Increases Outlook for Full Year 2024

Traeger, Inc. ("Traeger" or the "Company") (NYSE: COOK), creator

and category leader of the wood pellet grill, today announced its

financial results for the three months ended September 30,

2024.

Third Quarter FY 24 Highlights

- Total revenues increased 3.7% to $122.1 million

- Grill revenues increased 32.5% to $74.9 million

- Gross margin of 42.3%, up 440 basis points compared to prior

year

- Net loss of $19.8 million compared to net loss of $19.3 million

in the prior year

- Adjusted EBITDA of $12.3 million, up from $4.7 million in the

prior year

- Raises low-end of FY 2024 revenue guidance range

- Increases FY 2024 gross margin and Adjusted EBITDA

guidance

"Traeger delivered third quarter results which were ahead of our

expectations and which demonstrate our team's commitment to

execution," commented Jeremy Andrus, CEO of Traeger. "Strong

sell-through of our grills drove upside in our replenishment sales

in the quarter, resulting in a 32% increase in our grills revenues.

Furthermore, we continue to see significant gross margin expansion,

which drove meaningful growth in Adjusted EBITDA in the quarter.

Our results are allowing us to increase our financial guidance for

the year once again. We believe our progress on driving

efficiencies in the business over the last two years positions us

well to deliver growth and shareholder value, in particular as our

innovation pipeline accelerates into next year and beyond."

Operating Results for the Third Quarter

Total revenue increased 3.7% to $122.1 million, compared

to $117.7 million in the third quarter last year.

- Grills increased 32.5% to $74.9 million as compared to the

third quarter last year. The increase was primarily driven by unit

volume growth partially offset by a reduction in average selling

price. Higher unit volume was driven by effective promotional

activity and strategic pricing action on select grills. The

decrease in average selling price was primarily due to a mix shift

to lower priced grills, a higher mix of direct import sales, and

strategic pricing action on select grills.

- Consumables decreased 11.2% to $22.5 million as compared to the

third quarter last year. The decrease was primarily driven by a

reduction in wood pellet unit volume and a reduction in food

consumables unit volume. Lower wood pellet and food consumables

unit volume was due to seasonal ordering shifts.

- Accessories decreased 31.3% to $24.6 million as compared to the

third quarter last year. This decrease was driven by lower sales of

MEATER smart thermometers as well as unit volume reductions in

Traeger branded accessories.

North America revenue increased 10.4% in the third quarter

compared to the prior year. Rest of World revenues decreased 40.1%

in the third quarter compared to the prior year.

Gross profit increased to $51.7 million, compared to

$44.7 million in the third quarter last year. Gross profit margin

was 42.3% in the third quarter, compared to 37.9% in the same

period last year. The increase in gross margin was driven primarily

by favorability from freight, logistics, and other supply chain

costs.

Sales and marketing expenses were $26.2 million, compared

to $25.9 million in the third quarter last year. As a percentage of

sales, sales and marketing expenses were down 60 bps compared to

the third quarter last year.

General and administrative expenses were $24.1 million,

compared to $24.8 million in the third quarter last year. As a

percentage of sales, general and administrative expenses were down

130 bps compared to the third quarter last year.

Net loss was $19.8 million in the third quarter, or a

loss of $0.15 per diluted share, compared to net loss of $19.3

million in the third quarter of last year, or a loss of $0.16 per

diluted share.1

Adjusted net loss was $7.4 million, or $0.06 per diluted

share, compared to $14.3 million, or $0.12 per diluted share in the

third quarter last year.2

Adjusted EBITDA was $12.3 million in the third quarter

compared to Adjusted EBITDA of $4.7 million in the same period last

year.2

Balance Sheet

Cash and cash equivalents at the end of the third quarter

totaled $16.9 million, compared to $29.9 million at December 31,

2023.

Inventory at the end of the third quarter was $105.1

million, compared to $96.2 million at December 31, 2023.

Guidance For Full Year Fiscal 2024

Based on year to date performance and its outlook for the rest

of the year, the Company is updating its total revenue, gross

margin and Adjusted EBITDA guidance for Fiscal 2024.

- Total revenue is expected to be between $595 million and

$605 million

- Gross Margin is expected to be between 41.8% and

42.3%

- Adjusted EBITDA is expected to be between $78 million

and $81 million

A reconciliation of Adjusted EBITDA guidance to Net Loss on a

forward-looking basis cannot be provided without unreasonable

efforts, as the Company is unable to provide reconciling

information with respect to provision (benefit) for income taxes,

interest expense, depreciation and amortization, other (income)

expense, stock-based compensation, non-routine legal expenses, and

other adjustment items all of which are adjustments to Adjusted

EBITDA.

Conference Call Details

A conference call to discuss the Company's third quarter results

is scheduled for Wednesday, November 6, 2024, at 4:30 p.m. ET. To

participate, please dial (833) 470-1428 or +1 (929) 526-1599 for

international callers, conference ID 322897. The conference call

will also be webcast live at https://investors.traeger.com. A

recording will be available shortly after the conclusion of the

call. To access the replay, please dial (866) 813-9403, conference

ID 367971. A replay of the webcast will also be available

approximately two hours after the conclusion of the call on the

Company's website at https://investors.traeger.com. A supplemental

presentation has also been posted to the Company's website at

https://investors.traeger.com.

About Traeger

Traeger, headquartered in Salt Lake City, is the creator and

category leader of the wood pellet grill, an outdoor cooking system

that ignites all-natural hardwoods to grill, smoke, bake, roast,

braise, and barbecue. In 2023, Traeger entered the griddle

category, further establishing its leadership position in the

outdoor cooking space. Traeger grills are versatile and easy to

use, empowering cooks of all skill sets to create delicious meals

with flavor that cannot be replicated. Grills are at the core of

our platform and are complemented by Traeger wood pellets, rubs,

sauces, accessories, and MEATER smart thermometers.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements regarding our anticipated full year Fiscal 2024 results

and our position to deliver growth and shareholder value, as well

as our innovation pipeline. Words such as “believes,”

“anticipates,” “plans,” “expects,” “intends,” “will,” “goal,”

“potential” and similar expressions are intended to identify

forward-looking statements. These statements are neither promises

nor guarantees, but involve known and unknown risks, uncertainties

and other important factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements, including, but not limited to, our

history of operating losses, our ability to manage our future

growth effectively, our ability to expand into additional markets,

our ability to maintain and strengthen our brand to generate and

maintain ongoing demand for our products, our ability to

cost-effectively attract new customers and retain our existing

customers, our failure to maintain product quality and product

performance at an acceptable cost, the impact of product liability

and warranty claims and product recalls, the highly competitive

market in which we operate, the use of social media and community

ambassadors, a decline in sales of our grills, our dependence on

three major retailers, risks associated with our international

operations, our reliance on a limited number of third-party

manufacturers and problems with (or loss of) our suppliers or an

inability to obtain raw materials, and the ability of our

stockholders to influence corporate matters and other important

factors discussed under the caption "Risk Factors" in our periodic

and current reports filed with the Securities and Exchange

Commission from time to time, including our Annual Report on Form

10-K for the year ended December 31, 2023, as updated by Part II,

Item 1A. "Risk Factors" of our Quarterly Report on Form 10-Q for

the period ended September 30, 2024. Any such forward-looking

statements represent management's estimates as of the date of this

press release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events cause our views to change.

___________________

1 There were no potentially dilutive securities outstanding as

of September 30, 2024 and 2023. 2 Reconciliations of GAAP to

non-GAAP financial measures, as well as definitions for the

non-GAAP financial measures included in this press release and the

reasons for their use, are presented below.

TRAEGER, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share amounts)

September 30,

2024

December 31,

2023

(unaudited)

ASSETS

Current Assets

Cash and cash equivalents

$

16,872

$

29,921

Accounts receivable, net

70,786

59,938

Inventories

105,058

96,175

Prepaid expenses and other current

assets

24,348

30,346

Total current assets

217,064

216,380

Property, plant, and equipment, net

38,241

42,591

Operating lease right-of-use assets

45,429

48,188

Goodwill

74,725

74,725

Intangible assets, net

438,922

470,546

Other non-current assets

3,695

8,329

Total assets

$

818,076

$

860,759

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities

Accounts payable

$

30,575

$

33,280

Accrued expenses

56,630

52,941

Line of credit

12,000

28,400

Current portion of notes payable

250

250

Current portion of operating lease

liabilities

3,744

3,608

Current portion of contingent

consideration

—

15,000

Other current liabilities

498

495

Total current liabilities

103,697

133,974

Notes payable, net of current portion

398,159

397,300

Operating leases liabilities, net of

current portion

27,574

29,142

Deferred tax liability

8,241

8,236

Other non-current liabilities

579

759

Total liabilities

538,250

569,411

Commitments and contingencies—See Note

10

Stockholders’ equity:

Preferred stock, $0.0001 par value;

25,000,000 shares authorized and no shares issued or outstanding as

of September 30, 2024 and December 31, 2023

—

—

Common stock, $0.0001 par value;

1,000,000,000 shares authorized

Issued and outstanding shares -

130,427,492 and 125,865,303 as of September 30, 2024 and December

31, 2023

13

13

Additional paid-in capital

956,195

935,272

Accumulated deficit

(681,927

)

(654,877

)

Accumulated other comprehensive income

5,545

10,940

Total stockholders’ equity

279,826

291,348

Total liabilities and stockholders’

equity

$

818,076

$

860,759

TRAEGER, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

(in thousands, except share

and per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

122,050

$

117,730

$

435,435

$

442,403

Cost of revenue

70,362

73,064

248,856

278,983

Gross profit

51,688

44,666

186,579

163,420

Operating expenses:

Sales and marketing

26,162

25,913

76,065

75,903

General and administrative

24,135

24,823

86,764

103,873

Amortization of intangible assets

8,819

8,889

26,456

26,666

Change in fair value of contingent

consideration

—

(2,300

)

—

508

Restructuring costs

—

225

—

225

Total operating expense

59,116

57,550

189,285

207,175

Loss from operations

(7,428

)

(12,884

)

(2,706

)

(43,755

)

Other income (expense):

Interest expense

(8,534

)

(7,517

)

(25,308

)

(23,408

)

Other income (expense), net

(3,964

)

1,992

993

8,020

Total other expense

(12,498

)

(5,525

)

(24,315

)

(15,388

)

Loss before provision (benefit) for income

taxes

(19,926

)

(18,409

)

(27,021

)

(59,143

)

Provision (benefit) for income taxes

(137

)

852

29

1,214

Net loss

$

(19,789

)

$

(19,261

)

$

(27,050

)

$

(60,357

)

Net loss per share, basic and diluted

$

(0.15

)

$

(0.16

)

$

(0.21

)

$

(0.49

)

Weighted average common shares

outstanding, basic and diluted

128,291,933

124,053,643

126,886,385

123,265,134

Other comprehensive income (loss):

Foreign currency translation

adjustments

$

25

$

(27

)

$

111

$

(24

)

Change in cash flow hedge

—

—

—

(2,088

)

Amortization of dedesignated cash flow

hedge

(1,456

)

(2,666

)

(5,506

)

(7,808

)

Total other comprehensive loss

(1,431

)

(2,693

)

(5,395

)

(9,920

)

Comprehensive loss

$

(21,220

)

$

(21,954

)

$

(32,445

)

$

(70,277

)

TRAEGER, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited)

Nine Months Ended September

30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES

Net loss

$

(27,050

)

$

(60,357

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation of property, plant and

equipment

10,139

11,204

Amortization of intangible assets

31,936

32,074

Amortization of deferred financing

costs

1,500

1,519

Loss on disposal of property, plant and

equipment

414

2,262

Stock-based compensation expense

23,064

47,180

Unrealized loss (gain) on derivative

contracts

7,526

(2,689

)

Amortization of dedesignated cash flow

hedge

(5,506

)

(7,808

)

Change in contingent consideration

(15,000

)

288

Other non-cash adjustments

1,425

141

Change in operating assets and

liabilities:

Accounts receivable

(10,851

)

(9,099

)

Inventories

(8,883

)

51,580

Prepaid expenses and other current

assets

2,596

(6,077

)

Other non-current assets

86

(393

)

Accounts payable and accrued expenses

5,020

(15,467

)

Other non-current liabilities

—

1

Net cash provided by operating

activities

16,416

44,359

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant, and

equipment

(10,034

)

(15,678

)

Capitalization of patent costs

(312

)

(373

)

Proceeds from sale of property, plant, and

equipment

113

2,925

Net cash used in investing activities

(10,233

)

(13,126

)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from line of credit

47,000

103,100

Repayments on line of credit

(63,400

)

(161,809

)

Repayments of long-term debt

(188

)

(188

)

Payment of deferred financing costs

(119

)

—

Principal payments on finance lease

obligations

(384

)

(386

)

Payments of acquisition related contingent

consideration

—

(12,225

)

Taxes paid related to net share settlement

of equity awards

(2,141

)

—

Net cash used in financing activities

(19,232

)

(71,508

)

Net decrease in cash, cash equivalents and

restricted cash

(13,049

)

(40,275

)

Cash, cash equivalents and restricted cash

at beginning of period

29,921

51,555

CASH AND CASH EQUIVALENTS AT END OF

PERIOD

$

16,872

$

11,280

TRAEGER, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

(Continued)

Nine Months Ended September

30,

2024

2023

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION:

Cash paid during the period for

interest

$

29,643

$

30,243

Income taxes paid, net of refunds

$

1,575

$

2,449

NON-CASH FINANCING AND INVESTING

ACTIVITIES

Equipment purchased under finance

leases

$

206

$

451

Property, plant, and equipment included in

accounts payable and accrued expenses

$

51

$

2,152

TRAEGER, INC. RECONCILIATIONS OF AND

OTHER INFORMATION REGARDING NON-GAAP FINANCIAL MEASURES

(unaudited)

In addition to our results and measures of performance

determined in accordance with U.S. GAAP, we believe that certain

non-GAAP financial measures are useful in evaluating and comparing

our financial and operational performance over multiple periods,

identifying trends affecting our business, formulating business

plans and making strategic decisions.

Each of Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted

Net Income (Loss) per share, Adjusted EBITDA Margin, and Adjusted

Net Income (Loss) Margin are key performance measures that our

management uses to assess our financial performance and are also

used for internal planning and forecasting purposes. We believe

that these non-GAAP financial measures are useful to investors and

other interested parties in analyzing our financial performance

because they provide a comparable overview of our operations across

historical periods. In addition, we believe that providing each of

Adjusted EBITDA and Adjusted Net Income (Loss), together with a

reconciliation of Net Loss to each such measure, and providing

Adjusted Net Income (Loss) per share, together with a

reconciliation of Net Loss per share to such measure, and Adjusted

EBITDA Margin and Adjusted Net Income (Loss) Margin, together with

a reconciliation of Net Loss Margin to such measures, helps

investors make comparisons between our company and other companies

that may have different capital structures, different tax rates,

and/or different forms of employee compensation. For example, due

to finite-lived intangible assets included on our balance sheet

following our corporate reorganization in 2017, we have significant

non-cash amortization expense attributable to the nature of our

capital structure.

Each of Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted

Net Income (Loss) per share, and Adjusted Gross Margin are used by

our management team as an additional measure of our performance for

purposes of business decision-making, including managing

expenditures, and evaluating potential acquisitions.

Period-to-period comparisons of Adjusted EBITDA, Adjusted Net

Income (Loss), Adjusted Net Income (Loss) per share, and Adjusted

Gross Margin help our management identify additional trends in our

financial results that may not be shown solely by period-to-period

comparisons of Net Loss or Loss from Continuing Operations or Net

Loss per share. In addition, we may use Adjusted EBITDA in the

incentive compensation programs applicable to some of our

employees. Each of Adjusted EBITDA, Adjusted Net Income (Loss),

Adjusted Net Income (Loss) per share, and Adjusted Gross Margin has

inherent limitations because of the excluded items, and may not be

directly comparable to similarly titled metrics used by other

companies.

The following table presents a reconciliation of Net Loss, Net

Loss Margin and Net Loss per share, the most directly comparable

financial measures calculated in accordance with U.S. GAAP, to

Adjusted Net Income (Loss), Adjusted EBITDA, Adjusted EBITDA Margin

and Adjusted Net Income (Loss) per share, respectively, on a

consolidated basis.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(dollars in thousands, except

share and per share amounts)

Net loss

$

(19,789

)

$

(19,261

)

$

(27,050

)

$

(60,357

)

Adjustments:

Other (income) expense (1)

2,419

(5,644

)

(7,131

)

(16,302

)

Restructuring costs (2)

—

225

—

225

Stock-based compensation

5,901

6,201

23,064

47,180

Non-routine legal expenses (3)

79

—

1,782

481

Amortization of acquisition intangibles

(4)

8,246

8,253

24,756

24,762

Change in fair value of contingent

consideration

—

(2,300

)

—

508

Other adjustment items (5)

—

—

—

669

Tax impact of adjusting items (6)

(4,268

)

(1,765

)

(10,880

)

(14,686

)

Adjusted net income (loss)

$

(7,412

)

$

(14,291

)

$

4,541

$

(17,520

)

Net loss

$

(19,789

)

$

(19,261

)

$

(27,050

)

$

(60,357

)

Adjustments:

Provision (benefit) for income taxes

(137

)

852

29

1,214

Interest expense

8,534

7,517

25,308

23,408

Depreciation and amortization

13,885

14,433

42,076

43,275

Other (income) expense (7)

3,875

(2,978

)

(1,625

)

(8,494

)

Restructuring costs (2)

—

225

—

225

Stock-based compensation

5,901

6,201

23,064

47,180

Non-routine legal expenses (3)

79

—

1,782

481

Change in fair value of contingent

consideration

—

(2,300

)

—

508

Other adjustment items (5)

—

—

—

669

Adjusted EBITDA

$

12,348

$

4,689

$

63,584

$

48,109

Revenue

$

122,050

$

117,730

$

435,435

$

442,403

Net loss margin

(16.2

)%

(16.4

)%

(6.2

)%

(13.6

)%

Adjusted net income (loss) margin

(6.1

)%

(12.1

)%

1.0

%

(4.0

)%

Adjusted EBITDA margin

10.1

%

4.0

%

14.6

%

10.9

%

Net loss per diluted share

$

(0.15

)

$

(0.16

)

$

(0.21

)

$

(0.49

)

Adjusted net income (loss) per diluted

share

$

(0.06

)

$

(0.12

)

$

0.04

$

(0.14

)

Weighted average common shares outstanding

- diluted

128,291,933

124,053,643

126,886,385

123,265,134

(1) Represents realized and unrealized gains (losses) on the

interest rate swap, including amortization of dedesignated cash

flow hedge, losses on the disposal of property, plant, and

equipment, as well as unrealized gains (losses) from foreign

currency transactions and derivatives. (2) Represents the final

costs related to the 2022 restructuring plan. (3) Represents loss

contingency and external legal costs incurred in connection with

the settlement and defense of a class action lawsuit and

intellectual property litigation. (4) Represents the amortization

expense associated with intangible assets recorded in connection

with the 2017 acquisition of Traeger Pellet Grills Holdings LLC.

(5) Represents non-routine operational wind-down costs. (6)

Represents the tax effect of non-GAAP adjustments calculated at an

estimated blended statutory tax rate of 25.6% for both the three

and nine months ended September 30, 2024, respectively, and

26.2% and 25.5% for both the three and nine months ended

September 30, 2023. The amounts for the three and nine months

ended September 30, 2023 have been adjusted to reflect the

application of the estimated blended statutory tax rates, as

opposed to effective income tax rates that were used in prior

periods, in order to include the current and deferred income tax

expenses that are commensurate with the non-GAAP measure of

profitability. (7) Represents realized and unrealized gains

(losses) on the interest rate swap, losses on the disposal of

property, plant, and equipment, as well as unrealized gains

(losses) from foreign currency transactions and derivatives.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106888047/en/

Investors: Nick Bacchus Traeger, Inc. investor@traeger.com

Media: The Brand Amp Traeger@thebrandamp.com

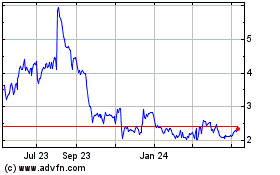

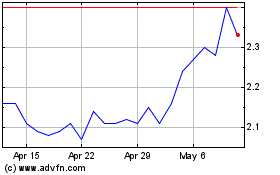

Traeger (NYSE:COOK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Traeger (NYSE:COOK)

Historical Stock Chart

From Dec 2023 to Dec 2024