CareTrust REIT Acquires Four Skilled Nursing Facilities in Mid-Atlantic for $74.7 Million; Reports Reloaded Pipeline of $240 Million

October 03 2024 - 5:00AM

Business Wire

CareTrust REIT, Inc. (NYSE:CTRE) announced today that it has

acquired a 4-facility, 396-bed/unit skilled nursing portfolio

located in the Mid-Atlantic for a total investment amount of

approximately $74.7 million (inclusive of transaction costs). One

of the four facilities acquired is a skilled nursing and assisted

living campus, which includes 47 assisted living units.

In connection with the acquisition, the company entered into a

triple-net master lease with a new operator relationship for the

company. The operator is an experienced skilled nursing operator

who has operated facilities across multiple states. The new master

lease has an initial term of 15 years with two, 5-year extension

options and provides for a year 1 contractual lease yield of 9.3%

(inclusive of transaction costs) with annual CPI-based escalators.

To facilitate certain local constraints, the acquisition of one of

the facilities was structured as a mortgage loan extended by

CareTrust to the operator, with the mortgage loan having

substantially the same economics, maturity, and other terms as the

master lease.

James Callister, CareTrust’s Chief Investment Officer, said,

“Today, we are thrilled to announce the acquisition of additional

facilities in the Mid-Atlantic region and to begin a new

relationship with an operator we are very excited about.” Mr.

Callister went on to state that, “Our year-to-date investments now

total over $900 million and we continue to actively seek and look

to execute upon additional acquisition opportunities.”

The investment was funded using cash on hand. In September 2024,

the company raised $309.9 million at an average price of $30.38 per

share under its new $750 million ATM program bringing its

outstanding share count to 171.5 million shares. Also in September

2024, the company paid off its $200 million term loan. The company

is currently in the process of amending and extending its existing

credit facility. As of today, the company currently has

approximately $280 million of cash on hand.

CareTrust also reported that subsequent to the closing of this

acquisition, the reloaded investment pipeline sits at $240 million

of near-term, actionable opportunities, not including larger

portfolios the company is reviewing. Dave Sedgwick, CareTrust’s

Chief Executive Officer, stated that “Today’s announcement not only

represents a quadrupling of our average annual rate of investments;

but it also represents an acceleration of our mission to facilitate

growth for strong skilled nursing and seniors housing operators

where they are needed.” Mr. Sedgwick continued, “As we head into

the final quarter of 2024, given the progress made throughout the

organization, the company has never been better positioned to grow

than now.”

About CareTrust™

CareTrust REIT, Inc. is a self-administered, publicly-traded

real estate investment trust engaged in the ownership, acquisition,

development and leasing of skilled nursing, seniors housing and

other healthcare-related properties. With a nationwide portfolio of

long-term net-leased properties, and a growing portfolio of quality

operators leasing them, CareTrust REIT is pursuing both external

and organic growth opportunities across the United States. More

information about CareTrust REIT is available at

www.caretrustreit.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements that are

not historical statements of fact and statements regarding the

Company’s intent, belief or expectations, including, but not

limited to, statements regarding the following: industry and

demographic conditions, the investment environment, the Company’s

investment pipeline, and financing strategy.

Words such as “anticipate,” “believe,” “could,” “expect,”

“estimate,” “intend,” “may,” “plan,” “seek,” “should,” “will,”

“would,” and similar expressions, or the negative of these terms,

are intended to identify such forward-looking statements, though

not all forward-looking statements contain these identifying words.

The Company’s forward-looking statements are based on management’s

current expectations and beliefs, and are subject to a number of

risks and uncertainties that could lead to actual results differing

materially from those projected, forecasted or expected. Although

the Company believes that the assumptions underlying these

forward-looking statements are reasonable, they are not guarantees

and the Company can give no assurance that its expectations will be

attained. Factors which could have a material adverse effect on the

Company’s operations and future prospects or which could cause

actual results to differ materially from expectations include, but

are not limited to: (i) the ability and willingness of our tenants

to meet and/or perform their obligations under the triple-net

leases we have entered into with them, including without

limitation, their respective obligations to indemnify, defend and

hold us harmless from and against various claims, litigation and

liabilities; (ii) the risk that we may have to incur additional

impairment charges related to our assets held for sale if we are

unable to sell such assets at the prices we expect; (iii) the

impact of healthcare reform legislation, including minimum staffing

level requirements, on the operating results and financial

conditions of our tenants; (iv) the ability of our tenants to

comply with applicable laws, rules and regulations in the operation

of the properties we lease to them; (v) the ability and willingness

of our tenants to renew their leases with us upon their expiration,

and the ability to reposition our properties on the same or better

terms in the event of nonrenewal or in the event we replace an

existing tenant, as well as any obligations, including

indemnification obligations, we may incur in connection with the

replacement of an existing tenant; (vi) the availability of and the

ability to identify (a) tenants who meet our credit and operating

standards, and (b) suitable acquisition opportunities and the

ability to acquire and lease the respective properties to such

tenants on favorable terms; (vii) the ability to generate

sufficient cash flows to service our outstanding indebtedness;

(viii) access to debt and equity capital markets; (ix) fluctuating

interest rates; (x) the impact of public health crises, including

significant COVID-19 outbreaks as well as other pandemics or

epidemics; (xi) the ability to retain our key management personnel;

(xii) the ability to maintain our status as a real estate

investment trust (“REIT”); (xiii) changes in the U.S. tax law and

other state, federal or local laws, whether or not specific to

REITs; (xiv) other risks inherent in the real estate business,

including potential liability relating to environmental matters and

illiquidity of real estate investments; and (xv) any additional

factors included in our Annual Report on Form 10-K for the year

ended December 31, 2023 and our Quarterly Report on Form 10-Q for

the quarter ended March 31, 2024, including in the section entitled

“Risk Factors” in Item 1A of such reports, as such risk factors may

be amended, supplemented or superseded from time to time by other

reports we file with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003290692/en/

CareTrust REIT, Inc. (949) 542-3130 ir@caretrustreit.com

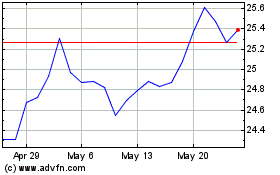

CareTrust REIT (NYSE:CTRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

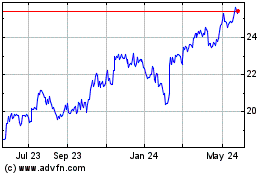

CareTrust REIT (NYSE:CTRE)

Historical Stock Chart

From Nov 2023 to Nov 2024