UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 6-K

_________________________

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

November 6, 2024

_________________________

NOVO NORDISK A/S

(Exact name of Registrant as specified in its charter)

_________________________

Novo Allé

DK-2880 Bagsværd

Denmark

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g-32(b):82-________

Financial report for the period 1 January 2024 to 30 September 2024

6 November 2024

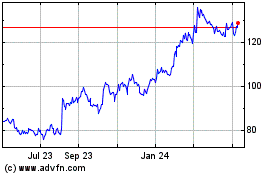

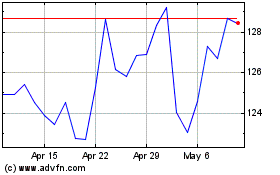

Novo Nordisk's sales increased by 23% in Danish kroner and by 24% at constant exchange rates to DKK 204.7 billion in the first nine months of 2024

•Operating profit increased by 21% in Danish kroner and by 22% at constant exchange rates (CER) to DKK 91.6 billion.

•Sales in North America Operations increased by 31% in Danish kroner (31% at CER). Sales growth in the US was positively impacted by gross-to-net sales adjustments related to prior years. Sales in International Operations increased by 13% in Danish kroner (15% at CER).

•Sales within Diabetes and Obesity care increased by 25% in Danish kroner to DKK 191.8 billion (26% at CER), mainly driven by GLP-1 diabetes sales growth of 25% in Danish kroner (26% at CER) and Obesity care growing by 44% in Danish kroner to DKK 43.7 billion (44% at CER). Rare disease sales increased by 3% in both Danish kroner and at CER.

•Within R&D, Novo Nordisk completed the phase 2a trial with monlunabant in obesity and expects to initiate a larger phase 2b trial in obesity in 2025 to further investigate the dosing and safety profile of monlunabant over a longer duration in a global population. Further, within diabetes, Novo Nordisk announced that oral semaglutide statistically significantly reduced the risk of major adverse cardiovascular events in the SOUL cardiovascular outcomes trial.

•Also within R&D, headline results were announced from the ESSENCE trial with semaglutide 2.4 mg in adults with MASH and liver fibrosis demonstrating superior improvement in both liver fibrosis and MASH resolution versus placebo.

•For the 2024 outlook, sales growth is now expected to be 23-27% at CER, and operating profit growth is now expected to be 21-27% at CER. Growth reported in Danish kroner is now expected to be 1 percentage point lower than at CER growth for sales and 2 percentage points lower for operating profit.

| | | | | | | | | | | | | | |

| PROFIT AND LOSS | 9M 2024 | 9M 2023 | Growth

as reported | Growth

at CER* |

| DKK million | | | | |

| Net sales | 204,720 | | 166,398 | | 23 | % | 24 | % |

| Operating profit | 91,602 | | 75,808 | | 21 | % | 22 | % |

| | | | |

| Net profit | 72,758 | | 61,720 | | 18 | % | N/A |

| Diluted earnings per share (in DKK) | 16.29 | | 13.71 | | 19 | % | N/A |

* CER: Constant exchange rates (average 2023). | | | | |

Lars Fruergaard Jørgensen, president and CEO: "We are pleased with the performance in the first nine months of 2024. The sales growth is driven by increasing demand for our GLP-1-based diabetes and obesity treatments, and we are serving more patients than ever before. Within R&D, we are very pleased about further read-outs across our semaglutide portfolio, including the SOUL trial in people living with diabetes and cardiovascular disease and the ESSENCE trial in people living with MASH."

On 6 November 2024 at 13.00 CET, corresponding to 07.00 am EST, an earnings call will be held. Investors will be able to listen in via a link on novonordisk.com, which can be found under 'Investors' (the contents of the company's website do not form a part of this Form 6-K).

| | | | | | | | | | | |

Novo Nordisk A/S Investor Relations | Novo Alle 1

2880 Bagsværd

Denmark | Telephone:

+45 4444 8888

www.novonordisk.com | CVR Number:

24 25 67 90 |

| | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

STRATEGIC ASPIRATIONS

STRATEGIC ASPIRATIONS 2025

The strategic aspirations are objectives that Novo Nordisk intends to work towards and are not a projection of Novo Nordisk's financial outlook or expected growth. Novo Nordisk intends to describe how its activities develop in relation to each of the four dimensions on an ongoing basis.

Performance highlights for the first nine months of 2024 (blue indicates third quarter developments)

| | | | | | | | | | | |

| PERFORMANCE HIGHLIGHTS | | | | | |

| | | | | |

| Purpose and sustainability (ESG) | | | | |

Progress towards zero environmental impact: –Overall CO2e emissions (scope 1, 2 and full scope 3) increased by 34% compared to the first nine months of 2023 Adding value to society: –Medical treatment provided to 41.5 million people living with diabetes and 1.8 million people living with obesity –Reached more than 59,000 children in the Changing Diabetes® in Children programme

| | Being recognised as a sustainable employer: –Share of women in senior leadership positions has increased by 0.5%-p to 41% compared to the end of September 2023

| | |

| Innovation and therapeutic focus | | | | |

Further raise innovation bar for diabetes treatment: –Successful completion of FLOW kidney outcomes trial –Awiqli® approved in the EU, Japan and China –Complete Response Letter received for insulin icodec in the US –Successful completion of COMBINE phase 3a programme with IcoSema –Successful completion of SOUL cardiovascular outcomes trial –Successful completion of STRIDE functional outcomes trial

Develop superior treatment solutions for obesity: –Phase 2 trial initiated with once-weekly GIP/GLP-1 dual agonist –Positive EU opinion for update of the Wegovy® label based on the SELECT, STEP 9 (OA) and STEP HFpEF and STEP HFpEF-DM trials –Phase 2a trial with monlunabant completed –Phase 1 trial with amylin 355 initiated

| | Strengthen and progress Rare disease pipeline: –Phase 3a trial, FRONTIER 2, with Mim8 successfully completed in people with haemophilia A –Concizumab re-submitted in the US for the treatment of haemophilia A and B with inhibitors –Positive EU opinion for Alhemo® (concizumab) for the treatment of haemophilia A and B with inhibitors –Successful completion of the phase 2 part (interim) of the etavopivat HIBISCUS phase 2/3 trial

Establish presence in Cardiovascular & Emerging Therapy Areas: –Agreement to acquire Cardior Pharmaceuticals and lead asset CDR132L in phase 2 development for treatment of heart failure –Phase 3 development initiated with ziltivekimab in HFpEF and AMI –Phase 3 trial CLARION-CKD trial stopped as ocedurenone failed to meet primary endpoint –Successful completion of part I of phase 3 trial ESSENCE with semaglutide 2.4 mg in MASH

| | |

| Commercial execution | | | | |

Strengthen diabetes leadership to more than one-third: –Diabetes value market share increased by 0.6 percentage point to 33.9% (MAT) | | More than DKK 25 billion in Obesity care sales by 2025: –Obesity care sales increased by 44% at (CER) to DKK 43.7 billion

Secure a sustained growth outlook for Rare Disease: –Rare disease sales increased by 3% (CER) to DKK 12.9 billion

| | |

| Financials | | | | |

Deliver solid sales and operating profit growth: –Sales growth of 24% (CER) –Operating profit growth of 22% (CER), impacted by the impairment loss related to ocedurenone. | | Drive operational efficiencies: –Operational leverage reflecting sales growth, excluding the impairment loss related to ocedurenone

Enable attractive capital allocation to shareholders: –Free cash flow of DKK 71.8 billion –DKK 56.8 billion returned to shareholders | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

PERFORMANCE HIGHLIGHTS

FINANCIAL HIGHLIGHTS FOR THE FIRST NINE MONTHS OF 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PROFIT AND LOSS | 9M 2024 | | 9M 2023 | | | | | | | % change

9M 2024 to

9M 2023 | | % change

9M 2024 to

9M 2023 at CER¹ |

(Amounts are in DKK million, except for earnings per share) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net sales | 204,720 | | 166,398 | | | | | | | 23 | % | | 24 | % | |

| | | | | | | | | | | | | |

| Gross profit | 173,222 | | 140,647 | | | | | | | 23 | % | | 24 | % | |

| Gross margin | 84.6% | | 84.5% | | | | | | | | | | |

| | | | | | | | | | | | | |

| Sales and distribution costs | (43,400) | | (39,573) | | | | | | | 10 | % | | 10 | % | |

| Percentage of sales | 21.2% | | 23.8% | | | | | | | | | | |

| | | | | | | | | | | | | |

| Research and development costs | (34,260) | | (21,983) | | | | | | | 56 | % | | 56 | % | |

| Percentage of sales | 16.7% | | 13.2% | | | | | | | | | | |

| | | | | | | | | | | | | |

| Administrative costs | (3,696) | | (3,399) | | | | | | | 9 | % | | 9 | % | |

| Percentage of sales | 1.8% | | 2.0% | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other operating income and expenses | (264) | | 116 | | | | | | | N/A | | N/A | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Operating profit (EBIT) | 91,602 | | 75,808 | | | | | | | 21 | % | | 22 | % | |

| Operating margin | 44.7% | | 45.6% | | | | | | | | | | |

| | | | | | | | | | | | | |

| Financial items (net) | 32 | | 1,246 | | | | | | | N/A | | N/A | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Profit before income taxes | 91,634 | | 77,054 | | | | | | | 19 | % | | N/A | |

| | | | | | | | | | | | | |

| Income taxes | (18,876) | | (15,334) | | | | | | | 23 | % | | N/A | |

| Effective tax rate | 20.6% | | 19.9% | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net profit | 72,758 | | 61,720 | | | | | | | 18 | % | | N/A | |

| Net profit margin | 35.5% | | 37.1% | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| OTHER KEY NUMBERS | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Depreciation, amortisation and impairment losses | 13,909 | | 6,421 | | | | | | | 117 | % | | N/A | |

| | | | | | | | | | | | | |

| Capital expenditure (PP&E) | 31,063 | | 16,399 | | | | | | | 89 | % | | N/A | |

| Net cash generated from operating activities | 108,667 | | 99,357 | | | | | | | 9 | % | | N/A | |

EBITDA 1) | 105,511 | | 82,229 | | | | | | | 28 | % | | 30 | % | |

Free cash flow 1) | 71,760 | | 75,576 | | | | | | | (5 | %) | | N/A | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Diluted earnings per share / ADR (in DKK) | 16.29 | | 13.71 | | | | | | | 19 | % | | N/A | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Full-time equivalent employees end of period | 71,880 | | 61,412 | | | | | | | 17 | % | | N/A | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

1) See appendix 7: Non-IFRS financial measures (additional information). | |

| |

| | | |

| | | | | | | | | | | | | |

These unaudited consolidated financial statements for the first nine months of 2024 have been prepared in accordance

with IAS 34 ‘Interim Financial Reporting’ and additional Danish disclosure requirements for listed companies.

The accounting policies adopted in the preparation are consistent with those applied in the Annual Report 2023 of Novo

Nordisk.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

COMMERCIAL EXECUTION

SALES DEVELOPMENT ACROSS THERAPEUTIC AREAS

Sales grew by 23% measured in Danish kroner and by 24% at CER in the first nine months of 2024, driven by Diabetes care sales growth of 21% (CER) and Obesity care sales growth of 44% (CER). Rare disease sales increased by 3% (CER). Sales growth has resulted in periodic supply constraints and related drug shortage notifications across a number of products and geographies. Sales growth in the US was positively impacted by gross-to-net sales adjustments related to prior years and the phasing of rebates in 2023.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Sales split per therapy | Sales 9M 2024

DKK million | Sales 9M 2023

DKK million | | Growth

as reported | Growth

at CER | Share of growth

at CER |

| Diabetes and Obesity care segment | | | | | | |

| | | | | | | |

| | | | | | | |

| Injectable GLP-1 | 90,568 | | 72,531 | | | 25 | % | 26 | % | 47 | % |

| - Ozempic® | 86,489 | | 65,653 | | | 32 | % | 32 | % | 54 | % |

| - Victoza® | 4,079 | | 6,878 | | | (41 | %) | (40 | %) | (7 | %) |

Rybelsus® | 16,384 | | 12,840 | | | 28 | % | 29 | % | 9 | % |

| | | | | | | |

| Total GLP-1 | 106,952 | | 85,371 | | | 25 | % | 26 | % | 56 | % |

| | | | | | | |

Long-acting insulin1 | 13,937 | | 11,179 | | | 25 | % | 26 | % | 7 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Premix insulin2 | 7,922 | | 7,451 | | | 6 | % | 8 | % | 2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fast-acting insulin3 | 12,505 | | 11,807 | | | 6 | % | 6 | % | 2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Human insulin | 5,122 | | 5,605 | | | (13 | %) | (11 | %) | (2 | %) |

| | | | | | | |

| Total insulin | 39,486 | | 36,042 | | | 9 | % | 10 | % | 9 | % |

| | | | | | | |

Other Diabetes care4 | 1,608 | | 1,990 | | | (7 | %) | (5 | %) | 0 | % |

| | | | | | | |

| Total Diabetes care | 148,046 | | 123,403 | | | 20 | % | 21 | % | 65 | % |

| | | | | | | |

Wegovy® | 38,340 | | 21,729 | | | 76 | % | 77 | % | 42 | % |

Saxenda® | 5,400 | | 8,674 | | | (38 | %) | (37 | %) | (8 | %) |

| | | | | | | |

| Total Obesity care | 43,740 | | 30,403 | | | 44 | % | 44 | % | 34 | % |

| | | | | | | |

| Diabetes and Obesity care total | 191,786 | | 153,806 | | | 25 | % | 26 | % | 99 | % |

| | | | | | | |

| Rare disease segment | | | | | | |

Rare blood disorders5 | 8,740 | | 8,842 | | | (1 | %) | (1 | %) | 0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Rare endocrine disorders6 | 3,070 | | 2,572 | | | 19 | % | 21 | % | 1 | % |

| | | | | | | |

Other Rare disease7 | 1,124 | | 1,178 | | | (5 | %) | (4 | %) | 0 | % |

| | | | | | | |

| Rare disease total | 12,934 | | 12,592 | | | 3 | % | 3 | % | 1 | % |

| | | | | | | |

| Total sales | 204,720 | | 166,398 | | | 23 | % | 24 | % | 100 | % |

| | | | | | | |

1) Comprises Tresiba®, Xultophy®, Levemir® and Awiqli® | | | | |

2) Comprises Ryzodeg® and NovoMix®. | | | | |

3) Comprises Fiasp® and NovoRapid®. | | | | |

4) Primarily NovoNorm®, needles and GlucaGen® HypoKit®. | | | | |

5) Comprises NovoSeven®, NovoEight®, Esperoct®, Refixia®, NovoThirteen® and Alhemo®. | | |

6) Primarily Norditropin® and Sogroya®. | | | | |

7) Primarily Vagifem® and Activelle®. |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

DIABETES AND OBESITY CARE

Diabetes care, sales and market share development

Sales in Diabetes care increased by 20% measured in Danish kroner and by 21% at CER to DKK 148,046 million driven by growth of GLP-1-based products. Novo Nordisk has improved the global diabetes value market share over the last 12 months to 33.9% from 33.3% in line with the strategic aspiration of strengthening the Diabetes care leadership, aiming at reaching a global value market share of more than one-third in 2025. The market share increase was driven by market share gains in both North America Operations and International Operations.

In the following sections, unless otherwise noted, market data are based on moving annual total (MAT) from August 2023 and August 2024 provided by the independent data provider IQVIA. EMEA covers Europe, the Middle East and Africa; Region China covers mainland China, Hong Kong and Taiwan; Rest of World covers all other countries except for North America. | | | | | | | | | | | | | | | | | |

| | | | | |

| Diabetes care, development per geographical area | Novo Nordisk’s share of the total diabetes market (value, MAT) | Diabetes care, sales development |

| | | | | |

| | | | | |

| | August | August | Sales 9M 2024

DKK million | Growth

at CER |

| | 2024 | 2023 |

| | | | | |

| | | | | |

| Global | 33.9 | % | 33.3 | % | 148,046 | | 21 | % |

| North America Operations | 35.4 | % | 34.7 | % | 84,480 | | 31 | % |

| - The US | 34.9 | % | 34.2 | % | 78,261 | | 33 | % |

| International Operations | 28.1 | % | 27.8 | % | 63,566 | | 10 | % |

| - EMEA * | 29.4 | % | 30.1 | % | 32,229 | | 8 | % |

| - Region China ** | 32.7 | % | 32.3 | % | 13,707 | | 12 | % |

| - Rest of World *** | 24.2 | % | 22.4 | % | 17,630 | | 11 | % |

| | | | | |

| | | | | |

Source: IQVIA, August 2024 data. *Data for EMEA available for European markets and seven markets outside Europe representing approximately 90% of Novo Nordisk Diabetes care sales in the area. **Data for mainland China, excluding Hong Kong and Taiwan. *** Data for Rest of World available for seven markets representing approximately 70% of total Novo Nordisk’s Diabetes care sales in the area.

GLP-1-based therapies for type 2 diabetes

Sales of GLP-1-based products for type 2 diabetes (Rybelsus®, Ozempic® and Victoza®) increased by 25% measured in Danish kroner and by 26% at CER to DKK 106,952 million. The estimated global GLP-1 share of total diabetes prescriptions has increased to 6.4% compared with 5.8% 12 months ago. Novo Nordisk continues to be the global market leader in the GLP-1 segment with a 55.6% value market share. | | | | | | | | | | | | | | | | | |

| | | | | |

| GLP-1 diabetes, development per geographical area | Novo Nordisk's share of the diabetes GLP-1 market (value, MAT) | GLP-1 diabetes, sales development |

| | | | | |

| | | | | |

| | August | August | Sales 9M 2024

DKK million | Growth

at CER |

| | 2024 | 2023 |

| | | | | |

| | | | | |

| Global | 55.6 | % | 54.4 | % | 106,952 | | 26 | % |

| North America Operations | 54.3 | % | 52.7 | % | 73,807 | | 32 | % |

| - The US | 53.3 | % | 51.6 | % | 68,318 | | 33 | % |

| International Operations | 66.8 | % | 68.7 | % | 33,145 | | 16 | % |

| - EMEA * | 59.0 | % | 62.9 | % | 17,554 | | 12 | % |

| - Region China ** | 79.1 | % | 74.6 | % | 5,709 | | 19 | % |

| - Rest of World *** | 84.8 | % | 82.1 | % | 9,882 | | 21 | % |

| | | | | |

| | | | | |

Source: IQVIA, August 2024 data. *Data for EMEA available for European markets and seven markets outside Europe representing approximately 90% of Novo Nordisk GLP-1 sales in the area. **Data for mainland China, excluding Hong Kong and Taiwan. ***Data for Rest of World available for seven markets representing approximately 70% of total Novo Nordisk Diabetes care sales in the area. Note: the estimated GLP-1 share of prescriptions is based on volume packs from IQVIA. Volume packs are converted into full-year patients/prescriptions based on WHO assumptions for average daily doses or if not available, Novo Nordisk assumptions.

Rybelsus® sales increased by 28% measured in Danish kroner and by 29% at CER to DKK 16,384 million. Sales growth was driven by EMEA and Rest of World as well as North America Operations.

Ozempic® sales increased by 32% in both Danish kroner and at CER to DKK 86,489 million. Sales growth was driven by both North America Operations and International Operations. Sales growth has resulted in periodic supply constraints and related drug shortage notifications across geographies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

Victoza® sales decreased by 41% measured in Danish kroner and by 40% at CER to DKK 4,079 million. This is driven by the GLP-1 diabetes market moving towards once-weekly treatments, in both North America Operations and International Operations, as well as negative gross-to-net adjustments during the third quarter in the US.

North America Operations

Sales of GLP-1 Diabetes care products in North America Operations increased by 31% measured in Danish kroner and by 32% at CER. Novo Nordisk is the market leader with a 54.3% value market share. The estimated GLP-1 share of total diabetes prescriptions has increased to 17.2% compared with 14.7% 12 months ago.

Sales of GLP-1 Diabetes care products in the US increased by 33% at CER. The sales increase was mainly driven by continued uptake of Ozempic®.

Sales growth in the US was driven by a prescription volume growth of the GLP-1 class above 15% in the third quarter of 2024 compared with the third quarter of 2023 as well as Novo Nordisk market share gains. Novo Nordisk is the market leader with 53.9% measured by total monthly prescriptions and 50.0% measured by new-to-brand prescriptions.

International Operations

Sales of GLP-1 Diabetes care products in International Operations increased by 14% measured in Danish kroner and by 16% at CER. Sales growth is driven by all Regions. The estimated GLP-1 share of total diabetes prescriptions has increased to 4.0% compared with 3.7% 12 months ago. Novo Nordisk is the market leader with a value market share of 66.8% compared with 68.7% 12 months ago. The sales growth has resulted in periodic supply constraints and related drug shortage notifications across a number of products and geographies.

EMEA

Sales in EMEA increased by 12% in both Danish kroner and at CER. The sales growth reflects the uptake of Rybelsus® and Ozempic®, partially offset by lower sales of Victoza®. Novo Nordisk remains the market leader in EMEA with a value market share of 59.0%. The estimated GLP-1 share of total diabetes prescriptions has increased to 5.5% compared with 5.1% 12 months ago.

Region China

Sales in Region China increased by 16% measured in Danish kroner and by 19% at CER. The sales growth mainly reflects the uptake of Ozempic®, partially countered by lower sales of Victoza®. GLP-1 sales growth was negatively impacted by periodic supply constraints. The GLP-1 share of total diabetes prescriptions has decreased to 3.1% compared with 3.3% 12 months ago. Novo Nordisk is the market leader in Region China with a value market share of 79.1%.

Rest of World

Sales in Rest of World increased by 17% measured in Danish kroner and by 21% at CER. The sales growth reflects increased sales of Rybelsus® and Ozempic®, partially offset by lower sales of Victoza®. The estimated GLP-1 share of total diabetes prescriptions has increased to 2.6% compared with 2.2% 12 months ago. Novo Nordisk remains the market leader with a value market share of 84.8%.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

Insulin

Sales of insulin increased by 9% measured in Danish kroner and by 10% at CER to DKK 39,486 million. Awiqli® has been launched in the first countries. | | | | | | | | | | | | | | | | | |

| | | | | |

| Insulin, development per geographical area | Novo Nordisk’s share of the total insulin market (volume, MAT) | Insulin, sales development |

| | | | | |

| | | | | |

| | August | August | Sales 9M 2024

DKK million | Growth

at CER |

| | 2024 | 2023 |

| | | | | |

| | | | | |

| Global | 44.5 | % | 45.4 | % | 39,486 | | 10 | % |

| North America Operations | 34.0 | % | 37.1 | % | 10,471 | | 31 | % |

| - The US | 33.7 | % | 36.7 | % | 9,781 | | 35 | % |

| International Operations | 48.0 | % | 48.4 | % | 29,015 | | 4 | % |

| - EMEA * | 47.5 | % | 47.2 | % | 14,156 | | 4 | % |

| - Region China ** | 41.4 | % | 42.4 | % | 7,390 | | 10 | % |

| - Rest of World *** | 56.5 | % | 57.4 | % | 7,469 | | 0 | % |

| | | | | |

| | | | | |

Source: IQVIA, August 2024 data. *Data for EMEA available for European markets and seven markets outside Europe representing approximately 90% of Novo Nordisk insulin sales in the area. **Data for mainland China, excluding Hong Kong and Taiwan. ***Data for Rest of World available for seven markets representing approximately 70% of total Novo Nordisk Diabetes care sales in the area.

North America Operations

Sales of insulin in North America Operations increased by 31% in both Danish kroner and at CER. The sales increase in the US was positively impacted by gross-to-net sales adjustments related to prior years, partially countered by a decline in volume. Novo Nordisk has a volume market share of 33.7% of the total US insulin market.

International Operations

Sales of insulin in International Operations increased by 3% measured in Danish kroner and by 4% at CER. The sales increase at CER was driven by Region China and EMEA. Novo Nordisk has a volume market share of 48.0% of the total insulin market in International Operations.

EMEA

Sales of insulin in EMEA increased by 3% measured in Danish kroner and by 4% at CER. The sales increase at CER was driven by long-acting insulin and fast-acting insulin, partially countered by human insulin. Novo Nordisk has a volume market share of 47.5% of the total insulin market.

Region China

Sales of insulin in Region China increased by 7% measured in Danish kroner and by 10% at CER. The sales increase was mainly driven by long-acting insulin and premix insulin, partially countered by human insulin. Novo Nordisk has a volume market share of 41.4% of the total insulin market.

Rest of World

Sales of insulin in Rest of World decreased by 2% measured in Danish kroner, and remained unchanged at CER. The sales decrease at CER was mainly driven by human insulin and fast-acting insulin, partially countered by premix insulin. Novo Nordisk has a volume market share of 56.5% of the total insulin market.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

Obesity care, sales development

Sales of Obesity care products, Wegovy® and Saxenda®, increased by 44% in both Danish kroner and at CER to DKK 43,740 million. Sales growth was driven by both North America Operations and International Operations. The volume growth of the global branded obesity market was 95%. Novo Nordisk is the global market leader with a volume market share of 74.0%.

| | | | | | | | | | | | | | | |

| | | | | |

| Obesity care, development per geographical area | Global branded obesity market growth (Volume, MAT) | Obesity care, sales development |

| | | | | |

| | | | | |

| | August | | Sales 9M 2024

DKK million | Growth

at CER |

| | 2024 | |

| | | | | |

| | | | | |

| Global | 95 | % | | 43,740 | | 44 | % |

| North America Operations | 133 | % | | 32,124 | | 32 | % |

| - The US | 136 | % | | 31,106 | | 30 | % |

| International Operations | 45 | % | | 11,616 | | 95 | % |

| - EMEA * | 69 | % | | 7,233 | | 82 | % |

| - Region China** | N/A | | 244 | | 92 | % |

| - Rest of World*** | (3 | %) | | 4,139 | | 122 | % |

| | | | | |

Source: IQVIA, August 2024 data. *Data for EMEA available for European markets and seven markets outside Europe representing approximately 90% of Novo Nordisk obesity care sales in the area. **Data for mainland China, excluding Hong Kong and Taiwan. ***Data for Rest of World available for seven markets representing approximately 70% of total Novo Nordisk Diabetes care sales in the area.

Wegovy® sales increased by 76% measured in Danish kroner and by 77% at CER to DKK 38,340 million. Sales of Saxenda® decreased by 38% measured in Danish kroner and by 37% at CER to DKK 5,400 million as the obesity care market is moving towards once-weekly treatments.

North America Operations

Sales of Obesity care products in North America Operations increased by 32% in both Danish kroner and at CER to DKK 32,124 million. Sales of Wegovy® increased by 50% in both Danish kroner and at CER to DKK 31,158 million, driven by increased volumes, partially countered by lower realised prices. Broad commercial formulary access has been achieved for Wegovy®. In the US, Wegovy® has around 215,000 weekly prescriptions in total, compared to around 100,000 weekly prescriptions in January of 2024, and above 25,000 weekly new-to-brand prescriptions. Novo Nordisk strives to safeguard continuity of care. Lastly, Wegovy® has been launched in Canada.

Sales of Saxenda® decreased by 73% in both Danish kroner and CER to DKK 966 million as the obesity care market is moving towards once-weekly treatments. The volume growth of the branded obesity market in the US was 136%.

International Operations

Sales of Obesity care products in International Operations increased by 93% measured in Danish kroner and by 95% at CER to DKK 11,616 million, driven by increased sales in EMEA and Rest of World. Sales of Saxenda® in International Operations decreased by 13% measured in Danish kroner and by 12% at CER to DKK 4,434 million, and sales of Wegovy® reached DKK 7,182 million. Wegovy® has now been launched in more than 15 countries in International Operations. The volume growth of the branded obesity market in International Operations was 45%.

EMEA

Sales of Obesity care products in EMEA increased by 82% in both Danish kroner and at CER to DKK 7,233 million reflecting uptake of Wegovy®, partially countered by declining sales of Saxenda®. The volume growth of the branded obesity market in EMEA was 69%.

Rest of World

Sales of Obesity care products in Rest of World increased by 117% measured in Danish kroner and by 122% at CER to DKK 4,139 million, driven by uptake of Wegovy®, including positive impact from supply chain pipeline filling. The volume of the branded obesity market in Rest of World declined by 3%.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

Rare disease, sales development

Rare disease sales increased by 3% in both Danish kroner and at CER to DKK 12,934 million. Sales of rare endocrine disorder products increased by 19% measured in Danish kroner and by 21% at CER to DKK 3,070 million. Novo Nordisk is working on gradually re-establishing supply of rare endocrine disorder products following a reduction of manufacturing output. Sogroya® has been launched in six countries, and the initial feedback from patients and physicians is encouraging. Sales of rare blood disorder products decreased by 1% in both Danish kroner and CER to DKK 8,740 million driven by NovoSeven® and haemophilia A sales, partially countered by increased haemophilia B sales.

| | | | | | | | | | | |

| | | |

| Rare disease, development per geographical area | Rare disease, sales development |

| | | |

| | | |

| | Sales 9M 2024

DKK million | Growth

at CER |

| |

| | | |

| | | |

| Global | 12,934 | | 3 | % |

| North America Operations | 6,204 | | 21 | % |

| - The US | 5,663 | | 22 | % |

| International Operations | 6,730 | | (9 | %) |

| - EMEA | 4,181 | | 0 | % |

| - Region China | 226 | | (61 | %) |

| - Rest of World | 2,323 | | (12 | %) |

| | | |

| | | |

North America Operations

Rare disease sales in North America Operations increased by 21% in both Danish kroner and at CER. The sales increase was driven by rare endocrine disorder products increasing by 82% measured in Danish kroner and by 83% at CER, reflecting the launch of Sogroya® and gross-to-net sales adjustments related to prior years in the US. Sales of rare blood disorder products increased by 9% measured in Danish kroner and by 10% at CER, mainly driven by increased NovoSeven® and haemophilia B sales.

International Operations

Rare disease sales in International Operations decreased by 10% measured in Danish kroner and by 9% at CER. The sales decline was driven by both rare bloods disorder and rare endocrine disorder products. Sales of rare blood disorder products decreased by 9% in both Danish kroner and CER, driven by decreased sales of NovoSeven® and haemophilia A products, partially countered by increased sales of haemophilia B products. Rare endocrine disorder products are decreasing by 14% measured in Danish kroner and by 12% at CER, reflecting a reduction in manufacturing output. Sogroya® has now been launched in five countries in International Operations with encouraging initial feedback.

EMEA

Rare disease sales remained unchanged both in Danish kroner and CER. Sales of rare blood disorder products decreased by 8% in both Danish kroner and CER, driven by lower NovoSeven® and haemophilia A sales, partially countered by increased haemophilia B sales. The increased sales of haemophilia B sales reflect the continued uptake of extended half-life products. Rare endocrine disorder products increased by 50% measured in Danish kroner and by 49% at CER.

Region China

Rare disease sales decreased by 62% measured in Danish kroner and by 61% at CER, driven by decreased sales of both rare endocrine products and rare blood disorder products.

Rest of World

Rare disease sales decreased by 13% measured in Danish kroner and by 12% at CER. Sales of rare endocrine disorder products decreased by 28% measured in Danish kroner and by 25% at CER, reflecting a reduction in manufacturing output. Sales of rare blood disorder products decreased by 4% in both Danish kroner and CER, driven by lower sales of NovoSeven®, partially countered by increased sales of haemophilia A products.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

FINANCIALS

GEOGRAPHIC SALES DEVELOPMENT

Sales increased by 23% measured in Danish kroner and by 24% at CER to DKK 204,720 million in the first nine months of 2024. Sales growth in the US was positively impacted by gross-to-net sales adjustments related to prior years and phasing of rebates in 2023. Sales growth has resulted in periodic supply constraints and related drug shortage notifications across a number of products and geographies. In North America Operations, sales increased by 31% in both Danish kroner and at CER. Sales in International Operations increased by 13% measured in Danish kroner and by 15% at CER.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Sales split per geographical area | Sales 9M 2024

DKK million | Growth

as reported | Growth

at CER | Share of growth

at CER |

| | | | |

| | | | |

| North America Operations | 122,808 | | 31 | % | 31 | % | 73 | % |

| - The US | 115,030 | | 32 | % | 32 | % | 70 | % |

| | | | | |

| International Operations | 81,912 | | 13 | % | 15 | % | 27 | % |

| - EMEA | 43,643 | | 14 | % | 15 | % | 14 | % |

| - Region China | 14,177 | | 7 | % | 10 | % | 3 | % |

| - Rest of World | 24,092 | | 15 | % | 18 | % | 10 | % |

| | | | | |

| Total sales | 204,720 | | 23 | % | 24 | % | 100 | % |

North America Operations

Sales in North America Operations increased by 31% in both Danish kroner and at CER. The sales increase reflects GLP-1 diabetes sales growing by 32% at CER and Obesity care sales growing by 32% at CER. GLP-1 diabetes sales growth in the US was positively impacted by gross-to-net sales adjustments related to prior years. Insulin sales increased by 31% at CER, mainly reflecting gross-to-net sales adjustments related to prior years, partially countered by a decline in volume. Rare disease sales increased by 21% at CER, driven by both Rare endocrine disorder and Rare blood disorder products.

International Operations

Sales in International Operations increased by 13% measured in Danish kroner and by 15% at CER. Sales growth was driven by Obesity care sales growing by 95% at CER, GLP-1 diabetes sales growing by 16% at CER. GLP-1 diabetes sales growth was negatively impacted by periodic supply constraints. Insulin sales are growing by 4% at CER, partially countered by Rare disease sales decreasing by 9% at CER, reflecting a reduction in manufacturing output.

EMEA

Sales in EMEA increased by 14% measured in Danish kroner and by 15% at CER. Sales growth was driven by Obesity care growing by 82% at CER. Diabetes care sales increased by 8% at CER, driven by GLP-1 diabetes sales growing by 12% at CER and insulin sales growing by 4% at CER. Rare disease sales were unchanged at CER.

Region China

Sales in Region China increased by 7% measured in Danish kroner and by 10% at CER. The sales increase at CER was driven by GLP-1 diabetes sales growing by 19% at CER and insulin sales increasing by 10% at CER. Other diabetes care sales decreased by 11% at CER. Rare disease sales decreased by 61% at CER.

Rest of World

Sales in Rest of World increased by 15% measured in Danish kroner and by 18% at CER. Sales growth was driven by Obesity care sales increased by 122% at CER and Diabetes care growing by 11% at CER, reflecting increased GLP-1 diabetes sales growing 21% at CER. Rare disease decreased by 12% at CER.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

DEVELOPMENT IN COSTS AND OPERATING PROFIT

The cost of goods sold increased by 22% in both Danish kroner and at CER to DKK 31,498 million, resulting in a gross margin of 84.6%, measured in Danish kroner, compared with 84.5% in the first nine months of 2023. The increase in gross margin is mainly reflecting a positive price impact due to gross-to-net sales adjustments related to prior years in the US and a positive product mix, driven by increased sales of GLP-1-based treatments. This is partially countered by costs related to ongoing capacity expansions.

Sales and distribution costs increased by 10% in both Danish kroner and at CER to DKK 43,400 million. The increase in costs is driven by both North America Operations and International Operations. In North America Operations, the cost increase is mainly driven by promotional activities related to Wegovy®. In International Operations, the increase is mainly related to Obesity care market development activities and Wegovy® launch activities as well as promotional activities for GLP-1 diabetes products. The increase in sales and distribution costs is impacted by adjustments to legal provisions in the second quarter of 2023. Sales and distribution costs amounted to 21.2% as a percentage of sales.

Research and development costs increased by 56% in both Danish kroner and at CER to DKK 34,260 million compared to the first nine months of 2023, mainly reflecting increased late-stage clinical trial activity, and increased early research activities as well as the impairment loss related to intangible assets, including ocedurenone of DKK 5.7 billion. Research and development costs amounted to 16.7% as a percentage of sales.

Administration costs increased by 9% in both Danish kroner and at CER to DKK 3,696 million. Administration costs amounted to 1.8% as a percentage of sales.

Other operating income and expenses (net) showed a loss of DKK 264 million compared to an income of DKK 116 million the first nine months of 2023. The loss is mainly reflecting impairments related to a partnership agreement of a company previously acquired by Novo Nordisk.

Operating profit increased by 21% measured in Danish kroner and by 22% at CER to DKK 91,602 million, reflecting the sales growth and impairment loss related to ocedurenone of DKK 5.7 billion. EBITDA increased by 28% measured in Danish kroner and by 30% at CER.

Financial items (net) showed a net gain of DKK 32 million, compared with a net gain of DKK 1,246 million in the first nine months of 2023,

In line with Novo Nordisk’s treasury policy, the most significant foreign exchange risks for Novo Nordisk have been hedged, primarily through foreign exchange forward contracts. The foreign exchange result was a gain of DKK 47 million compared with a net gain of DKK 1,190 million in 2023.

As per the end of September 2024, a positive market value of financial contracts of approximately DKK 0.1 billion has been deferred for recognition later in 2024 and 2025.

The effective tax rate was 20.6% in the first nine months of 2024, compared with an effective tax rate of 19.9% in the first nine months of 2023.

Net profit increased by 18% to DKK 72,758 million and diluted earnings per share increased by 19% to DKK 16.29. Net profit and diluted earnings per share are impacted by the impairment loss related to ocedurenone of DKK 5.7 billion.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

KEY DEVELOPMENTS IN THE THIRD QUARTER OF 2024

Sales in the third quarter of 2024 increased by 21% measured in Danish kroner and by 23% at CER compared to 2023. Sales growth in the US was negatively impacted by phasing of rebates in 2023. Operating profit increased by 26% measured in Danish kroner and by 28% at CER. Sales growth has resulted in periodic supply constraints and related drug shortage notifications across a number of products and geographies. Please refer to appendix 1 for an overview of the quarterly numbers in DKK and to appendix 6 for additional details on sales in the third quarter of 2024.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Sales split per geographical area | Sales Q3 2024

DKK million | Growth

as reported | Growth

at CER | Share of growth

at CER |

| | | | |

| | | | |

| North America Operations | 42,598 | | 22 | % | 23 | % | 60 | % |

| - The US | 39,844 | | 21 | % | 22 | % | 55 | % |

| International Operations | 28,713 | | 21 | % | 22 | % | 40 | % |

| - EMEA | 14,736 | | 17 | % | 18 | % | 17 | % |

| - Region China | 4,708 | | 8 | % | 8 | % | 3 | % |

| - Rest of World | 9,269 | | 37 | % | 40 | % | 20 | % |

| | | | | |

| Total sales | 71,311 | | 21 | % | 23 | % | 100 | % |

The increased global sales of 23% at CER were driven by increased sales across the portfolio. GLP-1 diabetes sales increased by 15% at CER and Obesity care sales increased by 55% at CER. Insulin sales increased by 10% at CER and rare disease sales increased by 17% at CER.

North America Operations

Sales in North America Operations increased by 22% measured in Danish kroner and by 23% at CER, negatively impacted by phasing of rebates in 2023. Sales growth was driven by GLP-1 diabetes sales growing by 19% at CER. Victoza® sales were mainly impacted by negative gross-to-net sales adjustments as well as lower volumes. Obesity care sales increased by 29% at CER. Insulin sales increased by 20% at CER, positively impacted by channel and payer mix and gross-to-net sales adjustments related to prior years, partially countered by lower realised volumes. Rare disease sales increased by 36% at CER, mainly driven by volume growth for rare endocrine disorder products as well a positive impact from phasing of rebates in 2023.

International Operations

Sales in International Operations increased by 21% measured in Danish kroner and by 22% at CER. Sales growth was driven by all Regions.

Sales growth was driven by Diabetes and Obesity care growing by 24% at CER, driven by Obesity care increasing by 189% at CER following uptake of Wegovy®, including positive impact from supply chain pipeline filling. GLP-1 diabetes sales grew by 8% at CER, and insulin sales increased by 7% at CER. Rare disease sales increased by 3% at CER.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

| | | | | | | | | | | | | | | | | | | | |

| PROFIT AND LOSS | Q3 2024 | Q3 2023 | | % change

Q3 2024 to

Q3 2023 | | % change

Q3 2024 to

Q3 2023 at CER |

| | | | | | |

| | | | | | |

| Net sales | 71,311 | 58,731 | | 21 | % | | 23 | % |

| | | | | | |

| Gross profit | 60,003 | 49,018 | | 22 | % | | 24 | % |

| Gross margin | 84.1% | 83.5% | | | | |

| | | | | | |

| Sales and distribution costs | (15,210) | (12,819) | | 19 | % | | 20 | % |

| Percentage of sales | 21.3% | 21.8% | | | | |

| | | | | | |

| Research and development costs | (9,488) | (8,128) | | 17 | % | | 17 | % |

| Percentage of sales | 13.3% | 13.8% | | | | |

| | | | | | |

| Administrative costs | (1,382) | (1,256) | | 10 | % | | 10 | % |

| Percentage of sales | 1.9% | 2.1% | | | | |

| | | | | | |

| Other operating income and expenses | (101) | 98 | | N/A | | N/A |

| | | | | | |

| | | | | | |

| Operating profit (EBIT) | 33,822 | 26,913 | | 26 | % | | 28 | % |

| Operating margin | 47.4% | 45.8% | | | | |

| | | | | | |

| Financial items (net) | 562 | 1,150 | | (51 | %) | | N/A |

| | | | | | |

| | | | | | |

| Profit before income taxes | 34,384 | 28,063 | | 23 | % | | N/A |

| | | | | | |

| Income taxes | (7,083) | (5,585) | | 27 | % | | N/A |

| Effective tax rate | 20.6% | 19.9% | | | | |

| | | | | | |

| Net profit | 27,301 | 22,478 | | 21 | % | | N/A |

| Net profit margin | 38.3% | 38.3% | | | | |

| | |

| | |

| | | | | | |

Costs and operating profit

The gross margin was realised at 84.1% in the third quarter of 2024 compared with 83.5% in 2023. The 0.6 percentage point gross margin increase is driven by a positive product mix, driven by increased sales of GLP-1-based treatments, partially countered by costs mainly related to ongoing capacity expansions as well as pricing impact due to the phasing of rebates in 2023.

Sales and distribution costs increased by 19% measured in Danish kroner and by 20% at CER compared with 2023. The increase in costs is driven by both North America Operations and International Operations. In North America Operations, the cost increase is mainly driven by promotional activities related to Wegovy®. In International Operations, the increase is mainly related to Obesity care market development activities and Wegovy® launch activities as well as promotional activities for GLP-1 diabetes products. Sales and distribution costs amounted to 21.3% as a percentage of sales.

Research and development costs increased by 17% in both Danish kroner and at CER compared with 2023, driven by both increased late-stage clinical trial and research activities mainly related to Obesity Care. Research and development costs amounted to 13.3% as a percentage of sales.

Administrative costs increased by 10% in both Danish kroner and at CER compared with the same period in 2023. Administration costs amounted to 1.9% as a percentage of sales.

Other operating income and expenses showed a loss of DKK 101 million in the third quarter of 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

Operating profit increased by 26% measured in Danish kroner and by 28% at CER compared with the third quarter of 2023. EBITDA increased by 22% measured in Danish kroner and by 24% at CER.

Financial items (net) showed a net gain of DKK 562 million compared with a net gain of DKK 1,150 million in the third quarter of 2023 reflecting gains on hedged currencies, primarily the US dollar.

The effective tax rate is 20.6% in the third quarter of 2024 compared with an effective tax rate of 19.9% in the third quarter of 2023.

Net profit increased by 21% to DKK 27,301 million and diluted earnings per share increased by 22% to DKK 6.12.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

CASH FLOW AND CAPITAL ALLOCATION

FREE CASH FLOW IN THE FIRST NINE MONTHS OF 2024 AND CAPITAL EXPENDITURE

Free cash flow in the first nine months of 2024 was realised at DKK 71.8 billion compared to DKK 75.6 billion in the first nine months of 2023. The lower free cash flow in 2024 reflects increasing capital expenditure, partially countered by net cash generated from operating activities.

Income under the 340B Program has been partially recognised.

Capital expenditure for property, plant and equipment was DKK 31.1 billion compared with DKK 16.4 billion in 2023, primarily reflecting investments in additional capacity for active pharmaceutical ingredient (API) production and fill-finish capacity for both current and future injectable and oral products. Capital expenditures for intangible assets was DKK 3.7 billion in the first nine months of 2024 compared with DKK 6.1 billion in 2023 reflecting business development activities.

Novo Nordisk to acquire three fill-finish sites from Novo Holdings A/S in connection with the Catalent, Inc. transaction

In February 2024, Novo Nordisk announced an agreement to acquire three fill-finish sites from Novo Holdings A/S (Novo Holdings) in connection with a transaction where Novo Holdings has agreed to acquire Catalent, Inc. (Catalent), a global contract development and manufacturing organisation. The fulfilment of various customary closing conditions is progressing, and Novo Nordisk still expects that the acquisition will be completed towards the end of 2024.

EQUITY AND CAPITAL ALLOCATION

Total equity was DKK 120,522 million at the end of September 2024, equivalent to 30.3% of total assets, compared with 31.0% at the end of September 2023. Please refer to appendix 5 for further elaboration of changes in equity. Novo Nordisk returned DKK 56.8 billion to shareholders via DKK 12.7 billion share buybacks and DKK 44.1 billion dividend in the first nine months of 2024.

2024 share repurchase programme

As of 4 November 2024, Novo Nordisk has repurchased 13,891,849 B shares of DKK 0.10 for an amount of DKK

12,127,705,653 as part of the overall share repurchase programme of up to DKK 20 billion to be executed during a 12-month period beginning 6 February 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

OUTLOOK

The current expectations for 2024 are summarised in the table below:

| | | | | | | | | |

| r | | | |

| | | |

| Expectations are as reported, if not otherwise stated | | Expectations

6 November 2024 | Expectations

7 August 2024 |

| | | |

| | | |

| Sales growth | | | |

| at CER | | 23% to 27% | 22% to 28% |

| as reported | | Around 1 percentage point lower than at CER | Around 1 percentage point lower than at CER |

| | | |

| | | |

| Operating profit growth | | | |

| at CER | | 21% and 27% | 20% and 28% |

| as reported | | Around 2 percentage points lower than at CER | Around 1 percentage point lower than at CER |

| | | |

| | | |

| Financial items (net) | | Loss of around 0.1 bDKK | Loss of around 0.5 bDKK |

| | | |

| Effective tax rate | | 20% to 21% | 19% to 21% |

| | | |

| Capital expenditure (PP&E) | | Around DKK 45 billion | Around DKK 45 billion |

| | | |

| Depreciation, amortisation and impairment losses | | Around DKK 17 billion | Around DKK 17 billion |

| | | |

| Free cash flow (excluding impact from business development) | | Between 57 and 65 bDKK | Between 59 and 69 bDKK |

| | | |

| | | |

Sales growth is now expected to be 23% to 27% at CER. Given the current exchange rates versus the Danish krone, sales growth reported in DKK is still expected to be 1 percentage point lower than at CER.

The guidance reflects expectations for sales growth in both North America Operations and International Operations, mainly driven by volume growth of GLP-1-based treatments for Obesity and Diabetes care. Continued pricing pressure within Diabetes and Obesity care is included in the guidance.

Following higher-than-expected volume growth in recent years, including GLP-1-based products such as Ozempic® and Wegovy®, combined with the expectation of continued volume growth and capacity limitations at some manufacturing sites, the outlook also reflects expected continued periodic supply constraints and related drug shortage notifications across a number of products and geographies. Novo Nordisk is investing in internal and external capacity to increase supply both short and long-term.

Operating profit growth is now expected to be 21% to 27% at CER. Given the current exchange rates versus the Danish krone, growth reported in DKK is now expected to be 2 percentage points lower than at CER.

The expectation for operating profit growth primarily reflects the sales growth outlook and continued investments in future and current growth drivers within Research, Development and Commercial. Within R&D, investments are related to the continued expansion and progression of the early and late-stage pipeline. Commercial investments are mainly related to Obesity care market development activities as well as investments related to GLP-1 diabetes care.

Novo Nordisk now expects financial items (net) to amount to a loss of around DKK 0.1 billion.

The effective tax rate for 2024 is now expected to be in the range of 20-21%.

Capital expenditure is still expected to be around DKK 45 billion in 2024, reflecting expansion of the global supply chain. The investments will create additional capacity across the supply chain, including manufacturing of active pharmaceutical ingredients (API), additional aseptic production and finished production processes as well as packaging capacity. In the coming years, the capital expenditure to sales ratio is still expected to be low double-digit.

Depreciation, amortisation and impairment losses are still expected to be around DKK 17 billion, including the impairment of ocedurenone.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

The free cash flow is now expected to be DKK 57-65 billion reflecting the sales growth, a favourable impact from rebates in the US, countered by investments in capital expenditure. The updated cash flow expectation mainly reflects phasing of payments related to rebates in the US as well as timing of investments related to capital expenditure.

Financial impacts related to and following the expected closing of the Catalent transaction have not been included in the financial guidance.

All of the above expectations are based on assumptions that the global or regional macroeconomic and political environment will not significantly change business conditions for Novo Nordisk during 2024, including energy and supply chain disruptions, the potential implications from major healthcare reforms and legislative changes as well as outcome of legal cases including litigations related to the 340B Drug Pricing Program in the US, and that the currency exchange rates, especially the US dollar, will remain at the current level versus the Danish krone. The guidance is also based on assumptions in relation to the estimation of gross-to-net developments in the US gross sales. Finally, the guidance does not include the financial implications of any new significant business development transactions and significant impairments of intangible assets during 2024. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| FX (average rates) | Q3 2024 | Q3 2023 | % change | | | | 9M 2024 | 9M 2023 | % change | Spot rate

30 October 2024 |

| | | | | | | | | | |

| USD | 679 | | 685 | | (1 | %) | | | | 686 | | 688 | | 0 | % | 690 | |

| CNY | 95 | | 95 | | 0 | % | | | | 95 | | 98 | | (3 | %) | 97 | |

| JPY | 4.56 | | 4.74 | | (4 | %) | | | | 4.55 | | 4.99 | | (9 | %) | 4.50 | |

| CAD | 498 | | 511 | | (3 | %) | | | | 504 | | 511 | | (1 | %) | 495 | |

| BRL | 123 | | 140 | | (12 | %) | | | | 131 | | 137 | | (4 | %) | 119 | |

| | | | | | | | | | |

| | | | | | | | | | |

Novo Nordisk has hedged expected net cash flows in a number of invoicing currencies, and, all other things being equal, movements in key invoicing currencies will impact Novo Nordisk’s operating profit as outlined in the table below. | | | | | | | | |

| | |

| | |

| Key invoicing currencies | Impact on Novo Nordisk's operating profit in the next 12 months of a 5% movement in currency | Hedging period (months)1 |

| | |

| | |

| USD | DKK 5,900 million | 12 | |

CNY2 | DKK 660 million | 12 |

| CAD | DKK 480 million | 0 |

| BRL | DKK 250 million | 0 |

| JPY | DKK 240 million | 12 | |

| | |

1) As of 30 September 2024.

2) Chinese yuan traded offshore (CNH) used as proxy when hedging Novo Nordisk’s CNY currency exposure.

The financial impact from foreign exchange hedging is included in Financial items (net).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

INNOVATION AND THERAPEUTIC FOCUS

Diabetes care

Once-weekly IcoSema submitted for regulatory approval in the EU

In October 2024, Novo Nordisk submitted IcoSema, a once-weekly combination of basal insulin icodec and semaglutide, for regulatory approval in the EU for the treatment of people with type 2 diabetes. The submission is based on the COMBINE clinical trial programme comprised of three phase 3a global clinical trials involving more than 2500 adults with type 2 diabetes.

FLOW data with semaglutide 1.0 mg submitted for regulatory approval in China

In August 2024, Novo Nordisk submitted a chronic kidney disease (CKD) label extension application to Centre for Drug Evaluation (CDE) for regulatory approval in China for Ozempic® to include results from the kidney outcomes trial FLOW.

Successful completion of STRIDE with semaglutide 1.0 mg, a functional outcomes trial in peripheral arterial disease (PAD)

In September 2024, Novo Nordisk successfully completed the phase 3b trial STRIDE, a 52-week trial comparing semaglutide 1.0 mg with placebo as an adjunct to standard of care in people living with type 2 diabetes and PAD with intermittent claudication (muscle pain in legs when active). After 52 weeks, the trial achieved its primary objective by demonstrating a statistically significant and superior improvement in maximum walking distance of 13% for people treated with semaglutide 1.0 mg compared to placebo. The results are considered clinically relevant. In the semaglutide 1.0 mg arm, the maximum walking distance increased by 21% (baseline: 185m) compared to 8% in the placebo arm (baseline: 186m). In the trial, semaglutide 1.0 mg appeared to have a safe and well-tolerated profile in line with previous semaglutide 1.0 mg trials. Novo Nordisk expects to file for regulatory approvals of a label expansion for Ozempic® in the US and EU in the first half of 2025.

Successful completion of the SOUL cardiovascular outcomes trial with oral semaglutide in people with type 2 diabetes

In October 2024, Novo Nordisk announced the headline results from the SOUL cardiovascular outcomes trial, comparing oral semaglutide with placebo, as an adjunct to standard of care, in people with type 2 diabetes and established cardiovascular disease (CVD) and/or chronic kidney disease (CKD). As part of standard of care, 49% of patients received SGLT2i at some point during the trial. The trial achieved its primary objective by demonstrating a statistically significant and superior reduction in major adverse cardiovascular events (MACE) of 14% for people treated with oral semaglutide compared to placebo. In the trial, oral semaglutide appeared to have a safe and well-tolerated profile in line with previous oral semaglutide trials. Novo Nordisk expects to file for regulatory approval of a label expansion for Rybelsus® in both the US and EU around the turn of the year. For further information, please see the company announcement here: https://www.novonordisk.com/news-and-media/news-and-ir-materials/news-details.html?id=171480 (the contents of the company's website do not form a part of this Form 6-K).

Phase 2 trial initiated with once-weekly subcutaneous and once daily oral amycretin in people with type 2 diabetes

In August 2024, Novo Nordisk initiated a phase 2 dose-finding trial with amycretin, a GLP-1 and amylin receptor dual agonist. The 36-week trial is investigating efficacy, safety and tolerability of different doses of once-weekly subcutaneous amycretin and once-daily oral amycretin compared with placebo in approximately 440 people living with type 2 diabetes.

Phase 1 trial with DNA immunotherapy successfully completed

In August 2024, Novo Nordisk successfully completed a phase 1 trial with a type 1 diabetes DNA immunotherapy, a DNA plasmid intended to preserve endogenous insulin production and in turn slow down or stop development of type 1 diabetes in people at high risk, before clinical diagnosis. The 12-week multiple dose phase 1 trial primarily investigated the safety and tolerability as well as pharmacokinetics of the DNA plasmid administered subcutaneously once weekly in people diagnosed with type 1 diabetes diagnosed within the past 48 months. The trial confirmed the defined trial objectives and the DNA plasmid appeared to have a safe and well-tolerated profile. Novo Nordisk is analysing the detailed data and, based on the data, will be further evaluating the next stage of clinical development with DNA immunotherapy.

Obesity care

Positive CHMP opinions for updates of the Wegovy® label in the EU

In September, Novo Nordisk announced that the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion for an update of the Wegovy® label in the EU. The label update incorporates data showing that Wegovy®, when added to standard of care, can reduce heart failure-related symptoms and

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

improve physical limitations and exercise function in people with obesity-related HFpEF, with or without type 2 diabetes. The positive opinion is based on results from the STEP HFpEF and STEP HFpEF-DM trials. Further, in October 2024, a positive opinion was also issued by the CHMP based on data from the STEP 9 trial in people with obesity and knee osteoarthritis (OA). The STEP 9 trial demonstrated a superior reduction in the WOMAC (Western Ontario and McMaster Universities Osteoarthritis Index) pain score and reduction in body weight compared to placebo.

Phase 2a trial with monlunabant completed

In September 2024, Novo Nordisk announced the headline results from a phase 2a clinical trial, completed with monlunabant. The trial investigated the efficacy and safety of a once-daily 10 mg, 20 mg and 50 mg dose of monlunabant compared to placebo on body weight after 16 weeks in 243 people with obesity and metabolic syndrome. Based on the results, Novo Nordisk expects to initiate a larger phase 2b trial in obesity to further investigate dosing and the safety profile of monlunabant over a longer duration in a global population. For further information, please see the company announcement here: https://www.novonordisk.com/news-and-media/news-and-ir-materials/news-details.html?id=170501 (the contents of the company's website do not form a part of this Form 6-K).

Phase 1 trial with amylin 355 initiated

In September 2024, Novo Nordisk initiated a phase 1 trial with once-weekly subcutaneous amylin 355. The 12-week trial is investigating safety, tolerability, pharmacokinetics and pharmacodynamics of different doses of amylin 355 in people with overweight or obesity.

Rare disease

Alhemo® receives positive opinion by the European Medicines Agency for people living with haemophilia A or B with inhibitors

In October 2024, the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion for Alhemo® (the brand name for concizumab) for prophylactic treatment for people living with haemophilia A or B with inhibitors. The CHMP positive opinion is based on data from the phase 3 explorer7 study and Novo Nordisk expects a final approval by the European Commission within approximately two months.

Successful completion of phase 3b trial FRONTIER 5 with Mim8

In October 2024, Novo Nordisk successfully completed the phase 3b trial FRONTIER 5, an open-label safety study in adults and adolescents with haemophilia A with and without inhibitors. The objective of the 26-week trial was to assess the safety of switching from emicizumab prophylaxis treatment to Mim8 prophylaxis treatment. In the trial, a switch from emicizumab treatment to Mim8 treatment was well tolerated. Further, the study participants had a strong preference for the Mim8 device and reported that the Mim8 pen injector was easy to use. Following regulatory interactions, Novo Nordisk now expects to submit Mim8 for the first regulatory approval during 2025.

Successful completion of the phase 2 part (interim) of the etavopivat HIBISCUS phase 2/3 trial

Novo Nordisk successfully completed the phase 2 part (interim) of the HIBISCUS phase 2/3 trial in adults and adolescents with sickle-cell disease (SCD), investigating the safety and efficacy of oral etavopivat 200mg and 400mg once-daily versus placebo in around 60 patients. After 52 weeks of etavopivat treatment, the interim analysis established proof of concept for etavopivat in SCD, and etavopivat appeared to have a safe and well-tolerated profile. The phase 3 part of the HIBISCUS is currently ongoing with expected read-out in 2026. The interim phase 2 results will be presented at a scientific conference later in 2024.

Phase 1 trial initiated with Inno8 in haemophilia

In October 2024, Novo Nordisk initiated a phase 1 trial with Inno8, an oral, once-daily antibody fragment for the treatment of haemophilia. The trial is investigating safety, tolerability, pharmacokinetics and pharmacodynamics of different doses of Inno8.

Phase 1 trial initiated with TMPRSS6 and the GalXC in Hereditary Haemochromatosis

In September 2024, Novo Nordisk initiated a phase 1 trial with TMPRSS6, a RNAi in development for rare blood disease. The trial is investigating safety, tolerability, pharmacokinetics and pharmacodynamics of TMPRSS6 in patients with Hereditary Haemochromatosis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

Cardiovascular & Emerging Therapy Areas

Phase 3 trial ESSENCE part I with semaglutide 2.4 mg in MASH successfully completed

In November 2024, Novo Nordisk announced the headline results from a phase 3 clinical trial, successfully completed with semaglutide 2.4 mg. The trial achieved its primary endpoints by demonstrating a statistically significant and superior improvement in liver fibrosis with no worsening of steatohepatitis, as well as resolution of steatohepatitis with no worsening of liver fibrosis with semaglutide 2.4 mg compared to placebo. At week 72, 37.0% of people treated with semaglutide 2.4 mg achieved improvement in liver fibrosis with no worsening of steatohepatitis compared to 22.5% on placebo. 62.9% of people treated with semaglutide 2.4 mg achieved resolution of steatohepatitis with no worsening of liver fibrosis compared to 34.1% on placebo. In the trial, semaglutide 2.4 mg appeared to have a safe and well-tolerated profile in line with previous semaglutide 2.4 mg trials. Novo Nordisk expects to file for regulatory approvals in the US and EU in the first half of 2025. For further information, please see the company announcement here: https://www.novonordisk.com/news-and-media/news-and-ir-materials/news-details.html?id=171971 (the contents of the company's website do not form a part of this Form 6-K).

Development of phase 3 ocedurenone across indications terminated

Following the stop of the ocedurenone CLARION-CKD phase 3 trial, based on the interim analysis in June, Novo Nordisk has further analysed detailed trial data and decided to terminate further development of ocedurenone.

Phase 1 trial with CNP initiated in cardiovascular disease

In October 2024, Novo Nordisk initiated a phase 1 trial with a C-type natriuretic peptide (CNP) analogue in development for heart failure. The single ascending dose (SAD) trial is investigating the safety, tolerability, pharmacokinetics, and pharmacodynamics of CNP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic aspirations | Performance highlights | Commercial execution | Financials | Cash flow and capital allocation | Outlook | Innovation and therapeutic focus | Purpose and sustainability | Legal | Financial Information |

| | | | | Company announcement No 81 / 2024 |

| | | | | |

| Financial report for the period 1 January 2024 to 30 September 2024 | |

PURPOSE AND SUSTAINABILITY

ENVIRONMENT

| | | | | | | | | | | | | | | | | |

| ENVIRONMENTAL PERFORMANCE | Unit | 9M 2024 | 9M 2023 | | | | % change

9M 2024 to

9M 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | 781 | | | | |

Total CO2e emissions | 1,000 tonnes CO2e | 3,446 | 2,574 | | | | 34 | % |

- Scope 1 CO2e emissions1 | 1,000 tonnes CO2e | 59 | 54 | | | | 9 | % |

- Scope 2 CO2e emissions2 | 1,000 tonnes CO2e | 17 | 11 | | | | 55 | % |

- Scope 3 CO2e emissions3 | 1,000 tonnes CO2e | 3,370 | 2,509 | | | | 34 | % |

| | | | | | | |

1. Scope 1: Direct CO2e emissions from sources that are owned or controlled by the Novo Nordisk Group. 2. Scope 2: Indirect emissions from purchased electricity, heat and steam. Market-based emissions are calculated based on CO2e emission factors from the previous year. 3. Scope 3: Indirect emissions from Novo Nordisk full value chain. |

| | | | | | | |

Emissions

Novo Nordisk aims to reach zero CO2e emissions from operations and transportation by 2030. Further, the aim is that goods and services from suppliers will be based on 100% sourced renewable power by 2030. In the first nine months of 2024, Novo Nordisk has reduced CO2e emissions from operations and transportation (Scope 1, 2 and partial Scope 3) by 38% compared to the first nine months of 2019. The reduction is driven by decarbonisation initiatives, including increased usage of renewable energy and biofuel as well as reduced business flights,

Compared to the first nine months of 2023, Scope 1 CO2e emissions increased by 9%, reflecting increased production volumes. This is partially countered by energy-saving initiatives and usage of renewable energy.

Scope 2 CO2e emissions increased by 55% compared to the first nine months of 2023, mainly reflecting the expansion of facilities, partially countered by an increase in the usage of renewable energy sources.

Scope 3 CO2e emissions increased by 34% compared to the first nine months of 2023 due to increased investments in capital expenditure for property, plant, and equipment.

SOCIAL

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SOCIAL PERFORMANCE | Unit | 9M 2024 | 9M 2023 | | | | % change

9M 2024 to

9M 2023 | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Patients | | | | | | | | | | | | | | |