0001818383FALSE00018183832025-02-242025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 24, 2025

_____________________________

MediaAlpha, Inc.

(Exact Name of Registrant as Specified in Its Charter)

_____________________________

| | | | | | | | |

| Delaware | 001-39671 | 85-1854133 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

700 South Flower Street, Suite 640 Los Angeles, California | 90017 |

| (Address of Principal Executive Offices) | (Zip Code) |

(213) 316-6256

(Registrant’s telephone number, including area code)

(Not Applicable)

(Former name or former address, if changed since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | MAX | | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

ITEM 2.02 – Results of Operations and Financial Condition.

On February 24, 2025, MediaAlpha, Inc. (“MediaAlpha”) issued a press release and an accompanying shareholder letter announcing its financial results as of and for the fourth quarter and full year ended December 31, 2024, and its financial outlook for the first quarter of 2025. Copies of the press release and shareholder letter are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Form 8-K and are incorporated by reference herein.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

MediaAlpha refers to non-GAAP financial information in the press release and shareholder letter. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in each document.

ITEM 9.01 – Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Description |

99.1 | |

99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MediaAlpha, Inc. |

| | |

| Date: February 24, 2025 | By: | /s/ Jeffrey B. Coyne |

| | Name: | Jeffrey B. Coyne |

| | Title: | General Counsel & Secretary |

MEDIAALPHA ANNOUNCES FOURTH QUARTER AND FULL YEAR 2024

FINANCIAL RESULTS

Exceeds Fourth Quarter Guidance with Revenue Growth of 157% and Transaction Value Growth of 202%; Delivers Record Transaction Value of $401 million in Property & Casualty Vertical

Full-Year 2024 Revenue Grew 123% to $865 million; Transaction Value Grew 151% to $1.5 billion, Driven by Robust Volume and Pricing

Full-Year 2024 Net Income Significantly Improved to $22.1 million; Record Adjusted EBITDA(1)of $96.1 million

Los Angeles, CA (February 24, 2025) – MediaAlpha, Inc. (NYSE: MAX) ("MediaAlpha" or the "Company") today announced its financial results for the fourth quarter and full year ended December 31, 2024.

“Our fourth quarter financial results surpassed our expectations, closing out a year of record-breaking performance,” said MediaAlpha co-founder and CEO Steve Yi. “Our Property & Casualty insurance vertical reached new highs, fueled by favorable trends in the auto insurance sector, including improving profitability and continued robust advertising spend by our key auto carrier partners, and we made meaningful market share gains driven by our leading marketplace model. As we look ahead, we remain confident that our commitment to our partnerships and industry leading scale and efficiency will drive long-term sustainable growth and shareholder value creation.”

Fourth Quarter 2024 Financial Results

•Revenue of $300.6 million, an increase of 157% year over year;

•Transaction Value of $499.2 million, an increase of 202% year over year;

◦Transaction Value from Property & Casualty of $401 million, an increase of 639% year over year;

◦Transaction Value from Health of $90 million, a decrease of 8% year over year;

•Gross margin of 16.3%, compared with 19.0% in the fourth quarter of 2023;

•Contribution Margin(1) of 17.1%, compared with 21.4% in the fourth quarter of 2023;

•Net income of $7.3 million, compared with a net loss of $3.3 million in the fourth quarter of 2023; and

•Adjusted EBITDA(1) of $36.7 million, compared with $12.7 million in the fourth quarter of 2023.

•Additionally, the Company remains in active settlement discussions with the FTC and has recorded a $7.0 million reserve related to this matter in accordance with U.S. GAAP.

Full Year 2024 Financial Results

•Revenue of $864.7 million, an increase of 123% year over year;

•Transaction Value of $1.5 billion, an increase of 151% year over year;

◦Transaction Value from Property & Casualty of $1.2 billion, an increase of 325% year over year;

◦Transaction Value from Health of $270 million, an increase of 4% year over year;

•Gross margin of 16.6%, compared with 17.2% in 2023;

•Contribution Margin(1) of 17.9%, compared with 20.1% in 2023;

•Net income of $22.1 million, compared with a net loss of $56.6 million in 2023; and

•Adjusted EBITDA(1) of $96.1 million, compared with $27.1 million in 2023.

(1)A reconciliation of GAAP to Non-GAAP financial measures has been provided at the end of this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Financial Outlook

MediaAlpha's guidance for the first quarter of 2025 reflects approximately 170% year-over-year growth in P&C Transaction Value, representing a high single-digit sequential decline as pricing moderates from fourth quarter levels, offset in part by rising volumes. In its Health vertical, the Company expects Transaction Value to decline by a high-teens percentage year over year as conditions in under-65 continue to soften.

For the first quarter of 2025, MediaAlpha currently expects the following:

•Transaction Value of $415 million to $440 million, representing a 95% year-over-year increase at the midpoint of the guidance range;

•Revenue of $225 million to $245 million, representing a 86% year-over-year increase at the midpoint of the guidance range;

•Adjusted EBITDA of $24.5 million to $26.5 million, representing a 77% year-over-year increase at the midpoint of the guidance range. The Company expects Contribution less Adjusted EBITDA to be approximately $0.5 - $1.0 million higher than in the fourth quarter of 2024.

With respect to the Company’s projections of Adjusted EBITDA and Contribution under “Financial Outlook,” MediaAlpha is not providing a reconciliation of Adjusted EBITDA to net income (loss), or of Contribution to gross profit, because the Company is unable to predict with reasonable certainty the reconciling items that may affect the corresponding GAAP measures without unreasonable effort. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the corresponding GAAP measures for the applicable period.

For a detailed explanation of the Company’s non-GAAP measures, please refer to the appendix section of this press release.

Conference Call Information

MediaAlpha will host a Q&A conference call today to discuss the Company's fourth quarter and full year 2024 results and its financial outlook for the first quarter of 2025 at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). A live audio webcast of the call will be available on the MediaAlpha Investor Relations website at https://investors.mediaalpha.com. To register for the webcast, click here. Participants may also dial-in, toll-free, at (800) 715-9871 or (646) 307-1963, with passcode 2616289. An audio replay of the conference call will be available following the call and available on the MediaAlpha Investor Relations website at https://investors.mediaalpha.com.

The Company has also posted a letter to shareholders on its investor relations website. MediaAlpha has used, and intends to continue to use, its investor relations website at https://investors.mediaalpha.com as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation our expectation that our commitment to our partnerships and industry leading scale and efficiency will drive long-term sustainable growth and shareholder value creation, and our financial outlook for the first quarter of 2025. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including those more fully described in MediaAlpha’s filings with the Securities and Exchange Commission (“SEC”), including the Form 10-K as of and for the year ended December 31, 2024 to be filed on February 24, 2025. These factors should not be construed as exhaustive. MediaAlpha disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this press release.

Non-GAAP Financial Measures and Operating Metrics

This press release includes Adjusted EBITDA and Contribution Margin, which are non-GAAP financial measures. The Company also presents Transaction Value, which is an operating metric not presented in accordance with GAAP. See the appendix for definitions of Adjusted EBITDA, Contribution, Contribution Margin and Transaction Value, as well as reconciliations to the corresponding GAAP financial metrics, as applicable.

We present Transaction Value, Adjusted EBITDA, Contribution, and Contribution Margin because they are used extensively by our management and board of directors to manage our operating performance, including evaluating our operational performance against budget and assessing our overall operating efficiency and operating leverage. Accordingly, we believe that Transaction Value, Adjusted EBITDA and Contribution Margin provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management team and board of directors. Each of Transaction Value, Adjusted EBITDA and Contribution Margin has limitations as a financial measure and investors should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP.

About MediaAlpha

We believe we are the insurance industry’s leading programmatic customer acquisition platform. With more than 1,200 active partners, excluding our agent partners, we connect insurance carriers with online shoppers and generated nearly 119 million Consumer Referrals in 2024. Our programmatic advertising technology over the last twelve months powered $1.5 billion in spend on brand, comparison, and metasearch sites across property & casualty insurance, health insurance, life insurance, and other industries. For more information, please visit www.mediaalpha.com.

Contacts:

Investors

Denise Garcia

Hayflower Partners

Denise@HayflowerPartners.com

MediaAlpha, Inc. and subsidiaries

Consolidated Balance Sheets

(In thousands, except share data and per share amounts)

| | | | | | | | | | | |

| As of December 31, |

| 2024 (unaudited) | | 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 43,266 | | | $ | 17,271 | |

| Accounts receivable, net of allowance for credit losses of $1,005 and $537, respectively | 142,932 | | | 53,773 | |

| Prepaid expenses and other current assets | 3,711 | | | 3,529 | |

| Total current assets | $ | 189,909 | | | $ | 74,573 | |

| Intangible assets, net | 19,985 | | | 26,015 | |

| Goodwill | 47,739 | | | 47,739 | |

| | | |

| Other assets | 4,814 | | | 5,598 | |

| Total assets | $ | 262,447 | | | $ | 153,925 | |

| Liabilities and stockholders' deficit | | | |

| Current liabilities | | | |

| Accounts payable | 105,563 | | | 56,279 | |

| Accrued expenses | 18,542 | | | 11,588 | |

| Current portion of long-term debt | 8,849 | | | 11,854 | |

| Total current liabilities | $ | 132,954 | | | $ | 79,721 | |

| Long-term debt, net of current portion | 153,596 | | | 162,445 | |

| Liabilities under tax receivables agreement, net of current portion | 7,006 | | | — | |

| Other long-term liabilities | 15,123 | | | 6,184 | |

| Total liabilities | $ | 308,679 | | | $ | 248,350 | |

Commitments and contingencies | | | |

| Stockholders’ deficit | | | |

| Class A common stock, $0.01 par value - 1.0 billion shares authorized; 55.5 million and 47.4 million shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | 555 | | | 474 | |

| Class B common stock, $0.01 par value - 100 million shares authorized; 11.6 million and 18.1 million shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | 116 | | | 181 | |

| Preferred stock, $0.01 par value - 50 million shares authorized; 0 shares issued and outstanding as of December 31, 2024 and December 31, 2023 | — | | | — | |

| Additional paid-in capital | 507,640 | | | 511,613 | |

| Accumulated deficit | (505,933) | | | (522,562) | |

| Total stockholders’ equity (deficit) attributable to MediaAlpha, Inc. | $ | 2,378 | | | $ | (10,294) | |

| Non-controlling interests | (48,610) | | | (84,131) | |

| Total stockholders' deficit | $ | (46,232) | | | $ | (94,425) | |

| Total liabilities and stockholders’ deficit | $ | 262,447 | | | $ | 153,925 | |

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Operations

(In thousands, except share data and per share amounts)

| | | | | | | | | | | | | |

| Year ended December 31, |

| 2024 (unaudited) | | 2023 | | |

| Revenue | $ | 864,704 | | | $ | 388,149 | | | |

| Cost and operating expenses | | | | | |

| Cost of revenue | 721,131 | | | 321,437 | | | |

| Sales and marketing | 24,725 | | | 25,432 | | | |

| Product development | 19,764 | | | 18,458 | | | |

| General and administrative | 56,359 | | | 62,746 | | | |

| Total cost and operating expenses | 821,979 | | | 428,073 | | | |

| Income (loss) from operations | 42,725 | | | (39,924) | | | |

Other expense, net | 4,872 | | | 1,779 | | | |

| Interest expense | 14,351 | | | 15,315 | | | |

Total other expense, net | 19,223 | | | 17,094 | | | |

| Income (loss) before income taxes | 23,502 | | | (57,018) | | | |

| Income tax expense (benefit) | 1,384 | | | (463) | | | |

| Net income (loss) | $ | 22,118 | | | $ | (56,555) | | | |

| | | | | |

| Net income (loss) attributable to non-controlling interest | 5,489 | | | (16,135) | | | |

| Net income (loss) attributable to MediaAlpha, Inc. | $ | 16,629 | | | $ | (40,420) | | | |

| Net income (loss) per share of Class A common stock | | | | | |

| -Basic and diluted | $ | 0.31 | | | $ | (0.89) | | | |

| | | | | |

| Weighted average shares of Class A common stock outstanding | | | | | |

| -Basic and diluted | 53,043,576 | | | 45,573,416 | | | |

| | | | | |

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Operations

(In thousands, except share data and per share amounts)

| | | | | | | | | | | |

| Three months ended December 31, |

| 2024 (unaudited) | | 2023 (unaudited) |

| Revenue | $ | 300,648 | | | $ | 117,174 | |

| Cost and operating expenses | | | |

| Cost of revenue | 251,666 | | | 94,892 | |

| Sales and marketing | 6,117 | | | 5,630 | |

| Product development | 5,021 | | | 3,933 | |

| General and administrative | 19,592 | | | 12,273 | |

| Total cost and operating expenses | 282,396 | | | 116,728 | |

| Income from operations | 18,252 | | | 446 | |

| Other expense, net | 6,843 | | | 614 | |

| Interest expense | 3,193 | | | 3,918 | |

| Total other expense, net | 10,036 | | | 4,532 | |

| Income (loss) before income taxes | 8,216 | | | (4,086) | |

| Income tax expense (benefit) | 915 | | | (793) | |

| Net income (loss) | $ | 7,301 | | | $ | (3,293) | |

| | | |

| Net income (loss) attributable to non-controlling interest | 2,661 | | | (927) | |

| Net income (loss) attributable to MediaAlpha, Inc. | $ | 4,640 | | | $ | (2,366) | |

| Net income (loss) per share of Class A common stock | | | |

| -Basic and diluted | $ | 0.08 | | | $ | (0.05) | |

| | | |

| Weighted average shares of Class A common stock outstanding | | | |

| -Basic and diluted | 55,277,134 | | | 46,991,824 | |

| | | |

MediaAlpha, Inc. and subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | | | | | | |

| Year ended December 31, |

| 2024 (unaudited) | | 2023 | | |

| Cash Flows from operating activities | | | | | |

| Net income (loss) | $ | 22,118 | | | $ | (56,555) | | | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | |

| Equity-based compensation expense | 34,083 | | | 53,321 | | | |

| Non-cash lease expense | 803 | | | 695 | | | |

| Depreciation expense on property and equipment | 252 | | | 353 | | | |

| Amortization of intangible assets | 6,430 | | | 6,917 | | | |

| Amortization of deferred debt issuance costs | 755 | | | 793 | | | |

| | | | | |

| Impairment of cost method investment | — | | | 1,406 | | | |

| | | | | |

| Credit losses | 497 | | | 5 | | | |

| | | | | |

| Tax receivables agreement liability related adjustments | 7,006 | | | 6 | | | |

| Changes in operating assets and liabilities: | | | | | |

| Accounts receivable | (89,656) | | | 6,220 | | | |

| Prepaid expenses and other current assets | (244) | | | 2,287 | | | |

| Other assets | 500 | | | 500 | | | |

| Accounts payable | 49,284 | | | 2,287 | | | |

| Accrued expenses | 14,044 | | | 1,996 | | | |

| Net cash provided by operating activities | $ | 45,872 | | | $ | 20,231 | | | |

| Cash flows from investing activities | | | | | |

| Purchases of property and equipment | (254) | | | (73) | | | |

| | | | | |

| Acquisition of intangible assets | (400) | | | — | | | |

| | | | | |

| Net cash (used in) investing activities | $ | (654) | | | $ | (73) | | | |

| Cash flows from financing activities | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Payments made for / proceeds received from: | | | | | |

| | | | | |

| Repayments on long-term debt | (12,547) | | | (9,500) | | | |

| | | | | |

| | | | | |

| | | | | |

| Payments pursuant to tax receivables agreement | — | | | (2,822) | | | |

| Shares withheld for taxes on vesting of restricted stock units | (6,308) | | | (3,721) | | | |

| | | | | |

| | | | | |

| Contributions from QLH’s members | 854 | | | 1,464 | | | |

| Distributions | (1,222) | | | (2,850) | | | |

| Net cash (used in) financing activities | $ | (19,223) | | | $ | (17,429) | | | |

Net increase in cash and cash equivalents | 25,995 | | | 2,729 | | | |

| Cash and cash equivalents, beginning of period | 17,271 | | | 14,542 | | | |

| Cash and cash equivalents, end of period | $ | 43,266 | | | $ | 17,271 | | | |

Key business and operating metrics and Non-GAAP financial measures

Transaction Value

We define “Transaction Value” as the total gross dollars transacted by our partners on our platform. Transaction Value is an operating metric not presented in accordance with GAAP, and is a driver of revenue based on the economic relationships we have with our partners. Our partners use our platform to transact via Open and Private Marketplace transactions. In our Open Marketplace model, revenue recognized represents the fees paid by our Demand Partners for Consumer Referrals sold and is equal to the Transaction Value and revenue share payments to our Supply Partners represent costs of revenue. In our Private Marketplace model, revenue recognized represents a platform fee billed to the Demand Partner or Supply Partner based on an agreed-upon percentage of the Transaction Value for the Consumer Referrals transacted, and accordingly there are no associated costs of revenue. We utilize Transaction Value to assess the overall level of transaction activity through our platform. We believe it is useful to investors to assess the overall level of activity on our platform and to better understand the sources of our revenue across our different transaction models and verticals.

The following table presents Transaction Value by platform model for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Full year ended December 31, |

| (dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

| Open Marketplace transactions | | $ | 294,655 | | | $ | 115,162 | | | $ | 841,604 | | | $ | 378,730 | |

| Percentage of total Transaction Value | | 59.0 | % | | 69.6 | % | | 56.4 | % | | 63.8 | % |

| Private Marketplace transactions | | 204,514 | | | 50,184 | | | 650,256 | | | 214,708 | |

| Percentage of total Transaction Value | | 41.0 | % | | 30.4 | % | | 43.6 | % | | 36.2 | % |

| Total Transaction Value | | $ | 499,169 | | | $ | 165,346 | | | $ | 1,491,860 | | | $ | 593,438 | |

The following table presents Transaction Value by vertical for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Full year ended December 31, |

| (dollars in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

| Property & Casualty insurance | | $ | 400,976 | | | $ | 54,247 | | | $ | 1,178,497 | | | $ | 277,552 | |

| Percentage of total Transaction Value | | 80.3 | % | | 32.8 | % | | 79.0 | % | | 46.8 | % |

| Health insurance | | 90,305 | | | 98,372 | | | 270,285 | | | 259,822 | |

| Percentage of total Transaction Value | | 18.1 | % | | 59.5 | % | | 18.1 | % | | 43.8 | % |

| Life insurance | | 6,278 | | | 8,015 | | | 30,662 | | | 34,057 | |

| Percentage of total Transaction Value | | 1.3 | % | | 4.8 | % | | 2.1 | % | | 5.7 | % |

Other(1) | | 1,610 | | | 4,712 | | | 12,416 | | | 22,007 | |

| Percentage of total Transaction Value | | 0.3 | % | | 2.9 | % | | 0.8 | % | | 3.7 | % |

| Total Transaction Value | | $ | 499,169 | | | $ | 165,346 | | | $ | 1,491,860 | | | $ | 593,438 | |

(1)Our other verticals include Travel and Consumer Finance.

Contribution and Contribution Margin

We define “Contribution” as revenue less revenue share payments and online advertising costs, or, as reported in our consolidated statements of operations, revenue less cost of revenue (i.e., gross profit), as adjusted to exclude the following items from cost of revenue: equity-based compensation; salaries, wages, and related costs; internet and hosting costs; amortization; depreciation; other services; and merchant-related fees. We define “Contribution Margin” as Contribution expressed as a percentage of revenue for the same period. Contribution and Contribution Margin are non-GAAP financial measures that we present to supplement the financial information we present on a GAAP basis. We use Contribution and Contribution Margin to measure the return on our relationships with our Supply Partners (excluding certain fixed costs), the financial return on and efficacy of our online advertising costs to drive consumers to our proprietary websites, and our operating leverage. We do not use Contribution and Contribution Margin as measures of overall profitability. We present Contribution and Contribution Margin because they are used by our management and board of directors to manage our operating performance, including evaluating our operational performance against budget and assessing our overall operating efficiency and operating leverage. For example, if Contribution increases and our headcount costs and other operating expenses remain steady, our Adjusted EBITDA and operating leverage increase. If Contribution Margin decreases, we may choose to re-evaluate and re-negotiate our revenue share agreements with our Supply Partners, to make optimization and pricing changes with respect to our bids for keywords from primary traffic acquisition sources, or to change our overall cost structure with respect to headcount, fixed costs and other costs. Other companies may calculate Contribution and Contribution Margin differently than we do. Contribution and Contribution Margin have their limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results presented in accordance with GAAP.

The following table reconciles Contribution with gross profit, the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Full year ended December 31, |

| (in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | $ | 300,648 | | | $ | 117,174 | | | $ | 864,704 | | | $ | 388,149 | |

| Less cost of revenue | | (251,666) | | | (94,892) | | | (721,131) | | | (321,437) | |

| Gross profit | | $ | 48,982 | | | $ | 22,282 | | | $ | 143,573 | | | $ | 66,712 | |

| Adjusted to exclude the following (as related to cost of revenue): | | | | | | | | |

| Equity-based compensation | | 372 | | | 916 | | | 3,026 | | | 3,875 | |

| Salaries, wages, and related | | 913 | | | 850 | | | 3,387 | | | 3,682 | |

| Internet and hosting | | 168 | | | 161 | | | 570 | | | 579 | |

| Depreciation | | 6 | | | 8 | | | 21 | | | 38 | |

| Other expenses | | 257 | | | 179 | | | 796 | | | 692 | |

| Other services | | 729 | | | 696 | | | 2,737 | | | 2,491 | |

| Merchant-related fees | | 89 | | | 18 | | | 306 | | | 32 | |

| Contribution | | $ | 51,516 | | | $ | 25,110 | | | $ | 154,416 | | | $ | 78,101 | |

| Gross Margin | | 16.3 | % | | 19.0 | % | | 16.6 | % | | 17.2 | % |

| Contribution Margin | | 17.1 | % | | 21.4 | % | | 17.9 | % | | 20.1 | % |

Adjusted EBITDA

We define “Adjusted EBITDA” as net income (loss) excluding interest expense, income tax expense (benefit), depreciation expense on property and equipment, amortization of intangible assets, as well as equity-based compensation expense and certain other adjustments as listed in the table below. Adjusted EBITDA is a non-GAAP financial measure that we present to supplement the financial information we present on a GAAP basis. We monitor and present Adjusted EBITDA because it is a key measure used by our management to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in the calculations of Adjusted EBITDA. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects. In addition, presenting Adjusted EBITDA provides investors with a metric to evaluate the capital efficiency of our business.

Adjusted EBITDA is not presented in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures presented in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP. These limitations include the fact that Adjusted EBITDA excludes interest expense on debt, income tax expense (benefit), equity-based compensation expense, depreciation and amortization, and certain other adjustments that we consider to be useful to investors and others in understanding and evaluating our operating results. In addition, other companies may use other measures to evaluate their performance, including different definitions of “Adjusted EBITDA,” which could reduce the usefulness of our Adjusted EBITDA as a tool for comparison.

The following table reconciles Adjusted EBITDA with net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31, | | Full year ended December 31, |

| (in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) | | $ | 7,301 | | | $ | (3,293) | | | $ | 22,118 | | | $ | (56,555) | |

| Equity-based compensation expense | | 7,631 | | | 9,378 | | | 34,083 | | | 53,321 | |

| Interest expense | | 3,193 | | | 3,918 | | | 14,351 | | | 15,315 | |

Income tax expense (benefit) | | 915 | | | (793) | | | 1,384 | | | (463) | |

| Depreciation expense on property and equipment | | 61 | | | 78 | | | 252 | | | 353 | |

| Amortization of intangible assets | | 1,603 | | | 1,729 | | | 6,430 | | | 6,917 | |

Transaction expenses(1) | | — | | | 88 | | | 1,172 | | | 641 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Impairment of cost method investment | | — | | | — | | | — | | | 1,406 | |

Contract Settlement(2) | | — | | | — | | | (1,725) | | | — | |

Changes in TRA related liability(3) | | 7,006 | | | — | | | 7,006 | | | 6 | |

Changes in Tax Indemnification Receivable | | 34 | | | 687 | | | (52) | | | 639 | |

| | | | | | | | |

| | | | | | | | |

Settlement of federal and state income tax refunds | | — | | | 2 | | | — | | | 5 | |

Legal expenses(4) | | 8,937 | | | 885 | | | 11,092 | | | 4,303 | |

Reduction in force costs (5) | | — | | | — | | | — | | | 1,233 | |

| Adjusted EBITDA | | $ | 36,681 | | | $ | 12,679 | | | $ | 96,111 | | | $ | 27,121 | |

(1)Transaction expenses for the year ended December 31, 2024 consist of $1.2 million of legal and accounting fees incurred by us in connection with resale registration statements filed with the SEC. Transaction expenses for the three months and year ended December 31, 2023 consist of $0.1 million and $0.6 million, respectively, of legal and accounting fees incurred by us in

connection with the amendment to the 2021 Credit Facilities, the tender offer filed by the Company's largest shareholder in May 2023, and a resale registration statement filed with the SEC.

(2)Contract settlement consists of $1.7 million of income for the year ended December 31, 2024 recorded in connection with a one-time contract termination fee received from one of our Supply Partners in the Health and Life insurance verticals that ceased operations during the year ended December 31, 2024.

(3)Changes in TRA related liability for the three months and year ended December 31, 2024 consist of a $7.0 million charge to increase the TRA liability as a result of remeasuring the non-current portion of the liability to the amount of payment under the agreement considered to be probable. Changes in TRA related liability for the year ended December 31, 2023 consist of immaterial expense.

(4)Legal expenses of $8.9 million and $11.1 million for the three months and year ended December 31, 2024, respectively, consist of a $7.0 million loss reserve established in connection with the FTC Matter and legal fees incurred in connection with such matter. Legal expenses of $0.9 million and $4.3 million for the three months and year ended December 31, 2023, respectively, consist of legal fees incurred in connection with the FTC Matter and costs associated with a legal settlement unrelated to our core operations.

(5)Reduction in force costs for the year ended December 31, 2023 consist of $1.2 million of severance benefits provided to the terminated employees in connection with the RIF Plan. Additionally, equity-based compensation expense includes $0.3 million of charges related to the RIF Plan for the year ended December 31, 2023.

| | | | | |

| |

|

|

SHAREHOLDER LETTER Q4 & FULL YEAR 2024 |

|

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Q4 | | | Year Ended | |

| (in millions, except percentages) | 2024 | 2023 | YoY Change | | 2024 | 2023 | YoY Change |

| | | | | | | |

| Revenue | $300.6 | $117.2 | 157% | | $864.7 | $388.1 | 123% |

Transaction Value 1 | $499.2 | $165.3 | 202% | | $1,491.9 | $593.4 | 151% |

| | | | | | | | |

| | | | | | | | |

| Gross Profit | $49.0 | $22.3 | 120% | | $143.6 | $66.7 | 115% |

Contribution 1 | $51.5 | $25.1 | 105% | | $154.4 | $78.1 | 98% |

| | | | | | | |

| | | | | | | | |

| Net Income (Loss) | $7.3 | $(3.3) | n/m | | $22.1 | $(56.6) | n/m |

Adjusted EBITDA 1 | $36.7 | $12.7 | 189% | | $96.1 | $27.1 | 254% |

| | | | | | | |

| n/m - Not Meaningful | | | | | | | |

__________________1.See “Key Business and Operating Metrics and Non-GAAP Financial Measures” for additional information regarding non-GAAP metrics and operating metrics used in this shareholder letter.

2024 was a remarkable year for MediaAlpha, as we delivered record-breaking financial results across all key metrics. Transaction Value increased over 150% to $1.5 billion, while Adjusted EBITDA more than tripled to $96.1 million, driven by gains in our Property & Casualty (P&C) insurance vertical. We achieved these exceptional results even as auto carrier participation remained well below its full potential.

We delivered a very strong fourth quarter, again exceeding our guidance. Transaction Value grew 202% year over year, reaching an all-time high of $499.2 million on the strength of our P&C insurance vertical. Adjusted EBITDA increased to $36.7 million, reflecting year-over-year growth of 189%. We gained share as we expanded our existing publisher and advertiser partnerships and delivered higher Adjusted EBITDA margins due to our efficient operating model and disciplined expense management.

Our P&C insurance vertical, which represented 79% of 2024 Transaction Value, was our primary driver of growth. We posted record Transaction Value in the fourth quarter, driven by new highs in both volume and pricing resulting from heightened shopping activity and the auto industry’s renewed focus on increasing market share. As carriers optimize their marketing investments, pricing has moderated in the first quarter from these levels, while we continue to see volumes trending upward in line with typical seasonality. Overall, we believe the outlook for the auto insurance market remains strong, supported by solid underlying fundamentals.

Our Health insurance vertical accounted for $270.3 million, or 18%, of 2024 Transaction Value at a 14% take rate, of which roughly two-thirds was from under-65 at a slightly higher take rate. Fourth quarter Transaction Value was down 8% year over year, slightly below our expectations, as we saw softening in under-65 as well as the expected headwinds in Medicare Advantage. In the first quarter of 2025, we expect Medicare Advantage to stabilize while conditions in under-65 continue to soften. Importantly, our long-term growth opportunity in the Health vertical is Medicare Advantage, which is a large and growing market in the early stages of digital disruption as more seniors shop online for policies.

Our balance sheet continued to improve throughout the year and we ended the fourth quarter with a net debt to 2024 Adjusted EBITDA ratio of less than 1.3x. We remain confident in our ability to convert a significant portion of Adjusted EBITDA into unlevered free cash flow going forward, driven by our capital-efficient business model. We remain committed to delivering long-term shareholder value through disciplined capital allocation.

As we previously shared, on October 30 we received a draft complaint and initial settlement demand from the Federal Trade Commission (FTC), related primarily to the operation of our under-65 health insurance business. We take compliance very seriously and disagree strongly with the FTC’s allegations, and we believe we have meritorious defenses. At the same time, we are actively engaged in discussions with the FTC staff in an effort to reach a mutually acceptable resolution. In accordance with U.S. GAAP, we have recorded a $7.0 million reserve in the fourth quarter related to this matter. Further details can be found in the Form 10-K we are filing today.

Looking forward, we are very excited about our multi-year outlook. Over the past five years, we have nearly tripled Transaction Value and gained significant market share. Our historical growth has been driven by strong execution, the insurance industry’s continuing secular shift to online advertising and our differentiated marketplace model. This has allowed our partners to rapidly scale to meet market demand while enabling us to operate with unrivaled efficiency. We expect these factors will continue to drive long-term, sustainable and profitable growth in 2025 and beyond.

| | |

| Financial Discussion - Transaction Value and Revenue Metrics |

Transaction Value increased 202% year over year to $499.2 million in Q4 2024, driven primarily by a 639% increase in the P&C insurance vertical. For the full year 2024, Transaction Value increased 151% year over year to $1.5 billion. Transaction Value represents the total gross investment in customer acquisition executed by our partners on our platform, and is one of the key metrics that reflects our ability to drive value for our partners and increase our share of wallet as Demand Partners’ budgets increasingly migrate online.

Transaction Value from our P&C insurance vertical increased 639% year over year to $401.0 million in Q4 2024, driven by significant year-over-year increases in marketing budgets and customer acquisition spending by select carrier partners as they focused on growth initiatives in response to improving underwriting profitability. For the full year 2024, Transaction Value from our P&C insurance vertical increased 325% year over year to $1.2 billion.

Transaction Value from our Health insurance vertical decreased 8% year over year to $90.3 million in Q4 2024, due primarily to ongoing profitability pressures and regulatory changes that affected carrier demand. Q4 is typically seasonally strong in this vertical due to the annual and open enrollment periods for Medicare and under 65 Health insurance. For the full year 2024, Transaction Value from our Health insurance vertical increased 4% year over year to $270.3 million.

Transaction Value from our Life insurance vertical decreased 22% year over year to $6.3 million in Q4 2024, driven by lower customer acquisition spending from our Demand Partners. For the full year 2024, Transaction Value from our Life insurance vertical decreased 10% year over year to $30.7 million.

Transaction Value from our Other vertical, which includes travel and consumer finance, decreased 66% year over year to $1.6 million in Q4 2024, due primarily to weakness in consumer finance. For the full year 2024, Transaction Value from our Other vertical decreased 44% year over year to $12.4 million.

We generated $300.6 million of total revenue in Q4 2024, up 157% year over year, and for the full year 2024, we generated $864.7 million of total revenue, up 123% year over year, driven primarily by higher revenue from our P&C insurance vertical.

Revenue from our P&C insurance vertical increased 525% year over year to $235.5 million in Q4 2024, driven by the increase in Transaction Value, offset in part by a higher mix of transactions from our Private Marketplaces, where revenue is recognized on a net basis. For the full year 2024, revenue from our P&C insurance vertical increased 301% year over year to $658.2 million.

Revenue from our Health insurance vertical decreased 18% year over year to $58.6 million in Q4 2024, a greater year-over-year decrease than Transaction Value due to a higher mix of transactions from our Private Marketplaces. For the full year 2024, revenue from our Health insurance vertical decreased 7% year over year to $173.5 million.

Revenue from our Life insurance vertical decreased 15% year over year to $5.1 million in Q4 2024, driven by lower customer acquisition spending by our Demand Partners, offset in part by a higher mix of transactions from our Open Marketplace, which positively impacted revenue. For the full year 2024, revenue from our Life insurance vertical remained flat year over year at $24.4 million.

Revenue from our Other vertical, which consists of travel and consumer finance, decreased 39% year over year to $1.5 million in Q4 2024. For the full year 2024, revenue from our Other vertical decreased 36% year over year to $8.6 million.

| | |

Financial Discussion - Profitability |

Gross profit was $49.0 million in Q4 2024, a year-over-year increase of 120%. For the full year 2024, gross profit was $143.6 million, a year-over-year increase of 115%. For the full year 2024, Gross Profit Margin was 16.6%, compared with 17.2% in 2023. Contribution, which generally represents revenue less revenue share payments and online advertising costs, was $51.5 million in Q4 2024, a year-over-year increase of 105%. For the full year 2024, Contribution was $154.4 million, a year-over-year increase of 98%. Contribution Margin was 17.1% in Q4 2024, compared with 21.4% in Q4 2023. For the full year 2024, Contribution Margin was 17.9%, compared with 20.1% in 2023.

Net income was $7.3 million in Q4 2024, compared with a net loss of $3.3 million in Q4 2023, driven primarily by higher Contribution of $26.4 million, offset in part by $8.0 million of higher FTC related costs (including a reserve of $7.0 million established for this matter), and a $7.0 million increase in the liability under our Tax Receivables Agreement. For the full year 2024, net income was $22.1 million, compared with a net loss of $56.6 million in 2023, driven primarily by higher Contribution.

Adjusted EBITDA was $36.7 million in Q4 2024, a year-over-year increase of 189%. Adjusted EBITDA margin was 12.2%, compared with 10.8% in Q4 2023. The increase was driven primarily by higher gross profit, offset in part by moderately higher investments in our operating expenses. For the full year 2024, Adjusted EBITDA was $96.1 million, a year-over-year increase of 254%.

Financial Discussion - Q1 2025 Outlook 1 | | | | | | | | | | | | | | |

| | Q1 2025 |

Transaction Value 2 | | $415 million | - | $440 million |

| Y/Y Growth | | 89% | | 101% |

| | | | |

| | | | |

| Revenue | | $225 million | - | $245 million |

| Y/Y Growth | | 78% | | 93% |

| | | | |

| | | | |

Adjusted EBITDA 2 | | $24.5 million | - | $26.5 million |

| Y/Y Growth | | 70% | | 84% |

Our guidance for Q1 2025 reflects approximately 170% year-over-year growth in P&C Transaction Value, representing a high single-digit sequential decline as pricing moderates from fourth quarter levels, offset in part by rising volumes. In our Health vertical, we expect Transaction Value to decline by a high-teens percentage year over year as conditions in under-65 continue to soften.

Transaction Value: For Q1 2025, we expect Transaction Value to be in the range of $415 million to $440 million, representing a year-over-year increase of 95% at the midpoint.

Revenue: For Q1 2025, we expect revenue to be in the range of $225 million to $245 million, representing a year-over-year increase of 86% at the midpoint.

Adjusted EBITDA: For Q1 2025, we expect Adjusted EBITDA to be in the range of $24.5 million to $26.5 million, representing a year-over-year increase of 77% at the midpoint. We are projecting Contribution less Adjusted EBITDA to be approximately $0.5 - $1.0 million higher than in Q4 2024.

Thank you, | | | | | | | | |

| Steve Yi | | Patrick Thompson |

| Chief Executive Officer, President and Co-Founder | | Chief Financial Officer & Treasurer |

1 With respect to the Company’s projections of Adjusted EBITDA and Contribution under “Financial Discussion – Q1 2025 Outlook”, MediaAlpha is not providing a reconciliation of Adjusted EBITDA to net income (loss), or of Contribution to gross profit, because the Company is unable to predict with reasonable certainty the reconciling items that may affect the corresponding GAAP measures without unreasonable effort. These reconciling items are uncertain, depend on various factors and could significantly impact, either individually or in the aggregate, the GAAP measures for the applicable period.

2 See “Key Business and Operating Metrics and Non-GAAP Financial Measures” for additional information regarding non-GAAP metrics and operating metrics used in this shareholder letter.

| | |

Key Business and Operating Metrics and Non-GAAP Financial Measures |

In addition to traditional financial metrics, we rely upon certain business and operating metrics that are not presented in accordance with GAAP to estimate the volume of spending on our platform, estimate and recognize revenue, evaluate our business performance and facilitate our operations. Such business and operating metrics should not be considered in isolation from, or as an alternative to, measures presented in accordance with GAAP and should be considered together with other operating and financial performance measures presented in accordance with GAAP. Also, such business and operating metrics may not necessarily be comparable to similarly titled measures presented by other companies.

Transaction Value

We define “Transaction Value” as the total gross dollars transacted by our partners on our platform. Transaction Value is an operating metric not presented in accordance with GAAP, and is a driver of revenue based on the economic relationships we have with our partners. Our partners use our platform to transact via Open and Private Marketplace transactions. In our Open Marketplace model, revenue recognized represents the fees paid by our Demand Partners for Consumer Referrals sold and is equal to the Transaction Value and revenue share payments to our Supply Partners represent costs of revenue. In our Private Marketplace model, revenue recognized represents a platform fee billed to the Demand Partner or Supply Partner based on an agreed-upon percentage of the Transaction Value for the Consumer Referrals transacted, and accordingly there are no associated costs of revenue. We utilize Transaction Value to assess the overall level of transaction activity through our platform. We believe it is useful to investors to assess the overall level of activity on our platform and to better understand the sources of our revenue across our different transaction models and verticals.

The following table presents Transaction Value by platform model for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Full year ended December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Open Marketplace transactions | $ | 294,655 | | | $ | 115,162 | | | $ | 841,604 | | | $ | 378,730 | |

| Percentage of total Transaction Value | 59.0 | % | | 69.6 | % | | 56.4 | % | | 63.8 | % |

| Private Marketplace transactions | 204,514 | | | 50,184 | | | 650,256 | | | 214,708 | |

| Percentage of total Transaction Value | 41.0 | % | | 30.4 | % | | 43.6 | % | | 36.2 | % |

| Total Transaction Value | $ | 499,169 | | | $ | 165,346 | | | $ | 1,491,860 | | | $ | 593,438 | |

The following table presents Transaction Value by vertical for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Full year ended December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Property & Casualty insurance | $ | 400,976 | | | $ | 54,247 | | | $ | 1,178,497 | | | $ | 277,552 | |

| Percentage of total Transaction Value | 80.3 | % | | 32.8 | % | | 79.0 | % | | 46.8 | % |

| Health insurance | 90,305 | | | 98,372 | | | 270,285 | | | 259,822 | |

| Percentage of total Transaction Value | 18.1 | % | | 59.5 | % | | 18.1 | % | | 43.8 | % |

| Life insurance | 6,278 | | | 8,015 | | | 30,662 | | | 34,057 | |

| Percentage of total Transaction Value | 1.3 | % | | 4.8 | % | | 2.1 | % | | 5.7 | % |

| Other | 1,610 | | | 4,712 | | | 12,416 | | | 22,007 | |

| Percentage of total Transaction Value | 0.3 | % | | 2.9 | % | | 0.8 | % | | 3.7 | % |

| Total Transaction Value | $ | 499,169 | | | $ | 165,346 | | | $ | 1,491,860 | | | $ | 593,438 | |

Contribution and Contribution Margin

We define “Contribution” as revenue less revenue share payments and online advertising costs, or, as reported in our consolidated statements of operations, revenue less cost of revenue (i.e., gross profit), as adjusted to exclude the following items from cost of revenue: equity-based compensation; salaries, wages, and related costs; internet and hosting costs; amortization; depreciation; other services; and merchant-related fees. We define “Contribution Margin” as Contribution expressed as a percentage of revenue for the same period. Contribution and Contribution Margin are non-GAAP financial measures that we present to supplement the financial information we present on a GAAP basis. We use Contribution and Contribution Margin to measure the return on our relationships with our Supply Partners (excluding certain fixed costs), the financial return on and efficacy of our online advertising costs to drive consumers to our proprietary websites, and our operating leverage. We do not use Contribution and Contribution Margin as measures of overall profitability. We present Contribution and Contribution Margin because they are used by our management and board of directors to manage our operating performance, including evaluating our operational performance against budget and assessing our overall operating efficiency and operating leverage. For example, if Contribution increases and our headcount costs and other operating expenses remain steady, our Adjusted EBITDA and operating leverage increase. If Contribution Margin decreases, we may choose to re-evaluate and re-negotiate our revenue share agreements with our Supply Partners, to make optimization and pricing changes with respect to our bids for keywords from primary traffic acquisition sources, or to change our overall cost structure with respect to headcount, fixed costs and other costs. Other companies may calculate Contribution and Contribution Margin differently than we do. Contribution and Contribution Margin have their limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results presented in accordance with GAAP.

The following table reconciles Contribution with gross profit, the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Full year ended December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 300,648 | | | $ | 117,174 | | | $ | 864,704 | | | $ | 388,149 | |

| Less cost of revenue | (251,666) | | | (94,892) | | | (721,131) | | | (321,437) | |

| Gross profit | $ | 48,982 | | | $ | 22,282 | | | $ | 143,573 | | | $ | 66,712 | |

| Adjusted to exclude the following (as related to cost of revenue): | | | | | | | |

| Equity-based compensation | 372 | | | 916 | | | 3,026 | | | 3,875 | |

| Salaries, wages, and related | 913 | | | 850 | | | 3,387 | | | 3,682 | |

| Internet and hosting | 168 | | | 161 | | | 570 | | | 579 | |

| Depreciation | 6 | | | 8 | | | 21 | | | 38 | |

| Other expenses | 257 | | | 179 | | | 796 | | | 692 | |

| Other services | 729 | | | 696 | | | 2,737 | | | 2,491 | |

| Merchant-related fees | 89 | | | 18 | | | 306 | | | 32 | |

| Contribution | $ | 51,516 | | | $ | 25,110 | | | $ | 154,416 | | | $ | 78,101 | |

| Gross margin | 16.3 | % | | 19.0 | % | | 16.6 | % | | 17.2 | % |

| Contribution Margin | 17.1 | % | | 21.4 | % | | 17.9 | % | | 20.1 | % |

Consumer Referrals

We define “Consumer Referral” as any consumer click, call or lead purchased by a buyer on our platform. Click revenue is recognized on a pay-per-click basis and revenue is earned and recognized when a consumer clicks on a listed buyer’s advertisement that is presented subsequent to the consumer’s search (e.g., auto insurance quote search or health insurance quote search). Call revenue is earned and recognized when a consumer transfers to a buyer and remains engaged for a requisite duration of time, as specified by each buyer. Lead revenue is recognized when we deliver data leads to buyers. Data leads are generated either through insurance carriers, insurance-focused research destination websites or other financial websites that make the data leads available for purchase through our platform, or when consumers complete a full quote request on our proprietary websites. Delivery occurs at the time of lead transfer. The data we generate from each Consumer Referral feeds into our analytics model to generate conversion probabilities for each unique consumer, enabling discovery of predicted return and cost per sale across the platform and helping us to improve our platform technology. We monitor the number of Consumer Referrals on our platform in order to measure Transaction Value, revenue and overall business performance across our verticals and platform models.

The following table presents the percentages of total Transaction Value generated from clicks, calls and leads for the years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| Clicks | | 84.1 | % | | 69.4 | % |

| Calls | | 9.4 | % | | 18.6 | % |

| Leads | | 6.5 | % | | 12.0 | % |

Adjusted EBITDA

We define “Adjusted EBITDA” as net income (loss) excluding interest expense, income tax expense (benefit), depreciation expense on property and equipment, amortization of intangible assets, as well as equity-based compensation expense and certain other adjustments as listed in the table below. We define “Adjusted EBITDA Margin” as Adjusted EBITDA as a percentage of revenue. Adjusted EBITDA is a non-GAAP financial measure that we present to supplement the financial information we present on a GAAP basis. We monitor and present Adjusted EBITDA because it is a key measure used by our management to understand and evaluate our operating performance, to establish budgets and to develop operational goals for managing our business. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in the calculations of Adjusted EBITDA. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects. In addition, presenting Adjusted EBITDA provides investors with a metric to evaluate the capital efficiency of our business.

Adjusted EBITDA is not presented in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures presented in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income, which is the most directly comparable financial measure calculated and presented in accordance with GAAP. These limitations include the fact that Adjusted EBITDA excludes interest expense on debt, income tax expense (benefit), equity-based compensation expense, depreciation and amortization, and certain other adjustments that we consider to be useful to investors and others in understanding and evaluating our operating results. In addition, other companies may use other measures to evaluate their performance, including different definitions of “Adjusted EBITDA,” which could reduce the usefulness of our Adjusted EBITDA as a tool for comparison.

The following table reconciles Adjusted EBITDA with net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, for the three months and full years ended December 31, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | Full year ended December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) | $ | 7,301 | | | $ | (3,293) | | | $ | 22,118 | | | $ | (56,555) | |

| Equity-based compensation expense | 7,631 | | | 9,378 | | | 34,083 | | | 53,321 | |

| Interest expense | 3,193 | | | 3,918 | | | 14,351 | | | 15,315 | |

Income tax expense (benefit) | 915 | | | (793) | | | 1,384 | | | (463) | |

| Depreciation expense on property and equipment | 61 | | | 78 | | | 252 | | | 353 | |

| Amortization of intangible assets | 1,603 | | | 1,729 | | | 6,430 | | | 6,917 | |

Transaction expenses(1) | — | | | 88 | | | 1,172 | | | 641 | |

| | | | | | | |

| | | | | | | |

| Impairment of cost method investment | — | | | — | | | — | | | 1,406 | |

Contract Settlement(2) | — | | | — | | | (1,725) | | | — | |

Changes in TRA related liability(3) | 7,006 | | | — | | | 7,006 | | | 6 | |

Changes in Tax Indemnification Receivable | 34 | | | 687 | | | (52) | | | 639 | |

Settlement of federal and state income tax refunds | — | | | 2 | | | — | | | 5 | |

Legal expenses(4) | 8,937 | | | 885 | | | 11,092 | | | 4,303 | |

Reduction in force costs (5) | — | | | — | | | — | | | 1,233 | |

| Adjusted EBITDA | $ | 36,681 | | | $ | 12,679 | | | $ | 96,111 | | | $ | 27,121 | |

(1)Transaction expenses for the year ended December 31, 2024 consist of $1.2 million of legal and accounting fees incurred by us in connection with resale registration statements filed with the SEC. Transaction expenses for the three months and year ended December 31, 2023 consist of $0.1 million and $0.6 million, respectively, of legal and accounting fees incurred by us in connection with the amendment to the 2021 Credit Facilities, the tender offer filed by the Company's largest shareholder in May 2023, and a resale registration statement filed with the SEC.

(2)Contract settlement consists of $1.7 million of income for the year ended December 31, 2024 recorded in connection with a one-time contract termination fee received from one of our Supply Partners in the Health and Life insurance verticals that ceased operations during the year ended December 31, 2024.

(3)Changes in TRA related liability for the three months and year ended December 31, 2024 consist of a $7.0 million charge to increase the TRA liability as a result of remeasuring the non-current portion of the liability to the amount of payment under the agreement considered to be probable. Changes in TRA related liability for the year ended December 31, 2023 consist of immaterial expense.

(4)Legal expenses of $8.9 million and $11.1 million for the three months and year ended December 31, 2024, respectively, consist of a $7.0 million loss reserve established in connection with the FTC Matter and legal fees incurred in connection with such matter. Legal expenses of $0.9 million and $4.3 million for the three months and year ended December 31, 2023, respectively, consist of legal fees incurred in connection with the FTC Matter and costs associated with a legal settlement unrelated to our core operations.

(5)Reduction in force costs for the year ended December 31, 2023 consist of $1.2 million of severance benefits provided to the terminated employees in connection with the RIF Plan. Additionally, equity-based compensation expense includes $0.3 million of charges related to the RIF Plan for the year ended December 31, 2023.

Forward-Looking Statements

This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation statements regarding our belief that the outlook for the auto insurance market remains strong, supported by solid underlying fundamentals; our belief that that our long-term growth opportunity in the Health vertical is Medicare Advantage, which is a large and growing market in the early stages of digital disruption as more seniors shop online for policies; our expectation that we will convert a significant portion of Adjusted EBITDA into unlevered free cash flow going forward, driven by our capital-efficient business model; our belief that we have meritorious defenses to the FTC’s allegations; our expectation that the insurance industry’s continuing secular shift to online advertising and our differentiated marketplace model will continue to drive long-term, sustainable and profitable growth in 2025 and beyond; and our financial outlook for the first quarter of 2025. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including those more fully described in MediaAlpha’s filings with the Securities and Exchange Commission (“SEC”), including the Form 10-K as of and for the year ended December 31, 2024 to be filed on or about February 24, 2025. These factors should not be construed as exhaustive. MediaAlpha disclaims any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this shareholder letter.

v3.25.0.1

Cover

|

Feb. 24, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 24, 2025

|

| Entity Registrant Name |

MediaAlpha, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39671

|

| Entity Tax Identification Number |

85-1854133

|

| Entity Address, Address Line One |

700 South Flower Street

|

| Entity Address, Address Line Two |

Suite 640

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90017

|

| City Area Code |

213

|

| Local Phone Number |

316-6256

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.01 par value

|

| Trading Symbol |

MAX

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001818383

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

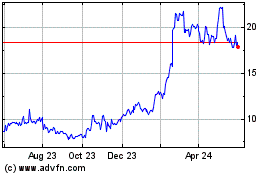

MediaAlpha (NYSE:MAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

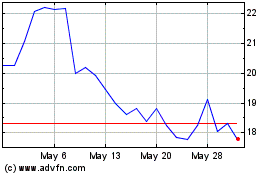

MediaAlpha (NYSE:MAX)

Historical Stock Chart

From Feb 2024 to Feb 2025