false000005604700000560472024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 30, 2024 |

KIRBY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada |

1-7615 |

74-1884980 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

55 Waugh Drive, Suite 1000 |

|

Houston, Texas |

|

77007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: 713-435-1000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KEX |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 30, 2024, Kirby Corporation (“Kirby” or the "Company") issued a press release announcing results for the third quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this report.

EBITDA, a non-GAAP financial measure, is used in the press release. Kirby defines EBITDA as net earnings attributable to Kirby before interest expense, taxes on income, and depreciation and amortization. Kirby has historically evaluated its operating performance using numerous measures, one of which is EBITDA. EBITDA is presented because of its wide acceptance as a financial indicator. EBITDA is one of the performance measures used in calculating performance compensation pursuant to the Company’s annual incentive plan. EBITDA is also used by rating agencies in determining Kirby’s credit rating and by analysts publishing research reports on Kirby, as well as by investors and investment bankers generally in valuing companies. A quantitative reconciliation of EBITDA to net earnings attributable to Kirby for the 2024 and 2023 third quarters and first nine months is included in the press release. EBITDA is not a calculation based on generally accepted accounting principles and should not be considered as an alternative to, but should only be considered in conjunction with, Kirby’s GAAP financial information.

The press release also includes non-GAAP financial measures which exclude certain one-time items, including earnings before taxes on income (excluding one-time items), net earnings attributable to Kirby (excluding one-time items), and diluted earnings per share (excluding one-time items). A reconciliation of these measures with GAAP is included in the press release. Management believes that the exclusion of certain one-time items from these financial measures enables it and investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of Kirby’s normal operating results. The press release additionally includes free cash flow, a non-GAAP financial measure, which Kirby defines as net cash provided by operating activities less capital expenditures. A reconciliation of free cash flow with GAAP is included in the press release. Kirby uses free cash flow to assess and forecast cash flow and to provide additional disclosures on the Company’s liquidity. Free cash flow does not imply the amount of residual cash flow available for discretionary expenditures as it excludes mandatory debt service requirements and other non-discretionary expenditures. These non-GAAP financial measures are not calculations based on generally accepted accounting principles and should not be considered as an alternative to, but should only be considered in conjunction with Kirby’s GAAP financial information.

Item 9.01. Financial Statements and Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

KIRBY CORPORATION |

|

|

|

|

Date: |

October 30, 2024 |

By: |

/s/ Raj Kumar |

|

|

|

Raj Kumar

Executive Vice President

and Chief Financial Officer |

|

|

KIRBY CORPORATION |

Contact: Kurt Niemietz |

|

713-435-1077 |

FOR IMMEDIATE RELEASE

KIRBY CORPORATION ANNOUNCES 2024 THIRD QUARTER RESULTS

•Third quarter 2024 earnings per share of $1.55

•Continued strength in inland marine with a sequential increase in spot market prices and operating margins in the low 20% range

•Continued strong market conditions in coastal marine with operating margins improving to the mid-teens range

•Strong free cash flow generation with over $130 million of free cash flow in the third quarter

•Kirby repurchased 483,335 shares at an average price of $115.46 for $55.8 million in the 2024 third quarter

HOUSTON, October 30, 2024 – Kirby Corporation (“Kirby”) (NYSE: KEX) today announced net earnings attributable to Kirby for the third quarter ended September 30, 2024, of $90.0 million or $1.55 per share, compared with earnings of $63.0 million, or $1.05 per share for the 2023 third quarter. Consolidated revenues for the 2024 third quarter were $831.1 million compared with $764.8 million reported for the 2023 third quarter.

David Grzebinski, Kirby’s Chief Executive Officer, commented, “Our third quarter results reflected steady market fundamentals in both marine transportation and distribution and services, even though we experienced some modest weather and navigational challenges for marine and continued supply challenges in distribution and services. These headwinds were mostly offset by good execution in both marine and distribution and services during the quarter that led to strong financial performance, with total revenues up 9% and earnings per share up 48% year-over-year.

“In inland marine transportation, our third quarter results reflected further gains in pricing combined with a modest negative impact from poor navigational conditions due to weather and lock delays. From a demand standpoint, customer activity was steady with barge utilization rates running in the 90% range throughout the quarter. Spot prices increased in the low to mid-single digits sequentially and in the low double-digit range year-over-year. Term contract prices also renewed up higher with high-single digit increases versus a year ago. Overall, third quarter inland revenues increased 11% year-over-year and margins were in the low 20% range.

“In coastal, market fundamentals remained steady with our barge utilization levels running in the mid to high-90% range. During the quarter, strong customer demand and limited availability of large capacity vessels continued which resulted in high 20% increases on term contract renewals year-over-year and average spot market rates that increased in the low double-digit range year-over-year. Overall, third quarter coastal revenues increased 23% year-over-year and had an operating margin in the mid-teens range.

“In distribution and services, demand was mixed across our end markets with growth in some areas offset by slowness or delays in other areas which netted a 3% increase in total segment revenues year-over-year. In power generation, revenue grew 4% sequentially but was down 6% year-over-year driven by supply delays. The pace of orders was strong and added to backlog with several large project wins from backup power and other industrial customers as power becomes more critical. In oil and gas, revenues were up 19% year-over-year and up 8% sequentially driven by

some growth in our e-frac business. In our commercial and industrial market, revenues were up 4% year-over-year driven by steady demand in marine engine repair partially offset by softness in on-highway truck service and repair.” Mr. Grzebinski concluded.

Segment Results – Marine Transportation

Marine transportation revenues for the 2024 third quarter were $486.1 million compared with $429.9 million for the 2023 third quarter. Operating income for the 2024 third quarter was $99.5 million compared with $63.5 million for the 2023 third quarter. Segment operating margin for the 2024 third quarter was 20.5% compared with 14.8% for the 2023 third quarter.

In the inland market, 2024 third quarter average barge utilization was in the 90% range compared to the high 80% range in the 2023 third quarter. During the quarter, average spot market rates increased in the low to mid-single digits sequentially and in the low double-digit range compared to the 2023 third quarter. Term contracts that renewed in the third quarter increased in the high-single digits on average compared to a year ago. Inland revenues increased 11% compared to the 2023 third quarter primarily due to pricing. The inland market represented 81% of segment revenues in the third quarter of 2024. Inland’s operating margin was in the low 20% range for the quarter.

In coastal, market conditions were strong during the quarter, with Kirby’s barge utilization in the mid to high-90% range. During the quarter, average spot market rates increased in the low double-digit range compared to the 2023 third quarter. Term contracts that renewed in the third quarter increased in the high-20% range on average compared to a year ago. Coastal revenues increased 23% year-over-year driven by better pricing and fewer shipyards. Coastal represented 19% of marine transportation segment revenues during the third quarter and had an operating margin in the mid-teens range.

Segment Results – Distribution and Services

Distribution and services revenues for the 2024 third quarter were $345.1 million compared with $334.9 million for the 2023 third quarter. Operating income for the 2024 third quarter was $30.4 million compared with $33.2 million for the 2023 third quarter. Operating margin was 8.8% for the 2024 third quarter compared with 9.9% for the 2023 third quarter.

Power generation revenues in industrial end markets were up 16% sequentially and 61% year-over-year while power generation revenues for oil & gas end markets were down over both periods. In total, power generation revenues were down 6% and operating income was down 26% when compared to the 2023 third quarter as delays in power generation equipment for oil and gas impacted the year-over-year comparison. Overall, power generation revenues represented approximately 32% of segment revenues. Power generation operating margins were in the high single digits.

In the commercial and industrial market, revenues grew 4% and operating income increased 15% when compared to the 2023 third quarter, as higher business levels in marine engine repair were offset by lower activity in on-highway service and repair. Overall, commercial and industrial revenues represented approximately 47% of segment revenues. Commercial and industrial operating margins were in the high single digits.

In the oil and gas market, revenues grew 8% and operating income increased 166% compared to the 2024 second quarter while year-over-year revenues grew 19% and operating income was down 14% due to lower levels of conventional oilfield activity which resulted in decreased demand for new transmissions and parts partially offset by deliveries of e-frac equipment. Overall, oil and gas revenues represented approximately 21% of segment revenues. Oil and gas operating margins were in the mid to high-single digits.

Cash Generation

For the 2024 third quarter, EBITDA was $190.5 million compared with $148.5 million for the 2023 third quarter. During the quarter, net cash provided by operating activities was $206.5 million, and capital expenditures were $76.4 million. During the quarter, the Company had net proceeds from asset sales totaling $4.8 million. Kirby also used $55.8 million to repurchase stock at an average price of $115.46. As of September 30, 2024, the Company had $67.1 million of cash and cash equivalents on the balance sheet and $570.2 million of liquidity available. Total debt was $978.6 million, and the debt-to-capitalization ratio improved to 22.9%.

2024 Outlook

Commenting on the outlook for the remainder of 2024, Mr. Grzebinski said, “Overall, solid execution and good market conditions led to a strong quarter for us and we have a favorable outlook as we look forward at next year. A lack of meaningful newbuild of equipment in marine has supply in check and we continue to receive new orders for power generation equipment as we work through supply issues. Our balance sheet is strong, and we expect to generate significant cash flow this year and next year. We see favorable fundamentals continuing and expect our businesses will produce solid financial results as we move through the remainder of this year and into next year.”

In inland marine, our outlook for the fourth quarter of 2024 anticipates continued positive market dynamics with limited new barge construction in the industry. We expect to see normal seasonal weather impacts and steady demand with slightly lower refinery utilization. With these market conditions, we expect our barge utilization rates to remain around the 90% range throughout the remainder of the year. We also expect continued improvement in term contract pricing as renewals occur during the final quarter of the year. Overall, inland revenues are expected to be flat to slightly down sequentially given the onset of normal seasonal weather patterns and some expected equipment maintenance. The Company expects operating margins to be slightly down as compared to the 2024 third quarter.

In coastal, market conditions remain very favorable with supply and demand in balance across the industry fleet. Steady customer demand is expected to continue in the fourth quarter with our barge utilization in the mid-90% range. As previously mentioned, we have a number of planned shipyards in the fourth quarter, and we expect margins to be in the mid-to-high single digits in the fourth quarter with coastal revenues expected to be down in the mid-single digits sequentially, as a result.

In the distribution and services segment, we see near-term uncertainty from supply issues, customer maintenance deferrals, and lower overall levels of activity in oil and gas. However, we expect incremental demand for products, parts, and services in the segment longer term as rates of investment improve from low levels. In commercial and industrial, the demand outlook in marine repair remains steady while on-highway service and repair is somewhat weak in the current environment. In power generation, we anticipate continued strong growth in orders as data center demand and the need for backup power is very strong. In oil and gas, activity levels are lower but have been stabilizing at these lower levels. We do anticipate extended lead times for certain OEM products to continue contributing to a volatile delivery schedule of new products in the fourth quarter and into 2025. Overall, the Company expects segment revenues to be down in the mid-single digits sequentially with operating margins in the mid to high-single digits but lower than the third quarter of 2024.

For the full year, Kirby expects to generate net cash provided from operating activities of $600 million to $700 million and capital spending is expected to range between $325 million to $355 million. Approximately $200 million to $240 million is associated with marine maintenance capital and improvements to existing inland and coastal marine equipment, and facility improvements. Approximately $115 million is associated with growth capital spending in both our businesses.

Conference Call

A conference call is scheduled for 7:30 a.m. Central Standard Time today, Wednesday, October 30, 2024, to discuss the 2024 third quarter performance as well as the outlook for 2024. To listen to the webcast, please visit the Investor Relations section of Kirby’s website at www.kirbycorp.com. For listeners who wish to participate in the question and answer session via telephone, please pre-register at Kirby Earnings Call Registration. All registrants will receive dial-in information and a PIN allowing them to access the live call. A slide presentation for this conference call will be posted on Kirby’s website approximately 15 minutes before the start of the webcast. A replay of the webcast will be available for a period of one year by visiting the News & Events page in the Investor Relations section of Kirby’s website.

GAAP to Non-GAAP Financial Measures

The financial and other information to be discussed in the conference call is available in this press release and in a Form 8-K filed with the Securities and Exchange Commission. This press release and the Form 8-K includes a non-GAAP financial measure, EBITDA, which Kirby defines as net earnings attributable to Kirby before interest expense, taxes on income, and depreciation and amortization. A reconciliation of EBITDA with GAAP net earnings attributable to Kirby is included in this press release. This press release also includes non-GAAP financial measures which exclude certain one-time items, including earnings before taxes on income (excluding one-time items), net earnings attributable to Kirby (excluding one-time items), and diluted earnings per share (excluding one-time items). A reconciliation of these measures with GAAP is included in this press release. Management believes the exclusion of certain one-time items from these financial measures enables it and investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of Kirby’s normal operating results. This press release additionally includes a non-GAAP financial measure, free cash flow, which Kirby defines as net cash provided by operating activities less capital expenditures. A reconciliation of free cash flow with GAAP is included in this press release. Kirby uses free cash flow to assess and forecast cash flow and to provide additional disclosures on the Company’s liquidity. Free cash flow does not imply the amount of residual cash flow available for discretionary expenditures as it excludes mandatory debt service requirements and other non-discretionary expenditures. This press release also includes marine transportation performance measures, consisting of ton miles, revenue per ton mile, towboats operated and delay days. Comparable marine transportation performance measures for the 2023 year and quarters are available in the Investor Relations section of Kirby’s website, www.kirbycorp.com, under Financials.

Forward-Looking Statements

Statements contained in this press release with respect to the future are forward-looking statements. These statements reflect management’s reasonable judgment with respect to future events. Forward-looking statements involve risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including adverse economic conditions, industry competition and other competitive factors, adverse weather conditions such as high water, low water, tropical storms, hurricanes, tsunamis, fog and ice, tornados, marine accidents, lock delays, fuel costs, interest rates, construction of new equipment by competitors, government and environmental laws and regulations, and the timing, magnitude and number of acquisitions made by the Company. Forward-looking statements are based on currently available information and Kirby assumes no obligation to update any such statements. A list of additional risk factors can be found in Kirby’s annual report on Form 10-K for the year ended December 31, 2023.

About Kirby Corporation

Kirby Corporation, based in Houston, Texas, is the nation’s largest domestic tank barge operator transporting bulk liquid products throughout the Mississippi River System, on the Gulf Intracoastal Waterway, and coastwise along all three United States coasts. Kirby transports petrochemicals, black oil, refined petroleum products and agricultural chemicals by tank barge. In addition, Kirby participates in the transportation of dry-bulk commodities in United States coastwise trade. Through the distribution and services segment, Kirby provides after-market service and genuine replacement parts for engines, transmissions, reduction gears, electric motors, drives, and controls, specialized electrical distribution and control systems, energy storage battery systems, and related equipment used in oilfield services, marine, power generation, on-highway, and other industrial applications. Kirby also rents equipment including generators, industrial compressors, high capacity lift trucks, and refrigeration trailers for use in a variety of industrial markets. For the oil and gas market, Kirby manufactures and remanufactures oilfield service equipment, including pressure pumping units, and manufactures electric power generation equipment, and specialized electrical distribution and control equipment for oilfield customers.

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited, $ in thousands, except per share amounts) |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Marine transportation |

|

$ |

486,054 |

|

|

$ |

429,885 |

|

|

$ |

1,446,274 |

|

|

$ |

1,269,342 |

|

Distribution and services |

|

|

345,095 |

|

|

|

334,887 |

|

|

|

1,017,287 |

|

|

|

1,023,122 |

|

Total revenues |

|

|

831,149 |

|

|

|

764,772 |

|

|

|

2,463,561 |

|

|

|

2,292,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

552,091 |

|

|

|

530,541 |

|

|

|

1,657,004 |

|

|

|

1,618,690 |

|

Selling, general and administrative |

|

|

84,119 |

|

|

|

79,125 |

|

|

|

254,708 |

|

|

|

250,870 |

|

Taxes, other than on income |

|

|

8,973 |

|

|

|

9,666 |

|

|

|

27,327 |

|

|

|

28,610 |

|

Depreciation and amortization |

|

|

60,653 |

|

|

|

53,445 |

|

|

|

177,777 |

|

|

|

156,251 |

|

Gain on disposition of assets |

|

|

(1,617 |

) |

|

|

(1,528 |

) |

|

|

(2,206 |

) |

|

|

(4,230 |

) |

Total costs and expenses |

|

|

704,219 |

|

|

|

671,249 |

|

|

|

2,114,610 |

|

|

|

2,050,191 |

|

Operating income |

|

|

126,930 |

|

|

|

93,523 |

|

|

|

348,951 |

|

|

|

242,273 |

|

Other income |

|

|

2,949 |

|

|

|

1,589 |

|

|

|

9,306 |

|

|

|

9,296 |

|

Interest expense |

|

|

(12,498 |

) |

|

|

(13,386 |

) |

|

|

(38,468 |

) |

|

|

(38,893 |

) |

Earnings before taxes on income |

|

|

117,381 |

|

|

|

81,726 |

|

|

|

319,789 |

|

|

|

212,676 |

|

Provision for taxes on income |

|

|

(27,350 |

) |

|

|

(18,722 |

) |

|

|

(75,861 |

) |

|

|

(51,733 |

) |

Net earnings |

|

|

90,031 |

|

|

|

63,004 |

|

|

|

243,928 |

|

|

|

160,943 |

|

Net (earnings) loss attributable to noncontrolling interests |

|

|

(63 |

) |

|

|

(40 |

) |

|

|

(38 |

) |

|

|

86 |

|

Net earnings attributable to Kirby |

|

$ |

89,968 |

|

|

$ |

62,964 |

|

|

$ |

243,890 |

|

|

$ |

161,029 |

|

Net earnings per share attributable to Kirby common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.56 |

|

|

$ |

1.06 |

|

|

$ |

4.20 |

|

|

$ |

2.70 |

|

Diluted |

|

$ |

1.55 |

|

|

$ |

1.05 |

|

|

$ |

4.17 |

|

|

$ |

2.68 |

|

Common stock outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

57,753 |

|

|

|

59,383 |

|

|

|

58,129 |

|

|

|

59,721 |

|

Diluted |

|

|

58,186 |

|

|

|

59,746 |

|

|

|

58,526 |

|

|

|

60,033 |

|

CONDENSED CONSOLIDATED FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited, $ in thousands) |

|

EBITDA: (1) |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to Kirby |

|

$ |

89,968 |

|

|

$ |

62,964 |

|

|

$ |

243,890 |

|

|

$ |

161,029 |

|

Interest expense |

|

|

12,498 |

|

|

|

13,386 |

|

|

|

38,468 |

|

|

|

38,893 |

|

Provision for taxes on income |

|

|

27,350 |

|

|

|

18,722 |

|

|

|

75,861 |

|

|

|

51,733 |

|

Depreciation and amortization |

|

|

60,653 |

|

|

|

53,445 |

|

|

|

177,777 |

|

|

|

156,251 |

|

|

|

$ |

190,469 |

|

|

$ |

148,517 |

|

|

$ |

535,996 |

|

|

$ |

407,906 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

76,383 |

|

|

$ |

103,718 |

|

|

$ |

245,990 |

|

|

$ |

274,963 |

|

Acquisitions of businesses and marine equipment |

|

$ |

— |

|

|

$ |

37,500 |

|

|

$ |

65,232 |

|

|

$ |

37,500 |

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

(unaudited, $ in thousands) |

|

Cash and cash equivalents |

|

$ |

67,073 |

|

|

$ |

32,577 |

|

Long-term debt, including current portion |

|

$ |

978,593 |

|

|

$ |

1,016,595 |

|

Total equity |

|

$ |

3,303,610 |

|

|

$ |

3,186,677 |

|

Debt to capitalization ratio |

|

|

22.9 |

% |

|

|

24.2 |

% |

MARINE TRANSPORTATION STATEMENTS OF EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited, $ in thousands) |

|

Marine transportation revenues |

|

$ |

486,054 |

|

|

$ |

429,885 |

|

|

$ |

1,446,274 |

|

|

$ |

1,269,342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

296,114 |

|

|

|

278,979 |

|

|

|

897,351 |

|

|

|

836,620 |

|

Selling, general and administrative |

|

|

34,064 |

|

|

|

33,000 |

|

|

|

103,712 |

|

|

|

101,592 |

|

Taxes, other than on income |

|

|

6,524 |

|

|

|

7,783 |

|

|

|

21,104 |

|

|

|

23,052 |

|

Depreciation and amortization |

|

|

49,876 |

|

|

|

46,656 |

|

|

|

146,772 |

|

|

|

137,324 |

|

Total costs and expenses |

|

|

386,578 |

|

|

|

366,418 |

|

|

|

1,168,939 |

|

|

|

1,098,588 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

99,476 |

|

|

$ |

63,467 |

|

|

$ |

277,335 |

|

|

$ |

170,754 |

|

Operating margin |

|

|

20.5 |

% |

|

|

14.8 |

% |

|

|

19.2 |

% |

|

|

13.5 |

% |

DISTRIBUTION AND SERVICES STATEMENTS OF EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited, $ in thousands) |

|

Distribution and services revenues |

|

$ |

345,095 |

|

|

$ |

334,887 |

|

|

$ |

1,017,287 |

|

|

$ |

1,023,122 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

255,835 |

|

|

|

251,163 |

|

|

|

758,980 |

|

|

|

779,684 |

|

Selling, general and administrative |

|

|

47,547 |

|

|

|

43,701 |

|

|

|

144,987 |

|

|

|

138,584 |

|

Taxes, other than on income |

|

|

2,414 |

|

|

|

1,812 |

|

|

|

6,142 |

|

|

|

5,370 |

|

Depreciation and amortization |

|

|

8,921 |

|

|

|

5,017 |

|

|

|

25,350 |

|

|

|

13,656 |

|

Total costs and expenses |

|

|

314,717 |

|

|

|

301,693 |

|

|

|

935,459 |

|

|

|

937,294 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

30,378 |

|

|

$ |

33,194 |

|

|

$ |

81,828 |

|

|

$ |

85,828 |

|

Operating margin |

|

|

8.8 |

% |

|

|

9.9 |

% |

|

|

8.0 |

% |

|

|

8.4 |

% |

OTHER COSTS AND EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(unaudited, $ in thousands) |

|

General corporate expenses |

|

$ |

4,541 |

|

|

$ |

4,666 |

|

|

$ |

12,418 |

|

|

$ |

18,539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on disposition of assets |

|

$ |

(1,617 |

) |

|

$ |

(1,528 |

) |

|

$ |

(2,206 |

) |

|

$ |

(4,230 |

) |

ONE-TIME CHARGES

The 2023 first nine months GAAP results include certain one-time charges. The following is a reconciliation of GAAP earnings to non-GAAP earnings, excluding the one-time items, for earnings before tax (pre-tax), net earnings attributable to Kirby (after-tax), and diluted earnings per share (per share):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Nine Months 2023 |

|

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Per Share |

|

|

|

(unaudited, $ in millions except per share amounts) |

|

GAAP earnings |

|

$ |

212.7 |

|

|

$ |

161.0 |

|

|

$ |

2.68 |

|

Costs related to strategic review and shareholder engagement |

|

|

3.0 |

|

|

|

2.4 |

|

|

|

0.04 |

|

IRS refund interest income |

|

|

(2.7 |

) |

|

|

(2.2 |

) |

|

|

(0.04 |

) |

Earnings, excluding one-time items(2) |

|

$ |

213.0 |

|

|

$ |

161.2 |

|

|

$ |

2.68 |

|

RECONCILIATION OF FREE CASH FLOW

The following is a reconciliation of GAAP net cash provided by operating activities to non-GAAP free cash flow(2):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023(3) |

|

|

2024 |

|

|

2023(3) |

|

|

|

(unaudited, $ in millions) |

|

Net cash provided by operating activities |

|

$ |

206.5 |

|

|

$ |

96.3 |

|

|

$ |

509.1 |

|

|

$ |

324.2 |

|

Less: Capital expenditures |

|

|

(76.4 |

) |

|

|

(103.8 |

) |

|

|

(246.0 |

) |

|

|

(275.0 |

) |

Free cash flow(2) |

|

$ |

130.1 |

|

|

$ |

(7.5 |

) |

|

$ |

263.1 |

|

|

$ |

49.2 |

|

MARINE TRANSPORTATION PERFORMANCE MEASUREMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter |

|

|

Nine Months |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Inland Performance Measurements: |

|

|

|

|

|

|

|

|

|

|

|

|

Ton Miles (in millions) (4) |

|

|

3,135 |

|

|

|

3,291 |

|

|

|

9,769 |

|

|

|

10,231 |

|

Revenue/Ton Mile (cents/tm) (5) |

|

|

12.5 |

|

|

|

10.7 |

|

|

|

12.0 |

|

|

|

10.2 |

|

Towboats operated (average) (6) |

|

|

287 |

|

|

|

274 |

|

|

|

286 |

|

|

|

279 |

|

Delay Days (7) |

|

|

2,061 |

|

|

|

1,548 |

|

|

|

8,902 |

|

|

|

7,990 |

|

Average cost per gallon of fuel consumed |

|

$ |

2.65 |

|

|

$ |

2.71 |

|

|

$ |

2.77 |

|

|

$ |

2.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barges (active): |

|

|

|

|

|

|

|

|

|

|

|

|

Inland tank barges |

|

|

|

|

|

|

|

|

1,095 |

|

|

|

1,071 |

|

Coastal tank barges |

|

|

|

|

|

|

|

|

28 |

|

|

|

28 |

|

Offshore dry-cargo barges |

|

|

|

|

|

|

|

|

4 |

|

|

|

4 |

|

Barrel capacities (in millions): |

|

|

|

|

|

|

|

|

|

|

|

|

Inland tank barges |

|

|

|

|

|

|

|

|

24.2 |

|

|

|

23.6 |

|

Coastal tank barges |

|

|

|

|

|

|

|

|

2.9 |

|

|

|

2.9 |

|

(1)Kirby has historically evaluated its operating performance using numerous measures, one of which is EBITDA, a non-GAAP financial measure. Kirby defines EBITDA as net earnings attributable to Kirby before interest expense, taxes on income, and depreciation and amortization. EBITDA is presented because of its wide acceptance as a financial indicator. EBITDA is one of the performance measures used in calculating performance compensation pursuant to Kirby’s annual incentive plan. EBITDA is also used by rating agencies in determining Kirby’s credit rating and by analysts publishing research reports on Kirby, as well as by investors and investment bankers generally in valuing companies. EBITDA is not a calculation based on generally accepted accounting principles and should not be considered as an alternative to, but should only be considered in conjunction with, Kirby’s GAAP financial information.

(2)Kirby uses certain non-GAAP financial measures to review performance excluding certain one-time items including: earnings before taxes on income, excluding one-time items; net earnings attributable to Kirby, excluding one-time items; and diluted earnings per share, excluding one-time items. Management believes the exclusion of certain one-time items from these financial measures enables it and investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of the company's normal operating results. Kirby also uses free cash flow, which is defined as net cash provided by operating activities less capital expenditures, to assess and forecast cash flow and to provide additional disclosures on the Company’s liquidity. Free cash flow does not imply the amount of residual cash flow available for discretionary expenditures as it excludes mandatory debt service requirements and other non-discretionary expenditures. These non-GAAP financial measures are not calculations based on generally accepted accounting principles and should not be considered as an alternative to but should only be considered in conjunction with Kirby’s GAAP financial information.

(3)See Kirby’s annual report on Form 10-K for the year ended December 31, 2023, and its quarterly report on Form 10-Q for the quarter ended September 30, 2023 for amounts provided by (used in) investing and financing activities.

(4)Ton miles indicate fleet productivity by measuring the distance (in miles) a loaded tank barge is moved. Example: A typical 30,000 barrel tank barge loaded with 3,300 tons of liquid cargo is moved 100 miles, thus generating 330,000 ton miles.

(5)Inland marine transportation revenues divided by ton miles. Example: Third quarter 2024 inland marine transportation revenues of $392.6 million divided by 3,135 million inland marine transportation ton miles = 12.5 cents.

(6)Towboats operated are the average number of owned and chartered towboats operated during the period.

(7)Delay days measures the lost time incurred by a tow (towboat and one or more tank barges) during transit. The measure includes transit delays caused by weather, lock congestion and other navigational factors.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

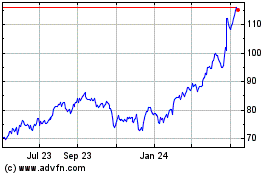

Kirby (NYSE:KEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

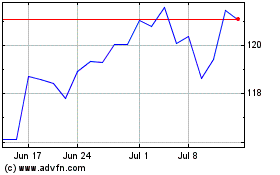

Kirby (NYSE:KEX)

Historical Stock Chart

From Feb 2024 to Feb 2025