Danaos Corporation Announces Senior Notes Repurchase

December 01 2022 - 7:29AM

Business Wire

Danaos Corporation (NYSE: DAC), one of the world’s largest

independent owners of containerships, today announced that it

expects to repurchase $37.234 million of its 8.500% unsecured

senior notes due 2028 in a privately negotiated transaction.

About Danaos Corporation

Danaos Corporation is one of the largest independent owners of

modern, large-size containerships. Our current fleet of 69

containerships aggregating 423,745 TEUs and 6 under construction

containerships aggregating 46,200 TEUs ranks Danaos among the

largest containership charter owners in the world based on total

TEU capacity. Our fleet is chartered to many of the world's largest

liner companies on fixed-rate charters. Our long track record of

success is predicated on our efficient and rigorous operational

standards and environmental controls. Danaos Corporation's shares

trade on the New York Stock Exchange under the symbol "DAC".

Forward-Looking

Statements

Matters discussed in this release may constitute forward-looking

statements within the meaning of the safe harbor provisions of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements reflect

our current views with respect to future events and financial

performance and may include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The forward-looking statements in

this release are based upon various assumptions. Although Danaos

Corporation believes that these assumptions were reasonable when

made, because these assumptions are inherently subject to

significant uncertainties and contingencies which are difficult or

impossible to predict and are beyond our control, Danaos

Corporation cannot assure you that it will achieve or accomplish

these expectations, beliefs or projections. Important factors that,

in our view, could cause actual results to differ materially from

those discussed in the forward-looking statements include the

ability to consummate the expected senior notes repurchase, the

impact of the COVID-19 pandemic and efforts throughout the world to

contain its spread, including effects on global economic activity,

demand for seaborne transportation of containerized cargo, the

ability and willingness of charterers to perform their obligations

to us, charter rates for containerships, shipyards constructing our

contracted newbuilding vessels, performing scrubber installations,

drydocking and repairs, changing vessel crews and availability of

financing, Danaos’ ability to achieve the expected benefits of the

2021 debt refinancing and comply with the terms of its new credit

facilities and other financing agreements, and to complete and

achieve the expected benefits of refinancing our existing

Citibank/Natwest credit facility with two new credit facilities as

planned, the strength of world economies and currencies, general

market conditions, including changes in charter hire rates and

vessel values, charter counterparty performance, changes in demand

that may affect attitudes of time charterers to scheduled and

unscheduled dry-docking, changes in Danaos Corporation's operating

expenses, including bunker prices, dry-docking and insurance costs,

ability to obtain financing and comply with covenants in our

financing arrangements, actions taken by regulatory authorities,

potential liability from pending or future litigation, domestic and

international political conditions, including the conflict in

Ukraine and related sanctions, potential disruption of shipping

routes due to accidents and political events or acts by

terrorists.

Risks and uncertainties are further described in reports filed

by Danaos Corporation with the U.S. Securities and Exchange

Commission.

Visit our website at www.danaos.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221130006213/en/

Company Contact: Evangelos Chatzis Chief Financial

Officer Danaos Corporation Athens, Greece Tel.: +30 210 419 6480

E-Mail: cfo@danaos.com

Iraklis Prokopakis Senior Vice President and Chief

Operating Officer Danaos Corporation Athens, Greece Tel.: +30 210

419 6400 E-Mail: coo@danaos.com

Investor Relations and Financial Media Rose & Company

New York Tel. 212-359-2228

E-Mail: danaos@rosecoglobal.com

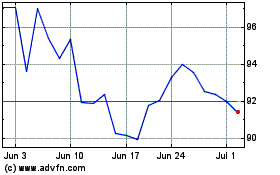

Danaos (NYSE:DAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

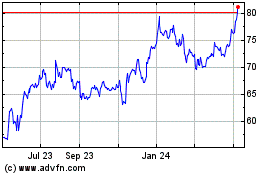

Danaos (NYSE:DAC)

Historical Stock Chart

From Feb 2024 to Feb 2025