false

0001324404

0001324404

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2024

CF

Industries Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-32597 |

|

20-2697511 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

2375 Waterview Drive

Northbrook,

Illinois |

|

|

|

60062 |

(Address

of principal

executive offices) |

|

|

|

(Zip

Code) |

Registrant’s telephone number, including

area code (847) 405-2400

(Former name or former address,

if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| common stock, par value $0.01 per share |

|

CF |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On October 31, 2024, CF Industries Holdings, Inc. will host

a conference call discussing its results for the quarter ended September 30, 2024, at which the presentation attached hereto as Exhibit 99.1

will be used.

The information set forth herein, including the exhibit attached hereto,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall

it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth

by specific reference in any such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 30,

2024 |

CF INDUSTRIES HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/ Gregory D. Cameron |

| |

Name: |

Gregory D. Cameron |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

2024 Third Quarter Financial Results October 30, 2024 NYSE: CF

Safe harbor statement All statements in this presentation by CF Industries Holdings, Inc. (together with its subsidiaries, the “Company”), other th an those relating to historical facts, are forward - looking statements. Forward - looking statements can generally be identified by their use of terms such as “anticipate,” “ believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” or “would” and similar terms and phrases, including reference s t o assumptions. Forward - looking statements are not guarantees of future performance and are subject to a number of assumptions, risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These statements may include, but are not limited to, statements about the synergies and other benefits, and other aspects of the transactions with Incitec Pivot Limited (“IPL”), strategic p lan s and management’s expectations with respect to the production of green and low - carbon ammonia, the development of carbon capture and sequestration projects, th e transition to and growth of a hydrogen economy, greenhouse gas reduction targets, projected capital expenditures, statements about future financial and ope rat ing results, and other items described in this presentation. Important factors that could cause actual results to differ materially from those in the forw ard - looking statements include, among others, the risk of obstacles to realization of the benefits of the transactions with IPL; the risk that the synergies from t he transactions with IPL may not be fully realized or may take longer to realize than expected; the risk that the completion of the transactions with IPL, including in teg ration of the Waggaman ammonia production complex into the Company’s operations, disrupt current operations or harm relationships with customers, employees and suppliers; the risk that integration of the Waggaman ammonia production complex with the Company’s current operations will be more costly or difficult th an expected or may otherwise be unsuccessful; diversion of management time and attention to issues relating to the transactions with IPL; unanticipated co sts or liabilities associated with the IPL transactions; the cyclical nature of the Company’s business and the impact of global supply and demand on the Company’s s ell ing prices; the global commodity nature of the Company’s nitrogen products, the conditions in the international market for nitrogen products, and th e i ntense global competition from other producers; conditions in the United States, Europe and other agricultural areas, including the influence of governmenta l p olicies and technological developments on the demand for our fertilizer products; the volatility of natural gas prices in North America and the United Kin gdom; weather conditions and the impact of adverse weather events; the seasonality of the fertilizer business; the impact of changing market conditions on the Co mpany’s forward sales programs; difficulties in securing the supply and delivery of raw materials or utilities, increases in their costs or delays or interru pti ons in their delivery; reliance on third party providers of transportation services and equipment; the Company’s reliance on a limited number of key facilities; risks assoc iat ed with cybersecurity; acts of terrorism and regulations to combat terrorism; risks associated with international operations; the significant risks and haza rds involved in producing and handling the Company’s products against which the Company may not be fully insured; the Company’s ability to manage its indebtedness a nd any additional indebtedness that may be incurred; the Company’s ability to maintain compliance with covenants under its revolving credit agreement and th e a greements governing its indebtedness; downgrades of the Company’s credit ratings; risks associated with changes in tax laws and disagreements with ta xin g authorities; risks involving derivatives and the effectiveness of the Company’s risk management and hedging activities; potential liabilities and expendit ure s related to environmental, health and safety laws and regulations and permitting requirements; regulatory restrictions and requirements related to greenhouse g as emissions; the development and growth of the market for green and low - carbon ammonia and the risks and uncertainties relating to the development and implementa tion of the Company’s green and low - carbon ammonia projects; and risks associated with expansions of the Company’s business, including unanticipated adverse consequences and the significant resources that could be required. More detailed information about factors that may affect the Company’s performance and could cause actual results to differ materially from those in any forward - looking statements may be found in CF Industries Holdings, Inc.’s filings with the S ecurities and Exchange Commission, including CF Industries Holdings, Inc.’s most recent annual and quarterly reports on Form 10 - K and Form 10 - Q, which are availabl e in the Investor Relations section of the Company’s web site. It is not possible to predict or identify all risks and uncertainties that might affect th e a ccuracy of our forward - looking statements and, consequently, our descriptions of such risks and uncertainties should not be considered exhaustive. There is no guarante e t hat any of the events, plans or goals anticipated by these forward - looking statements will occur, and if any of the events do occur, there is no guarantee what effect they will have on our business, results of operations, cash flows, financial condition and future prospects. Forward - looking statements are given only as of the date of this presentation and the Company disclaims any obligation to update or revise the forward - looking statements, whether as a result of new informat ion, future events or otherwise, except as required by law.

Note regarding non - GAAP financial measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Management believes that EBITDA, adjusted EBITDA, free cash flow, and free cash flow to adjusted EBITDA conversion, which are non - GAAP financial measures, provide additional meaningful information regarding the Company's performance and financial strength. Non - GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results prepar ed in accordance with GAAP. In addition, because not all companies use identical calculations, EBITDA, adjusted EBITDA, free cash f low , and free cash flow to adjusted EBITDA conversion included in this presentation may not be comparable to similarly titled meas ure s of other companies. Reconciliations of EBITDA, adjusted EBITDA, and free cash flow to the most directly comparable GAAP measures are provided in the tables accompanying this presentation. EBITDA is defined as net earnings attributable to common stockholders plus interest expense (income) — net, income taxes, and depreciation and amortization. Other adjustments include the elimination of loan fee amortization that is included in both in ter est and amortization, and the portion of depreciation that is included in noncontrolling interest. The Company has presented EBITDA because management uses the measure to track performance and believes that it is frequently used by securities analysts, inve sto rs and other interested parties in the evaluation of companies in the industry. Adjusted EBITDA is defined as EBITDA adjusted with the selected items as summarized in the tables accompanying this presentation. The Company has presented adjusted EBITDA because management uses adjusted EBITDA, and believes it is useful to investors, as a supplemental financial measure in the comparison of year - over - year performance. Free cash flow is defined as net cash provided by operating activities, as stated in the consolidated statements of cash flow s, reduced by capital expenditures and distributions to noncontrolling interests. Free cash flow to adjusted EBITDA conversion i s defined as free cash flow divided by adjusted EBITDA.

4 Industry leading operational excellence drives cash generation (1) See appendix for reconciliation of adjusted EBITDA to the most directly comparable GAAP measure (2) Last twelve months share repurchases and dividends through September 30, 2024 (3) See appendix for reconciliation of free cash flow to the most directly comparable GAAP measure (4) Per 200,000 work hours as of September 30, 2024 (5) Represents Q3 2024 LTM free cash flow divided by Q3 2024 LTM adjusted EBITDA; see appendix for reconciliations of free cash f low and adjusted EBITDA to the most directly comparable GAAP measures ~93% Q3 2024 Capacity Utilization 0.17 12 - month Rolling Average Recordable Incident Rate (4) World’s Largest Ammonia Producer 65% Q3 2024 LTM FCF/Adj EBITDA Conversion (5) $511M Q3 2024 Adjusted EBITDA (1) $1.7B 9M 2024 Adjusted EBITDA (1) $2.3B LTM Cash from Operations $1.5B LTM FCF (3) $1.7B LTM Capital Returned to Shareholders (2) $1.4B Remaining in Current $3B Share Repurchase Authorization $890M 9M 2024 Net Earnings $276M Q3 2024 Net Earnings

5 First nine months and third quarter 2024 adjusted EBITDA (1) See appendix for reconciliation of adjusted EBITDA to the most directly comparable GAAP measure 5 Adj. EBITDA 9M 2023 Price $ millions Volume Realized Gas Cost Other 9M 2024 vs 9M 2023 Adjusted EBITDA (1) Q3 2024 vs Q3 2023 Adjusted EBITDA (1) $ millions Adj. EBITDA 9M 2024 $2,168 $(680) $(116) $390 $(40) $1,722 $445 $52 $(13) $40 $(13) $511 Adj. EBITDA Q3 2023 Price Volume Realized Gas Cost Other Adj. EBITDA Q3 2024

6 Strong cash generation with significant return to shareholders $1,819 $931 $(139) $(164) $(580) $10 $1,877 Cash (1) Q2 2024 Cash from Operations Capex CHS Distribution (2) Return to Shareholders (3) Other Q3 2024 Cash (1) $2,032 $1,877 $1,851 $(321) $(308) $(1,412) $35 Q3 2024 Cash Sources and Uses 9M 2024 Cash Sources and Uses $ millions $ millions Cash (1) 2023 Cash from Operations Capex CHS Distributions (2) Return to Shareholders (3) Other Cash (1) Q3 2024 (1) Represents the cash and cash equivalents balance on the Company's Consolidated Balance Sheet at the end of each respective pe rio d (2) Semi - annual distribution(s) paid to noncontrolling interest in Q3 2024 and 9M 2024 (3) Share repurchases and dividends paid in Q3 2024 and 9M 2024

7 Evaluate accretive acquisitions Margin enhancing projects Share repurchases and quarterly dividends Low - carbon ammonia production growth Pathways to grow shareholder value Creating substantial value for long - term shareholders Return capital to shareholders Inorganic growth opportunities Invest in high return projects within our network Disciplined growth initiatives & clean energy

8 8.2 8.2 7.0 (2) 6.0 (1) Production Capacity millions (nutrient tons) Annual Nitrogen Equivalent Tons per 1,000 Shares Outstanding 17 30 39 47 2010 2015 2020 Q324 Creating value by increasing nitrogen participation per share Million Shares Outstanding (3) Since 2010: Increased production capacity 36% Decreased share count 51% 174.3 214.0 233.1 356.3 +16% (35)% +18% (8)% (19)% • UK decommissioned • Waggaman acquired Notes: • Beginning in 2015 includes incremental 50% interest in CF Fertilisers UK acquired from Yara • Beginning in 2016 excludes nitrogen equivalent of 1.1 million tons of urea and 0.58 million tons of UAN under CHS supply agreement and includes expansion project capacity at Donaldsonville and Port Neal • Beginning in 2018 includes incremental 15% of Verdigris production to reflect CF’s acquisition of publicly traded TNH units • Q3 2024 includes decrease in production capacity due to Ince plant closure • Q3 2024 includes decrease in production capacity due to Billingham NH 3 plant closure and additional production capacity from Waggaman ammonia production complex All N production numbers based on year end figures per 10 - K filings (1) Beginning in 2010 includes capacity from Terra Industries acquisition (2) Beginning in 2013 includes incremental 34% of Medicine Hat production to reflect CF acquisition of Viterra's interests (3) Share count based on end of period common shares outstanding; share count prior to 2015 based on 5 - for - 1 split - adjusted shares Intend to repurchase remaining $1.4B of authorization by December 2025 expiration

9 Highlights: Strategic Initiatives Donaldsonville Dehydration & Compression Unit Early mover advantage with low - carbon ammonia available in 2025 On track to complete construction in 2025 45Q tax credit generation expected in 2025 Capture up to 2M metric tons of CO 2 per year Partnered with ExxonMobil for sequestration ~10% Scope 1 emissions to be sequestered ~$100M projected in FCF annually for 12 years

10 2019 2020 2021 2022 2023 2024F Positive global nitrogen supply - demand dynamics Sources: Industry Publications, CRU Urea Market Outlook as of September 2024, CF Analysis (1) For traditional applications India Urea Imports 7.4 MMT ~ 6 MMT 2019 2020 2021 2022 2023 2024F China Urea Exports Million metric tons 4.3 MMT < 1 MMT 2019 2020 2021 2022 2023 2024F Brazil Urea Imports 7.3 MMT Nitrogen Market Outlook Chinese exports expected <1MMT India and Brazil remain significant importers North American producer inventories low Russian exports remain below pre - war levels Global nitrogen demand growth ~1.5% (1) per year Announced capacity additions remain limited 7 - 8 MMT Near - term global nitrogen market remains constructive Long - term demand outpaces expected capacity additions

11 0 200 400 $600 North America Other FSU MENA Russia Latin America South Asia Indonesia China - Advanced Inland Low China - Natural Gas Low Southeast Asia India China - Anthracite Low China - Advanced Coastal China - Advanced Inland High China - Natural Gas High Western Europe China - Anthracite High Ukraine Eastern Europe 2025 global delivered U.S. Gulf urea cost curve suggests elevated pricing on high European costs Estimated 2025 Cost Range: $310 - $400 Illustrative of Seasonal H ighs Illustrative of S easonal Lows Note: Illustrative seasonal range represents two thirds of one standard deviation from the estimated cost range midpoint base d o n historic trend the past 20 years Source: Industry Publications, CF Analysis 2025F Shipments: 18.0M Tons Avg. Appx. Monthly Range 2025 Monthly Delivered U.S. Gulf Urea Cost Curve 15 5 10 20 5 Y - axis: USD/ st X - axis: Monthly Production Capacity at 95% Operating Rate, 85% Operating Rate in China, million short tons Energy (N.G.) Other Cash Freight Energy (Coal)

Appendix

13 Advancing decarbonization through significant progress on strategic initiatives Clean Energy Growth Purchased natural gas certified by MiQ Donaldsonville green ammonia Donaldsonville CCS low - carbon ammonia Engineering activities SMR w/CCS FEED study ATR FEED study Clean ammonia industry demand milestones Potential supply of low - carbon ammonia into Asia PROJECTS Decarbonization Inorganic Growth Acquired 12/1/2023 Waggaman ammonia production facility 2025 project start - up Purchased 2.2 BCF Purchased 4.4 BCF European CBAM implementation JERA: first commercial co - fire test at Hekinan coal - fired power plant Integration continues FEED study completed MOUs signed between CF, JERA, POSCO & LOTTE Expected METI carbon intensity guidelines SMR w/Flue gas capture FEED study Expected completion Q4 202 4 Yazoo City CCS low - carbon ammonia Signed definitive commercial agreement with ExxonMobil 2028 project start - up Expected completion Q4 202 4 Low - carbon ammonia production technologies

14 $5.00 $4.50 $4.00 $3.50 $3.00 $2.50 $2.00 $1.0 $1.1 $1.2 $1.4 $1.5 $1.6 $1.8 $300 $1.7 $1.8 $2.0 $2.1 $2.2 $2.4 $2.5 $350 $2.4 $2.6 $2.7 $2.8 $3.0 $3.1 $3.2 $400 $3.1 $3.3 $3.4 $3.5 $3.7 $3.8 $4.0 $450 $3.9 $4.0 $4.1 $4.3 $4.4 $4.5 $4.7 $500 $4.6 $4.7 $4.9 $5.0 $5.1 $5.3 $5.4 $550 $5.3 $5.5 $5.6 $5.7 $5.9 $6.0 $6.1 $600 CF Industries Adjusted EBITDA sensitivity table Table illustrates the CF Industries business model across a broad range of industry conditions $50/ton urea realized movement implies ~$725M change in Adjusted EBITDA on an annual basis (1) Based on 2023 sales volumes of approximately 19.1 million product tons, 2023 gas consumption of 341 million MMBtus and 2023 n itr ogen product sales price relationships. Changes in product prices and gas costs are not applied to the CHS minority interest or industrial contracts w her e CF Industries is naturally hedged against changes in product prices and gas costs (2) Assumes that a $50 per ton change in urea prices is also applied proportionally to all nitrogen products and is equivalent to a $34.78 per ton change in UAN price, $36.96 per ton change in AN price, $89.14 per ton change in ammonia price, and $21.20 per ton change in the price of t he Other segment Adjusted EBITDA Sensitivity to Natural Gas and Urea Prices (1) $ billions CF Realized Natural Gas Cost ($/MMBtu) CF Realized Urea Price ($/ton) (2)

15 Annual Average Energy Cost 2025F (3) Current (2) 2024E (1) Source Location Gas Prices ($/MMBtu) 3.23 2.30 2.96 NYMEX Henry Hub 12.60 12.75 10.35 ICE TTF 12.87 12.74 10.06 ICE NBP 13.35 13.47 11.66 ICE JKM Oil ($/ Bbl ) 77 79 78 NYMEX Brent Crude China Coal ($/ tonne ) 103 99 100 SX Coal/ Woodmac Thermal 157 151 148 Anthracite Powder 185 179 195 Anthracite Exchange Rates 6.88 7.07 7.06 Bloomberg Composite RMB/USD 1.12 1.09 1.09 Bloomberg Composite USD/EUR 1.30 1.31 1.28 Bloomberg Composite USD/GBP Notes: Market prices updated as of 10/14/2024; Coal prices as of 10/8/2024 (1) 2024E represents assumptions from February 2024 forecast cost curve, published in the CF Industries Q4 2023 Earnings presentation (2) Observed values as of October 14, 2024; Chinese coal prices reflected 2024 monthly average (3) Observed values in forward energy strips as of October 14, 2024 and Woodmac forecast 2025 cost curve assumptions

Financial results – third quarter and first nine months 2024 9M 2023 9M 2024 Q3 2023 Q3 2024 In millions, except percentages, per MMBtu and EPS $ 5,060 $ 4,412 $ 1,273 $ 1,370 Net sales 2,044 1,532 377 444 Gross margin 40.4 % 34.7 % 29.6 % 32.4 % - As a percentage of net sales $ 1,251 $ 890 $ 164 $ 276 Net earnings attributable to common stockholders 6.42 4.86 0.85 1.55 Net earnings per diluted share 2,151 1,749 372 509 EBITDA (1) 2,168 1,722 445 511 Adjusted EBITDA (1) 194.9 183.1 192.9 178.6 Diluted weighted - average common shares outstanding $ 3.43 $ 2.23 $ 2.53 $ 2.09 Natural gas costs in cost of sales (per MMBtu) (2) 0.47 0.15 0.01 0.01 Realized derivatives loss in cost of sales (per MMBtu) (3) Cost of natural gas used for production in cost of sales (per MMBtu) $ 2.10 $ 2.54 $ 2.38 $ 3.90 2.46 2.19 2.58 2.08 Average daily market price of natural gas Henry Hub - Louisiana (per MMBtu) 640 704 213 229 Depreciation and amortization 311 321 147 139 Capital expenditures (1) See appendix for reconciliations of EBITDA and adjusted EBITDA to the most directly comparable GAAP measures (2) Includes the cost of natural gas used for production and related transportation that is included in cost of sales during the period under the first - in, first - out inventory method (3) Includes realized gains and losses on natural gas derivatives settled during the period. Excludes unrealized mark - to - market gains and losses on natural gas derivatives 16

Non - GAAP: reconciliation of net earnings to EBITDA and adjusted EBITDA 9M 2023 9M 2024 Q3 2023 Q3 2024 In millions $ 1,486 $ 1,085 $ 230 $ 341 Net earnings (235) (195) (66) (65) Less: Net earnings attributable to noncontrolling interest 1,251 890 164 276 Net earnings attributable to common stockholders — (16) (6) (32) Interest expense (income) — net 326 244 23 59 Income tax provision 640 704 213 229 Depreciation and amortization Less other adjustments: (63) (70) (21) (22) Depreciation and amortization in noncontrolling interest (3) (3) (1) (1) Loan fee amortization (1) $ 2,151 $ 1,749 $ 372 $ 509 EBITDA Unrealized net mark - to - market loss (gain) on natural gas derivatives Loss on foreign currency transactions, including intercompany loans U.K. operations restructuring Acquisition and integration costs Impairment of equity method investment in PLNL Total adjustments Adjusted EBITDA $ (65) (33) 7 1 5 2 7 1 7 — 5 — 27 4 11 — 43 — 43 — 17 (27) 73 2 2,168 $ 1,722 $ 445 $ 511 (1) Loan fee amortization is included in both interest expense (income) — net and depreciation and amortization 17

Non - GAAP: reconciliation of net earnings to EBITDA and adjusted EBITDA, continued 18 Q3 2024 LTM In millions $ 1,437 Net earnings (273) Less: Net earnings attributable to noncontrolling interest 1,164 Net earnings attributable to common stockholders (24) Interest expense (income) — net 328 Income tax provision 933 Depreciation and amortization Less other adjustments: (92) Depreciation and amortization in noncontrolling interest (4) Loan fee amortization (1) $ 2,305 EBITDA (7) Unrealized net mark - to - market gain on natural gas derivatives (3) Gain on foreign currency transactions, including intercompany loans 3 U.K. operations restructuring 16 Acquisition and integration costs 9 Total adjustments $ 2,314 Adjusted EBITDA (1) Loan fee amortization is included in both interest expense (income) — net and depreciation and amortization

Non - GAAP: reconciliation of cash from operations to free cash flow and free cash flow to adjusted EBITDA conversion 19 Q3 2024 LTM In millions, except percentages $ 2,331 Cash provided by operating activities (509) Capital expenditures (308) Distributions to noncontrolling interest $ 1,514 Free cash flow $ 2,314 Adjusted EBITDA 65 % Free cash flow to Adjusted EBITDA conversion (1) (1) Represents Q3 2024 LTM free cash flow divided by Q3 2024 LTM adjusted EBITDA

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

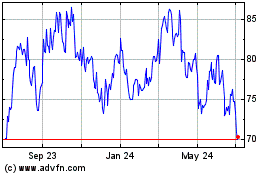

CF Industries (NYSE:CF)

Historical Stock Chart

From Oct 2024 to Nov 2024

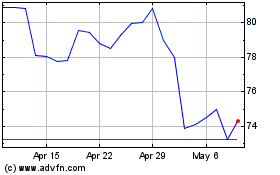

CF Industries (NYSE:CF)

Historical Stock Chart

From Nov 2023 to Nov 2024