Delivers Results In-Line with Expectations

Increases Merchandise Margin Rate and Average

Transaction Value

Reiterates Fiscal 2025 Guidance

Signet Jewelers Limited (“Signet” or the "Company") (NYSE:SIG),

the world's largest retailer of diamond jewelry, today announced

its results for the 13 weeks ended August 3, 2024 (“second quarter

Fiscal 2025”).

"I’d like to thank our Signet team for delivering our fifth

consecutive quarter of sequential same store sales improvement, up

more than 5 points compared to the first quarter of this year and

turning positive third quarter to date. Our strategy to accelerate

new merchandise at the right price points is capturing customer

demand and driving merchandise margin expansion,” said Signet Chief

Executive Officer Virginia C. Drosos. “Both the internal and

external metrics we track indicate increasing engagements as we

head into the back-half of the year. This combined with growth in

new high margin fashion merchandise and services gives us

confidence in delivering our annual guidance."

"Our strategy of balancing new merchandise, competitive pricing,

and sourcing savings drove merchandise margin expansion of 120

basis points and an increase in average transaction value compared

to this time last year,” said Joan Hilson, Chief Financial,

Strategy & Services Officer. “In addition to continuing this

strategy, our fiscal year guidance includes an increase in cost

savings, now up to $200 million for the year, which we believe

provides for flexibility in a competitive environment in the

back-half."

Second Quarter Fiscal 2025 Highlights:

- Sales of $1.5 billion, down $122.6 million or 7.6% (down

7.6%(1) on a constant currency basis) to Q2 of FY24.

- Same store sales (“SSS”)(2) down 3.4% to Q2 of FY24.

- Gross Margins expanded 10 basis points to 38.0% of sales.

- Operating loss of $100.9 million, down from operating income of

$90.2 million in Q2 of FY24, due to $166 million of non-cash

impairment charges substantially related to Digital Banners

goodwill and the Blue Nile trade name.

- Adjusted operating income(1) of $68.6 million, down from $102.7

million in Q2 of FY24.

- Diluted loss per share of $2.28, compared to diluted earnings

per share ("EPS") of $1.38 in Q2 of FY24. The current quarter

diluted loss per share includes $3.73 of non-cash impairment

charges referenced above.

- Adjusted diluted EPS(1) of $1.25, compared to $1.55 in Q2 of

FY24.

- Cash and cash equivalents, at quarter end, of $403.1 million,

compared to $690.2 million in Q2 of FY24.

- Repurchased $39.8 million, or approximately 441,000 common

shares, during the second quarter.

(1)

See the non-GAAP financial measures

section below.

(2)

Same store sales include physical stores

and eCommerce sales. As described further below, Fiscal 2025 Q2

same store sales have been calculated by aligning the sales weeks

of the current quarter to the equivalent sales weeks in the prior

fiscal year period.

(in millions, except per share

amounts)

Fiscal 25 Q2

Fiscal 24 Q2

YTD Fiscal 2025

YTD Fiscal 2024

Sales

$

1,491.0

$

1,613.6

$

3,001.8

$

3,281.6

SSS % change (1) (2)

(3.4

)%

(12.0

)%

(6.2

)%

(13.0

)%

GAAP

Operating (loss) income

$

(100.9

)

$

90.2

$

(51.1

)

$

191.9

Operating margin

(6.8

)%

5.6

%

(1.7

)%

5.8

%

Diluted EPS (loss per share)

$

(2.28

)

$

1.38

$

(3.17

)

$

3.17

Adjusted (3)

Adjusted operating income

$

68.6

$

102.7

$

126.4

$

209.2

Adjusted operating margin

4.6

%

6.4

%

4.2

%

6.4

%

Adjusted diluted EPS

$

1.25

$

1.55

$

2.35

$

3.33

(1)

Same store sales include physical stores

and eCommerce sales.

(2)

The 53rd week in Fiscal 2024 has resulted

in a shift as the current fiscal year began a week later than the

previous fiscal year. As such, same store sales for Fiscal 2025

have been calculated by aligning the sales weeks of the current

quarter and year to date periods to the equivalent sales weeks in

the prior fiscal year. Total reported sales continue to be

calculated based on the reported fiscal periods.

(3)

See non-GAAP financial measures below.

Second Quarter Fiscal 2025 Results:

Change from previous

year

Second Quarter Fiscal 2025

Same store

sales(1)

Non-same store

sales, net

Total sales at

constant exchange rate(2)

Exchange

translation impact

Total sales as

reported

Total sales (in

millions)

North America segment

(3.7

)%

(3.1

)%

(6.8

)%

(0.1

)%

(6.9

)%

$

1,397.6

International segment

1.7

%

(17.5

)%

(15.8

)%

0.6

%

(15.2

)%

$

86.5

Other segment (3)

nm

nm

nm

nm

nm

$

6.9

Signet

(3.4

)%

(4.2

)%

(7.6

)%

—

%

(7.6

)%

$

1,491.0

(1)

As noted above, Fiscal 2025 Q2 same store

sales have been calculated by aligning the sales weeks of the

current quarter to the equivalent sales weeks in the prior fiscal

year period.

(2)

See non-GAAP financial measures below.

(3)

Includes sales from Signet’s diamond

sourcing operation.

nm Not meaningful.

By reportable segment:

North America

- Total sales of $1.4 billion, down $103.5 million or 6.9% to Q2

of FY24 reflecting an increase of 1.6% in total average transaction

value ("ATV"), on a lower number of transactions.

- SSS declined 3.7% compared to Q2 of FY24.

International

- Total sales of $86.5 million, down $15.5 million or 15.2% to Q2

of FY24 (down 15.8% on a constant currency basis) reflecting a

decrease of 13.4% in total ATV driven by the previously announced

sale of prestige watch locations, as well as a lower number of

transactions.

- SSS increased 1.7% compared to Q2 of FY24.

Gross margin was $566.3 million, down from $610.8 million in Q2

of FY24. Gross margin was 38.0% of sales, 10 basis points

improvement to Q2 of FY24 driven by a 120 basis point merchandise

margin improvement from a higher mix of Services and Fashion

revenue, partially offset by deleveraging of fixed costs such as

store occupancy.

SG&A was $498.4 million, down from $511.2 million in Q2 of

FY24. SG&A was 33.4% of sales, 170 basis points higher versus

Q2 of FY24. The change in SG&A as a percentage of sales was

primarily driven by deleverage of fixed costs.

Operating loss was $100.9 million or (6.8)% of sales, compared

to operating income of $90.2 million, or 5.6% of sales in Q2 of

FY24. The operating loss was due to the impairment charges at the

Digital Banners referenced above. The impairment of the Digital

Banners was substantially caused by the on-going challenges from

the Blue Nile integration, the lag in engagement recovery, and to a

much lesser degree, impacts from market declines in lab created

diamond pricing. Notably, Digital Banners bridal penetration of

over 80% is more than four times the industry average.

Adjusted operating income was $68.6 million, or 4.6% of sales,

compared to $102.7 million, or 6.4% of sales in Q2 of FY24.

Second quarter Fiscal

2025

Second quarter Fiscal

2024

Operating (loss) income in

millions

$

% of sales

$

% of sales

North America segment

$

(77.2

)

(5.5

)%

$

117.1

7.8

%

International segment

(4.2

)

(4.9

)%

(7.0

)

(6.9

)%

Other segment

(2.6

)

nm

(1.0

)

nm

Corporate and unallocated expenses

(16.9

)

nm

(18.9

)

nm

Total operating (loss) income

$

(100.9

)

(6.8

)%

$

90.2

5.6

%

Second quarter Fiscal

2025

Second quarter Fiscal

2024

Adjusted operating income in millions

(1)

$

% of sales

$

% of sales

North America segment

$

90.1

6.4

%

$

129.6

8.6

%

International segment

(2.0

)

(2.3

)%

(7.0

)

(6.9

)%

Other segment

(2.6

)

nm

(1.0

)

nm

Corporate and unallocated expenses

(16.9

)

nm

(18.9

)

nm

Total adjusted operating income

$

68.6

4.6

%

$

102.7

6.4

%

(1) See non-GAAP financial measures

below.

nm Not meaningful.

The current quarter income tax expense was $1.6 million compared

to income tax expense of $17.2 million in Q2 of FY24. Adjusted

income tax expense was $13.3 million compared to $20.4 million in

Q2 of FY24.

Diluted loss per share was $2.28, down from diluted EPS of $1.38

in Q2 of FY24. Diluted loss per share in the current quarter

primarily includes $3.73 of asset impairment charges. Excluding

these charges (and related tax effects), diluted EPS was $1.25 on

an adjusted basis.

The preferred shares had no impact on either diluted loss per

share or adjusted diluted EPS for the second quarter of Fiscal

2025.

Balance Sheet and Statement of Cash Flows Highlights:

Year to date cash used in operating activities was $114.4

million compared to cash used in operating activities of $253.3

million in Q2 of FY24. Cash and cash equivalents were $403.1

million as of quarter end, compared to $690.2 million in Q2 of FY24

due to $689 million of cash outlays to redeem preferred shares and

retire unsecured notes over the last 12 months. Inventory ended the

quarter at $2.0 billion, down $116.7 million or 5.6% to Q2 of FY24,

driven by Signet's demand planning efforts and life cycle

management.

In May, Leonard Green Partners elected to redeem 100,000 of the

remaining 312,500 preferred shares for approximately $129.0

million, bringing the total number of preferred shares retired to

412,500. As of today, 212,500 preferred shares remain

outstanding.

The Company ended the second quarter with an Adjusted Debt to

Adjusted EBITDAR ratio of 2.0x on a trailing 12-month basis, well

below the stated goal of at or below 2.5x, and was 1.7x on an

Adjusted Net Debt basis. Net Debt to Adjusted EBITDA was (0.2)x on

a trailing 12-month basis.

Subsequent to quarter end, the Company completed a three-year

extension of its asset backed loan facility, now scheduled to

mature on August 23rd, 2029. The agreement also amends the total

facility to $1.2 billion to align with Signet’s lower inventory

base. The Company believes this facility will cover liquidity needs

for the next 5 years at attractive terms, providing flexibility on

capital priorities which include retiring the remainder of the

convertible preferred shares.

Capital Returns to Shareholders:

Signet's Board of Directors has declared a quarterly cash

dividend on common shares of $0.29 per share for the third quarter

of Fiscal 2025, payable November 22, 2024 to shareholders of record

on October 25, 2024, with an ex-dividend date of October 25,

2024.

In the second quarter Signet repurchased approximately 441,000

common shares at an average cost per share of $90.35, or $39.8

million. The Company had approximately $813.8 million in share

repurchase authorization remaining at the end of the second

quarter.

Third Quarter and Full Year Fiscal 2025 Guidance:

Third Quarter

Total sales

$1.345 billion to $1.380

billion

Same store sales

(1.0%) to +1.5%

Adjusted operating income (1)

$8 million to $25 million

Adjusted EBITDA (1)

$55 million to $72 million

(1) See description of non-GAAP financial

measures below.

Forecasted adjusted operating income and

adjusted EBITDA exclude potential non-recurring charges, such as

restructuring charges, asset impairments or integration-related

costs. However, given the potential impact of non-recurring charges

to the GAAP operating income, we cannot provide forecasted GAAP

operating income or the probable significance of such items without

unreasonable efforts. As such, we do not present a reconciliation

of forecasted adjusted operating income or adjusted EBITDA to

corresponding forecasted GAAP amounts.

Fiscal 2025

Total sales

$6.66 billion to $7.02

billion

Same store sales

(4.5%) to +0.5%

Adjusted operating income (1)

$590 million to $675 million

Adjusted EBITDA (1)

$780 million to $865 million

Adjusted diluted EPS (1)

$9.90 to $11.52

(1) See description of non-GAAP financial

measures below.

Forecasted adjusted operating income,

adjusted EBITDA and adjusted diluted EPS provided above exclude

potential non-recurring charges, such as restructuring charges,

asset impairments or integration-related costs. However, given the

potential impact of non-recurring charges to the GAAP operating

income and diluted EPS, we cannot provide forecasted GAAP operating

income or diluted EPS or the probable significance of such items

without unreasonable efforts. As such, we do not present a

reconciliation of forecasted adjusted operating income, adjusted

EBITDA and adjusted diluted EPS to corresponding forecasted GAAP

amounts.

The Company's Fiscal 2025 guidance is based on the following

assumptions:

- Engagements to increase by up to 5% in Fiscal 2025; however,

Signet's guidance accommodates a range of engagements from (5%) to

+5%. The Company's Q3 to-date engagement units are positive year on

year.

- Fashion sales to be more robust based on recent trends and a

modest improvement in the Digital Banners combine to offset the

slower than expected engagement recovery.

- Up to $200 million in cost savings initiatives in Fiscal 2025,

up from our previous expectations of $150 million to $180

million.

- Capital expenditures of approximately $160 million to $180

million.

- Annual tax rate of 19% to 20% excludes potential discrete

items.

- Up to $1.1 billion allocated to retirement of debt, redemption

of preferred shares and open-market common share repurchases in

Fiscal 2025.

- Approximately $225 million in non-comparable sales headwinds

reflecting over $100 million from the 53rd week in Fiscal 2024,

approximately $75 million in the UK from the sale of previously

announced prestige watch locations in the UK and up to 30 Ernest

Jones store closures, and approximately $50 million from total

store closures in North America in Fiscal 2024 and Fiscal

2025.

- Net square footage decline of 1% to flat for the year.

Our Purpose and Sustainable Growth:

Signet’s banner, Zales, continued their partnership with the

Black College Football Hall of Fame (BCFHOF) as the official

jeweler, further strengthening their support for Historically Black

Colleges and Universities (HBCUs). Zales exclusively created

ceremonial rings for the Hall of Fame inductees. The 2024 inductees

were presented their custom rings in June at the induction ceremony

for the College Football Hall of Fame in Atlanta, Georgia. In

addition to the rings, Zales participated in the Hall of Fame

Classic kick-off reception and career fair, which took place in

late August at the Pro Football Hall of Fame, in Canton, Ohio,

furthering its commitment to be an inclusive employer of

choice.

Conference Call:

A conference call is scheduled for September 12, 2024 at 8:30

a.m. ET and a simultaneous audio webcast is available at

www.signetjewelers.com.

The call details are: Toll Free – North America +1 800 549 8228

Local – Toronto +1 289 819 1520 Conference ID 97777 Registration

for the listen-only webcast is available at the following link:

https://events.q4inc.com/attendee/463875715

A replay and transcript of the call will be posted on Signet's

website as soon as they are available and will be accessible for

one year.

About Signet and Safe Harbor Statement:

Signet Jewelers Limited is the world's largest retailer of

diamond jewelry. As a Purpose-driven and sustainability-focused

company, Signet is a participant in the United Nations Global

Compact and adheres to its principles-based approach to responsible

business. Signet operates approximately 2,700 stores primarily

under the name brands of Kay Jewelers, Zales, Jared, Banter by

Piercing Pagoda, Diamonds Direct, Blue Nile, James Allen, Rocksbox,

Peoples Jewellers, H. Samuel, and Ernest Jones. Further information

on Signet is available at www.signetjewelers.com. See also

www.kay.com, www.zales.com, www.jared.com, www.banter.com,

www.diamondsdirect.com, www.bluenile.com, www.jamesallen.com,

www.rocksbox.com, www.peoplesjewellers.com, www.hsamuel.co.uk,

www.ernestjones.co.uk.

This release contains statements which are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based upon management's

beliefs and expectations as well as on assumptions made by and data

currently available to management, appear in a number of places

throughout this document and include statements regarding, among

other things, results of operations, financial condition,

liquidity, prospects, growth, strategies and the industry in which

we operate. The use of the words "expects," "intends,"

"anticipates," "estimates," "predicts," "believes," "should,"

"potential," "may," "preliminary," "forecast," "objective," "plan,"

or "target," and other similar expressions are intended to identify

forward-looking statements. These forward-looking statements are

not guarantees of future performance and are subject to a number of

risks and uncertainties which could cause the actual results to not

be realized, including, but not limited to: difficulty or delay in

executing or integrating an acquisition, including Diamonds Direct

and Blue Nile; executing other major business or strategic

initiatives, such as expansion of the services business or

realizing the benefits of our restructuring plans; the impact of

the Israel-Hamas conflict on the operations of our quality control

and technology centers in Israel; the negative impacts that public

health crisis, disease outbreak, epidemic or pandemic has had, and

could have in the future, on our business, financial condition,

profitability and cash flows, including without limitation risks

relating to shifts in consumer spending away from the jewelry

category, trends toward more experiential purchases such as travel,

disruptions in the dating cycle caused by the COVID-19 pandemic and

the pace at which such impacts on engagements are expected to

recover, and the Company’s ability to capture market share of the

bridal category upon the recovery of engagements; general economic

or market conditions, including impacts of inflation or other

pricing environment factors on our commodity costs (including

diamonds) or other operating costs; a prolonged slowdown in the

growth of the jewelry market or a recession in the overall economy;

financial market risks; a decline in consumer discretionary

spending or deterioration in consumer financial position;

disruptions in our supply chain; our ability to attract and retain

labor; our ability to optimize our transformation strategies;

changes to regulations relating to customer credit; disruption in

the availability of credit for customers and customer inability to

meet credit payment obligations, which has occurred and may

continue to deteriorate; our ability to achieve the benefits

related to the outsourcing of the credit portfolio, including due

to technology disruptions and/or disruptions arising from changes

to or termination of the relevant outsourcing agreements, as well

as a potential increase in credit costs due to the current interest

rate environment; deterioration in the performance of individual

businesses or of our market value relative to its book value,

resulting in further impairments of long-lived assets or intangible

assets or other adverse financial consequences; the volatility of

our stock price; the impact of financial covenants, credit ratings

or interest volatility on our ability to borrow; our ability to

maintain adequate levels of liquidity for our cash needs, including

debt obligations, payment of dividends, planned share repurchases

(including future Preferred Share conversions, execution of

accelerated share repurchases and the payment of related excise

taxes) and capital expenditures as well as the ability of our

customers, suppliers and lenders to access sources of liquidity to

provide for their own cash needs; potential regulatory changes;

future legislative and regulatory requirements in the US and

globally relating to climate change, including any new climate

related disclosure or compliance requirements, such as those

recently issued in the state of California or adopted by the SEC;

exchange rate fluctuations; the cost, availability of and demand

for diamonds, gold and other precious metals, including any impact

on the global market supply of diamonds due to the ongoing

Israel-Hamas conflict, the potential sale or divestiture of the De

Beers Diamond Company and its diamond mining operations by parent

company Anglo-American plc, and the ongoing Russia-Ukraine conflict

or related sanctions; stakeholder reactions to disclosure regarding

the source and use of certain minerals; scrutiny or detention of

goods produced in certain territories resulting from trade

restrictions; seasonality of our business; the merchandising,

pricing and inventory policies followed by us and our ability to

manage inventory levels; our relationships with suppliers including

the ability to continue to utilize extended payment terms and the

ability to obtain merchandise that customers wish to purchase; the

failure to adequately address the impact of existing tariffs and/or

the imposition of additional duties, tariffs, taxes and other

charges or other barriers to trade or impacts from trade relations;

the level of competition and promotional activity in the jewelry

sector; our ability to optimize our multi-year strategy to gain

market share, expand and improve existing services, innovate and

achieve sustainable, long-term growth; the maintenance and

continued innovation of our OmniChannel retailing and ability to

increase digital sales, as well as management of digital marketing

costs; changes in consumer attitudes regarding jewelry and failure

to anticipate and keep pace with changing fashion trends; changes

in the costs, retail prices, supply and consumer acceptance of, and

demand for gem quality lab-created diamonds and adequate

identification of the use of substitute products in our jewelry;

ability to execute successful marketing programs and manage social

media; the ability to optimize our real estate footprint, including

operating in attractive trade areas and accounting for changes in

consumer traffic in mall locations; the performance of and ability

to recruit, train, motivate and retain qualified team members -

particularly in regions experiencing low unemployment rates;

management of social, ethical and environmental risks; ability to

deliver on our environmental, social and governance goals; the

reputation of Signet and its banners; inadequacy in and disruptions

to internal controls and systems, including related to the

migration to new information technology systems which impact

financial reporting; risks associated with the Company’s use of

artificial intelligence; security breaches and other disruptions to

our or our third-party providers’ information technology

infrastructure and databases; an adverse development in legal or

regulatory proceedings or tax matters, including any new claims or

litigation brought by employees, suppliers, consumers or

shareholders, regulatory initiatives or investigations, and ongoing

compliance with regulations and any consent orders or other legal

or regulatory decisions; failure to comply with labor regulations;

collective bargaining activity; changes in corporate taxation

rates, laws, rules or practices in the US and other jurisdictions

in which our subsidiaries are incorporated, including developments

related to the tax treatment of companies engaged in Internet

commerce or deductions associated with payments to foreign related

parties that are subject to a low effective tax rate; risks related

to international laws and Signet being a Bermuda corporation; risks

relating to the outcome of pending litigation; our ability to

protect our intellectual property or assets including cash which

could be affected by failure of a financial institution or

conditions affecting the banking system and financial markets as a

whole; changes in assumptions used in making accounting estimates

relating to items such as extended service plans; or the impact of

weather-related incidents, natural disasters, organized crime or

theft, increased security costs, strikes, protests, riots or

terrorism, acts of war (including the ongoing Russia-Ukraine and

Israel-Hamas conflicts), or another public health crisis or disease

outbreak, epidemic or pandemic on our business.

For a discussion of these and other risks and uncertainties

which could cause actual results to differ materially from those

expressed in any forward looking statement, see the “Risk Factors”

and “Forward-Looking Statements” sections of Signet’s Fiscal 2024

Annual Report on Form 10-K filed with the SEC on March 21, 2024 and

quarterly reports on Form 10-Q and the “Safe Harbor Statements” in

current reports on Form 8-K filed with the SEC. Signet undertakes

no obligation to update or revise any forward-looking statements to

reflect subsequent events or circumstances, except as required by

law.

Non-GAAP Financial Measures

In addition to reporting the Company's financial results in

accordance with generally accepted accounting principles ("GAAP"),

the Company reports certain financial measures on a non-GAAP basis.

The Company believes that non-GAAP financial measures, when

reviewed in conjunction with GAAP financial measures, can provide

more information to assist investors in evaluating historical

trends and current period performance and liquidity. These non-GAAP

financial measures should be considered in addition to, and not

superior to or as a substitute for, the GAAP financial measures

presented in this earnings release and the Company’s condensed

consolidated financial statements and other publicly filed reports.

In addition, our non-GAAP financial measures may not be the same as

or comparable to similar non-GAAP measures presented by other

companies.

The Company previously referred to certain non-GAAP measures as

non-GAAP operating income, non-GAAP operating margin and non-GAAP

diluted EPS. Beginning in Fiscal 2025, these non-GAAP measures are

now referred to as adjusted operating income, adjusted operating

margin and adjusted diluted EPS, respectively. There have been no

changes to how these non-GAAP measures are defined or reconciled to

the most directly comparable GAAP measures.

The Company reports the following non-GAAP financial measures:

sales changes on a constant currency basis, free cash flow,

adjusted operating income, adjusted operating margin, adjusted

diluted earnings per share ("EPS"), adjusted earnings before

interest, income taxes, depreciation and amortization (“adjusted

EBITDA”) and adjusted EBITDAR, and the debt and net debt leverage

ratios, including on an adjusted basis.

The Company provides the year-over-year change in total sales

excluding the impact of foreign currency fluctuations to provide

transparency to performance and enhance investors’ understanding of

underlying business trends. The effect from foreign currency,

calculated on a constant currency basis, is determined by applying

current year average exchange rates to prior year sales in local

currency.

Free cash flow is a non-GAAP measure defined as the net cash

provided by (used in) operating activities less purchases of

property, plant and equipment. Management considers this metric to

be helpful in understanding how the business is generating cash

from its operating and investing activities that can be used to

meet the financing needs of the business. Free cash flow is an

indicator frequently used by management to evaluate its overall

liquidity needs and determine appropriate capital allocation

strategies. Free cash flow does not represent the residual cash

flow available for discretionary purposes.

Adjusted operating income is a non-GAAP measure defined as

operating income excluding the impact of certain items which

management believes are not necessarily reflective of normal

operational performance during a period. Management finds the

information useful when analyzing operating results to

appropriately evaluate the performance of the business without the

impact of these certain items. Management believes the

consideration of measures that exclude such items can assist in the

comparison of operational performance in different periods which

may or may not include such items. Management also utilizes

adjusted operating margin, defined as adjusted operating income as

a percentage of total sales, to further evaluate the effectiveness

and efficiency of the Company’s flexible operating model.

Adjusted diluted EPS is a non-GAAP measure defined as diluted

EPS excluding the impact of certain items which management believes

are not necessarily reflective of normal operational performance

during a period. Management finds the information useful when

analyzing financial results in order to appropriately evaluate the

performance of the business without the impact of these certain

items. In particular, management believes the consideration of

measures that exclude such items can assist in the comparison of

performance in different periods which may or may not include such

items. The Company estimates the tax effect of all non-GAAP

adjustments by applying a statutory tax rate to each item. The

income tax items are used to estimate adjusted income tax expense

and represent the discrete amount that affected the diluted EPS

during the period.

Adjusted EBITDA is a non-GAAP measure, defined as earnings

before interest and income taxes, depreciation and amortization,

share-based compensation expense, other non-operating expense, net

and certain non-GAAP accounting adjustments. Adjusted EBITDAR takes

this adjusted EBITDA and further excludes minimum fixed rent

expense for properties occupied under operating leases. Adjusted

EBITDA and Adjusted EBITDAR are considered important indicators of

operating performance as they exclude the effects of financing and

investing activities by eliminating the effects of interest,

depreciation and amortization costs and certain accounting

adjustments.

The debt and net debt leverage ratios are non-GAAP measures

calculated by dividing Signet’s debt or net debt by adjusted

EBITDA. Debt as used in these ratios is defined as current or

long-term debt recorded in the condensed consolidated balance sheet

plus Preferred Shares. Net debt as used in these ratios is debt

less the cash and cash equivalents on hand as of the balance sheet

date. The adjusted debt and adjusted net debt leverage ratios are

non-GAAP measures calculated by dividing Signet’s adjusted debt or

adjusted net debt by adjusted EBITDAR. Adjusted debt is a non-GAAP

measure defined as debt recorded in the condensed consolidated

balance sheets, plus Preferred Shares, plus an adjustment for

operating leases (5x annual rent expense). Adjusted net debt, a

non-GAAP measure, is adjusted debt less the cash and cash

equivalents on hand as of the balance sheet dates. Management

believes these financial measures are helpful to investors and

analysts to analyze trends in Signet’s business and evaluate

Signet’s performance. The debt and adjusted debt leverage ratios

are key to the Company’s capital allocation strategy as measures of

the Company’s optimized capital structure. The net debt and

adjusted net debt leverage ratios are supplemental to the debt and

adjusted debt ratios as both investors and management find it

useful to consider cash and cash equivalents available to pay down

debt. These ratios are presented on a trailing twelve-month (“TTM”)

basis, which uses either adjusted EBITDA or adjusted EBITDAR

calculated on the prior four fiscal quarters.

The following information provides reconciliations of the most

comparable financial measures calculated and presented in

accordance with GAAP to presented non-GAAP financial measures.

Free cash flow

26 weeks ended

(in millions)

August 3, 2024

July 29, 2023

Net cash used in operating activities

$

(114.4

)

$

(253.3

)

Purchase of property, plant and

equipment

(51.3

)

(55.4

)

Free cash flow

$

(165.7

)

$

(308.7

)

Adjusted operating income

13 weeks ended

26 weeks ended

(in millions)

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

Total operating (loss) income

$

(100.9

)

$

90.2

$

(51.1

)

$

191.9

Asset impairments (1)

166.2

3.5

168.1

3.5

Restructuring charges (2)

1.2

4.2

5.8

4.2

Loss on divestitures, net (3)

1.2

—

2.5

—

Integration-related expenses (4)

0.9

4.8

1.1

12.6

Litigation charges (5)

—

—

—

(3.0

)

Total adjusted operating income

$

68.6

$

102.7

$

126.4

$

209.2

North America segment adjusted operating income

13 weeks ended

26 weeks ended

(in millions)

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

North America segment operating (loss)

income

$

(77.2

)

$

117.1

$

6.0

$

241.8

Asset impairments (1)

166.2

3.5

167.4

3.5

Restructuring charges (2)

0.2

4.2

0.8

4.2

Integration-related expenses (4)

0.9

4.8

1.1

12.6

Litigation charges (5)

—

—

—

(3.0

)

North America segment adjusted operating

income

$

90.1

$

129.6

$

175.3

$

259.1

International segment adjusted operating loss

13 weeks ended

26 weeks ended

(in millions)

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

International segment operating loss

$

(4.2

)

$

(7.0

)

$

(17.2

)

$

(13.9

)

Restructuring charges (2)

1.0

—

5.0

—

Asset impairments (1)

—

—

0.7

—

Loss on divestitures, net (3)

1.2

—

2.5

—

International segment adjusted operating

loss

$

(2.0

)

$

(7.0

)

$

(9.0

)

$

(13.9

)

Adjusted income tax provision

13 weeks ended

26 weeks ended

(in millions)

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

Income tax expense

$

1.6

$

17.2

$

8.1

$

26.7

Asset impairments (1)

10.8

0.9

11.3

0.9

Restructuring charges (2)

0.4

1.1

1.5

1.1

Loss on divestitures, net (3)

0.3

—

0.6

—

Integration-related expenses (4)

0.2

1.2

0.2

3.1

Pension settlement loss

—

—

—

4.1

Litigation charges (5)

—

—

—

(0.8

)

Adjusted income tax expense

$

13.3

$

20.4

$

21.7

$

35.1

Adjusted effective tax rate

13 weeks ended

August 3, 2024

July 29, 2023

Effective tax rate

(1.7

)%

18.6

%

Asset impairments (1)

18.5

%

0.2

%

Restructuring charges (2)

0.7

%

0.3

%

Loss on divestitures, net (3)

0.5

%

—

%

Integration-related expenses (4)

0.3

%

0.4

%

Adjusted effective tax rate

18.3

%

19.5

%

Adjusted diluted EPS

13 weeks ended

26 weeks ended

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

Diluted EPS

$

(2.28

)

$

1.38

$

(3.17

)

$

3.17

Asset impairments (1)

3.73

0.06

3.77

0.06

Restructuring charges (2)

0.03

0.08

0.13

0.08

Loss on divestitures, net (3)

0.03

—

0.06

—

Integration-related expenses (4)

0.02

0.09

0.02

0.24

Litigation charges (5)

—

—

—

(0.06

)

Tax impact of items above (6)

(0.26

)

(0.06

)

(0.30

)

(0.16

)

Deemed dividend on redemption of Preferred

Shares (7)

—

—

1.91

—

Dilution effect (8)

(0.02

)

—

(0.07

)

—

Adjusted diluted EPS

$

1.25

$

1.55

$

2.35

$

3.33

Adjusted EBITDA and adjusted EBITDAR

26 weeks ended

53 week period ended

52 week period ended

53 week period ended

52 week period ended

(in millions)

August 3, 2024

July 29, 2023

July 30, 2022

February 3, 2024

January 28, 2023

August 3, 2024

July 29, 2023

Calculation:

A

B

C

D

E

A + D - B

B + E - C

Net (loss) income

$

(46.4

)

$

172.5

$

61.9

$

810.4

$

376.7

$

591.5

$

487.3

Income taxes

8.1

26.7

(19.6

)

(170.6

)

74.5

(189.2

)

120.8

Interest (income) expense, net

(11.0

)

(7.4

)

7.8

(18.7

)

13.5

(22.3

)

(1.7

)

Depreciation and amortization

74.5

86.7

79.8

161.9

164.5

149.7

171.4

Amortization of unfavorable contracts

(0.9

)

(0.9

)

(0.9

)

(1.8

)

(1.8

)

(1.8

)

(1.8

)

Other non-operating (income) expense, net

(9)

(1.8

)

0.1

136.9

0.4

140.2

(1.5

)

3.4

Share-based compensation

18.3

25.2

22.9

41.1

42.0

34.2

44.3

Other accounting adjustments (10)

177.5

17.3

200.8

21.3

245.5

181.5

62.0

Adjusted EBITDA

$

218.3

$

320.2

$

489.6

$

844.0

$

1,055.1

$

742.1

$

885.7

Rent expense

218.3

220.5

220.6

439.8

446.5

437.6

446.4

Adjusted EBITDAR

$

436.6

$

540.7

$

710.2

$

1,283.8

$

1,501.6

$

1,179.7

$

1,332.1

Debt and net debt leverage ratios

As of

(in millions)

August 3, 2024

July 29, 2023

Debt and net

debt:

Current portion of long-term debt

$

—

$

147.5

Redeemable Series A Convertible Preference

Shares

223.1

654.7

Debt

$

223.1

$

802.2

Less: Cash and cash equivalents

403.1

690.2

Net debt

$

(180.0

)

$

112.0

TTM Adjusted EBITDA

$

742.1

$

885.7

Debt leverage ratio

0.3x

0.9x

Net debt leverage ratio

-0.2x

0.1x

Adjusted debt and adjusted net debt leverage ratios

As of

(in millions)

August 3, 2024

July 29, 2023

Adjusted debt and

adjusted net debt:

Current portion of long-term debt

$

—

$

147.5

Redeemable Series A Convertible Preference

Shares

223.1

654.7

Adjustments:

TTM 5x rent expense

2,188.0

2,232.0

Adjusted debt

$

2,411.1

$

3,034.2

Less: Cash and cash equivalents

403.1

690.2

Adjusted net debt

$

2,008.0

$

2,344.0

TTM Adjusted EBITDAR

$

1,179.7

$

1,332.1

Adjusted debt leverage ratio

2.0x

2.3x

Adjusted net debt leverage

ratio

1.7x

1.8x

Footnotes to Non-GAAP Reconciliation Tables

(1)

Primarily includes asset impairment

charges related to goodwill and indefinite-lived intangible

assets.

(2)

Restructuring charges were incurred

primarily as a result of the Company’s rationalization of its store

footprint and reorganization of certain centralized functions.

(3)

Includes net losses from the previously

announced divestiture of the UK prestige watch business.

(4)

Fiscal 2025 includes severance and

retention expenses related to the integration of Blue Nile which

were recorded to SG&A. Fiscal 2024 includes primarily severance

and retention, exit and disposal, and system decommissioning costs

incurred for the integration of Blue Nile. The 13 and 26 weeks

ended July 29, 2023 includes $0.1 million and $1.4 million,

respectively, recorded to cost of sales, and $4.7 million and $11.2

million, respectively, recorded to SG&A.

(5)

Includes a credit to income related to the

adjustment of a prior litigation accrual recognized in Fiscal

2023.

(6)

The Fiscal 2024 tax effect includes a

$0.07 impact of the other comprehensive income recognized in

earnings from the release of the remaining tax benefit associated

with the buy-out of the UK pension completed in the first quarter

of Fiscal 2024.

(7)

The Company recorded a deemed dividend to

net (loss) income attributable to common shareholders of $85.1

million in the first quarter of Fiscal 2025, which represents the

excess of the conversion value of the Preferred Shares over their

carrying value upon redemption, and includes $1.5 million of

related expenses.

(8)

Adjusted diluted EPS for the 13 and 26

weeks ended August 3, 2024 was calculated using 44.9 million and

47.9 million diluted weighted average common shares outstanding,

respectively. The additional dilutive shares were excluded from the

calculation of GAAP diluted EPS as their effect was

antidilutive.

(9)

For the 26 weeks ended July 30, 2022 and

52 weeks ended January 28, 2023 non-operating expenses primarily

includes pre-tax pension settlement charges of $132.8 million and

$133.7 million, respectively.

(10)

Other accounting adjustments are inclusive

of those items described within footnotes 1 through 5 above.

Additional accounting adjustments include litigation charges;

acquisition and integration-related expenses, including the impact

of the fair value step-up for inventory from Diamonds Direct and

Blue Nile, as well as direct transaction-related and integration

costs, primarily professional fees and severance, incurred related

to the acquisition of Blue Nile; and certain asset impairments as

previously disclosed in prior periods.

Condensed Consolidated Statements of Operations

(Unaudited)

13 weeks ended

26 weeks ended

(in millions, except per share

amounts)

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

Sales

$

1,491.0

$

1,613.6

$

3,001.8

$

3,281.6

Cost of sales

(924.7

)

(1,002.8

)

(1,863.1

)

(2,038.8

)

Gross margin

566.3

610.8

1,138.7

1,242.8

Selling, general and administrative

expenses

(498.4

)

(511.2

)

(1,013.8

)

(1,041.6

)

Asset impairments, net

(166.2

)

(3.8

)

(168.6

)

(5.6

)

Other operating expense, net

(2.6

)

(5.6

)

(7.4

)

(3.7

)

Operating (loss) income

(100.9

)

90.2

(51.1

)

191.9

Interest income, net

2.4

1.8

11.0

7.4

Other non-operating income (expense),

net

1.6

0.3

1.8

(0.1

)

(Loss) income before income taxes

(96.9

)

92.3

(38.3

)

199.2

Income taxes

(1.6

)

(17.2

)

(8.1

)

(26.7

)

Net (loss) income

$

(98.5

)

$

75.1

$

(46.4

)

$

172.5

Dividends on redeemable convertible

preferred shares

(3.0

)

(8.6

)

(95.2

)

(17.2

)

Net (loss) income attributable to common

shareholders

$

(101.5

)

$

66.5

$

(141.6

)

$

155.3

Earnings (loss) per common share:

Basic

$

(2.28

)

$

1.47

$

(3.17

)

$

3.43

Diluted

$

(2.28

)

$

1.38

$

(3.17

)

$

3.17

Weighted average common shares

outstanding:

Basic

44.5

45.2

44.6

45.3

Diluted

44.5

54.3

44.6

54.5

Dividends declared per common share

$

0.29

$

0.23

$

0.58

$

0.46

Condensed Consolidated Balance Sheets (Unaudited)

(in millions)

August 3, 2024

February 3, 2024

July 29, 2023

Assets

Current assets:

Cash and cash equivalents

$

403.1

$

1,378.7

$

690.2

Inventories

1,977.2

1,936.6

2,093.9

Income taxes

9.2

9.4

9.5

Other current assets

186.2

211.9

193.8

Total current assets

2,575.7

3,536.6

2,987.4

Non-current assets:

Property, plant and equipment, net

470.5

497.7

553.5

Operating lease right-of-use assets

956.2

1,001.8

1,060.2

Goodwill

631.5

754.5

754.1

Intangible assets, net

358.9

402.8

406.5

Other assets

320.3

319.3

287.9

Deferred tax assets

300.7

300.5

37.8

Total assets

$

5,613.8

$

6,813.2

$

6,087.4

Liabilities, Redeemable convertible

preferred shares, and Shareholders’ equity

Current liabilities:

Current portion of long-term debt

$

—

$

147.7

$

147.5

Accounts payable

547.6

735.1

570.7

Accrued expenses and other current

liabilities

363.1

400.2

386.7

Deferred revenue

347.8

362.9

358.3

Operating lease liabilities

250.9

260.3

332.2

Income taxes

17.6

69.8

56.9

Total current liabilities

1,527.0

1,976.0

1,852.3

Non-current liabilities:

Operating lease liabilities

793.5

835.7

832.3

Other liabilities

90.5

96.0

98.3

Deferred revenue

874.0

881.8

869.0

Deferred tax liabilities

188.5

201.7

166.7

Total liabilities

3,473.5

3,991.2

3,818.6

Commitments and contingencies

Redeemable Series A Convertible Preference

Shares

223.1

655.5

654.7

Shareholders’ equity:

Common shares

12.6

12.6

12.6

Additional paid-in capital

165.2

230.7

220.0

Other reserves

0.4

0.4

0.4

Treasury shares at cost

(1,659.7

)

(1,646.9

)

(1,596.4

)

Retained earnings

3,664.6

3,835.0

3,238.0

Accumulated other comprehensive loss

(265.9

)

(265.3

)

(260.5

)

Total shareholders’ equity

1,917.2

2,166.5

1,614.1

Total liabilities, redeemable convertible

preferred shares and shareholders’ equity

$

5,613.8

$

6,813.2

$

6,087.4

Condensed Consolidated Statements of Cash Flows

(Unaudited)

26 weeks ended

(in millions)

August 3, 2024

July 29, 2023

Operating activities

Net (loss) income

$

(46.4

)

$

172.5

Adjustments to reconcile net (loss) income

to net cash used in operating activities:

Depreciation and amortization

74.5

86.7

Amortization of unfavorable contracts

(0.9

)

(0.9

)

Share-based compensation

18.3

25.2

Deferred taxation

(13.1

)

47.8

Asset impairments, net

168.6

5.6

Other non-cash movements

3.1

1.2

Changes in operating assets and

liabilities:

Inventories

(41.4

)

65.0

Other assets

33.2

(27.2

)

Accounts payable

(193.3

)

(300.0

)

Accrued expenses and other liabilities

(36.1

)

(257.1

)

Change in operating lease assets and

liabilities

(6.8

)

(31.8

)

Deferred revenue

(22.1

)

(24.8

)

Income tax receivable and payable

(52.0

)

(15.5

)

Net cash used in operating activities

(114.4

)

(253.3

)

Investing activities

Purchase of property, plant and

equipment

(51.3

)

(55.4

)

Other investing activities, net

(5.9

)

(5.5

)

Net cash used in investing activities

(57.2

)

(60.9

)

Financing activities

Dividends paid on common shares

(23.1

)

(19.4

)

Dividends paid on redeemable convertible

preferred shares

(14.4

)

(16.4

)

Repurchase of common shares

(47.2

)

(82.4

)

Repurchase of redeemable convertible

preferred shares

(541.0

)

—

Repayment of Senior Notes

(147.8

)

—

Other financing activities, net

(28.4

)

(45.6

)

Net cash used in financing activities

(801.9

)

(163.8

)

Cash and cash equivalents at beginning of

period

1,378.7

1,166.8

Decrease in cash and cash equivalents

(973.5

)

(478.0

)

Effect of exchange rate changes on cash

and cash equivalents

(2.1

)

1.4

Cash and cash equivalents at end of

period

$

403.1

$

690.2

Real Estate Portfolio:

Signet has a diversified real estate portfolio. On August 3,

2024, Signet operated 2,668 stores totaling 4.1 million square feet

of selling space. Compared to year-end Fiscal 2024, store count

decreased by 30 and square feet of selling space decreased

0.6%.

Store count by segment

February 3, 2024

Openings

Closures

August 3, 2024

North America segment

2,411

3

(13

)

2,401

International segment

287

—

(20

)

267

Signet

2,698

3

(33

)

2,668

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912263568/en/

Investors: Rob Ballew Senior Vice President, Investor

Relations robert.ballew@signetjewelers.com or

investorrelations@signetjewelers.com Media: Colleen Rooney

Chief Communications & ESG Officer +1-330-668-5932

colleen.rooney@signetjewelers.com

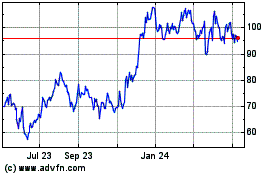

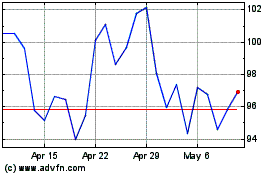

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Nov 2023 to Nov 2024