 5 where we

outlined our new long-range plan to accelerate growth,

profitability and returns. We laid out our financial algorithm from

2025 through 2027 of growing sales at a 5% CAGR, increasing

Adjusted EBITDA at a 10% CAGR, expanding EBITDA margin by at least

20 basis points per year and growing Adjusted Diluted EPS at a 20%

CAGR. We are confident that we have the right strategy and the

operational rigor in place to deliver on our 2027 financial

targets, all underpinned by our 30,000 hardworking and dedicated

associates.”

“We delivered record profitability in the second quarter through

our balanced approach to drive top- and bottom-line gains despite

the operating environment,” added Dirk Locascio, CFO. “Maintaining

our disciplined approach to capital deployment and intense focus on

driving long-term shareholder value creation, we closed on the IWC

acquisition, repurchased $41 million of shares and further reduced

our net leverage while continuing to invest in the business. Given

our strong first half of the year and outlook for the remainder of

2024, we are reiterating our net sales, Adjusted EBITDA and

Adjusted Diluted EPS guidance.”

Second Quarter Fiscal Year 2024

Results

Net sales of $9.7 billion for the quarter increased 7.7% from

the prior year, driven by total case volume growth and food cost

inflation of 2.9%. Total case volume increased 5.2% from the prior

year driven by a 5.7% increase in independent restaurant case

volume, a 6.0% increase in healthcare volume, a 2.1% increase in

hospitality volume and a 4.2% increase in chain volume.

Gross profit of $1.7 billion increased by $115 million, or 7.2%

from the prior year, primarily as a result of an increase in total

case volume, improved cost of goods sold and pricing optimization,

partially offset by an unfavorable year-over-year LIFO adjustment.

Gross profit as a percentage of net sales was 17.6%. Adjusted Gross

profit was $1.7 billion, an increase of $130 million or 8.2% from

the prior year. Adjusted Gross profit as a percentage of net sales

was 17.6%.

Operating expenses of $1.4 billion increased by $84 million, or

6.6% from the prior year, primarily as a result of an increase in

total case volume and higher distribution costs, reflecting

increased labor costs, partially offset by continued distribution

productivity improvement driven by routing efficiency gains,

turnover reduction and process standardization as well as actions

to streamline administrative processes and costs. Operating

expenses as a percentage of net sales were 13.9%. Adjusted

Operating expenses were $1.2 billion, an increase of $68 million or

5.9% from the prior year. Adjusted Operating expenses as a

percentage of net sales were 12.5%.

Net income was $198 million, an increase of $16 million compared

to the prior year. Net income margin was 2.0%, an increase of 2

basis points compared to the prior year. Adjusted EBITDA was $489

million, an increase of $57 million or 13.2%, compared to the prior

year. Adjusted EBITDA margin was 5.0%, an increase of 25 basis

points compared to the prior year. Diluted EPS was $0.80; Adjusted

Diluted EPS was $0.93.

Cash Flow and Debt

Cash flow provided by operating activities for the first six

months of fiscal year 2024 was $621 million, a decrease of $32

million from the prior year due to less working capital benefit

than prior year. Cash capital expenditures for the first six months

of fiscal year 2024 totaled $156 million, an increase of $48

million from the prior year period, related to investments in

information technology, property and equipment for fleet

replacement and maintenance of distribution facilities.

Net Debt at the end of the second quarter of fiscal year 2024

was $4.3 billion. The ratio of Net Debt to Adjusted EBITDA was 2.6x

at the end of the second quarter of fiscal year 2024, compared to

2.8x at the end of fiscal year 2023 and 3.0x at the end of the

second quarter of fiscal year 2023.

During the second quarter of fiscal year 2024, the Company

repurchased 0.7 million shares of common stock at an aggregate

purchase price of $41 million.

On June 1, 2024, the Board authorized a new share repurchase

program of up to $1 billion. Under this new authorization, the

Company repurchased $21 million of shares in June 2024 and in the

third quarter through August 7, 2024, the Company repurchased

approximately $61 million of shares and has approximately $918

million in remaining funds authorized.

M&A Update

During the second quarter of fiscal year 2024, the Company

acquired IWC Food Service, a broadline distributor which serves the

greater Nashville area, for a purchase price of approximately $220

million. The acquisition was funded with cash from operations and

closed on April 5, 2024.

Outlook for Fiscal Year

20241

The Company is reiterating its Fiscal Year 2024 guidance.

- Net Sales of $37.5 to $38.5 billion

- Adjusted EBITDA of $1.69 to $1.74 billion

- Adjusted Diluted EPS of $3.00 to $3.20

________________________

1 The Company is not providing a

reconciliation of certain forward-looking non-GAAP financial

measures, including Adjusted EBITDA and Adjusted Diluted EPS,

because the Company is unable to predict with reasonable certainty

the financial impact of certain significant items, including

restructuring activity and asset impairment charges, share-based

compensation expenses, non-cash impacts of LIFO reserve

adjustments, losses on extinguishments of debt, business

transformation costs, other gains and losses, business acquisition

and integration related costs and diluted earnings per share. These

items are uncertain, depend on various factors, and could have a

material impact on GAAP reported results for the guidance periods.

For the same reasons, the Company is unable to address the

significance of the unavailable information, which could be

material to future results.

Conference Call and Webcast

Information

US Foods will host a live webcast to discuss second quarter

fiscal year 2024 results on Thursday, August 8, 2024, at 8 a.m.

CDT. The call can also be accessed live over the phone by dialing

(877) 344-2001; the conference ID number is 2528845. Presentation

slides will be available before the webcast begins. The webcast,

slides and a copy of this press release can be found in the

Investor Relations section of our website at https://ir.usfoods.com.

About US Foods

With a promise to help its customers Make It, US Foods is one of

America’s great food companies and a leading foodservice

distributor, partnering with approximately 250,000 restaurants and

foodservice operators to help their businesses succeed. With more

than 70 broadline locations and approximately 90 cash and carry

stores, US Foods and its 30,000 associates provides its customers

with a broad and innovative food offering and a comprehensive suite

of e-commerce, technology and business solutions. US Foods is

headquartered in Rosemont, Ill. Visit www.usfoods.com to learn

more.

Forward-Looking

Statements

Statements in this press release which are not historical in

nature, including those under the heading “Outlook for Fiscal Year

2024,” are “forward-looking statements” within the meaning of the

federal securities laws. These statements often include words such

as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,”

“outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,”

“should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,”

or similar expressions (although not all forward-looking statements

may contain such words) and are based upon various assumptions and

our experience in the industry, as well as historical trends,

current conditions, and expected future developments. However, you

should understand that these statements are not guarantees of

performance or results and there are a number of risks,

uncertainties and other important factors, many of which are beyond

our control, that could cause our actual results to differ

materially from those expressed in the forward-looking statements,

including, among others: economic factors affecting consumer

confidence and discretionary spending and reducing the consumption

of food prepared away from home; cost inflation/deflation and

commodity volatility; competition; reliance on third party

suppliers and interruption of product supply or increases in

product costs; changes in our relationships with customers and

group purchasing organizations; our ability to increase or maintain

the highest margin portions of our business; achievement of

expected benefits from cost savings initiatives; increases in fuel

costs; changes in consumer eating habits; cost and pricing

structures; the impact of climate change or related legal,

regulatory or market measures; impairment charges for goodwill,

indefinite-lived intangible assets or other long-lived assets; the

impact of governmental regulations; product recalls and product

liability claims; our reputation in the industry; labor relations

and increased labor costs and continued access to qualified and

diverse labor; indebtedness and restrictions under agreements

governing our indebtedness; interest rate increases; disruption of

existing technologies and implementation of new technologies;

cybersecurity incidents and other technology disruptions; risks

associated with intellectual property, including potential

infringement; effective consummation of pending acquisitions and

effective integration of acquired businesses; potential costs

associated with shareholder activism; changes in tax laws and

regulations and resolution of tax disputes; certain provisions in

our governing documents; health and safety risks to our associates

and related losses; adverse judgments or settlements resulting from

litigation; extreme weather conditions, natural disasters and other

catastrophic events; and management of retirement benefits and

pension obligations.

For a detailed discussion of these risks, uncertainties and

other factors that could cause our actual results to differ

materially from those anticipated or expressed in any

forward-looking statements, see the section entitled “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended

December 30, 2023 filed with the Securities and Exchange Commission

(“SEC”). Additional risks and uncertainties are discussed from time

to time in current, quarterly and annual reports filed by the

Company with the SEC, which are available on the SEC’s website at

www.sec.gov. Additionally, we operate in a highly competitive and

rapidly changing environment; new risks and uncertainties may

emerge from time to time, and it is not possible to predict all

risks nor identify all uncertainties. The forward-looking

statements contained in this press release speak only as of the

date of this press release and are based on information and

estimates available to us at this time. We undertake no obligation

to update or revise any forward-looking statements, except as may

be required by law.

Non-GAAP Financial

Measures

We report our financial results in accordance with U.S.

generally accepted accounting principles (“GAAP”). However,

Adjusted Gross profit, Adjusted Operating expenses, EBITDA,

Adjusted EBITDA, Adjusted EBITDA margin, Net Debt, Adjusted Net

income and Adjusted Diluted EPS are non-GAAP financial measures

regarding our operational performance and liquidity. These non-GAAP

financial measures exclude the impact of certain items and,

therefore, have not been calculated in accordance with GAAP.

We use Adjusted Gross profit and Adjusted Operating expenses as

supplemental measures to GAAP measures to focus on

period-over-period changes in our business and believe this

information is helpful to investors. Adjusted Gross profit is Gross

profit adjusted to remove the impact of the LIFO inventory reserve

adjustments. Adjusted Operating expenses are Operating expenses

adjusted to exclude amounts that we do not consider part of our

core operating results when assessing our performance.

We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA margin

provide meaningful supplemental information about our operating

performance because they exclude amounts that we do not consider

part of our core operating results when assessing our performance.

EBITDA is Net income (loss), plus Interest expense-net, Income tax

provision (benefit), and Depreciation and amortization. Adjusted

EBITDA is EBITDA adjusted for (1) Restructuring activity and asset

impairment charges; (2) Share-based compensation expense; (3) the

non-cash impact of LIFO reserve adjustments; (4) loss on

extinguishment of debt; (5) Business transformation costs; and (6)

other gains, losses or costs as specified in the agreements

governing our indebtedness. Adjusted EBITDA margin is Adjusted

EBITDA divided by total net sales.

We use Net Debt as a supplemental measure to GAAP measures to

review the liquidity of our operations. Net Debt is defined as

total debt net of total Cash, cash equivalents and restricted cash

remaining on the balance sheet as of the end of the most recent

fiscal quarter. We believe that Net Debt is a useful financial

metric to assess our ability to pursue business opportunities and

investments. Net Debt is not a measure of our liquidity under GAAP

and should not be considered as an alternative to Cash Flows

Provided by Operations or Cash Flows Used in Financing

Activities.

We believe that Adjusted Net income is a useful measure of

operating performance for both management and investors because it

excludes items that are not reflective of our core operating

performance and provides an additional view of our operating

performance including depreciation, interest expense, and Income

taxes on a consistent basis from period to period. Adjusted Net

income is Net income (loss) excluding such items as restructuring

activity and asset impairment charges, Share-based compensation

expense, the non-cash impacts of LIFO reserve adjustments,

amortization expense, loss on extinguishment of debt, Business

transformation costs and other items, and adjusted for the tax

effect of the exclusions and discrete tax items. We believe that

Adjusted Net income may be used by investors, analysts, and other

interested parties to facilitate period-over-period comparisons and

provides additional clarity as to how factors and trends impact our

operating performance.

We use Adjusted Diluted Earnings per Share, which is calculated

by adjusting the most directly comparable GAAP financial measure,

Diluted Earnings per Share, by excluding the same items excluded in

our calculation of Adjusted EBITDA to the extent that each such

item was included in the applicable GAAP financial measure. We

believe the presentation of Adjusted Diluted Earnings per Share is

useful to investors because the measurement excludes amounts that

we do not consider part of our core operating results when

assessing our performance. We also believe that the presentation of

Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Diluted

Earnings per Share is useful to investors because these metrics may

be used by securities analysts, investors and other interested

parties in their evaluation of the operating performance of

companies in our industry.

Management uses these non-GAAP financial measures (a) to

evaluate our historical and prospective financial performance as

well as our performance relative to our competitors as they assist

in highlighting trends, (b) to set internal sales targets and

spending budgets, (c) to measure operational profitability and the

accuracy of forecasting, (d) to assess financial discipline over

operational expenditures, and (e) as an important factor in

determining variable compensation for management and employees.

EBITDA and Adjusted EBITDA are also used in connection with certain

covenants and restricted activities under the agreements governing

our indebtedness. We also believe these and similar non-GAAP

financial measures are frequently used by securities analysts,

investors, and other interested parties to evaluate companies in

our industry.

We caution readers that our definitions of Adjusted Gross

profit, Adjusted Operating expenses, EBITDA, Adjusted EBITDA,

Adjusted EBITDA margin, Net Debt, Adjusted Net income and Adjusted

Diluted EPS may not be calculated in the same manner as similar

measures used by other companies. Definitions and reconciliations

of the non-GAAP financial measures to their most comparable GAAP

financial measures are included in the schedules attached to this

press release.

US FOODS HOLDING CORP.

Consolidated Balance

Sheets

(Unaudited)

($ in millions)

June 29, 2024

December 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

405

$

269

Accounts receivable, less allowances of

$20 and $18

1,976

1,854

Vendor receivables, less allowances of $6

and $5

212

156

Inventories—net

1,593

1,600

Prepaid expenses

131

138

Other current assets

17

14

Total current assets

4,334

4,031

Property and equipment—net

2,359

2,280

Goodwill

5,779

5,697

Other intangibles—net

867

803

Other assets

364

376

Total assets

$

13,703

$

13,187

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Cash overdraft liability

$

193

$

220

Accounts payable

2,349

2,051

Accrued expenses and other current

liabilities

706

731

Current portion of long-term debt

118

110

Total current liabilities

3,366

3,112

Long-term debt

4,589

4,564

Deferred tax liabilities

282

293

Other long-term liabilities

455

469

Total liabilities

8,692

8,438

Shareholders’ equity:

Common stock

3

3

Additional paid-in capital

3,696

3,663

Retained earnings

1,789

1,509

Accumulated other comprehensive loss

(112

)

(115

)

Treasury Stock

(365

)

(311

)

Total shareholders’ equity

5,011

4,749

Total liabilities and shareholders’

equity

$

13,703

$

13,187

US FOODS HOLDING CORP.

Consolidated Statements of

Operations

(Unaudited)

13 Weeks Ended

26 Weeks Ended

($ in millions, except share and per

share data)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net sales

$

9,709

$

9,013

$

18,658

$

17,555

Cost of goods sold

8,003

7,422

15,457

14,539

Gross profit

1,706

1,591

3,201

3,016

Distribution, selling and administrative

costs

1,354

1,269

2,671

2,507

Restructuring activity and asset

impairment charges

(1

)

—

12

—

Total operating expenses

1,353

1,269

2,683

2,507

Operating income

353

322

518

509

Other expense (income)—net

3

(2

)

2

(3

)

Interest expense—net

81

82

160

163

Income before income taxes

269

242

356

349

Income tax provision

71

60

76

85

Net income

$

198

$

182

$

280

$

264

Net income

$

198

$

182

$

280

$

264

Series A convertible preferred stock

dividends

—

—

—

(7

)

Net income available to common

shareholders

$

198

$

182

$

280

$

257

Net income per share

Basic

$

0.81

$

0.76

$

1.14

$

1.11

Diluted

$

0.80

$

0.73

$

1.13

$

1.05

Weighted-average common shares

outstanding

Basic

245,729,372

238,302,347

245,396,094

232,277,995

Diluted

248,312,117

250,991,512

248,393,517

251,389,602

US FOODS HOLDING CORP.

Consolidated Statements of

Cash Flows

(Unaudited)

26 Weeks Ended

($ in millions)

June 29, 2024

July 1, 2023

Cash flows from operating activities:

Net income

$

280

$

264

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

213

193

Gain on disposal of property and

equipment—net

(1

)

(2

)

Amortization of deferred financing

costs

5

10

Deferred tax (benefit) provision

(11

)

1

Share-based compensation expense

30

28

Provision for doubtful accounts

15

16

Changes in operating assets and

liabilities:

Increase in receivables

(181

)

(199

)

Decrease in inventories

19

85

Decrease (increase) in prepaid expenses

and other assets

13

(6

)

Increase in accounts payable and cash

overdraft liability

277

309

Decrease in accrued expenses and other

liabilities

(38

)

(46

)

Net cash provided by operating

activities

621

653

Cash flows from investing activities:

Proceeds from sales of property and

equipment

2

2

Purchases of property and equipment

(156

)

(108

)

Acquisition of businesses—net of cash

received

(214

)

—

Net cash used in investing activities

(368

)

(106

)

Cash flows from financing activities:

Principal payments on debt and financing

leases

(1,568

)

(446

)

Principal payments on debt repricing

(14

)

—

Proceeds from debt repricing

14

—

Proceeds from debt borrowings

1,503

255

Dividends paid on Series A convertible

preferred stock

—

(7

)

Repurchase of common stock

(54

)

(202

)

Debt financing costs and fees

(1

)

—

Proceeds from employee stock purchase

plan

14

13

Proceeds from exercise of stock

options

9

22

Purchase of interest rate caps

—

(3

)

Tax withholding payments for net

share-settled equity awards

(20

)

(11

)

Net cash used in financing activities

(117

)

(379

)

Net increase in cash, cash equivalents and

restricted cash

136

168

Cash, cash equivalents and restricted

cash—beginning of period

269

211

Cash, cash equivalents and restricted

cash—end of period

$

405

$

379

Supplemental disclosures of cash flow

information:

Conversion of Series A Convertible

Preferred Stock

$

—

$

534

Interest paid—net of amounts

capitalized

147

147

Income taxes paid—net

57

67

Property and equipment purchases included

in accounts payable

29

24

Leased assets obtained in exchange for

financing lease liabilities

94

81

Leased assets obtained in exchange for

operating lease liabilities

19

22

Cashless exercise of stock options

5

1

US FOODS HOLDING CORP.

Non-GAAP

Reconciliation

(Unaudited)

13 Weeks Ended

($ in millions, except share and per

share data)

June 29, 2024

July 1, 2023

Change

%

Net income and net income margin

(GAAP)

198

2.0

%

182

2.0

%

16

8.8

%

Interest expense—net

81

82

(1

)

(1.2

)%

Income tax provision

71

60

11

18.3

%

Depreciation expense

96

84

12

14.3

%

Amortization expense

12

11

1

9.1

%

EBITDA and EBITDA margin

(Non-GAAP)

458

4.7

%

419

4.6

%

39

9.3

%

Adjustments:

Restructuring activity and asset

impairment charges (1)

(1

)

—

(1

)

NM

Share-based compensation expense (2)

15

14

1

7.1

%

LIFO reserve adjustment (3)

—

(15

)

15

(100.0

)%

Business transformation costs (4)

9

3

6

200.0

%

Business acquisition and integration

related costs and other (5)

8

11

(3

)

(27.3

)%

Adjusted EBITDA and Adjusted EBITDA

margin (Non-GAAP)

489

5.0

%

432

4.8

%

57

13.2

%

Depreciation expense

(96

)

(84

)

(12

)

14.3

%

Interest expense—net

(81

)

(82

)

1

(1.2

)%

Income tax provision, as adjusted (6)

(81

)

(67

)

(14

)

20.9

%

Adjusted Net Income (Non-GAAP)

$

231

$

199

$

32

16.1

%

Diluted EPS (GAAP)

$

0.80

$

0.73

$

0.07

9.6

%

Restructuring activity and asset

impairment charges (1)

—

—

—

NM

Share-based compensation expense (2)

0.06

0.06

—

—

%

LIFO reserve adjustment (3)

—

(0.06

)

0.06

(100.0

)%

Business transformation costs (4)

0.04

0.01

0.03

300.0

%

Business acquisition and integration

related costs and other (5)

0.03

0.04

(0.01

)

(25.0

)%

Income tax provision, as adjusted (6)

—

0.01

(0.01

)

NM

Adjusted Diluted EPS (Non-GAAP)

(7)

$

0.93

$

0.79

$

0.14

17.7

%

Weighted-average diluted shares

outstanding (Non-GAAP) (8)

248,312,117

250,991,512

Gross profit (GAAP)

$

1,706

$

1,591

$

115

7.2

%

LIFO reserve adjustment (3)

—

(15

)

15

(100.0

)%

Adjusted Gross profit

(Non-GAAP)

$

1,706

$

1,576

$

130

8.2

%

Operating expenses (GAAP)

$

1,353

$

1,269

$

84

6.6

%

Depreciation expense

(96

)

(84

)

(12

)

14.3

%

Amortization expense

(12

)

(11

)

(1

)

9.1

%

Restructuring activity and asset

impairment charges (1)

1

—

1

NM

Share-based compensation expense (2)

(15

)

(14

)

(1

)

7.1

%

Business transformation costs (4)

(9

)

(3

)

(6

)

200.0

%

Business acquisition and integration

related costs and other (5)

(8

)

(11

)

3

(27.3

)%

Adjusted Operating expenses

(Non-GAAP)

$

1,214

$

1,146

$

68

5.9

%

NM - Not Meaningful

(1)

Consists primarily of severance and

related costs associated with organizational realignment and other

impairment charges.

(2)

Share-based compensation expense for

expected vesting of stock awards and employee stock purchase

plan.

(3)

Represents the impact of LIFO reserve

adjustments.

(4)

Transformation costs represent

non-recurring expenses prior to formal launch of strategic projects

with anticipated long-term benefits to the Company. These costs

generally relate to third party consulting and non-capitalizable

technology. For the 13 weeks ended June 29, 2024, business

transformation costs related to projects associated with

information technology infrastructure initiatives and workforce

efficiency initiatives. For the 13 weeks ended July 1, 2023,

business transformation costs related to projects associated with

projects associated with information technology infrastructure

initiatives.

(5)

Includes: (i) aggregate acquisition and

integration related costs of $8 million and $11 million for the 13

weeks ended June 29, 2024 and July 1, 2023, respectively and (ii)

other gains, losses or costs that we are permitted to addback for

purposes of calculating Adjusted EBITDA under certain agreements

governing our indebtedness.

(6)

Represents our income tax provision

adjusted for the tax effect of pre-tax items excluded from Adjusted

net income and the removal of applicable discrete tax items.

Applicable discrete tax items include changes in tax laws or rates,

changes related to prior year unrecognized tax benefits, discrete

changes in valuation allowances, and excess tax benefits associated

with share-based compensation. The tax effect of pre-tax items

excluded from Adjusted net income is computed using a statutory tax

rate after taking into account the impact of permanent differences

and valuation allowances.

(7)

Adjusted Diluted EPS is calculated as

Adjusted net income divided by weighted average diluted shares

outstanding (Non-GAAP).

(8)

For purposes of the Adjusted Diluted EPS

calculation (Non-GAAP), when the Company has net income (GAAP),

weighted average diluted shares outstanding (Non-GAAP) is used and

assumes conversion of the Series A convertible preferred stock,

and, when the Company has net loss (GAAP) and assumed conversion of

the Series A convertible preferred stock would be antidilutive,

weighted-average diluted shares outstanding (GAAP) is used.

US FOODS HOLDING CORP.

Non-GAAP

Reconciliation

(Unaudited)

26 Weeks Ended

($ in millions, except share and per

share data)

June 29, 2024

July 1, 2023

Change

%

Net income available to common

shareholders and net income margin (GAAP)

$

280

1.5

%

$

257

1.5

%

$

23

8.9

%

Series A convertible preferred stock

dividends

—

(7

)

7

(100.0

)%

Net income and net income margin

(GAAP)

280

1.5

%

264

1.5

%

16

6.1

%

Interest expense—net

160

163

(3

)

(1.8

)%

Income tax provision

76

85

(9

)

(10.6

)%

Depreciation expense

189

171

18

10.5

%

Amortization expense

24

22

2

9.1

%

EBITDA and EBITDA margin

(Non-GAAP)

729

3.9

%

705

4.0

%

24

3.4

%

Adjustments:

Restructuring costs and asset impairment

charges (1)

12

—

12

—

%

Share-based compensation expense (2)

30

28

2

7.1

%

LIFO reserve adjustment(3)

45

5

40

800.0

%

Business transformation costs (4)

18

7

11

157.1

%

Business acquisition and integration

related costs and other (5)

11

24

(13

)

(54.2

)%

Adjusted EBITDA and Adjusted EBITDA

margin (Non-GAAP)

845

4.5

%

769

4.4

%

76

9.9

%

Depreciation expense

(189

)

(171

)

(18

)

10.5

%

Interest expense—net

(160

)

(163

)

3

(1.8

)%

Income tax provision, as adjusted (6)

(131

)

(111

)

(20

)

18.0

%

Adjusted Net Income (Non-GAAP)

$

365

$

324

$

41

12.7

%

Diluted EPS (GAAP)

$

1.13

$

1.05

$

0.08

7.6

%

Restructuring costs and asset impairment

charges (1)

0.05

—

0.05

—

%

Share-based compensation expense (2)

0.12

0.11

0.01

9.1

%

LIFO reserve adjustment (3)

0.18

0.02

0.16

800.0

%

Business transformation costs (4)

0.07

0.03

0.04

133.3

%

Business acquisition and integration

related costs and other (5)

0.04

0.10

(0.06

)

(60.0

)%

Income tax provision, as adjusted (6)

(0.12

)

(0.02

)

(0.10

)

500.0

%

Adjusted Diluted EPS (Non-GAAP)

(7)

$

1.47

$

1.29

$

0.18

14.0

%

Weighted-average diluted shares

outstanding (Non-GAAP) (8)

248,393,517

251,389,602

Gross profit (GAAP)

$

3,201

$

3,016

$

185

6.1

%

LIFO reserve adjustment (3)

45

5

40

800.0

%

Adjusted Gross profit

(Non-GAAP)

$

3,246

$

3,021

$

225

7.4

%

Operating expenses (GAAP)

$

2,683

$

2,507

$

176

7.0

%

Depreciation expense

(189

)

(171

)

(18

)

10.5

%

Amortization expense

(24

)

(22

)

(2

)

9.1

%

Restructuring costs and asset impairment

charges (1)

(12

)

—

(12

)

—

%

Share-based compensation expense (2)

(30

)

(28

)

(2

)

7.1

%

Business transformation costs (5)

(18

)

(7

)

(11

)

157.1

%

Business acquisition and integration

related costs and other (6)

(11

)

(24

)

13

(54.2

)%

Adjusted Operating expenses

(Non-GAAP)

$

2,399

$

2,255

$

144

6.4

%

NM - Not Meaningful

(1)

Consists primarily of severance and

related costs, organizational realignment costs and other asset

impairment charges.

(2)

Share-based compensation expense for

expected vesting of stock awards and employee stock purchase

plan.

(3)

Represents the impact of LIFO reserve

adjustments.

(4)

Transformational costs represent

non-recurring expenses prior to formal launch of strategic projects

with anticipated long-term benefits to the Company. These costs

generally relate to third party consulting and non-capitalizable

technology. For the 26 weeks ended June 29, 2024, business

transformation costs related to projects associated with

information technology infrastructure initiatives and workforce

efficiency initiatives. For the 26 weeks ended July 1, 2023,

business transformation costs related to projects associated with

information technology infrastructure initiatives.

(5)

Includes: (i) aggregate acquisition and

integration related costs of $10 million and $21 million for the 26

weeks ended June 29, 2024 and July 1, 2023, respectively; (ii) CEO

sign on bonus of $3 million for the 26 weeks ended July 1, 2023 and

(iii) other gains, losses or costs that we are permitted to addback

for purposes of calculating Adjusted EBITDA under certain

agreements governing our indebtedness.

(6)

Represents our income tax provision

adjusted for the tax effect of pre-tax items excluded from Adjusted

net income and the removal of applicable discrete tax items.

Applicable discrete tax items include changes in tax laws or rates,

changes related to prior year unrecognized tax benefits, discrete

changes in valuation allowances, and excess tax benefits associated

with share-based compensation. The tax effect of pre-tax items

excluded from Adjusted net income is computed using a statutory tax

rate after taking into account the impact of permanent differences

and valuation allowances.

(7)

Adjusted Diluted EPS is calculated as

Adjusted net income divided by weighted average diluted shares

outstanding (Non-GAAP).

(8)

For purposes of the Adjusted Diluted EPS

calculation (Non-GAAP), when the Company has net income (GAAP),

weighted average diluted shares outstanding (Non-GAAP) is used and

assumes conversion of the Series A convertible preferred stock,

and, when the Company has net loss (GAAP) and assumed conversion of

the Series A convertible preferred stock would be antidilutive,

weighted-average diluted shares outstanding (GAAP) is used.

US FOODS HOLDING CORP.

Non-GAAP

Reconciliation

Net Debt and Net Leverage

Ratios

($ in millions, except ratios)

June 29, 2024

December 30, 2023

July 1, 2023

Total Debt (GAAP)

$

4,707

$

4,674

$

4,751

Cash, cash equivalents and restricted

cash

(405

)

(269

)

(379

)

Net Debt (Non-GAAP)

$

4,302

$

4,405

$

4,372

Adjusted EBITDA (1)

$

1,635

$

1,559

$

1,470

Net Leverage Ratio (2)

2.6

2.8

3.0

(1) Trailing Twelve Months (TTM) Adjusted

EBITDA

(2) Net Debt/TTM Adjusted EBITDA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807211740/en/

INVESTOR CONTACT: Mike Neese (847) 232-5894

Michael.Neese@usfoods.com

MEDIA CONTACT: Sara Matheu (773) 580-3775

Sara.Matheu@usfoods.com

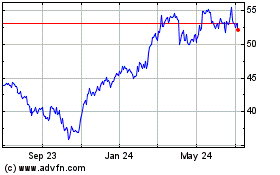

US Foods (NYSE:USFD)

Historical Stock Chart

From Jan 2025 to Feb 2025

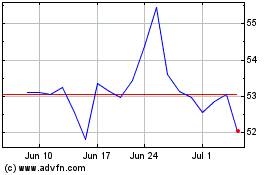

US Foods (NYSE:USFD)

Historical Stock Chart

From Feb 2024 to Feb 2025