false

0000095029

0000095029

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

October

31, 2024

STURM, RUGER & COMPANY, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation) |

001-10435

(Commission File Number) |

06-0633559

(IRS Employer Identification Number) |

| One Lacey Place, Southport, Connecticut |

06890 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(203) 259-7843

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

RGR |

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

On October 31, 2024, the Company hosted its post-earnings

release conference call and webcast to discuss our third quarter 2024 financial results. The transcript of the conference call and webcast

is included as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K (including

the exhibit) is furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This Report on Form 8-K will not

be deemed an admission as to the materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

The text included with this Report on Form 8-K

and the replay of the conference call and webcast on October 31, 2024, is available on our website located at Ruger.com/corporate, although

we reserve the right to discontinue that availability at any time.

Certain statements contained in this Report on

Form 8-K (including the exhibit) may be deemed to be forward-looking statements under federal securities laws, and we intend that such

forward-looking statements be subject to the safe harbor created thereby. Such forward-looking statements include, but are not limited

to, statements regarding market demand, sales levels of firearms, anticipated castings sales and earnings, the need for external financing

for operations or capital expenditures, the results of pending litigation against the Company, the impact of future firearms control and

environmental legislation, and accounting estimates. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date made. The Company undertakes no obligation to publish revised forward-looking statements to reflect events

or circumstances after the date such forward-looking statements are made or to reflect the occurrence of subsequent unanticipated events.

| Item 9.01 | Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

STURM, RUGER & COMPANY, INC. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ Thomas A. Dineen |

| |

|

Name: |

Thomas A. Dineen |

| |

|

Title: |

Principal Financial Officer, |

| |

|

|

Principal Accounting Officer, |

| |

|

|

Senior Vice President, Treasurer and |

| |

|

|

Chief Financial Officer |

Dated: November 1, 2024

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

CORPORATE PARTICIPANTS

| • | Christopher Killoy Sturm Ruger & Company Inc - President, Chief Executive Officer, Director |

| • | Kevin Reid Sturm Ruger & Company Inc - Vice President, General Counsel, Corporate Secretary |

| • | Thomas Dineen Sturm Ruger & Company Inc - Chief Financial Officer, Senior Vice President,

Treasurer |

CONFERENCE CALL PARTICIPANTS

| • | Mark Smith Lake Street Capital Markets - Analyst |

| • | Rommel Dionisio Aegis Capital - Analyst |

PRESENTATION

Operator

Good day and thank you for standing by. Welcome to the Q3 2024 Sturm,

Ruger earnings conference call. (Operator Instructions) Please be advised that today's conference is being recorded.

I would now like to hand the conference over to your first speaker

today, Chris Killoy, President and CEO. Please go ahead.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Good morning and welcome to the Sturm, Ruger & Company third-quarter

2024 conference call. I'll ask Kevin Reid, our General Counsel, to read the caution on forward-looking statements. Tom Dineen, our Chief

Financial Officer, will then give an overview of the third-quarter 2024 financial results, and then I will discuss our operations and

the market. After that, we'll get to your questions. Kevin?

Kevin Reid Sturm Ruger & Company Inc - Vice President, General

Counsel, Corporate Secretary

Thanks, Chris. We just want to remind everyone that statements made

in the course of this meeting that state the company's or management's intentions, hopes, beliefs, expectations, or predictions of the

future are forward-looking statements. It is important to note that the company's actual results could differ materially from those projected

in such forward-looking statements.

Additional information concerning factors that could cause actual results

to differ materially from those in the forward-looking statements is contained from time to time in the company's SEC filings, including,

but not limited to, the company's reports on Form 10-K for the year ended December 31, 2023, and of course, on the Form 10-Q for the third

quarter of 2024, which we filed last night. Copies of these documents may be obtained by contacting the company or the SEC or on the company

website at ruger.com/corporate or, of course, the SEC website at sec.gov.

We do reference non-GAAP EBITDA. Please note that the reconciliation

of GAAP net income to non-GAAP EBITDA can be found in our Form 10-K for the year ended December 31, 2023, and our Form 10-Q for the third

quarter of 2024, both of which are also posted to our website. Furthermore, the company disclaims all responsibility to update forward-looking

statements. Chris?

2

2

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thank you, Kevin. Now Tom will discuss the company's third-quarter

2024 results.

Thomas Dineen Sturm Ruger & Company Inc - Chief Financial

Officer, Senior Vice President, Treasurer

Thanks, Chris. For the third quarter of 2024, net sales were $122.3

million and diluted earnings were $0.28 per share. For the corresponding period in 2023, net sales were $120.9 million and diluted earnings

were $0.42 per share. For the nine months ended September 28, 2024, net sales were $389.9 million and diluted earnings were $1.15 per

share. For the corresponding period in 2023, net sales were $413.2 million and diluted earnings were $2.13 per share.

At September 28, 2024, our cash and short-term investments totaled

$96 million. Our short-term investments are invested in United States treasury bills and in a money market fund that invests exclusively

in United States treasury instruments, which mature within one year.

At September 28, 2024, our current ratio was 4.5:1, and we had no debt.

Stockholders' equity was $314.9 million, which equates to a book value of $18.76 per share, of which $5.72 was cash and short-term investments.

In the first nine months of 2024, we generated $35.5 million of cash from operations. Our year-to-date capital expenditures totaled $17.2

million. We expect our 2024 capital expenditures will total approximately $20 million.

In the first nine months of 2024, we returned $39.3 million to our

shareholders through the payment of $10 million of quarterly dividends and the repurchase of 699,000 shares of our common stock at an

average price of $41.99 per share for a total of $29.3 million.

Our Board of Directors declared an $0.11 per share quarterly dividend

for shareholders of record as of November 13, 2024, payable on November 27, 2024. As a reminder, our quarterly dividend is approximately

40% of net income and, therefore, varies quarter to quarter.

Our variable dividends -- our variable dividend strategy, coupled

with our strong debt-free balance sheet, allows us to continually and consistently provide returns to our shareholders without sacrificing

our ability to capitalize on opportunities that emerge. That's the financial update for the third quarter. Chris?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Tom. After a sluggish first half of the year, overall market

demand appeared to recover somewhat in the third quarter as NICS background checks, as adjusted by the National Shooting Sports Foundation,

increased by 4.5% from last year.

For the same period, the estimated unit sell-through of our products

from the independent distributors to retailers increased 9%, twice the rate of the NICS increase. For the first nine months of 2024, adjusted

NICS decreased 3%, while our estimated distributor sell-through increased 4%, again, outpacing NICS. These quarterly and year-to-date

metrics indicate that we likely picked up some market share.

That's not surprising given the strong demand for several of our product

families, including the American Rifle Generation II and Marlin lever-action rifles, coupled with increased production on these lines.

Furthermore, used gun sales appear to represent a larger percentage of overall retail firearm sales.

An increase in used gun sales is not unusual during tough economic

times like we are currently experiencing with decreased disposable income, high interest rates, and rising consumer debt. This would suggest

that our gains are perhaps even greater than the NICS data would indicate since NICS does not distinguish between used gun sales and new

gun sales.

The diversity of our products and the strong demand for several of

our product families has allowed us to grow without sacrificing our long-term focus or pricing discipline despite the current promotion-rich

environment.

Consequently, our finished goods inventory and our distributors' inventories

have decreased 125,000 units in the past year. We are well positioned to increase production entering the traditionally stronger fall

and winter selling season, allowing us to capitalize on the pent-up demand for some of our more sought-after products.

3

3

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

Developing innovative new products to drive growth, excitement, and

profitability is not new at Ruger. Rather, it has been the blueprint for our success since our inception in 1949. We are proud to have

introduced so many new offerings during our 75th anniversary, including the American Gen II family of rifles, the Marlin 1894, 1895, and

336 lever-action rifles, the LC Carbine chambered in 45 auto and the recently launched 10-millimeter auto, 75th anniversary models of

the Mark IV Target pistol, 10/22 rifles, LCP MAX pistol, the No. 1 rifle, and the Mini 14 with side-folding stock. And we will culminate

this milestone year with another exciting new product launch coming to a retailer near you.

New product sales totaled $113 million or 31% of firearm sales in the

first nine months of 2024. New product sales include only major new products that were introduced in the past two years. We remain focused

on the long-term goal of creating shareholder value.

Our disciplined pricing and promotion strategy may not always benefit

current period sales and profitability but instead enhances our long-term performance and promotes consistency throughout the distribution

channel, allowing both distributors and retailers to confidently invest in our inventory is essential to Ruger's long-term success and

leadership in the volatile firearms market.

Two weeks ago, we were thrilled to be recognized by our wholesale customers

with three industry awards at this year's NASGW Show in Kansas City, Missouri. We were named Firearm Manufacturer of the Year for the

second consecutive year and the 12th time in the last 15 years.

Additionally, the Ruger American Gen II rifle earned the NASGW POA

Caliber Awards for Best New Rifle and Best New Overall Product. I would also like to thank the NASGW Board of Directors for presenting

me with their Chairman's Award in recognition of my 35 years in the outdoor shooting sports industry.

It was truly an honor. I have been blessed with the opportunity to

work alongside and do business with so many great people over the years. I can't think of another industry where I would rather have spent

my career. It's been a great run.

Those are the highlights of the third quarter of 2024. Operator, may

we please have the first question?

QUESTIONS AND ANSWERS

Operator

(Operator Instructions) Mark Smith, Lake Street.

Mark Smith Lake Street Capital Markets - Analyst

Hi, guys. First question for me, and we've talked about this one before,

but I just wanted to discuss the big delta between ASP of orders versus orders still in the backlog, much higher price. Is this a function

of just timing on maybe building some rifles and shipping them? Or anything you can discuss to give us color on the difference between

those two numbers?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Mark. The biggest thing when we look at the products in the

backlog, the biggest impact there that drives that ASP up is the Marlins. Marlins are a much higher selling price. There's also a good

number of American Gen IIs but the biggest thing that skews that number north is the number of Marlins that are in that backlog.

Mark Smith Lake Street Capital Markets - Analyst

And are those rifles that you feel like you get out here in this important

fourth quarter and in time to get in consumers' hands for key hunting seasons? Or is this may be more delayed into '25 in building and

shipping a lot of those rifles?

4

4

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

A lot of them are go into 2025. We're going to maximize production

in Q4 for Marlin in particular. We're building more Marlins right now than we've ever built. The team down in Mayodan, North Carolina

is doing a great job maximizing production but making sure we don't sacrifice quality. So I suspect that will -- the backlog numbers

will continue into at least Q1 and Q2.

Mark Smith Lake Street Capital Markets - Analyst

Okay. And then as we look at gross profit margin during the quarter,

that being down. Was that really a function of mix and pricing of items that were shipped during the quarter?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

There's certainly some mix. I mean one of the things this year, we

didn't take an overall price increase based on the competition in the market. We also -- when we saw where the market was this year, we

made some strategic decisions on our 75th anniversary guns to implement some fairly sharp prices on those to make sure we get the volume.

And then the other thing, of course, is that these volume levels we're

at today versus several years ago, deleveraging those fixed costs is really the biggest factor when we look at that. The other thing

to remember in our third quarter, fewer workdays because we take the July shutdown, the 4th of July week always has a negative impact

on our Q3.

Mark Smith Lake Street Capital Markets - Analyst

Okay. And I think the last one for me, Chris, any comments just on

consumer demand, how it fits? I know you talked about in your commentary, I think used gun sales being up and that being a function of

where the consumer is at. But any additional insights you can give us on that? And then also the promotional environment.

You just discussed being -- I don't know if aggressive is the right

word but trying to price some of these anniversary items at the right level. As we rotate through these other items, do you feel like

you need to move and be more promotional to compete? Or do you feel like you're not seeing that pressure in the industry?

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

There's definitely pressure out there. We're seeing -- we just got

back from the NASGW Show where we're meeting with our wholesalers. We're looking at what's happening in the industry. We're seeing a lot

of rebates. If you look at the gun store calendar over the next month or so, you'll see a lot of rebates from manufacturers.

That's typically not where Ruger participates. Right now, I think we'll

get through Q4 without any aggressive promotional efforts. But we're keeping our powder dry. We -- that may change as we get into 2025.

Like I said, there's lots of capacity out there, particularly from

players that are maybe only one category deep. If all you're making is AR platform rifles, MSRs, so to speak, then you've got nowhere

to turn but to continue to discount.

In Ruger's case, the breadth of our product line and the variety of

products we offer help us -- keep us somewhat insulated from having to defend market share in one single category. So we're going to

stay disciplined, keep the powder dry and continue to do our best to drive innovation with some really exciting new products, one of

which you'll see in just a couple of weeks, and we're very, very excited about.

Mark Smith Lake Street Capital Markets - Analyst

Excellent. Looking forward to it.

5

5

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Mark.

Operator

Rommel Dionisio, Aegis Capital.

Rommel Dionisio Aegis Capital - Analyst

Hi. Good morning. Thanks for taking my question. Chris, I wonder if

we could just get your perspective on the competitive promotional environment a bit. I mean, obviously, this is a cyclical industry over

the years. But while demand hasn't been particularly robust for several quarters, it's been somewhat stable.

Is there -- do you think this is maybe more of a permanent thing in

the industry that we're seeing just because, again, there's been some stability in the industry. Is there oversupply? I mean I'd just

love to hear your general thoughts on why promotions are continuing for such a fairly extended period of time at this point. Thanks.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Rommel. Good question. We were just talking about this with

our own team this week. And one of the things I think we've seen is one of the industry gun writers turned the phrase crisis fatigue.

And perhaps our customer base is not going out in an election year, for example, and buying more rifles like they might have in previous

election cycles. We certainly didn't see an uptick in demand there.

We do think there is quite a bit of capacity out there. Some manufacturers

have not slowed down. They've probably over inventoried at their location. They've got their wholesalers and retailers perhaps over inventoried.

So that results in some of that discounting. I think as we look at

2025 and look at absent any artificial stimulation in demand, I think it's pretty stable. I mean I think you're right, it's a stable environment

but we're going to see these upticks from quarter to quarter.

I think right now, what we're looking at in 2025, I wish my crystal

ball was clearer but we're planning to be aggressive with our new products. We know, in Ruger's case, we're far better off trying to gain

market share and take business based on exciting new product launches rather than trying to discount our way to success.

And in our case, we've got the American centerfire Gen II family of

rifles is off to a great start. Marlins, of course, continue to be a big driver for us. But the Gen II American centerfire rifles in particular,

have really hit a home run. We heard that loud and clear from our distributors. We certainly saw the impact with some of our competitors

that are scrambling to do rebates and things like that.

But the Gen II American family of rifles is going to continue to grow,

and we're very excited about that. And like I said, we've got a very exciting fourth quarter launch coming up that I think is going to

be very strong for Ruger, and we're going to try to do our best to take market share in the old-fashioned way by exciting new products

and not discount our way.

Rommel Dionisio Aegis Capital - Analyst

Great. Okay. We look forward to hearing more about that. Just maybe

a follow-up. The -- obviously, there were a lot of moving parts during the pandemic and all that.

What -- are there any other big picture items that you see moving

around, whether that's participation or more first-time shooters, women in the marketplace that -- some of those bigger picture items

that you're seeing change around here these last few quarters? Thanks.

6

6

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Good question. We did gain a lot of new customers, the entire industry

did during the pandemic. It's incumbent upon us to turn those first-time buyers into lifelong customers. And we've been trying to do that,

particularly with some of our exciting offerings in things like the Mark IV pistols, the 10/22s and things like to target some of the

niches, like you mentioned, our female customers or frankly, some of our older customers who may not have the hand strength they once

did, products like the Security-380, which have done extremely well, have a much easier to manipulate slide and easier to control in the

fairly comfortable to shoot 380 ACP caliber. We're going to continue to go after those new customers, those niche customers and try to

grow that again with our new products and some of our product variations.

We've been very successful this year with, like I said, particularly

the Mark IV and 10/22s using the 22 long rifle caliber. They are a lot of fun at the range and a great way to hang on to those new customers

that may have been a onetime purchaser they thought when they bought a gun for home or personal protection during the pandemic. But if

we can get a Mark IV pistol or a 10/22 rifle into their hands, they're going to become a lifelong customer and a lifelong participant

in the shooting sports.

Rommel Dionisio Aegis Capital - Analyst

Great. Thanks very much for the insights.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

Thanks, Rommel.

Operator

Thank you. And I'm showing no further questions at this time. So I

would like to turn it back to Chris Killoy, President and CEO, for closing remarks.

Christopher Killoy Sturm Ruger & Company Inc - President,

Chief Executive Officer, Director

I would like to thank all of you for attending this call, especially

our shareholders. I want to mention two important upcoming dates. Next Tuesday is election day. As we head into an uncertain global, political,

and economic future, your voice of the polls is of great importance. Please educate yourself on the issues that are important to you,

learn about the candidates, and vote.

And the following Monday, November 11, is Veterans Day. Without the

sacrifice of those who served our great country, we wouldn't have the ability to exercise our many freedoms, including the right to vote.

Please take a moment to say a quick prayer of thanks to all the brave service men and service women who fought to attain and protect these

rights for all of us.

We thank all veterans, especially the veteran members of the Ruger

family for their service and sacrifice to our country. And I would like to thank our loyal customers and our 1,800 hardworking members

of the Ruger team who design, build, and sell rugged, reliable firearms.

We look forward to speaking with you at our next quarterly call in

February. Thank you.

Operator

Thank you for your participation in today's conference. This does conclude

the program. You may now disconnect.

7

7

| October 31, 2024 / 1:00PM UTC, Q3 2024 Sturm Ruger & Company Inc Earnings Call |

DISCLAIMER

The London Stock Exchange Group and its affiliates (collectively, "LSEG")

reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person

of such changes. No content may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database

or retrieval system, without the prior written permission of LSEG. The content shall not be used for any unlawful or unauthorized purposes.

LSEG does not guarantee the accuracy, completeness, timeliness or availability of the content. LSEG is not responsible for any errors

or omissions, regardless of the cause, for the results obtained from the use of the content. In no event shall LSEG be liable to any party

for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees,

or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection

with any use of the content even if advised of the possibility of such damages.

In the conference calls upon which Summaries are based, companies may

make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current

expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement

based on a number of important factors and risks, which are more specifically identified in the companies’ most recent SEC filings.

Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of

the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking

statements will be realized.

LSEG assumes no obligation to update the content following publication

in any form or format. The content should not be relied on and is not a substitute for the skill, judgment and experience of the user,

its management, employees, advisors and/or clients when making investment and other business decisions. LSEG does not act as a fiduciary

or an investment advisor except where registered as such.

THE INFORMATION CONTAINED IN TRANSCRIPT SUMMARIES REFLECTS LSEG'S SUBJECTIVE

CONDENSED PARAPHRASE OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING

OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES LSEG OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR

OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY SUMMARY. USERS ARE ADVISED TO REVIEW THE APPLICABLE

COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

Copyright ©2024 LSEG. All Rights Reserved.

8

8

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

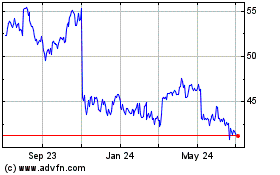

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

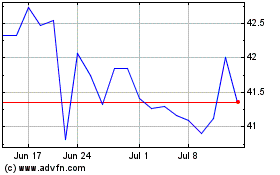

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Dec 2023 to Dec 2024