Inspire Medical Systems, Inc. (NYSE: INSP) (Inspire, or the

company), a medical technology company focused on the development

and commercialization of innovative, minimally invasive solutions

for patients with obstructive sleep apnea, today reported financial

results for the quarter ended June 30, 2024.

Recent Business Highlights

- Generated revenue of $195.9 million in the second quarter of

2024, a 30% increase over the same quarter last year

- Achieved gross margin of 84.8% in the second quarter of

2024

- Generated $5.1 million in operating income and earnings per

share of $0.32 in the second quarter of 2024

- Activated 81 new U.S. centers in the second quarter of 2024,

bringing the total to 1,316 U.S. medical centers providing Inspire

therapy

- Created 12 new U.S. sales territories in the second quarter of

2024, bringing the total to 310 U.S. sales territories

- Received CE Mark Certification under the European Union’s

Medical Device Regulation (EU MDR)

- Received countrywide reimbursement for Inspire therapy in

France

- Received FDA approval of the Inspire V neurostimulation

system

- Authorized the repurchase of up to $150.0 million of

the company’s outstanding shares of common stock

“We are excited with our strong execution in the second quarter

which drove robust revenue performance and continued operating

leverage,” said Tim Herbert, Chairman and CEO of Inspire Medical

Systems. “Based on our strong first half results, we are increasing

our full year revenue guidance to $788 million to $798 million,

representing 26% to 28% growth, up from of $783 million to $793

million announced previously, and we are raising our full year

earnings per share guidance to $0.60 to $0.80, up from $0.10 to

$0.20 previously.”

“In addition to our healthy financial performance, there are

many important achievements worth highlighting. First, we received

CE mark certification under the European Union’s Medical Device

Regulation including full-body MRI compatibility in Europe. Second,

we received countrywide reimbursement for Inspire therapy in France

at a rate consistent with other European markets. Both achievements

represent significant milestones for the company and should drive

many years of strong growth in Europe. Third, we received FDA

approval for the Inspire V neurostimulation system, marking an

important milestone for the future of Inspire therapy. Lastly, we

authorized a share repurchase program of up to $150.0 million, the

first in company history, as we believe the repurchase of our

common stock represents an attractive investment opportunity,”

concluded Mr. Herbert.

Second Quarter

2024 Financial Results

Revenue was $195.9 million for the three months ended June 30,

2024, a 30% increase from $151.1 million in the corresponding

period in the prior year. U.S. revenue for the quarter was $187.8

million, an increase of 30% as compared to the prior year quarter.

Second quarter revenue outside the U.S. was $8.1 million, an

increase of 27% as compared to the second quarter of 2023.

Gross margin was 84.8% for the three months ended June 30, 2024,

compared to 83.9% for the corresponding prior year period.

Operating expenses increased to $160.9 million for the second

quarter of 2024, as compared to $143.4 million in the corresponding

prior year period, an increase of 12%. This increase primarily

reflected ongoing investments in the expansion of the U.S. sales

organization and general corporate costs.

Operating income increased to $5.1 million for the second

quarter of 2024, as compared to an operating loss of $16.6 million

in the prior year period.

Net income was $9.8 million for the second quarter of 2024, as

compared to a net loss of $12.0 million in the corresponding prior

year period. The diluted net income per share for the second

quarter of 2024 was $0.32 per share, as compared to a diluted net

loss of $0.41 in the prior year period.

As of June 30, 2024, cash, cash equivalents, and investments

decreased to $466.0 million from $469.5 million on

December 31, 2023.

Full Year 2024

Guidance

Inspire is increasing its full year 2024 revenue guidance to

between $788 million to $798 million, which represents growth of

26% to 28% over full year 2023 revenue of $624.8 million. This

compares to the prior revenue guidance of $783 million to $793

million.

The company is maintaining its full year 2024 gross margin

guidance of 83% to 85%.

Inspire is increasing diluted net income per share guidance for

the full year 2024 to between $0.60 to $0.80 per share, excluding

the impact of any share repurchases that may be effected during the

year. This compares to the prior guidance of $0.10 to $0.20 per

share.

Inspire is also maintaining its guidance relating to the opening

of new U.S. medical centers of 52 to 56 per quarter, as well as its

guidance of 12 to 14 new U.S. territories per quarter for the

remainder of 2024.

Webcast and Conference Call

Inspire’s management will host a conference call after market

close today, Tuesday, August 6, 2024, at 5:00 p.m. Eastern

Time to discuss these results and answer questions.

To access the conference call, please preregister on

https://register.vevent.com/register/BI2e8b55545d72404cb4e58c6f3b9c27d7.

Registrants will receive confirmation with dial-in details.

A live webcast of the event can be accessed on

https://edge.media-server.com/mmc/p/c8jt7ki8/. A replay of the

webcast will be available on https://investors.inspiresleep.com/

starting approximately two hours after the event and archived on

the site for two weeks.

About Inspire Medical Systems

Inspire is a medical technology company focused on the

development and commercialization of innovative, minimally invasive

solutions for patients with obstructive sleep apnea. Inspire’s

proprietary Inspire therapy is the first and only FDA, EU MDR and

PDMA-approved neurostimulation technology of its kind that provides

a safe and effective treatment for moderate to severe obstructive

sleep apnea.

For additional information about Inspire, please visit

www.inspiresleep.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical facts are

forward-looking statements, including, without limitation,

statements regarding full year 2024 financial outlook, our

expectations to activate new U.S. medical centers and add new

territories per quarter in 2024 and the impact of such additions,

our expectations regarding operating leverage and profitability

during 2024, the drivers of short- and long-term growth for our

business, and our strategy and investments to grow and scale our

business. In some cases, you can identify forward-looking

statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’

‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,”

“outlook,” “guidance,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’

‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’

‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or

other similar expressions, although not all forward-looking

statements contain these words.

These forward-looking statements are based on management’s

current expectations and involve known and unknown risks and

uncertainties that may cause our actual results, performance, or

achievements to be materially different from any future results,

performance, or achievements expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, estimates regarding the annual total addressable

market for our Inspire therapy in the U.S. and our market

opportunity outside the U.S.; future results of operations,

financial position, research and development costs, capital

requirements and our needs for additional financing; commercial

success and market acceptance of our Inspire therapy; the impact of

macroeconomic trends; general and international economic,

political, and other risks, including currency, inflation, stock

market fluctuations and the uncertain economic environment;

challenges experienced by patients in obtaining prior

authorization, our ability to achieve and maintain adequate levels

of coverage or reimbursement for our Inspire system or any future

products we may seek to commercialize; competitive companies and

technologies in our industry; our ability to enhance our Inspire

system, expand our indications and develop and commercialize

additional products; our business model and strategic plans for our

products, technologies and business, including our implementation

thereof; our ability to accurately forecast customer demand for our

Inspire system and manage our inventory; our dependence on

third-party suppliers, contract manufacturers and shipping

carriers; consolidation in the healthcare industry; our ability to

expand, manage and maintain our direct sales and marketing

organization, and to market and sell our Inspire system in markets

outside of the U.S.; risks associated with international

operations; our ability to manage our growth; our ability to

increase the number of active medical centers implanting Inspire

therapy; our ability to hire and retain our senior management and

other highly qualified personnel; risk of product liability claims;

risks related to information technology and cybersecurity; risk of

damage to or interruptions at our facilities; our ability to

commercialize or obtain regulatory approvals for our Inspire

therapy and system, or the effect of delays in commercializing or

obtaining regulatory approvals; FDA or other U.S. or foreign

regulatory actions affecting us or the healthcare industry

generally, including healthcare reform measures in the U.S. and

international markets; and the timing or likelihood of regulatory

filings and approvals. Other important factors that could cause

actual results, performance or achievements to differ materially

from those contemplated in this press release can be found under

the captions “Risk Factors” and "Management's Discussion and

Analysis of Financial Condition and Results of Operations“ in our

Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, as updated in our Quarterly Report on Form

10-Q for the quarter ended June 30, 2024 to be filed with the SEC,

and as such factors may be updated from time to time in our other

filings with the SEC, which are accessible on the SEC’s website at

www.sec.gov and the Investors page of our website at

www.inspiresleep.com. These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, unless

required by applicable law, we disclaim any obligation to do so,

even if subsequent events cause our views to change. Thus, one

should not assume that our silence over time means that actual

events are bearing out as expressed or implied in such

forward-looking statements. These forward-looking statements should

not be relied upon as representing our views as of any date after

the date of this press release.

Investor & Media ContactEzgi YagciVice

President, Investor

Relationsezgiyagci@inspiresleep.com617-549-2443

| Inspire

Medical Systems, Inc. |

| Consolidated

Statements of Operations and Comprehensive Income (Loss)

(unaudited) |

| (in

thousands, except share and per share amounts) |

| |

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

195,885 |

|

|

$ |

151,092 |

|

|

$ |

359,895 |

|

|

$ |

278,989 |

|

| Cost of goods sold |

|

29,843 |

|

|

|

24,252 |

|

|

|

54,600 |

|

|

|

44,140 |

|

| Gross profit |

|

166,042 |

|

|

|

126,840 |

|

|

|

305,295 |

|

|

|

234,849 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

28,859 |

|

|

|

30,821 |

|

|

|

57,709 |

|

|

|

56,340 |

|

|

Selling, general and administrative |

|

132,084 |

|

|

|

112,618 |

|

|

|

257,705 |

|

|

|

214,606 |

|

| Total operating expenses |

|

160,943 |

|

|

|

143,439 |

|

|

|

315,414 |

|

|

|

270,946 |

|

| Operating income (loss) |

|

5,099 |

|

|

|

(16,599 |

) |

|

|

(10,119 |

) |

|

|

(36,097 |

) |

| Other (income) expense: |

|

|

|

|

|

|

|

|

Interest and dividend income |

|

(5,882 |

) |

|

|

(4,922 |

) |

|

|

(11,805 |

) |

|

|

(9,195 |

) |

|

Other expense, net |

|

135 |

|

|

|

61 |

|

|

|

195 |

|

|

|

44 |

|

| Total other income |

|

(5,747 |

) |

|

|

(4,861 |

) |

|

|

(11,610 |

) |

|

|

(9,151 |

) |

| Income (loss) before income

taxes |

|

10,846 |

|

|

|

(11,738 |

) |

|

|

1,491 |

|

|

|

(26,946 |

) |

| Income taxes |

|

1,053 |

|

|

|

214 |

|

|

|

1,703 |

|

|

|

430 |

|

| Net income (loss) |

|

9,793 |

|

|

|

(11,952 |

) |

|

|

(212 |

) |

|

|

(27,376 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

Foreign currency translation (loss) gain |

|

(39 |

) |

|

|

72 |

|

|

|

(173 |

) |

|

|

177 |

|

|

Unrealized (loss) gain on investments |

|

(200 |

) |

|

|

(1 |

) |

|

|

(742 |

) |

|

|

12 |

|

| Total comprehensive income

(loss) |

$ |

9,554 |

|

|

$ |

(11,881 |

) |

|

$ |

(1,127 |

) |

|

$ |

(27,187 |

) |

| Net income (loss) per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.33 |

|

|

$ |

(0.41 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.94 |

) |

|

Diluted |

$ |

0.32 |

|

|

$ |

(0.41 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.94 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

29,728,849 |

|

|

|

29,229,922 |

|

|

|

29,672,006 |

|

|

|

29,160,323 |

|

|

Diluted |

|

30,408,439 |

|

|

|

29,229,922 |

|

|

|

29,672,006 |

|

|

|

29,160,323 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inspire Medical Systems, Inc. |

|

Consolidated Balance Sheets (unaudited) |

|

(in thousands, except share and per share

amounts) |

| |

| |

June 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

188,035 |

|

|

$ |

185,537 |

|

|

Investments, short-term |

|

251,629 |

|

|

|

274,838 |

|

|

Accounts receivable, net of allowance for credit losses of $515 and

$1,648, respectively |

|

79,716 |

|

|

|

89,884 |

|

|

Inventories, net |

|

59,025 |

|

|

|

33,885 |

|

|

Prepaid expenses and other current assets |

|

28,755 |

|

|

|

9,595 |

|

|

Total current assets |

|

607,160 |

|

|

|

593,739 |

|

| Investments, long-term |

|

26,344 |

|

|

|

9,143 |

|

| Property and equipment,

net |

|

61,701 |

|

|

|

39,984 |

|

| Operating lease right-of-use

assets |

|

22,189 |

|

|

|

22,667 |

|

| Other non-current assets |

|

10,995 |

|

|

|

11,278 |

|

|

Total assets |

$ |

728,389 |

|

|

$ |

676,811 |

|

| Liabilities and

stockholders' equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

33,621 |

|

|

$ |

38,839 |

|

|

Accrued expenses |

|

32,036 |

|

|

|

39,266 |

|

|

Total current liabilities |

|

65,657 |

|

|

|

78,105 |

|

| Operating lease liabilities,

non-current portion |

|

24,512 |

|

|

|

24,846 |

|

| Other non-current

liabilities |

|

149 |

|

|

|

1,346 |

|

|

Total liabilities |

|

90,318 |

|

|

|

104,297 |

|

| Stockholders' equity: |

|

|

|

|

Preferred Stock, $0.001 par value, 10,000,000 shares authorized; no

shares issued and outstanding |

|

— |

|

|

|

— |

|

|

Common Stock, $0.001 par value per share; 200,000,000 shares

authorized; 29,805,301 and 29,560,464 issued and outstanding at

June 30, 2024 and December 31, 2023, respectively |

|

30 |

|

|

|

30 |

|

|

Additional paid-in capital |

|

983,791 |

|

|

|

917,107 |

|

|

Accumulated other comprehensive (loss) income |

|

(115 |

) |

|

|

800 |

|

|

Accumulated deficit |

|

(345,635 |

) |

|

|

(345,423 |

) |

|

Total stockholders' equity |

|

638,071 |

|

|

|

572,514 |

|

|

Total liabilities and stockholders' equity |

$ |

728,389 |

|

|

$ |

676,811 |

|

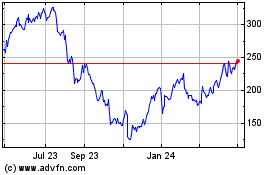

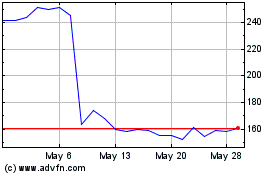

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Inspire Medical Systems (NYSE:INSP)

Historical Stock Chart

From Nov 2023 to Nov 2024