UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-34984

FIRST MAJESTIC SILVER CORP.

(Translation of registrant's name into English)

Suite 1800, 925 West Georgia Street

Vancouver, British Columbia V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [X]

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. |

|

| (Registrant) |

|

| |

|

| /s/ Samir Patel |

|

| Samir Patel |

|

| General Counsel & Corporate Secretary |

|

| |

|

| September 10, 2024 |

|

NEWS RELEASE

|

New York - AG

Toronto - FR

Frankfurt - FMV

|

September 10, 2024 |

First Majestic Announces Share Repurchase Program

Vancouver, British Columbia, Canada - First Majestic Silver Corp. (NYSE:AG) (TSX:AG) (FSE:FMV) (the "Company" or "First Majestic") announces that the Toronto Stock Exchange ("TSX") has accepted for filing First Majestic's Notice of Intention to Make a Normal Course Issuer Bid (the "Share Repurchase Program") to be transacted through the facilities of the TSX and/or through Canadian alternative trading systems.

Pursuant to the NCIB, First Majestic may, during the 12-month period commencing September 12, 2024, and ending on or before September 11, 2025, purchase up to 10,000,000 of its common shares ("Shares"), being approximately 3.32% of the 301,616,350 issued and outstanding Shares as of September 4, 2024. All purchases under the Share Repurchase Program will be made at prevailing market prices.

First Majestic may purchase up to a daily maximum of 193,454 Shares (being 25% of the average daily trading volume of the Shares for the last six calendar months, which was 773,816 Shares), subject to the TSX rules permitting block purchases. Any purchases under the Share Repurchase Program will depend on future market conditions, and any Shares purchased by the Company will be cancelled. Purchases under the Share Repurchase Program will be made by First Majestic's broker based upon the parameters prescribed by the TSX and by applicable law. First Majestic has not repurchased any of its Shares by way of a normal course issuer bid in the previous 12 months.

First Majestic believes that, from time to time, the market price of its Shares may not fully reflect the underlying value of the Company's business and its future business prospects. The Company believes that at such times the purchase of Shares would be in the best interests of the Company. Such purchases are expected to benefit all shareholders by increasing their proportionate equity interest in the Company.

About First Majestic

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, and the La Encantada Silver Mine as well as a portfolio of development and exploration assets, including the Jerritt Canyon Gold project located in northeastern Nevada, U.S.A.

First Majestic is proud to own and operate its own minting facility, First Mint, LLC, and to offer a portion of its silver production for sale to the public. Bars, ingots, coins and medallions are available for purchase online at www.firstmint.com, at some of the lowest premiums available.

For further information, visit our website at www.firstmajestic.com. You can contact us by e-mail at info@firstmajestic.com, or by telephone at 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking Statements

This news release contains "forward‐looking information" and "forward-looking statements" under applicable Canadian and United States securities laws (collectively, "forward‐looking statements"). Forward-looking statements in this news release include, but are not limited to, statements with respect to potential purchases of Shares under the Company's NCIB bid and the timing of such purchases. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are discussed in the section entitled "Description of the Business - Risk Factors" in the Company's most recent Annual Information Form for the year ended December 31, 2023 filed with the Canadian securities regulatory authorities under the Company's SEDAR+ profile at www.sedarplus.ca, and in the Company's Annual Report on Form 40-F for the year ended December 31, 2023 filed with the United States Securities and Exchange Commission on EDGAR at www.sec.gov/edgar.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management's estimates or opinions should change, or otherwise.

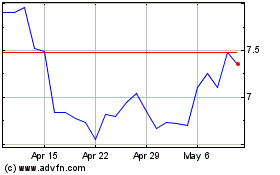

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Nov 2024 to Dec 2024

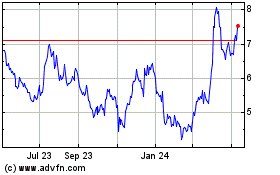

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Dec 2023 to Dec 2024